Market

OpSec CEO and Team Resign Amid Fraud Allegations by ZachXBT

Chris Williams, CEO of OpSec, a purported AI Cloud Security platform, announced that he and “the entire core team” resigned. Williams cited a recent investigation from ZachXBT, who claimed that OpSec was fraudulent.

One user, Zopp0, simultaneously owned OpSec and several other projects and withheld critical information and even payment from Williams’ team.

ZachXBT’s OpSec Investigation

Chris Williams, CEO of AI Cloud Security Platform OpSec, announced that he and OpSec’s entire core team were resigning en masse. Williams cited a recent investigation by crypto sleuth ZachXBT and claimed that the business was “no longer viable.” Specifically, he claimed that OpSec’s anonymous founder deliberately withheld critical information.

“This decision follows recent findings, highlighted by ZachXBT, along with our own assessment of OpSec’s operations. These revelations, coupled with the un-doxxed founder’s prolonged absence and sole control over the company’s finances, have severely limited our ability to lead and execute our vision effectively,” Williams claimed.

So, what were ZachXBT’s allegations, and how did they impact the firm’s operations? On the surface level, OpSec appeared to be a legitimate business, even partnering with other cloud computing firms to create DePin solutions. However, Zach stated that one user, Zopp0, created at least four shaky crypto startups, hoping to attract naive investors.

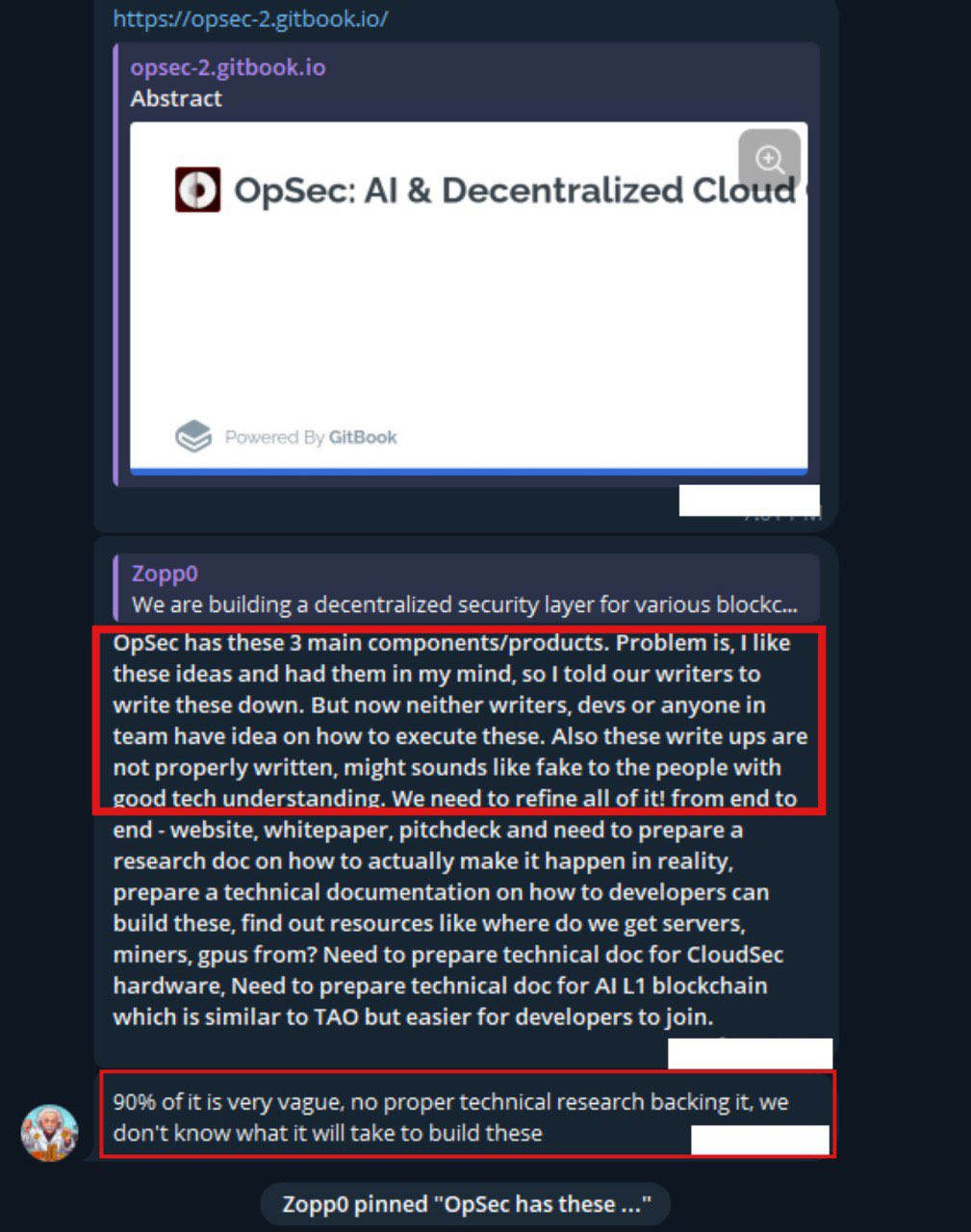

ZachXBT’s investigation began in March when he posted evidence that OpSec’s purported hardware capacities were nonexistent. In November, however, he followed this up with leaked Telegram chats in which Zopp0 openly discussed his total lack of a plan for executing OpSec’s business model. These chats made it clear that the business had no real core.

In other words, Zopp0 managed to insulate Williams and the rest of OpSec’s developers from this lack of functionality. Positive social media buzz, partnerships, and other publicity actions drove up OpSec’s price. Behind the scenes, however, Williams said Zopp0 provided a “lack of clarity regarding OpSec’s direction,” and frequently withheld pay.

The actual fraud here is somewhat similar to several which ZachXBT previously investigated. A seemingly legitimate project courts public interest, but upon closer inspection it cannot execute the purported vision. Zach also claimed that Zopp0 was secretly running OpSec and several less prominent “businesses”, a common tactic in token scams.

After obtaining this leaked information, ZachXBT confronted Zopp0, who became increasingly agitated in private chats. Excerpts from these were again leaked to ZachXBT, building evidence of misconduct.

Zach then released most of this leaked information at once. Williams claimed that this corroborated his team’s own suspicions, leading to the mass resignation.

As of yet, none of Zopp0’s other alleged sham businesses have gone through public employee discontent. Nonetheless, ZachXBT also compiled a list of influencers who helped pump OpSec’s social media presence. He warned of a heightened risk of scammers due to crypto’s bull run and encouraged users to conduct due diligence.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin (BTC) Struggles to Hold $90,000 Amid Profit-Taking

Bitcoin (BTC) rallied past the $90,000 psychological barrier on November 12. That day, it briefly traded at a new all-time high of $93,265. However, as of this writing, the king coin trades at $87,757, having shed 6% of its value in the past two days.

On-chain data has revealed that Bitcoin has since witnessed a pullback due to a spike in profit-taking activity, mostly by short-term holders. As these paper-handed investors scamper to lock in gains, the chances of the Bitcoin price at $90,000 in the near term appear increasingly slim.

Bitcoin Short-Term Holders Are Market Movers

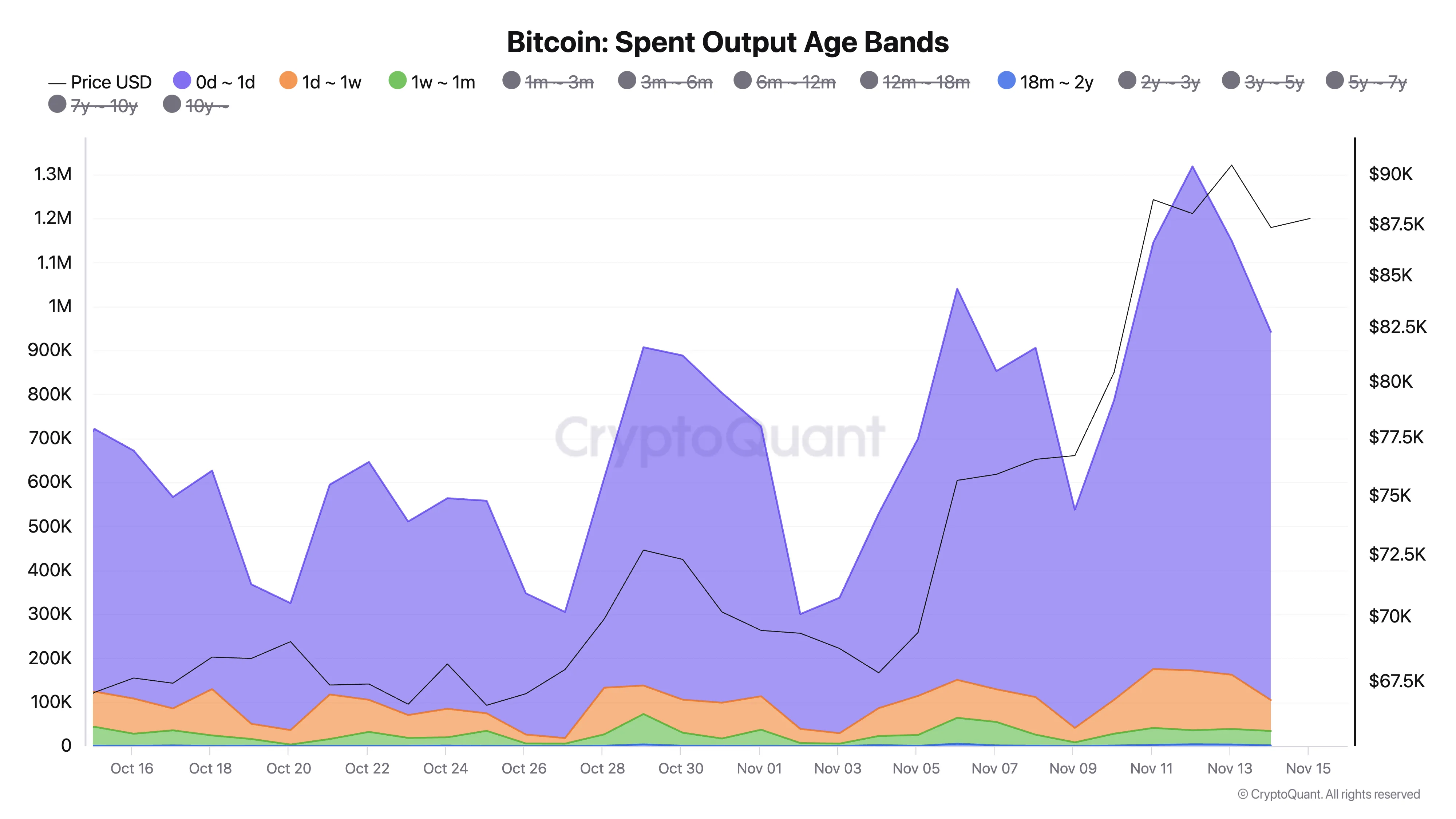

BeInCrypto’s assessment of Bitcoin’s Spent Output Age Bands (SOAB) offers insights into the activity of its holders. This metric categorizes Bitcoin Unspent Transaction Outputs (UTXOs) based on age and tracks their spending activity. Bitcoin UTXOs represent the amount of coins a user has available to spend and are tracked across the network as inputs for new transactions.

Analyzing BTC’s SOAB gives insights into market sentiment and potential price movements. For example, a spike in younger age bands often indicates increased trading activity and profit-taking by short-term holders (those who have held their coins for less than 30 days). This has played out in the BTC market since it first rallied above the $90,000 mark on Wednesday.

According to CryptoQuant’s data, Bitcoin holders who had held their coins for only a day transferred 1,146,151 BTC on that day—their highest level in two months. Holders with a holding period of one to seven days moved 135,950 BTC, while those holding between seven and 30 days transferred 32,021 BTC.

A surge in the spent output of coin holders with less than a month of holding time typically signals that newer, short-term investors are selling or moving their BTC. This indicates increased profit-taking or reduced confidence among recent buyers, often adding selling pressure and contributing to short-term price volatility.

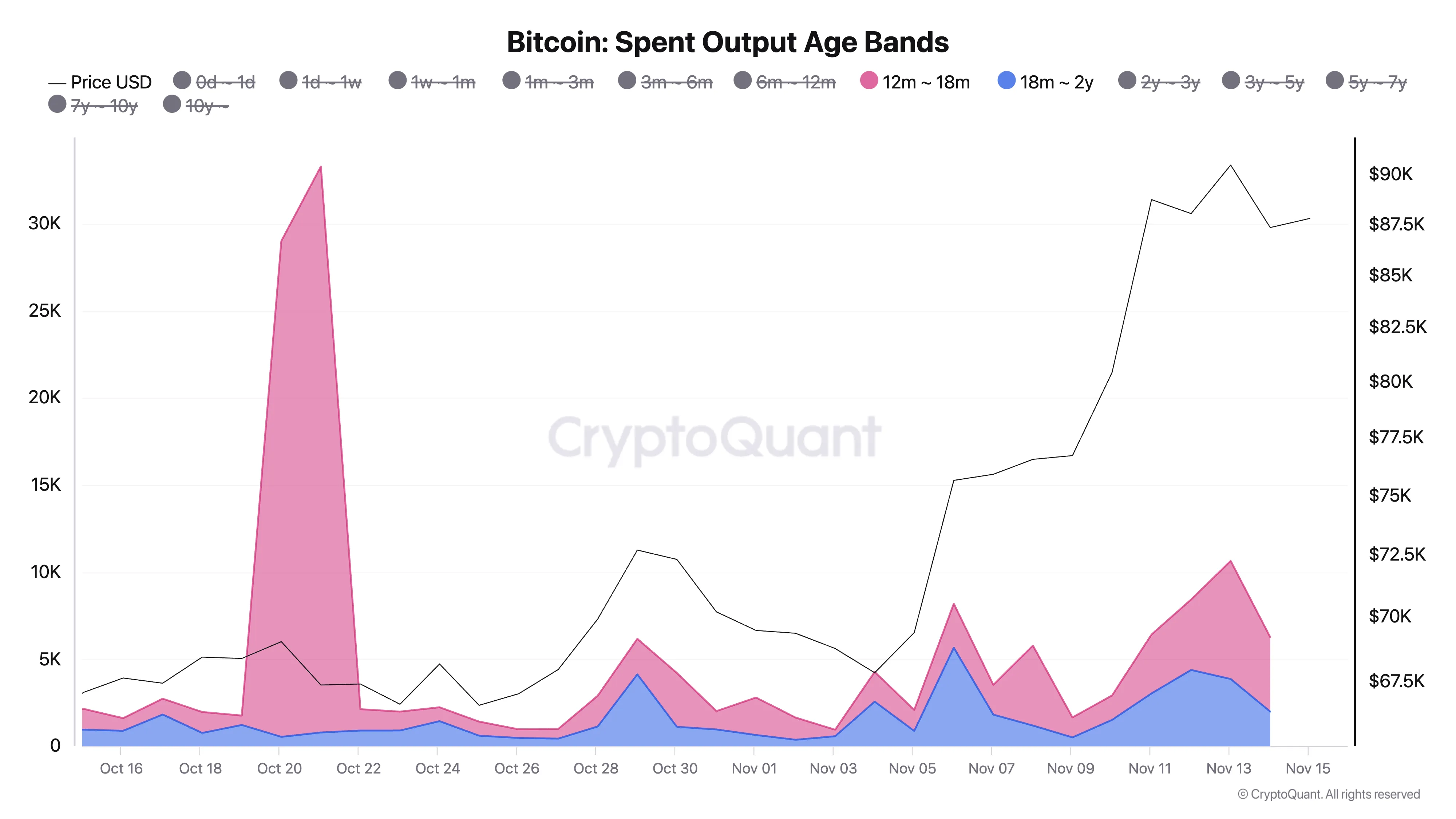

Long-Term Holders Steadies the Boat

Notably, Bitcoin’s long-term holders, who have kept their coins for over 12 months, have taken a different approach. Although there have been some coin movements, they remain relatively minimal.

This suggests that since Bitcoin’s rally to $90,000, the price fluctuations have been largely driven by short-term holders eager to lock in quick gains.

BTC Price Prediction: What To Look Out For

Short-term holders hold a significant portion of Bitcoin’s circulating supply. As such, a sustained spike in selling activity from that class of investors can put downward pressure on the coin’s price. BTC may fall further from the $90,000 mark if it continues to sell.

According to readings from the coin’s Fibonacci Retracement tool, should this play out, BTC’s next price target is $83,792. If this level fails to hold as support, BTC may slip under the $80,000 mark to trade at $76,356.

However, if the short-term holders refrain from selling, this bearish projection will be invalidated. This will increase the likelihood of the Bitcoin price soaring above $90,000. It may reclaim its all-time high of $93,256 and even attempt to rally toward the $100,000 milestone.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

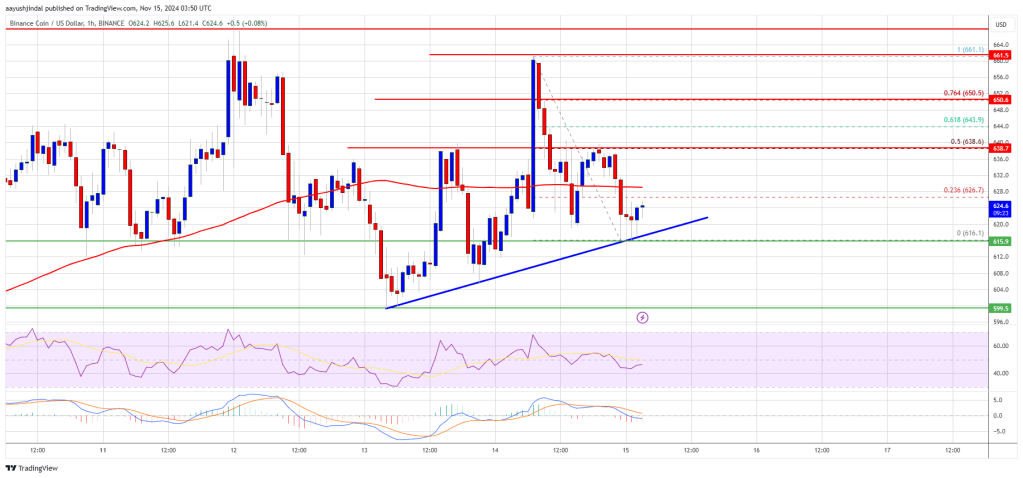

BNB Price Poised for Takeoff: Will It Be The Next to Rally?

BNB price struggled to clear the $665 resistance zone. The price is consolidating and might aim for a fresh increase above the $635 level.

- BNB price started a downside correction from the $665 resistance zone.

- The price is now trading below $640 and the 100-hourly simple moving average.

- There is a connecting bullish trend line forming with support at $620 on the hourly chart of the BNB/USD pair (data source from Binance).

- The pair must stay above the $600 level to start another increase in the near term.

BNB Price Holds Support

After a close above the $620 level, BNB price extended its increase. However, upsides were limited above $660 and the price remained capped, unlike Ethereum and Bitcoin.

There was a move below the $632 and $620 levels. However, the price is now holding gains above the $600 level. A low was formed at $616 and the price is now consolidating near the 23.6% Fib retracement level of the downward move from the $661 swing high to the $616 low.

The price is now trading below $620 and the 100-hourly simple moving average. There is also a connecting bullish trend line forming with support at $620 on the hourly chart of the BNB/USD pair.

If there is a fresh increase, the price could face resistance near the $626 level. The next resistance sits near the $638 level or the 50% Fib retracement level of the downward move from the $661 swing high to the $616 low. A clear move above the $638 zone could send the price higher.

In the stated case, BNB price could test $650. A close above the $650 resistance might set the pace for a larger move toward the $665 resistance. Any more gains might call for a test of the $680 level in the near term.

More Losses?

If BNB fails to clear the $638 resistance, it could start another decline. Initial support on the downside is near the $620 level and the trend line. The next major support is near the $615 level.

The main support sits at $600. If there is a downside break below the $600 support, the price could drop toward the $585 support. Any more losses could initiate a larger decline toward the $565 level.

Technical Indicators

Hourly MACD – The MACD for BNB/USD is losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BNB/USD is currently below the 50 level.

Major Support Levels – $620 and $615.

Major Resistance Levels – $638 and $650.

Market

Bitcoin Rally Boosts Coinbase, Robinhood in Global App Store

The recent Bitcoin rally has driven Coinbase to the ninth spot in global app rankings, followed by Robinhood at 13.

This surge in popularity marks a resurgence of retail interest, as Coinbase was ranked 435 the night before the US elections.

Retail Interest Revives: Coinbase Climbs to Ninth Globally in App Store

Coinbase’s rapid rise reflects retail investors returning to the crypto market, eager to join the Bitcoin rally. With Bitcoin’s price on the rise, users are downloading trading apps in large numbers to participate.

Robinhood, another major trading platform, is also trending upward, now ranking 13 in the US App Store, while CashApp trails behind at number 30. This simultaneous growth for Coinbase and Robinhood shows a renewed demand for easy-to-use crypto trading platforms.

In March 2024, Coinbase reappeared among the top 100 apps for a brief period. It was the first time it had done so since two years prior, marking the beginning of this renewed interest.

Now, its spot in the top 10 confirms a new wave of retail adoption, likely driven by Bitcoin’s recent performance. As retail investors respond to these market shifts, the crypto space appears to be gaining fresh momentum.

When Bitcoin and other cryptocurrencies surge, retail investors flock to trading platforms, fueling increased app downloads. Robinhood’s ranking at 20th also suggests that traditional trading apps that cater to retail crypto demand stand to make significant gains.

Known primarily for stock trading, Robinhood now attracts users seeking both stock and crypto investments in a single app. This rise of Robinhood signals that retail investors want easy, simplified access to crypto, especially during price surges.

“Bitcoin sentiment check: Coinbase App Store ranking on apple iOS 7 day moving average = 191 Possibly only 1-2 weeks away from hitting extreme levels, based on the current pace. *The app reached no.1 in December 2017, April 2021, and November 2021,” said one analyst on X on November 11.

Polymarket Bets on the Bitcoin Rally

Polymarket bettors have been quick to jump on the subject. At the time of writing, users estimate a 58% chance that Coinbase will remain among the top 10 free apps on November 15.

In the crypto industry, app rankings often signal market enthusiasm and can indicate an approaching bull market. This trend also highlights how retail adoption shapes the market for crypto apps.

As platforms like Coinbase climb app rankings, they reveal the crypto market’s vibrancy and responsiveness to price gains. If this pattern persists, more crypto apps could gain popularity, attracting even more retail investors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin22 hours ago

Bitcoin22 hours ago57% of Investors Eye More Crypto

-

Market20 hours ago

Market20 hours agoCan Chainlink Help WLFI Beat Setbacks?

-

Altcoin23 hours ago

Altcoin23 hours agoS. Korean Exchange Body DAXA Suspending Radiant Capital (RDNT) Trading

-

Market22 hours ago

Market22 hours agoSolana, Base Top Blockchain Ranks with 56% Traffic Share

-

Altcoin22 hours ago

Altcoin22 hours agoLitecoin Says It “Now Identify As a Memecoin”, LTC Price Spikes 15%

-

Market23 hours ago

Market23 hours agoIs Another Rally in Sight?

-

Altcoin18 hours ago

Altcoin18 hours agoDogecoin Eyes Parabolic Rally To Price Discovery, Is The 16,000% Surge From 2020 Possible This Time?

-

Market17 hours ago

Market17 hours agoTether Injects $7 Billion into the Market in Six Days