Market

Why the MAGA (TRUMP) Coin Price Will Test Its 2024 Low?

The Donald Trump-linked meme coin MAGA (TRUMP) has experienced a sharp decline over the past week. This diverges from the broader market rally sparked by Trump’s victory in the 2024 US presidential elections. TRUMP trades at $1.48 as of this writing, marking a 35% drop in the past seven days.

With plunging buying pressure, the meme coin is on track to retest its year-to-date low. The question now is how soon TRUMP will breach this level.

MAGA Traders Continue To Dump Holdings

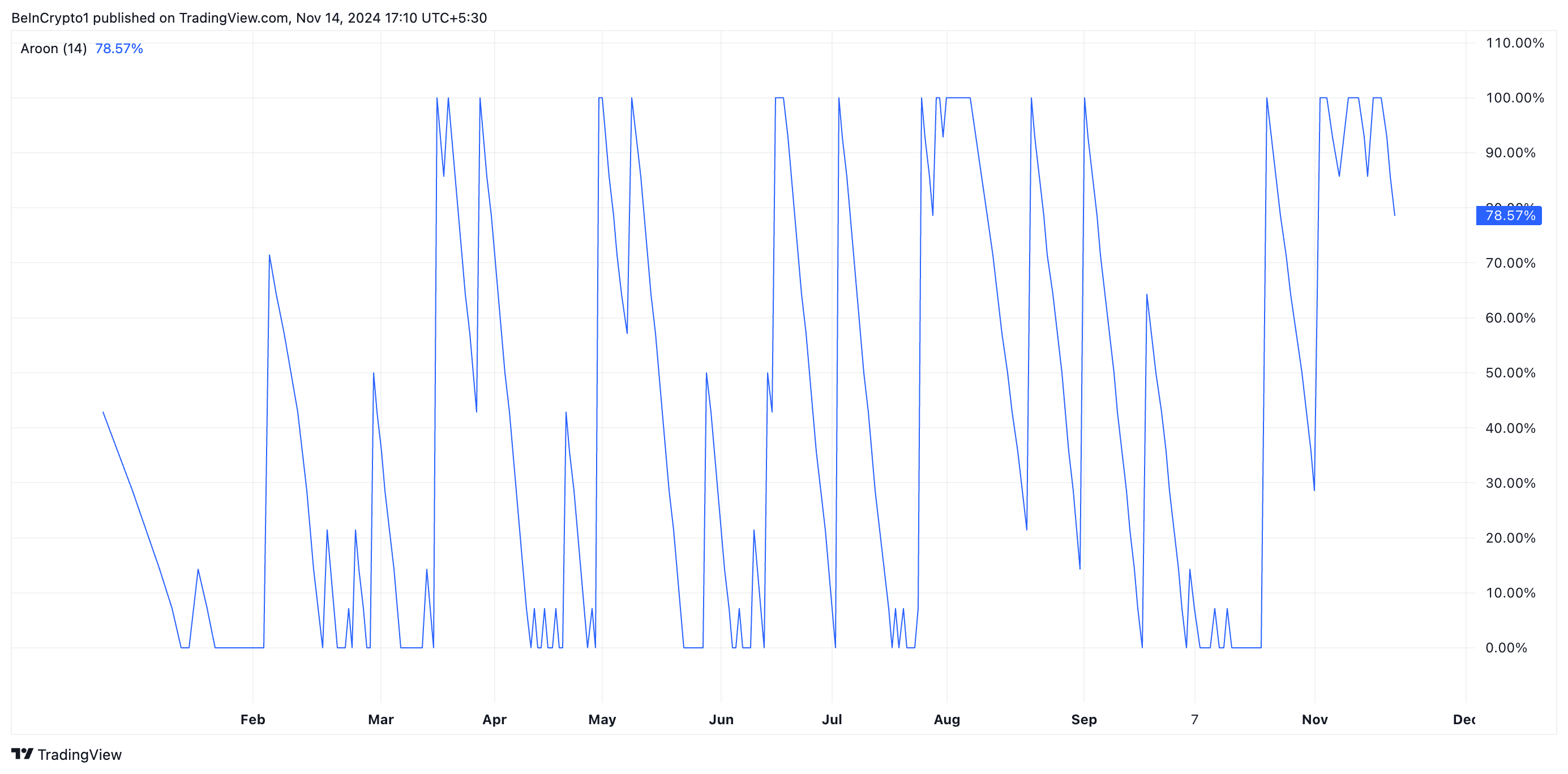

TRUMP’s Aroon Down Line confirms the strength of its current downward trend. The indicator’s value is close to 100 at 78.57 at press time.

The Aroon indicator identifies the strength and direction of a trend. When the Aroon Down Line is close to 100, the asset’s price has consistently made recent lows over the measured period. It suggests the asset has been in a strong downtrend, indicating sustained bearish momentum.

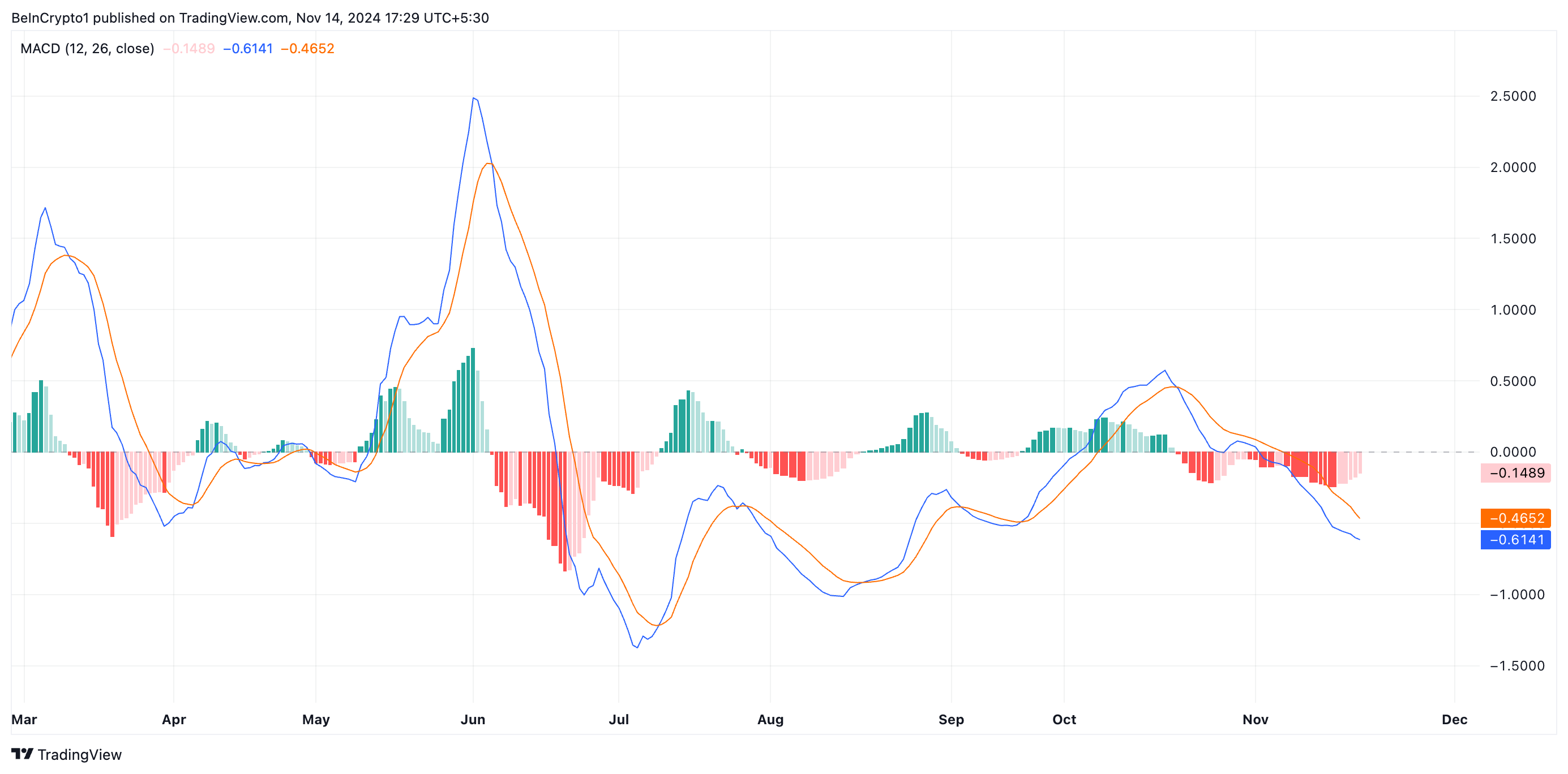

Additionally, the setup of TRUMP’s moving average convergence/divergence (MACD) indicator confirms the rising selling pressure in the market. As of this writing, the meme coin’s MACD line (blue) rests below its signal line (orange) and is under its zero line.

This indicator tracks an asset’s trend direction, shifts, and potential price reversal points. When the MACD line is below both the signal and zero lines, the asset’s short-term momentum is weak, signaling a potential bearish trend. Traders interpret this as a strong selling signal, as it implies that the price is likely to continue declining.

TRUMP Price Prediction: Meme Coin May Be Oversold

Currently, TRUMP trades at $1.48. If the decline continues, its next price target is its January low of $0.14, which is its year-to-date low.

However, readings from the meme coin’s Relative Strength Index (RSI) suggest that it is almost oversold and due for a price rebound. At press time, TRUMP’s RSI is at 32.58.

The RSI indicator assesses whether an asset is oversold or overbought. Its values range between 0 and 100. Values above 70 indicate that the asset is overbought and due for a correction, while values below 30 suggest that the asset is oversold and may experience a rebound.

TRUMP’s RSI of 32.58 indicates that the meme coin is nearing the oversold threshold. Traders may start to watch for signs of a price bounce or trend shift, and if this happens, its price may climb toward $3.92.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will the SEC Approve Grayscale’s Solana ETF?

Grayscale has submitted a registration statement with the SEC to convert its Grayscale Solana Trust (GSOL) into an ETF listed on NYSE Arca.

Despite the filing, prediction markets remain unconvinced about the chances of approval.

Is a Solana ETF Approval Still Unlikely for Q2?

On Polymarket, odds for a Solana ETF approval in the second quarter of 2025 stand at just 23%. Broader expectations for any 2025 approval are at 83%, down from 92% earlier this year.

The decline reflects regulatory delays. In March, the SEC extended review timelines for several ETF applications tied to Solana, XRP, and other altcoins.

This pattern suggests the agency may be holding off on decisions until a permanent chair takes over. Mark Uyeda, currently serving as interim chair, has not signaled a shift in stance.

Paul Atkins, Trump’s nominee to lead the agency, appeared before the Senate last week. Lawmakers questioned his involvement in crypto-related businesses, adding further uncertainty around future approvals.

Grayscale’s latest filing excludes staking, which could speed up the review process. The SEC has previously objected to staking features in ETF proposals.

When spot Ethereum ETFs moved forward last year, Grayscale, Fidelity, and Ark Invest/21Shares all removed staking components to align with the SEC’s expectations at the time.

Under Gary Gensler’s leadership, the SEC expressed concern that proof-of-stake protocols could fall under securities law. Asset managers adjusted their applications accordingly to move forward.

Following approvals for spot Bitcoin and Ethereum ETFs, several firms aim to expand their offerings to include other cryptocurrencies. They plan to offer access through traditional brokerage accounts without requiring direct asset custody.

Solana remains a strong contender due to its growing futures market in the US and a more favorable regulatory environment. Analysts view it as one of the next likely approvals if the SEC opens the door to more altcoin ETFs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

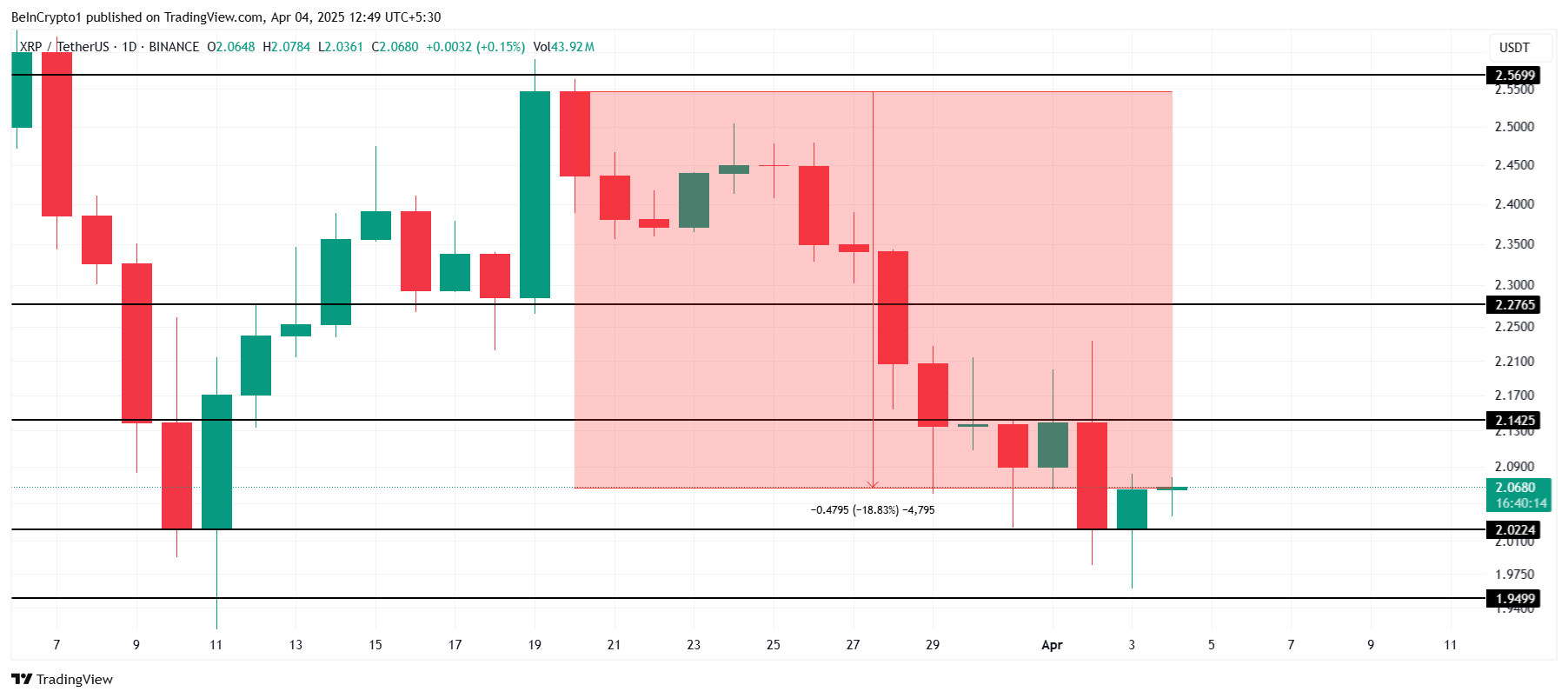

XRP Price Vulnerable To Falling Below $2 After 18% Decline

XRP has faced a significant correction in recent weeks, resulting in an 18% decline in the altcoin’s price. As a result, XRP is currently struggling to maintain upward momentum, with investors losing confidence.

This recent slump has raised concerns about the asset’s future, especially as certain XRP holders begin to sell their positions, increasing bearish pressure.

XRP Investors Are Pulling Back

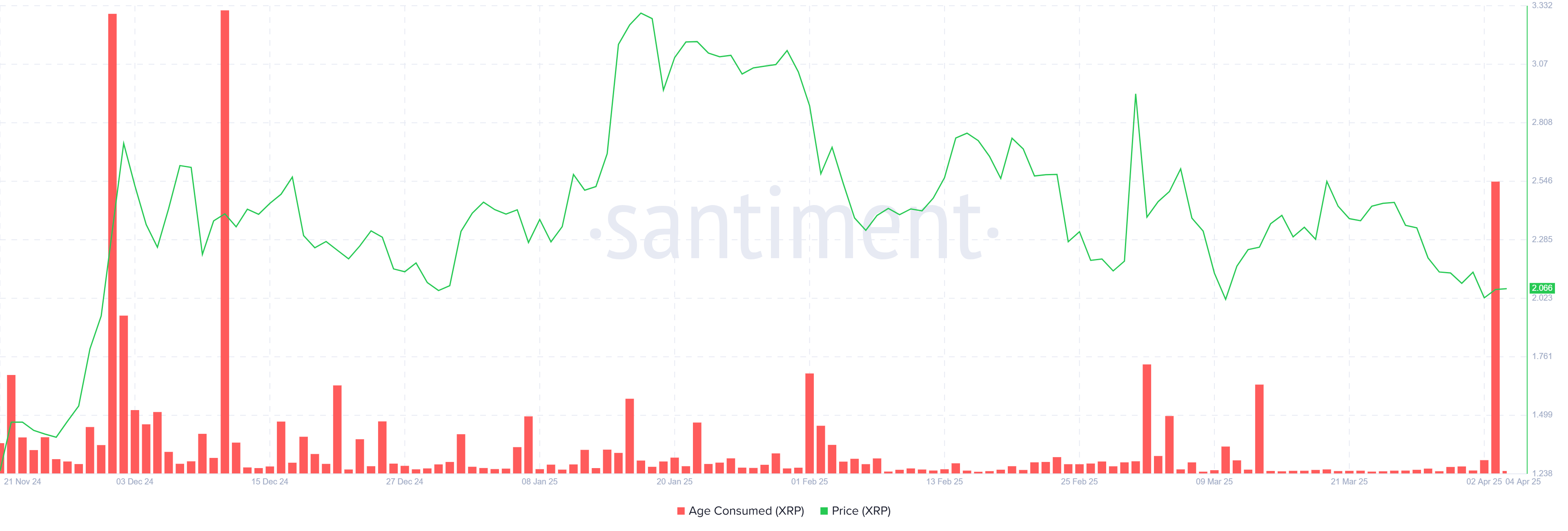

The recent downturn in XRP’s price has triggered a sharp spike in the “Age Consumed” metric. This indicator tracks the movement of coins from long-term holders (LTHs) and has reached its highest level in over four months. The increase suggests that LTHs, who have been holding XRP for extended periods, are now losing patience.

This selling behavior may be driven by the lack of price recovery and the overall weak market conditions that have not improved. These holders appear to be attempting to limit their losses by liquidating their positions, which in turn increases the downward pressure on XRP’s price. This mass selling from LTHs further compounds the challenges for XRP, as their decision to sell is often seen as a sign of waning confidence in the cryptocurrency.

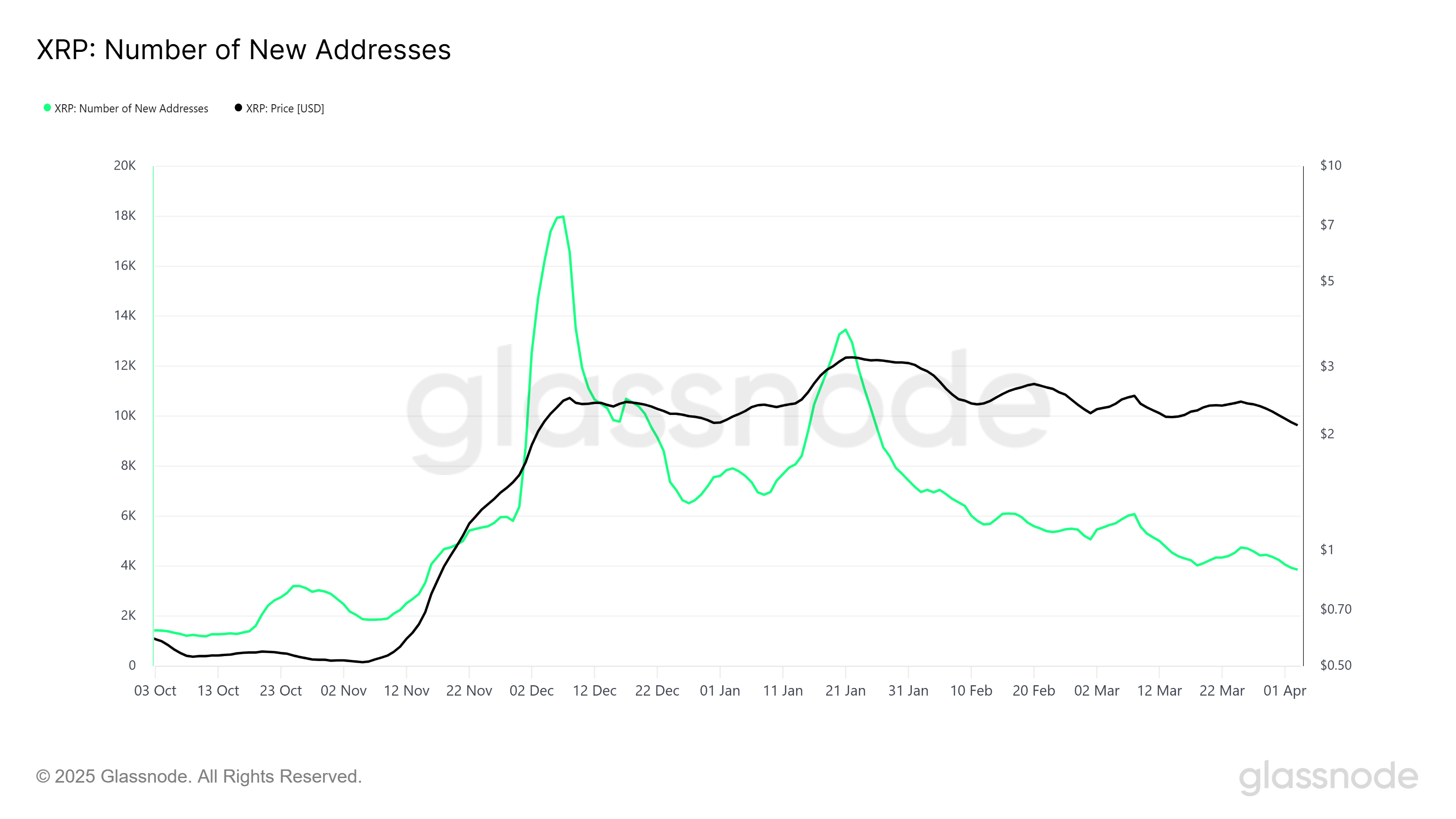

XRP’s market momentum appears to be weakening, as evidenced by the recent decline in the number of new addresses. The metric tracking new addresses has fallen to a five-month low, suggesting that XRP is struggling to attract new investors. This lack of fresh interest signals growing skepticism within the broader market, with potential investors hesitant to buy into an asset that has failed to deliver strong price action.

The drop in new addresses reflects a broader trend of reduced market traction and the lack of conviction from buyers. When combined with the selling pressure from LTHs, it creates a challenging environment for XRP to regain bullish momentum

XRP Price Needs A Boost

XRP’s price is currently holding at $2.06, just above the key support level of $2.02. If it manages to stabilize and break through the immediate resistance at $2.14, there could be a potential rebound, taking XRP higher.

However, with the continued weakness in market sentiment and the aforementioned bearish cues, XRP remains vulnerable to further declines. If the support of $2.02 fails, the price could drop further to $1.94, extending the 18% decline noted in the last two weeks.

If XRP manages to reclaim the $2.14 level and holds above it, the price could make its way toward $2.27. Breaching this level would invalidate the bearish outlook, signaling a potential recovery and restoring investor confidence in the cryptocurrency.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Futures Traders Lead the Charge as Buying Pressure Grows

Hedera Foundation’s recent move to partner with Zoopto for a late-stage bid to acquire TikTok has sparked renewed investor interest in HBAR, driving a fresh wave of demand for the altcoin.

Market participants have grown increasingly bullish, with a notable uptick in long positions signaling growing confidence in HBAR’s future price performance.

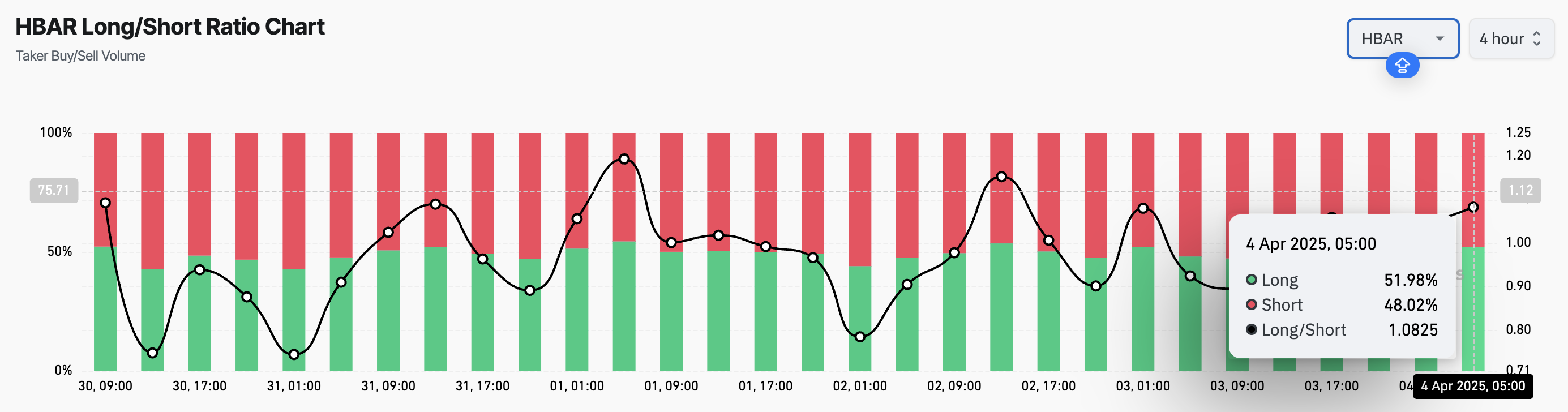

HBAR’s Futures Market Sees Bullish Spike

HBAR’s long/short ratio currently sits at a monthly high of 1.08. Over the past 24 hours, its value has climbed by 17%, reflecting the surge in demand for long positions among derivatives traders.

An asset’s long/short ratio compares the proportion of its long positions (bets on price increases) to short ones (bets on price declines) in the market.

When the long/short ratio is above one like this, more traders are holding long positions than short ones, indicating bullish market sentiment. This suggests that HBAR investors expect the asset’s price to rise, a trend that could drive buying activity and cause HBAR’s price to extend its rally.

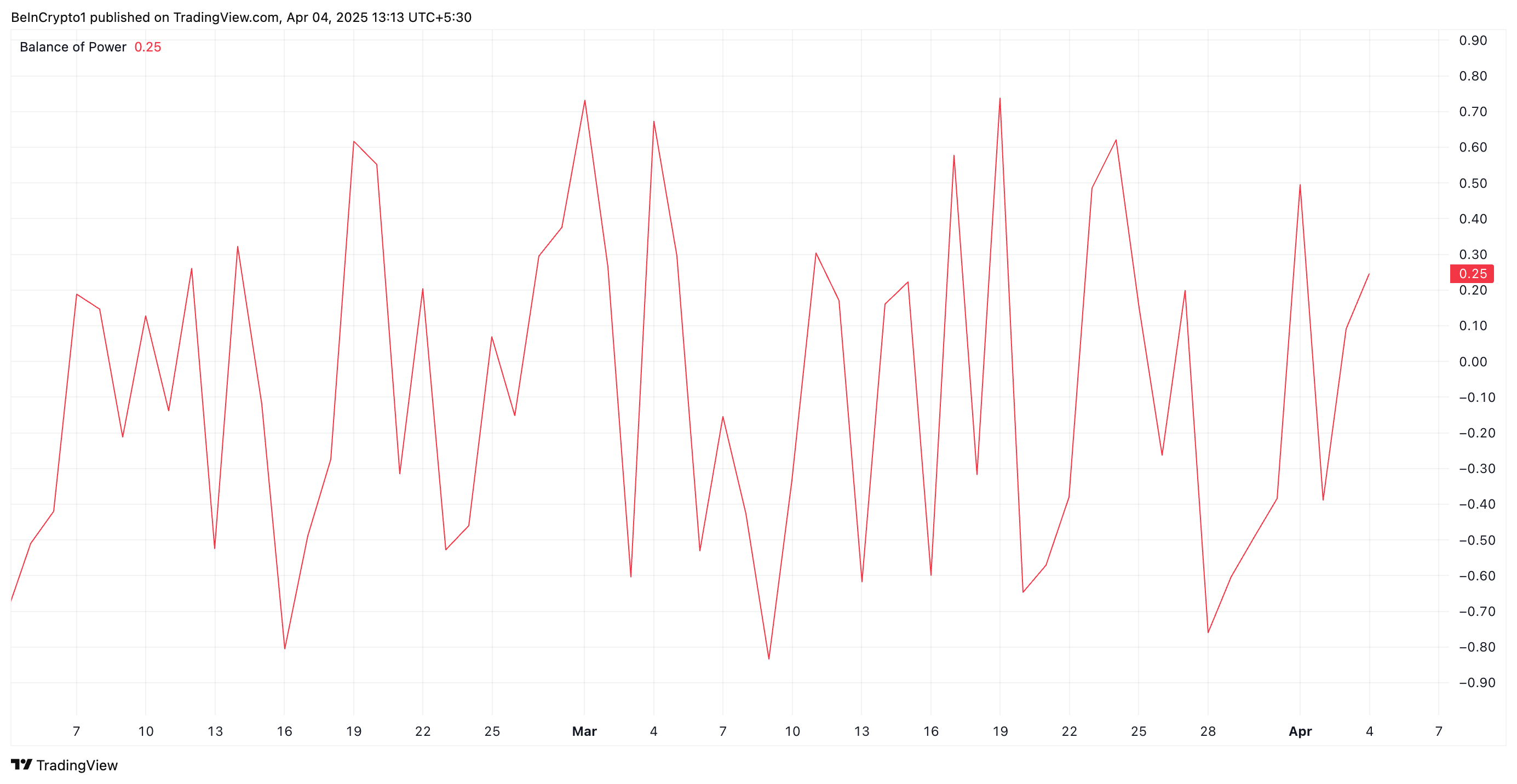

Further, the token’s Balance of Power (BoP) confirms this bullish outlook. At press time, this bullish indicator, which measures buying and selling pressure, is above zero at 0.25.

When an asset’s BoP is above zero, buying pressure is stronger than selling pressure, suggesting bullish momentum. This means HBAR buyers dominate price action, and are pushing its value higher.

HBAR Buyers Push Back After Hitting Multi-Month Low

During Thursday’s trading session, HBAR traded briefly at a four-month low of $0.153. However, with strengthening buying pressure, the altcoin appears to be correcting this downward trend.

If HBAR buyers consolidate their control, the token could flip the resistance at $0.169 into a support floor and climb toward $0.247.

However, a resurgence in profit-taking activity will invalidate this bullish projection. HBAR could resume its decline and fall to $0.129 in that scenario.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoBinance Managed 94% of All Crypto Airdrops and Staking Rewards

-

Regulation23 hours ago

Regulation23 hours agoUS SEC Acknowledges Fidelity’s Filing for Solana ETF

-

Market21 hours ago

Market21 hours agoWormhole (W) Jumps 10%—But Is a Pullback Coming?

-

Altcoin21 hours ago

Altcoin21 hours agoAltcoin Season Still In Sight Even As Ethereum Struggles To Gain Upward Momentum

-

Market23 hours ago

Market23 hours agoXRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

-

Market22 hours ago

Market22 hours agoRipple Shifts $1B in XRP Amid Growing Bearish Pressure

-

Market20 hours ago

Market20 hours agoBinance’s CZ is Helping Kyrgyzstan Become A Crypto Hub

-

Bitcoin17 hours ago

Bitcoin17 hours agoWhy ETF Issuers are Buying Bitcoin Despite Recession Fears