Market

Farm Free ADIX, FXAS, and More

As Bitcoin (BTC) eyes further gains, with potential to hit $90,000, traders and investors remain optimistic. Amid this bullish sentiment, several crypto airdrops offer lucrative opportunities with minimal investment.

These airdrops distribute free tokens to attract new users and expand communities. For crypto enthusiasts, the following airdrops present a chance to earn new tokens and engage with emerging projects.

ADLTIX

ADLTIX offers a novel artificial intelligence (AI) platform designed to transform data into actionable insights. With up to 125,000 ADIX tokens to be airdropped, this Telegram bot project’s airdrop started in August and will end on November 20.

“Participate in our airdrop and share 125,000 ADIX tokens by completing tasks. Rewards were distributed around Nov 20. 1000 lucky participants will win! Top 200 referrals get extra ADIX tokens,” ADLTIX noted.

Fortified X

Fortified X is a novel blockchain project focused on enhancing the security and accessibility of decentralized finance (DeFi) assets. Starting in September, this Telegram bot’s airdrop climaxes on November 20, with up to 217,500 FXAS tokens to be allocated.

Notably, the airdrop will take place five days before the project’s public sale, strategically positioning airdrop farmers for possible gains during the IPO.

“The FXAS Public Sale is happening on 25th Nov 2024,” Fortified X shared recently.

As the countdown continues, Fortified X indicated that top-tier KOLs back the imminent launch, bringing massive support and hype to its public sale.

Renewable Energy Ventures

Leading the clean energy revolution, this project aims to drive sustainable solutions while pushing the boundaries of crypto innovation. The Renewable Energy Ventures (REV) airdrop, set to end on November 22, will distribute up to 100,000 REV tokens. To participate, users must submit their Ethereum wallet addresses via the Gleam page and can earn additional points by referring friends.

The project is also running a referral program until Thursday, November 14, offering rewards for participants. However, it has issued a warning against any fraudulent activity, emphasizing the importance of fair participation.

“Referrals will be monitored, and any form of cheating, like bot entries or duplicate accounts, will result in immediate disqualification, and a ban from the community. Violators will lose access to all future events and campaigns,” an official post on X read.

DeusWallet

DeusWallet is a multi-currency crypto wallet that combines advanced security features with comprehensive DeFi functionality. The project confirmed its airdrop after launching a prize distribution campaign with a substantial $250,000 reward.

“The campaign rewards users based on their blockchain activity and wallet usage, with prizes distributed proportionally to participants’ involvement,” DeusWallet said.

The distribution event is scheduled to conclude on December 25, when the project will reveal the winners and distribute the rewards within 24 hours. Meanwhile, to participate in the DeusWallet airdrop, participants must share a screenshot from the ‘Receive’ menu.

Participants are also eligible for maximized rewards when they maintain a higher balance in their DeusWallet to increase potential prize share. The reward system considers balances when calculating prize distributions. Users can also employ multiple addresses and join the project’s referral program.

“Earn a 10% bonus based on your referees’ prize balances,” it said.

Loop

Loop also confirmed its airdrop as it presents a dedicated lending market for Ethereum carry trades. The project is running a points program for its users, incentivizing them to lock their Ethereum (ETH), or liquid restaking tokens (LRT), into the protocol.

This crypto airdrop project announced that at its token generation event (TGE), 7% of the tokens will be airdropped with a linear conversion among all participants.

“At TGE, 7% of the supply will be distributed among the participants depending on the number of points earned,” Loop said.

Participants can also refer their friends to earn 20% of the points (Quaaloops) given to the depositor.

Swing.xyz

Swing.xyz airdrop is slated for some time in the fourth quarter (Q4). Airdrop farmers interested in Swing can acquire points by using the Swing protocol through Galaxy Exchange. The accumulation of points is achieved through a variety of activities, including making Swaps and Bridge transfers. Users can also perform quests and refer friends.

Further, the launch of Swing points is the primary method for transferring power to the community over time. It serves as a distribution channel, enabling everyone to actively contribute and participate in future Swing governance.

zkFinance

This is an all-in-one DeFi solution for zkSync, offering lending and borrowing, bridge, cross-chain swaps, and concentrated liquidity.

Standing among the top eight crypto airdrops to watch this week, zkFinance plans to distribute 20 million ZGT tokens over the course of 100 days. With this, 200,000 ZGT tokens are distributed daily for participants who supply or/and borrow a minimum of $200.

Some users have compared the zkFinance airdrop to Scroll, with the former said to be presenting better prospects.

“Zksync airdrop 17.5% launch at $7 billion fully diluted valuation (FDV) and now Scroll airdrop only 5% but $1 billion FDV. Even your first airdrop is lower than the incentive next coming from zkSync. I’m going to move my asset back to ZK,” wrote Justin Ng.

Stacking DAO

This is the leading liquid staking protocol (LSP) and the largest DeFi app on the Stacks blockchain. STX stacking is made easy by providing access to stacking yields up to 10% and unlocking STX liquidity to earn more rewards across DeFi.

“…250k Jindo tokens were airdropped to Stacking DAO and Zest depositors. Textbook play of how to tap into established Stacks DeFi communities and generate awareness,” the project shared recently.

Even as the project runs its airdrop, it is worth noting that users in the USA are not eligible for this and are barred from participating.

While these are some of the best upcoming airdrops, investors should conduct thorough research when choosing which projects and opportunities to farm.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Cash (BCH) Price Up, Leads Daily Gains

Bitcoin Cash (BCH) price has risen more than 10% in the last 24 hours, surpassing the $10 billion market cap and signaling renewed bullish momentum. The recent surge has brought BCH closer to key resistance levels, indicating the potential for further gains if the uptrend strengthens.

However, indicators like the RSI and ADX show that while the trend is improving, it is not yet fully strong. Whether BCH can sustain its upward momentum or face a pullback will depend on how it navigates critical resistance and support levels in the coming days.

BCH Current Uptrend Is Getting Stronger

BCH currently has an ADX of 19.31, up from 12 just a day ago. This increase indicates that the strength of the trend is gradually gaining momentum after being weak.

However, since the ADX is still below 25, it suggests that the uptrend has not yet reached a strong or sustained level of trend strength.

The ADX measures the strength of a trend, with values above 25 indicating a strong trend and below 20 indicating a weak or uncertain trend. While Bitcoin Cash is currently in an uptrend, the ADX at 19.31 suggests that the trend is still in its early stages of strengthening.

If the ADX continues to rise above 25, it could confirm a stronger uptrend, but for now, Bitcoin Cash price movement remains cautious, with room for further development.

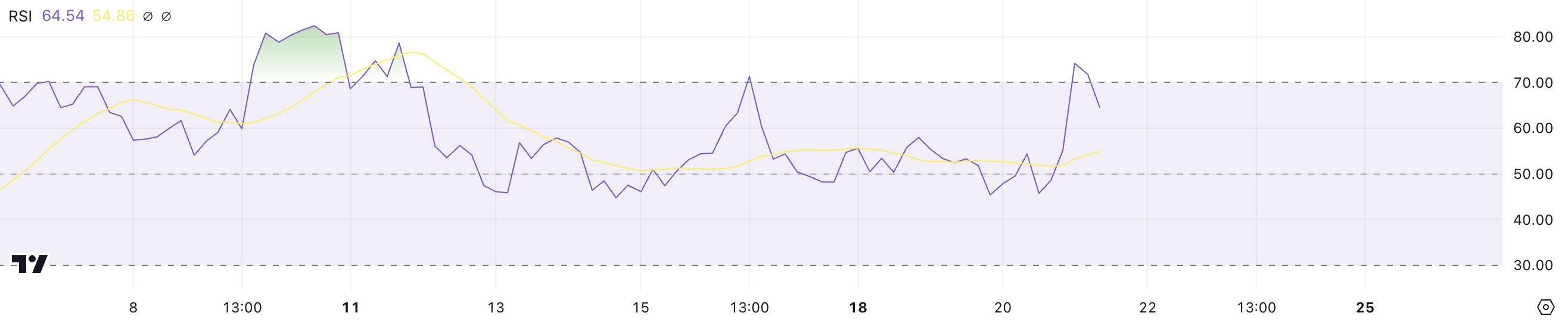

Bitcoin Cash Is Not In The Overbought Zone Anymore

Bitcoin Cash has an RSI of 64.5, down from over 70 just a day ago. This decline suggests that while the asset is still experiencing bullish momentum, the intensity of buying pressure has started to decrease.

The drop below 70 takes BCH out of the overbought zone, indicating a more balanced market sentiment.

The RSI measures the speed and magnitude of price changes, with values above 70 indicating overbought conditions and below 30 signaling oversold levels. At 64.5, BCH remains in bullish territory, which supports the ongoing uptrend.

However, the slight decline in RSI could mean the pace of gains is moderating, potentially leading to BCH price consolidation before any further upward movement.

BCH Price Prediction: Will a New Surge Occur Soon?

If BCH maintains its current uptrend and gains additional momentum, it could continue its rise after climbing more than 10% in the last 24 hours.

This strength could push BCH price to test the resistance at $536.9. Breaking this level would signal a continuation of bullish momentum and could attract further buying interest.

On the other hand, if the uptrend fades away and reverses, BCH price could retrace to test the nearest support levels at $424 and $403. If these supports fail to hold, the price could fall further to $364, representing a potential 27% correction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Custodia Bank to Retrench Staff Again Amid Regulatory Heat

Wyoming-based crypto bank Custodia is reportedly deliberating more layoffs as it braces for ongoing regulatory scrutiny under the Biden administration. The decision comes as the crypto sector faces unprecedented challenges, including de-bankings and increasing pressure from US regulatory agencies.

Meanwhile, cryptocurrency market participants remain hopeful of a better regulatory environment amid expectations of policy shifts with the incoming Donald Trump administration.

Custodia Banks Plans More Layoffs Amid Regulatory Pressure

Custodia Bank might enact more layoffs after retrenching 25% of its staff in August. This comes as the digital asset-focused bank continues to devote resources to its ongoing lawsuit with the Federal Reserve (Fed), which denied the lender a master account last year.

“Fox Business has learned that Wyoming-based crypto bank Custodia Bank will implement further layoffs in order to preserve capital,” Fox Business correspondent Eleanor Terrett reported.

The bank did not immediately respond to BeInCrypto’s request for comment on the supposed layoffs. Early in 2023, Custodia Bank was denied a master account, which would give it access to the Fed’s liquidity facilities. The lawsuit challenges this denial.

Custodia Bank has been trying to conserve capital as it continues its legal battle against the Fed. During its last layoffs three months ago, the company’s founder and CEO Caitlin Long attributed the retrenchments to “right-sizing.” She said it was necessary to maintain operations while preserving capital during the lawsuit against the Fed.

Long also indicated that the efforts could continue “until after Operation Choke Point 2.0 ends,” referring to the alleged ongoing crackdown on digital assets under the Biden administration. Operation Choke Point was the name of an Obama-era effort that “choked off” high-risk industries such as payday lending, gambling, and firearms from banking access.

“I’m incredibly proud of the Custodia team, the services we’re building for our customers and our resilience in the face of repeated de-bankings due to no fault of our own. I especially thank Custodia’s customers and shareholders who have helped us continue the fight for the durability of banking access for the law-abiding US crypto industry,” Terrett added, citing Long.

Noteworthy, oral arguments in the lawsuit will take place on January 21. This will be the day after Donald Trump’s inauguration, following his recent win.

Regulatory Pressures Intensify But There’s Hope for Change Under Trump

Custodia is not alone in struggling against regulatory pressure. The crypto industry at large has recently faced mounting regulatory challenges. High-profile companies like Consensys have also recently announced significant layoffs.

As BeInCrypto reported in late October, the blockchain software firm behind Ethereum infrastructure tools like MetaMask revealed it was cutting 20% of its workforce. Its CEO, Joe Lubin, cited mounting pressure from the US SEC (Securities and Exchange Commission), among other uncertainties in the regulatory space.

“The broader macroeconomic conditions over the past year and ongoing regulatory uncertainty have created broad challenges for our industry, especially for US-based companies,” Lubin shared.

Meanwhile, the Biden administration has been accused of taking an increasingly aggressive stance toward the crypto industry. Among the accusations include enforcing stringent banking restrictions and debankings. Nevertheless, Trump’s recent win and upcoming inauguration reignited hope within the crypto sector for a more supportive regulatory environment.

The hope hinges on the delivery of Trump’s crypto blueprint. Experts believe Trump’s pro-business stance could revive the industry by easing regulatory pressures on crypto.

Brian Armstrong, CEO of Coinbase, has also expressed optimism about a potential shift in regulatory attitudes. Armstrong recently urged the next SEC chair to drop “frivolous cases” against crypto firms and issue a public apology. He slammed the current SEC composition for what he views as overly aggressive enforcement, calling out Gary Gensler.

“The next SEC chair should withdraw all frivolous cases and issue an apology to the American people. It would not undo the damage done to the country, but it would start the process of restoring trust in the SEC as an institution,” Armstrong posted.

Still, Custodia’s ongoing lawsuit is a symbol of the crypto industry’s fight for legitimacy and fair treatment within the financial sector. While the industry’s outlook remains uncertain in the short term, there is cautious optimism that the incoming Trump administration could bring relief to embattled crypto firms.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

As BNB Remains Above $600, Can the Price Climb Higher?

Binance Coin (BNB) has stayed above $600 since November 8 but has struggled to retest $700 or near its all-time high.

This stagnation has left many BNB holders disappointed, raising the question: can BNB reach a new peak?

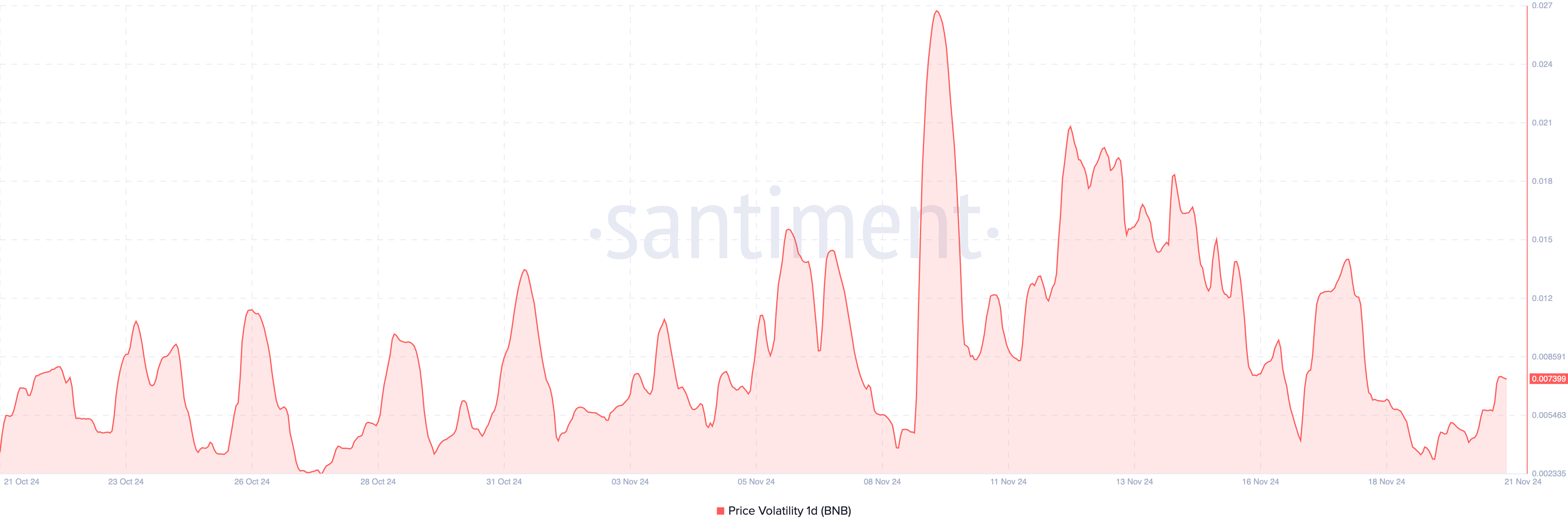

Binance Coin Experiences Low Volatility, Falling Interest

While BNB trades around $612, the volatility around it appears to be the reason why it has remained above $600 but has yet to make another substantial price increase.

When an asset is described as volatile, it means its price experiences significant fluctuations within a short timeframe. High volatility signals greater risk due to unpredictable price swings, but it also offers the potential for higher rewards.

Therefore, if buying pressure increases during high volatility, the asset’s price might increase significantly. If this volatility comes during high selling pressure, the price might tumble significantly.

According to Santiment, BNB’s one-day volatility has declined from its recent peak, suggesting reduced price fluctuations. This drop in volatility could make it difficult for BNB to achieve a notable breakout above the $600 mark, as the market may lack the momentum needed for a significant move.

In addition, Open Interest (OI), a metric that tracks the level of speculative activity around a cryptocurrency, has declined. High OI usually signals increased capital inflows into contracts, often indicating strong buying pressure capable of driving prices upward.

Conversely, a drop in OI reflects reduced liquidity in the market, often associated with selling pressure and a potential price decline. For BNB, the OI has remained relatively stagnant since November 19, indicating that traders are hesitant to inject additional liquidity or take on new contracts.

Further, the OI is notably lower at $532.08 million than on November 14. This lack of speculative activity indicates reduced market momentum, reinforcing the likelihood that BNB’s price will struggle to break above the $600 threshold.

BNB Price Prediction: Drop to $551 Likely

Similar to Open Interest, BNB’s price has followed a consistent trend since July, repeatedly facing resistance around $612. This indicates persistent efforts by bears to prevent the cryptocurrency from challenging its $724 all-time high.

Currently, with BNB trading near the same resistance level, a decline is possible. Historical patterns suggest that if the coin fails to break through, it could retrace to $551, as it did previously.

Similar to Open Interest, BNB’s price has followed a consistent trend since July, repeatedly facing resistance around $612. This indicates persistent efforts by bears to prevent the cryptocurrency from challenging its $724 all-time high.

However, a surge in volatility paired with strong buying pressure could challenge this outlook. In such a scenario, BNB might not stop at holding above $600 but also climb toward $660—or even retest the $724 high.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market10 hours ago

Market10 hours agoThis is Why MoonPay Shattered Solana Transaction Records

-

Regulation15 hours ago

Regulation15 hours agoUS SEC Pushes Timeline For Franklin Templeton Crypto Index ETF

-

Market15 hours ago

Market15 hours agoRENDER Price Soars 48%, But Whale Activity Declines

-

Market19 hours ago

Market19 hours agoArkham Spot Trading Platform Set to Launch in the US Market

-

Regulation14 hours ago

Regulation14 hours agoBitClave Investors Get $4.6M Back In US SEC Settlement Distribution

-

Ethereum7 hours ago

Ethereum7 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Regulation18 hours ago

Regulation18 hours agoDonald Trump’s transition team considering first-ever White House crypto office

-

Market14 hours ago

Market14 hours agoNvidia Q3 Revenue Soars 95% to $35.1B, Beats Estimates