Market

Altcoins Crypto Whales Bought: October 2024 Fourth Week

Despite the lackluster performance of many cryptos this week, a few altcoins crypto whales bought and increased their exposure.

In this analysis, BeInCrypto examines the top altcoins targeted by whales and explores the reasons behind their purchases. This week’s top picks include Immutable (IMX), Pendle (PENDLE), and Injective (INJ).

Immutable (IMX)

Immutable (IMX), the native token of the Ethereum-based layer-2 scaling solution Immutable, emerged as the top choice for crypto whales this week.

Data from IntoTheBlock shows that the net flow of IMX held by large investors surged from 288,177 tokens to 16.02 million. This indicates a net purchase of around 15.71 million IMX tokens in October’s fourth week.

At the current IMX price of $1.44, this influx amounts to approximately $22.62 million. According to BeInCrypto’s findings, this large accumulation could be linked to the upcoming token unlock, scheduled to take place in six days.

Read more: 10 Alternative Crypto Exchanges After Bybit Exits France

Despite this substantial buying activity, IMX’s price declined by 5% over the past seven days. However, if whales continue their accumulation, IMX could see a price rebound in the coming weeks.

Injective (INJ)

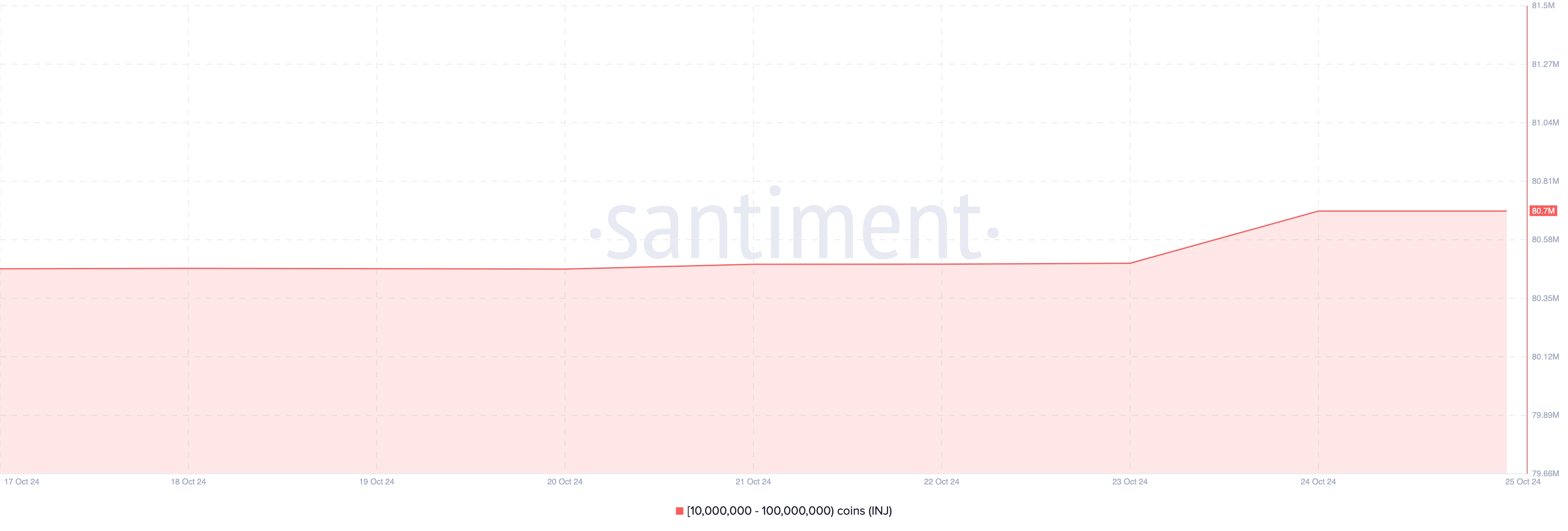

The Injective token is also part of the altcoins crypto whales bought this week. According to Santiment, the balance of addresses holding between 10 million and 100 million INJ moved from 80.49 million to 80.70 million.

This surge in INJ accumulation indicates that crypto whales may anticipate a potential price increase. Additionally, the move could be tied to speculation that Injective might join the Artificial Superintelligence Alliance merger.

Despite the accumulation, INJ’s price dropped by 7% this week. But if whales continue to buy the altcoin, then a recovery could be an option in the short term.

Pendle (PENDLE)

Unlike IMX and INJ prices, PENDLE produced a positive return this week as the price climbed by 8%. Amid this price increase, crypto whales decided to buy the token, which enhanced the trading of future yields on the Pendle protocol.

On October 23, the large holders’ netflow was 165,260. But as of this writing, the figure has increased to 1.33 million, meaning whales bought about 1.16 million PENDLE tokens, valued at $5.42 million.

The exact reason behind whales’ recent purchases of Pendle remains uncertain. However, the current buying activity could suggest a “buy the dip” approach, as PENDLE is trading 37% below its all-time high.

Read more: Which Are the Best Altcoins To Invest in October 2024?

Should this buying momentum persist, PENDLE’s value may see an upward move in response to increased demand. Conversely, if whales reduce their accumulation, PENDLE’s price could face downward pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Traders Show Confidence in Solana Recovery After Sub-$260 Dip

On November 23, Solana’s (SOL) price hit a new all-time high, sparking speculation that the altcoin could rally as high as $300. While that did not happen, recent data shows that Solana traders are betting on a rebound.

Why are traders confident? This on-chain analysis explores whether these positions could deliver gains or if many are at risk of liquidation.

Solana Longs Keep Shorts Out of the Way

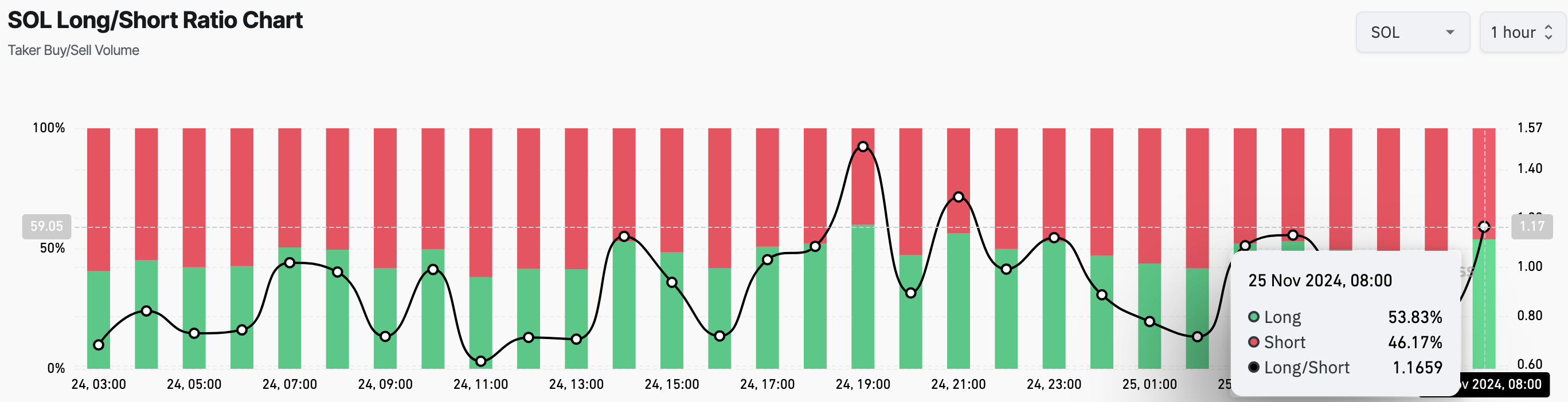

Data from Coinglass reveals that Solana’s Long/Short ratio on the 1-hour timeframe has climbed to 1.17. This ratio gauges market expectations, indicating whether most traders hold bearish or bullish positions.

When the ratio falls below 1, it indicates more shorts (sellers) than longs (buyers). Conversely, a ratio above 1 suggests a higher number of traders betting on a price increase compared to those anticipating a decline.

Currently, 54% of Solana traders hold long positions, while 46.17% expect a drop below $255. This indicates a bullish leaning among traders, with more optimism about the token’s price rising than falling.

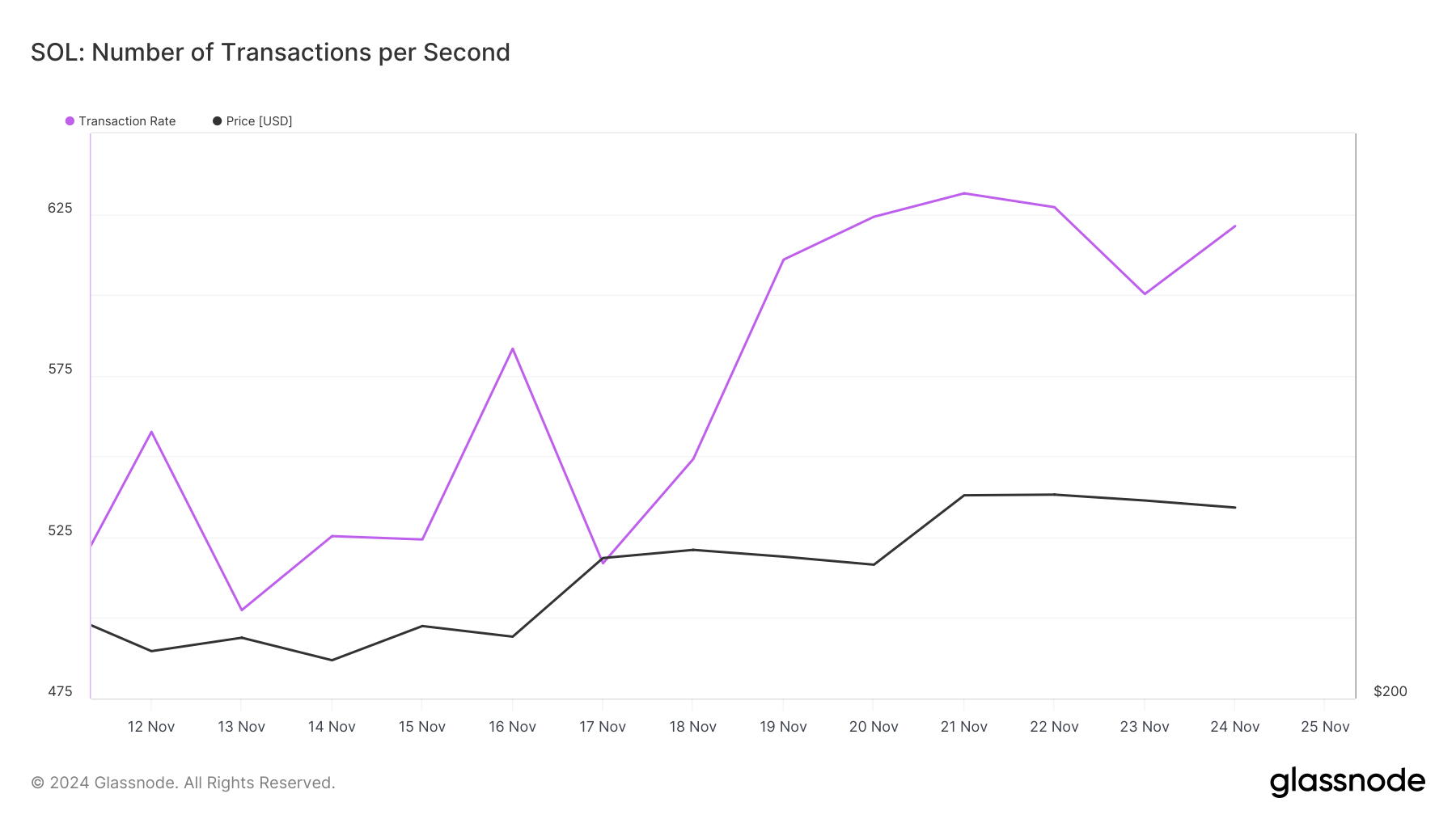

Additionally, it appears that these traders’ positions could prove profitable, thanks to an uptick in Solana’s Transaction Rate, which is the number of successful transactions processed per second on its blockchain.

An increasing Transaction Rate signals heightened user activity and engagement with the cryptocurrency, while a decline indicates reduced interest. According to Glassnode, Solana’s Transaction Rate has been climbing. If this trend continues, it could propel SOL’s price past its all-time high.

SOL Price Prediction: Upside Potential Remains

On the weekly chart, Solana’s price has surged above the 20 and 50 Exponential Moving Averages (EMAs), key indicators that measure trends. When the price sits above the EMAs, it signals a bullish trend, while a drop below them typically signals bearish momentum.

With SOL currently priced at $255, above both EMAs, the altcoin seems poised to continue its upward direction. The formation of a bull flag further supports this bullish outlook.

A bull flag is a continuation pattern, indicating that once the price breaks out, it’s likely to maintain the prior upward momentum. As seen below, SOL has already broken out of the consolidation pattern and is heading higher.

As long as the price remains above the upper trendline of the consolidation phase, it could rise toward $325. However, if selling pressure takes hold, this bullish scenario could shift. In that case, SOL might fall below $200.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Are Shiba Inu Holders Selling Their Coins?

The meme coin mania of the past few weeks pushed Shiba Inu’s (SHIB) price to an eight-month high of $0.000030 on November 12. Due to this hike, a significant portion of SHIB’s supply is now profitable.

However, as market sentiment shifts, many Shiba Inu holders are now opting to secure their gains by selling their SHIB coins.

Shiba Inu Holders Sell For Profit

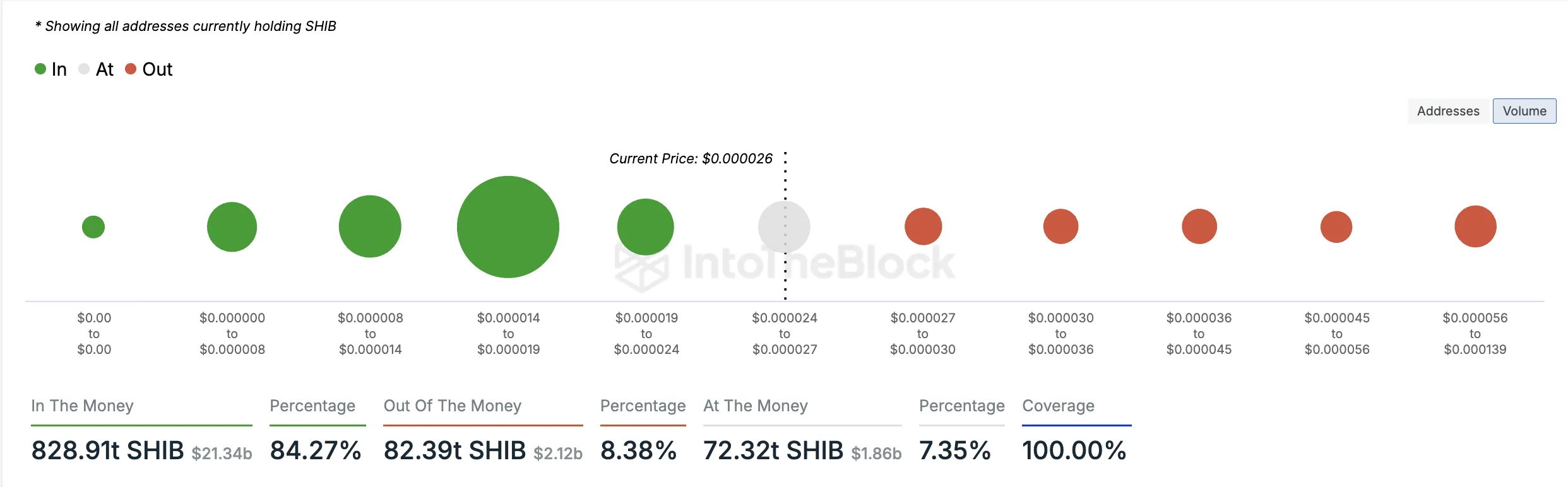

According to IntoTheBlock’s Global In/Out of the Money indicator, 829 trillion SHIB coins held by 851,000 addresses, which comprise 62% of all the meme coins holders, are “in the money.”

An address is considered “in the money” when the current market price of the asset it holds is higher than the average acquisition cost of the tokens in that address. This indicates that the holder would realize a profit by selling their holdings at the prevailing market price.

On the other hand, 82.39 trillion SHIB coins held by 398,000 addresses are “out of the money.” These are addresses that currently hold their coins at a loss.

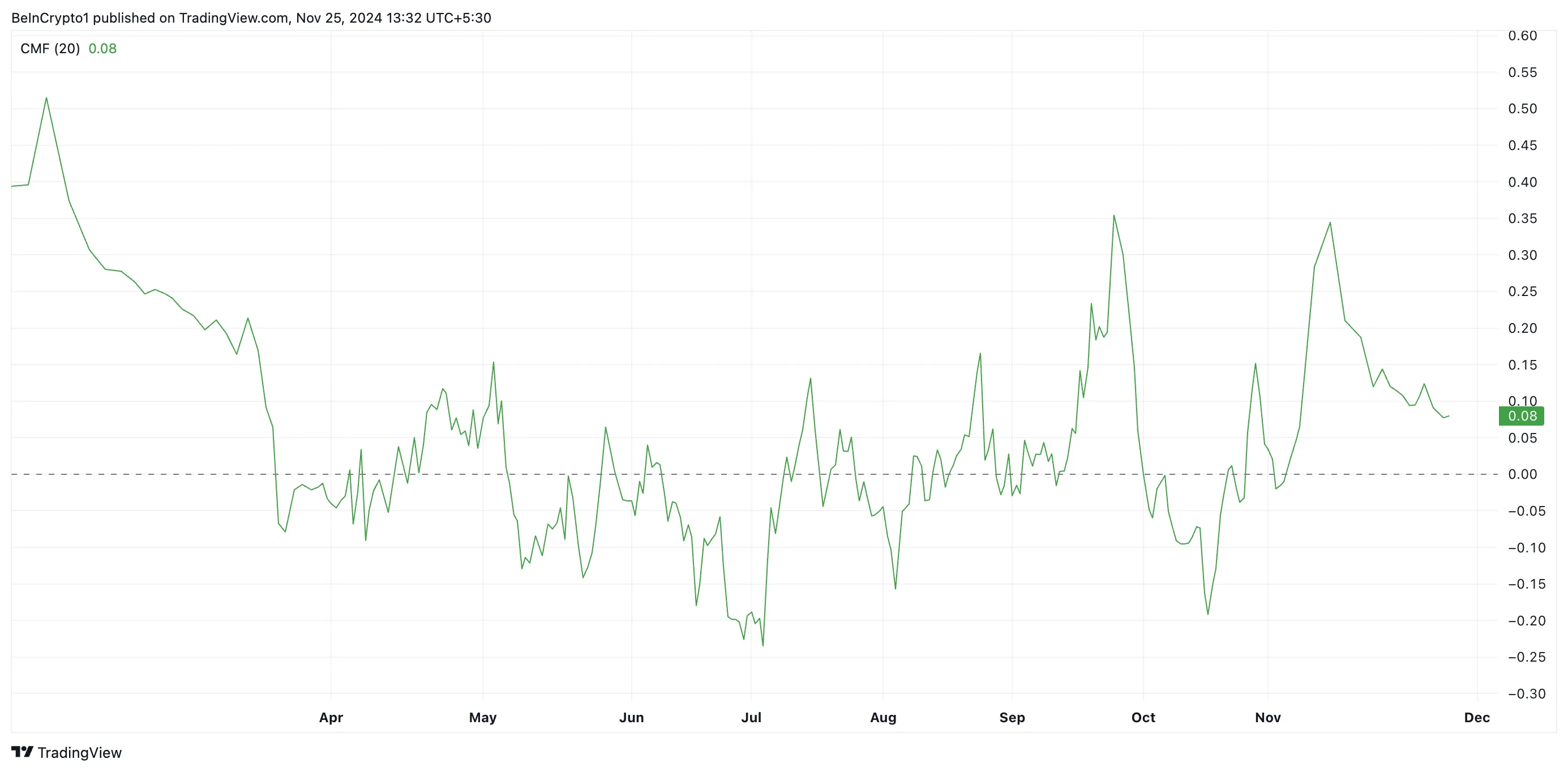

With 62% of all its holders now in profit, there has been a resurgence in profit-taking activity. This is reflected in SHIB’s declining Chaikin Money Flow (CMF). As of this writing, this indicator is at 0.08, trending downward toward the center zero line.

The CMF measures the market’s buying and selling pressure. When it falls toward the zero line, it signals weakening buying momentum, indicating that market participants are losing conviction in the uptrend.

Additionally, the setup of SHIB’s moving average convergence divergence (MACD) indicator confirms this bearish outlook. At press time, the coin’s MACD line (blue) rests below its signal line (orange).

This indicator measures an asset’s price trends and momentum and identifies its potential buy or sell signals. When the MACD line falls below the signal line, it indicates a bearish trend and confirms the reversal of an uptrend. It suggests that selling pressure is increasing, and the asset’s price could decline further.

SHIB Price Prediction: A Decline To $0.000020?

SHIB is trading at $0.000025, marking a 4% decline in the last 24 hours. It remains above key support at $0.000022. If SHIB falls below this support, its price could drop further to $0.000020.

On the other hand, if profit-taking activity relaxes and the meme coin witnesses a resurgence in new demand, it will break above resistance at $0.000026 to reclaim its eight-month peak of $0.000030.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will the MANA Crypto Price Rally End After a 70% Weekly Surge?

MANA, Decentraland’s native cryptocurrency, has seen an impressive 70% price increase over the past week. This MANA crypto price surge is part of a broader rally in Metaverse-related tokens, which has caught the attention of the market.

While the development might have surprised some, a closer look by BeInCrypto provides insights into the catalysts behind this movement. This on-chain analysis looks at what could be next for the token.

Decentraland Active Addresses, Volume Reach New Heights

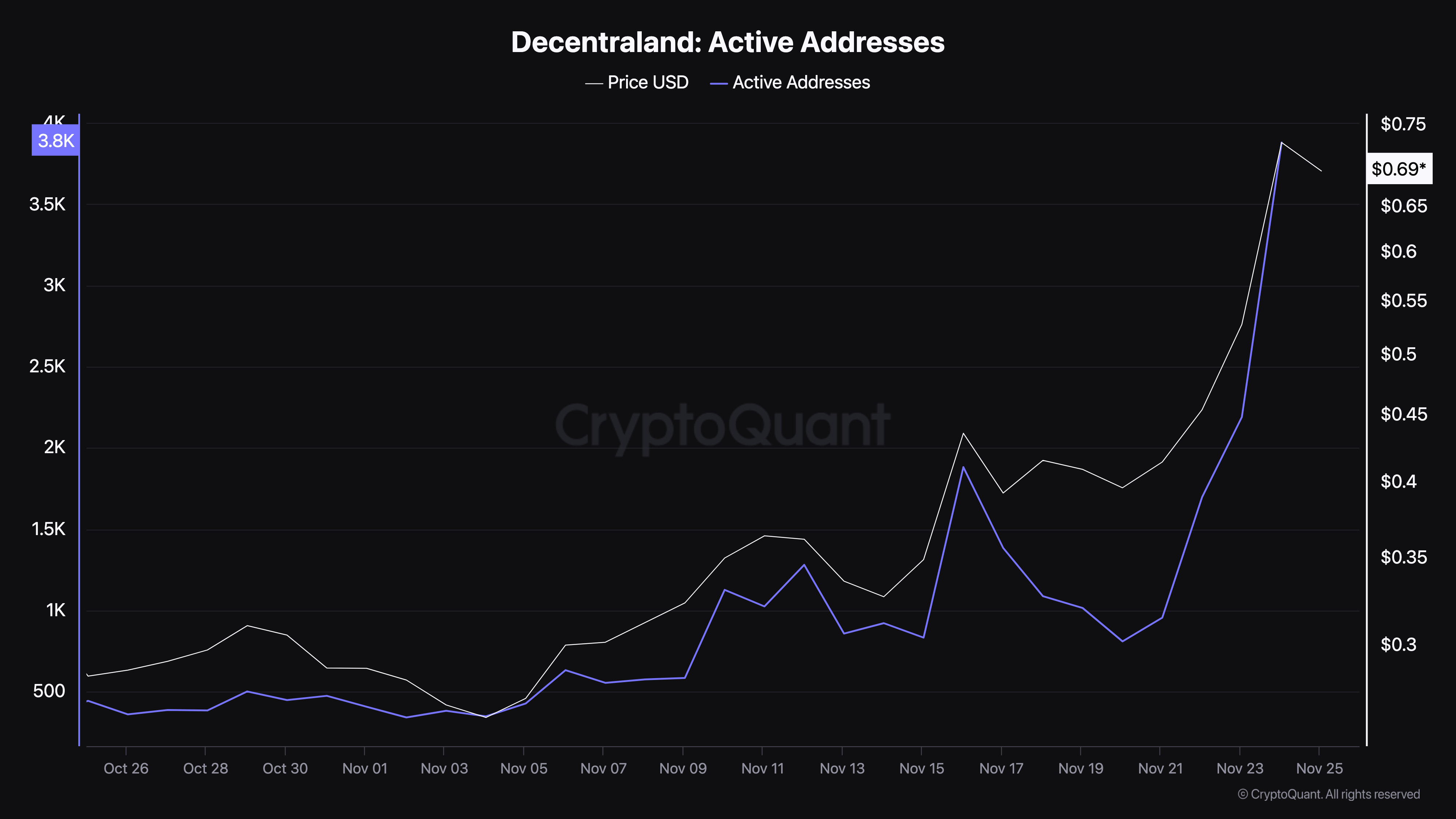

The recent rally in MANA crypto price can be attributed to a significant increase in the token’s active addresses, which indicates heightened user interaction on the blockchain. Interestingly, this also matches the condition of The Sandbox (SAND), which was also one of the frontrunners of the Metaverse revival.

Active addresses measure the number of unique users successfully completing transactions. A rise in this metric signals increased engagement with the network, which is often considered bullish for a cryptocurrency. Conversely, a decline implies reduced traction, which is typically seen as bearish.

On November 20, MANA’s active addresses were around 810. Fast-forward a few days, and this figure has surged nearly fivefold, reflecting a growing interest in the token. This spike in activity likely provided the momentum for MANA’s price to climb from $0.40 to $0.70 — the highest level since March.

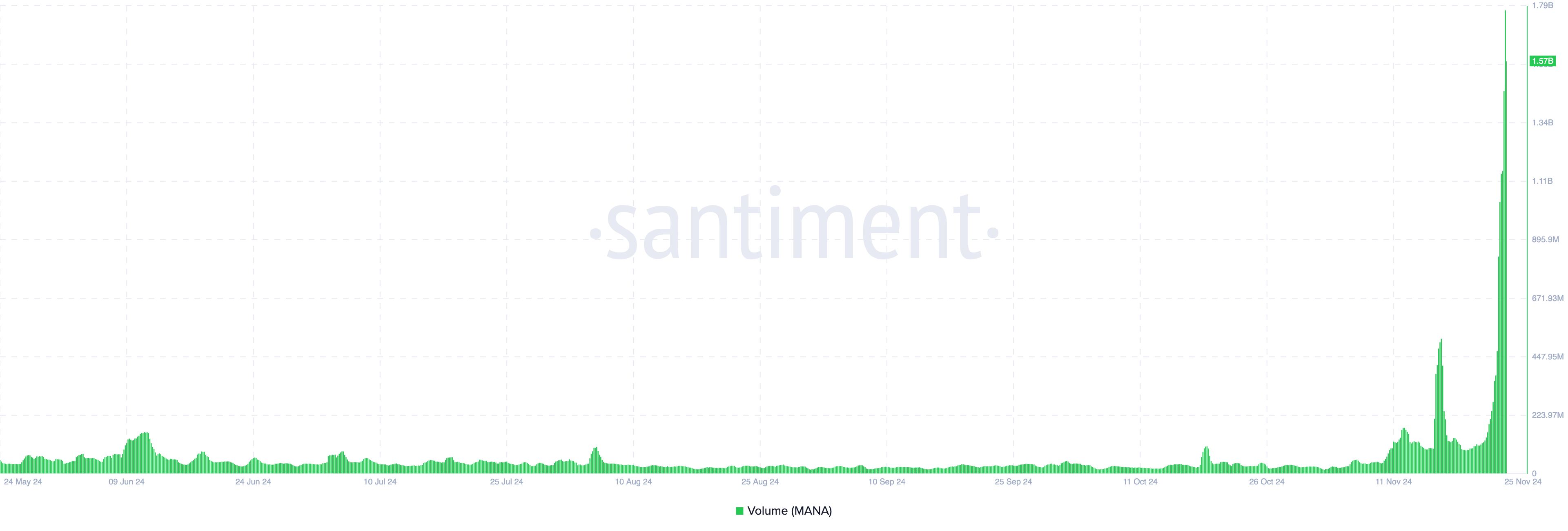

Following the development, Santiment data showed that MANA’s volume climbed to $1.57 billion. Volume represents the total value of a specific cryptocurrency traded over a defined period.

This metric reflects a coin’s level of activity and liquidity. A high trading volume indicates notable buying and selling, which often suggests strong market participation. On the other hand, low volume may signify reduced activity, leading to weaker market interest.

Therefore, the hike in the token’s volume validated the signs shown by the active addresses. However, since MANA’s price has dropped from its recent peak, it could be challenging to keep up with the uptrend, with this analysis suggesting that another pullback could be close.

MANA Price Prediction: Pullback Imminent

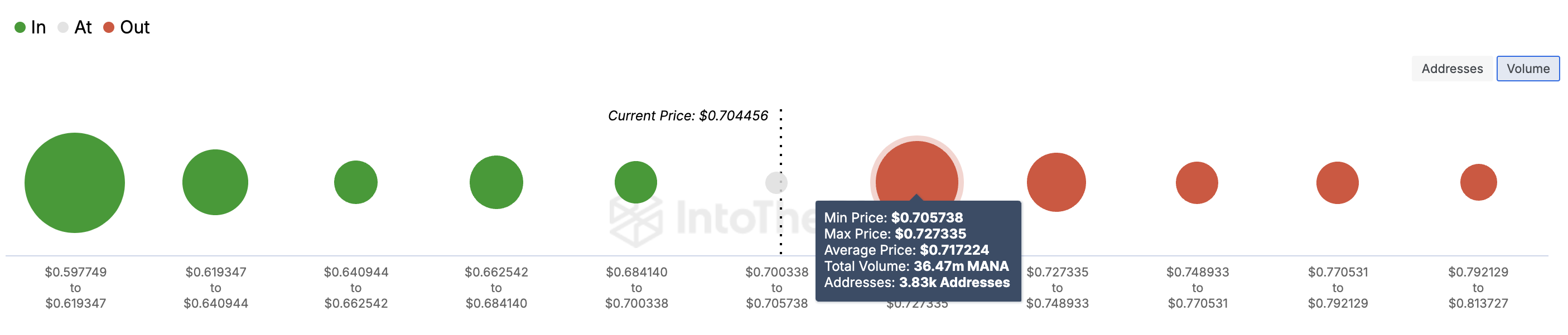

From an on-chain perspective, the MANA crypto price rally might have hit a local top. This prediction is based on the signs shown by the In/Out of Money Around Price (IOMAP).

The IOMAP is a key metric that analyzes the distribution of cryptocurrency holders based on whether their holdings are in profit, loss, or at breakeven. It also provides insights into potential support and resistance levels in the market.

When there are large clusters “out of the money,” this indicates addresses holding at a higher price than the current market value. Such areas often act as resistance. Conversely, Large clusters “in the money” typically act as support, as holders may buy more or hesitate to sell, expecting further price gains.

For MANA, approximately 36.47 million tokens held by addresses that accumulated near $0.70 are currently “out of the money.” This volume surpasses the tokens held between $0.61 and $0.68, marking that range as a key resistance zone.

As such, the MANA crypto price might experience retracement. If that is the case, then the cryptocurrency’s value could drop to $0.61 in the short term.

However, if buying pressure increases and volume outpaces the one at $0.70, this might not happen. Instead, MANA could climb to $0.80.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin24 hours ago

Bitcoin24 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?

-

Market24 hours ago

Market24 hours agoWinklevoss Urges Scrutiny of FTX and SBF Political Donations

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Correction Looms As Analyst Predicts Fall To $85,600

-

Bitcoin22 hours ago

Bitcoin22 hours agoAI Company Invests $10 Million In BTC Treasury

-

Market22 hours ago

Market22 hours agoIs the XRP Price Decline Going To Continue?

-

Bitcoin20 hours ago

Bitcoin20 hours agoSenator’s Bold Proposal To Replenish US Reserves

-

Market18 hours ago

Market18 hours agoCan the SAND Token Price Rally Be Sustained?

-

Bitcoin18 hours ago

Bitcoin18 hours agoBitcoin Whales Remain Determined, $3.96 Billion Worth Of BTC Gobbled Up In 96 Hours