Market

XRP Price Prediction November 2024: Will Institutions Return?

Ripple (XRP) price has seen a challenging trend recently, with consistent failures to close above the $0.60 level for four months. Despite these setbacks, XRP has managed to hold above a crucial support floor, giving investors hope.

A shift in institutional sentiment could help XRP regain its upward momentum, potentially changing the narrative around the cryptocurrency.

XRP Needs the Institutions

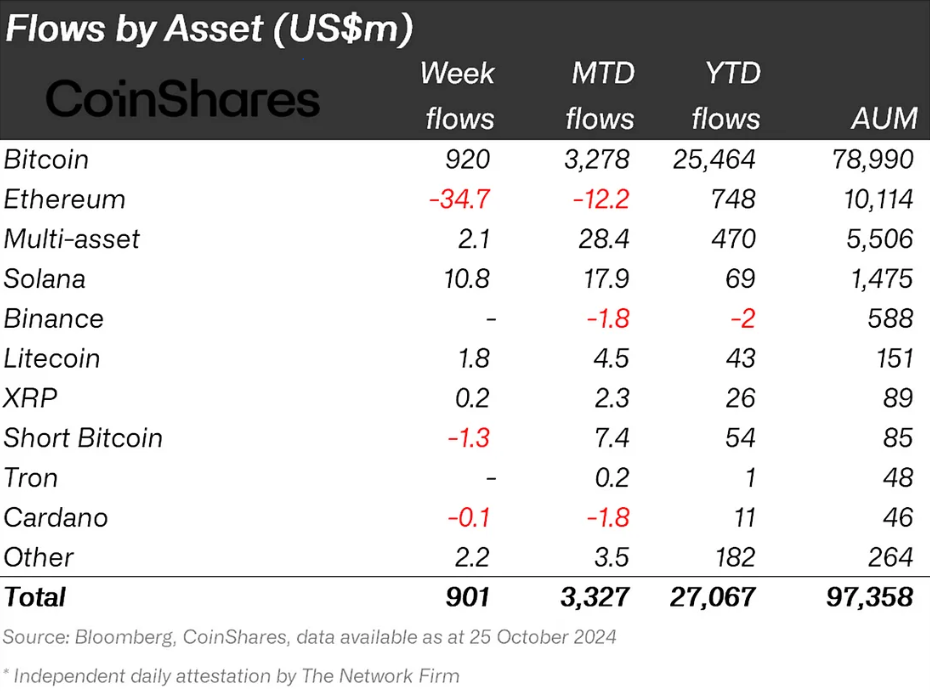

Institutional interest in XRP remained low throughout October, creating headwinds for the asset. Money flowing into XRP in the month of October reached only $2.3 million, significantly lagging behind Solana and Litecoin, which saw inflows of $17.9 million and $4.5 million, respectively.

This limited inflow reflects cautious investor sentiment, indicating that institutions are not as confident in XRP’s growth potential compared to other altcoins. For XRP to thrive in November, it will need stronger institutional support.

Victor Tan, founder and CEO of TrinityPad, shared a similar viewpoint regarding the future of XRP while talking to BeInCrypto.

“While recent ETF optimism and the “Uptober” hype have done little to drive significant movement, XRP could see modest growth if Ripple secures more institutional partnerships or regulatory clarity. Without major news, XRP may remain range-bound but could still gain 10-15% with favorable developments,” Tan told.

Higher inflows typically drive confidence and provide the stability necessary for price growth. Without increased institutional interest, XRP could continue struggling to break key resistance levels, limiting its potential for a strong rally in the near term.

Read more: XRP ETF Explained: What It Is and How It Works

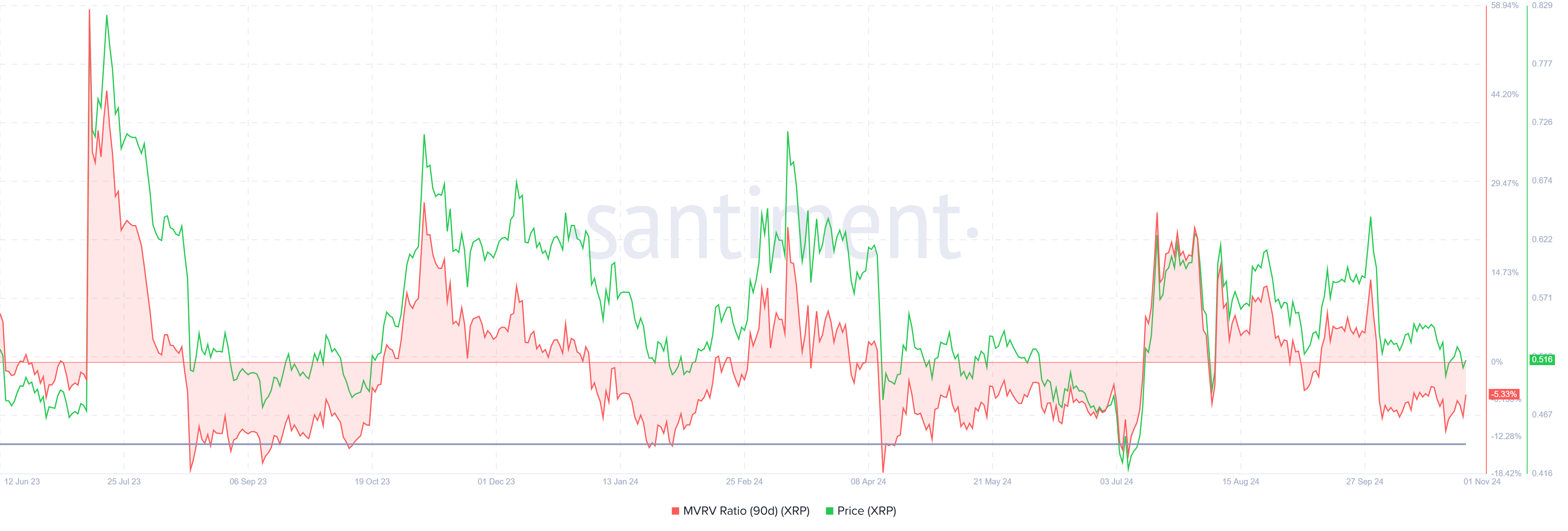

XRP’s macro momentum shows it is currently undervalued, as indicated by the 90-day Market Value to Realized Value (MVRV) ratio. This metric suggests that XRP is trading below its fair value, which can sometimes prompt buying interest.

However, the altcoin has not entered the “opportunity zone,” which typically triggers accumulation; this zone is defined by a drop below -13%, signifying extreme losses for holders. When XRP falls into this territory, investors often shift from selling to buying, which can help stabilize the price.

Currently, XRP’s undervalued status is not enough to spur a reversal. The altcoin may remain in this undervalued territory unless there is a change in sentiment. Investors may need a significant event or market shift to rebuild confidence, which would likely be necessary for a more pronounced recovery in XRP’s price.

XRP Price Prediction: Long Wait Ahead

XRP’s price has faced challenges around the 38.2% Fibonacci Retracement line at $0.52, which has served as a support floor in recent weeks. Despite its stabilizing role, XRP recently dipped below this level, indicating weakened support. This drop reflects a cautious stance among investors, who are wary of further losses.

Unless broader market conditions become overwhelmingly bullish, XRP’s recovery may remain slow. A gradual price increase could lead to consolidation below $0.55 and above $0.52, trapping XRP in a narrow range. This consolidation would limit significant upward movement, leaving the asset in a prolonged stagnation phase.

Read more: How To Buy XRP and Everything You Need To Know

If XRP experiences renewed bearish pressure, a drop to $0.47 is likely, aligning with the 23.6% Fibonacci level, also known as the bear market support floor. This level could prevent further declines, but a breach below it would invalidate any remaining bullish outlook, potentially leading to further price erosion.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Turns Green, Sparks Hopes of a Fresh Upside Push

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Ethereum Price Steadies After Increase—Now Eyes More Gains Ahead

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

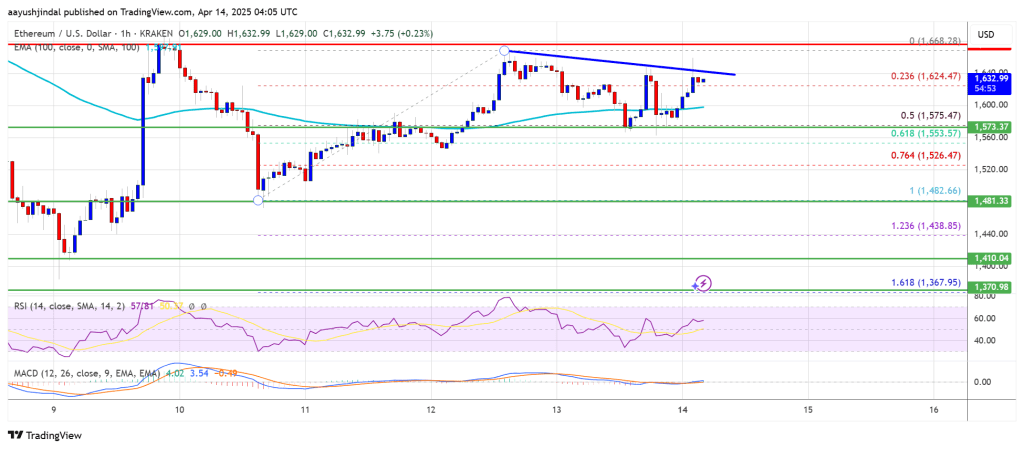

Ethereum price started a fresh increase above the $1,580 zone. ETH is now consolidating gains and might aim for more gains above $1,665.

- Ethereum started a decent increase above the $1,580 and $1,620 levels.

- The price is trading below $1,620 and the 100-hourly Simple Moving Average.

- There is a new connecting bearish trend line forming with resistance at $1,640 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,665 resistance zone.

Ethereum Price Gains Pace

Ethereum price formed a base above $1,500 and started a fresh increase, like Bitcoin. ETH gained pace for a move above the $1,550 and $1,580 resistance levels.

The bulls even pumped the price above the $1,620 zone. A high was formed at $1,668 and the price recently started a downside correction. There was a move below the $1,650 support zone. The price dipped below the 23.6% Fib retracement level of the upward move from the $1,482 swing low to the $1,668 high.

Ethereum price is now trading below $1,600 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,640 level. There is also a new connecting bearish trend line forming with resistance at $1,640 on the hourly chart of ETH/USD.

The next key resistance is near the $1,665 level. The first major resistance is near the $1,680 level. A clear move above the $1,680 resistance might send the price toward the $1,720 resistance. An upside break above the $1,720 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,750 resistance zone or even $1,800 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $1,640 resistance, it could start a downside correction. Initial support on the downside is near the $1,600 level. The first major support sits near the $1,575 zone and the 50% Fib retracement level of the upward move from the $1,482 swing low to the $1,668 high.

A clear move below the $1,575 support might push the price toward the $1,550 support. Any more losses might send the price toward the $1,520 support level in the near term. The next key support sits at $1,480.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,575

Major Resistance Level – $1,665

Market

MANTRA’s OM Token Crashes 90% Amid Insider Dump Allegations

The MANTRA (OM) token suffered a catastrophic price collapse on April 13, plummeting over 90% in under an hour and wiping out more than $5.5 billion in market capitalization.

The sudden crash, which took OM from a high of $6.33 to below $0.50, has drawn comparisons to the infamous Terra LUNA meltdown, with thousands of holders reportedly losing millions.

Why did MANTRA (OM) Crash?

Multiple reports suggest that the trigger is a large token deposit linked to a wallet allegedly associated with the MANTRA team. Onchain data shows a deposit of 3.9 million OM tokens to OKX, sparking concerns about a possible incoming sell-off.

Given that the MANTRA team reportedly controls close to 90% of the token’s total supply, the move raised immediate red flags about potential insider activity and price manipulation.

The OM community has long expressed concerns around transparency. Allegations have surfaced over the past year suggesting the team manipulated the token’s price through market makers, changed tokenomics, and repeatedly delayed a community airdrop.

When the OKX deposit was spotted, fears that insiders might be preparing to offload were amplified.

Reports also indicate that MANTRA may have engaged in undisclosed over-the-counter (OTC) deals, selling tokens at steep discounts — in some cases at 50% below market value.

As OM’s price rapidly declined, these OTC investors were thrown into losses, which allegedly sparked a mass exodus as panic selling took hold. The chain reaction triggered stop-loss orders and forced liquidations on leveraged positions, compounding the collapse.

The MANTRA team has denied all allegations of a rug pull and maintains that its members did not initiate the sell-off.

In a public statement, co-founder John Patrick Mullin said the team is investigating what went wrong and is committed to finding a resolution.

The project’s official Telegram channel was locked during the fallout, which added to community frustration and speculation.

“We have determined that the OM market movements were triggered by reckless forced closures initiated by centralized exchanges on OM account holders. The timing and depth of the crash suggest that a very sudden closure of account positions was initiated without sufficient warning or notice,” wrote MANTRA founder JP Mullin.

If OM fails to recover, this would mark one of the largest collapses in crypto history since the Terra LUNA crash in 2022.

Thousands of affected holders are now demanding transparency and accountability from the MANTRA team, while the broader crypto community watches closely for answers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin7 hours ago

Altcoin7 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Market12 hours ago

Market12 hours agoHackers are Targeting Atomic and Exodus Wallets

-

Market11 hours ago

Market11 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Bitcoin19 hours ago

Bitcoin19 hours agoCryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Reclaims Key Support At $1,574, Here’s The Next Price Target

-

Market17 hours ago

Market17 hours agoDOGE Spot Outflows Exceed $120 Million in April

-

Market15 hours ago

Market15 hours agoFARTCOIN Is Overbought After 250% Rally – Is the Bull Run Over?

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Stays Below Realized Price: Once-In-A-Cycle Opportunity?