Market

Linea Network Moves Toward Community Control with 2025 TGE

Consensys has unveiled a plan to transfer governance of its Linea network to its community.

This decentralization process begins with the creation of the Switzerland-based Linea Association, which will guide Linea’s shift into a fully community-driven ecosystem. A token generation event (TGE) is slated for Q1 2025.

Linea’s Community-Driven Governance and Phased Transition

Linea’s founder, Nicolas Liochon, explained that Consensys views decentralization as a “multidimensional approach” that goes beyond technical changes.

Linea’s transition includes inviting new teams, like Status, which developed the Nimbus client and secured 10% of Ethereum’s Proof-of-Stake network. Liochon emphasized that updates, proposals, and community feedback will be pivotal as they prepare for the TGE.

“For Linea, this means decentralizing technical aspects, starting with sequencer decentralization, and opening team participation to diverse contributors,” Liochon told BeInCrypto.

Consensys aims for a phased approach to governance decentralization. To support this transition, the newly formed Linea Association will temporarily oversee governance until the network is fully ready to shift control to the community.

While decentralizing Linea’s governance, Consensys also plans to maintain strong links with its flagship platforms, MetaMask and Infura. Joe Lubin, Consensys’ Founder and CEO, stated that Linea’s MetaMask integration will help them onboard new users.

“Our initial use cases include MetaMask Card payments and identity projects through attestation registries like Verax,” Lubin told BeInCrypto.

Consensys’s partnerships, including over 420 collaborating entities, combined with MetaMask integration, aim to support Linea’s framework. The team will also integrate MetaMask features such as Embedded Wallet, Portfolio, Push Notifications, and dApp discovery into Linea’s tools.

In June, a security incident prompted the crypto community to weigh in on Linea’s L2 solution’s perceived readiness to decentralize. Following a security breach on Velocore, a decentralized exchange (DEX) using Linea, $2.6 million was transferred to an undisclosed bridge service. In response, Linea promptly halted its sequencer to contain the breach.

“Linea’s goal is to decentralize our network – including the sequencer. When our network matures to a decentralized, censorship-resistant environment, Linea’s team will no longer have the ability to halt block production and censor addresses – this is a primary goal of our network,” the team responded on X.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Artificial Intelligence Coins on the Rise: TFUEL, ZIG, and AKT

Artificial Intelligence (AI) is now the most dominant narrative in crypto, and some coins are capitalizing on it. TFUEL is nearing a $500 million market cap after an 18% rise in the last seven days, though it remains far below its 2021 peak. ZIG, up 15% in the past week, is closing in on its all-time high, fueled by strong market interest and its growing $200 million market cap.

Meanwhile, AKT, the fifth-largest AI-focused coin, has gained 22% this week and is on the verge of breaking the $1 billion market cap, highlighting its strong momentum and expanding role in decentralized cloud computing.

Theta Fuel (TFUEL)

TFUEL is the coin of Theta Network, a blockchain-powered video streaming platform. Its approach aims to lower streaming costs while improving content quality and expanding distribution reach.

TFUEL has gained 18% in the past seven days and is now approaching the $500 million market cap. Despite this recent growth, the altcoin remains significantly below its 2021 all-time high, sitting at just one-tenth of that peak value. This highlights both its potential for recovery and the challenges it faces in regaining former levels.

TFUEL’s RSI is currently at 50, indicating neutral momentum where neither buyers nor sellers dominate. If the uptrend gets strong again, it could rise to test $0.080 and potentially reach $0.1. However, if the trend is reverted, it could go down as much as $0.054 or even $0.047.

ZIGDAO (ZIG)

ZIGDAO, formerly known as Zignaly, is a platform designed to enable crypto copy trading with artificial intelligence. It allows users to invest in digital assets by following the strategies of top managers and funds.

ZIG is currently 20% below its all-time high but may be gearing up to test it again. The coin has recently surpassed a $200 million market cap and is up 15% over the last seven days.

If the uptrend remains strong, ZIG could break past its all-time high, surpassing $0.19. However, a reversal in market sentiment could see the coin testing its support at $0.127. If that level fails, ZIG may face a deeper correction, potentially dropping to $0.081.

Akash Network (AKT)

Akash Network is a decentralized, open-source cloud computing platform designed to connect those in need of computing power with providers offering cloud resources using artificial intelligence.

AKT, Akash’s native token, is currently the fifth-largest AI-focused coin in the market and is approaching a $1 billion market cap. With a 22% gain over the past seven days, AKT has demonstrated strong momentum, positioning itself for potential further growth as it eyes this significant milestone in the coming weeks.

If the uptrend continues, AKT could test resistance at $4.71 and possibly push toward $5 for the first time since May 2024. However, if market sentiment shifts and the trend reverses, AKT may face downward pressure, testing support levels at $2.87 and $2.43.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump Taps Pro-Crypto Scott Bessent for Treasury Secretary Role

Donald Trump, the President-elect of the United States, has nominated Scott Bessent as Treasury Secretary for his administration. This decision has generated enthusiasm in the emerging industry due to Bessent’s pro-crypto reputation.

Bessent and Cantor Fitzgerald CEO Howard Lutnick had been considered strong favorites for the position. However, Lutnick was eventually nominated as Commerce Secretary.

Crypto Industry Welcomes Scott Bessent’s Nomination for Treasury Secretary

In a November 22 announcement on Truth Social, Trump praised Bessent as the ideal candidate to support his administration’s economic goals. The President stated that Bessent will play a pivotal role in strengthening the US economy, fostering innovation, and maintaining the dollar’s status as the global reserve currency.

“Scott will support my policies that will drive US competitiveness, and stop unfair trade imbalances, work to create an economy that places growth at the forefront, especially through our coming world energy dominance,” Trump added.

Wall Street veteran Bessent, who founded the international macro investment company Key Square Group, brings extensive experience to the role. He had previously served as the chief investment officer for the prominent investor George Soros.

While President Trump’s announcement did not directly reference cryptocurrencies, many in the digital asset space view Bessent’s appointment as a positive sign. In past statements, Bessent has described crypto as a symbol of financial freedom. He also called Bitcoin an alternative investment for younger investors disillusioned with the traditional financial system.

“I have been excited about the president’s embrace of crypto and I think it fits very well with the Republican Party, crypto is about freedom in the crypto economy is here to stay,” Bessent stated.

His pro-crypto stance has led many to believe his leadership could encourage a more balanced approach to digital asset regulation. This would contrast with the outgoing administration’s enforcement-heavy tactics, such as its controversial sanctions on decentralized platforms like Tornado Cash.

Indeed, crypto industry leaders have responded enthusiastically to Bessent’s nomination. Ripple CEO Brad Garlinghouse commended Bessent’s nomination, calling it a win for innovation. He noted that Bessent’s leadership could mark a turning point for crypto-friendly policies in Washington.

Similarly, Kristin Smith, CEO of the Blockchain Association, highlighted the importance of Bessent working with Congress to establish clear regulations, ensure fair tax treatment, and protect self-custody rights for digital assets.

“Critical to this nomination would be working with Congress on a regulatory framework for digital assets, protecting the right to self custody, pushing for clearer tax treatment of digital assets, and working closely with industry experts to protect our nation’s security,” Smith remarked.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will the Cardano Coin Price Rally Continue?

ADA, the native coin of the Cardano blockchain, has made a significant price breakthrough. It has surpassed the $1 mark for the first time in two years. As of this writing, the altcoin trades at $1.09, a price level last observed in April 2022. `

Over the past 24 hours, ADA’s price has rocketed by 24%, and its trading volume has increased by 131% during the same period. With heightening buying pressure, the Cardano coin price rally is poised to continue.

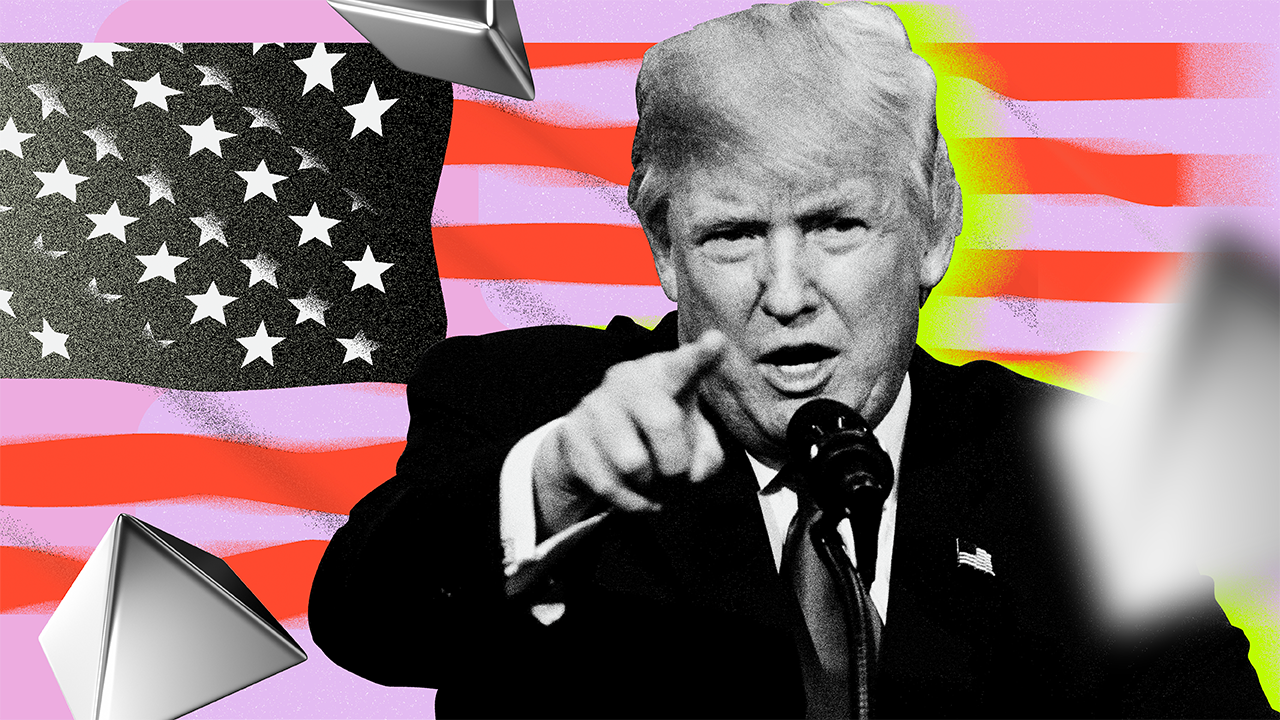

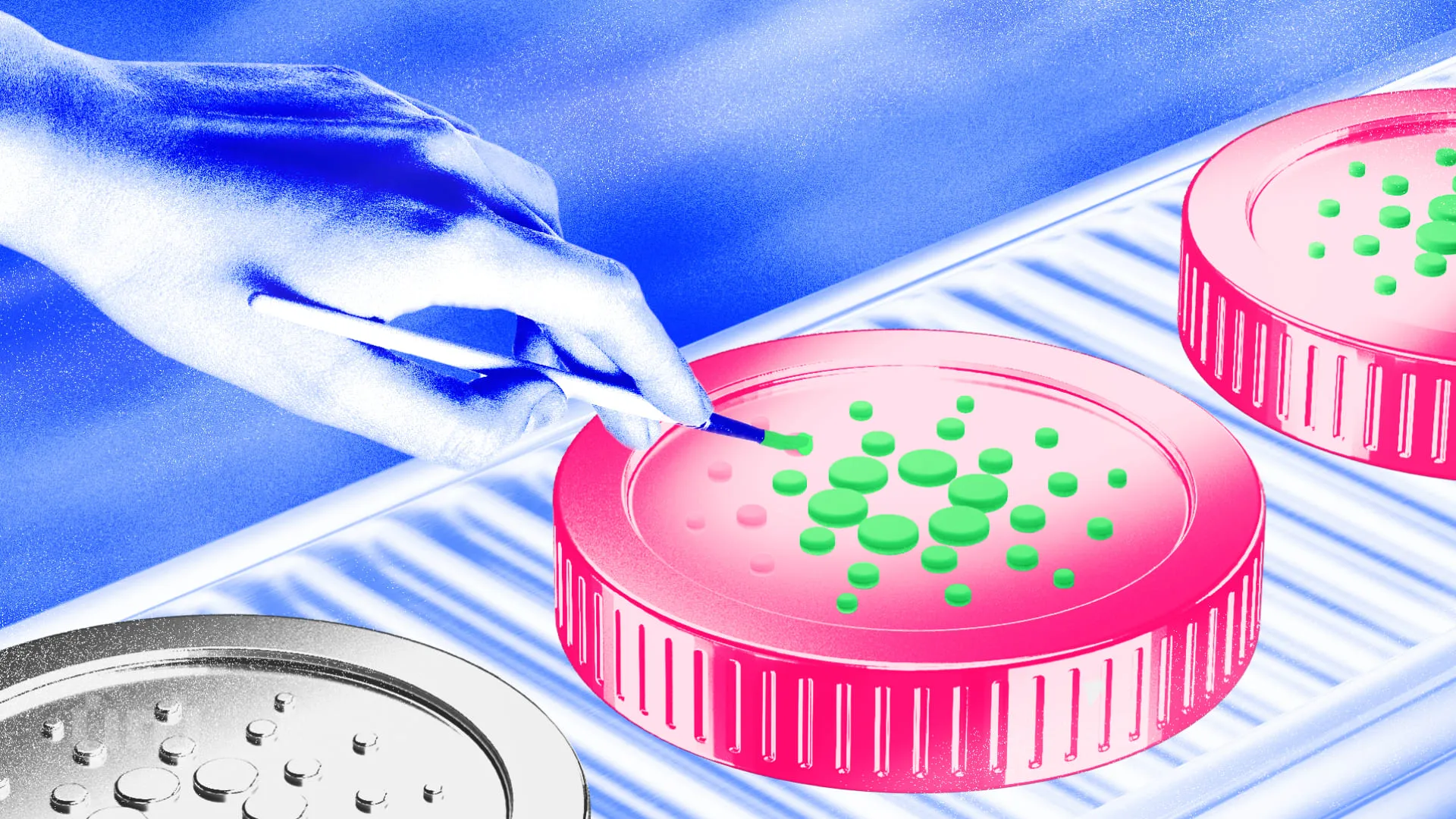

Cardano Holders See Green

Cardano’s ascent above the $1 price mark has put many of its holders in profit. According to IntoTheBlock’s Global In/Out of the Money indicator, 3.15 million addresses, which comprise 71% of all ADA holders, are “in the money.”

An address is said to be “in the money” if the current market price of the asset it holds is higher than the average cost at which the address acquired those tokens. This means the holder would profit if they sold their holdings at the current market price.

Conversely, 715,230 addresses, which comprise 16% of all ADA holders, are “out of the money.” These addresses would incur a loss if they sold at the current price. Per IntoTheBlock’s data, this cohort of investors acquired their coins when ADA sold above $1.40.

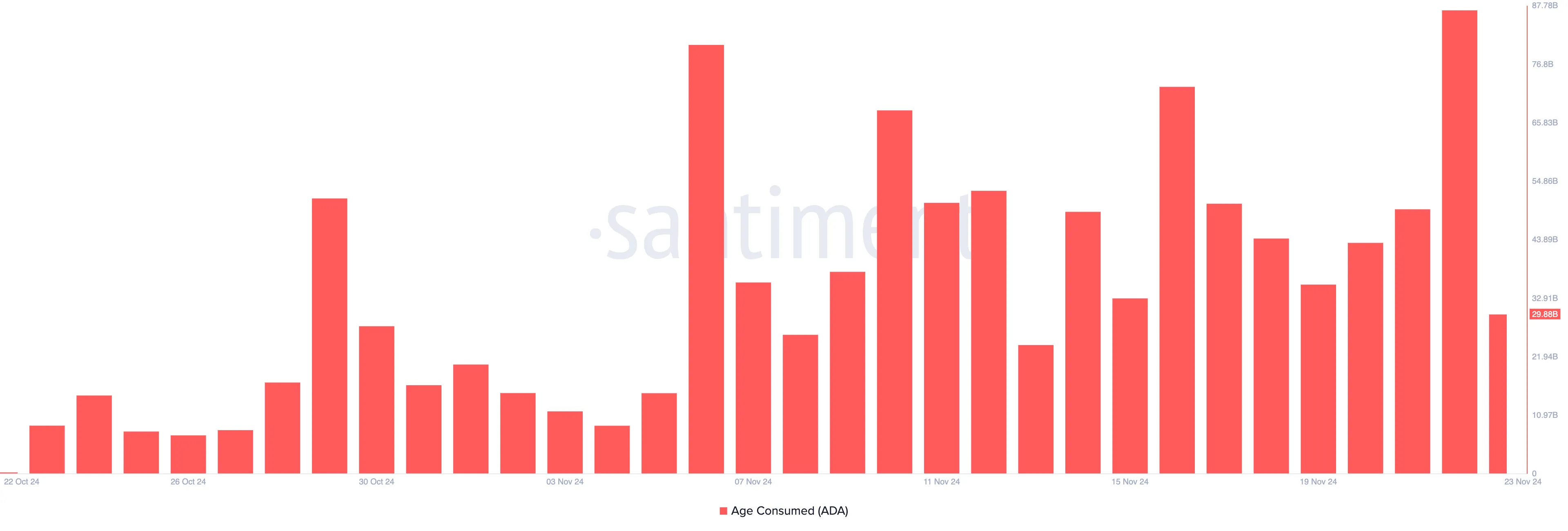

Notably, with many addresses now holding unrealized profits, long-term holders (LTHs) of ADA are repositioning, potentially to secure gains. This activity is reflected by the spike in ADA’s age-consumed metric, which, per Santiment’s data, skyrocketed to a monthly high of 86.91 billion on November 22, when the uptrend began.

This surge is notable because long-term holders rarely move their coins around. When they do, it often hints at a shift in market trends. Therefore, as in ADA’s case, if the spike is accompanied by increased trading volume and positive price action, it suggests that long-term holders are taking profits. This may fuel further price increases as new buyers enter the market.

ADA Price Prediction: The Upward Trend Is Strong

On the daily chart, ADA’s Aroon Up Line is at 100%. The Aroon indicator measures the strength and direction of a trend. When the Aroon Up line is at 100%, it indicates a strong upward trend, suggesting a recent high and a potential continuation of the bullish momentum.

If this holds and new demand continues to enter the market, the Cardano coin price rally will continue toward $1.24, a price high it last reached in March 2022.

On the other hand, if profit-taking intensifies and buying pressure weakens, ADA’s price may fall to retest support at $1. Should this level fail to hold, the downtrend will be confirmed, and ADA’s price will plunge to $0.85.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation18 hours ago

Regulation18 hours agoUS SEC Commissioner Jaime Lizárraga to resign in January

-

Market23 hours ago

Market23 hours agoInvestors Says Rally Is Not Over

-

Altcoin23 hours ago

Altcoin23 hours agoDeribit To Integrate Ethena USDe As Crypto Margin Collateral

-

Market22 hours ago

Market22 hours agoGensler’s Exit, Bitfinex Hack, Bitcoin in the US

-

Blockchain21 hours ago

Blockchain21 hours agoSui and Franklin Templeton Team Up To Drive DeFi Adoption: Details

-

Market21 hours ago

Market21 hours agoAltcoins Trending Today — November 22: MYTH, MAD, MODE

-

Market20 hours ago

Market20 hours agoSui Partners with Franklin Templeton for Blockchain Development

-

Regulation20 hours ago

Regulation20 hours agoBlockchain Association Outlines 5 Crypto Priorities For Donald Trump’s Administration