Bitcoin

3 US Economic Events to Watch for Crypto Market Impact

Crypto markets are bracing for what is arguably the most volatile week in 2024. Three US macroeconomic data events are on the calendar and have the potential to affect investors’ portfolios significantly.

Meanwhile, Bitcoin (BTC) is trading below $70,000, with prospects for more gains as the fourth quarter (Q4) has historically boded well for the pioneer crypto.

US Elections: Donald Trump vs. Kamala Harris

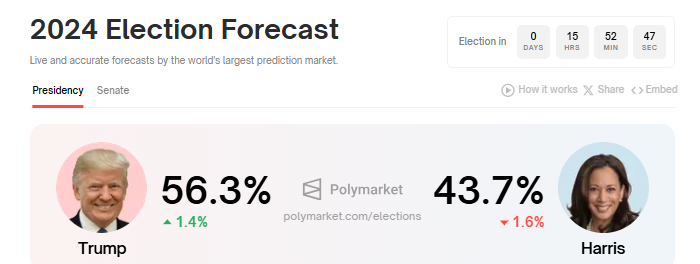

The US market is approaching the climax of its political showdown between Donald Trump and Kamala Harris, from the Republican and Democratic parties, respectively, on Tuesday, November 5. Based on data on Polymarket, the US elections are only hours away, with Trump narrowly in the lead.

Read More: How Can Blockchain Be Used for Voting in 2024?

Nevertheless, Polymarket’s industry peer in the prediction market, Kalshi, shows an almost similar margin, with Trump leading by 52% against Harris’ 48%. This contrast reflects the differences in these platforms’ user bases. Notwithstanding, analysts anticipate a volatile day for Bitcoin.

The US election results could have significant implications for economic policy, regulatory environments, and investor sentiment. Depending on the winner, policies regarding cryptocurrency might change, potentially affecting Bitcoin price, with the sentiment spilling over to other crypto tokens.

“I’m expecting this week to be a real firecracker, with lots of volatility. The Key day will be Tuesday, as the US election voting comes to a close. If there is no clear winner as the day progresses, it could get quite scary for Bitcoin,” said Mark Cullen, an analyst at AlphaBTC.

Initial Jobless Claims: Labor Market Gauge

Beyond the US elections, crypto markets will also monitor the initial jobless claims on Thursday, November 7. This economic data helps gauge the tightness or softness of the labor market in the US. While the job market has softened, unemployment rates remain low on an absolute basis.

Last week, US citizens filing new applications for unemployment insurance came in at 216,000 from the week ending October 25, down from the previous 228,000. However, there is a consensus forecast of 220,000.

High initial jobless claims in the Thursday report suggest increasing economic hardship and a weakening labor market. This could lead to decreased consumer spending and investment in traditional assets like stocks and bonds. Consequently, some investors may turn to alternative assets like cryptocurrencies as a hedge against economic uncertainty.

FOMC Interest Rate Decision and Jerome Powell Speech

On Thursday, the Federal Open Market Committee (FOMC) will release minutes from its last meeting, followed by comments from Federal Reserve (Fed) Chair Jerome Powell. The Fed operates under a dual mandate: to keep inflation, as measured by the Consumer Price Index (CPI), at 2% annually, and to sustain full employment.

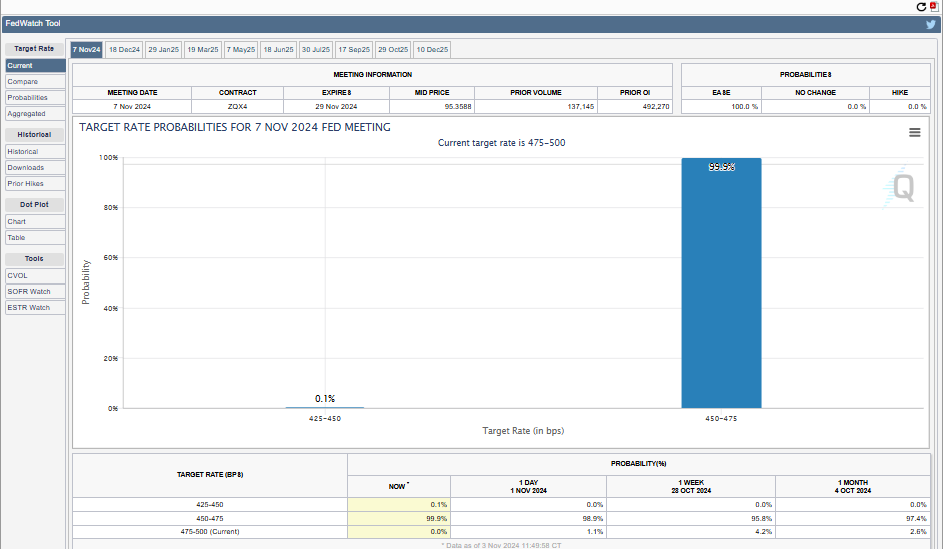

The FOMC’s November meeting is scheduled for next Wednesday and Thursday, with economists speculating on the possibility of another rate cut. At the previous meeting, the Fed reduced interest rates by 50 basis points (0.5%) as US CPI dropped to 2.4%.

Another rate cut may be likely as inflation nears the Fed’s 2% target, while the unemployment rate has risen from 3.7% to 4.1% this year, indicating potential softening in the job market.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Recently, Powell said the downside risks to employment have increased, hinting at more rate cuts to support economic growth before the situation worsens. Moreover, the FOMC’s forecast in September suggested that the federal funds rate could fall by another 50 basis points before the end of 2024.

With only November and December meetings remaining, likely, two 25-basis-point cuts are likely underway. Against this backdrop, the CME Fed Watchtool shows a 99.9% probability of a 25 bps rate cut in the Thursday US economic data release.

Meanwhile, Spotonchain anticipates a further upside for Bitcoin after the US elections and FOMC meeting, setting a BTC price target of $100,000 in 2024. The rally, Spotonchain says, will come regardless of who wins the elections.

“The market is entering its most volatile week with the US election and FOMC meeting, but this rally may be here to stay. Historically, the real bull run begins post-election, and we believe that whether Trump or Harris becomes the next president, BTC will continue its upward journey, potentially reaching 100,000 this year,” Spotonchain said.

At the time of writing, BTC is trading for $68,698, signifying a modest 0.34% surge since the Monday session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Institutional Risk Aversion Drives $218 Million Bitcoin ETF Outflows

Bitcoin ETFs (exchange-traded funds) continue to record negative flows this week as President Trump’s Liberation Day countdown continues.

Sentiment is cautious across crypto markets, with traders and investors adopting a wait-and-see approach.

Bitcoin ETF See Outflows Amid Investor Caution

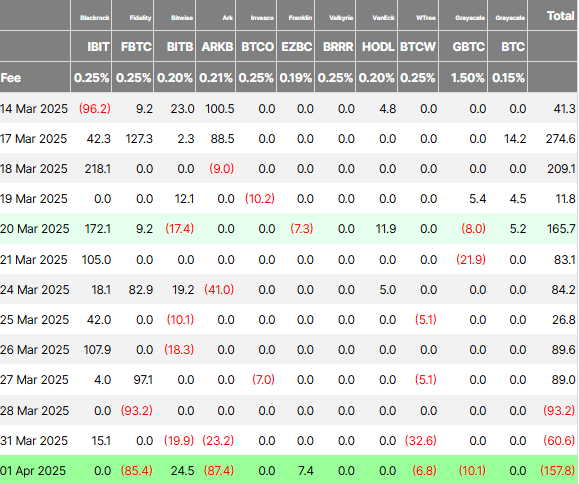

Data on Farside Investors shows two consecutive days of net outflows for Bitcoin ETFs since Monday. Financial instruments from Bitwise (BITB), Ark Invest (ARKB), and WisdomTree (BTCW) were in the frontline for Monday’s $60.6 million outflows, with only BlackRock’s IBIT seeing positive flows.

Meanwhile, Tuesday saw even more outflows, approaching $158 million, with Bitwise and Ark Invest leading the charge. Then, on April 1, BlackRock’s IBIT recorded zero flows. Meanwhile, Ethereum ETFs recorded net outflows of $3.6 million, data on Farside shows. This suggests a cautious sentiment among institutional investors.

“The Spot Bitcoin ETFs saw $157.8 million outflow yesterday. The Spot Ethereum ETFs saw a $3.6 million outflow. Institutions are reducing risk ahead of today’s tariff announcement,” analyst Crypto Rover noted.

Indeed, sentiment suggests traders are exercising caution, choosing to remain in “wait-and-see” mode. The caution comes ahead of Trump’s Liberation Day announcement, which is due later in the day on April 2.

With POTUS poised to unveil sweeping new tariffs, traders and investors across financial playing fields wait to see the scope of an onslaught that could spark a global trade war. Specifically, there is generally very little information about the tariffs’ specifics, which creates uncertainty regarding their impact on the broader economy and the crypto market.

“The White House has not reached a firm decision on their tariff plan,” Bloomberg reported, citing people close to the matter.

Despite the lack of clarity, it is understandable why investors would be cautious considering the impact of previous tariff announcements on Bitcoin price. Meanwhile, analysts predict extreme market volatility, with potential stock and crypto crashes reaching 10-15% if Trump enforces broad tariffs.

“April 2nd is similar to election night. It is the biggest event of the year by an order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen,” economic analyst Alex Krüger predicted.

While sentiment is cautious in the crypto market, some investors are channeling toward gold as a safe haven. A Bank of America survey showed that 58% of fund managers prefer gold as a trade war safe haven, while only 3% back Bitcoin.

These findings came as institutional investors cite Bitcoin’s volatility and limited crisis-time liquidity as key barriers to its safe-haven adoption. Trade tensions have historically driven capital into safe-haven assets.

With Trump’s Liberation Day announcement looming, investors preemptively position themselves again, favoring gold over Bitcoin.

Nevertheless, despite Bitcoin’s struggle to capture institutional safe-haven flows, its long-term narrative remains intact. This is seen with Bitcoin supply on exchanges dropping to just 7.53%, the lowest since February 2018.

When an asset’s supply on exchanges reduces, investors are unwilling to sell, suggesting strong long-term holder confidence.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Could Serve as Inflation Hedge or Tech Stock, Say Experts

Bitcoin may be a useful hedge against inflation in the near future as market uncertainty is growing. In the long run, it may also be useful to envision Bitcoin differently, treating it as a barometer for the tech industry.

Standard Chartered’s Head of Digital Assets Research and WeFi’s Head of Growth both shared exclusive comments with BeInCrypto regarding this topic.

Bitcoin: Inflation Hedge or Magnificent 7 Candidate?

Since the early days of the crypto space, investors have been using it as a hedge against inflation. However, it’s only recently that institutional investors are beginning to treat it the same way. According to Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, the trend of Bitcoin as an inflation hedge is increasing.

Still, this view may be too narrow in a few ways. Since the Bitcoin ETFs were first approved, BTC has been increasingly well-integrated with traditional finance. Kendrick noted this, saying that it is highly correlated with the NASDAQ in the short term. He claimed that Bitcoin might represent more than an inflation hedge, instead serving as an ersatz tech stock:

“BTC may be better viewed as a tech stock than as a hedge against TradFi issues. If we create a hypothetical index where we add BTC to the ‘Magnificent 7’ tech stocks, and remove Tesla, We find that our index, ‘Mag 7B’, has both higher returns and lower volatility than Mag 7,” Kendrick said in an exclusive interview with BeInCrypto.

This comparison is particularly apt for a few reasons. Tesla’s stock price is heavily entangled with Bitcoin, but it’s also been dropping due to political controversies. If Bitcoin were to replace Tesla’s position in the Magnificent 7, it may be a welcome addition. Of course, there is currently no mechanism to cleanly treat Bitcoin as a similar type of product. That could change.

However, Bitcoin’s role as an inflation hedge might be more immediately relevant. As Trump’s Liberation Day approaches, the crypto markets are becoming increasingly nervous about new US tariffs. As Agne Linge, Head of Growth at WeFi, said in an exclusive interview, these fears are impacting all risk-on assets, Bitcoin included.

“Crypto markets are closely tracking investor sentiment ahead of Trump’s…tariff announcement, with growing concerns over the potential economic impact. Bitcoin’s increasing correlation with traditional markets has amplified its exposure to broader macroeconomic trends, making it more sensitive to the risk-off sentiment that has affected equity markets,” Linge claimed.

She went on to state that US economic uncertainty was at record levels, surpassing both the 2008 financial crisis and the pandemic in April 2020. In these circumstances, recent inflation indicators are showing expected rates above expectations.

In such an environment, the crypto market is sure to take a hit, but traditional finance and the dollar is also in great jeopardy. All that is to say, Bitcoin is likely to be a solid inflation hedge in the near future. Even if it falls dramatically, it has worldwide appeal and the ability to rebound.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

Michael Saylor, one of the most outspoken supporters of Bitcoin, is back and bolder than ever. In a recent statement, the former MicroStrategy CEO predicted that the alpha coin will potentially hit a $500 trillion market cap. Saylor’s bold prediction for the world’s top digital asset comes during the intensified push for a Strategic Bitcoin Reserve (SBR).

In his latest pro-crypto statement, Saylor argued that the digital asset will “demonetize gold”, then it will demonetize real estate, which he calculated as 10x more than gold. To summarize his argument, Saylor further states that Bitcoin will demonetize “all long-term store of value”.

Push For SBR Gains Ground

Saylor’s latest statement comes as Congress intensifies its efforts to build the country’s BTC holdings. United States President Donald Trump formalized the plans to build crypto holdings through an executive order to establish a strategic crypto reserve that will initially include $17 billion worth of BTC that the country currently controls.

Michael Saylor: Bitcoin Headed to $500 Trillion 🚀₿

– At Digital Asset Summit, MicroStrategy’s Saylor predicted:

• BTC will reach $500T market cap

• It will “demonetize gold, real estate & all long-term stores of value”

– Capital shift: “From physical to digital, from…— AFV GLOBAL (@afvglobal) March 28, 2025

According to the president, additional acquisitions of cryptocurrency are allowed, provided these are done through “budget-neutral” approaches. Senator Cynthia Lummis initially proposed in the Senate, through the Bitcoin Act, the plan to create a Bitcoin reserve. Under the proposal, the administration can purchase 1 million Bitcoin to complement the reserve.

Saylor Explains Crypto’s Role During Blockchain Summit

Saylor’s latest prediction on Bitcoin was made during his appearance at the DC Blockchain Summit. He was joined on stage by Jason Les, the CEO of Rito Platforms, and Lummis, the principal author of the Bitcoin Act.

During the program, Saylor was asked about America’s need for Bitcoin. Saylor answered with conviction, saying the rising importance of BTC is inevitable and will happen with the US’ participation. During his talk, he shared that Bitcoin, created by the enigmatic Satoshi Nakamoto, is unstoppable.

Image: Gemini Imagen

Saylor added that the premier digital asset is the next stage in money’s evolution, and it’s currently absorbing value from traditional assets like currency reserves and real estate.

Saylor Predicts Top Coin Will Reach $500 Trillion In Market Cap

During his talk, Saylor predicted that BTC will eventually grow from $2 billion to $20 billion, which can hit $200 billion and beyond. Finally, he thinks the asset can achieve a $500 trillion market capitalization, reflecting more than 29,000% increase from its current market capitalization of $1.67 trillion.

Saylor’s recent bold prediction aligns with his firm conviction and support for the asset. He argues that Bitcoin’s unique features, its decentralized nature and fixed supply, make it a perfect hedge against economic uncertainties like inflation.

Featured image from Gemini Imagen, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market23 hours ago

Market23 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Bitcoin20 hours ago

Bitcoin20 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Bitcoin21 hours ago

Bitcoin21 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Market20 hours ago

Market20 hours agoCoinbase Stock Plunges 30% in Worst Quarter Since FTX Collapse

-

Altcoin19 hours ago

Altcoin19 hours agoWill XRP, SOL, ADA Make the List?

-

Market18 hours ago

Market18 hours agoTrump’s USD1 Stablecoin Eyes Trust Recovery in Crypto

-

Altcoin18 hours ago

Altcoin18 hours agoBTC, ETH, XRP, DOGE Fall Following Weak PMI, JOLTS Data

-

Altcoin17 hours ago

Altcoin17 hours agoBinance Update Sparks 50% Decline For Solana Meme Coin ACT: Details