Regulation

Former SEC Official Asks Gary Gensler To Resign, Here’s Why

Gary Gensler, the current Chair of the U.S. Securities and Exchange Commission (SEC), has recently come under renewed scrutiny. Former SEC official John Reed Stark publicly suggested that Gensler should step down to allow for a new direction regarding cryptocurrency regulation. Stark’s comments follow Donald Trump’s 2024 presidential election victory, with some analysts speculating that a leadership change may soon take place.

Ex-SEC Official John Reed Stark Calls for Gensler’s Resignation

John Reed Stark, who formerly served with the SEC, has urged Chair Gary Gensler to resign. The former SEC official emphasized the need to halt ongoing crypto-related investigations and policy initiatives. Stark proposed that SEC staff compile a comprehensive list of all active cryptocurrency cases to ease the transition for any incoming chair.

This recommendation aligns with a perceived shift in public sentiment regarding regulatory practices, John Reed Stark added,

“Like it or not, the people have spoken and their will must be respected.”

Stark’s statement comes amid heightened debate over the SEC’s stance on digital assets. Over the past few years, the agency has implemented stringent measures on various cryptocurrency entities and has frequently engaged in litigation to enforce compliance. Stark’s call reflects a growing sentiment among industry stakeholders who seek a balanced regulation approach under new leadership.

Will Gary Gensler Resign This Week? Who’s Next Chair?

In light of the recent concerns, XRP attorney James Murphy has also predicted that Gary Gensler may step down soon. Murphy pointed out a historical pattern where SEC chairs often resign following a new presidential administration. For instance, Mary Jo White’s departure in 2016 after Trump’s first election and Jay Clayton’s exit in 2020 after Biden’s win.

Murphy’s observations suggest that Gary Gensler may follow suit as the new administration begins.

Richard Farley, a Wall Street lawyer with extensive experience in finance, has emerged as a potential candidate for SEC Chair under the incoming administration. Farley is known for his work with financial institutions like Goldman Sachs and UBS. More so, his legal expertise aligns with a potential shift towards a more crypto-friendly SEC. Farley’s appointment would signal a policy shift, with a likely emphasis on fostering balanced approach to crypto regulation.

This potential appointment underscores Trump’s intention to take a different approach to digital assets.

In addition, as Trump assembles his new administration, insiders reveal that the President-elect is inclined to let Jerome Powell complete his term as Federal Reserve Chair, which runs until May 2026. Although Trump has previously criticized Powell, his decision to retain Powell would ensure continuity in monetary policy.

In recent reports, another pro-crypto figure, CEO of Cantor Fitzgerald, Howard Lutnick, is considered a leading candidate for the role of U.S. Treasury Secretary under President-elect Donald Trump. Known for his support of Tether, Lutnick is actively lobbying for the position, intensifying speculation about Trump’s pro-Bitcoin administration.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

US SEC Drops Charges Against Hawk Tuah Girl Hailey Welch

Hawk Tuah girl Hailey Welch, known for her association with the controversial $HAWK token, has been cleared of any wrongdoing after a lengthy investigation by the U.S. Securities and Exchange Commission (SEC). The SEC has decided not to press charges against Welch in connection with the rapid rise and subsequent collapse of the meme-based cryptocurrency.

US SEC Investigation Into Hawk Tuah Girl Concludes Without Charges

The SEC had launched an investigation into the $HAWK token after its dramatic price drop. The token, which was linked to Welch’s viral persona, initially saw a market cap surge to $490 million before crashing by over 90%. Investors who were impacted by the crash filed a lawsuit against those behind the project, alleging that the coin had been promoted and sold without proper registration.

Hawk Tuah girl Hailey Welch, who cooperated fully with the investigation, expressed relief after the SEC’s decision. “For the past few months, I’ve been cooperating with all the authorities and attorneys, and finally, that work is complete,” Welch told TMZ.

Her attorney, James Sallah, confirmed that the SEC had closed the case without any findings against her, adding that there would be no monetary sanctions or restrictions on Welch’s future involvement in cryptocurrency or securities.

This Is A Developing News, Please Check Back For More

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

Sonic Labs To Abandon Plans For Algorithmic USD Stablecoin, Here’s Why

Barely a week after hinting at launching an algorithmic USD stablecoin, Sonic Labs is shuttering its plans. Sonic Labs co-founder Andre Cronje revealed that incoming stablecoin regulation in the US contributes to the change of stance.

Sonic Labs Makes U-Turn Over Algorithmic USD Stablecoin

In mid-March, Sonic Labs disclosed plans for a yield-generating algorithmic stablecoin for its blockchain. However, new developments in the US regulatory landscape are forcing the company to ditch its algorithmic stablecoin ambitions.

Sonic Labs co-founder Andre Cronje confirmed the change in direction via an X post following the release of the full draft of the STABLE Act by Congress for clearer oversight. According to the text, lawmakers are pushing for a two-year moratorium on algorithmic stablecoin, souring Sonic Labs plans.

Unlike mainstream stablecoins backed by fiat or other commodities, algorithmic stablecoins rely on smart contracts to maintain their peg. The 2022 implosion of Terra’s ecosystem following the de-pegging of its TerraUSD (UST) algorithmic stablecoin stunned regulators.

“We will no longer be releasing a USD-based algorithmic stablecoin,” said Cronje.

In a light-hearted note, community members teased potential strategies for Sonic Labs to sidestep incoming stablecoin regulation. Apart from the loophole of launching the algorithmic stablecoin before the regulation goes live, Cronje teased an algorithmic dirham that will be denominated in USD.

Industry Players Are Bracing For New Stablecoin Regulations

Stablecoin issuers are steeling themselves for incoming stablecoin regulations in the US. While the GENIUS Act and STABLE Act continue to inch forward, there are common denominators in both bills.

For starters, there is the requirement for equivalent reserves at a 1:1 ratio with both bills steering clear of algorithmic stablecoins. The White House is favoring the GENIUS Act over the STABLE Act as lobbyists rally to stifle the possibility of a Conference Committee.

Authorities are targeting stablecoin regulation to reach Trump in two months as issuers jostle for position. Tether, Circle, and Ripple are staking their claims to lead the US government’s ambitions to rely on stablecoins to maintain the dollar’s dominance.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

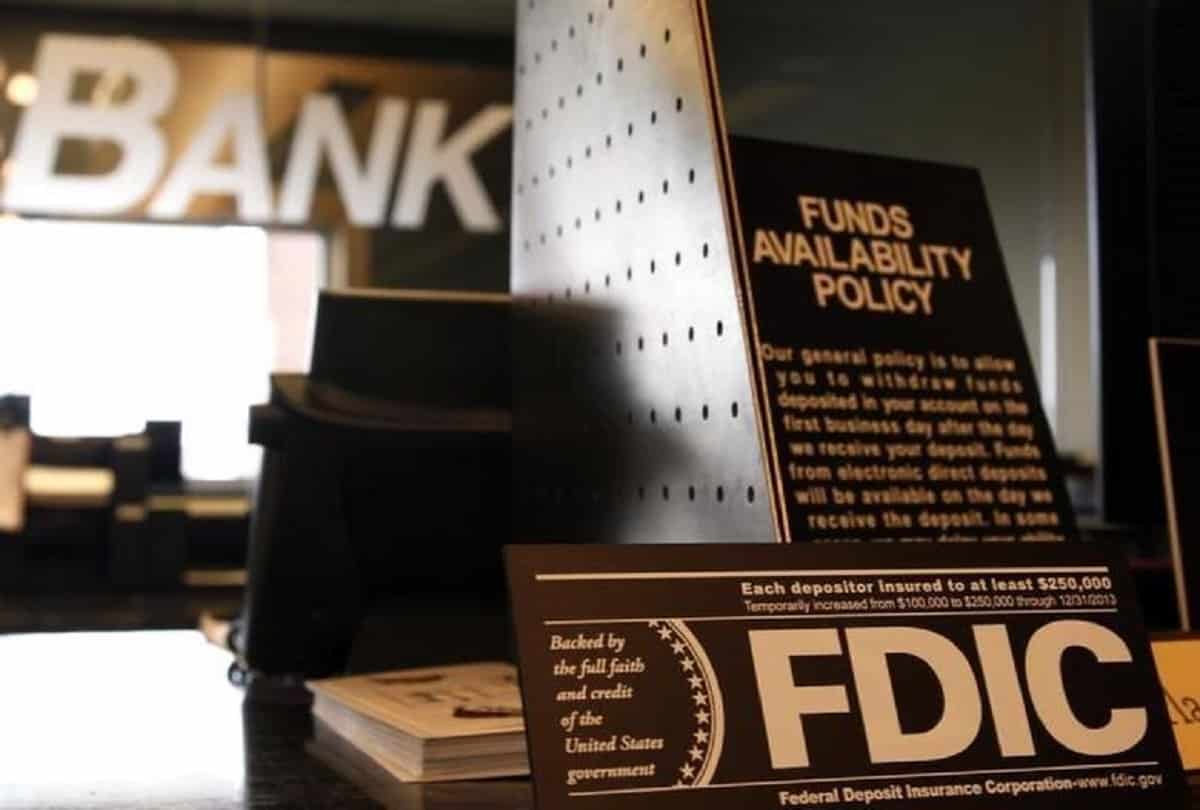

FDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

The Federal Deposit Insurance Corporation (FDIC) has updated its guidelines, enabling banks to engage in cryptocurrency-related activities without seeking prior approval. This new policy shift signals a change in the FDIC’s approach to the growing role of digital assets in the banking sector.

New FDIC Guidelines on Crypto-Related Activities

The FDIC has issued a new Financial Institution Letter (FIL-7-2025), which provides updated guidance for banks looking to engage in cryptocurrency activities. The new guidance rescinds the previous policy set out in FIL-16-2022, which required banks to notify the FDIC before engaging in such activities.

Under the new rules, banks can now participate in permissible crypto-related activities without waiting for FDIC approval, as long as they manage the risks appropriately.

This change is seen as a shift in the FDIC’s stance, following the agency’s earlier stance that required prior approval for crypto engagements. FDIC Acting Chairman Travis Hill expressed that this new approach aims to establish a more consistent framework for banks to explore and adopt emerging technologies like crypto-assets and blockchain.

“With today’s action, the FDIC is turning the page on the flawed approach of the past three years,” said Hill in a statement.

This Is A Developing News, Please Check Back For More

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Regulation21 hours ago

Regulation21 hours agoFDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

-

Altcoin24 hours ago

Altcoin24 hours agoDogecoin Price Set To Reach $1 As Once In A Year Buy Opportunity Returns

-

Regulation24 hours ago

Regulation24 hours agoAVAX Price Eyes Rally To $44 As Grayscale Files For Avalanche ETF

-

Altcoin23 hours ago

Altcoin23 hours agoTRUMP Crypto Whale Incurs Massive $15M Loss Amid Price Slump, Here’s How

-

Market22 hours ago

Market22 hours agoPopular Analyst Peter Brandt Identifies XRP Head & Shoulder Pattern, Reveals Path To Take

-

Market21 hours ago

Market21 hours agoWhat to Expect from XRP Price in April 2025

-

Market16 hours ago

Market16 hours agoWhy Did MUBARAK Drop 40% Despite Binance Listing?

-

Altcoin21 hours ago

Altcoin21 hours agoShiba Inu Price Set To Repeat History? Falling Wedge Pattern Shows A Rally

✓ Share: