Market

DWF Labs Partner Dismissed Following Drink-Spiking Allegations

According to reports, a partner at DWF Labs has been accused of drugging a woman at a Hong Kong bar on October 24. The entire incident was caught on CCTV and reported to the Hong Kong police.

The victim’s name is Hana, a Tokyo-based USD fund employee. Hana revealed the entire incident today in a lengthy X (formerly Twitter) thread.

DWF Labs released an official press statement today explaining that the firm has immediately dismissed the partner from all management and operational roles.

“We are aware of the recent and deeply concerning allegations involving one of our partners, who has been accused of inappropriate and unacceptable behaviour. While the matter is under investigation, DWF Labs has decided to dismiss the said partner from management and operational roles effective immediately,” DWF Labs wrote in an X (formerly Twitter) post.

Read More: How To Protect Yourself From Binance P2P Scams and Fraud

According to Hana’s post, the man spiked her drink multiple times with an unidentified object when she went to the restroom. However, before any further malicious actions could take place, a waiter from the bar told her about the man’s actions.

Asian journalist Colin Wu identified the suspected DWF Labs partner to be Eugene Ng. He’s also the co-founder of the Binance-backed RWA project OpenEden. Ng’s social media account has been disabled since the incident.

Hana mentioned that Eugene Ng had previously approached her for a job opportunity in crypto. She reportedly accepted his invitation to learn more about the opportunity.

“I could see from his confident behavior that this wasn’t his first attempt, it was a well-executed setup – there must have been other victims. So I went to the local police station, lodged a report, and gathered the CCTV recording from the venue,” the victim Hana wrote in her X post.

As of now, there haven’t been any concrete reports of an arrest by the Hong Kong police. However, DWF Labs stated that the investigation is still ongoing and they are cooperating with law enforcement.

Read More: Top Cryptocurrency Scams in 2024

This scandal can potentially shadow a successful financial year for the Web3 firm. DWF Labs recently announced plans to launch its own synthetic collateralized stablecoin amid growing market demand. As a VC, the firm has also invested in over 700 companies to date.

It remains to be seen whether this case will affect the firm’s reputation in the industry and its market credibility.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump Taps Pro-Crypto Scott Bessent for Treasury Secretary Role

Donald Trump, the President-elect of the United States, has nominated Scott Bessent as Treasury Secretary for his administration. This decision has generated enthusiasm in the emerging industry due to Bessent’s pro-crypto reputation.

Bessent and Cantor Fitzgerald CEO Howard Lutnick had been considered strong favorites for the position. However, Lutnick was eventually nominated as Commerce Secretary.

Crypto Industry Welcomes Scott Bessent’s Nomination for Treasury Secretary

In a November 22 announcement on Truth Social, Trump praised Bessent as the ideal candidate to support his administration’s economic goals. The President stated that Bessent will play a pivotal role in strengthening the US economy, fostering innovation, and maintaining the dollar’s status as the global reserve currency.

“Scott will support my policies that will drive US competitiveness, and stop unfair trade imbalances, work to create an economy that places growth at the forefront, especially through our coming world energy dominance,” Trump added.

Wall Street veteran Bessent, who founded the international macro investment company Key Square Group, brings extensive experience to the role. He had previously served as the chief investment officer for the prominent investor George Soros.

While President Trump’s announcement did not directly reference cryptocurrencies, many in the digital asset space view Bessent’s appointment as a positive sign. In past statements, Bessent has described crypto as a symbol of financial freedom. He also called Bitcoin an alternative investment for younger investors disillusioned with the traditional financial system.

“I have been excited about the president’s embrace of crypto and I think it fits very well with the Republican Party, crypto is about freedom in the crypto economy is here to stay,” Bessent stated.

His pro-crypto stance has led many to believe his leadership could encourage a more balanced approach to digital asset regulation. This would contrast with the outgoing administration’s enforcement-heavy tactics, such as its controversial sanctions on decentralized platforms like Tornado Cash.

Indeed, crypto industry leaders have responded enthusiastically to Bessent’s nomination. Ripple CEO Brad Garlinghouse commended Bessent’s nomination, calling it a win for innovation. He noted that Bessent’s leadership could mark a turning point for crypto-friendly policies in Washington.

Similarly, Kristin Smith, CEO of the Blockchain Association, highlighted the importance of Bessent working with Congress to establish clear regulations, ensure fair tax treatment, and protect self-custody rights for digital assets.

“Critical to this nomination would be working with Congress on a regulatory framework for digital assets, protecting the right to self custody, pushing for clearer tax treatment of digital assets, and working closely with industry experts to protect our nation’s security,” Smith remarked.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will the Cardano Coin Price Rally Continue?

ADA, the native coin of the Cardano blockchain, has made a significant price breakthrough. It has surpassed the $1 mark for the first time in two years. As of this writing, the altcoin trades at $1.09, a price level last observed in April 2022. `

Over the past 24 hours, ADA’s price has rocketed by 24%, and its trading volume has increased by 131% during the same period. With heightening buying pressure, the Cardano coin price rally is poised to continue.

Cardano Holders See Green

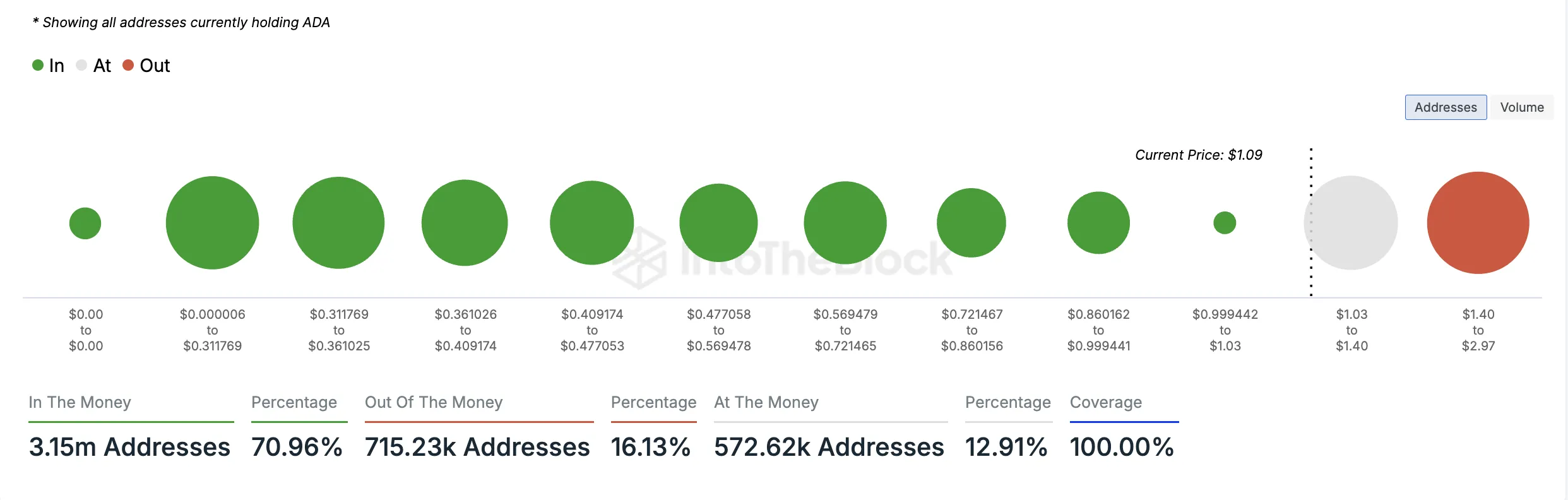

Cardano’s ascent above the $1 price mark has put many of its holders in profit. According to IntoTheBlock’s Global In/Out of the Money indicator, 3.15 million addresses, which comprise 71% of all ADA holders, are “in the money.”

An address is said to be “in the money” if the current market price of the asset it holds is higher than the average cost at which the address acquired those tokens. This means the holder would profit if they sold their holdings at the current market price.

Conversely, 715,230 addresses, which comprise 16% of all ADA holders, are “out of the money.” These addresses would incur a loss if they sold at the current price. Per IntoTheBlock’s data, this cohort of investors acquired their coins when ADA sold above $1.40.

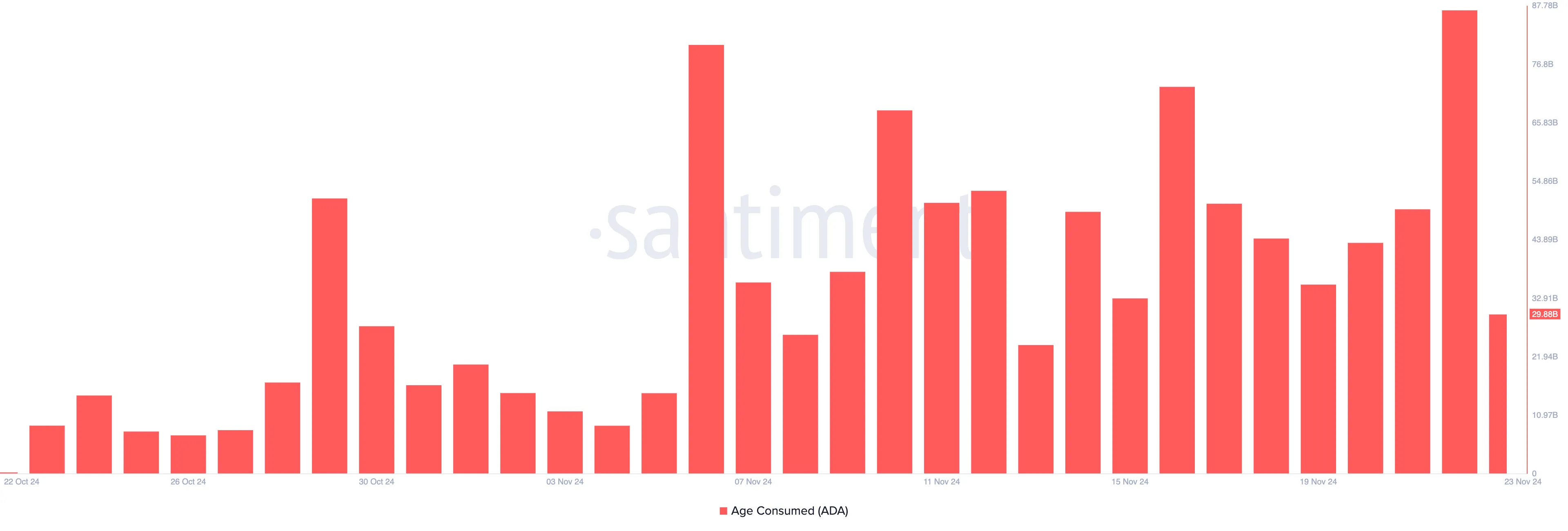

Notably, with many addresses now holding unrealized profits, long-term holders (LTHs) of ADA are repositioning, potentially to secure gains. This activity is reflected by the spike in ADA’s age-consumed metric, which, per Santiment’s data, skyrocketed to a monthly high of 86.91 billion on November 22, when the uptrend began.

This surge is notable because long-term holders rarely move their coins around. When they do, it often hints at a shift in market trends. Therefore, as in ADA’s case, if the spike is accompanied by increased trading volume and positive price action, it suggests that long-term holders are taking profits. This may fuel further price increases as new buyers enter the market.

ADA Price Prediction: The Upward Trend Is Strong

On the daily chart, ADA’s Aroon Up Line is at 100%. The Aroon indicator measures the strength and direction of a trend. When the Aroon Up line is at 100%, it indicates a strong upward trend, suggesting a recent high and a potential continuation of the bullish momentum.

If this holds and new demand continues to enter the market, the Cardano coin price rally will continue toward $1.24, a price high it last reached in March 2022.

On the other hand, if profit-taking intensifies and buying pressure weakens, ADA’s price may fall to retest support at $1. Should this level fail to hold, the downtrend will be confirmed, and ADA’s price will plunge to $0.85.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ADA Sights More Growth After Breaking $0.8119

My name is Godspower Owie, and I was born and brought up in Edo State, Nigeria. I grew up with my three siblings who have always been my idols and mentors, helping me to grow and understand the way of life.

My parents are literally the backbone of my story. They’ve always supported me in good and bad times and never for once left my side whenever I feel lost in this world. Honestly, having such amazing parents makes you feel safe and secure, and I won’t trade them for anything else in this world.

I was exposed to the cryptocurrency world 3 years ago and got so interested in knowing so much about it. It all started when a friend of mine invested in a crypto asset, which he yielded massive gains from his investments.

When I confronted him about cryptocurrency he explained his journey so far in the field. It was impressive getting to know about his consistency and dedication in the space despite the risks involved, and these are the major reasons why I got so interested in cryptocurrency.

Trust me, I’ve had my share of experience with the ups and downs in the market but I never for once lost the passion to grow in the field. This is because I believe growth leads to excellence and that’s my goal in the field. And today, I am an employee of Bitcoinnist and NewsBTC news outlets.

My Bosses and co-workers are the best kinds of people I have ever worked with, in and outside the crypto landscape. I intend to give my all working alongside my amazing colleagues for the growth of these companies.

Sometimes I like to picture myself as an explorer, this is because I like visiting new places, I like learning new things (useful things to be precise), I like meeting new people – people who make an impact in my life no matter how little it is.

One of the things I love and enjoy doing the most is football. It will remain my favorite outdoor activity, probably because I’m so good at it. I am also very good at singing, dancing, acting, fashion and others.

I cherish my time, work, family, and loved ones. I mean, those are probably the most important things in anyone’s life. I don’t chase illusions, I chase dreams.

I know there is still a lot about myself that I need to figure out as I strive to become successful in life. I’m certain I will get there because I know I am not a quitter, and I will give my all till the very end to see myself at the top.

I aspire to be a boss someday, having people work under me just as I’ve worked under great people. This is one of my biggest dreams professionally, and one I do not take lightly. Everyone knows the road ahead is not as easy as it looks, but with God Almighty, my family, and shared passion friends, there is no stopping me.

-

Market23 hours ago

Market23 hours ago3 altcoins that could go ballistic if Bitcoin (BTC) crosses $120,000 mark

-

Market24 hours ago

Market24 hours agoCardano Whales Accumulation Hits $55 Million: $1 Target Soon?

-

Altcoin23 hours ago

Altcoin23 hours agoDormant Ethereum Whale Dumps $224M Tokens, Has ETH Price Topped?

-

Regulation15 hours ago

Regulation15 hours agoUS SEC Commissioner Jaime Lizárraga to resign in January

-

Market20 hours ago

Market20 hours agoGensler’s Exit, Bitfinex Hack, Bitcoin in the US

-

Blockchain19 hours ago

Blockchain19 hours agoSui and Franklin Templeton Team Up To Drive DeFi Adoption: Details

-

Market19 hours ago

Market19 hours agoAltcoins Trending Today — November 22: MYTH, MAD, MODE

-

Market18 hours ago

Market18 hours agoSui Partners with Franklin Templeton for Blockchain Development