Ethereum

Buenos Aires launches QuarkID, a digital identity service using ZK proofs

- Buenos Aires has launched a digital identity service called QuarkID that uses zero-knowledge proofs

- The service enables privacy by verifying documents without revealing personal data

- QuarkID will expand nationally, with pilots in other Argentinian regions underway

The city of Buenos Aires has unveiled a ground-breaking digital identity service called QuarkID, aimed at enhancing residents’ privacy through advanced cryptographic technology known as zero-knowledge proofs.

Integrated into the miBA app, a platform that has facilitated access to municipal services for the past seven years, QuarkID seeks to give approximately 3.6 million people greater control over their personal information.

Zero-knowledge proofs allow users to verify the authenticity of documents without revealing unnecessary personal data. For instance, residents can confirm their age when purchasing alcohol without disclosing their full birth date or address.

This approach is designed to empower citizens by providing a self-sovereign identity system that prioritizes privacy and security.

“The decision from the beginning was to create a self-sovereign identity system so that citizens can have privacy and security over the documents they acquire ownership of,” stated Diego Fernandez, Buenos Aires’ secretary of innovation and digital transformation.

While zero-knowledge proofs can function independently of blockchain technology, QuarkID utilizes the Ethereum layer-2 network ZKsync Era, which serves as a “security anchor.” This ensures that data can be proven to exist in a specific form at a specific time, thereby reducing the risk of identity theft and fraud.

Users can upload more than 60 types of documents, including birth certificates and vaccination records, with additional documents expected to be added in the coming months. Importantly, no third party, including the municipality, has control over these documents, significantly mitigating the risk of data breaches.

The initiative promises to reduce costs for the government compared to traditional methods of document management, and the pilot program is set to expand beyond Buenos Aires to regions like Jujuy and Tucumán, as well as small towns such as Luján de Cuyo.

Fernandez emphasized the potential for national scaling, stating that technology developed in Buenos Aires could be implemented throughout Argentina and even in other Latin American countries, such as Uruguay.

Ethereum

Ethereum Analyst Predicts $3,700 Once ETH Breaks Through Resistance

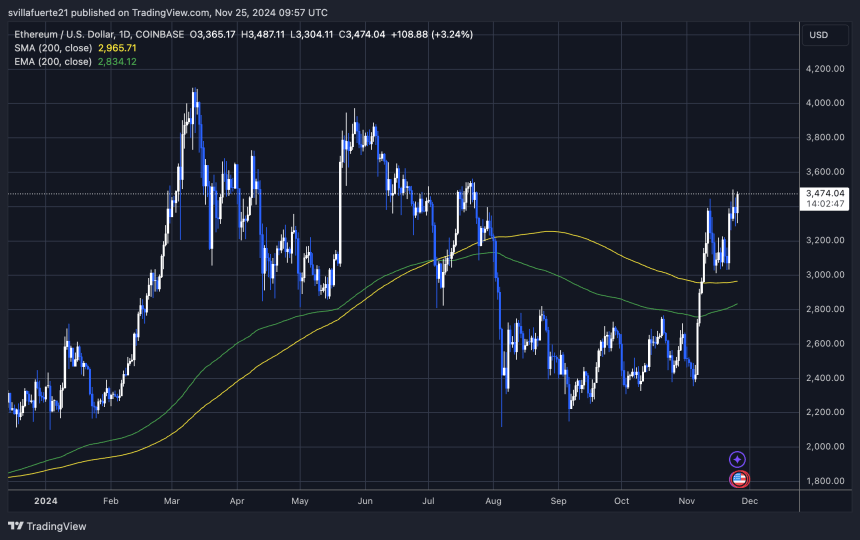

Ethereum has been trading at its highest levels since late July, hovering around $3,470. This marks a significant rebound for the second-largest cryptocurrency, which has managed to hold above the crucial 200-day moving average (MA) at $2,965. By maintaining this level, Ethereum confirmed a bullish price structure, paving the way for continued momentum as it approaches its next milestone—yearly highs near $4,000.

Top analyst and investor Carl Runefelt recently shared his technical analysis on X, pointing out that Ethereum’s price action has built a solid foundation for further growth. According to Runefelt, Ethereum is poised for a substantial rally once it breaks above key resistance levels, signaling increased confidence among traders and investors.

Related Reading

This bullish sentiment is further fueled by Ethereum’s consistent on-chain activity and growing institutional interest, which continue to support its upward trajectory. However, breaking past $4,000 will require Ethereum to overcome resistance zones that have historically triggered pullbacks.

As ETH consolidates gains, market participants are watching closely for signs of the next breakout, which could set the tone for the remainder of the year. Ethereum’s recent strength underscores its role as a market leader and a bellwether for broader cryptocurrency trends.

Ethereum Testing Crucial Supply

Ethereum is testing a crucial supply zone just below the $3,500 level, a key resistance that could propel the cryptocurrency to yearly highs in the coming days. This level has become a focal point for traders and investors, as breaking it would likely signal a bullish continuation of Ethereum’s recent momentum.

Top analyst Carl Runefelt recently shared his insights on X, emphasizing the significance of this resistance. According to his technical analysis, once Ethereum breaks through the $3,500 barrier, it could rapidly climb to $3,700, potentially within hours. The market sentiment surrounding Ethereum remains optimistic, with surging demand as a catalyst for further price gains.

Ethereum’s strength at this critical level is also reigniting speculation about a possible Altseason. If ETH continues its upward trajectory and attracts more capital, it could pave the way for other altcoins to follow suit. Historically, Ethereum’s price action has been a leading indicator for broader market movements, and this time appears no different.

Related Reading

As ETH approaches this pivotal moment, all eyes are on its ability to maintain upward momentum. A strong push past $3,500 would confirm the bullish structure and set the stage for Ethereum to dominate market narratives in the weeks ahead.

Key Levels To Watch

Ethereum is trading at $3,470, hovering below the crucial $3,500 resistance level. This local high has become a key area of focus for traders and analysts, as breaking above it could set the stage for a significant rally. If Ethereum manages to push through this resistance with strength, it could trigger a breakout that propels the price toward $3,900 within days.

However, the market remains cautious about the potential risks associated with this pivotal moment. A failed breakout at the $3,500 mark could lead to sideways consolidation as Ethereum seeks stronger buying pressure to resume its upward momentum. In a more bearish scenario, a substantial correction could occur, driving ETH back to lower levels to establish a more solid base of support.

Related Reading

The current price action highlights the importance of this resistance zone. A clean break above $3,500 would likely confirm Ethereum’s bullish structure and reinforce confidence in a continued uptrend.

On the other hand, any hesitation or rejection at this level could signal the need for further consolidation before the next major move. As ETH approaches this critical juncture, the market is closely watching to determine its next direction and the potential implications for the broader crypto landscape.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum’s Staking Weekly Net Inflows Increased Sharply, What’s Behind The Surge?

Interest in Ethereum, the second-largest cryptocurrency asset, is gaining momentum once again among retail and institutional investors, as evidenced by a robust increase in its net staking inflows in the past week in tandem with recent improvements in the price of ETH.

Consistent Growth In Ethereum’s Staking Net Inflows

In a positive development, Ethereum’s staking has attracted significant capital over the past week, leading to a surge in its net weekly inflows. Maartuun, a market watcher and analyst at leading on-chain data and analytics platform CryptoQuant, reported the development, reflecting growing commitment.

The spike in staking activity indicates that many investors are interested in supporting Ethereum’s proof-of-stake (PoS) ecosystem while receiving passive returns. It also bolsters ETH’s robust security and position in the cryptocurrency landscape.

Data shared by the analyst shows that Ethereum staking saw a net influx of +10,000 ETH over the past week, with 115,000 ETH being deposited and 105,000 ETH being withdrawn. This shows that deposits have surpassed withdrawals once again after months of net outflows, marking a significant change. With the total staked ETH rising again, it indicates renewed confidence and optimism in staking as a long-term strategy, which could be crucial in strengthening ETH’s ecosystem.

Addressing the components behind the surge, Maartuun has pointed out a mix of possible factors. These include rising ETH prices, improved staking infrastructure like liquid staking options, and institutional players entering the market.

Furthermore, the expert highlighted that this surge in net inflows might be a reaction from long-term investors to Ethereum’s stability after the merger and their increasing trust in the ecosystem.

In the event that the current rate of deposits keeps up, Maartuun is confident that the development could limit the availability of ETH in the market, which might affect price movements. “Overall, this recent inflow is a positive sign for Ethereum’s ecosystem and long-term growth,” he added.

ETH’s Open Interest Reaches New Milestone

Ethereum has been seeing major advancements lately in several key metrics, such as its Open Interest (OI). ETH’s open interest experienced a notable uptick in the past few days, surging to a new all-time high.

A report from CryptoQuant reveals that ETH’s open interest is valued at over $13 billion, representing an increase of more than 14% in the past four months. Additionally, funding rates demonstrate a positive trend, signaling that long-position traders dominate the market. This spike shows that interest in ETH’s derivative markets is rising sharply and growing market sentiment that supports price increases in the short term.

CryptoQuant also revealed that Ethereum’s estimated leverage ratio has hit a new all-time high, reaching +0.40 for the first time in history. This metric, which is determined by dividing the open interest by the exchange’s coin reserves, suggests a huge rise in leverage positions, indicating increased risk-taking by traders in derivatives trading.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Ethereum Price Repeats Bullish ‘Megaphone’ Pattern From 2017

The Ethereum price has formed a key technical pattern reminiscent of the one observed in 2017 when the cryptocurrency embarked on a major bull rally. According to a crypto analyst, this pattern, known as the ‘Bullish Megaphone‘, could signal a possible price rise to $10,000 for ETH.

Related Reading

Bullish Megaphone Sets Stage For Ethereum Price Rise To $10,000

A Blockchain and crypto technical analyst, identified as ‘EtherNasyonal,’ on X (formerly Twitter), has predicted that the Ethereum price could soon surpass $10,000. According to the analyst, Ethereum‘s price action currently showcases a historical chart pattern, the Bullish Megaphone, observed during the 2016 to 2017 bull market.

The Bullish Megaphone pattern is a technical indicator consisting of two higher highs and two lower lows, often indicating a potential uptrend continuation for a cryptocurrency. This technical pattern is considered bullish when a cryptocurrency’s price breaks above the trend line with increasing volume.

Looking at the analyst’s Ethereum price chart from 2016 to 2017 and another for 2024 to 2025, the Bullish megaphone pattern has formed in both bull cycles. Moreover, at the end of the key technical pattern in 2017, the Ethereum price skyrocketed to new price levels, surpassing the $1,200 mark by 2018.

EtherNasyonal has suggested that as Ethereum repeats this pattern in the current bull market, it could signal a similar massive price surge, with a potential rally above $10,000. As of writing, CoinMarketCap reveals that the price of Ethereum is trading at $3,353, marking a 7.24% surge in the last seven days. At its current price, a rally to the $10,000 mark would represent a 198% increase for Ethereum, highlighting a substantial surge in value.

The analyst has also noted that altcoins will likely follow Ethereum’s bullish momentum and experience a similar uptrend. This price rally in ETH could further impact the future trajectory of altcoins in the crypto market this bullish cycle.

Is The Altcoin Season Here?

Historically, Ethereum has been a significant catalyst or determining factor to the start of the highly anticipated altcoin season. While Bitcoin’s dominance tends to decline significantly around this period after experiencing a remarkable bull run, altcoins typically follow this bullish trajectory, with Ethereum taking the lead as it trails behind Bitcoin’s price rally.

MikyBull Crypto, a prominent analyst on X, declared that the altcoin season for this current bull cycle has officially begun. For clarity, the altcoin season is after Bitcoin’s consolidation phase, which follows a rally, where smaller-cap cryptocurrencies begin a strong market rally.

Related Reading

MikyBull Crypto has optimistically revealed that from late December 2024 to March 2025, investors and the broader crypto market may witness “the real fun” of the altcoin season. This suggests that the altcoin market is expected to embark on a significant rally, with numerous small-cap cryptocurrencies experiencing varying price increases.

Feaatured image from The Guardian, chart from TradingView

-

Altcoin19 hours ago

Altcoin19 hours agoBinance Announces Official Launch of BFUSD

-

Market18 hours ago

Market18 hours agoBulls Ready for The Next Move?

-

Market23 hours ago

Market23 hours agoDid It Manipulate Prices Again?

-

Bitcoin17 hours ago

Bitcoin17 hours agoThe Future of Decentralized Lending?

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Faces 25% Correction Risk Amid Global Liquidity Tightening

-

Market22 hours ago

Market22 hours agoBNB Price Sets Up for a Comeback: Bulls Eye Higher Levels

-

Market21 hours ago

Market21 hours agoWisdomTree Files for XRP ETF Trust Amid SEC Changes

-

Altcoin21 hours ago

Altcoin21 hours agoShiba Inu Lead Lauds TRON’s Justin Sun As SHIB Prepares TREAT Token Launch