Market

Trump’s Bullish Election, XRP ETFs, and More

This week in crypto, BeInCrypto unpacks everything from Donald Trump’s historic election, its impacts on Bitcoin and SEC Chair Gary Gensler, to new XRP ETF applications amidst institutional support, and a major new upgrade for Cardano.

These chaotic and interrelated developments have spurred bullish sentiment across the entire crypto community.

Cardano’s Node 10.11 Upgrade Opens New Era

On November 1, the Cardano-led member organization Intersect MBO launched the Node 10.11 update. It was the first mainnet update for the platform to support the Chang #2 hard fork. This update offered several major technical and democratic innovations, and will hopefully mark a new era in Cardano’s maturity as an on-chain governance model.

“Following a successful Chang #2 hard fork, decisions on the Cardano blockchain will be shaped and voted on via fully decentralized governance, as detailed in CIP-1694,” Intersect stated.

However, although the community was excited about these decentralization upgrades, it has also taken an increasingly polarized view of Cardano founder Charles Hoskinson. Hoskinson posted a poll via social media, asking, “Is Charles Hoskinson a Cancer for Cardano?” The results were almost a perfect tie, highlighting the community’s mixed views of him.

Grayscale Offers XRP Trust, 21Shares’ ETF Application

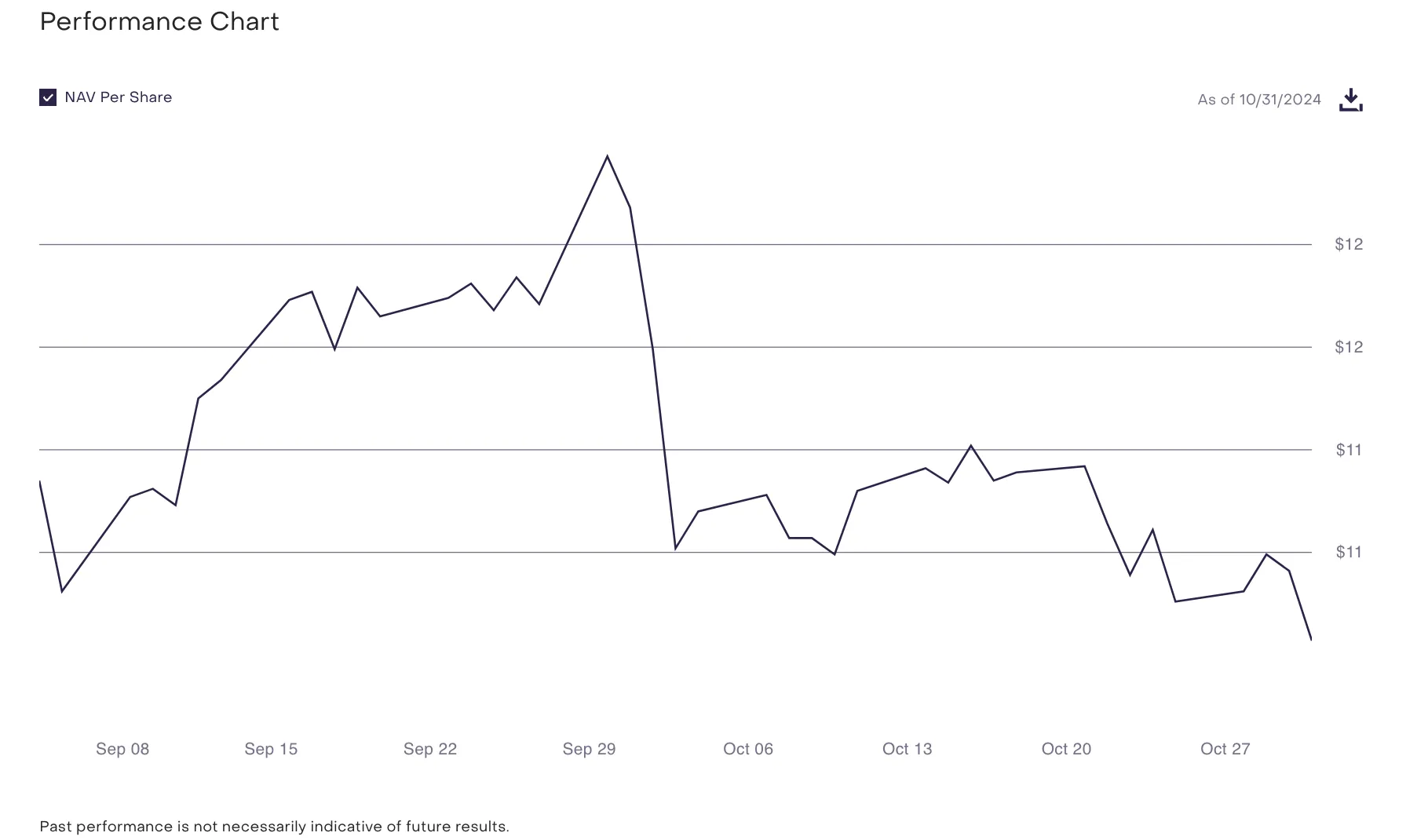

Grayscale, a major ETF issuer, launched trading on a new XRP-based trust fund. This aligns with Grayscale’s previous history of ETFs; namely, its Bitcoin ETF was converted from a similar trust fund. These trusts are legal to sell before official ETF approval, but their market value often suffers when approval takes place. This XRP Trust actually declined when sales went live.

21Shares, a competing ETF issuer, also applied for an official XRP ETF this week. The SEC has yet to officially confirm or reject it, but the race is officially on for a new crypto product. BitWise, too, filed for an XRP ETF, and Ripple CEO Brad Garlinghouse considers an eventual SEC approval “inevitable.”

Bitcoin Hits $77,000 All-Time High After Trump Win

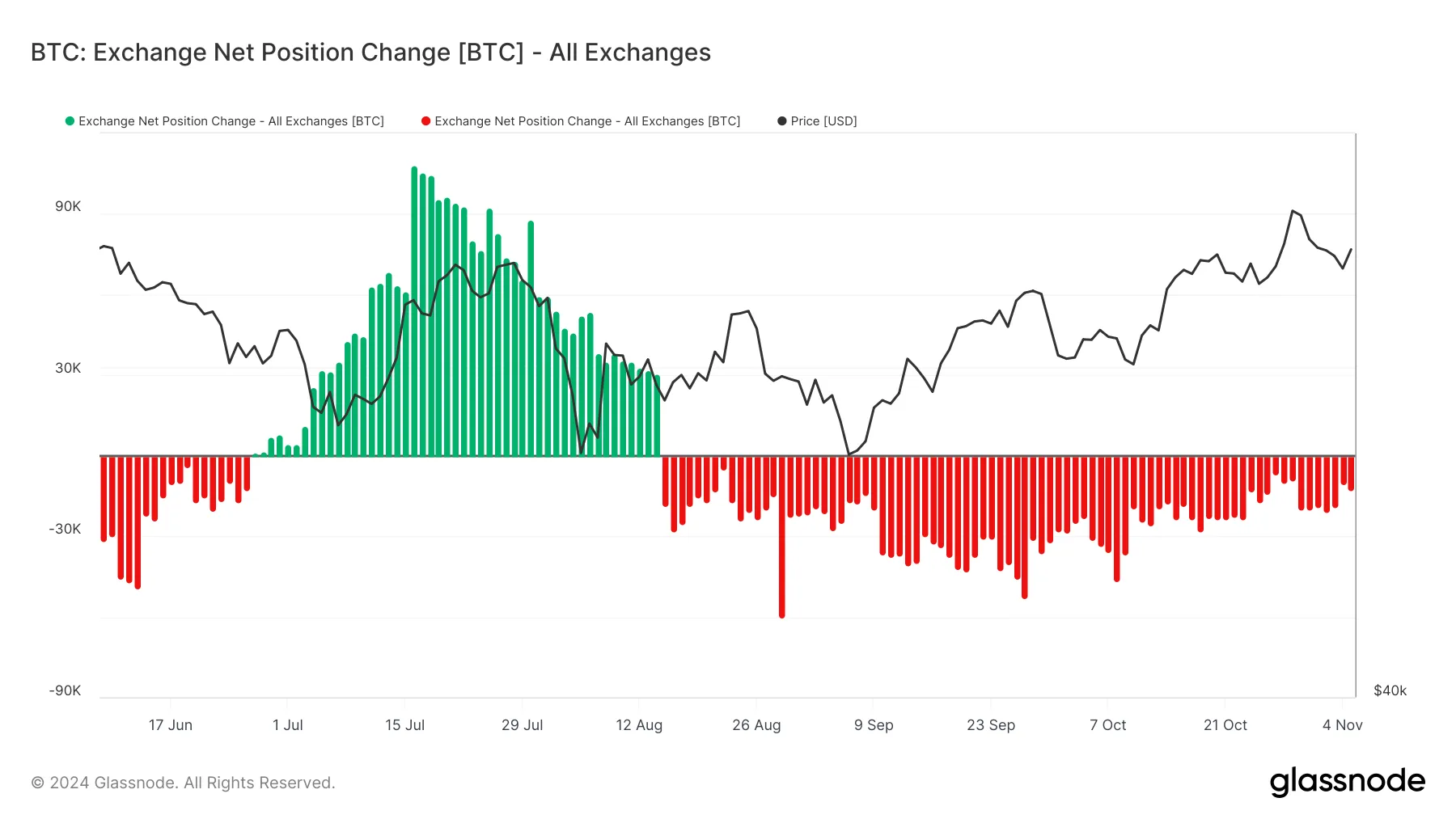

After Donald Trump won the recent Presidential election, Bitcoin reached a new all-time high. Its value jumped to over $75,000 in the immediate aftermath of his victory, and has continued rising to shift around $77,000 Friday. New investor interest in Bitcoin purchases has seen a massive demand on crypto exchanges.

A series of positive factors related to political developments are increasing the bullish case for Bitcoin. Trump’s election also brought heightened gains for risk-on ETF assets, and cryptoassets qualify as risk-on assets. BlackRock’s IBIT has already benefitted from this trend. Additionally, the Federal Reserve cut interest rates by 25 bps, another bullish signal.

Ripple Transactions Boosted By Institutional Demand

Ripple also reported strong growth in Q3 2024, claiming that institutional interest spurred the majority of this action. Major financial institutions like the Chicago Mercantile Exchange began offering XRP offerings, highlighting this acceptance. This trend took place despite regulatory challenges from the SEC, instilling confidence in CEO Brad Garlinghouse.

“The message from the market is clear — institutional interest in XRP products is stronger than ever…The SEC’s war on crypto has lost battle after battle — their continued disregard for the court’s authority will further erode the SEC’s credibility and reputation,” Garlinghouse said.

XRP as a whole enjoyed elevated trade volumes during this period. Average daily volumes on several exchanges consistently remained between $600 and $700 million, with a few outliers going much higher. XRP transaction volumes also nearly doubled, but a large proportion of these were microtransactions. These tiny moves left a reduced impact on total on-chain volume.

Justin Sun Offers Job to Gary Gensler if Trump Fires Him

Tron founder Justin Sun also offered a job to SEC Chairman Gary Gensler, in the event that Trump fires him upon taking office. At the Bitcoin Conference in Nashville, Trump publicly vowed to fire Gensler if elected, drawing an outsized reaction from the crowd. Trump made several promises to halt a “crypto crackdown” from regulators and legislators, and that includes Gensler.

“As an industry, we should have an inclusive heart, no matter who it is. I’m open to hiring Gensler if he can genuinely treat the crypto industry with sincerity. After all, this person also has a family to support,” Sun claimed.

It is unclear if Sun made this as a genuine offer, or mockery. Gensler’s hostile activities towards the crypto industry have earned him many enemies in the space, but he is intimately familiar with it. Sun also congratulated Trump on his electoral success, hoping he can “promote industry growth” through pro-crypto regulations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin (DOGE) Bulls In Trouble—Can They Prevent a Drop Below $0.15?

Dogecoin started a fresh decline from the $0.1880 zone against the US Dollar. DOGE is declining and might test the $0.150 support zone.

- DOGE price started a fresh decline below the $0.1850 and $0.1750 levels.

- The price is trading below the $0.1750 level and the 100-hourly simple moving average.

- There is a key bearish trend line forming with resistance at $0.170 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could extend losses if it breaks the $0.1620 support zone.

Dogecoin Price Dips Further

Dogecoin price started a fresh decline after it failed to clear $0.200, like Bitcoin and Ethereum. DOGE dipped below the $0.1880 and $0.1820 support levels.

The bears were able to push the price below the $0.1750 support level. It even traded close to the $0.1620 support. A low was formed at $0.1628 and the price is now consolidating losses below the 23.6% Fib retracement level of the downward move from the $0.2057 swing high to the $0.1628 low.

Dogecoin price is now trading below the $0.1750 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.170 level. There is also a key bearish trend line forming with resistance at $0.170 on the hourly chart of the DOGE/USD pair.

The first major resistance for the bulls could be near the $0.1730 level. The next major resistance is near the $0.1770 level. A close above the $0.1770 resistance might send the price toward the $0.1850 resistance.

The 50% Fib retracement level of the downward move from the $0.2057 swing high to the $0.1628 low is also near the $0.1850 zone. Any more gains might send the price toward the $0.1880 level. The next major stop for the bulls might be $0.1950.

More Losses In DOGE?

If DOGE’s price fails to climb above the $0.1770 level, it could start another decline. Initial support on the downside is near the $0.1635 level. The next major support is near the $0.1620 level.

The main support sits at $0.1550. If there is a downside break below the $0.1550 support, the price could decline further. In the stated case, the price might decline toward the $0.1320 level or even $0.120 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now gaining momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now below the 50 level.

Major Support Levels – $0.1620 and $0.1550.

Major Resistance Levels – $0.1720 and $0.1770.

Market

XRP Price Fate Hangs on $2.00—Major Move Incoming?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Ethereum Price Weakens—Can Bulls Prevent a Major Breakdown?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started another decline and traded below the $1,880 level. ETH is now consolidating and remains at risk of more losses.

- Ethereum struggled to continue higher above the $2,000 resistance level.

- The price is trading below $1,880 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $1,820 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,820 and $1,880 resistance levels to start a decent increase.

Ethereum Price Dips Again

Ethereum price failed to continue higher above $2,100 and started another decline, like Bitcoin. ETH declined below the $1,920 and $1,880 support levels.

It tested the $1,765 zone. A low was formed at $1,767 and the price recently attempted a fresh upward move. There was a move above the $1,800 level but the price is still below the 23.6% Fib retracement level of the recent decline from the $2,033 swing high to the $1,767 low.

Ethereum price is now trading below $1,880 and the 100-hourly Simple Moving Average. There is also a connecting bearish trend line forming with resistance at $1,820 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $1,820 level. The next key resistance is near the $1,880 level and the 50% Fib retracement level of the recent decline from the $2,033 swing high to the $1,767 low. The first major resistance is near the $1,920 level.

A clear move above the $1,920 resistance might send the price toward the $2,000 resistance. An upside break above the $2,000 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,050 resistance zone or even $2,120 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $1,880 resistance, it could start another decline. Initial support on the downside is near the $1,780 level. The first major support sits near the $1,765 zone.

A clear move below the $1,765 support might push the price toward the $1,720 support. Any more losses might send the price toward the $1,680 support level in the near term. The next key support sits at $1,650.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,765

Major Resistance Level – $1,880

-

Market21 hours ago

Market21 hours agoWhale Leverages $27.5 Million PEPE Long on Hyperliquid

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum May Have Hit Cycle Bottom, But Pricing Bands Signal Strong Resistance At $2,300

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Analyst Eyes $1,200-$1,300 Level As Potential Acquisition Zone – Details

-

Ethereum18 hours ago

Ethereum18 hours agoWhales Accumulate 470,000 Ethereum In One Week – Bullish Momentum Ahead?

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Playing Catch-Up? Bloomberg Examines ETH’s Struggles In New Report

-

Market14 hours ago

Market14 hours agoTop 3 Made in USA Coins to Watch This Week

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum MVRV Ratio Nears 160-Day MA Crossover – Accumulation Trend Ahead?

-

Market19 hours ago

Market19 hours agoBitcoin (BTC) Whales Accumulate as Market Faces Uncertainty