Bitcoin

Bitcoin, Ethereum Face $5 Billion Options Expiry Today

Traders and investors in the crypto market should brace for volatility, with $5.26 billion worth of Bitcoin and Ethereum options expiring today.

Specifically, Bitcoin (BTC) options due for expiry total $4.25 billion in notional value, while Ethereum (ETH) options account for $1.01 billion. With this, markets await the impact of such expansive contracts’ expiring.

What $5 Billion Bitcoin, Ethereum Options Expiry Means

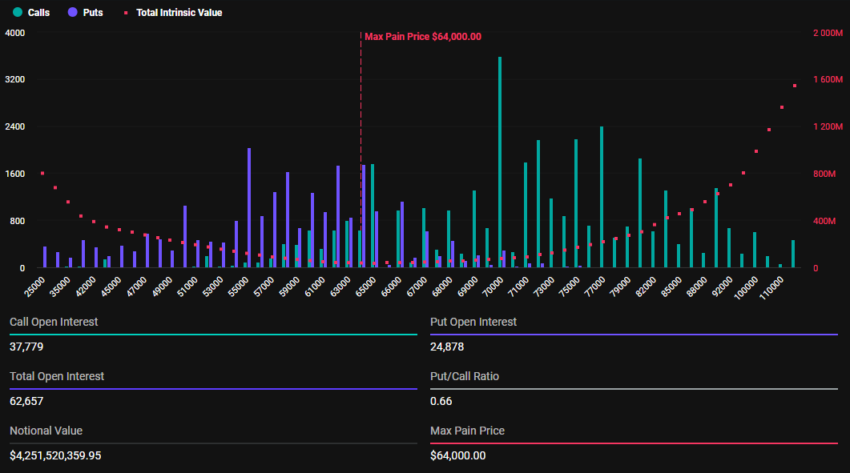

According to data on Deribit, an expansive 62,657 Bitcoin options contracts will expire on October 25, with a put-to-call ratio of 0.66 and a maximum pain point of $64,000.

At the same time, Ethereum’s options market is set to expire with 403,426 contracts. Today’s expiring Ethereum contracts have a put-to-call ratio of 0.97, with a maximum pain point of $2,600.

Read more: An Introduction to Crypto Options Trading.

The put-to-call ratio is an important sentiment indicator in options trading. It compares the volume of put options traded to call options. When this metric is below 1, it generally signals bullish sentiment, with more investors expecting market gains. On the other hand, a ratio above 1 often suggests bearish sentiment, signaling concerns about a market decline.

Meanwhile, based on BeInCrypto data, Bitcoin is trading at $67,962 as of this writing, while Ethereum is trading at $2,490. This means that while BTC is trading above its maximum paint point, Ethereum is trading below it.

Price Implication Based On Max Pain Point Theory

With Bitcoin price currently above its max pain point, if the options expire at the current level, it would generally signify losses for options contract holders. The reverse applies to Ethereum, which is below its strike price as options holders stand to benefit. This is based on the Max Pain theory, which predicts that options prices will converge around the strike prices where the largest number of contracts — calls and puts alike — expire worthless.

Therefore, it means that as the options contracts near expiration, Bitcoin and Ethereum prices are likely to draw toward their respective maximum pain points. This means BTC value may drop while ETH price could rise in a calculated move by smart money. Nevertheless, the pressure on BTC and ETH prices will reduce after 08:00 UTC on Friday, when Deribit settles the contracts.

It is also worth mentioning that the volume of BTC and ETH options expiring today is significantly higher than what was seen earlier in the month. BeInCrypto reported $1.4 billion in the trading week ending October 4, followed by $1.6 billion in the week ending October 11.

Subsequently, the week ending October 18 saw up to $1.62 billion option contracts expire. The leap to over $5 billion options expiring is therefore significant, with a sustained rising trend. Meanwhile, analysts at BloFin Academy say there is also a notable change in implied volatility (IV) ahead of the US elections.

“The change in implied volatility first reflects the election’s impact on the expected volatility of the crypto market. Whether it is BTC or ETH options, the implied volatility level of options expiring on November 8 has increased significantly and exceeded that of far-month options,” said the analysts.

They ascribe the change in IV to investors’ hedging and speculative needs. The analysts also observe relatively higher increases in BTC’s “election day option.” This shows that BTC is relatively more sensitive to macro events. For now, however, most investors remain on the sidelines, limiting the amount of volatility that should be expected in October.

Read more: 9 Best Crypto Options Trading Platforms.

“Interestingly, investors seem to believe that there will not be much volatility in the rest of October. As most investors are on the sidelines before the election, the performance of the crypto market is mainly consolidation, which also boosts investors’ confidence in pricing lower volatility. Of course, affected by supply, demand, and sentiment, options expiring on Nov 8 are becoming more expensive,” BioFin Academy analysts added.

Another influencing factor, according to the analysts, is policy uncertainties in the US by the Federal Reserve.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Is Bitcoin Ready for Another Surge?

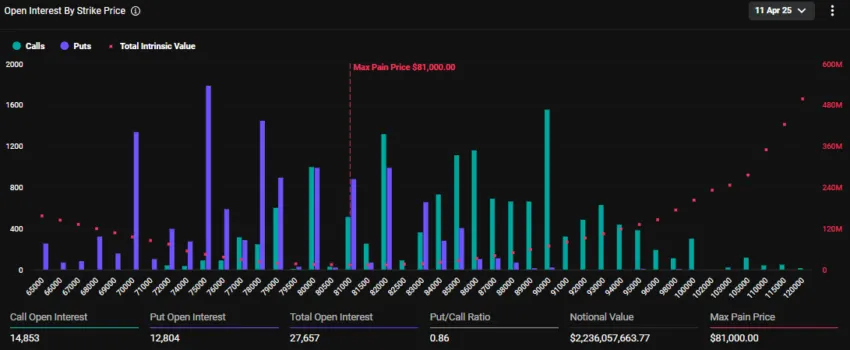

The US Dollar Index (DXY), which measures the dollar’s value against a basket of foreign currencies, has dropped to a three-year low. The decline contrasts with gold’s performance, which hit an all-time high of $3,220 amid rising trade war tensions.

Yet, DXY’s dip has sparked optimism among cryptocurrency investors. Many see the weakening dollar as a bullish signal for Bitcoin (BTC), which has recently shown signs of modest recovery.

Will Bitcoin Rally Following the DXY Index’s Fall?

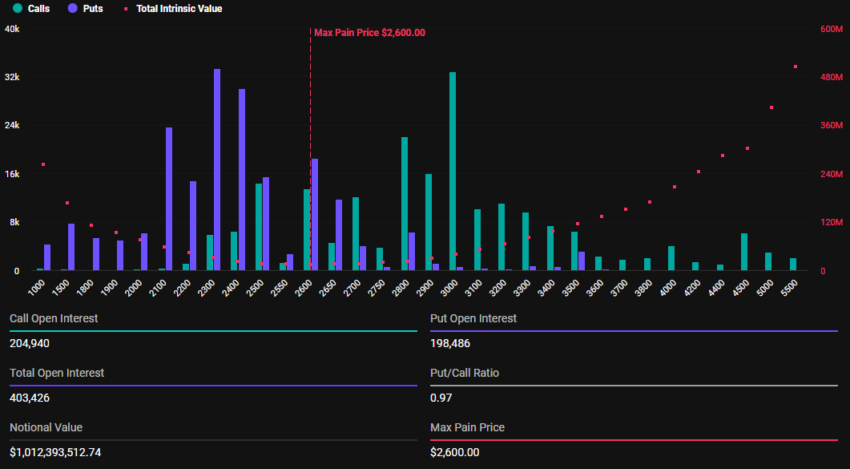

Data shows that the DXY index dropped by 1.5% in the last 24 hours. As of press time, it stood at 99.4, marking its lowest level since April 2022. The decline is part of a broader trend in 2025, with the DXY down 8.3% since January.

“The US dollar index dropped to its lowest level in nearly three years amid capital outflows from American assets. Escalating trade tensions and growing concerns over broader economic fallout, particularly for the US, have weighed heavily on market sentiment,” CryptoQuant’s Alex Adler told BeInCrypto.

Notably, the index’s fall below 100 marks a critical threshold. Historical data highlights a strong correlation between a declining DXY and substantial Bitcoin price surges.

The last two times the DXY fell below the 100 mark—in April 2017 and May 2020—Bitcoin experienced significant, months-long rallies. These substantial increases have led to speculation that history could repeat itself. If it does, Bitcoin could potentially be poised for another major surge.

Interestingly, Bitcoin has already shown signs of recovery after the 90-day tariff pause. The largest cryptocurrency reclaimed the $80,000 level, signaling renewed investor confidence. According to BeInCrypto data, Bitcoin appreciated by 0.8% over the past 24 hours. This reflected minor but positive gains that suggest momentum could be building.

In fact, the market watchers on X (formerly Twitter) share a similar outlook.

“Weak dollar is going to be a surprising tailwind for emerging markets this year that wasn’t on anyone’s bingo card,” a user wrote.

Meanwhile, an analyst observed that the US dollar’s decline has occurred despite the Federal Reserve’s failure to reduce interest rates or implement quantitative easing (QE).

“Traditionally, DXY going down is very bullish for BTC,” he said.

The analyst also highlighted a notable bearish divergence on the charts. Thus, he predicted that the dollar could potentially drop to 90, signaling a further decline in its value.

Similarly, another analyst described DXY’s decline as “one of the best anticipated macro moves ahead.”

“Each time this has happened in the past, it resulted in a massive bull market for Bitcoin, Crypto, and stocks,” Jackis remarked.

He also acknowledged that the markets have been slow to react, attributing this delay to a lag of more than three months. Additionally, he noted that the ongoing bond situation between China and the US, driven by escalating trade tensions, is contributing to this slow reaction.

Yet, he believes this situation will either be resolved through a deal between the two countries or the Federal Reserve will intervene by buying long-term bonds to stabilize the market. Now, the coming weeks will be crucial to determine whether Bitcoin will actually enter another bull run or falter under geopolitical tensions and broader market shifts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Over $2.5 Billion in Bitcoin and Ethereum Options Expire Today

Crypto markets will witness over $2.5 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today.

Traders are particularly attentive to this event because it has the potential to influence short-term trends through the volume of contracts due for expiry and their notional value. Examining the put-to-call ratios and maximum pain points can provide insights into traders’ expectations and possible market directions.

Bitcoin and Ethereum Options Expiring Today

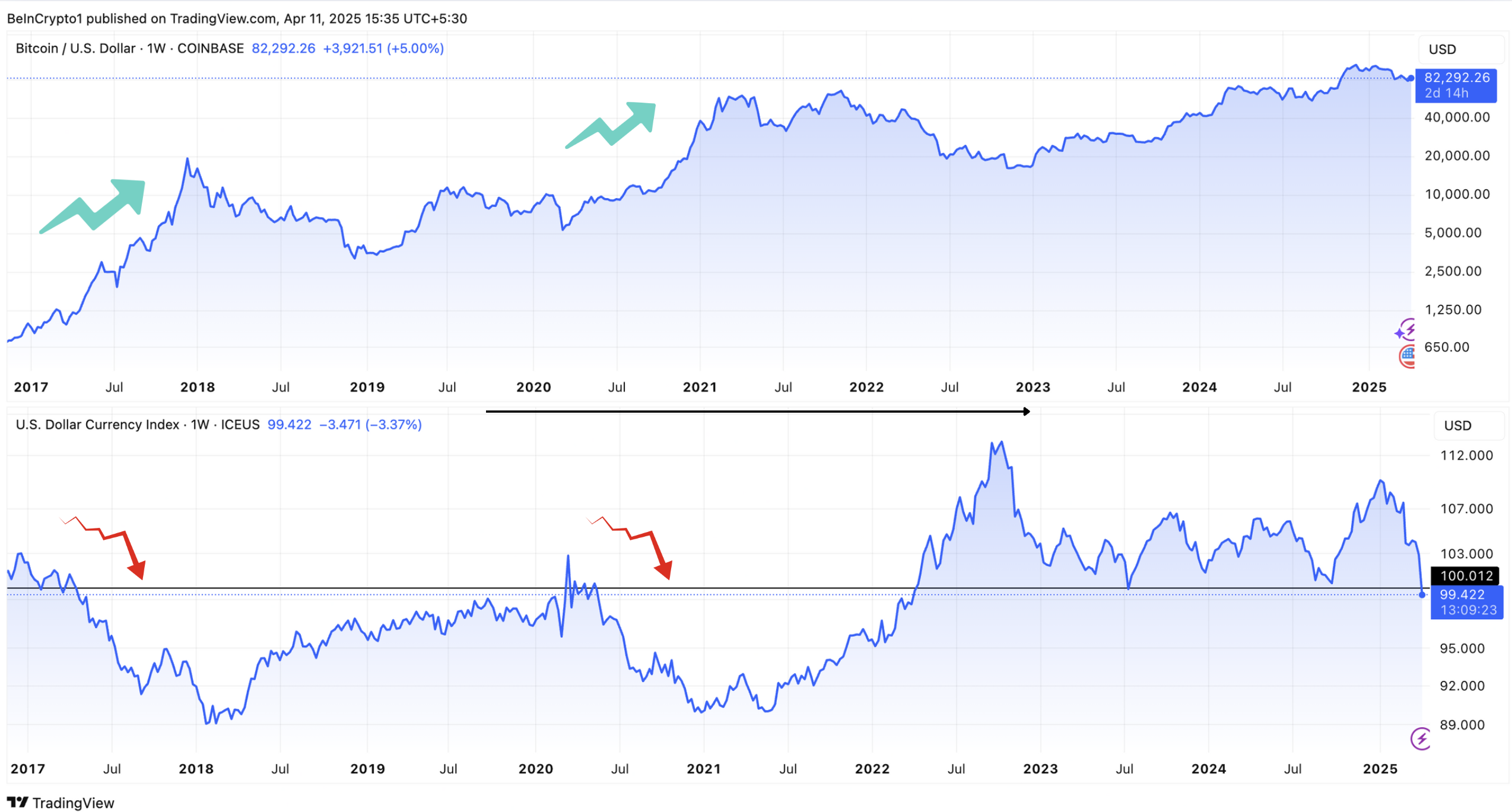

The notional value of today’s expiring BTC options is $2.23 billion. According to Deribit’s data, these 27,657 expiring Bitcoin options have a put-to-call ratio of 0.86. This ratio suggests a prevalence of purchase options (calls) over sales options (puts).

The data also reveals that the maximum pain point for these expiring options is $81,000. In crypto options trading, the maximum pain point is the price at which most contracts expire worthless. Here, the asset will cause the greatest number of holders’ financial losses.

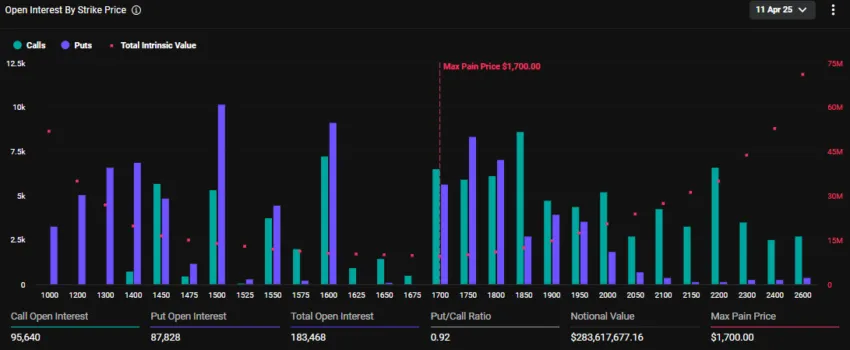

In addition to Bitcoin options, 183,468 Ethereum contracts are set to expire today. These expiring options have a notional value of $283.6 million and a put-to-call ratio of 0.92. The maximum pain point is $1,700.

The current market prices for Bitcoin and Ethereum are below their respective maximum pain points. BTC is trading at $80,622, while ETH sits at $1,543.

“With recent market volatility and ongoing tariff developments, how do you think these expiries will impact price action?” Deribit posed.

Deribit is a crypto options and futures exchange. Indeed, crypto markets are reeling from massive volatility induced by the trade war chaos following President Trump’s tariffs. Meanwhile, Cardano founder Charles Hoskinson says future tariffs will be ineffective on crypto.

He thinks that tariffs are already priced and that future announcements will be a ‘dud’ for the crypto market.

Traders Brace for Extended Weakness as Call Premium Fades Until September

Elsewhere, analysts at Deribit note a shift in crypto options, with short-term dips still bringing put demand. Meanwhile, the call premium is further out of the curve and fades.

“You now have to look all the way to September before calls retake the skew. Traders might be bracing for extended weakness,” Deribit noted.

This suggests traders might be bracing for extended weakness in the crypto market. A fading call premium, where the implied volatility (IV) of calls drops relative to puts, suggests that traders are less optimistic about price increases in the near to medium term.

A negative or reverse volatility skew, where OTM puts ((out-of-the-money puts) have higher IV than OTM calls ((out-of-the-money calls), is common in equity markets when investors fear price drops.

This pattern appears to play out in the crypto options market, reflecting heightened concerns about downside risks. Analysts at Greeks.live note that BTC’s IV has declined significantly and is now largely holding nearly 50% across all maturities.

On the other hand, ETH’s IV has maintained a higher level, with short to medium-term volatility holding near 80%. Selling ETH options in the short term would be a good trade for traders.

Global economic uncertainty, including the US-China tariff war, has dampened risk appetite. Crypto’s inherent volatility could also be fueling this cautious outlook.

“Sentiment was more panicky this week, with Trump’s frequent switching of tariff policies making the market extremely risk averse,” analysts at Greeks.live wrote.

The Greeks.live analysts agree with Deribit’s expectations of extended weakness. However, unlike Hoskinson, they expect continued uncertainty and volatility in the market for a long time.

For traders, this suggests a need for hedging strategies, like buying puts or diversifying into stablecoins.

“Cryptocurrencies are currently suffering from a lack of new incoming money, a lack of new narratives, and a more subdued investor sentiment. In this worse market of bulls to bears, the probability of a black swan will be significantly higher, and buying some deep vanilla puts would be a good choice,” Greeks.live analysts concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Holders are More Profitable Than Ethereum Since 2023

New data from Glassnode suggests that Bitcoin’s MVRV (Market Value to Realized Value) has been higher than Ethereum’s for 812 consecutive days. This means that the average BTC investor has accumulated much larger profits than their ETH counterpart since 2023.

Due to recent losses, Ethereum’s MVRV actually fell below 1.0, suggesting that the average investor has lost money. It may be undervalued and well-posed for a resurgence, but this will take time.

Bitcoin vs Ethereum: Which is More Profitable?

Despite a few recent market turmoils, the price of Bitcoin is doing reasonably well right now. Although much of its gains since Trump’s election have been wiped out, its pre-election value spent most of 2024 at a shelf near its previous all-time high.

According to new data from Glassnode, Bitcoin’s investor profitability is far above Ethereum’s.

“Since November 2022 (FTX collapse), Bitcoin’s realized cap has grown by $468 billion (+117%), while Ethereum’s increased by just $61 billion (+32%). Bitcoin investors have held consistently larger unrealized profits than #Ethereum holders since January 2023. BTC investor profitability has exceeded ETH for 812 consecutive days – an all-time record,” Glassnode said.

Glassnode came to these conclusions by analyzing both tokens’ MVRV and their ratio of market value to realized value. This metric compares the listed price of Bitcoin and Ethereum to the actual price at which these tokens were most recently traded.

Despite maintaining similar MVRVs for a prolonged period, Bitcoin is plowing well ahead today:

While Bitcoin has been more volatile than Ethereum, the altcoin has seen a much smaller uptick during bullish cycles. For instance, in the latest bull run between October and December 2024, Bitcoin surged by nearly 70%.

In the same period, Ethereum’s price increase was less than 50%. Yet, if we look at the drop during the current market downturn, BTC lost 3% in the first week of April, while ETH lost over 15%.

Meanwhile, the altcoin’s investor sentiment is also dropping. Major whales who HODL’ed the token for many years are now selling their ETH holdings.

Also, the average Bitcoin holder enjoys an MVRV of around 2.0, meaning that they have huge unrealized gains. Most of their counterparts have an MVRV below 1.0, signifying that they have lost money. These data points are concerning, especially for the median ETH holder.

However, there’s a silver lining. Ethereum recently fell to a yearly low, but there’s also a strong uptick of new investors. New developments, like the SEC approving ETH ETF options trading, could spur a recovery.

In other words, Ethereum may be highly undervalued and, therefore, an attractive investment.

Still, for the time being, Bitcoin holders are in a much better position than ETH holders. Ethereum is still the second-largest cryptoasset by market cap, and it can always make a comeback. This will almost certainly pose a significant challenge.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin20 hours ago

Altcoin20 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Market19 hours ago

Market19 hours agoPresident Trump Signs First-Ever Crypto Bill into Law

-

Market18 hours ago

Market18 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Altcoin18 hours ago

Altcoin18 hours agoBNB Chain Completes Lorentz Testnet Hardforks; Here’s The Timeline For Mainnet

-

Market20 hours ago

Market20 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

-

Market13 hours ago

Market13 hours agoHBAR Buyers Fuel Surge with Golden Cross, Suggesting Upside

-

Bitcoin17 hours ago

Bitcoin17 hours agoOver $2.5 Billion in Bitcoin and Ethereum Options Expire Today

-

Market12 hours ago

Market12 hours agoChina Raises Tariffs on US to 125%, Crypto Markets Steady