Bitcoin

BlackRock Buys $1 Billion in Bitcoin: Here’s What It Means

BlackRock bought $1 billion in Bitcoin last week, according to trading data, with an additional $300 million purchased on Monday.

The asset manager has also invested in MicroStrategy, signaling a deepening connection with the BTC market.

BlackRock’s Bitcoin Strategy

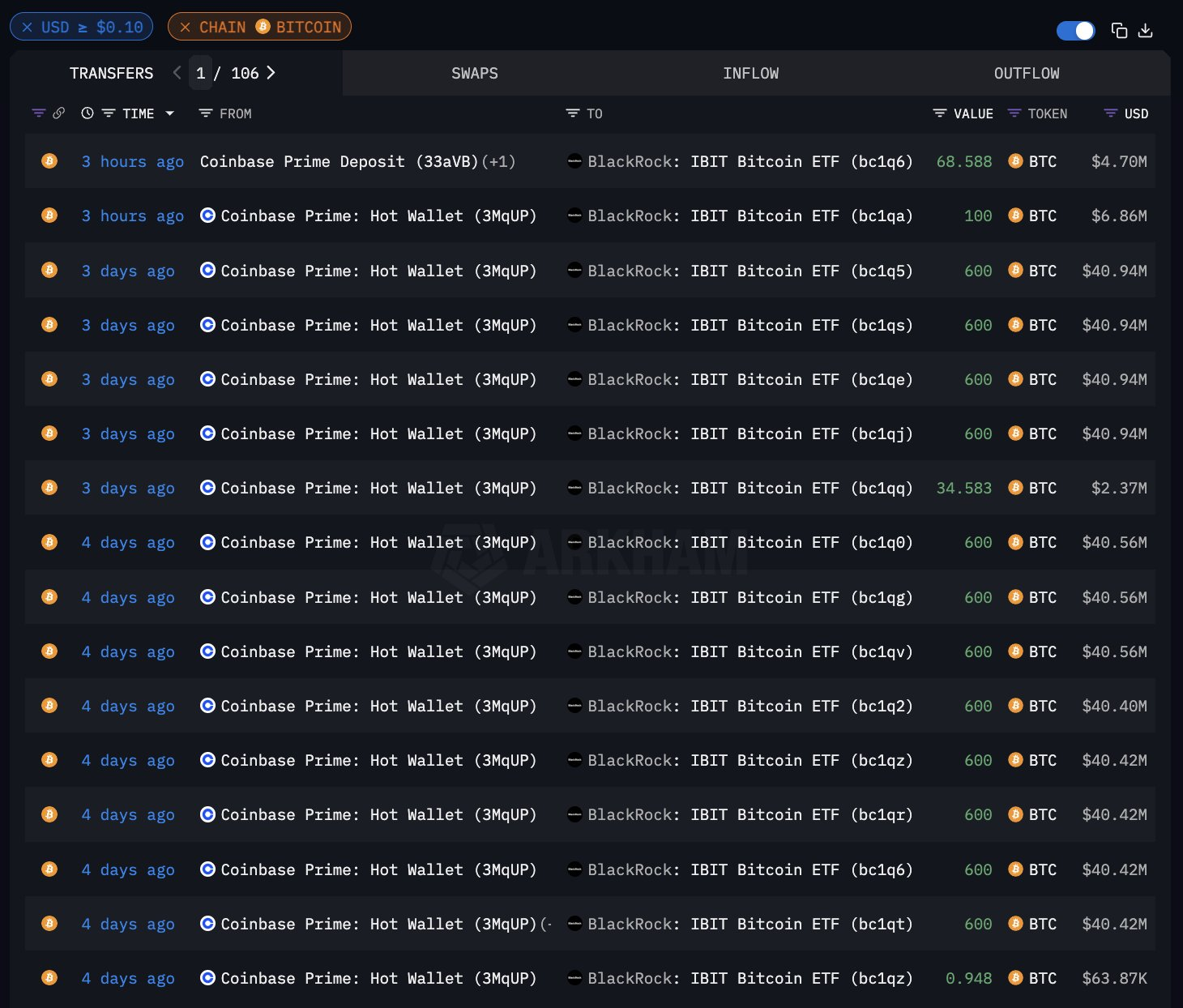

According to Arkham Intelligence data , BlackRock purchased $1 billion worth of Bitcoin in the last week. Its current total holdings sit at 399,525 BTC, which is a substantial amount, but nonetheless a far cry from Binance’s 667,526. Arkham’s data shows that BlackRock has been buying BTC steadily throughout each day, typically in 600 BTC transactions.

Read more: Who Owns the Most Bitcoin in 2024?

BlackRock has gone on a Bitcoin buying spree this October, initially purchasing $680 million worth of the asset over two days before shifting to a steady acquisition plan. Its Bitcoin ETF, IBIT, led October ETF inflows, reflecting the success of BlackRock’s deep BTC investments. CEO Larry Fink has endorsed Bitcoin as a distinct asset class and remains a strong supporter.

This pattern of major purchases by BlackRock shows no sign of slowing. Data from Lookonchain reveals that on Monday, BlackRock invested another $300 million into BTC, acquiring 4,369 coins. This accounted for the majority of Bitcoin bought by all ETF issuers on October 28.

However, BlackRock is also diversifying its Bitcoin-centric investment strategies. Last week, it expanded its stake in MicroStrategy to 5.2%. MicroStrategy may not be an ETF issuer, but it is also a leading corporate investor in Bitcoin, and their values are closely tied.

“T-Rex’s 2x Microstrategy ETF…is essentially a 4x Bitcoin ETF. It’s 30 day volatility is 168%; IBIT’s is 41%. It’s notable because you can’t launch a 4x Bitcoin ETF…but by [doubling] MicroStrategy, they effectively created the ultimate degenerate trading tool,” Bloomberg ETF analyst Eric Balchunas stated.

BlackRock’s investment in MicroStrategy carries less volatility than an ETF tied to Bitcoin’s valuation. However, it remains a relevant comparison, especially as Balchunas directly compared MicroStrategy’s volatility and returns to BlackRock’s IBIT. With Bitcoin’s recent strong performance, BlackRock’s involvement has helped drive MicroStrategy’s stock to a 24-year high.

Read more: What Is a Bitcoin ETF?

In conclusion, BlackRock has displayed a deep affinity towards continued BTC investment. The firm has been buying astronomical quantities of the asset on an elongated timeline. Besides this, it’s also been making major investments into Bitcoin-adjacent properties like MicroStrategy. On this trajectory, BlackRock is growing into one of the largest Bitcoin holders.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Marathon Digital Raises $1B to Expand Bitcoin Holdings

Marathon Digital Holdings, one of the largest Bitcoin miners, has completed a record $1 billion offering of 0% convertible senior notes due 2030. The net proceeds from the sale were approximately $980 million.

According to the firm’s statement, the net proceeds will be primarily used to buy Bitcoin.

Marathon Digital Holds over $2.5 Billion Worth of Bitcoin

After its last purchase in September, Marathon Digital’s Bitcoin holdings stand at 25,945 BTC. This is currently worth approximately $2.52 billion, as Bitcoin reached an all-time high of $98,000 earlier today.

However, the company’s decision to expand its holdings potentially points to a larger bullish cycle for the token in the long term. According to its press release, Marathon Digital plans to use $199 million of the net proceeds to repurchase existing convertible notes due 2026.

The remainder will be used to acquire additional Bitcoin and for general corporate purposes. Marathon Digital is currently the second largest Bitcoin holder among publicly traded companies.

The notes offer flexibility, with options for conversion into cash, shares of Marathon’s common stock, or a combination of both. Redemption terms include the ability for the company to redeem the notes at full principal value plus accrued interest.

“$1 Billion. 0% interest. MARA has completed the largest convertible notes offering ever amongst BTC miners. The mission, as always: Provide value. Acquire #bitcoin,” the company wrote on X (formerly Twitter).

Increasing Bitcoin Acquisition Among Public Firms

Marathon Digital is following an ongoing trend of public companies increasing their Bitcoin holdings in this bull market. Earlier this week, MicroStrategy announced plans to issue $1.75 billion in convertible notes maturing in 2029. The proceeds will be used to fund additional Bitcoin purchases.

On the same day, the company secured $4.6 billion worth of Bitcoin, building on a $2 billion acquisition from the prior week.

Bitcoin’s all-time high and these aggressive purchases propelled MicroStrategy’s stock price by nearly 120% in a single month. The largest Bitcoin holder also entered the list of top 100 public companies in the US.

Meanwhile, Marathon Digital has faced challenges despite its growing Bitcoin reserves. The company reported a $125 million net loss in Q3. This was driven by a $92 million year-over-year increase in operating costs.

However, its operational capacity has strengthened. Earlier this month, its energized hash rate surged by 93%, signaling increased mining efficiency. Marathon Digital also signed an $80 million agreement with the Keynan government to expand its Bitcoin mining capabilities.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

cbBTC Surges Past $1 Billion as Coinbase Ends WBTC Support

Coinbase, the largest US-based crypto exchange, has announced it will suspend trading for Wrapped Bitcoin (WBTC) on December 19, 2024, at approximately 12 p.m. ET.

The decision, revealed in a post on X (formerly Twitter), cites a routine review of its listed assets to ensure compliance with listing standards.

Coinbase Sidesteps WBTC Amid cbBTC Boom

The suspension will apply to both Coinbase Exchange and Coinbase Prime. Although trading will cease, WBTC holders will retain full access to their funds and the ability to withdraw them at any time. In preparation for the transition, Coinbase has moved WBTC trading to a limit-only mode, where users can place and cancel limit orders while matches may still occur.

“Coinbase will suspend trading for WBTC (WBTC) on December 19, 2024, at or around 12 pm ET. Your WBTC funds will remain accessible to you, and you will continue to have the ability to withdraw your funds at any time. We have moved our WBTC order books to limit-only mode. Limit orders can be placed and canceled, and matches may occur,” Coinbase detailed.

Coinbase’s move to suspend WBTC comes amid the rapid success of its wrapped Bitcoin token, cbBTC. Recently, cbBTC surpassed a $1 billion market capitalization, reflecting growing adoption and trust within the crypto community. This milestone has further cemented cbBTC’s position as a strong competitor to WBTC in the decentralized finance (DeFi) space.

As of this writing, data on Dune shows that cbBTC market capitalization has increased to $1.44 billion. CBTC’s native availability on networks like Solana, Ethereum, and Base has significantly expanded its accessibility, with Arbitrum being the latest addition.

“cbBTC is live on Arbitrum. cbBTC is an ERC-20 token that is backed 1:1 by Bitcoin (BTC) held by Coinbase. It is natively available on Arbitrum and securely accessible to more users across the Ethereum ecosystem,” Coinbase shared on Tuesday.

Additionally, prominent DeFi protocol Aave is targeting cbBTC for its Version 3 (V3) platform, enhancing its utility within the ecosystem. This growing momentum may have played a key role in Coinbase’s decision to phase out WBTC trading.

WBTC Core Team Urge Coinbase to Reconsider

The team behind Wrapped Bitcoin expressed regret and surprise at Coinbase’s decision. In a statement on X, WBTC’s core team emphasized its commitment to compliance, transparency, and decentralization.

“We regret and are surprised by Coinbase’s decision to delist WBTC…We urge Coinbase to reconsider this decision and continue supporting WBTC trading,” the team said.

The statement outlined WBTC’s longstanding reputation for novel mechanisms, regulatory compliance, and decentralized governance. Highlighting its seamless integration with DeFi protocols, WBTC described itself as an essential liquidity solution for Bitcoin users. Urging Coinbase to reconsider, WBTC reaffirmed its readiness to address any concerns or provide additional information to support its case.

Meanwhile, Coinbase’s announcement has sparked mixed reactions across the crypto community. Some users criticized the exchange, suggesting the decision reflects an inability to handle competition.

“Coinbase can’t handle fair competition?? WBTC superior to cbBTC” said Gally Sama in a post.

Nevertheless, others support the move, citing concerns over WBTC’s custody model, with one user referencing BitGo’s recent adoption of a multi-jurisdictional custody system.

“You put custody in the hands of a fraud. What did you think was gonna happen?” the user expressed.

This critique aligns with growing fears about Justin Sun’s involvement in WBTC’s custody processes, as BeInCrypto reported recently. Some users have acted preemptively to avoid potential risks, with one commenter sharing their reservations.

“When Sun got on the multisig for WBTC, I sent all my WBTC on OP to Coinbase and exchanged for true BTC that I withdrew to my hardware wallet… You gave me confirmation just now that I made the right move,” they wrote.

The decision to suspend WBTC trading could mark a pivotal moment in the competition between wrapped Bitcoin solutions. While cbBTC’s integration across multiple blockchain networks has gained momentum, skepticism surrounding WBTC’s custody model and leadership has intensified.

Justin Sun has voiced criticism of Coinbase’s cbBTC strategy, labeling it a setback for Bitcoin’s broader adoption. As the debate continues, the industry watches closely to see whether Coinbase’s cbBTC will solidify its dominance or if WBTC can regain its position as a leading wrapped Bitcoin solution. Regardless, the shifting dynamics reflect the importance of transparency, governance, and community trust in shaping the future of DeFi.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Faces ‘Bank Run’ Risk, Cyber Capital’s Bons Warns

Bitcoin (BTC) may be at risk of a catastrophic “bank run,” according to Justin Bons, founder and CIO of Cyber Capital.

A bank run is when customers withdraw their deposits from a financial institution over fears of insolvency.

Bitcoin Cannot Handle Mass Exits, Bons Says

In a detailed social media thread, Bons highlighted critical flaws in Bitcoin’s transaction capacity, self-custody model, and network security. In his opinion, these could lead to a crisis that would destabilize the network and devastate investors.

Bons’ analysis centers on Bitcoin’s limited transaction processing capability, which he calculated at approximately seven transactions per second (TPS). Using data from Glassnode and Bitcoin’s code, he argued that Bitcoin’s 33 million on-chain users would face a bottleneck if a mass panic triggered simultaneous exits.

“At this rate, the queue would be 1.82 months long under optimal conditions. However, in reality, transactions would get stuck and eventually be dropped, making it impossible for smaller parties to exit unless they pay exorbitant fees,” Bons explained.

Bons warned that this limitation could lead to a “death spiral,” where a price crash forces miners to shut down, slowing the network further. The resulting delays could deepen the panic, creating a vicious cycle of declining hash rates, prolonged block times, and falling prices.

Further in his critique of BTC, Bons claimed Bitcoin’s transaction capacity is insufficient for real-world use. He compared Bitcoin’s 7 TPS to other systems, such as Visa’s 5,000 TPS, or even competitors in the crypto space that exceed 10,000 TPS without sacrificing decentralization.

“There are literally ZERO use cases that can be supported by 7 TPS. Mass self-custody over BTC is a dangerous narrative. The only scalable path forward for BTC adoption is through centralized custodians and banks, contradicting its ethos as ‘freedom money’,” he stated.

Bons also questioned Bitcoin’s long-term sustainability, citing its shrinking security budget. This, in his opinion, is a critical issue that could exacerbate the risks he outlined. The thread also touches on Bitcoin’s deviation from its original vision as “peer-to-peer (P2P) electronic cash.” He lamented that the network’s constraints and governance have turned it into a speculative asset rather than a practical medium of exchange.

Bons’ remarks ignited a heated debate on X (formerly Twitter). Patrick Flanagan, a self-described tech expert, dismissed the claims.

“This is pure fantasy. If this was going to occur, it would have occurred years ago,” Flanagan argued.

Bons rebutted, asserting that the risk increases as the number of users grows. He noted that even a fraction of users leaving could trigger a run and added that the larger the network gets, the more severe the problem becomes.

Other users highlighted potential alternatives, such as trading wrapped Bitcoin (WBTC) on Ethereum, which bypasses Bitcoin’s base layer limitations. Bons acknowledged this but noted that wrapped BTC users could exit quickly while on-chain users would be trapped, exacerbating the sell-off. The discussion also extended to Bitcoin’s self-custody model.

“This is something that self-custody advocates should pay attention to. One tiny bit of FUD and everyone gets their money stuck,” DashPay’s Joel Venezuela remarked.

Bons responded, acknowledging the difficult position he finds himself in as a cypherpunk and self-custody advocate. Another user raised a comparison to gold, questioning how long it would take to liquidate global gold holdings. Bons countered that while gold also has practical limits, its theoretical transaction capacity far exceeds Bitcoin’s, making it less susceptible to such bottlenecks.

Critics of Bons’ analysis argue that Bitcoin has weathered similar concerns in the past without collapsing. However, his warning adds to a growing chorus of voices calling for a reevaluation of Bitcoin’s scalability and usability.

Despite his grim outlook for Bitcoin, Bons remains optimistic about the broader cryptocurrency space. “There is much hope left for cryptocurrency as a whole,” he concluded, suggesting that Bitcoin’s original ethos now thrives in other blockchain projects.

Meanwhile, while Bitcoin remains the dominant cryptocurrency, debates over its scalability and resilience continue. Bons’ warning serves as a stark reminder of the challenges Bitcoin faces as it seeks broader adoption in a changing financial space. Elsewhere, Galaxy CEO Mike Novogratz has almost similar reservations about a Bitcoin reserve in the US.

“I think that it would be very smart for the United States to take the Bitcoin they have and maybe add some to it… I don’t necessarily think that the dollar needs anything to back it up,” Novogratz claimed.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum23 hours ago

Ethereum23 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market19 hours ago

Market19 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Market24 hours ago

Market24 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Altcoin17 hours ago

Altcoin17 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Market22 hours ago

Market22 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?

-

Altcoin16 hours ago

Altcoin16 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin21 hours ago

Altcoin21 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Bitcoin14 hours ago

Bitcoin14 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings