Market

What Crypto Whales Bought This Week: AAVE, ADA, AVAX

Investors often monitor the buying patterns of crypto whales, as these large players can heavily influence market prices. The first week of November 2024 has been no exception, with whales funneling substantial funds into several altcoins.

In this analysis, BeInCrypto examines the altcoins that have attracted these significant investments and why whales are buying them. The top three include Aave (AAVE), Cardano (ADA), and Avalanche (AVAX).

Aave (AAVE)

AAVE, the native token of the decentralized lending platform Aave, is among the altcoins that crypto whales have bought this week. This trend is closely linked to Donald Trump’s recent election victory and his launch of a crypto project using the protocol, which has drawn increased interest in AAVE and other DeFi tokens.

Data from IntoTheBlock reveals that Aave’s large holders’ netflow surged by 1,000% over the last seven days, indicating substantial whale accumulation outpacing sales.

This influx of whales has also positively impacted AAVE’s price, reinforcing the significance of their buying power in the market.

At press time, AAVE’s price was $182.95, representing a 27% hike in the last 30 days. Should whales continue to buy the token, the price can increase. On the other hand, if these investors opt against that, the altcoin’s value might drop.

Cardano (ADA)

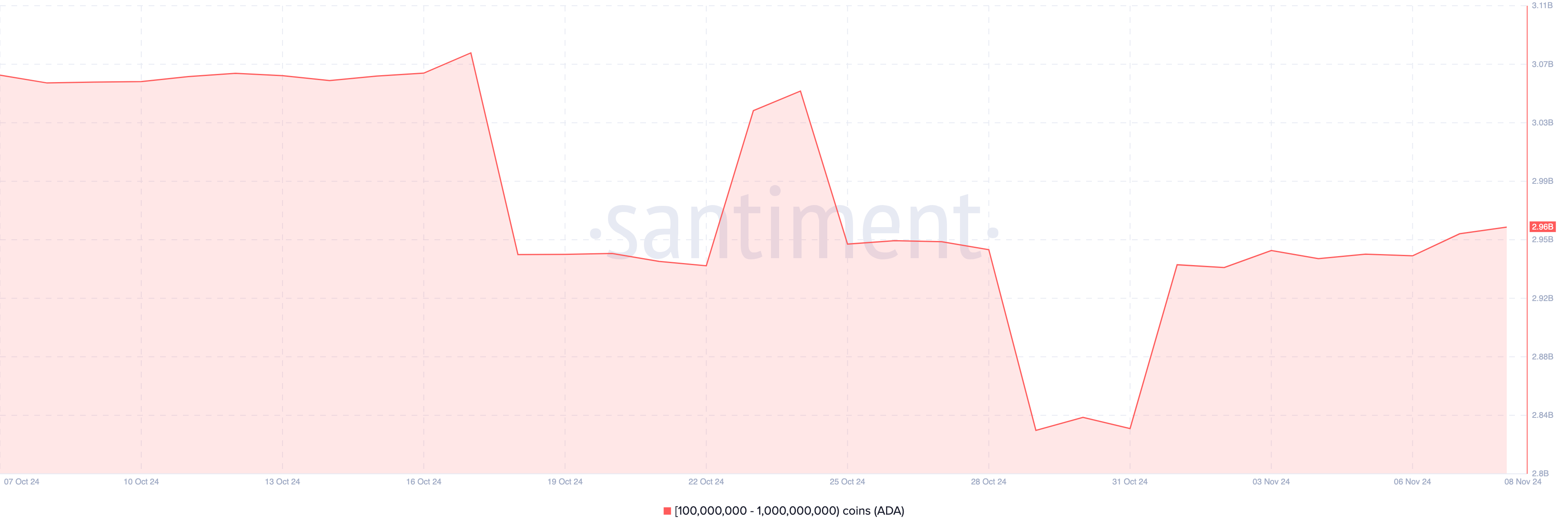

Cardano is also another altcoin that crypto whales bought this week. According to Santiment, the balance of addresses holding between 100 million to 1 billion ADA was 2.83 billion on October 31.

Today, that figure has increased to 2.96 billion, meaning crypto whales bought 130 million ADA this week. At the altcoin’s current price, this amounts to 55.90 million. Due to the purchase, ADA’s price increased by 25.31% in the last seven days and is the performing altcoin out of the top 10 cryptocurrencies.

Should whales continue to accumulate more tokens, ADA’s price might continue to increase. Otherwise, the altcoin’s value might decrease.

Avalanche (AVAX)

Last on the list of altcoins that crypto whales bought is Avalanche (AVAX). On November 6, AVAX large holders’ netflow was -85,700, indicating that Whales had sold a lot of the altcoin.

But as reports spread that BlacRock could launch its tokenization Fund on the Avalanche blockchain, things changed, and whales began to buy the token. As of this writing, the large holder’s netflow is 533,580, meaning that these stakeholders purchased over $15 million worth of the token.

This accumulation also impacted AVAX’s price, which saw a 12% hike to $28.2 this week. Thus, if the altcoin continues to see such accumulation, the price can go higher. If not, it could consolidate or trade lower.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump’s USD1 Stablecoin Eyes Trust Recovery in Crypto

Trump made headlines again last week after World Liberty Financial announced the launch of USD1, its very own stablecoin. However, much anticipation surrounds just how successful the project will be. The launch of Trump’s meme coin at the beginning of the year resulted in billions of dollars in losses. Retail investors, in particular, have learned to be more cautious with Trump-backed endeavors.

BeInCrypto spoke with nine industry experts to learn more about USD1 and what it needs to restore public confidence in investors disappointed by Trump’s previous crypto ventures. These representatives unanimously agreed that USD1’s success hinges on transparency, proper utility, and a distinct advantage over well-established competitors.

USD1’s Promise and Trump’s Crypto History

Last week, World Liberty Financial (WLF), a token project heavily affiliated with the Trump family, officially acknowledged that it had launched USD1, its very own stablecoin. To a certain degree, the announcement was unsurprising.

During the Digital Assets Summit the White House held at the beginning of March, Treasury Secretary Scott Bessent said that the Trump administration would use stablecoins to preserve the US dollar’s role as the world’s strongest reserve currency.

USD1 aims to do exactly this. The stablecoin will be pegged to the US dollar and supported by a reserve comprised of short-term US Treasury securities, dollar deposits, and other highly liquid assets.

“Trump is not simply issuing his stablecoin. He is legitimizing stablecoins in general to support the US dollar. If you go through his stablecoin legislation, it is essentially about increasing the dollarization by making the US dollar easier and safer to use and selling more dollars in the process. Every USD stablecoin in circulation means USD-denominated asset in a bank somewhere. Not in CNY or any other currency,” Tae Oh, Founder of Creditcoin, told BeInCrypto.

But Trump’s track record in crypto has been polluted by heavy losses for retail investors and reiterated accusations of conflicts of interest. While some welcome the idea of a sitting president backing the launch of a new stablecoin, others say that it sparks further cause for trouble.

Can USD1 Redeem Trump’s Crypto Reputation?

The crypto market went berzerk when Trump launched his meme coin two days before assuming office. Within a day of trading, the token reached a market capitalization of over $14.5 billion.

But, since that moment, the meme coin has been in freefall, tainted by constant volatility and evidence of insider trading. According to Chainalysis, while early buyers were able to cash out $6.6 billion in profits, smaller traders have experienced collective losses of over $2 billion.

Meanwhile, the Trump family has made nearly $100 million from trading fees alone.

WLF, the President’s decentralized finance (DeFi) experiment, largely failed to restore confidence in Trump-backed crypto projects. Reports quickly unveiled that the Trump family holds a 75% stake in the platform’s net revenue and a 60% stake in the holding company.

Applying these percentages to WLF’s most recent token sale, Trump would have earned $400 million in revenue.

Now, WLF has launched USD1. Unlike meme coins, stablecoins offer investors a much higher degree of stability. Some industry leaders believe this could be Trump’s opportunity to redeem himself, while others remain doubtful. S, the pseudonymous community lead behind NEIRO, summarized it cleanly:

“If USD1 is structured well and managed transparently, it could help regain confidence, especially among newer users. But it won’t erase the impact of previous rug pulls and hype-driven projects. That healing process takes time and accountability,” he said, adding that “Authentic community engagement is now essential—it’s not enough to slap a famous name on a token.”

At the same time, the meme coin’s turbulent journey revealed Trump’s capacity to introduce newcomers to crypto, a lesson potentially applicable to USD1’s launch

Trump’s Meme Coin Impact on New Investors

TRUMP’s initial $14.5 billion market capitalization set the highest benchmark achieved by a meme coin backed by a public figure. Aside from that, according to a survey by NFTvening, 42% of TRUMP meme coin buyers were first-time crypto investors.

In other words, Trump’s meme coin project did wonders in exposing outsider investors to the cryptocurrency market. According to Oh, the same can be done with USD1– at least initially.

“The association with Trump is the strongest branding you can get in the current market. However, at the end of Trump’s term, the project needs to become disassociated from the President and more politically neutral,” he said.

Oh also added that Trump’s frequent project launches have demonstrated similarities. Though they haven’t necessarily filled a gap in the market, they have managed to onboard new users.

“I think Trump is showing us a pattern. He is legitimizing various types of cryptocurrency by issuing them himself or through his affiliate organizations. He started with memecoin and now on fiat-backed stablecoin. Is adoption the main objective of the projects? We shall see,” Oh said.

For Anthony Anzalone, CEO of XION, a Trump-backed stablecoin could create pathways for sustainable adoption compared to any meme coin.

“In the specific context of a stablecoin, Trump’s association likely provides advantages rather than disadvantages. Unlike speculative tokens, where celebrity involvement often signals short-term marketing over substance, stablecoins derive their value from stability, regulatory compliance, and institutional adoption – areas where political connections potentially confer meaningful benefits. The technical requirements and operational challenges of stablecoins are significantly different from speculative tokens, making this a more suitable venture for political backing,” Anzalone told BeInCrypto.

However, market adoption won’t exclusively hinge on presidential backing.

Will Trump’s Name Help or Hurt USD1 Adoption?

While a Trump-endorsed stablecoin could greatly increase USD1 adoption, it could also have the opposite effect.

“Trump’s polarizing presence could create skepticism, especially among those wary of political influence in financial products. While his involvement might appeal to his supporters, it risks alienating a broad portion of the market,” said Cathy Yoon, General Counsel at the Wormhole Foundation.

This risk is especially true when applied to users who believe that Trump has entered the crypto space exclusively for profit.

“Trump’s main motivation is making money from this venture, so his involvement is certainly more likely to be a downside than an advantage. You know he’ll try everything to suck as much profit out of this venture as possible, and it could be at the expense of the end user,” Jean Rausis, Co-founder of SMARDEX, told BeInCrypto.

The fact that WLF, a Trump-backed project associated with several conflicts of interest, launched USD1 does little to assuage skeptics about future risks.

Conflicts of Interest and USD1 Transparency

Trump failed to prevent similar accusations of conflicts of interest by directly associating himself with the USD1 launch through WLF.

“A conflict of interest arises when the current US President is also a key figure in World Liberty Financial. He will be closely monitored and face regulatory hurdles to ensure there is no manipulation of the financial system, but this alone could deter investors when there are highly competitive and much more mature products in that market,” Vivien Lin, Chief Product Officer at BingX, told BeInCrypto.

Suppose Trump wants to distance himself from the criticism his previous projects received. In that case, he will have to ensure that USD1 adheres to transparency mechanisms and regular audits—not only for public trust but also to ensure that the sitting President doesn’t break the law.

“Transparency should be at the forefront of all communications, especially with Trump’s involvement as the US President and stakeholder in World Liberty Financial. This situation could violate the Constitution’s emoluments clause, which broadly refers to any advantage, profit, or gain received due to holding office. If violated, this could significantly hurt the public’s trust. Another aspect that should be considered is establishing safeguards against potential market manipulation, especially given WLFI’s history of large crypto purchases before important events to prevent market manipulation,” Lin added.

USD1’s success will also largely depend on its execution.

USD1’s Path in a Competitive Market

Stablecoins have existed since 2014 and are finding a permanent home in the broader market. According to the World Economic Forum, the current supply of stablecoins in circulation exceeds $208 billion.

With a market capitalization approaching $144 billion, Tether (USDT) is today’s most dominant stablecoin. In second place comes Circle’s USDC, with a market capitalization of over $60 billion. Driven by their dollar peg and perceived inflation hedge, stablecoins have become highly popular, prompting increased stablecoin launches from banks and tech firms.

“The more we see responsible innovation that includes utility use cases– such as prudentially regulated stablecoins for global payment processing – the more crypto’s reputation will solidify and credibility will grow. I don’t think we need to rely or wait for one product such as USD1. The momentum has been building and will continue,” Beth Haddock, Global Policy Lead at Stablecoin Standard, told BeInCrypto.

USD1 must set itself apart to succeed in an already cutthroat market.

“If USD1 lacks interoperability, has limited on/off-ramps, or fails to differentiate from incumbents like USDC or USDT, it risks being relegated to a niche use case. Ultimately, mainstream success will come down to execution, partnerships, and solving real user pain points—especially in markets where traditional financial access is limited or inefficient,” said Mouloukou Sanoh, CEO of MANSA.

According to Martins Benkitis, CEO of Gravity Team, catering to niche markets isn’t a bad idea. But in an already competitive field, it might not be enough.

“If it becomes a gateway for on-chain political donations or movement-aligned payments, it’s filling a niche. The question is whether that niche is big enough to sustain a stablecoin. Jury’s still out, but it’s an angle,” he said.

Inevitably, providing some utility that is not currently available will factor into USD1’s eventual success.

What Utility Will USD1 Offer?

What USD1 can offer the market boils down to what Trump has in store. Several details regarding its launch have yet to be released.

Nonetheless, if executed properly, the stablecoin has the potential to offer a degree of stability and predictability that TRUMP’s meme coin was unable to deliver. It could also give the President the golden opportunity to restore the trust that he lost from his previous crypto ventures.

If this is among Trump’s matters of concern for USD1, he will have to prioritize factors like transparency, security, and clear utility. These will be the aspects the public will be looking out for.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Reclaims Top DeFi Spot As Solana DEX Volume Drops

Ethereum (ETH) has regained its position as the leading blockchain for decentralized exchange (DEX) trading volume.

On this metric, Ethereum has effectively surpassed Solana (SOL) for the first time since September 2024.

Ethereum Surpasses Solana in DEX Trading Volume

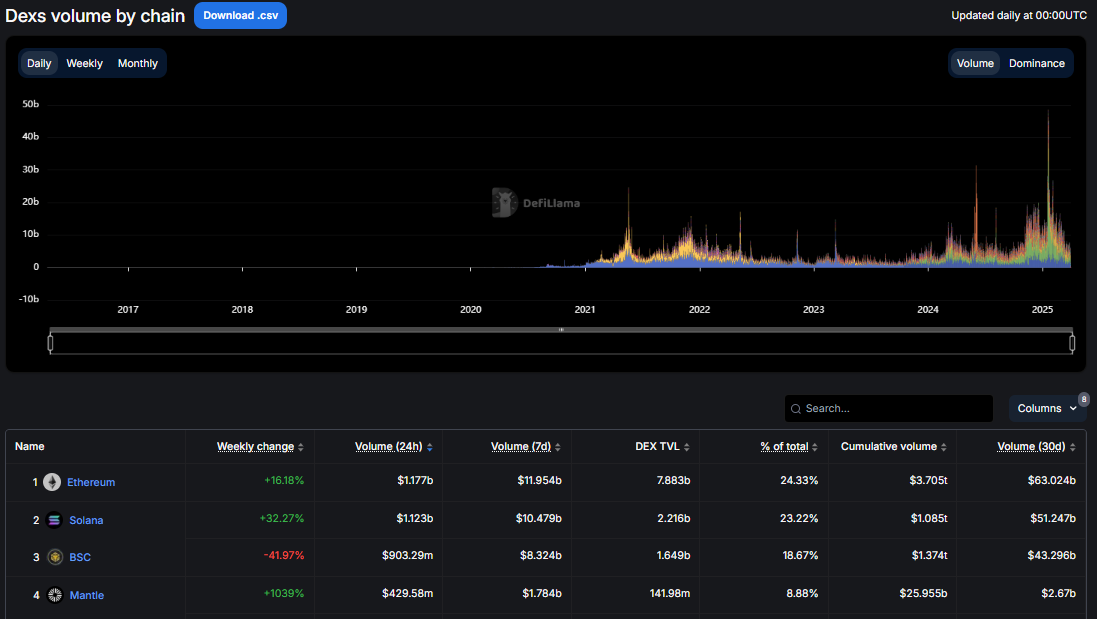

According to data from DefiLlama, Ethereum-based DEXs recorded approximately $63 billion in trading volume throughout March 2025. This traction saw Ethereum overtake Solana’s $51 billion during the same period.

The shift marks a significant moment in the ongoing competition between Ethereum and Solana in the decentralized finance (DeFi) ecosystem.

Solana had dominated the DEX space for months, bolstered by its low fees and high transaction throughput. Franklin Templeton noticed the trend and predicted Solana’s DeFi surge could rival Ethereum’s valuation.

“Solana DeFi valuation multiples trade on average lower than their Ethereum counterparts despite significantly higher growth profiles. This highlights an apparent valuation asymmetry between the two ecosystems,” read an excerpt in Franklin Templeton’s report.

However, recent declines in trading volume on key Solana-based platforms suggest a changing market dynamic. The drop in Solana’s DEX trading volume is closely tied to decreased activity on major platforms like Raydium (RAY) and Pump.fun.

Pump.fun, in particular, has seen a sharp decline in trading volume since the beginning of the year. Monthly volumes fell from a January peak of $7.75 billion to just $2.53 billion in March, representing a 67% drop.

Data on Dune shows that this downturn aligns with a slowdown in the platform’s token graduation rate, which has fallen from 0.8% to 0.65% per week.

The graduation rate reflects the percentage of new tokens reaching the $100,000 market capitalization threshold required to migrate from Pump.fun to the Raydium platform.

A lower graduation rate suggests fewer tokens are reaching this threshold, which is reducing overall trading activity on Solana’s DEX ecosystem.

Ethereum’s Strength in the DEX Market

While Solana’s DEX activity has faltered, Ethereum’s trading volume has remained resilient. This is likely bolstered by the strong performance of platforms like Uniswap (UNI) and Curve Finance (CRV).

In March, Uniswap alone facilitated over $30 billion in trading volume, significantly contributing to Ethereum’s overall market dominance.

Ethereum’s ability to reclaim the top spot is also attributed to its established infrastructure and network effects. Despite higher gas fees than Solana, Ethereum continues attracting high-value trades, institutional interest, and liquidity. These reinforce its position as the primary blockchain for DeFi activity.

Against this backdrop, industry analysts believe that while Solana is very competitive, it still has a long way to go before it can dethrone Ethereum.

Meanwhile, others say Ethereum’s resurgence may extend into the second quarter (Q2), driven by upcoming network upgrades and broader market trends.

“On-chain developments offer some hope for ETH…With Pectra now successfully deployed on the Holesky testnet and a mainnet upgrade expected in Q2, could we see a reversal of the downward ETH/BTC trend in the coming quarter?” analysts at QCP Capital noted.

The Pectra upgrade, once implemented on the Ethereum mainnet, is expected to improve scalability and efficiency, potentially boosting user adoption and trading activity.

Adding to the positive momentum, spot Ethereum ETFs (exchange-traded funds) saw net inflows on Monday, contrasting with net outflows from Bitcoin ETFs. This trend suggests growing investor confidence in Ethereum’s market position.

This shift in ETF flows could indicate a broader reallocation of capital within the crypto market, particularly as Ethereum strengthens its DeFi ecosystem and prepares for key upgrades.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

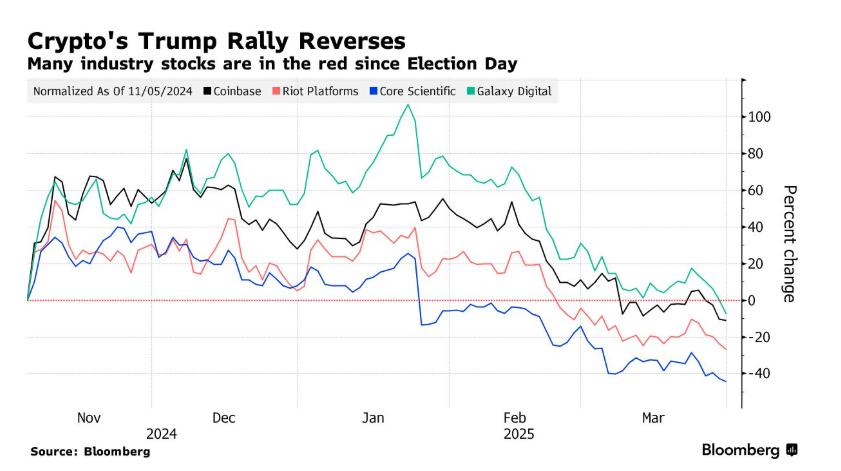

Coinbase Stock Plunges 30% in Worst Quarter Since FTX Collapse

Coinbase, the largest US crypto exchange, has recorded its worst quarter since the dramatic collapse of FTX in late 2022.

Coinbase’s stock (COIN) plummeted by 30% in Q1 2025, mirroring the steep losses seen across the broader crypto market.

Crypto Stocks and Assets Bleed Red in Q1

According to Bloomberg, the sharp decline has hit several other major crypto-related stocks as well. This includes Galaxy Digital, Riot Blockchain, and Core Scientific, all of which have experienced significant downturns.

Furthermore, the broader crypto market is facing tough times. Bitcoin, which has long been considered the bellwether of digital assets, has dropped by 10% this quarter. More dramatically, Ethereum (ETH) has seen a staggering 45% decline. These losses reflect a broader downturn in the crypto market, fueled by several macroeconomic factors.

Analysts point to the global uncertainty surrounding the US economy, including concerns over Trump’s tariffs and recession fears. This has resulted in a general “risk-off” mood among investors.

“In a risk-off mood, no asset is safe stocks, crypto, all get hit. It’s more about sentiment than fundamentals in those moments,” an investor commented on X.

While some point to these macroeconomic pressures as the primary cause, others argue that the market’s underperformance is more due to lingering fears of trade wars and broader geopolitical instability.

“Trump’s trade wars are driving markets into a panic. As much as he is doing for crypto, the macro market conditions are speaking louder – as bullish as the news is from the white house – His trash trade war is squelching any price surge,” another X user remarked.

Coinbase has been hit especially hard in this downturn. Coinbase’s revenue model is heavily reliant on altcoins and transaction volumes beyond Bitcoin. Hence, the overall market drop could have made a mark on the exchange’s stock prices. Moreover, the news comes as Coinbase users have collectively lost more than $46 million to scams in March.

While crypto has been in a freefall, other assets have fared much better. Gold, for example, has surged, posting its best quarter since 1986 as investors flock to safer assets amid the market turmoil. The shift toward traditional assets is particularly noticeable as the post-election crypto hype, which briefly boosted Bitcoin’s value to $109,000, begins to fade.

Despite the overall market challenges, some crypto-related firms have shown resilience. MicroStrategy, led by CEO Michael Saylor, remains in the green year-to-date, bolstered by its substantial Bitcoin holdings.

For now, the crypto market is left to weather the storm, with analysts continuing to scrutinize the interplay of macroeconomic factors and its impact on digital assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoTrump Family Gets Most WLFI Revenue, Causing Corruption Fears

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum’s Price Dips, But Investors Seize The Opportunity To Stack Up More ETH

-

Market24 hours ago

Market24 hours agoBitcoin Mining Faces Tariff Challenges as Hashrate Hits New ATH

-

Regulation23 hours ago

Regulation23 hours agoUSDC Issuer Circle Set To File IPO In April, Here’s All

-

Market23 hours ago

Market23 hours agoPi Network Struggles, On Track for New All-Time Low

-

Bitcoin22 hours ago

Bitcoin22 hours agoStrategy Adds 22,048 BTC for Nearly $2 Billion

-

Market22 hours ago

Market22 hours agoBNB Breaks Below $605 As Bullish Momentum Fades – What’s Next?

-

Market18 hours ago

Market18 hours agoBlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar