Market

Why Altcoin Season May Be Delayed Till After Elections

As the US Presidential Election draws near, Bitcoin’s dominance over the cryptocurrency market is rising. This potentially dampens hopes for an altcoin season.

Bitcoin’s dominance, measured by BTC.D, has climbed to its highest level since 2021. This surge coincides with significant capital inflows into Bitcoin ETFs and a relatively stagnant performance of many altcoins.

Bitcoin For the Win

Bitcoin dominance measures the coin’s market capitalization relative to the total market capitalization of all other cryptocurrencies. As of this writing, it sits at 59.77, its highest level since April 2021.

When BTC.D climbs, Bitcoin’s share of the total cryptocurrency market capitalization is increasing relative to altcoins. BeInCrypto’s assessment of its key momentum indicators confirms the strengthening bullish bias toward the leading coin and the likelihood of extended dominance.

Read more: Which Are the Best Altcoins To Invest in October 2024?

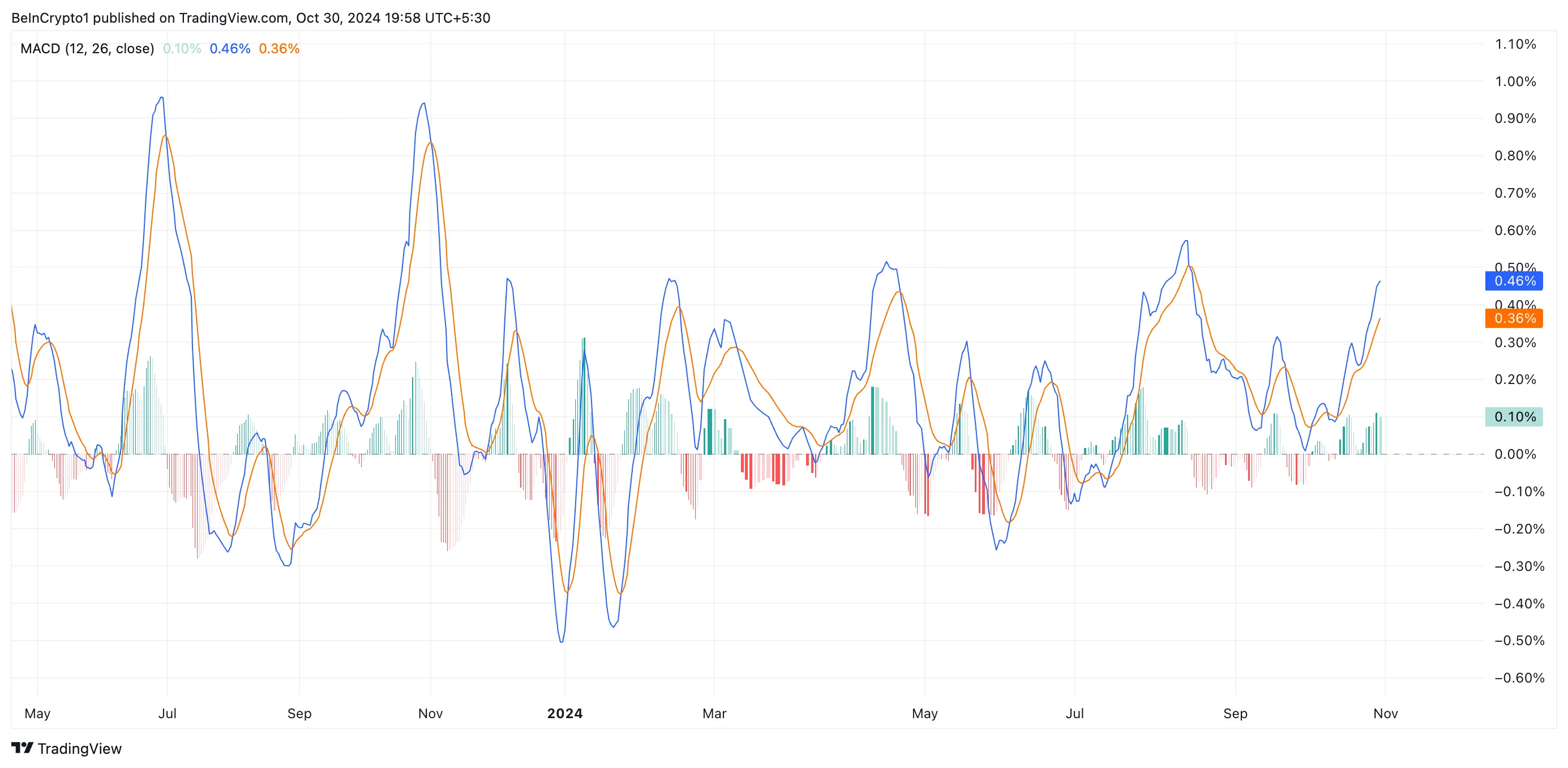

For example, readings from the BTC.D’s moving average convergence/divergence (MACD) show its MACD (blue) resting above its signal line (orange) as of this writing.

This setup suggests that Bitcoin is currently seeing increasing strength within the crypto market, outpacing altcoins in terms of market cap share. It indicates that the current market conditions are less conducive for an altcoin season, with Bitcoin likely to outperform many of these assets in the near term.

Demand for Bitcoin spot exchange-traded funds (ETFs) has surged recently, highlighting strong interest in the leading cryptocurrency. In a recent report, digital asset research firm 10X Research indicated that rising BTC ETF demand could drive Bitcoin’s price to $100,000 by January 2025.

“Bitcoin spot ETFs purchased $4.1 billion in October alone— the highest volume since March 2024—with buy momentum showing no signs of slowing as all ETF buyers remain profitable. Last night, spot ETFs acquired an additional $830 million in Bitcoin, bringing the 5-day total to $2.1 billion. With ETF demand going parabolic, Bitcoin is set to follow suit. If this trend holds, our quant signal also projects a potential rally to $100,000 by the end of January 2025,” the research firm wrote.

TOTAL2 Consolidates Within a Range

With capital flowing into Bitcoin ETFs, individual and institutional investors are more likely to prioritize BTC investments over less-established altcoins. As a result, less capital flows into the altcoin market reducing their price momentum and trading volumes.

This has played out as reflected by TOTAL2’s (the total market capitalization of all cryptocurrencies excluding Bitcoin) sideways movements since early August. While BTC.D has rallied, TOTAL2 has consolidated within the $967 billion and $856 billion price range.

This consolidation indicates that altcoin traders have been uncertain about the next direction prices will take. This has led to decreased volatility and trading volume, further delaying the altcoin season.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

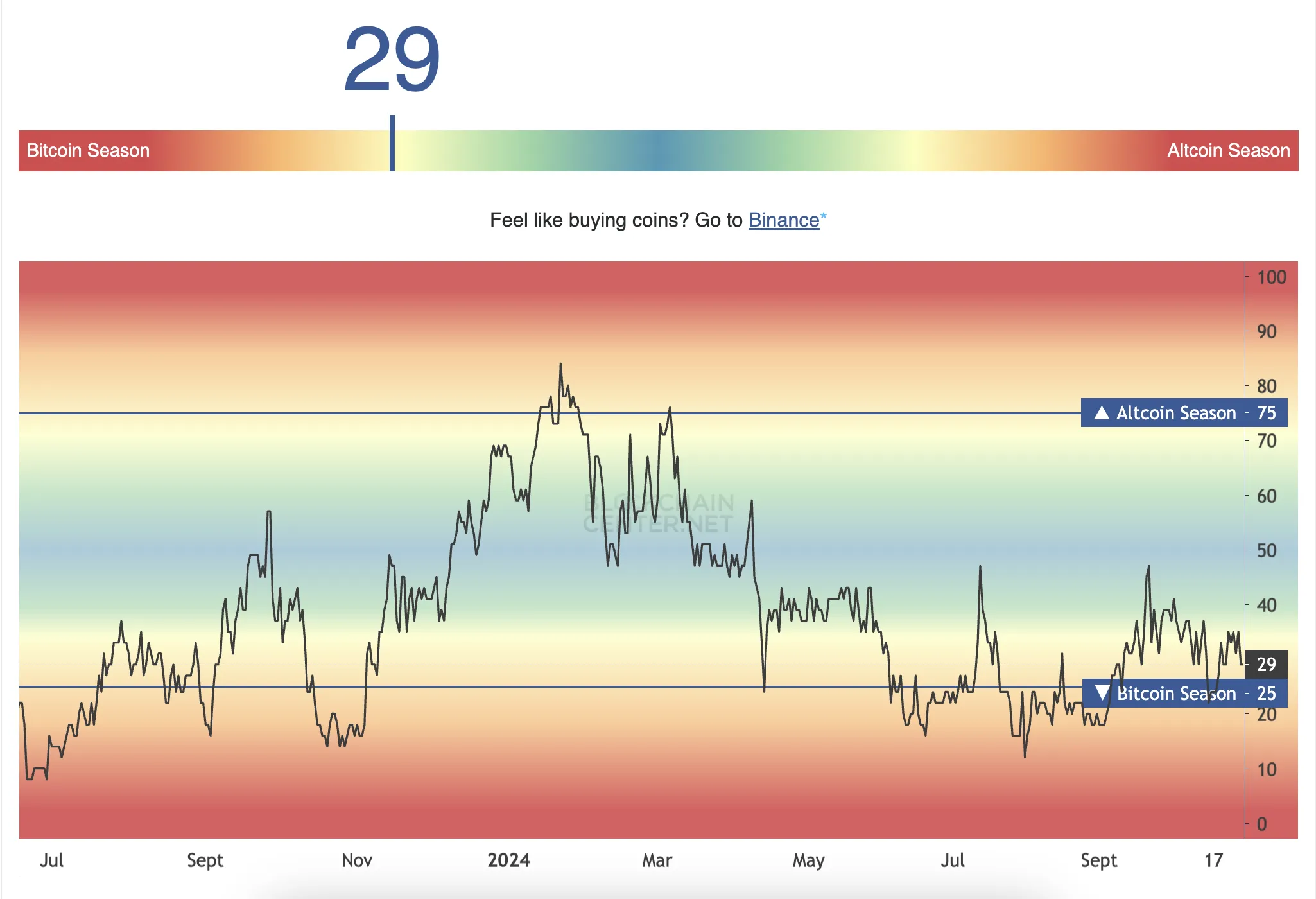

Moreover, the altcoin season commences when at least 75% of the top 50 altcoins outperform Bitcoin over a three-month period. Recent data from Blockchain Center reveals that only 29% of these top altcoins have surpassed Bitcoin’s performance in the past 90 days — well below the 75% threshold required to declare an altcoin season officially.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hill Rejects Interest-Bearing Stablecoins Despite Armstrong’s Wish

Representative French Hill, who Chairs the House Committee on Financial Services, rejected requests to approve interest-bearing stablecoins. Coinbase CEO Brian Armstrong made a public appeal in support of this yesterday.

Hill has been a vocal supporter of new stablecoin regulations, and the crypto industry counted his Committee appointment as a victory.

French Hill Rejects Interest-Bearing Stablecoins

If there’s one topic that’s a top priority for US crypto policy, it’d be stablecoin regulations. Significant momentum is building behind pro-industry regulations, and President Trump claimed that stablecoins will play a role in dollar dominance. However, Representative French Hill pushed back on one request, saying he opposes interest-bearing stablecoins:

“I hear the point of view, but I don’t think that there’s consensus among the parties or the Houses [of Congress] on having a dollar-backed payment stablecoin pay interest to the holder of that stablecoin,” Hill told reporters earlier today.

Although Hill portrayed this position on stablecoins as a common-sense viewpoint, it represents a limit to the crypto industry’s political influence. When Hill was chosen to head the House Committee on Financial Services, crypto took it as a big win. Further, he’s been a visible presence in the fight for stablecoin regulation. So, what’s the problem?

Essentially, Coinbase CEO Brian Armstrong made an appeal to Hill and other legislators regarding interest-bearing stablecoins. Just yesterday, Armstrong called this policy a “win-win” and a huge opportunity to help consumers and the economy.

“US stablecoin legislation should allow consumers to earn interest on stablecoins. The government shouldn’t put it’s thumb on the scale to benefit one industry over another. Banks and crypto companies alike should both be allowed to, and incentivized to, share interest with consumers. This is consistent with a free market approach,” Armstrong claimed.

Since Armstrong made this public appeal yesterday, it’s remarkable that Hill rejected his vision of stablecoins so quickly. Ostensibly, Armstrong’s political influence has been on the rise, as he played a prominent role in Trump’s Crypto Summit, and the SEC dropped its suit against Coinbase.

It’s an important fact for the US crypto industry to learn: no matter how quickly its influence is growing, it’s still very new to most people. Earlier this year, a string of state-level Bitcoin Reserve proposals failed in Republican-controlled states. President Trump may support crypto, but his supporters have limits.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How Did UPCX Lose $70 Million in a UPC Hack?

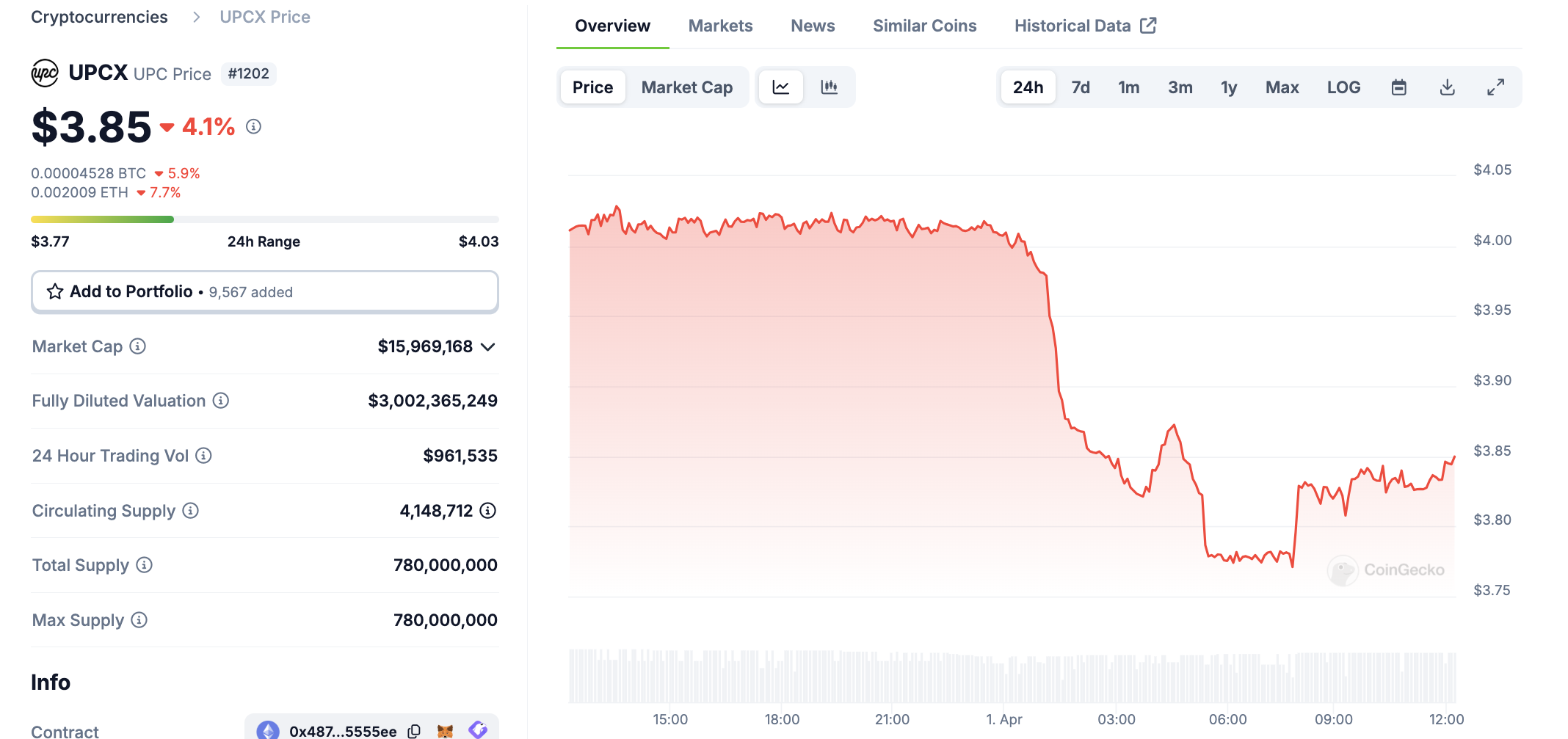

UPCX suffered a major hack today, with 18.4 million UPC tokens stolen from its management accounts. This amounts to about $70 million dollars, and the price of UPC fell drastically.

The hackers stole more UPC than is currently circulating in the markets and haven’t offloaded any assets yet. It is unclear who did this or how they will be able to secure their gains in other assets.

UPCX Suffers Major Hack

Cyvers, a crypto security firm that has tracked and uncovered several major crimes, identified a serious hack this morning. Multiple suspicious transactions took place involving UPCX’s management account, and the firm acknowledged suspicious activity. UPCX didn’t go into great detail, only describing a few security measures, but Cyvers showed the extent of the hack:

“It appears that someone gained access to the address 0x4C….3583E, upgraded the ‘ProxyAdmin’ contract, and executed the ‘withdrawByAdmin’ function, resulting in the transfer of 18.4 million UPC (approximately $70 million) from three different management accounts,” Cyvers claimed via social media.

UPCX is an open-source crypto payment system, and this hack may represent a serious blow to the company. According to CoinGecko data, the hackers stole significantly more UPC tokens than are currently available, which is around 4 million. Naturally, this caused the price to drop significantly, in an immediate drop of over 4%:

Although a $70 million hack will certainly damage UPCX individually, it’s unclear if it will actually impact the broader market much. The largest hack in crypto history took place a little over a month ago, and the community is still assessing the fallout. Meanwhile, UPCX is comparatively tiny; less than 10,000 X users viewed its post admitting to the security breach.

Since the UPCX hack took place, the recipient account hasn’t moved any of its UPC tokens. Indeed, it may be difficult for the perpetrator to convert these assets into usable fiat in the first place. If the hackers stole nearly 5x the amount of UPC tokens in circulation, any attempt to liquidate them will crash UPC’s token price even further.

Ultimately, the UPCX hack is strange for several reasons. Despite a large dollar amount, it hasn’t attracted a huge amount of buzz or impacted the market outside UPC. Hopefully, further analysis will identify the perpetrators, and possibly freeze the assets. Otherwise, the threat of a future sale could hamper UPC’s recover for the foreseeable future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Struggles to Break Out as Bear Trend Fades

Ethereum (ETH) enters the week with mixed signals as traders brace for tomorrow’s “Liberation Day” tariff announcement, a potential macro catalyst that could impact risk assets. While the BBTrend indicator remains deeply negative, it’s beginning to ease, hinting at a possible slowdown in bearish momentum.

On-chain data shows a slight uptick in whale accumulation, suggesting cautious optimism from large holders. Meanwhile, Ethereum’s EMA setup shows early signs of a trend reversal, but the price still needs to break key resistance levels to confirm a shift in direction.

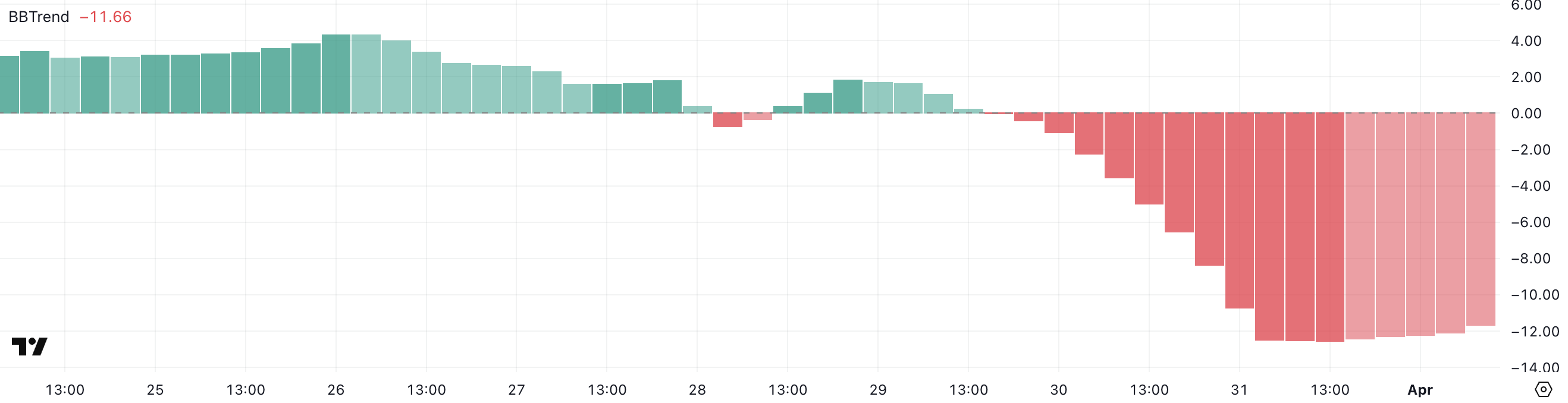

ETH BBTrend Is Easing, But Still Very Negative

Ethereum’s BBTrend indicator is currently reading -11.66, slightly improved from -12.54 the day before, but still in negative territory for the second consecutive day.

The Bollinger Band Trend (BBTrend) measures the strength and direction of a trend based on how price interacts with the upper and lower Bollinger Bands.

A positive BBTrend suggests bullish momentum, with the price expanding toward the upper band, while a negative BBTrend indicates bearish momentum, with the price leaning toward the lower band. Typically, a value beyond 10 is considered a strong trend signal, making the current -11.66 reading a sign of continued downside pressure.

The persistent negative BBTrend suggests that Ethereum remains in a short-term bearish phase, with sellers still dominating the price action.

While yesterday’s slight uptick hints at a potential slowing of downward momentum, the indicator remains well below the neutral zone, meaning any reversal is still unconfirmed, despite Ethereum flipping Solana in DEX trading volume for the first time in 6 months.

Traders may interpret this as a warning to stay cautious, especially if ETH continues hugging the lower Bollinger Band. For now, price action remains fragile, and any bounce will need to be supported by a decisive shift in volume and sentiment to signal a meaningful reversal.

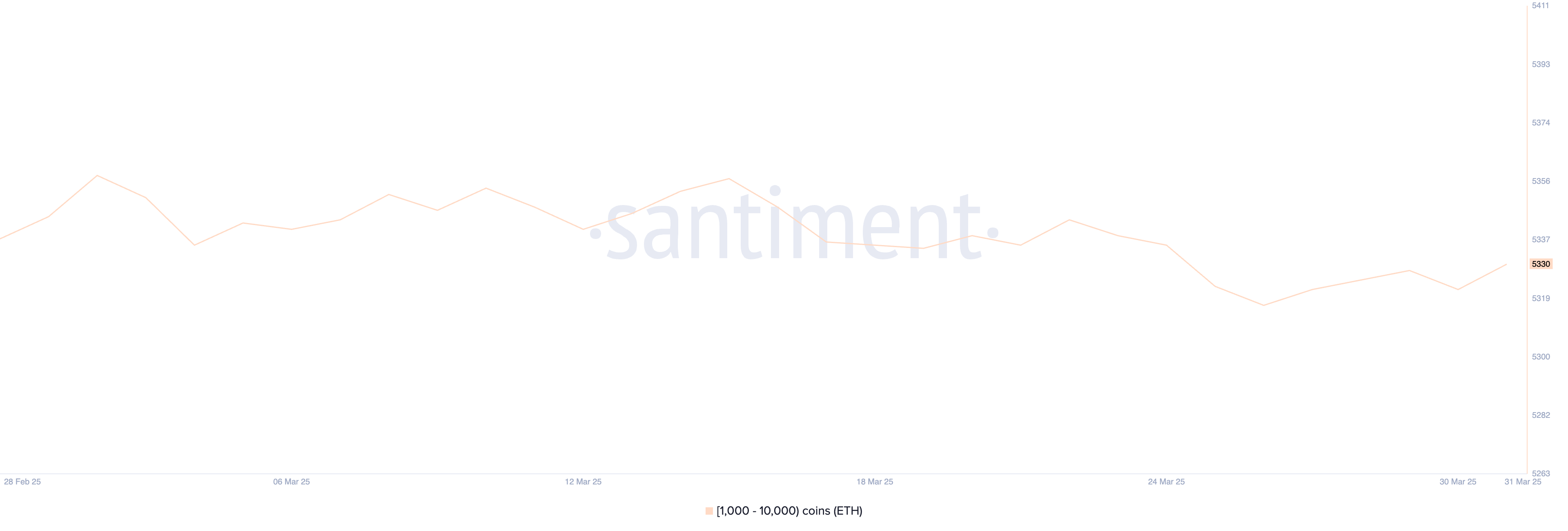

Ethereum Whales Are Accumulating Again

The number of Ethereum whales—wallets holding between 1,000 and 10,000 ETH—has ticked up slightly, rising from 5,322 to 5,330 in the past 24 hours.

While this is a modest increase, whale activity remains one of the most closely watched on-chain metrics, as these large holders often influence market direction. Whales’ accumulation can signal growing confidence in Ethereum’s medium—to long-term prospects, especially during periods of price uncertainty or consolidation.

Conversely, a decline in whale addresses typically suggests weakening conviction or profit-taking.

Although the recent uptick is a positive sign, it’s important to note that the current number of Ethereum whales is still below the levels observed in prior weeks.

This means that while some large holders may be re-entering the market, the broader whale cohort has yet to fully commit to an accumulation phase.

If the upward trend in whale numbers continues, it could support a bullish shift in sentiment and price. However, for now, the data points to cautious optimism rather than a decisive reversal.

Will Ethereum Break Above $2,100 Soon?

Ethereum’s EMA lines are showing early signs of a potential trend reversal, with price action attempting to break above key short-term averages.

If Ethereum price can push through the resistance at $1,938, it may signal the start of a broader recovery, potentially targeting the next resistance levels at $2,104, and if momentum builds—especially with supportive macro catalysts—increasing toward $2,320 and even $2,546.

On the flip side, if Ethereum fails to maintain its upward push and bearish momentum resumes, the focus will shift back to downside levels.

The first key support sits at $1,823; a break below that could expose Ethereum to further losses toward $1,759.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoCoinbase Tries to Resume Lawsuit Against the FDIC

-

Altcoin23 hours ago

Altcoin23 hours agoCharles Hoskinson Reveals How Cardano Will Boost Bitcoin’s Adoption

-

Market22 hours ago

Market22 hours agoHedera (HBAR) Bears Dominate, HBAR Eyes Key $0.15 Level

-

Market24 hours ago

Market24 hours agoBlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar

-

Altcoin24 hours ago

Altcoin24 hours agoEthereum Bitcoin Ratio Drops to Record Low, What Next for ETH?

-

Market21 hours ago

Market21 hours agoThis is Why PumpSwap Brings Pump.fun To the Next Level

-

Market20 hours ago

Market20 hours agoCardano (ADA) Whales Hit 2-Year Low as Key Support Retested

-

Altcoin14 hours ago

Altcoin14 hours agoA Make or Break Situation As Ripple Crypto Flirts Around $2