Market

Can Whales Reverse the Crash?

Ethereum’s (ETH) price recently experienced a 10% decline, with failed attempts to establish $2,700 as a support level. Despite these setbacks, the altcoin has managed to hover above the uptrend line for the past two months, a feat largely sustained by strategic whale activity.

With substantial assets at play, these high-value investors might hold the key to a potential reversal.

Ethereum Holders Panic

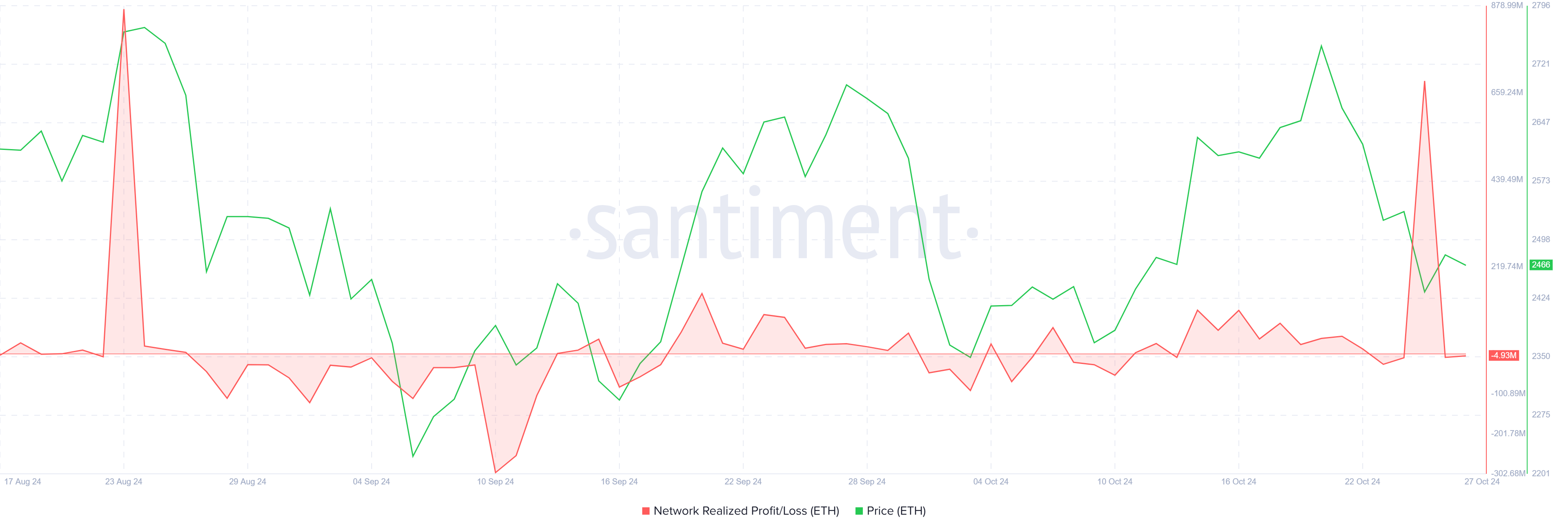

Ethereum recently experienced a notable rise in profit-taking, marking the highest level of realized profits in two months. This surge indicates that numerous ETH holders chose to cash in on previous gains, contributing to recent price fluctuations. The spike in selling activity coincides with a broader market decline, reflecting a defensive move by investors aiming to secure profits amid a downturn.

This trend could lead to a sharp decline in ETH’s value, heightening concerns and potentially sparking a panic-driven sell-off. Such increases in realized profits often suggest diminished short-term market confidence among investors.

Read more: How to Invest in Ethereum ETFs?

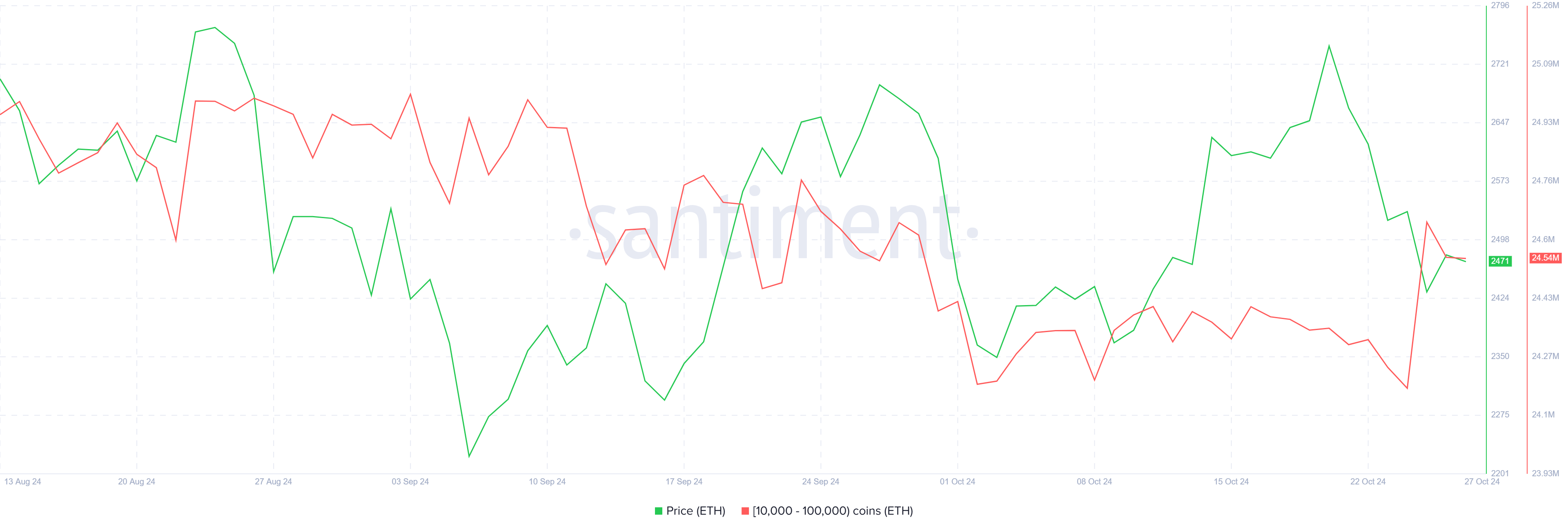

Amid the sell-off, whales are taking measures to counteract the drawdown. This group of high-value investors, particularly those holding between 10,000 and 100,000 ETH, recently accumulated over 360,000 ETH, valued at more than $880 million.

The accumulation efforts by whales highlight their strategic approach and bolster broader market sentiment. Their actions demonstrate a vote of confidence in Ethereum’s long-term potential, even as the price navigates through the current volatility. With whales capitalizing on lower prices, there is hope for more stable support levels, at least temporarily.

![]() ETH Price Prediction: Not Repeating History

ETH Price Prediction: Not Repeating History

Ethereum’s recent 10% decline has brought it precariously close to the uptrend line, testing this level as support. The downturn followed a series of failed attempts to break above $2,700, placing the altcoin’s current price under significant pressure. This fourth failed attempt has increased ETH’s vulnerability, although the uptrend line continues to offer a semblance of stability.

Currently, ETH’s immediate target is to flip the local resistance at $2,546 into support. Achieving this would provide Ethereum with a strong foundation for another attempt to breach the $2,698 mark, setting the stage for a move above $2,700. Reclaiming this level as support would mark a notable shift in sentiment, signaling the potential for further gains.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, failure to breach $2,546 or a renewed wave of selling could jeopardize ETH’s position along the uptrend line. Losing this support could drive Ethereum’s price down to $2,344, invalidating any bullish-neutral outlook and ushering in a more cautious sentiment across the market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Rallies 10% and Targets More Upside

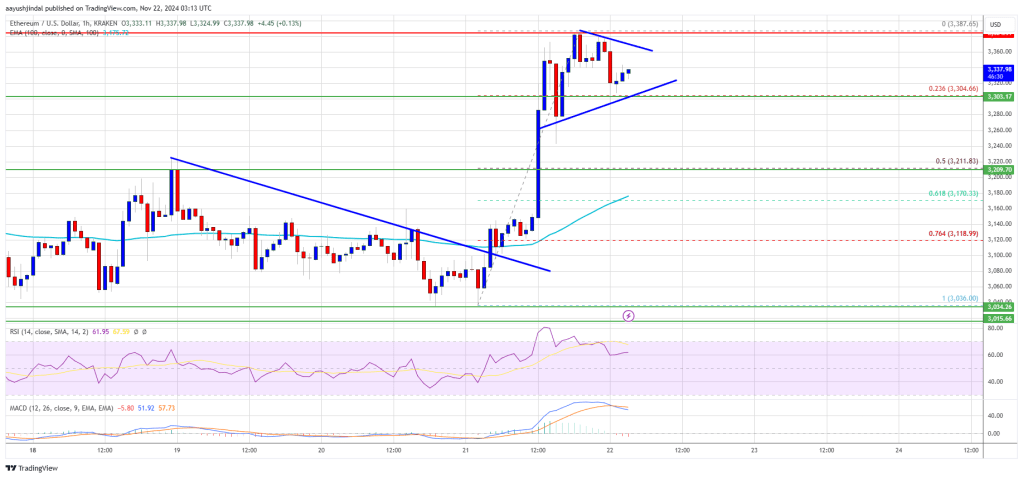

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

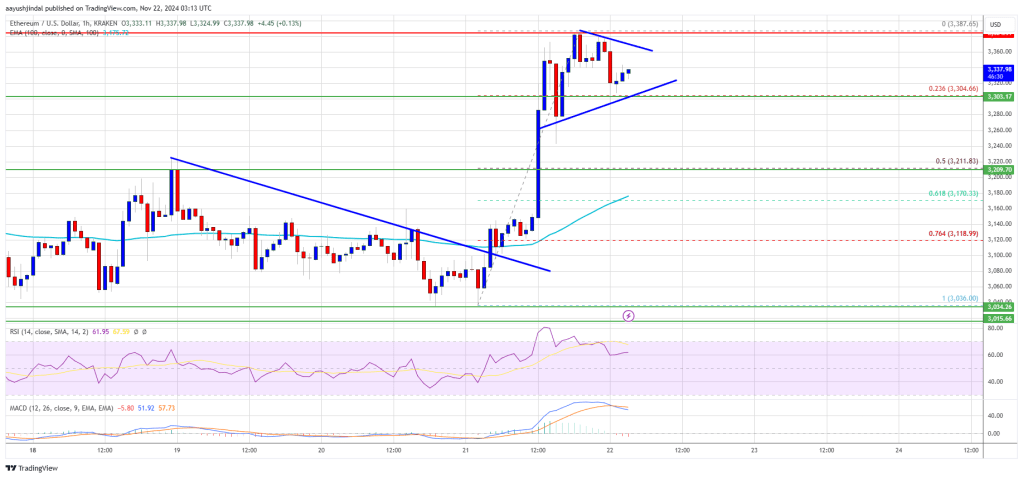

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

Market

Rallies 10% and Targets More Upside

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

Market

GOAT Price Sees Slower Growth After Reaching $1B Market Cap

GOAT price has skyrocketed 214.29% in one month, recently breaking into the $1 billion market cap and securing its place as the 10th largest meme coin. It now stands just ahead of MOG, which closely trails its position in the rankings.

However, recent indicators suggest that GOAT’s uptrend may be weakening, raising questions about whether it can sustain its rally or face a potential correction.

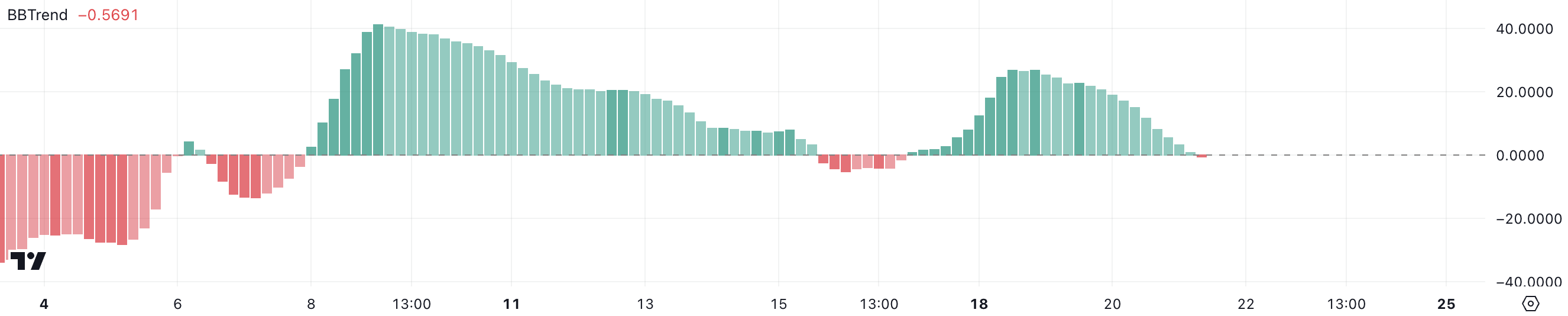

GOAT BBTrend Is Negative For The First Time In 4 Days

GOAT BBTrend has turned negative for the first time since November 17, now sitting at -0.54. This shift suggests that bearish momentum is beginning to take hold, with the asset’s recent upward trajectory starting to weaken potentially.

BBTrend measures the strength and direction of price trends using Bollinger Bands, with positive values indicating an uptrend and negative values signaling a downtrend. A negative BBTrend reflects increased downward pressure, which could indicate the start of a broader market shift.

GOAT has had an impressive November, gaining 61% and reaching a new all-time high on November 17.

However, the current negative BBTrend, if it persists and grows, could signal the potential for further bearish momentum.

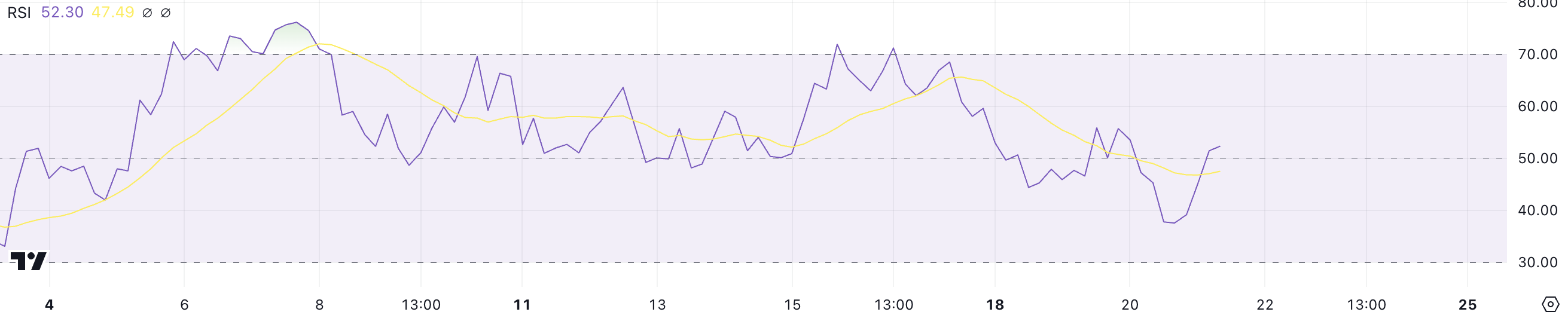

GOAT Is In A Neutral Zone

GOAT’s RSI has dropped to 52, down from over 70 a few days ago when it reached its all-time high. This decline indicates that buying momentum has cooled off, and the market has moved out of the overbought zone.

The drop suggests a shift toward a more neutral sentiment as traders consolidate gains and the strong bullish pressure seen earlier subsides.

RSI measures the strength and velocity of price changes, with values above 70 indicating overbought conditions and below 30 signaling oversold levels. At 52, GOAT’s RSI is in a neutral zone, neither signaling strong bullish nor bearish momentum.

This could mean the current uptrend is losing strength, and the price may consolidate or move sideways unless renewed buying pressure reignites upward momentum.

GOAT Price Prediction: A New Surge Until $1.50?

If GOAT current uptrend regains strength, it could retest its all-time high of $1.37, establishing its market cap above $1 billion, a fundamental threshold for being among the biggest meme coins in the market today.

Breaking above this level could pave the way for further gains, potentially reaching the next thresholds at $1.40 or even $1.50, signaling renewed bullish momentum and market confidence.

However, as shown by indicators like RSI and BBTrend, the uptrend may be losing steam. If a downtrend emerges, GOAT price could test its nearest support zones at $0.80 and $0.69.

Should these levels fail to hold, the price could fall further, potentially reaching $0.419, putting its position in the top 10 ranking of biggest meme coins at risk.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum21 hours ago

Ethereum21 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market22 hours ago

Market22 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Market18 hours ago

Market18 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Altcoin23 hours ago

Altcoin23 hours agoSHIB Burn Rate Surges 2200%, Shiba Inu Eyes Parabolic Rally Ahead?

-

Altcoin16 hours ago

Altcoin16 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Market21 hours ago

Market21 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?

-

Altcoin15 hours ago

Altcoin15 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin20 hours ago

Altcoin20 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?