Ethereum

Ethereum Analyst Sees Altseason Potential As BTS Is Still Outpacing ETH – Time To Buy Altcoins?

Ethereum has finally surged after breaking through a critical resistance level that had kept the price subdued since early August. This move has shifted market sentiment, as many investors and analysts previously doubted ETH’s potential in the current cycle, expecting it to lag behind. However, Ethereum’s recent strength is starting to reshape these perspectives.

Prominent analyst and investor Ali Martinez recently shared insights indicating that while Ethereum’s momentum is building, the much-anticipated “Altseason” hasn’t arrived just yet.

Related Reading

According to Martinez, this stage of the cycle typically sees Bitcoin outperforming Ethereum and other altcoins—a common pattern as BTC often leads market rallies. This dynamic could provide a strategic opportunity for investors looking to enter ETH and other altcoins before the broader market euphoria begins.

As Ethereum gains traction, market participants are keeping an eye on further confirmations of its breakout, with many speculating that once Bitcoin’s lead cools, capital may flow more aggressively into altcoins.

Ethereum Waking Up

Ethereum is making a remarkable comeback, surging over 22% in just two days of strong upward momentum. While this performance is impressive, key data highlights that Bitcoin is still leading the market, slightly overshadowing Ethereum’s gains. For savvy investors, this could present a prime opportunity to start accumulating Ethereum and select altcoins before they potentially rally in the next phase of the cycle.

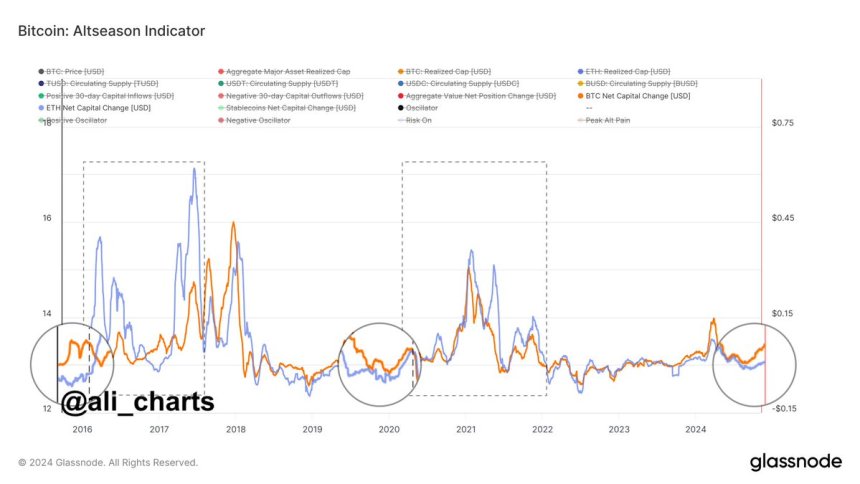

Ali Martinez, a prominent analyst, recently shared a Glassnode chart revealing insights on the “Bitcoin Altseason Indicator.” This tool compares net capital flows between Bitcoin and Ethereum, showing that while Ethereum is on the rise, Bitcoin’s net capital change is currently outpacing it.

This trend confirms that Altseason—where altcoins outperform Bitcoin—hasn’t begun yet. Martinez points out that such dynamics are typical for this stage, with Bitcoin usually leading the initial rally and Ethereum following shortly after.

Related Reading

Historically, Altseason often arrives once Bitcoin’s price momentum stabilizes, as capital flows from Bitcoin into high-potential altcoins. Many seasoned investors recognize this part of the cycle as an ideal time to accumulate ETH and strong altcoins at attractive prices before the broader market shifts its focus.

In the coming weeks, the relationship between BTC and ETH performance will be closely watched, potentially setting up a shift in market sentiment and capital distribution.

ETH Technical View

Ethereum recently surged past a critical resistance at $2,820, breaking above the 200-day exponential moving average (EMA) and touching the 200-day moving average (MA) at $2,955. This marks a significant bullish move, as ETH had been trading below these levels since early August, and reclaiming these indicators is seen as a positive signal for further gains.

For the bullish momentum to continue, ETH must break above and sustain itself above the daily MA at $2,955, solidifying this breakout as a foundation for the next phase of the uptrend. However, some analysts suggest that a period of consolidation just below the 200 MA could be beneficial, allowing ETH to gather strength for a more sustained rally. This pause could temper the rising euphoria and avoid overextension in the short term.

Related Reading

As the market sentiment turns increasingly optimistic, many investors are eyeing this level closely. Holding above these critical indicators would give bulls more control, potentially setting Ethereum up for a more robust recovery as it targets new highs.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum’s Price Dips, But Investors Seize The Opportunity To Stack Up More ETH

Comparing current price action with past performances, Ethereum, the second-largest crypto asset, seems to have witnessed its worst-ever first quarter as it draws closer to its end. However, many investors are expressing interest in ETH’s prospects again, purchasing the asset in huge chunks.

Investors Buying The Ethereum’s Price Dip

Ethereum has continued to struggle to undergo a major upward move even as other digital assets make history in the ongoing market cycle. Despite the recent pullback in ETH’s price, Ali Martinez, a seasoned crypto analyst and trader, has highlighted a renewed bullish sentiment among investors.

Specifically, investors are seizing the opportunity to stack up on ETH in light of ongoing price correction, signaling interest and confidence in the asset’s long-term potential. This buying activity suggests that seasoned traders are considering the current drop as a strategic entry or buying point.

According to Ali Martinez, the development was spotted as Ethereum encountered a significant resistance wall between the $2,200 and $2,580 price mark. Examining the data from IntoTheBlock, the expert reported that over 12.43 million investors purchased a massive portion of 66.18 million ETH within the $2,200 and $2,580 price zones.

These kinds of accumulation show that both retail and institutional investors are hopeful about the market. Should this substantial buying activity extend, Ali Martinez is confident that bullish momentum might build up for ETH, leading to a break above the zone.

Market analyst and trader CryptoELITES predicts a robust upswing for ETH to new all-time highs in the upcoming weeks. CryptoELITES prediction is based on past price trends in which ETH witnessed a massive rally after a lengthy period of downward movements.

Delving into the recent price action, the expert believes ETH’s correction has reached a bottom similar to the 2017 and 2021 bull market cycles. With the altcoin potentially reaching a bottom, CryptoELITES anticipates an over 700% upsurge in 2025.

A 700% surge will bring the altcoin’s price to the $15,000 milestone before the ongoing bull market cycle completes. Given that Ethereum is mirroring past trends, a possible price reversal could be on the horizon.

ETH Eyeing A Breakout From Key Chart Pattern

While ETH is facing volatility, it is presently at a critical junction that might determine its next move. Jonathan Carter, a crypto and technical analyst, reveals that Ethereum is holding above the lower boundary of a Descending Triangle formation after navigating its price in the 4-hour time frame.

At this zone, the asset might muster enough momentum for a rebound. Carter expects a bounce from the current support zone to push ETH toward key resistance levels at $1,950, $2,080, $2,230, and $2,320. However, if the altcoin falls below the support, the price may drop further to the downside.

Featured image from Pexels, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Ethereum Price Confirms Breakout From Ascending Triangle, Target Set At $7,800

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Ethereum price has finally broken out of a months-long consolidation pattern, signaling the possible start of a significant bullish move. The recent breakout of an Ascending Triangle formation suggests that ETH is set for more gains, with a crypto analyst suggesting a price target of $7,800 in the coming months.

Ethereum Price Targets $7,700 ATH

The Ethereum price is believed to be targeting a new all-time high of $7,800 after its recent breakout from an Ascending Triangle. For months now, the cryptocurrency has been trading within this classic bullish chart pattern, where prices make higher lows while facing strong resistance at a fixed level.

Related Reading

This consolidation pattern has been active since late 2024, establishing strong resistance at $4,000. TradingView analyst Sohaibfx has predicted that if Ethereum can surpass this resistance level, it would confirm a bullish trend, leading to a strong upward continuation in its price.

Looking at the analyst’s price chart, Ethereum spent several months navigating between $2,000 and $4,000 in Q1 2025. This region represented an accumulation phase where buyers had quietly built their positions in anticipation of a potential rally.

A descending channel marked in orange in the price chart also shows that Ethereum had experienced a significant pullback mid-to-late 2024 before breaking out. This was likely the final shakeout before it regained its bullish momentum.

According to Sohaibfx, a measured move of the Ascending Triangle suggests that Ethereum is poised for an explosive 333% surge to $7,800. This bullish target is calculated by determining the height of the triangle, which is the difference between its base at $2,000 and resistance level at $4,000.

When the price breaks above the resistance, the common method for estimating the possible next move is to add the triangle’s height to the breakout point, which gives a technical target of $6,000. However, based on past price behaviour and strong buying momentum, the Ethereum price could push even higher, with $7,800 being a key psychological level.

Support Levels And Momentum Indicators To Watch

In his price analysis, Sohaibfx has pinpointed the $4,000 and $3,000 price levels as support levels for Ethereum. This support should act as a safety net, where buyers are likely to step in to prevent further decline after Ethereum reaches its projected $7,800 target.

Related Reading

Moving forward, the analyst highlights key momentum indicators that should be monitored. While the analyst’s chart does not specify indicators like Moving Average Convergence Divergence (MACD) or Relative Strength Index (RSI), Ethereum’s sharp upward move suggests that strong momentum will be a major contributor to its rise to a new ATH.

Sohaibfx has advised traders to watch out for RSI levels above 70, as overbought conditions could signal a potential pullback while Ethereum approaches higher levels.

Featured image from Adobe Stock, chart from Tradingview.com

Ethereum

Ethereum To $20K? Investor Says Real-World Adoption Is The Key

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.