Market

New Cross-Appeal Could Set Precedent

Updates in the Second Circuit appeal proceedings reveal the latest legal developments in the SEC vs. Ripple case. Emerging strategies suggest that the ongoing courtroom battle between the US Securities and Exchange Commission (SEC) and Ripple Labs has taken a new turn.

Despite launching his Senate race against Elizabeth Warren, pro-XRP advocate John Deaton has pledged to remain steadfast in representing XRP holders’ interests in the SEC versus Ripple case.

Ripple’s Cross-Appeal Filing Adds Pressure on SEC

Attorney James Filan reported that Ripple’s legal team filed a cross-appeal in response to the SEC’s ongoing litigation. Ripple’s filing, appearing on the Second Circuit docket, presents a strong defense strategy. It argues that the SEC’s classification of XRP as an unregistered security is legally flawed.

The company’s cross-appeal also emphasizes Ripple’s contention that XRP is not an investment contract. It pushes that XRP should not be regulated as a security, an argument grounded in legal precedent and market realities.

Jeremy Hogan, a prominent attorney, has provided ongoing analysis of the case. He highlighted key elements of Ripple’s arguments, detailing discrepancies in the SEC’s approach toward cryptocurrencies.

Hogan also noted that Ripple’s filing could shape a landmark decision in the crypto industry. This is more so if Ripple’s arguments influence the court’s interpretation of what constitutes security under US law.

Read More: Crypto Regulation: What Are the Benefits and Drawbacks?

This development comes after the US regulator appealed the Ripple (XRP) case. As BeInCrypto reported, the SEC seeks a “de novo” review after Judge Analisa Torres’ July 13, 2023, ruling. The judge had ruled in partial favor of Ripple’s token as non-security.

Adding to the legal tension, the SEC has requested an extension to file its “Principal Brief” in the case until January 15, 2025. If granted, this extension would provide the SEC with additional time to solidify its arguments against Ripple’s cross-appeal.

The extended timeline could allow the SEC to refine its stance and address criticisms that its approach to crypto regulation lacks consistency. The agency faces scrutiny for its perceived ambiguity around classifying digital assets.

The SEC’s requested extension comes as the agency grapples with multiple cases related to cryptocurrency and digital assets. This reflects the growing challenge of regulating a fast-paced sector without comprehensive legislative guidance.

With the SEC’s briefing extension request pending and Ripple’s cross-appeal now under review, the court’s eventual decision could have far-reaching consequences. It could potentially reshape the future of digital assets in the United States.

John Deaton’s Continued Role as XRP Advocate Despite Senate Race

Amid the high-stakes legal maneuvers, John Deaton, a vocal XRP advocate, has confirmed his ongoing involvement in the case. This is despite his recent decision to run for the US Senate.

“Senate race or not, I don’t walk away from what I started,” Fox Business correspondent Eleanor Terret reported, citing Deaton.

Notably, Deaton has acted as an “amicus” (friend of the court) for XRP holders. His comment highlights his dedication to representing their interests. Deaton is also committed to defending the right to participate in a fair and transparent cryptocurrency market.

This commitment, alongside his Senate aspirations, illustrates the broader political dimension of the SEC vs. Ripple legal battle. With his Senate run focused on issues including financial and cryptocurrency regulation, Deaton’s involvement in the Ripple case aligns with his campaign message advocating for clear and reasonable crypto policies.

He has previously criticized the SEC’s approach to the case, describing it as overly aggressive and detrimental to innovation within the US crypto industry. However, the outcome of this case holds significant implications for Ripple, XRP holders, and the entire crypto industry.

A ruling in favor of Ripple could set a precedent that influences how other cryptocurrencies are regulated in the United States. This could curb the SEC’s authority to classify tokens as securities without clearer legislative guidance. Ripple CEO Brad Garlinghouse is optimistic about a victory.

“I am so confident that we’re going to win the appeal and that would put a dagger in Gary Gensler’s whole agenda around crypto regulation…I’m not losing any sleep over it at all. I’m so confident about it because I believe we’re on the right side of the law. I think we’re on the right side of history,” Garlinghouse reportedly told Terrett.

Read more: Everything You Need To Know About Ripple vs. SEC.

Conversely, a ruling supporting the SEC’s claims could empower the agency to take similar actions against other crypto firms. This could shape the regulatory framework governing digital assets in the US. On this account, Hogan takes a more stance.

“Sometimes win vs. lose in these cases is not a clear line. Nevertheless, yes, I think there is an 80% chance Ripple comes away from the appeal in a better position than now,” Hogan expressed.

Amidst these developments, BeInCrypto data shows that the XRP price has fallen 0.84% in the past 24 hours, trading for $0.5239 as of this writing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This is Why PumpSwap Brings Pump.fun To the Next Level

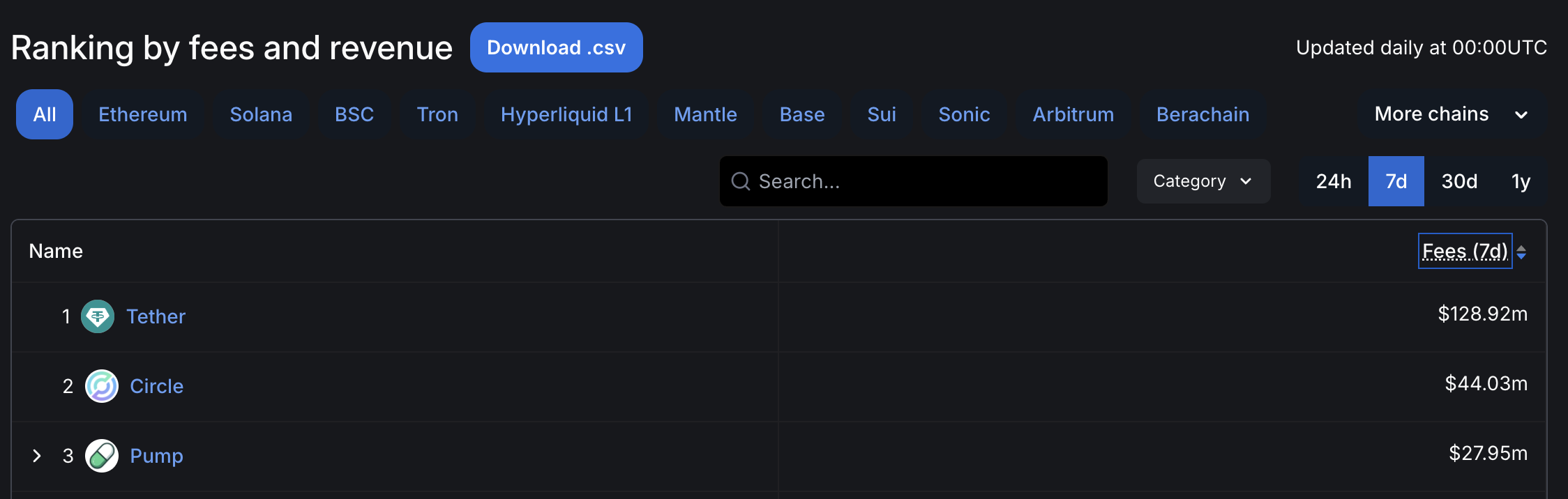

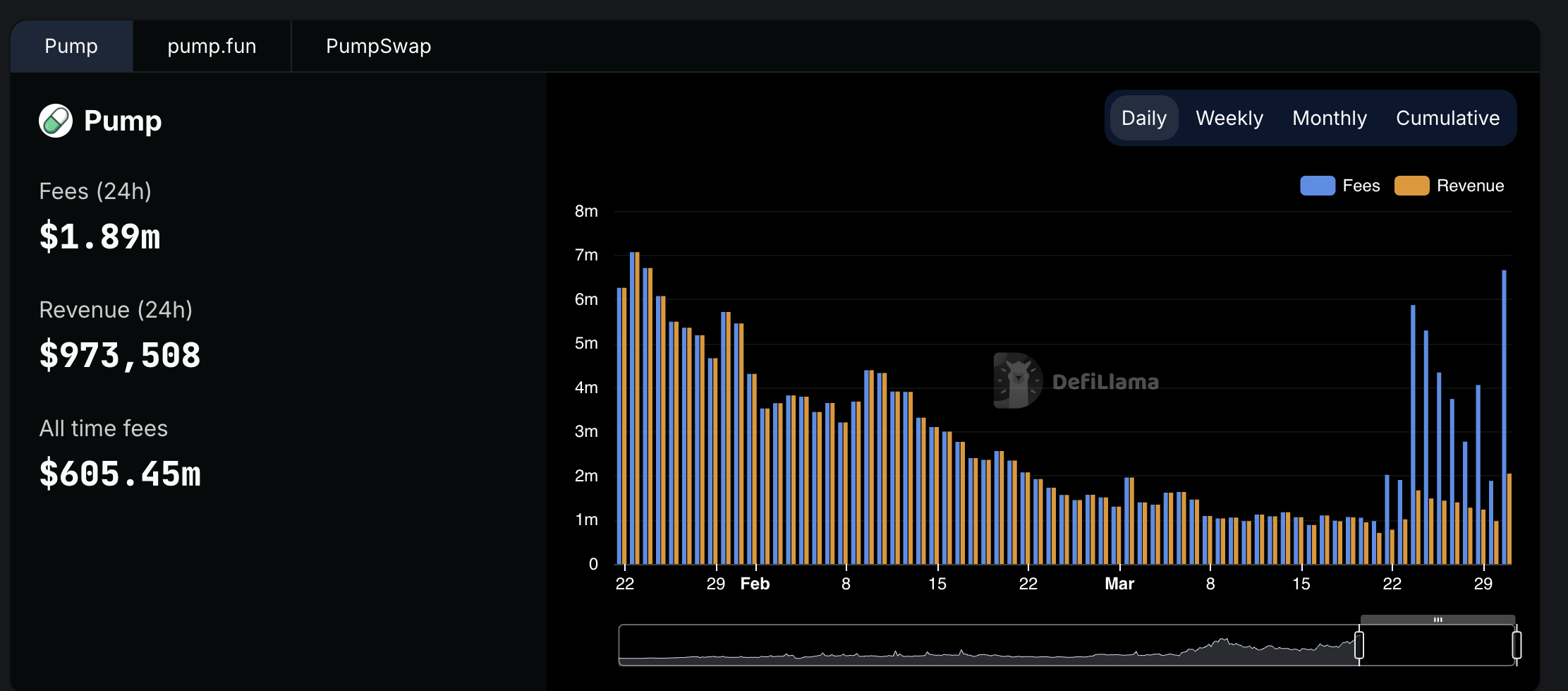

Since launching PumpSwap, token launchpad Pump.fun has resumed its position as a top-level protocol by fees and revenue. It saw over $2.62 billion in volume in less than two weeks, signifying high market interest.

Nonetheless, the meme coin sector as a whole has been more volatile than usual lately. PumpSwap is an attractive new option, but it still needs to stand the test of time.

Pump.fun Surges with PumpSwap

Pump.fun, a prominent meme coin creation platform, recently suffered some difficulties in the market. Facing lawsuits and criticism from the industry, the platform’s revenue had been declining in 2025. However, since launching PumpSwap, Pump.fun’s income has rebounded, making it one of the largest protocols by fees and revenue.

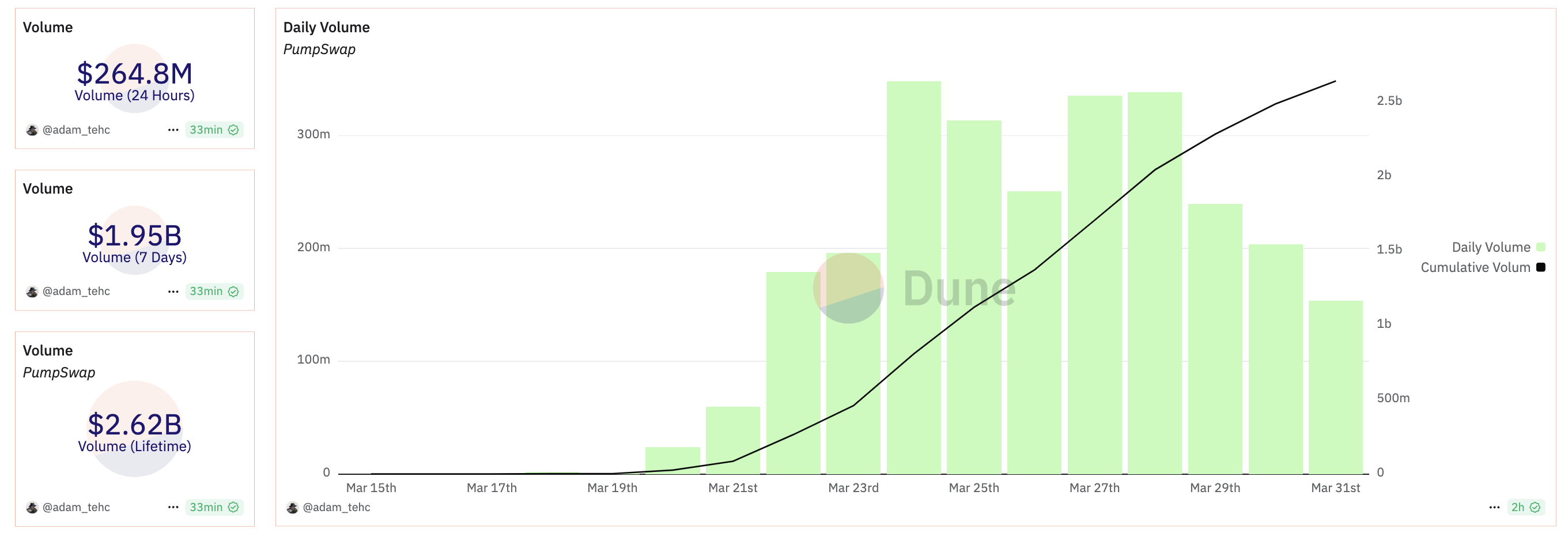

PumpSwap is a decentralized exchange on Solana’s blockchain, and it has grown very quickly since its launch less than two weeks ago. It has already managed over $2.62 billion in trade volume, although its daily volume fell over the weekend. Pump.fun’s cofounder spoke highly about PumpSwap, calling it a “crucial step that will help grow the ecosystem.”

Pump.fun’s overall revenues were declining before it launched PumpSwap, and they have since jumped back up. However, it’s important to not overstate the new exchange’s success. The exchange’s total fees collected have skyrocketed compared to Pump.fun, but the actual revenue growth has been comparatively small.

Still, these low fees also have significant advantages. Demand seems to be drying up in the meme coin sector, but Pump.fun faces stiff competition in the form of firms like Raydium, using low fees as a competitive edge. It has also promised things like revenue sharing with token creators to promote ecosystem growth.

Ultimately, the meme coin market as a whole is full of uncertainty. PumpSwap has been able to keep Pump.fun competitive as a top-level platform in this space, giving it a welcome reprieve. The real challenge will come in determining long-term viability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera (HBAR) Bears Dominate, HBAR Eyes Key $0.15 Level

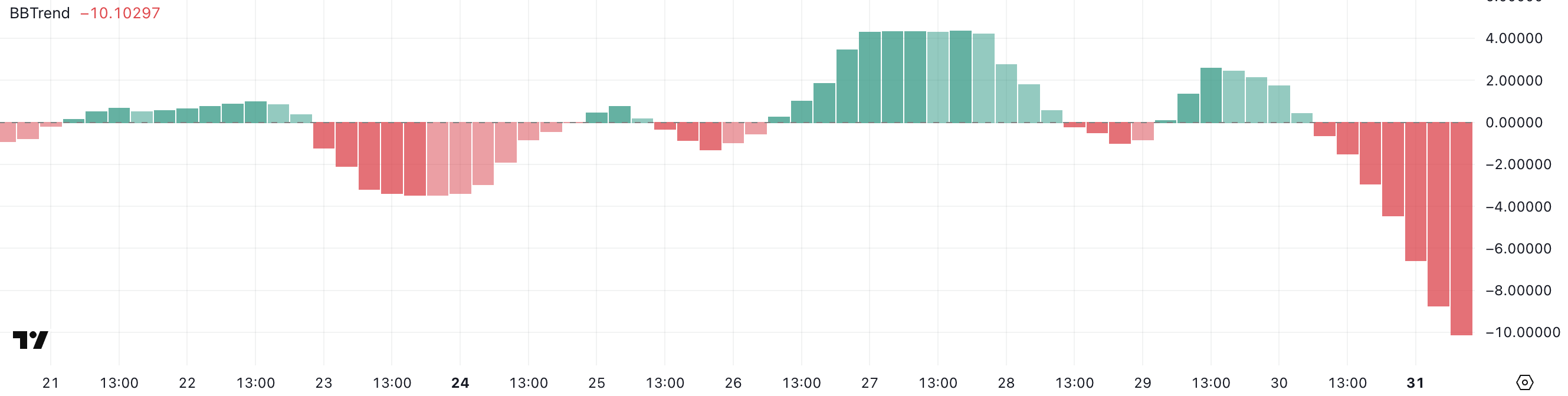

Hedera (HBAR) is under pressure, down roughly 13.5% over the past seven days, with its market cap holding at around $7 billion. Recent technical signals point to growing bearish momentum, with both trend and momentum indicators leaning heavily negative.

The price has been hovering near a critical support zone, raising the risk of a breakdown below $0.15 for the first time in months. Unless bulls regain control soon, HBAR could face further losses before any meaningful recovery attempt.

HBAR BBTrend Has Been Turning Heavily Down Since Yesterday

Hedera’s BBTrend indicator has dropped sharply to -10.1, falling from 2.59 just a day ago. This rapid decline signals a strong shift in momentum and suggests that HBAR is experiencing an aggressive downside move.

Such a steep drop often reflects a sudden increase in selling pressure, which can quickly change the asset’s short-term outlook.

The BBTrend, or Bollinger Band Trend, measures the strength and direction of a trend using the position of price relative to the Bollinger Bands. Positive values generally indicate bullish momentum, while negative values point to bearish momentum.

The further the value is from zero, the stronger the trend. HBAR’s BBTrend is now at -10.1, signaling strong bearish momentum.

This suggests that the price is trending lower and doing so with increasing strength, which could lead to further downside unless buyers step in to slow the momentum.

Hedera Ichimoku Cloud Paints a Bearish Picture

Hedera’s Ichimoku Cloud chart reflects a strong bearish structure, with the price action positioned well below both the blue conversion line (Tenkan-sen) and the red baseline (Kijun-sen).

This setup indicates that short-term momentum is clearly aligned with the longer-term downtrend.

The price has consistently failed to break above these dynamic resistance levels, signaling continued seller dominance.

The future cloud is also red and trending downward, suggesting that bearish pressure is expected to persist in the near term.

The span between the Senkou Span A and B lines remains wide, reinforcing the strength of the downtrend. For any potential reversal to gain credibility, HBAR would first need to challenge and break above the Tenkan-sen and Kijun-sen, and eventually push into or above the cloud.

Until then, the current Ichimoku configuration supports a continuation of the bearish outlook.

Can Hedera Fall Below $0.15 Soon?

Hedera price has been hovering around the $0.16 level and is approaching a key support at $0.156.

If this support fails to hold, it could open the door for further downside, potentially pushing HBAR below the $0.15 mark for the first time since November 2024.

However, if HBAR manages to reverse its current trajectory and regain bullish momentum, the first target to watch is the resistance at $0.179.

A breakout above that level could lead to a stronger rally toward $0.20 and, if momentum continues, even reach $0.215. In a more extended bullish scenario, HBAR could climb to $0.25, signaling a full recovery and trend reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Tries to Resume Lawsuit Against the FDIC

Coinbase asked a DC District Court if it could resume its old lawsuit against the FDIC. Coinbase sued this regulator over Operation Choke Point 2.0 and claimed that it’s still refusing to release relevant information.

Based on the information available so far, it’s difficult to draw definitive conclusions. The FDIC maintains that it responded to its opponents’ questions truthfully, though it has shown delays in the past.

Coinbase vs the FDIC

Coinbase, one of the world’s largest crypto exchanges, has been in a few fights with the FDIC. The firm has been pursuing the FDIC over Operation Choke Point 2.0 for months now, and has achieved impressive results. Despite this, however, Coinbase is asking the DC District Court to resume its litigation against the regulator:

“We’re asking the Court to resume our lawsuit because the FDIC has unfortunately stopped sharing information. While we would have loved to resolve this outside of the legal system – and we do appreciate the increased cooperation we’ve seen from the new FDIC leadership – we still have a ways to go,” claimed Paul Grewal, Coinbase’s Chief Legal Officer.

The FDIC has an important role in US financial regulation, primarily dealing with banks. This gave it a starring role in Operation Choke Point 2.0, hampering banks’ ability to deal with crypto businesses. However, it recently started a pro-crypto turn, releasing tranches of incriminating documents and revoking several of its anti-crypto statutes.

Grewal said that he “appreciated the increased cooperation” from the FDIC but that the cooperation stopped weeks ago. According to Coinbase’s filing, the FDIC hasn’t sent any new information since late February and claimed in early March that the exchange’s subsequent requests were “unreasonable and beyond the scope of discovery.”

On one hand, the FDIC has previously been slow to make relevant disclosures in the Coinbase lawsuit. On the other hand, Operation Choke Point 2.0 sparked significant tension within the industry, and a determined group is now aiming to significantly weaken the regulatory bodies involved.

Until the legal battle continues, it’ll be difficult to make any definitive statements. The FDIC will likely have two weeks to respond to Coinbase’s request.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market20 hours ago

Market20 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?

-

Market19 hours ago

Market19 hours agoXRP Price Fate Hangs on $2.00—Major Move Incoming?

-

Ethereum11 hours ago

Ethereum11 hours agoEthereum To $20K? Investor Says Real-World Adoption Is The Key

-

Market17 hours ago

Market17 hours agoDogecoin (DOGE) Bulls In Trouble—Can They Prevent a Drop Below $0.15?

-

Bitcoin11 hours ago

Bitcoin11 hours agoBTC Price Rebound Likely as Long-Term Holders Reenter Market

-

Market16 hours ago

Market16 hours agoBitcoin Price Nears $80,000; Fuels Death Cross Potential

-

Market10 hours ago

Market10 hours ago3 Altcoins to Watch in the First Week of April 2025