Market

What Are the Top DePIN Altcoins to Watch in November 2024?

As the Decentralized Physical Infrastructure Network (DePIN) sector gains traction, November 2024 presents an opportunity for investors to capitalize on emerging altcoins in this space. These altcoins have been disrupting the crypto market by merging blockchain technology with real-world applications.

Given this trend, it seems these cryptos may continue to surge in popularity. Here are five top DePIN altcoins that investors should watch in the coming month.

Bittensor (TAO)

At the top of this list of DePIN altcoins is Bittensor, the open-source protocol that powers a decentralized, blockchain-based machine-learning network.

Bittensor’s native token, TAO, has decreased by 15% in the last 30 days, trading at $510.86. At some point in the year, the altcoin’s value was close to $800. Therefore, the recent decline suggests that TAO might have presented a buying opportunity.

On the daily chart, TAO’s price is below the 20-day Exponential Moving Average (EMA), in blue. However, the same token has yet to fall below 50 EMA (yellow). By the look of things, it is unlikely to drop below this threshold, indicating that TAO’s price might jump toward $681.85 in November.

However, this forecast might not come to pass if the DePIN altcoin drops below the 50 EMA. In that scenario, TAO might sink to $397.32.

Filecoin (FIL)

Filecoin is another altcoin in the DePIN sector to watch out for in November 2024. As the native token of the decentralized storage system, FIL has hovered around $3 and $4 for the last 30 days.

Further, it appears that this token is largely undervalued, as it is well below its yearly high. However, the daily chart shows that FIL’s price has increased by nearly 10% since October 26, indicating that bulls are determined to help the altcoin rebound.

If this continues, then Filecoin might jump above the $3.85 overhead resistance and rally toward $4.29. On the other hand, the token could reverse these gains if bulls fail in their attempt to push the price higher. In that case, the altcoin’s value might drop to $3.41.

JasmyCoin (JASMY)

This list would be incomplete without mentioning JasmyCoin, one of the top DePIN altcoins focused on the Internet of Things (IoT). JASMY currently trades around $0.019 and has a similar technical setup to FIL.

Besides that, the altcoin has formed a falling wedge, and the price is about to break out of it. Once this happens, JASMY’s price is likely to rally toward the 61.8% Fibonacci sequence level at $0.034.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

On the flip side, if the altcoin fails to break above $0.020, this prediction might be invalidated. In that case, JASMY might drop back to $0.016.

Livepeer (LPT)

LPT, the native token of the blockchain-based streaming network protocol Livepeer, is also one of the top DePIN altcoins that investors might need to watch in November 2024. One reason investors should keep an eye on this is because it is one of the few altcoins with a Grayscale Trust.

While LPT’s price has decreased by 25% in the last 30 days, it could replicate the performance of alts like Sui (SUI), which performed well after Grayscale added it. From a technical point of view, bulls have defended the $10.68 support on the LPT/USD daily chart.

Going by this bounce, the altcoin’s value is likely to continue rising into November. Without any obstacle, LPT’s price might break the $11.84 resistance and rise toward $13.27. In a highly bullish scenario, the altcoin might jump to $15.23.

On the other hand, if buying pressure wanes, the Livepeer token could drop to $9.96. Investors should be on the lookout for this.

Grass (GRASS)

Last on the list of DePIN altcoins to watch out for is Grass, the project that launched earlier this week. Despite some issues with its airdrop, GRASS is one crypto that investors should watch out for, especially as it has shown strength amid the controversy.

A major reason for GRASS’ inclusion is that it is still in price discovery mode. As such, buyers and sellers have not agreed on a fair value. But in November 2024, that is likely to happen, and due to the project’s use case and potential altcoin season, the price is likely to increase.

Read more: 10 Best Altcoin Exchanges In 2024

As seen above, the altcoin is attempting to retest $1. If that happens, GRASS’ price could inch closer to $2 next month. However, the forecast will be invalidated if token holders liquidate most of their assets.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PENDLE Token Outperforms BTC and ETH with a 10% Rally

PENDLE has surged by 10% in the past 24 hours, making it the market’s top gainer during this period. The altcoin has even outperformed major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

With buying activity still underway, the PENDLE token is poised to extend its uptrend in the short term.

PENDLE Soars 43% After March Lows

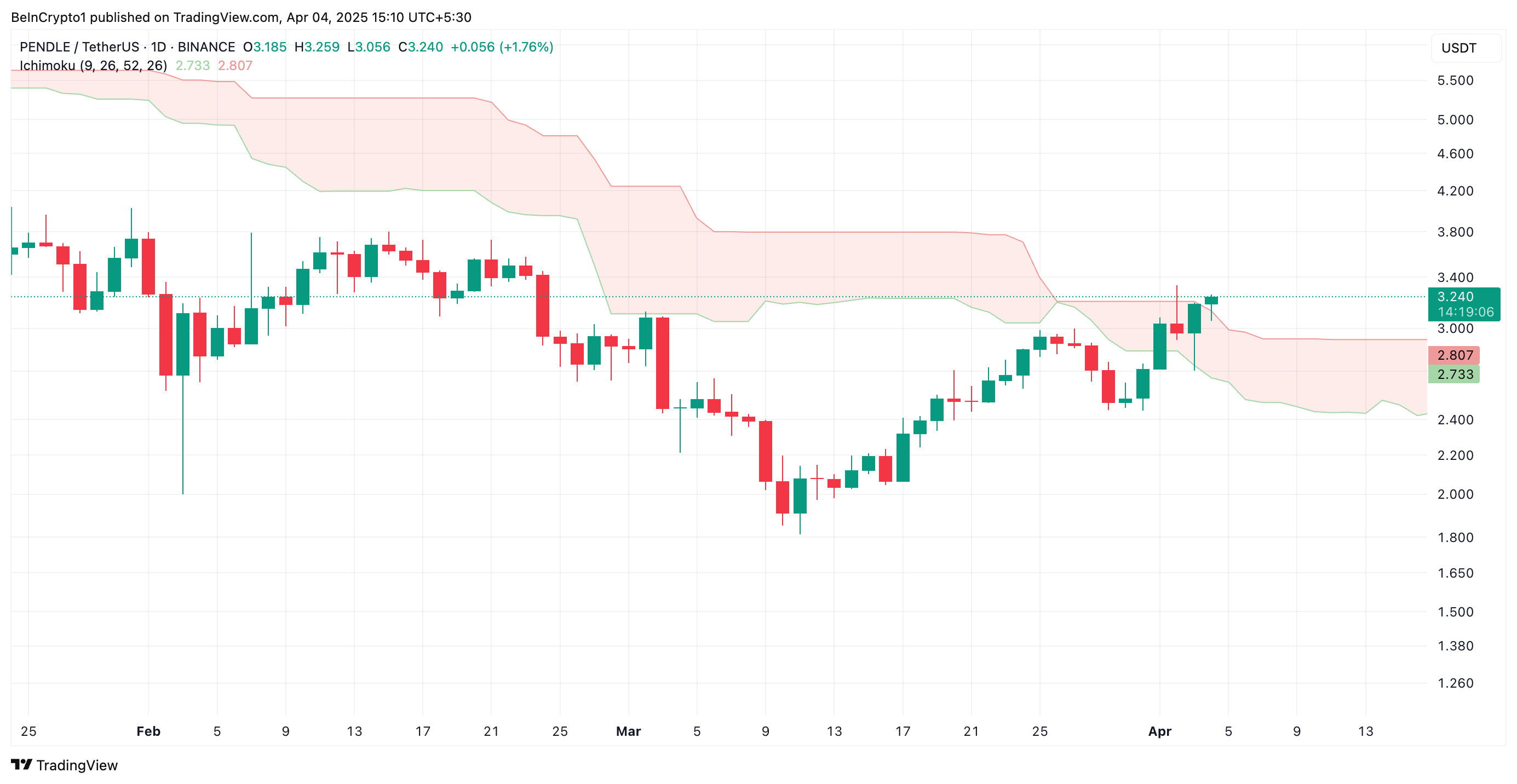

PENDLE cratered to a seven-month low of $1.81 on March 11. As sellers got exhausted, the token’s buyers regained dominance and drove a rally. Trading at $3.24 at press time, PENDLE’s value has since climbed 43%.

The double-digit surge in the altcoin’s price has pushed it above the Leading Spans A and B of its Ichimoku Cloud indicator. They now form dynamic support levels below PENDLE’s price at $2.73 and $2.80, respectively.

The Ichimoku Cloud tracks the momentum of an asset’s market trends and identifies potential support/resistance levels. When an asset trades above the leading spans A and B of this indicator, its price is in a strong bullish trend. The area above the Cloud is considered a “bullish zone,” indicating that market sentiment is positive, with PENDLE buyers in control.

This pattern suggests that the token’s price could continue to rise, with the Cloud acting as a support level if prices pull back.

In addition, PENDLE currently trades above its Super Trend indicator, confirming the likelihood of extended gains.

The Super Trend indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the trend: green for an uptrend and red for a downtrend.

If an asset’s price is above this line, it signals bullish momentum in the market. In this scenario, this line represents a support level that will prevent the price from any significant dips. For PENDLE, this is formed at $2.34.

PENDLE Holds Above Key Trendline

Since its rally began on March 11, PENDLE has traded above an ascending trendline. This pattern forms when a series of higher lows connect, indicating that the price of an asset is consistently rising over time.

It represents a bullish trend, showing that PENDLE demand exceeds supply, with buyers pushing prices higher.

This trendline acts as a support level. With the token’s price bouncing off the trendline, it signals that the asset is in an uptrend and likely to continue. In this scenario, PENDLE could rally to $3.60.

However, if selloffs commence, the PENDLE token could lose some of its recent gains and fall to $3.06.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will the SEC Approve Grayscale’s Solana ETF?

Grayscale has submitted a registration statement with the SEC to convert its Grayscale Solana Trust (GSOL) into an ETF listed on NYSE Arca.

Despite the filing, prediction markets remain unconvinced about the chances of approval.

Is a Solana ETF Approval Still Unlikely for Q2?

On Polymarket, odds for a Solana ETF approval in the second quarter of 2025 stand at just 23%. Broader expectations for any 2025 approval are at 83%, down from 92% earlier this year.

The decline reflects regulatory delays. In March, the SEC extended review timelines for several ETF applications tied to Solana, XRP, and other altcoins.

This pattern suggests the agency may be holding off on decisions until a permanent chair takes over. Mark Uyeda, currently serving as interim chair, has not signaled a shift in stance.

Paul Atkins, Trump’s nominee to lead the agency, appeared before the Senate last week. Lawmakers questioned his involvement in crypto-related businesses, adding further uncertainty around future approvals.

Grayscale’s latest filing excludes staking, which could speed up the review process. The SEC has previously objected to staking features in ETF proposals.

When spot Ethereum ETFs moved forward last year, Grayscale, Fidelity, and Ark Invest/21Shares all removed staking components to align with the SEC’s expectations at the time.

Under Gary Gensler’s leadership, the SEC expressed concern that proof-of-stake protocols could fall under securities law. Asset managers adjusted their applications accordingly to move forward.

Following approvals for spot Bitcoin and Ethereum ETFs, several firms aim to expand their offerings to include other cryptocurrencies. They plan to offer access through traditional brokerage accounts without requiring direct asset custody.

Solana remains a strong contender due to its growing futures market in the US and a more favorable regulatory environment. Analysts view it as one of the next likely approvals if the SEC opens the door to more altcoin ETFs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Vulnerable To Falling Below $2 After 18% Decline

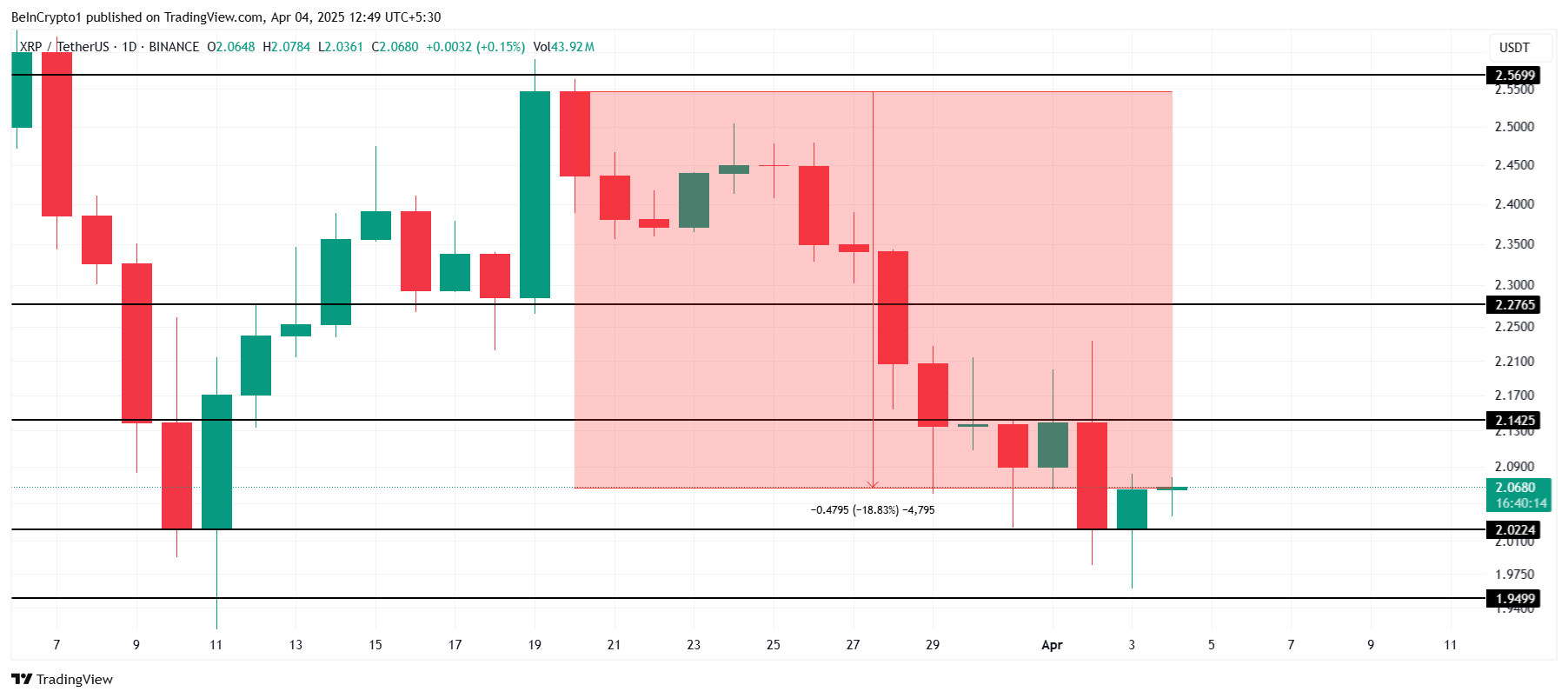

XRP has faced a significant correction in recent weeks, resulting in an 18% decline in the altcoin’s price. As a result, XRP is currently struggling to maintain upward momentum, with investors losing confidence.

This recent slump has raised concerns about the asset’s future, especially as certain XRP holders begin to sell their positions, increasing bearish pressure.

XRP Investors Are Pulling Back

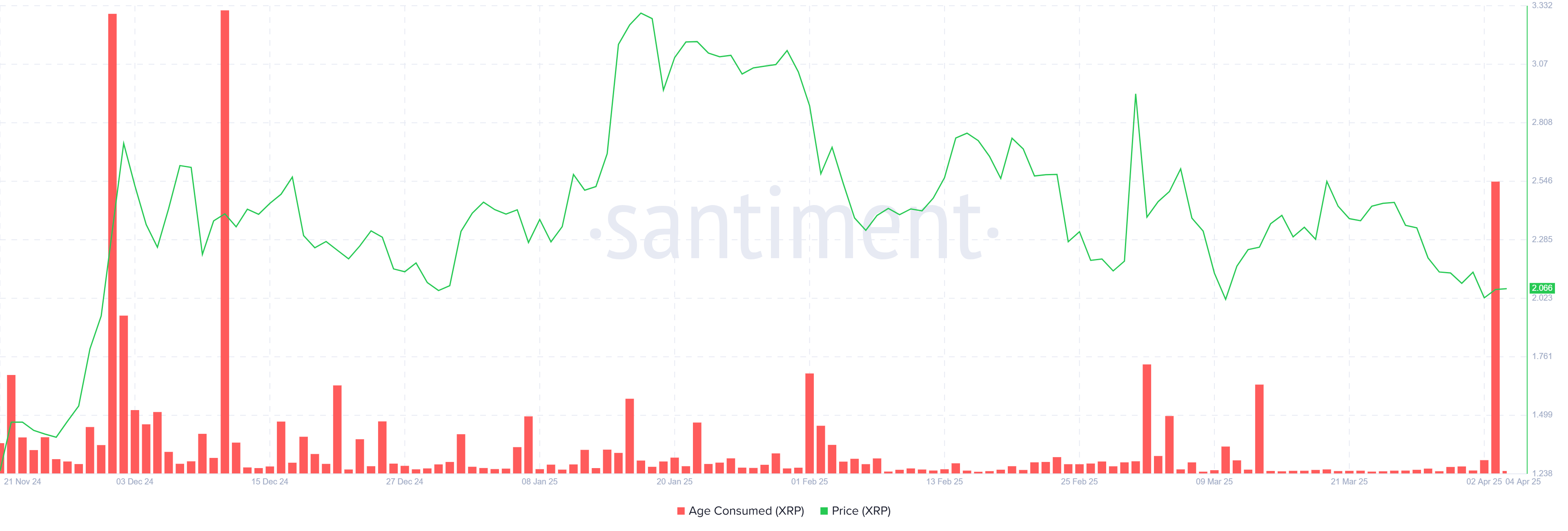

The recent downturn in XRP’s price has triggered a sharp spike in the “Age Consumed” metric. This indicator tracks the movement of coins from long-term holders (LTHs) and has reached its highest level in over four months. The increase suggests that LTHs, who have been holding XRP for extended periods, are now losing patience.

This selling behavior may be driven by the lack of price recovery and the overall weak market conditions that have not improved. These holders appear to be attempting to limit their losses by liquidating their positions, which in turn increases the downward pressure on XRP’s price. This mass selling from LTHs further compounds the challenges for XRP, as their decision to sell is often seen as a sign of waning confidence in the cryptocurrency.

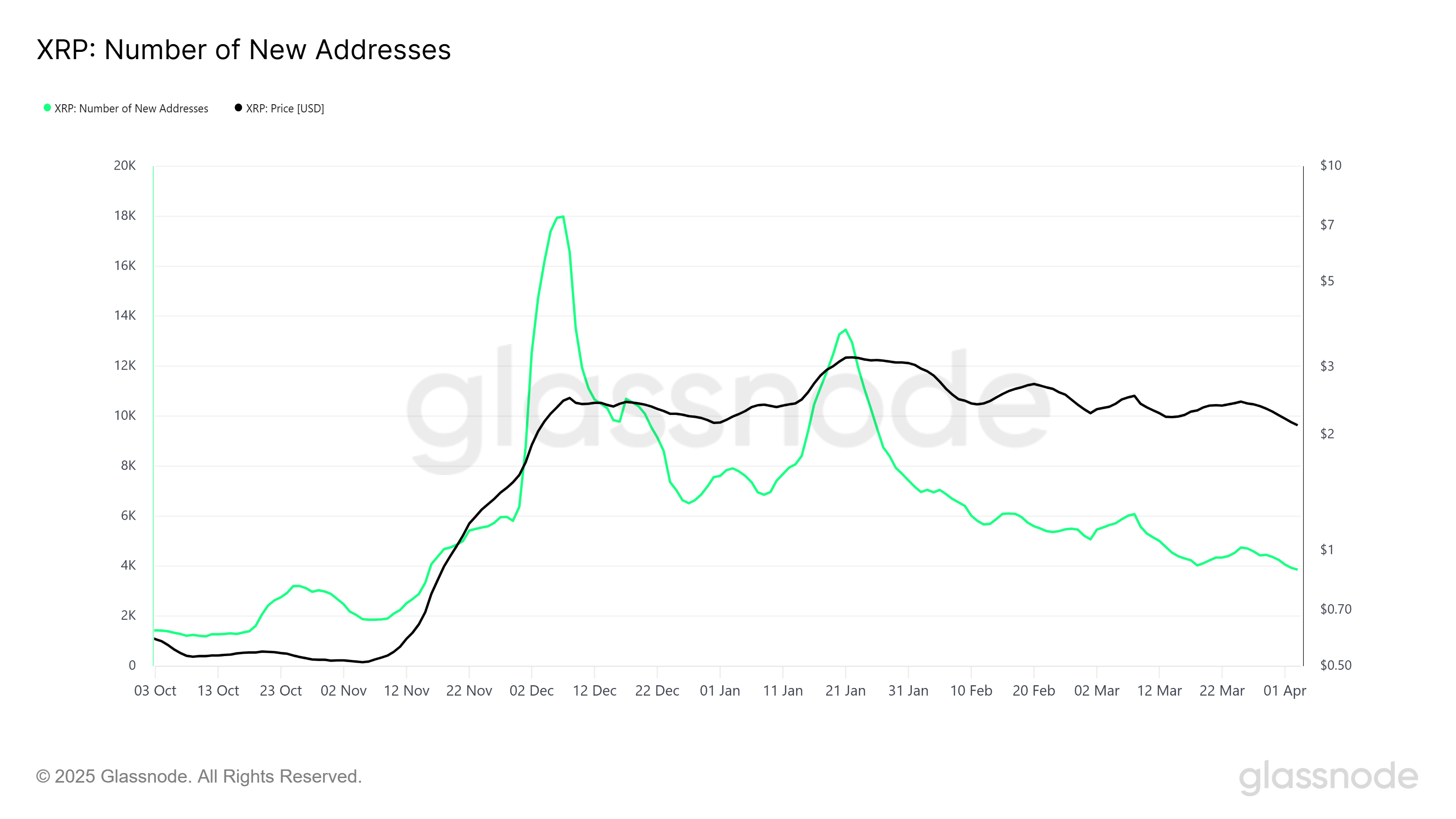

XRP’s market momentum appears to be weakening, as evidenced by the recent decline in the number of new addresses. The metric tracking new addresses has fallen to a five-month low, suggesting that XRP is struggling to attract new investors. This lack of fresh interest signals growing skepticism within the broader market, with potential investors hesitant to buy into an asset that has failed to deliver strong price action.

The drop in new addresses reflects a broader trend of reduced market traction and the lack of conviction from buyers. When combined with the selling pressure from LTHs, it creates a challenging environment for XRP to regain bullish momentum

XRP Price Needs A Boost

XRP’s price is currently holding at $2.06, just above the key support level of $2.02. If it manages to stabilize and break through the immediate resistance at $2.14, there could be a potential rebound, taking XRP higher.

However, with the continued weakness in market sentiment and the aforementioned bearish cues, XRP remains vulnerable to further declines. If the support of $2.02 fails, the price could drop further to $1.94, extending the 18% decline noted in the last two weeks.

If XRP manages to reclaim the $2.14 level and holds above it, the price could make its way toward $2.27. Breaching this level would invalidate the bearish outlook, signaling a potential recovery and restoring investor confidence in the cryptocurrency.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoWormhole (W) Jumps 10%—But Is a Pullback Coming?

-

Altcoin22 hours ago

Altcoin22 hours agoAltcoin Season Still In Sight Even As Ethereum Struggles To Gain Upward Momentum

-

Market23 hours ago

Market23 hours agoRipple Shifts $1B in XRP Amid Growing Bearish Pressure

-

Market21 hours ago

Market21 hours agoBinance’s CZ is Helping Kyrgyzstan Become A Crypto Hub

-

Altcoin21 hours ago

Altcoin21 hours agoHere’s Why Is Shiba Inu Price Crashing Daily?

-

Market20 hours ago

Market20 hours agoCrypto Market Mirrors Nasdaq and S&P 500 Amid Recession Fears

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Reveals XRP Price Could Drop To $1.90 Before Rally To New Highs

-

Bitcoin18 hours ago

Bitcoin18 hours agoWhy ETF Issuers are Buying Bitcoin Despite Recession Fears