Market

Sky or Maker? Vote Reveals MakerDAO’s Centralization Concerns

Sky will not re-rebrand as MakerDAO after a community vote that favored keeping the new identity.

The rebranding is central to founder Rune Christensen’s “Endgame” strategy, which aims to reshape the protocol for more competitiveness and resilience.

MakerDAO Governance Vote Dominated By Whales

Sky confirmed the identity stay in a post on X after an on-chain vote to continue using the new brand name as the ecosystem’s primary backend protocol.

“This decision supports the ongoing transition from MKR to SKY and establishes Sky as the core brand, denoting both the Sky app frontend and the backend Sky Ecosystem and Sky Protocol,” the project team said.

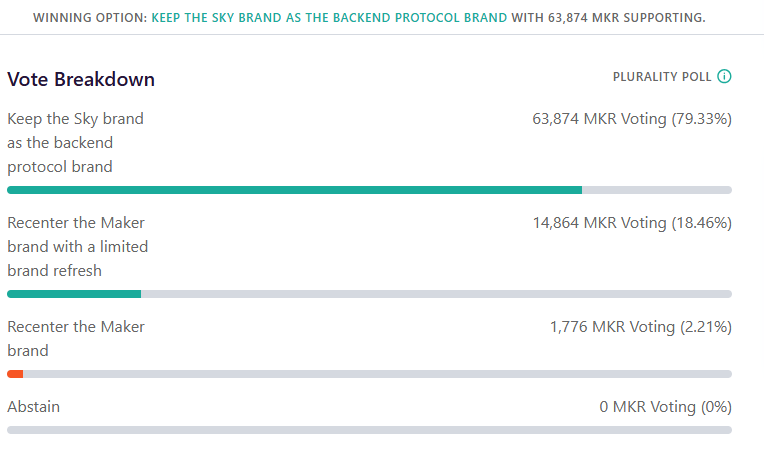

The governance polls show that the proposal to revert Sky to its original Maker branding faced substantial opposition. Specifically, nearly 80% of the vote share leaned toward maintaining the Sky identity as the protocol’s “backend protocol brand.”

The decision revealed an underlying centralization issue within MakerDAO’s governance. According to Sky’s voting metrics, four large entities controlled most of the voting power. Each entity secured about 20% of the votes, and only one prominent entity voted against the proposal. This left smaller stakeholders with limited influence over the outcome.

“Four MKR whales hold 98% of voting power, rejecting the rebranding of the DeFi protocol Sky back to Maker. This highlights the influence of a few in decentralized governance. It raises concerns about true decentralization in such ecosystems,” said HUDI, a web3 data layer builder.

Nevertheless, this turnout to maintain Sky aligns with Christensen’s ambitious “Endgame” strategy, kickstarted in late 2022. The Sky co-founder proposed the strategy to revitalize what he perceived as a stagnating DeFi project.

He wants to diversify MakerDAO’s services and develop new products. The plans include launching a range of new stablecoins, creating an alternative governance token called SKY, and establishing “subDAOs.”

In September, MakerDAO members voted to give DAI holders the option to exchange their tokens for a new stablecoin named Sky Dollar (USDS) at a 1:1 ratio. Likewise, MKR holders could swap their tokens for SKY tokens at a 1:24,000 ratio.

Of note is that the organization clarified that DAI and MKR tokens will continue to exist alongside USDS and SKY in the near future. Nevertheless, the introduction of SKY and USDS represents a strategic effort to attract new users and accommodate diverse regulatory and decentralization demands in the market.

Products and Tokens Under the Sky Brand

With Sky now in place, the rebranding may proceed to introduce a new suite of tokens and products under the new banner. This includes launching decentralized and regulatory-compliant stablecoins like puredai and NewStable, respectively. These products target different segments: puredai for censorship-resistant uses and NewStable for broader, compliance-driven adoption.

Sky is preparing to introduce these stablecoins on Solana and Ethereum Layer-2 Base, suggesting possible integrations across blockchains and maximizing accessibility. Another notable development is Sky’s planned collaboration with Aave, a leading DeFi protocol, to offer stacked USDS rewards. Sky will also introduce a staking system using both SKY and MKR tokens alongside a custom bridge called SkyLink for EVM chains.

Despite the strategic rationale behind the rebrand, the move has not been universally welcomed. Community members have voiced concerns that the new brand does not resonate with Maker’s established reputation. Others continue to cite confusion between SKY and MKR. Christensen attempted to quell some of the fears.

“It’s gonna take a bit more planning but I will make a follow-up proposal where MKR will be renamed to indicate it is a SKY wrapper. This way, MKR holders will automatically upgrade to SKY and there will be no confusion around two tokens. This will not affect tokenomics,” the Sky co-founder explained.

While Christensen’s Sky brand could reach new users, it also risks alienating legacy supporters who identify with the original Maker. For investors, the vote reflects the complex dynamics at play within MakerDAO’s governance, where large holders wield outsized influence. In such situations, changes can carry both potential upsides and risks for the protocol’s market perception.

The Endgame strategy could ultimately redefine Sky as a leader in DeFi. Nevertheless, this hinges on the successful rollout of its ambitious projects. The ability to harmonize with the demands of a loyal but change-averse community is also a factor.

According to BeInCrypto data, the Maker (MKR) token has surged nearly 5% following this news, currently trading at $1,503.47.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Token Unlocks for April: Parcl, deBridge, Scroll

Three major token unlocks involving PRCL, DBR, and SCR are set to take place in April. Parcl will unlock 161.7 million PRCL on April 16, followed by deBridge unlocking 1.11 billion DBR on April 17 and Scroll releasing 40 million SCR on April 22.

These events could significantly impact each token’s supply dynamics and short-term price action. With large allocations set aside for contributors, partners, and airdrops, these unlocks are worth watching closely.

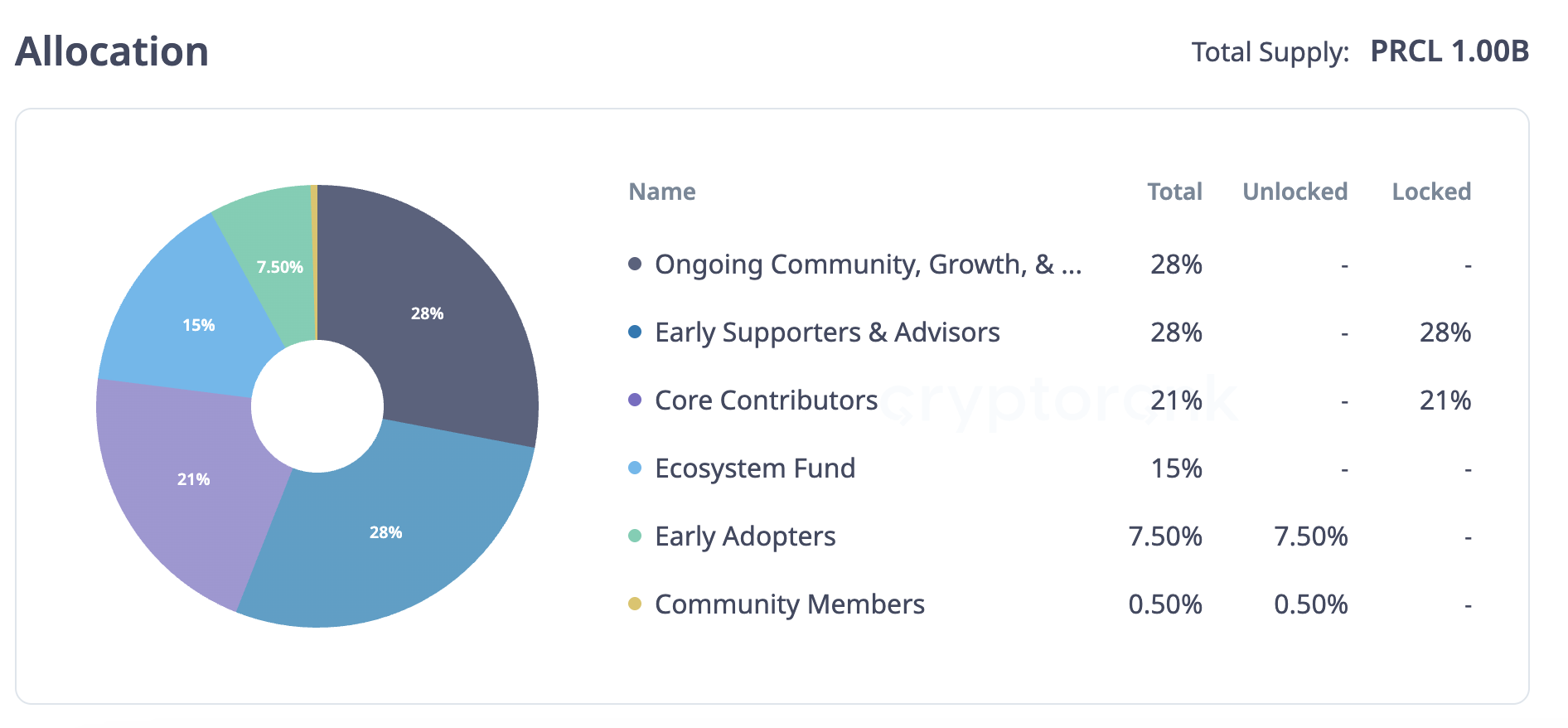

Parcl (PRCL)

Unlock Date: April 16

Number of Tokens to be Unlocked: 161.7 million PRCL (16.2% of Total Supply)

Current Circulating Supply: 270.8 million PRCL

Total supply: 1 Billion PRCL

Parcl is a decentralized exchange that lets users trade real estate price movements without owning property. The ecosystem—made up of Parcl, Parcl Labs, and Parcl Limited—governs the Parcl Protocol, which offers synthetic exposure to real-world real estate markets. It allows users to go long or short on property prices across different regions.

On April 16, 161.7 million PRCL tokens, worth roughly $15.56 million, will be unlocked. This could increase the token supply and lead to short-term market volatility.

The unlock includes 92.4 million tokens for early supporters and advisors, and 69.3 million for core contributors. PRCL price is down 33% in the last 30 days and trading below $0.1 since yesterday.

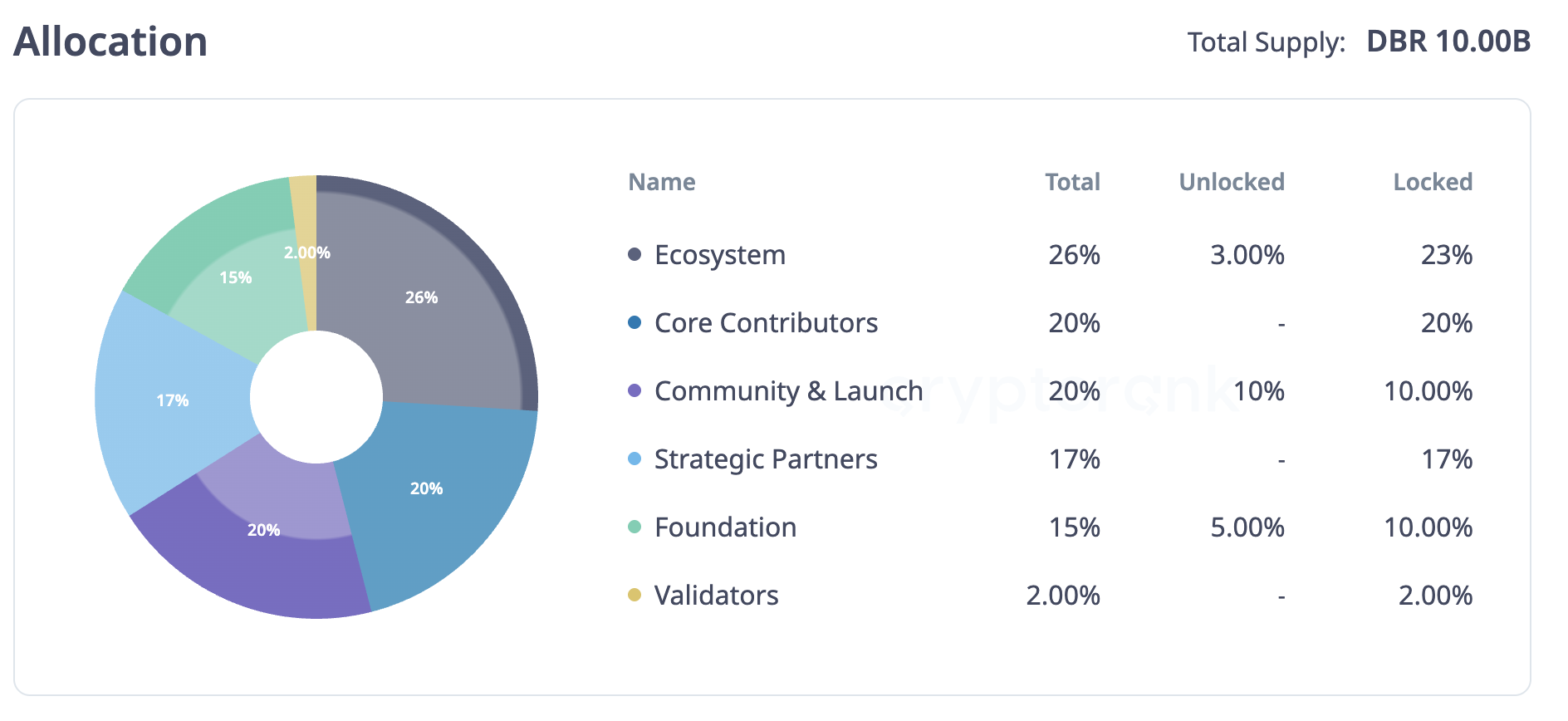

deBridge (DBR)

Unlock Date: April 17

Number of Tokens to be Unlocked: 1.11 billion DBR (11.1% of Total Supply)

Current Circulating Supply: 1.16 billion

Total supply: 10 Billion DBR

deBridge is a cross-chain protocol that allows users to transfer assets and data between different blockchains. It aims to simplify interoperability and make decentralized applications more connected and efficient.

On April 17, 1.11 billion BDR tokens, worth around $32.19 million, will be unlocked. This unlock will nearly double the current circulating supply, adding roughly 95% more tokens to the market.

The allocation includes 400 million for core contributors, 340 million for strategic partners, and 176.93 million for the ecosystem. The rest goes to the community, foundation, and validators. Despite the upcoming unlock, deBridge has gained nearly 38% in the past month, with its market cap now nearing $34 million.

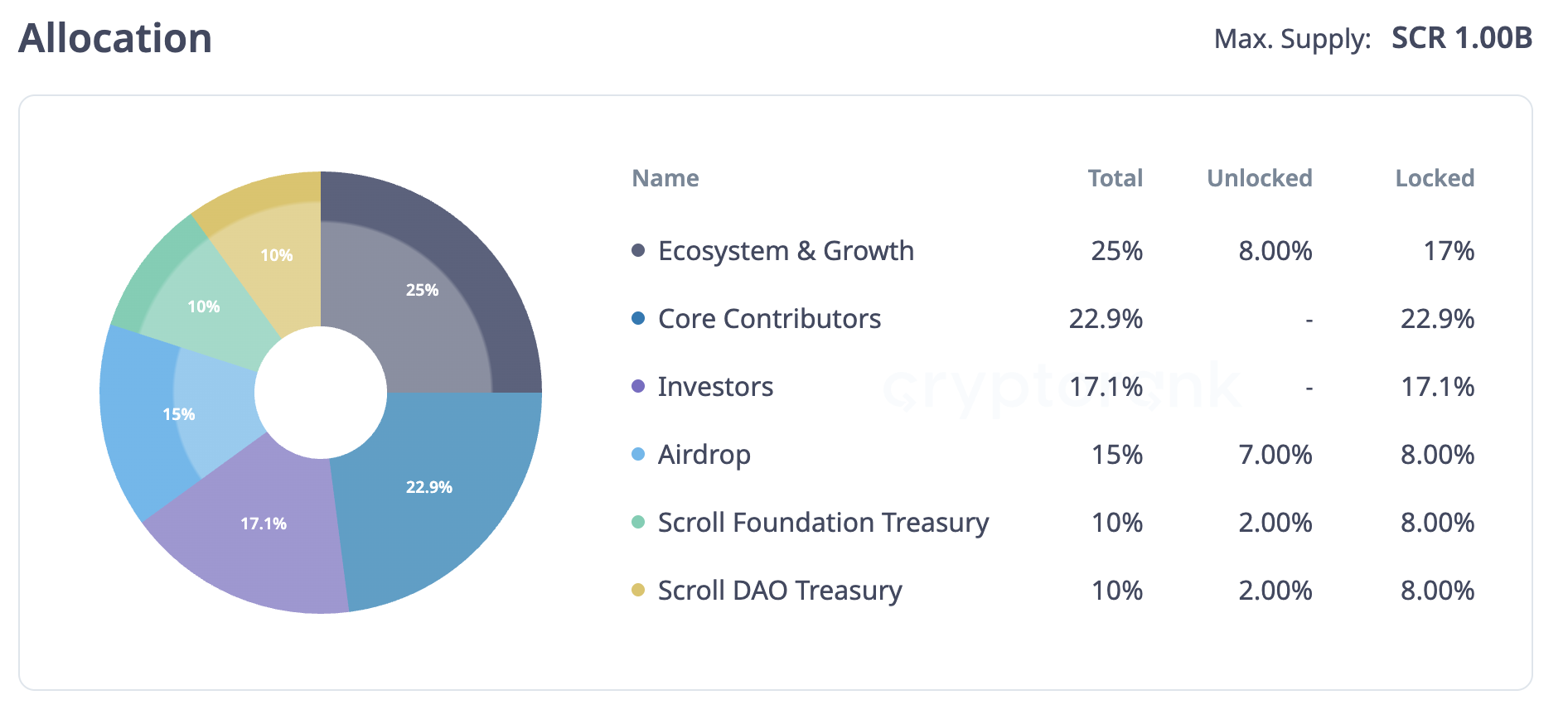

Unlock Date: April 22

Number of Tokens to be Unlocked: 40 million SCR (4% of Total Supply)

Current Circulating Supply: 190 million

Total supply: 1 Billion SCR

Scroll is a Layer 2 solution built to improve Ethereum’s scalability and efficiency. It uses zkRollup technology to lower transaction costs and increase throughput, helping ease issues like high gas fees and congestion.

On April 22, 40 million SCR tokens, valued at about $11.52 million, will be unlocked. This unlock could introduce added liquidity to the market and maybe renewed interest in Scroll. Its price is down roughly 46% in the last 30 days, with its market cap at $55 million, down from its peak of $265 in October 2024.

All 40 million tokens are allocated for airdrops.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin (BTC) Whales Accumulate as Market Faces Uncertainty

Bitcoin (BTC) has been trading below the $90,000 mark since March 7, struggling to regain upward momentum amid shifting market sentiment.

Meanwhile, technical indicators such as the Ichimoku Cloud and EMA lines suggest the trend remains bearish, though a potential reversal is not off the table.

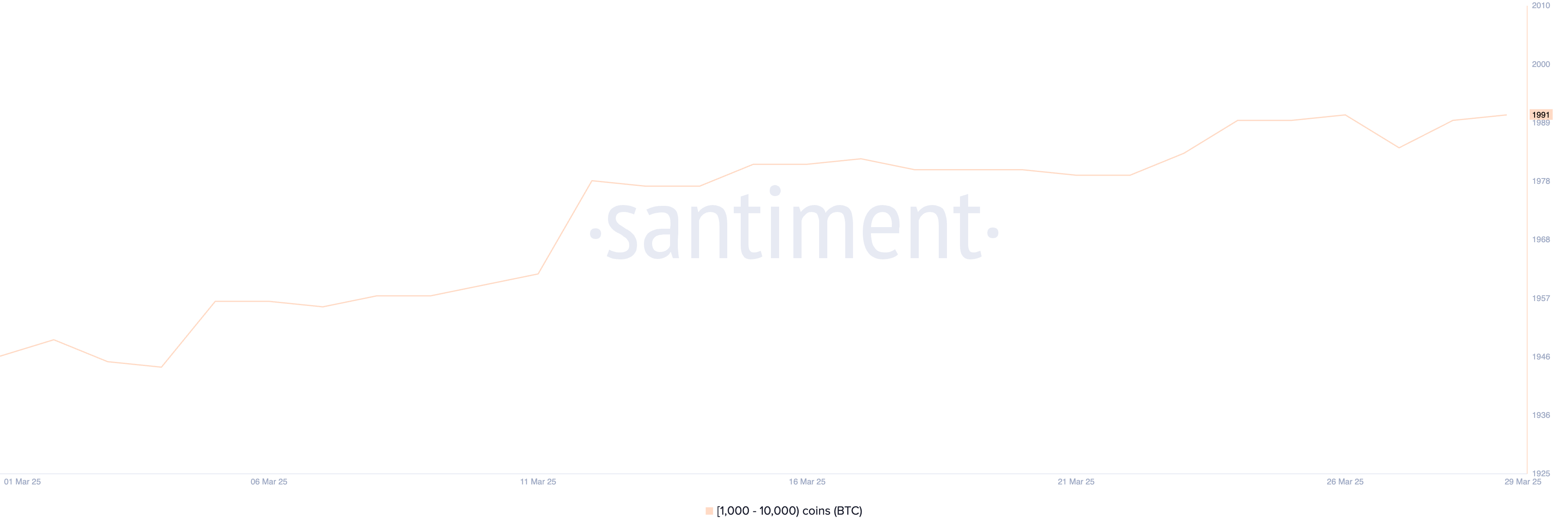

Bitcoin Whales Just Hit Its Highest Level In More Than 3 Months

The number of Bitcoin whales—wallets holding at least 1,000 BTC—has been steadily increasing in recent weeks. On March 22, there were 1,980 such addresses, and that figure has since climbed to 1,991.

While a change of 11 might seem modest at first glance, it represents a meaningful uptick in large-scale accumulation, especially considering this is the highest number of BTC whales recorded in over three months.

Tracking Bitcoin whales is critical because these large holders often have the power to influence price movements due to the sheer size of their positions. An increase in whale addresses can signal rising confidence among institutional investors and high-net-worth individuals.

When more whales accumulate rather than distribute, it often suggests bullish sentiment and reduced selling pressure.

With the current whale count hitting a multi-month high, it could imply that significant players are positioning ahead of a potential upward move in Bitcoin’s price.

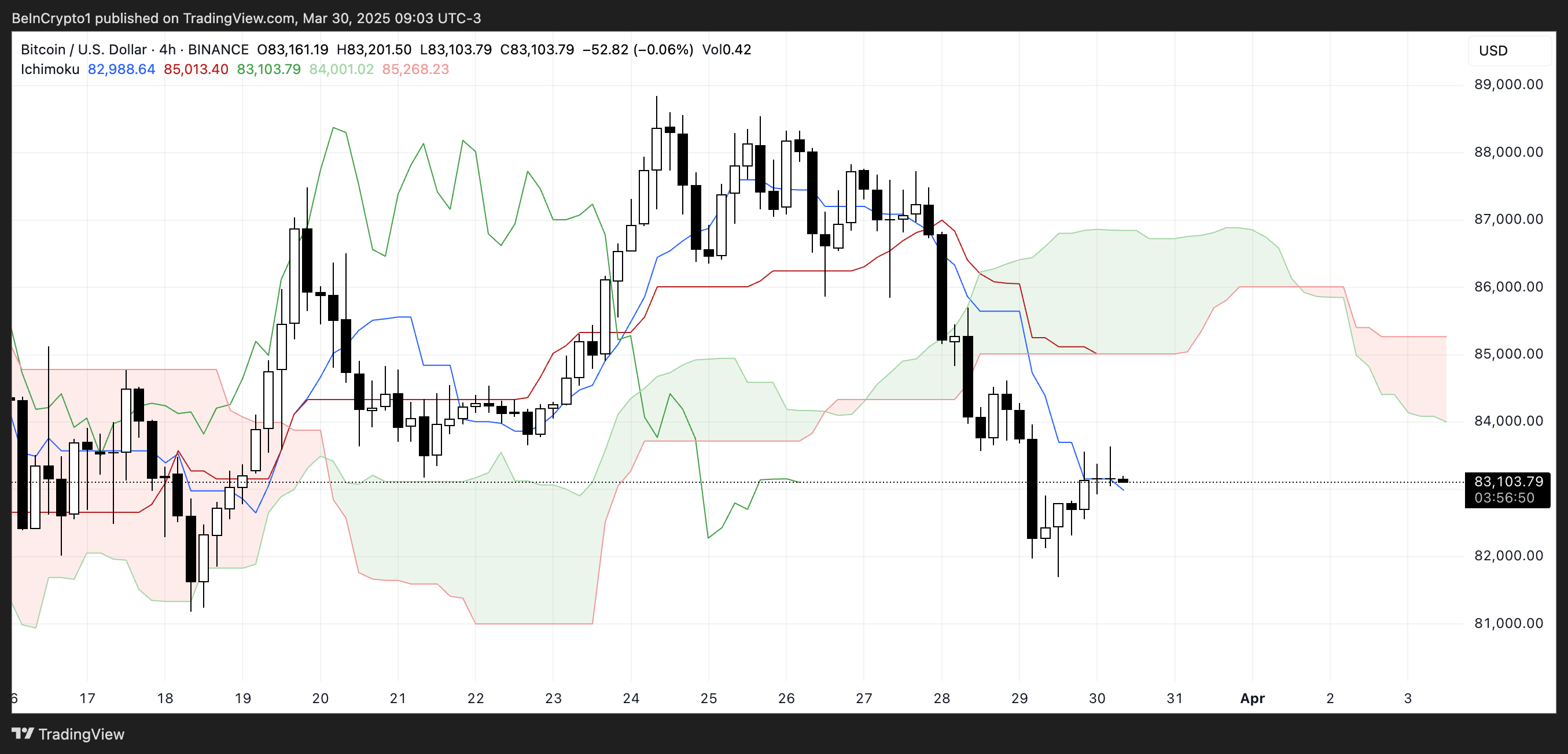

BTC Ichimoku Cloud Shows Challenges Ahead

The Ichimoku Cloud chart for Bitcoin shows the price consolidating just below the Kijun-sen (red line) after a strong downward move.

The Tenkan-sen (blue line) remains below the Kijun-sen, indicating short-term bearish momentum. Price action is attempting to stabilize but has yet to show a decisive shift in trend.

The Lagging Span (green line) trails below both the price and the cloud, reinforcing a bearish outlook from a historical perspective.

The Kumo (cloud) ahead is bearish, with the Senkou Span A (green cloud boundary) positioned below the Senkou Span B (red cloud boundary), and the cloud itself projecting downward.

This suggests resistance overhead and limited bullish momentum unless price manages to break through the cloud decisively.

The thin structure of the current cloud, however, hints at possible vulnerability—if buyers step in with strength, there could be a window for a reversal.

But for now, the overall setup favors caution, as the prevailing trend remains bearish according to Ichimoku principles.

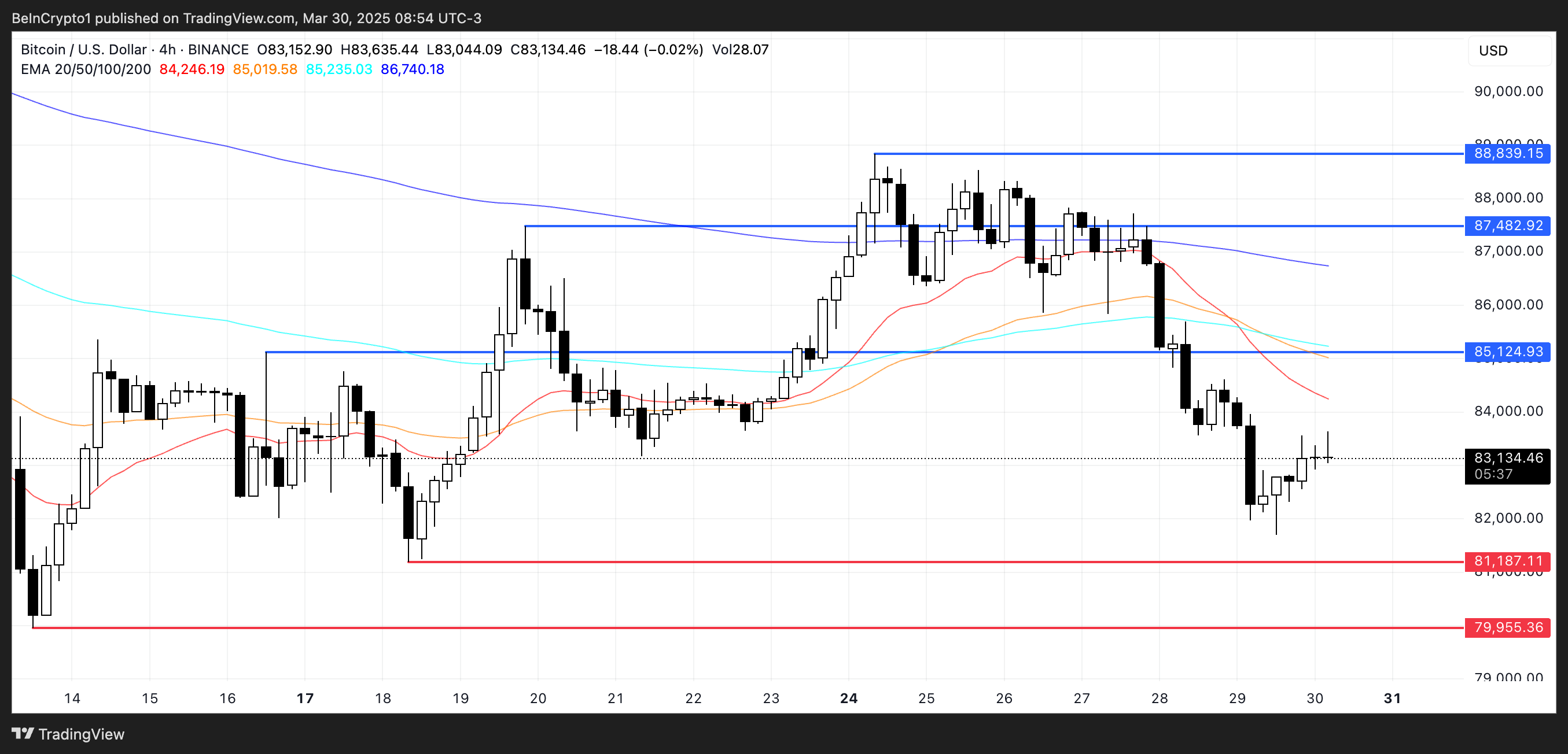

Can Bitcoin Rise To Test $88,000 Soon?

Bitcoin’s EMA lines continue to indicate a downtrend, with short-term moving averages positioned below the longer-term ones. This alignment suggests bearish momentum remains dominant for now.

However, if buyers can regain control and establish an uptrend, Bitcoin price may climb toward the next key resistance levels.

The first challenge would be the resistance near $85,124—if broken, this could open the path to $87,482 and potentially $88,839, assuming bullish momentum strengthens and sustains.

On the flip side, failure to build upward momentum would reinforce the current bearish structure.

In that case, Bitcoin could revisit the support level around $81,187.

A breakdown below this point would further validate the downtrend, potentially dragging the price down to $79,955.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Whale Leverages $27.5 Million PEPE Long on Hyperliquid

A crypto whale’s high-stakes, 10x leveraged PEPE position on Hyperliquid faces mounting risk. The whale’s leveraged PEPE bet remains precarious, risking liquidation amid market instability.

With added margin but persistent losses, any adverse price move could trigger cascading sell-offs and broader crypto turbulence.

Whale Opens 10X Leverage on PEPE

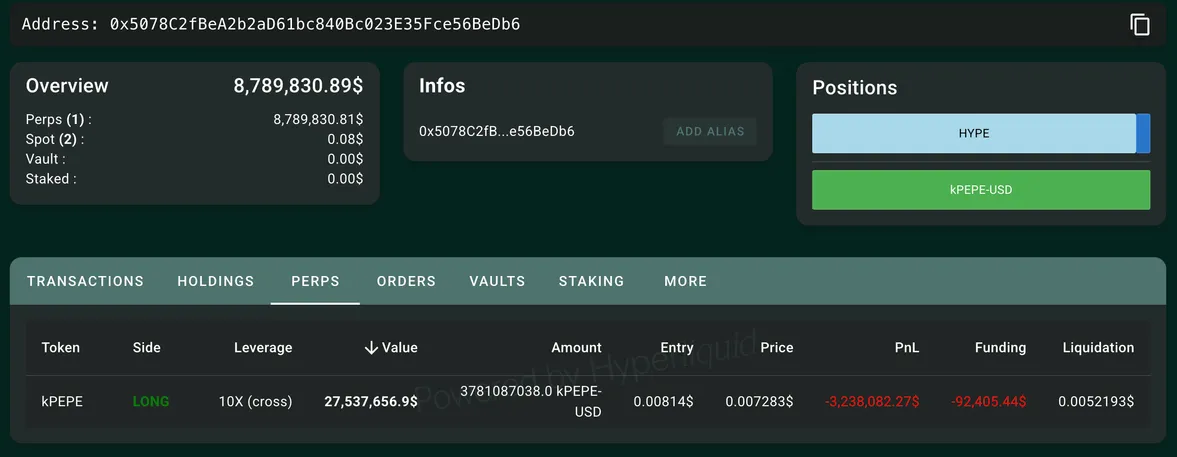

Crypto and DeFi analyst Ai revealed a notable gamble by a whale trader, placing a high-stakes bet on the PEPE meme coin. They opened a 10x leveraged long position worth $27.53 million on the Hyperliquid network.

However, the trade quickly turned against them, with unrealized losses amounting to $3.238 million.

The whale, identified by the address 0x507…BeDb6 initiated the position on March 24 at an entry price of $0.00814 per 1,000 PEPE. As it stands, they are now at risk of liquidation should the price fall to $0.005219.

To prevent forced closure, they have added 3.818 million USDC in margin (approximately $3.8 million).

The precarious nature of the position raises concerns about the broader risks to PEPE’s market stability and the implications for leveraged trading on Hyperliquid.

Using 10X leverage dramatically amplifies potential gains and losses, making this a highly volatile bet. Even minor price fluctuations can lead to significant swings in the whale’s account balance.

If PEPE’s price continues to decline and reaches the liquidation threshold, Hyperliquid’s automated systems will forcibly close the position.

This could further drive down PEPE’s price. Such liquidations often lead to cascading sell-offs as other leveraged traders get caught in a feedback loop, exacerbating market volatility.

Meanwhile, the whale’s decision to inject more margin suggests they are committed to defending their position. However, this also signals the pressure they are under to maintain solvency.

What Are the Perceived Risks?

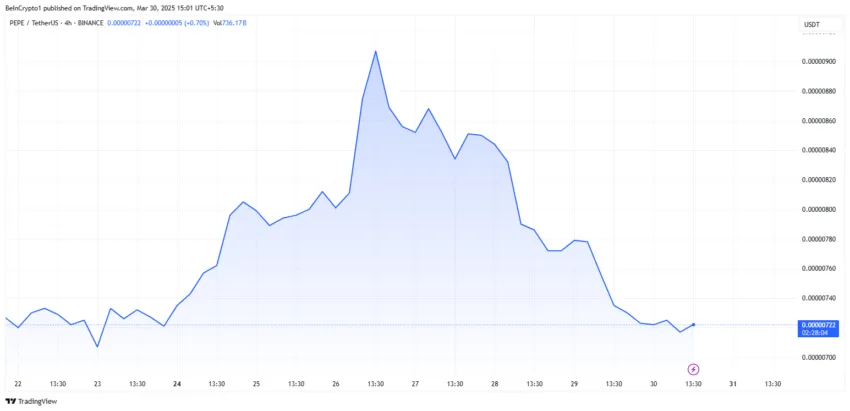

PEPE’s inherent volatility adds another layer of risk. As a meme coin, its price movements are often driven by social sentiment rather than fundamental value. This makes it particularly vulnerable to quick price swings, which could trouble the whale’s position.

If negative market sentiment prevails due to external factors such as regulatory news or shifting trader interest, PEPE’s price could decline further.

Given that the market has already been experiencing a downturn, the likelihood of additional price pressure remains a significant concern.

Another critical issue is the potential for whale-induced market manipulation. Large-scale traders have the power to sway market trends, either through direct trades or by influencing sentiment.

By continuously adding margin to avoid liquidation, the whale may attempt to prop up PEPE’s price and prevent a major sell-off.

However, such efforts can only go so far. If the whale ultimately exits their position, it could trigger panic among smaller traders, leading to a rapid decline in PEPE’s value.

The broader impact on retail investors closely tracking whale activity could exacerbate instability.

The risks associated with liquidation cascades also cannot be ignored. Hyperliquid’s decentralized liquidation mechanism allows efficient order processing.

However, a large liquidation can spark a chain reaction in highly leveraged markets.

The PEPE price has fallen by over 5% in the last 24 hours and was trading for $0.00000721 as of this writing.

If PEPE’s price nears the whale’s liquidation point, other traders may begin preemptively selling to avoid losses, creating a snowball effect.

This could result in PEPE experiencing sharp price declines quickly, potentially affecting other meme coins and broader crypto markets.

KOL Opens Similar Leverage Position for Ethereum

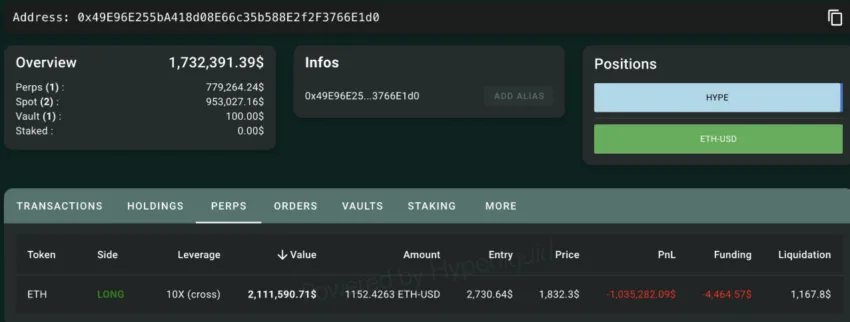

The risks are not limited to PEPE alone. A similar situation is unfolding with another prominent trader, CBB, a Key Opinion Leader (KOL) on X. They opened a 10X leveraged long position on Ethereum (ETH) worth $2.11 million.

Currently, they are facing an unrealized loss of $1.035 million due to an entry price of $2,730. Given current market conditions, this has proven to be too high.

However, unlike the PEPE whale, this trader has a more comfortable margin buffer, with a liquidation price of $1,167.8.

While not in immediate danger, this case further reflects the precarious nature of highly leveraged trading in volatile markets.

The unfolding drama surrounding these positions highlights the risks of excessive leverage, particularly in a declining market.

With PEPE’s whale struggling to maintain their position and Ethereum’s long traders facing mounting losses, the broader crypto market could see increased volatility in the coming days.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoGRASS Jumps 30% in a Week, More Gains Ahead?

-

Market22 hours ago

Market22 hours agoONDO Whales Retreat as Price Risks Dropping Below $0.70

-

Altcoin22 hours ago

Altcoin22 hours agoPepe Coin Whale Sells 150 Billion Tokens, Price Fall Ahead?

-

Market21 hours ago

Market21 hours agoXRP Falls 12% in a Week as Network Activity Declines

-

Altcoin21 hours ago

Altcoin21 hours agoIs Burger King Teasing Crypto Launch? Decoding Their X Post

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Bulls Disappointed As Recovery Attempt Fails At $2,160 Resistance

-

Bitcoin23 hours ago

Bitcoin23 hours ago8,000 Dormant Bitcoin Suddenly Move: What’s Next For The Market?

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Monthly RSI At 2018 Market Low — What Happened Last Time?