Market

Toncoin Network Growth Hits 8-Month Low—Will Price Fall?

Toncoin (TON) price has been on a four-month downtrend, showing no sign of reversal as it struggles to hold above $5.0. Recent price action has underscored the ongoing weakness, raising concerns among investors.

Despite intermittent rallies, TON has been unable to escape the bearish trajectory that began in June, pushing the price below critical support levels and possibly priming it for further declines.

New Investors Lose Interest in Toncoin

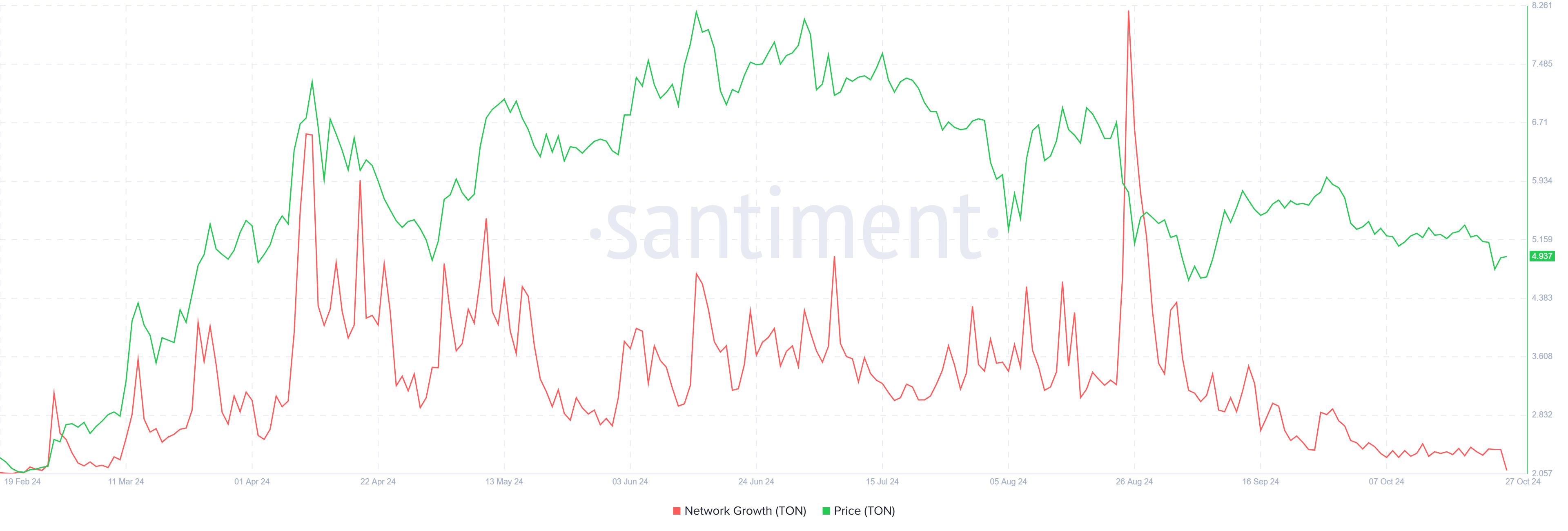

Toncoin’s network growth has seen a significant dip, with adoption hitting an eight-month low. This indicator, which gauges the number of new addresses created, is vital in assessing whether a cryptocurrency is gaining or losing market interest. The current decline implies that fewer new investors and users are joining the TON ecosystem, suggesting diminishing confidence.

When fewer new addresses appear, it generally signals waning adoption, which could contribute to downward price pressure. As long as this trend persists, TON may struggle to find a strong base, leaving its price susceptible to further depreciation.

Read more: What Are Telegram Bot Coins?

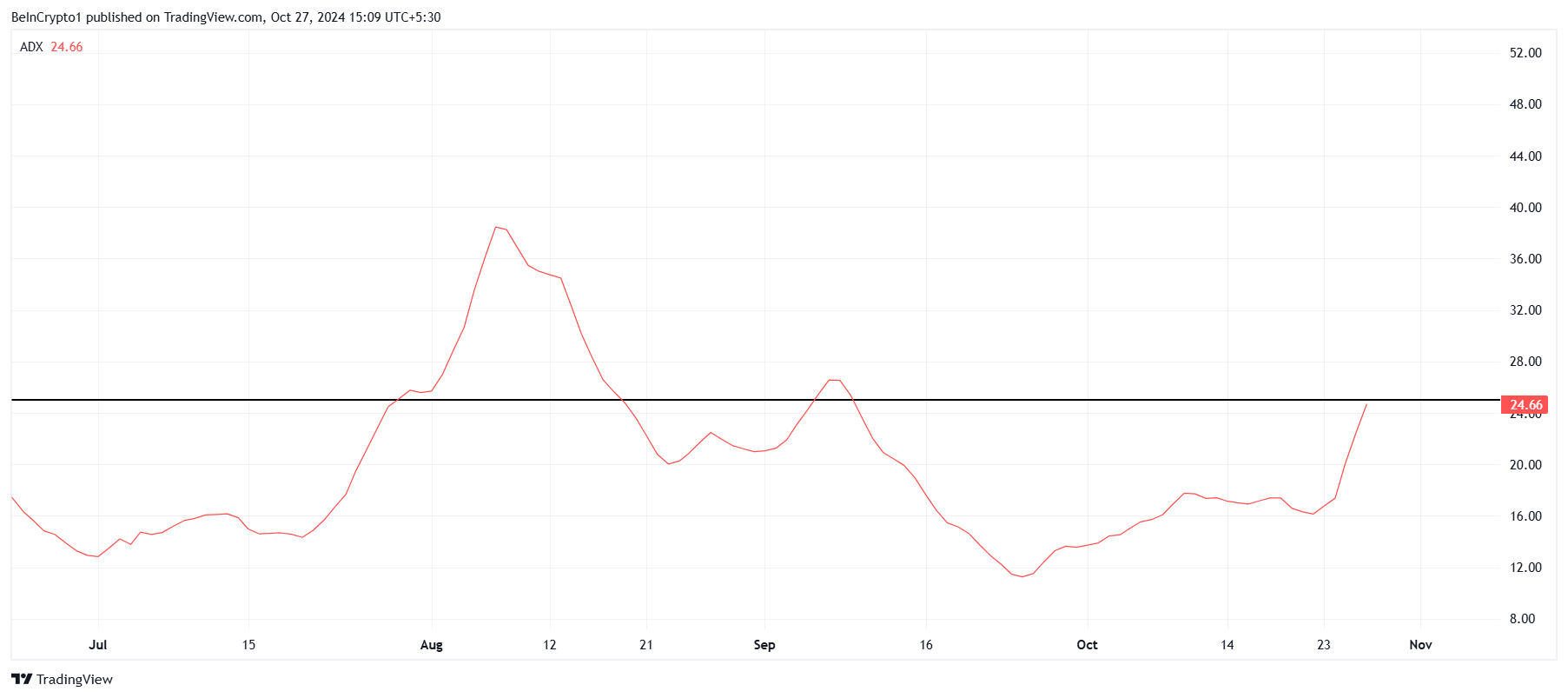

Analyzing the macro trend reveals that Toncoin’s overall momentum remains bearish. The Average Directional Index (ADX) currently sits just below the 25.0 mark, a critical threshold that indicates trend strength. If the ADX breaches above 25.0, it signals a strengthening active trend. For Toncoin, this would mean intensifying bearish momentum.

The ADX has yet to confirm an uptick, but if it does, the active downtrend could accelerate. A strong ADX reading over 25.0 would indicate that the ongoing sell-off might deepen, potentially pushing Toncoin’s price to new lows. As a result, unless a reversal is triggered, the cryptocurrency may continue to face bearish pressures in the short term.

TON Price Prediction: Steady Downtrend

Toncoin’s price fell approximately 11% this past week as it battles to recover from its latest lows. Despite attempts to break free from its current downtrend, TON has been unable to establish a lasting upward momentum. The ongoing macro downtrend, lasting four months, has made it challenging for the cryptocurrency to regain lost ground.

Attempts to breach the downtrend line have so far been unsuccessful, raising concerns about TON’s sustainability at current levels. With the price already below $5.0, a continued decline could push Toncoin down to around $4.6 or even lower if selling pressure persists.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

However, a reversal is possible if Toncoin can break above the downtrend line in the coming weeks. For this bullish scenario to unfold, TON would need to push through the $5.3 resistance and establish it as new support. Achieving this would invalidate the current bearish thesis, potentially sparking a sustained recovery and attracting fresh buying interest.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Aptos Partners with Circle and Stripe to Revitalize Network

The Aptos Foundation announced a new partnership with Circle and Stripe, hoping to revolutionize its network functionality. Circle’s CCTP and USDC stablecoin will enhance blockchain interoperability, while Stripe will attract TradFi by simplifying fiat interactions.

Aptos has set ambitious goals with this partnership, but APT’s upward momentum has stagnated.

Aptos Partners with Circle and Stripe

According to a new announcement from the Aptos (APT) Foundation, its network is integrating Circle’s USDC stablecoin and Cross-Chain Transfer Protocol (CCTP). Additionally, Aptos is integrating the payment platform Stripe, generally streamlining fiat-related features. These include on- and off-ramps, payment processing, and TradFi ease of adoption.

“Once the integration is complete, users will be able to seamlessly transfer USDC between Aptos and 8 major blockchains. In addition to USDC and CCTP, Stripe will soon launch its payment services on Aptos, creating a reliable fiat on-ramp to streamline merchant pay-ins and payouts using Aptos-compatible wallets,” the firm claimed via press release.

In other words, Aptos aims to use this partnership to make itself “the ultimate hub for interoperable DeFi.” These companies will approach this goal from both ends: enticing new users and investors while substantially improving the core experience. This partnership marks a new development for Stripe’s integration with crypto.

Indeed, Stripe took a six-year hiatus from cryptocurrency payments, which only ended this April. Since then, however, it’s been engaging seriously with the industry. The firm entered an earlier partnership with Circle this June, hoping to promote USDC adoption. Additionally, Stripe acquired Bridge, a crypto payment platform, last month.

For its part, Aptos is undertaking a recovery process. Despite a major price spike in March, it suffered a lingering decline for most of 2024. The asset began regaining steam in October, and the November bull market has brought increased optimism. Still, its gains have stagnated for about a week.

This partnership between Aptos, Circle, and Stripe may help APT regain its forward momentum. These ambitious new features will greatly add functionality and accessibility to Aptos’ network. Still, the firm has set a very ambitious goal for itself: to solidify “its place as a leader in interoperable DeFi and enterprise-grade blockchain technology.” Only time can tell its success level.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift

The SEC is quietly meeting with several issuers to discuss approving a Solana ETF, claims Fox Business reporter Eleanor Terrett. With Trump’s impending pro-crypto administration, the SEC seems more inclined to approve such a product.

However, anti-crypto figure Gary Gensler is still nominally in charge of the SEC, and public progress might not begin until 2025.

Solana ETF Approval Is Getting Closer

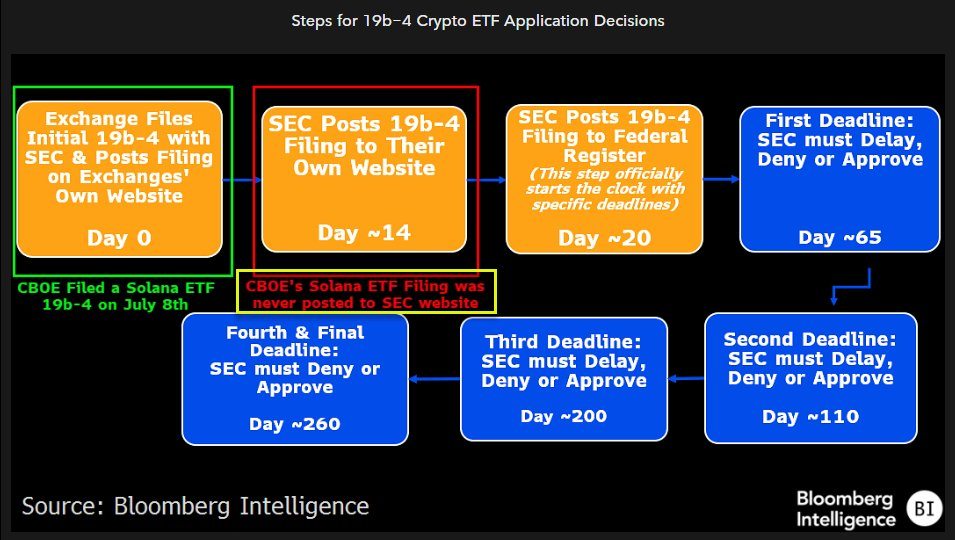

According to a scoop from Fox Business reporter Eleanor Terrett, the SEC and several ETF issuers are in talks to approve a Solana ETF. Currently, Brazil is the only country that has given this product a green light. As recently as September, Polymarket odds gave the SEC a dismal 3% chance of approving it. This reluctance, however, might soon be changing:

“Talks between SEC staff and issuers looking to launch a Solana spot ETF are “progressing” with the SEC now engaging on S-1 applications. Recent engagement from staff, coupled with the incoming pro-crypto administration, is sparking a renewed sense of optimism that a Solana ETF could be approved sometime in 2025,” Terrett claimed.

Terrett was very clear about the impetus for this progress in negotiations: Donald Trump’s re-election. On the campaign trail, Trump vowed to significantly reform US crypto policy, and one cornerstone was firing anti-crypto SEC Chair Gary Gensler. Gensler has apparently conceded to his impending ouster, and his replacement will undoubtedly support the industry.

Previous attempts have floundered at an early step in the process. Once the SEC officially acknowledges an application, it must confirm or deny it within a 240-day window. Previous filings have lingered in limbo at this stage. However, the list of candidates is now growing: Canary Capital filed for a Solana ETF in October, and BitWise did the same earlier today.

Nonetheless, these positive negotiations still only consist of anonymous rumors. The Commission has not publicly moved to begin this process, and Gensler is still nominally in charge. Terrett posits that the SEC will only make serious progress on the Solana ETF at the start of 2025. Compared to previous pessimism, however, this is a complete sea change.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

The ETH/BTC ratio, a metric measuring Ethereum’s price performance compared to Bitcoin, has reached its lowest point since March 2021. This development comes amid BTC’s brief rise to $98,000.

While the flagship cryptocurrency has increased by 7.45% in the last seven days, ETH has hovered around the same region, with investors raising concerns about the altcoin’s future.

Ethereum Continues to Lag Behind Bitcoin

In February, the ETH/BTC ratio climbed to a yearly high of 0.060. During that time, speculation spread that Ethereum’s price would begin to outperform Bitcoin and validate the altcoin season. However, that has not happened, as Bitcoin’s price has continued to make new highs

Ethereum, on the other hand, is yet to retest to reclaim its all-time high despite reaching $4,000 earlier in the year. This disparity in performance could be linked to several factors. For instance, both cryptocurrencies saw approval for exchange-traded funds (ETFs) this year.

However, while Bitcoin has seen billions of dollars in inflows, ETH has been inconsistent in attracting capital. Hence, the institutional inflow has driven BTC toward $100,000, ensuring that the ETH/BTC ratio drops to $0.033 — the lowest level in 42 months.

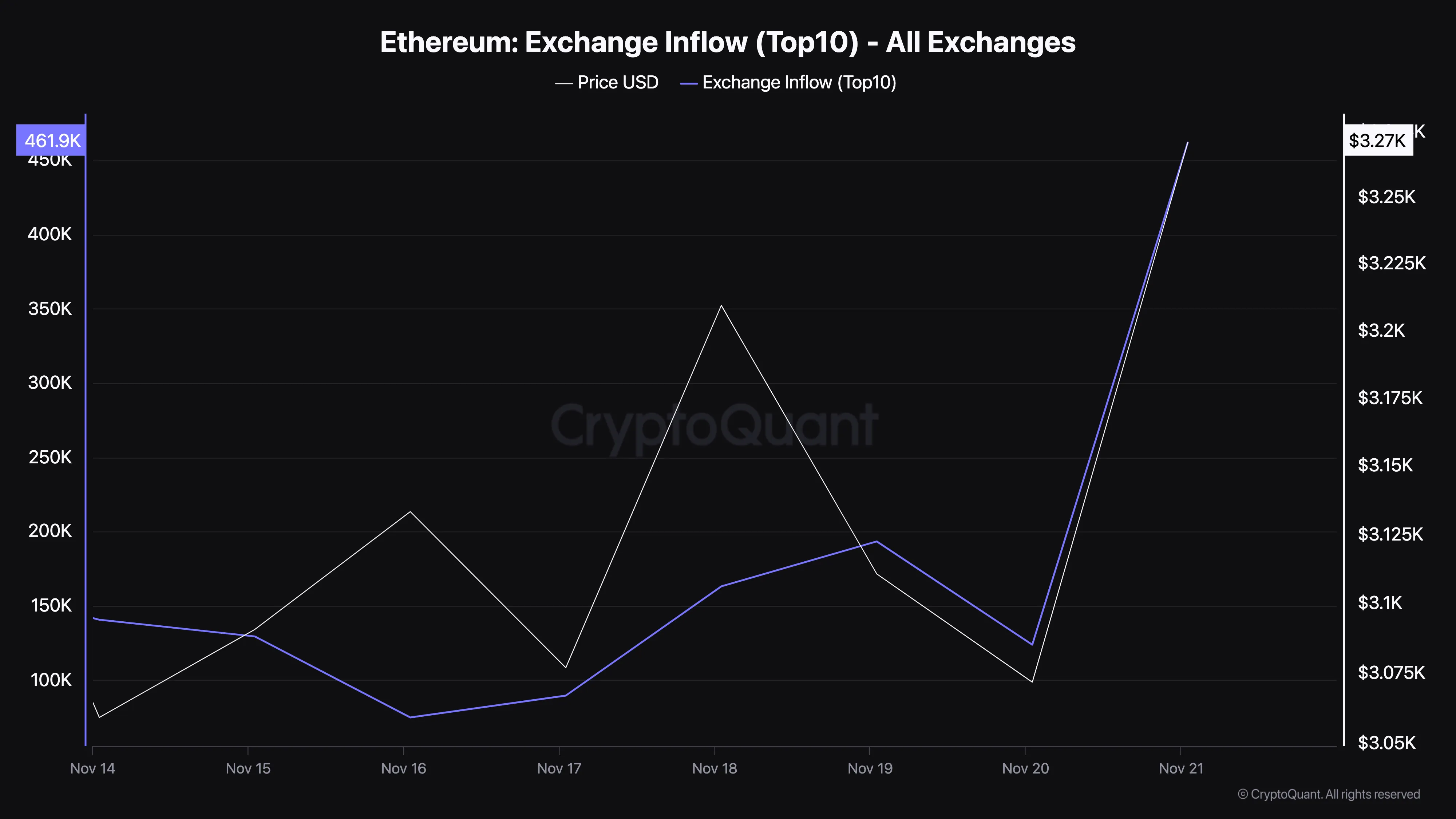

Further, the disparity in Ethereum’s performance can largely be attributed to sustained selling pressure. For instance, CryptoQuant data reveals that exchange inflows into the top 10 exchanges have climbed to 461,901 ETH, valued at approximately $1.50 billion as of this writing.

This surge in exchange inflow reflects large deposits by investors, indicating a heightened willingness to sell. Such movements typically increase the supply of ETH on exchanges, raising the likelihood of a price drop.

In contrast, a low exchange inflow generally indicates that investors are holding onto their assets, which is not the current scenario for ETH.

ETH Price Prediction: Crypto Could Retrace

As of this writing, ETH trades at $3,317, which is a higher close than yesterday’s. Despite that, the altcoin is still below the Parabolic Stop And Reverse (SAR) indicator. The Parabolic SAR generates a series of dots that track the price movement, positioning above the price during a downtrend and below the price during an uptrend.

A “flip” in the dots — shifting from one side to the other — often signals a potential trend reversal. As seen below, the indicator is above ETH’s price, suggesting that the cryptocurrency could reverse its recent gains.

If this is the case and the ETH/BTC ratio declines, Ethereum’s price could decline to $3,083. However, if buying pressure increases, that might not happen. Instead, the value could surge above $3,500 and toward 4,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market14 hours ago

Market14 hours agoThis is Why MoonPay Shattered Solana Transaction Records

-

Ethereum11 hours ago

Ethereum11 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Regulation18 hours ago

Regulation18 hours agoUS SEC Pushes Timeline For Franklin Templeton Crypto Index ETF

-

Market18 hours ago

Market18 hours agoRENDER Price Soars 48%, But Whale Activity Declines

-

Market22 hours ago

Market22 hours agoArkham Spot Trading Platform Set to Launch in the US Market

-

Regulation17 hours ago

Regulation17 hours agoBitClave Investors Get $4.6M Back In US SEC Settlement Distribution

-

Regulation21 hours ago

Regulation21 hours agoDonald Trump’s transition team considering first-ever White House crypto office

-

Market17 hours ago

Market17 hours agoNvidia Q3 Revenue Soars 95% to $35.1B, Beats Estimates