Market

Buterin’s ‘Purge’ to Simplify Ethereum’s Protocol and Storage

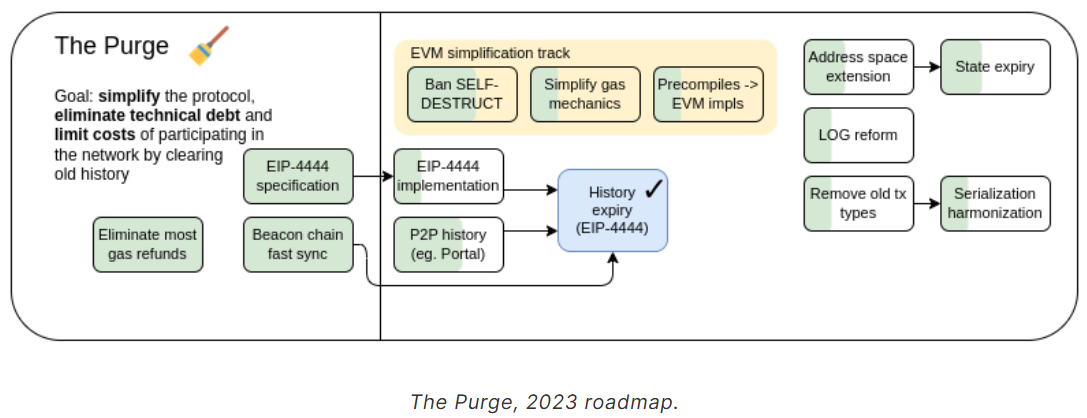

Ethereum’s co-founder, Vitalik Buterin, has presented “The Purge,” the fifth installment in a series of proposed upgrades designed to streamline the Ethereum network’s data storage and protocol complexity.

This update is crucial as Ethereum’s long-term scalability, security, and sustainability hinge on a stable, manageable data architecture.

Tackling Ethereum Data Storage

Buterin’s Purge upgrade introduces a framework that targets Ethereum’s growing storage demands. By eliminating outdated network history, it aims to alleviate bottlenecks and cut the hard drive space required to run a node.

Currently, running an Ethereum node requires around 1.1 terabytes of disk space for the execution client alone, along with several hundred more gigabytes for the consensus client. Indeed, storage requirements grow by hundreds of gigabytes each year, even without raising Ethereum’s gas limit.

Read more: A Deeper Look into the Ethereum Network

The Purge suggests a decentralized approach to data storage across network nodes. Instead of each node holding the full network history, they could store smaller, randomized segments. This would allow the network to maintain data redundancy without every node needing to store the same information.

“If, by making node running more affordable, we can get to a network with 100,000 nodes, where each node stores a random 10% of the history, then each piece of data would get replicated 10,000 times – exactly the same replication factor as a 10,000-node network where each node stores everything,” Buterin explained.

Another key proposal is to introduce a “stateless” approach to manage Ethereum’s state data. This could help keep total data under 8 terabytes for decades.

To further streamline storage, Buterin also suggests exploring either partial or full state expiry, where certain old data might phase out, combined with adjustments in address space. He noted that state expiry could simplify transitions between data formats, as new state trees could be phased in without complex conversions.

Simplifying the Protocol

Beyond storage, Buterin highlights the need to keep Ethereum’s protocol efficient and user-friendly. Simplifying the protocol could reduce bugs and make the network easier for developers and users to navigate.

One option is “ossification,” a process that freezes the protocol, halting new changes to enhance stability. Alternatively, Ethereum could selectively phase out outdated features, maintaining backward compatibility while minimizing unnecessary complexity.

“An intermediate route, of making fewer changes to the protocol, and also removing at least a little complexity over time, is also possible,” Buterin added.

Read more: When Are Ethereum Gas Fees Lowest?

Meanwhile, Buterin reiterated the need for simplicity and backward compatibility. According to him, this would provide stability for applications needing reliable, long-term support.

“Ethereum’s value as a chain comes from it being a platform where you can deploy an application and be confident that it will still work many years from now,” he concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift

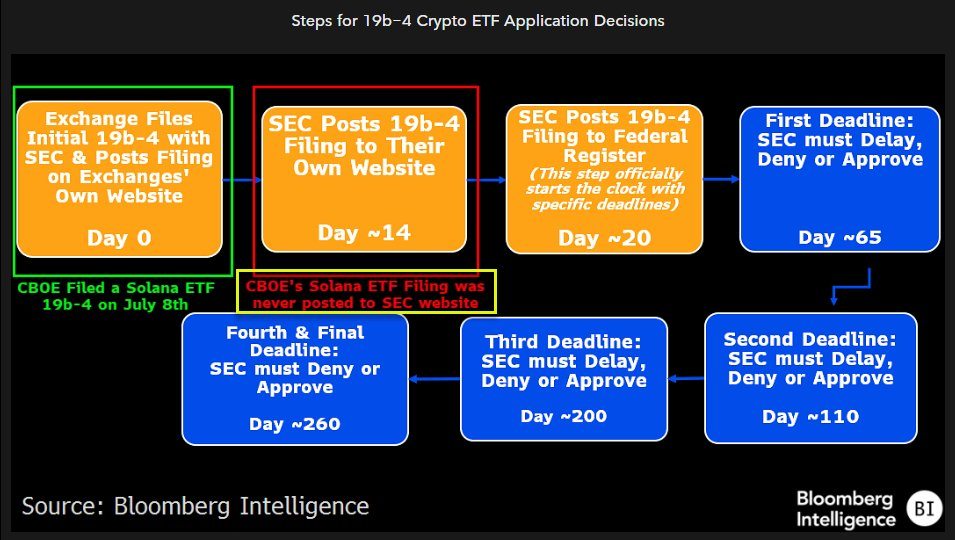

The SEC is quietly meeting with several issuers to discuss approving a Solana ETF, claims Fox Business reporter Eleanor Terrett. With Trump’s impending pro-crypto administration, the SEC seems more inclined to approve such a product.

However, anti-crypto figure Gary Gensler is still nominally in charge of the SEC, and public progress might not begin until 2025.

Solana ETF Approval Is Getting Closer

According to a scoop from Fox Business reporter Eleanor Terrett, the SEC and several ETF issuers are in talks to approve a Solana ETF. Currently, Brazil is the only country that has given this product a green light. As recently as September, Polymarket odds gave the SEC a dismal 3% chance of approving it. This reluctance, however, might soon be changing:

“Talks between SEC staff and issuers looking to launch a Solana spot ETF are “progressing” with the SEC now engaging on S-1 applications. Recent engagement from staff, coupled with the incoming pro-crypto administration, is sparking a renewed sense of optimism that a Solana ETF could be approved sometime in 2025,” Terrett claimed.

Terrett was very clear about the impetus for this progress in negotiations: Donald Trump’s re-election. On the campaign trail, Trump vowed to significantly reform US crypto policy, and one cornerstone was firing anti-crypto SEC Chair Gary Gensler. Gensler has apparently conceded to his impending ouster, and his replacement will undoubtedly support the industry.

Previous attempts have floundered at an early step in the process. Once the SEC officially acknowledges an application, it must confirm or deny it within a 240-day window. Previous filings have lingered in limbo at this stage. However, the list of candidates is now growing: Canary Capital filed for a Solana ETF in October, and BitWise did the same earlier today.

Nonetheless, these positive negotiations still only consist of anonymous rumors. The Commission has not publicly moved to begin this process, and Gensler is still nominally in charge. Terrett posits that the SEC will only make serious progress on the Solana ETF at the start of 2025. Compared to previous pessimism, however, this is a complete sea change.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

The ETH/BTC ratio, a metric measuring Ethereum’s price performance compared to Bitcoin, has reached its lowest point since March 2021. This development comes amid BTC’s brief rise to $98,000.

While the flagship cryptocurrency has increased by 7.45% in the last seven days, ETH has hovered around the same region, with investors raising concerns about the altcoin’s future.

Ethereum Continues to Lag Behind Bitcoin

In February, the ETH/BTC ratio climbed to a yearly high of 0.060. During that time, speculation spread that Ethereum’s price would begin to outperform Bitcoin and validate the altcoin season. However, that has not happened, as Bitcoin’s price has continued to make new highs

Ethereum, on the other hand, is yet to retest to reclaim its all-time high despite reaching $4,000 earlier in the year. This disparity in performance could be linked to several factors. For instance, both cryptocurrencies saw approval for exchange-traded funds (ETFs) this year.

However, while Bitcoin has seen billions of dollars in inflows, ETH has been inconsistent in attracting capital. Hence, the institutional inflow has driven BTC toward $100,000, ensuring that the ETH/BTC ratio drops to $0.033 — the lowest level in 42 months.

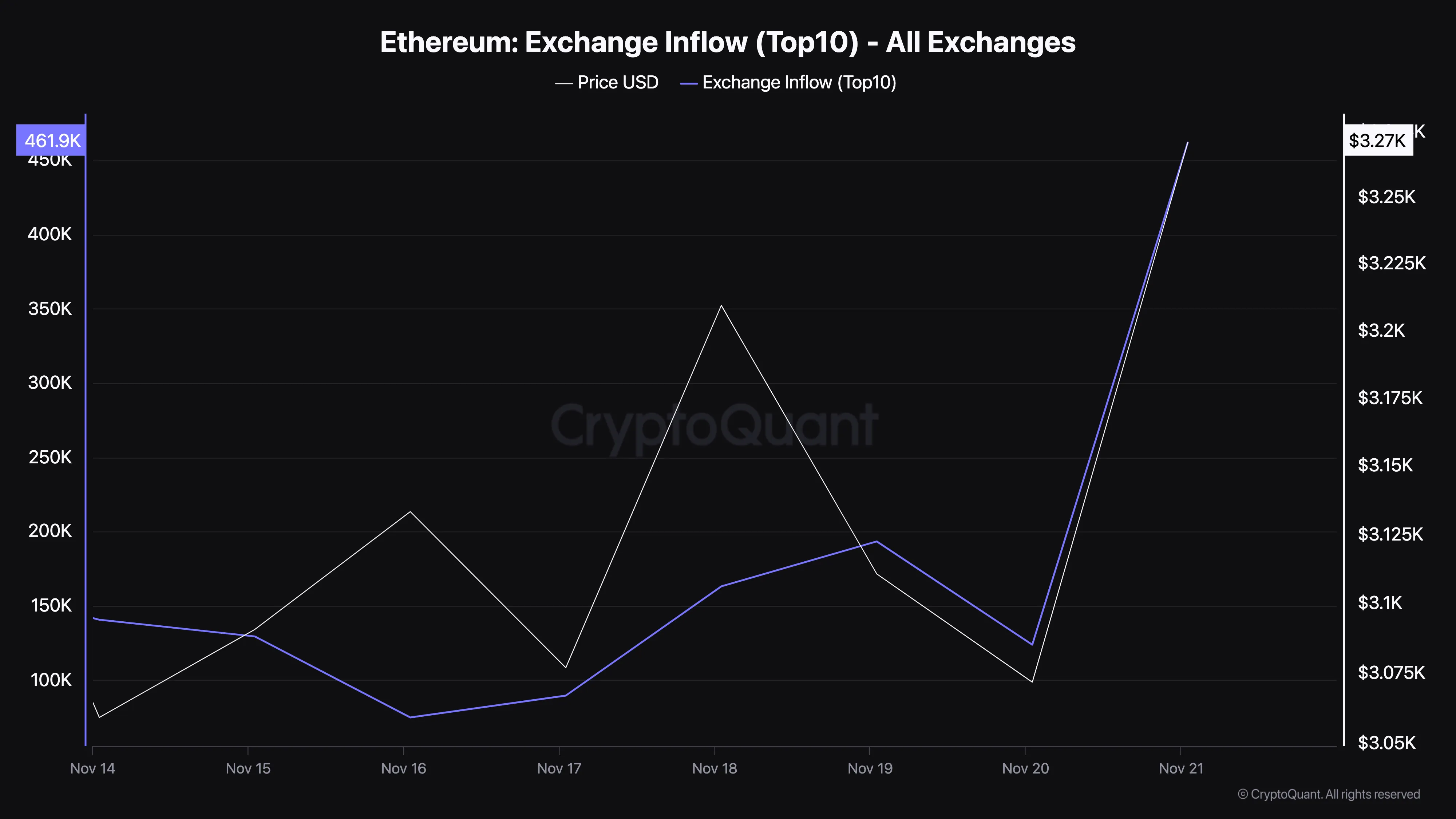

Further, the disparity in Ethereum’s performance can largely be attributed to sustained selling pressure. For instance, CryptoQuant data reveals that exchange inflows into the top 10 exchanges have climbed to 461,901 ETH, valued at approximately $1.50 billion as of this writing.

This surge in exchange inflow reflects large deposits by investors, indicating a heightened willingness to sell. Such movements typically increase the supply of ETH on exchanges, raising the likelihood of a price drop.

In contrast, a low exchange inflow generally indicates that investors are holding onto their assets, which is not the current scenario for ETH.

ETH Price Prediction: Crypto Could Retrace

As of this writing, ETH trades at $3,317, which is a higher close than yesterday’s. Despite that, the altcoin is still below the Parabolic Stop And Reverse (SAR) indicator. The Parabolic SAR generates a series of dots that track the price movement, positioning above the price during a downtrend and below the price during an uptrend.

A “flip” in the dots — shifting from one side to the other — often signals a potential trend reversal. As seen below, the indicator is above ETH’s price, suggesting that the cryptocurrency could reverse its recent gains.

If this is the case and the ETH/BTC ratio declines, Ethereum’s price could decline to $3,083. However, if buying pressure increases, that might not happen. Instead, the value could surge above $3,500 and toward 4,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Cash (BCH) Price Up, Leads Daily Gains

Bitcoin Cash (BCH) price has risen more than 10% in the last 24 hours, surpassing the $10 billion market cap and signaling renewed bullish momentum. The recent surge has brought BCH closer to key resistance levels, indicating the potential for further gains if the uptrend strengthens.

However, indicators like the RSI and ADX show that while the trend is improving, it is not yet fully strong. Whether BCH can sustain its upward momentum or face a pullback will depend on how it navigates critical resistance and support levels in the coming days.

BCH Current Uptrend Is Getting Stronger

BCH currently has an ADX of 19.31, up from 12 just a day ago. This increase indicates that the strength of the trend is gradually gaining momentum after being weak.

However, since the ADX is still below 25, it suggests that the uptrend has not yet reached a strong or sustained level of trend strength.

The ADX measures the strength of a trend, with values above 25 indicating a strong trend and below 20 indicating a weak or uncertain trend. While Bitcoin Cash is currently in an uptrend, the ADX at 19.31 suggests that the trend is still in its early stages of strengthening.

If the ADX continues to rise above 25, it could confirm a stronger uptrend, but for now, Bitcoin Cash price movement remains cautious, with room for further development.

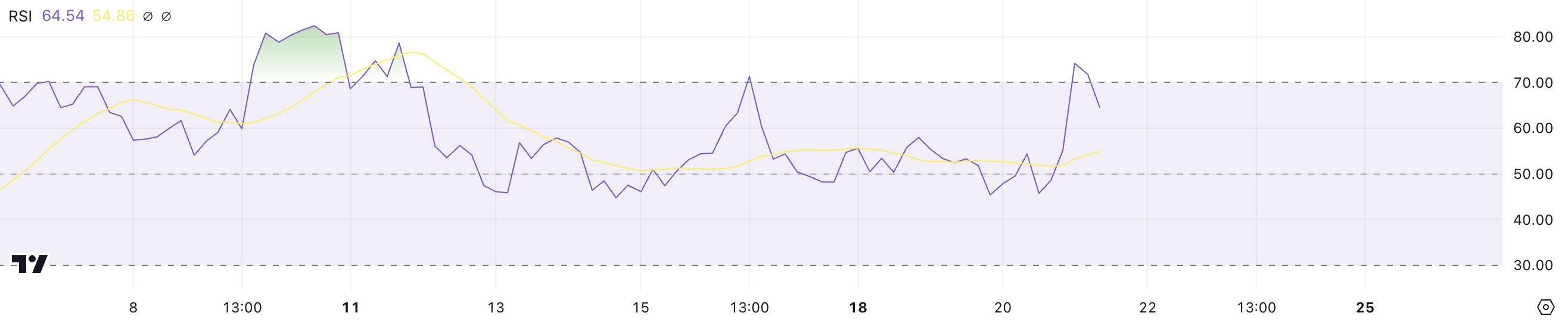

Bitcoin Cash Is Not In The Overbought Zone Anymore

Bitcoin Cash has an RSI of 64.5, down from over 70 just a day ago. This decline suggests that while the asset is still experiencing bullish momentum, the intensity of buying pressure has started to decrease.

The drop below 70 takes BCH out of the overbought zone, indicating a more balanced market sentiment.

The RSI measures the speed and magnitude of price changes, with values above 70 indicating overbought conditions and below 30 signaling oversold levels. At 64.5, BCH remains in bullish territory, which supports the ongoing uptrend.

However, the slight decline in RSI could mean the pace of gains is moderating, potentially leading to BCH price consolidation before any further upward movement.

BCH Price Prediction: Will a New Surge Occur Soon?

If BCH maintains its current uptrend and gains additional momentum, it could continue its rise after climbing more than 10% in the last 24 hours.

This strength could push BCH price to test the resistance at $536.9. Breaking this level would signal a continuation of bullish momentum and could attract further buying interest.

On the other hand, if the uptrend fades away and reverses, BCH price could retrace to test the nearest support levels at $424 and $403. If these supports fail to hold, the price could fall further to $364, representing a potential 27% correction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market13 hours ago

Market13 hours agoThis is Why MoonPay Shattered Solana Transaction Records

-

Ethereum10 hours ago

Ethereum10 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Regulation17 hours ago

Regulation17 hours agoUS SEC Pushes Timeline For Franklin Templeton Crypto Index ETF

-

Market17 hours ago

Market17 hours agoRENDER Price Soars 48%, But Whale Activity Declines

-

Market21 hours ago

Market21 hours agoArkham Spot Trading Platform Set to Launch in the US Market

-

Regulation16 hours ago

Regulation16 hours agoBitClave Investors Get $4.6M Back In US SEC Settlement Distribution

-

Regulation21 hours ago

Regulation21 hours agoDonald Trump’s transition team considering first-ever White House crypto office

-

Market16 hours ago

Market16 hours agoNvidia Q3 Revenue Soars 95% to $35.1B, Beats Estimates