Market

JENNER Meme Coin Surges 90% Amid Fraud Suit Against Caitlyn

Celebrity meme coin JENNER surged over 90% on Thursday, even as a securities lawsuit was filed against Caitlyn Jenner.

Victims accuse the Olympic gold medalist of misleading investors in the token’s offering.

Fraud Allegations Against Caitlyn Jenner Spurs Interest in JENNER

Two international investors, Naeem Azad from the UK and Mihai Caluseru from Romania, initiated legal action in a federal California court. They claim combined losses of more than $50,000. Part of the allegations include Jenner using her celebrity status to attract unwary investors to the cryptocurrency project without full transparency or registration.

Launched on the Solana and Ethereum blockchains, JENNER aimed to capitalize on Caitlyn’s fame and leverage the growing trend of celebrity meme coins. The token debuted on Solana’s meme coin launchpad, Pump.Fun.

According to court documents, JENNER saw trading volume soar to over $250 million in its early days, attracting approximately 20,000 investors globally. However, the lawsuit claims this early success was short-lived. It notes that after reaching record highs, JENNER lost 99% of its peak value as alleged insider trading and project mismanagement surfaced.

The plaintiffs argue that Jenner, her manager Sophia Hutchins, and alleged crypto advisor Sahil Arora violated securities laws.

“They are tokens without proper registration or transparency,” the document reads.

Arora, a figure reportedly linked to prior financial scams, allegedly dumped a substantial portion of his holdings after the token’s initial surge. This triggered a sell-off that led to the token’s collapse.

In response, the project was relaunched on Ethereum. This, according to the lawsuit, further harmed holders of the original Solana-based token.

The lawsuit highlights various alleged misrepresentations, including unfulfilled promises to list JENNER on major exchanges. Others include unkept commitments for token buybacks and a 3% transaction tax added without informing investors.

Additionally, Jenner reportedly pledged to donate a portion of the project’s revenue to Donald Trump’s 2024 presidential campaign. This promise is also said to have gone unfulfilled.

By failing to disclose details such as insider holdings, purchase prices for early acquisitions, and associated financial risks, the plaintiffs claim that Jenner misled investors about the viability of JENNER as an investment.

Despite this report, data on DexScreener shows that the JENNER meme coin has been up 90% since Thursday’s session opened. As of this writing, it is trading for $0.0007250.

A Broader Trend of Celebrity Crypto Controversies

The law firm representing Azad and Caluseru, Fitzgerald Monroe Flynn PC, notes that the JENNER case reflects an ongoing pattern of celebrity cryptocurrency promotions gone awry.

“This case is part of a growing trend where celebrities leverage their public image to launch meme coins, but when the projects collapse, investors are left with the financial consequences.” said Attorney Peter Grazul, who is representing the plaintiffs.

According to Grazul, cases like these highlight the need for tighter regulatory scrutiny to protect investors.

The launch of JENNER gained traction as Jenner actively promoted the coin on social media. She emphasized its novelty and potential as a celebrity-backed meme coin. However, according to the lawsuit, Jenner gradually distanced herself from the project.

Insider allegations even surfaced, suggesting that her early gains from JENNER’s price surge could constitute insider trading. On-chain sleuths began digging into transaction records, alleging that Jenner and her team may have benefited from premeditated price manipulation.

The plaintiffs argue that Jenner’s apparent abandonment of the project signals a disregard for investors’ financial losses.

Meanwhile, celebrity involvement in cryptocurrency has become a double-edged sword. Public figures are progressively lending credibility to projects but often raise red flags about ethical conduct and transparency.

JENNER is not Caitlyn’s only venture in the crypto space. She also launched the MEDAL token, drawing inspiration from her 1976 Olympic gold medal.

While MEDAL is not named in the current lawsuit, its association with Caitlyn and the JENNER controversy could influence investor confidence in the project. This could attract regulatory attention to her other crypto initiatives.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Altcoins to Watch in the First Week of April 2025

As the crypto market enters Q2 2025, both investors and traders are anticipating a shift from bearish to bullish momentum. This change is essential for altcoins to recover, as many are currently facing challenges in bouncing back. However, growth potential remains for select tokens in the short term.

BeInCrypto has analyzed three altcoins to watch closely as April begins, highlighting the catalysts that could influence their price movements.

THORChain (RUNE)

RUNE’s price is currently at $1.117, hovering just above the $1.110 support level. For a potential rebound, the altcoin needs to reclaim $1.198 as support. Investor sentiment will play a crucial role in whether this upward movement materializes, leading to possible gains for THORChain (RUNE).

THORChain’s 3.4.0 upgrade is scheduled to take place this week, bringing significant improvements to the network. The upgrade could drive positive market sentiment, helping RUNE reclaim $1.198 as support. This momentum may push RUNE towards $1.396, aiding in recovering recent losses and supporting continued price growth.

If the support at $1.110 is broken, RUNE may fall to $1.021, pushing it closer to losing the critical $1.000 level. A failure to maintain support could signal a bearish trend, invalidating the bullish outlook.

Artificial Superintelligence Alliance (FET)

FET price saw a 20% decline over the last five days, dropping to $0.452 after losing the support of $0.458. This decline puts the altcoin under pressure. However, the doors for potential recovery are open due to upcoming developments within the network.

The Artificial Superintelligence Alliance network is set for a mainnet upgrade this week, bringing new features to the ASI-1 Mini. This upgrade is expected to act as a catalyst for the price, pushing it toward the key resistance levels of $0.524 and $0.572 to recover recent losses.

If the bearish trend continues, FET could fall further to $0.400, which would invalidate the bullish outlook and lead to extended losses. The price would need to hold above critical support levels to avoid deeper declines.

Ethereum (ETH)

Ethereum’s price is nearing a 17-month low of $1,745, following a 13.42% drop after failing to break through the $2,141 resistance. This recent price action suggests the altcoin king is struggling to regain momentum. The market conditions remain unfavorable for a quick recovery at this point.

Despite the current market downturn, Ethereum could see some recovery as investors look to capitalize on low prices. A short-term bounceback is possible if ETH successfully flips $1,862 into support, potentially pushing the price above $2,000. This would mark a significant recovery attempt from the recent drop.

If bearish conditions continue, Ethereum’s price might fall below $1,745, testing the next support at $1,625. A failure to hold this level would invalidate the bullish outlook and open the door for further declines, extending the recent losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top Crypto Airdrops to Watch in the First Week of April

As traders and investors anticipate the beginning of April and the onset of the second quarter (Q2) of 2025, crypto airdrops present an opportunity to join promising communities while they are still on the ground floor.

This week, three notable crypto airdrops stand out as worth watching.

Walrus

Walrus (WAL), a decentralized storage protocol on the Sui blockchain, launched its mainnet and token generation event (TGE) on March 27. The event coincided with South Korea’s Upbit exchange listing WAL.

The TGE saw Walrus distribute 4% of its 5 billion token supply via an airdrop. Eligible participants, including early Sui ecosystem users and testnet contributors, received Soulbound NFTs redeemable for WAL tokens. As April commences, 6% of Walrus tokens are reserved for future community rewards.

“At the moment 4% of the 10% tokens allocated for the airdrop have been distributed, so Walrus still has tokens to reward users,” Cryptorank.io noted.

WAL powers storage payments, staking, and governance, with listings on exchanges like Crypto.com and MEXC offering prize pools. The project’s airdrop comes after raising $140 million from Andreessen Horowitz, Standard Crypto, Electric Capital, and Comma3 Ventures, among others.

Meanwhile, Walrus’s market cap exceeds $573 million, reflecting strong adoption potential. Data on CoinGecko shows it was trading for $0.45 as of this writing.

Staking opportunities with validators like Mysten Labs or Nansen enhance rewards, but high commissions (up to 60%) apply. One of Walrus and Sui’s founders recently announced that users could stake WAL tokens to get airdrops. As this could mean airdrops from Walrus and projects from the Sui ecosystem, engaging with Sui dApps and testnets remains key for future allocations.

Nansen

The project has raised up to $88.2 million from investors such as Andreessen Horowitz, Coinbase Ventures, Accel, and Mechanism Capital, among others. Coupled with the fundraiser, Nansen has a valuation of $750 million.

Nansen, a leading blockchain analytics platform, confirmed an airdrop, drawing excitement due to its prominence and past reward patterns. The project launched a staking program and announced a point system in 2025.

“We’re excited to announce that we have acquired Stakewithus (SWU)! SWU is a non-custodial staking service provider with $80m+ staked by 30k+ users & supports 20+ chains You can now analyze data, monitor your portfolio, and stake assets in one place with Nansen,” read the announcement.

Users can stake assets (STRK and TRX), and points are expected to be credited retrospectively. Nansen also mentions the NSG token, so participants will most likely receive an airdrop for points.

Market participants should monitor Nansen’s social channels and partnerships for updates, as airdrops typically reward active users or data contributors.

With no token launched yet, any potential airdrop might tie into a future native token, likely incentivizing early adopters or premium subscribers. Given Nansen’s influence in the crypto space, tracking wallet activity and on-chain data, its airdrop could attract significant attention.

Participants should engage with its tools and stake in supported ecosystems to position themselves for unannounced opportunities.

OG Labs

This modular AI chain combines Layer-1 blockchain with decentralized AI, focusing on scalable Data Availability for AI applications.

The status of OG Labs airdrop stands confirmed, bringing forth an emerging player in the crypto space. This makes it a speculative target for market participants. It boasts up to $325 million in funds raised from investors such as Delphi Ventures, Hack VC, Animoca Brands, and OKX Ventures, among others.

The airdrop is potentially tied to Web3 innovation or NFT ecosystems (given the “OG” moniker). It follows models like Walrus, rewarding early testers or community members.

“There are new activities on the OG test network – we can request test tokens and make swaps,” Cryptorank.io noted.

The OG Labs airdrop requires no investment. Users can engage through OG Labs’ Newton Testnet, which tests-core functionalities like decentralized storage, consensus, and data availability services. Participants must complete at least 20 transactions, stay active for three days, and interact with features like swaps, storage scans, and NFT minting.

“Interact with the OG Labs Testnet and Become Eligible for the Airdrop,” crypto researcher Guatamgg stated.

Additionally, users can boost eligibility by taking Discord roles such as OGurus or OG Role. These activities involve community contributions and verification steps. This airdrop targets active ecosystem participants, aligning with OG Labs’ emphasis on community-driven development.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Strategic Move for Trump Family in Crypto

Energy infrastructure platform Hut 8 Corp has partnered with US President Donald Trump’s sons, Eric Trump and Donald Trump Jr., to launch American Bitcoin Corp.

The company is dedicated to industrial-scale Bitcoin mining and developing a strategic reserve.

All You Need to Know about American Bitcoin

American Bitcoin’s leadership team includes Mike Ho as executive chair, Matt Prusak as CEO, and Eric Trump as CSO. The Board of Directors comprises Mike Ho, Asher Genoot (also Hut 8 CEO), Justin Mateen, and Michael Broukhim.

According to the announcement, Hut 8 holds an 80% ownership stake in American Bitcoin. This follows the contribution of its ASIC miners to American Data Centers Inc., a company formed by investors including the Trump brothers.

Subsequently, they renamed and relaunched the entity as American Bitcoin. As a new subsidiary focused on industrial-scale Bitcoin mining, this move aims for an efficiency of 50+ EH/s (exahashes per second). Meanwhile, Hut 8 remains the key infrastructure partner, consolidating financials under its brand.

Eric Trump, co-founder and chief strategy officer of American Bitcoin, expressed enthusiasm about the collaboration. He also emphasized the synergy between Hut 8’s operational excellence and shared passion for decentralized finance (DeFi) as a foundation for significant future growth.

“…By combining Hut 8’s proven operational excellence in data centers with our shared passion for Bitcoin and decentralized finance, we are poised to strengthen our foundation and drive significant future growth,” an excerpt in the announcement read, citing Eric Trump.

Donald Trump Jr. highlighted their longstanding commitment to Bitcoin, noting their conviction in Bitcoin personally and through their businesses. He reiterated the opportunity presented by mining Bitcoin under favorable economics and the potential for investors to participate in Bitcoin’s growth through this new platform.

Similarly, Genoot described the launch of American Bitcoin as a pivotal evolution in their platform strategy. By establishing a standalone entity for mining operations, Hut 8 aims to align each business segment with its respective cost of capital. Specifically, they would create two focused yet complementary companies.

Meanwhile, this venture is part of the Trump family’s broader engagement in the crypto industry. World Liberty Financial, the crypto venture linked to the Trump family, recently launched USD1. US treasuries, dollars, and cash equivalents back the stablecoin. The venture aims to facilitate secure cross-border transactions for investors and institutions.

Furthermore, reports indicate that the Trump family is discussing acquiring a stake in Binance.US. This is the American arm of the world’s largest cryptocurrency exchange, Binance. Given the family’s growing involvement in the sector, such an investment could significantly influence the crypto market.

These initiatives reflect the Trump family’s commitment to positioning the US at the forefront of the crypto industry. It also aligns with President Donald Trump’s ambition to establish the US as a global leader in digital assets.

“While people are worrying about the daily price action, President Trump and Eric Trump are building the infrastructure to take crypto to the next level,” crypto investor Gordon noted.

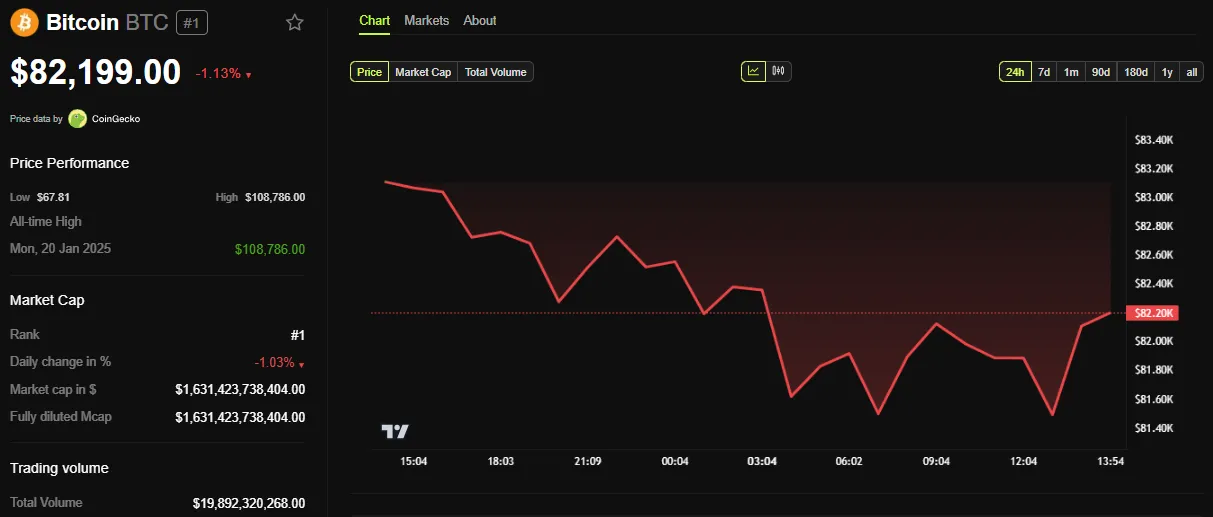

BeInCrypto data shows BTC was trading for $82,199 as of this writing. It is down by over 1.13% in the last 24 hours, unmoved by news of American Bitcoin. However, this could change once US markets open.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoWhales Accumulate 470,000 Ethereum In One Week – Bullish Momentum Ahead?

-

Regulation21 hours ago

Regulation21 hours agoJapan Set To Classify Cryptocurrencies As Financial Products, Here’s All

-

Market23 hours ago

Market23 hours ago3 Token Unlocks for April: Parcl, deBridge, Scroll

-

Market20 hours ago

Market20 hours agoTop 3 Made in USA Coins to Watch This Week

-

Market19 hours ago

Market19 hours agoSolana (SOL) Price Risks Dip Below $110 as Bears Gain Control