Market

How CrossFi Is Creating a Seamless Payment Future

CrossFi, a blockchain solutions company, has launched its EVM-compatible mainnet with a bold mission: to reshape the future of global crypto payments. While the blockchain sector has seen unprecedented growth, CrossFi aims to solve one of its biggest challenges — bridging the gap between digital currencies and traditional financial systems. Their payment solution allows crypto to be seamlessly integrated into everyday life, offering the ability to use digital assets just as fiat currencies.

In an exclusive interview with BeInCrypto, CrossFi CEO Alexander Mamasidikov shared insights into the company’s origins, the obstacles they’ve faced along the way, and the unique approach they’ve taken to create a truly decentralized, efficient, and user-friendly payment system.

Solving a Major Problem in the Crypto Space

The company’s journey began by addressing a critical pain point for crypto users: how to spend digital assets. While many individuals were earning crypto, using it in real-world transactions remained challenging.

“We were earning crypto, but spending it was difficult. You had to make calls, take risks, or search for intermediaries to exchange it. At that time, the market was highly unstable, and many people were even jailed for exchanging, buying, or selling cryptocurrency,” Mamasidikov recalled.

These hurdles made it clear that there was a significant gap between the potential of cryptocurrencies and their practical applications. In response to this problem, CrossFi set out to build a payment solution that mimicked the convenience of fiat currencies, allowing users to spend crypto without the friction of converting it first.

“Our goal was to eliminate any noticeable difference between using cryptocurrency and traditional fiat money. Essentially, we wanted people to be able to use crypto in their daily lives just as easily as they use fiat, at any time. To achieve this, we developed a payment solution — a blockchain-based system — that facilitates smooth settlements between cryptocurrencies and fiat currencies,” he explained.

At its core, the solution offers users the ability to bridge the divide between cryptocurrencies and fiat, enabling payments to be processed as seamlessly as traditional financial transactions. Focusing on interoperability and ease of use, CrossFi has developed a system that caters to the everyday needs of crypto users while preserving the decentralization and security that are fundamental to blockchain technology.

The Revolutionary Payment System

One of CrossFi’s standout features is its blockchain-based payment system, which goes beyond mere conversion of crypto into fiat. Instead, the system allows users to spend cryptocurrencies directly without the need for intermediaries.

“We developed a unique blockchain settlement layer that facilitates peer-to-peer transactions between crypto and fiat, eliminating the need for third-party intermediaries,” Mamasidikov shared.

This system effectively ensures that the user experience remains seamless, even when transacting with digital currencies. Importantly, it preserves the decentralized nature of crypto, allowing users to maintain control of their funds while making payments. According to the Mamasidikov, this innovation is at the heart of CrossFi’s success.

A critical differentiator of CrossFi’s payment solution is its focus on non-custodial payments. While many crypto payment solutions require to transfer the funds to a third-party platform before spending them, CrossFi has eliminated this step.

“Most payment solutions are custodial, meaning you have to transfer your funds to an intermediary. We wanted to ensure that crypto users wouldn’t have to sacrifice control or security in order to use their assets in the real world. With us, you can use your MetaMask, Trust or other wallet directly, paying without ever moving your assets to a third party,” the CEO explained.

The focus on non-custodial payments strengthens the core principles of decentralization and user control, which lie at the heart of Web3. CrossFi’s system provides a unique level of freedom and flexibility that distinguishes it from competitors.

Additionally, the company has integrated its solution with traditional financial infrastructure, ensuring seamless interaction between crypto and fiat. This interoperability is essential to CrossFi’s vision of making digital assets as easy to use as traditional currencies.

New Level of Security

In addition to offering a decentralized payment experience, CrossFi has developed a highly secure system for protecting users’ assets. An impressive feature of the system is its card, which not only functions as a payment method but also serves as an encryption key for users’ wallets. This added layer of security ensures that transactions remain private and protected.

“When you use the card, it decrypts your wallet, allowing transactions to proceed. This means users must confirm transactions in MetaMask when shopping online, but when paying in person, the card itself handles the secure transfer,” Mamasidikov explained.

CrossFi’s approach to security goes beyond traditional methods, leveraging blockchain’s transparency and immutability to offer a level of protection that is difficult to achieve in fiat-based payment systems. The integration of cryptographic methods ensures that users’ funds and personal information are kept safe, even in the event of a cyberattack or data breach.

The company’s innovation, however, does not stop at payment systems. CrossFi has built an extensive blockchain infrastructure, providing a solid foundation for a wide range of decentralized financial services.

This includes their Automated Banking System (ABS), which is fully integrated with blockchain technology and traditional banking systems. The ABS allows CrossFi to provide the same level of efficiency, speed, and security as conventional financial institutions while maintaining the advantages of decentralized finance (DeFi).

“Our processing system is certified by PCI DSS, and we connect host-to-host with any bank or processor. This ensures that our users’ payment data and funds are always secure, and the system itself meets all regulatory standards,” the CEO elaborated.

Financial Products Designed for Crypto Users

The CrossFi ecosystem consists of six core components, with the CrossFi Chain, a Layer-1 blockchain, serving as its primary foundation. This blockchain underpins a range of innovative tools designed to support the seamless movement and utilization of digital assets.

Central to this ecosystem is the CrossFi xApp — a DeFi platform designed to empower users with a comprehensive suite of financial activities. It supports token swaps, asset bridging across numerous chains, and liquidity mining of native tokens like XFI and XUSD.

XStake is another crucial component, focused on maximizing the efficiency of staked assets. This omnichain meta-yield aggregator delivers the highest possible returns through vaults that deploy strategies across various networks. Its oracle system continuously monitors incentives and market conditions, autonomously rebalancing assets across chains and protocols.

“xStake is a multi-yield protocol that searches across 12 blockchains to find the best yield strategies available. It automatically rebalances and gives users the highest return. This makes XStake a user-friendly solution, eliminating the need for constant manual adjustments,” Mamasidikov explained.

Completing the system is XAssets, which provides exposure to traditional financial assets without leaving the crypto environment. Users can buy and sell these assets in real-time, with prices reflecting market fluctuations instantly. Additionally, the CrossFi Foundation, a nonprofit organization, is focused on promoting the platform’s development.

The CrossFi ecosystem operates on a technological foundation built with Cosmos SDK and Tendermint. The Cosmos SDK provides a customizable framework, allowing CrossFi to interact seamlessly with other blockchains.

Tendermint, a consensus algorithm, ensures the platform’s ability to process transactions with speed, security, and reliability. This combination of technology creates a versatile ecosystem tailored to meet the diverse needs of digital asset users.

A Full-Fledged Web3 Bank

At the core of CrossFi’s vision is the creation of a full-fledged Web3 bank. This bank will offer all the services of a traditional financial institution, but with the added transparency, security, and flexibility of blockchain technology. It’s designed to provide users with a range of financial services, including peer-to-peer lending, staking, and trading synthetic assets.

“We’re building a Web3 bank where users can not only spend crypto but also take advantage of financial services like peer-to-peer lending, staking, and investing in synthetic assets,” the CEO shared.

A key component of the Web3 bank is CrossFi’s stablecoin, XUSD. This stablecoin is fully backed and allows users to easily convert between various cryptocurrencies and fiat. XUSD offers the stability of fiat while maintaining the flexibility of crypto, making it a critical part of CrossFi’s ecosystem.

“XUSD can be minted from assets on 24 different blockchains with just one click. We’re preparing for a future where decentralized finance will be the norm, and people will control their funds independently,” Mamasidikov said.

While CrossFi is pushing the boundaries of blockchain technology, it is also acutely aware of the regulatory challenges. The company has taken steps to ensure that its platform complies with all relevant regulations, particularly in terms of Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

“We’re compliant with all KYC and AML requirements. We’ve made sure that our systems align with traditional financial regulations while preserving the decentralization of crypto,” he stated.

CrossFi’s Vision for a Unified Payment System

Looking to the future, CrossFi’s primary goal is to facilitate the mass adoption by providing users with a seamless, frictionless experience.

“Our goal is to become the number one payment gateway between crypto and fiat. We want to give people who don’t have access to traditional banking systems the ability to manage their finances using crypto,” Mamasidikov emphasized.

CrossFi CEO also predicted that the upcoming crypto bull run would likely be the last one without strict regulations, as governments and financial institutions are starting to adopt blockchain technology.

“This will be the last unregulated bull run. Many smaller players will struggle as getting licenses and approvals becomes more difficult. Only the strongest and most compliant companies will survive,” he explained.

As CrossFi continues to develop its Web3 bank and expand its financial products, the company is in a strong position to lead the move toward mainstream blockchain-based financial services. The platform is designed to be secure and easy to use, making it a key player in the future of DeFi.

With the recent launch of its mainnet, CrossFi is already making a serious impact in the crypto industry. Their focus on innovation and giving users more control sets them apart, as they work to make crypto payments as common and accessible as traditional banking.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

10 Altcoins at Risk of Binance Delisting

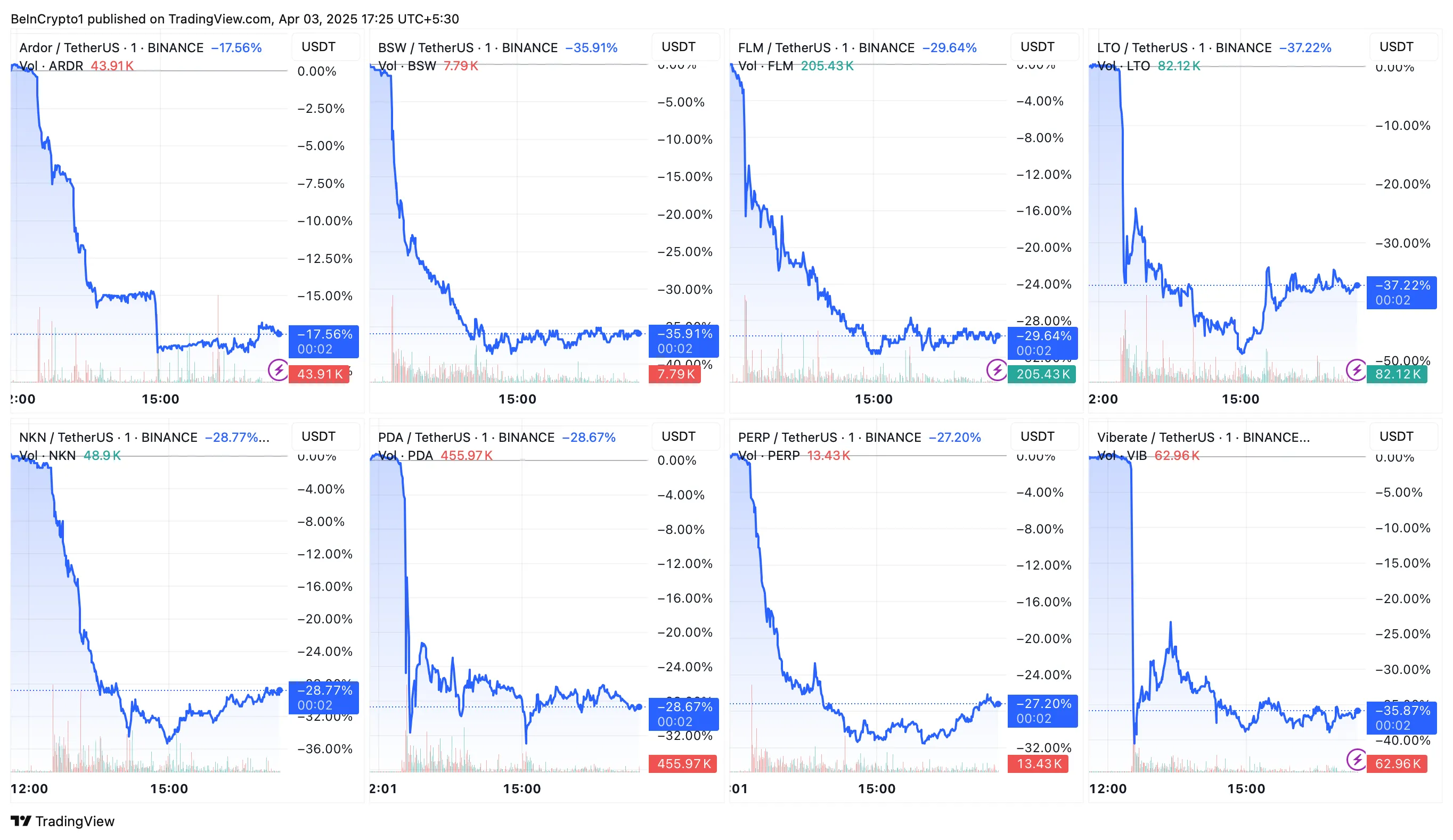

On April 3, Binance announced that it would add a new set of tokens to its monitoring list. These tokens are under closer scrutiny and may face delisting following the upcoming review period.

This move follows the exchange’s aims to increase transparency while offering more clarity regarding the risk levels associated with different cryptocurrencies.

10 Altcoins in Danger of Binance Delisting

As part of this update, the following tokens will be added to the Monitoring Tag list: Ardor (ARDR), Biswap (BSW), Flamingo (FLM), LTO Network (LTO), NKN (NKN), PlayDapp (PDA), Perpetual Protocol (PERP), Viberate (VIB), Voxies (VOXEL) and Wing Finance (WING).

Tokens added to the Monitoring Tag exhibit notably higher volatility and risk compared to other listed tokens. Binance will closely monitor these tokens, with regular reviews to assess their compliance with the platform’s listing criteria.

“Tokens with the Monitoring Tag are at risk of no longer meeting our listing criteria and being delisted from the platform,” Binance said.

Following the announcement, the prices of the mentioned altcoins plummeted by double-digits.

In addition to the new Monitoring Tag additions, Binance will also remove the Seed Tag from Jupiter (JUP), Starknet (STRK), and Toncoin (TON).

Tokens marked with the Seed Tag are those that are still in their early stages of development and have not yet met Binance’s full listing criteria. The removal of the Seed Tag indicates a change in the status of these projects. This suggests that they no longer fit the initial criteria for such a label.

Tokens with the Monitoring Tag or Seed Tag come with inherent risks. Binance ensures that users are well-informed before trading them. To access trading for these tokens, users must pass a risk awareness quiz every 90 days.

The quiz makes sure that users understand the potential risks associated with trading higher-risk tokens. Binance will also display a risk warning banner for these tokens on its Spot and Margin platforms.

Binance will continue to conduct periodic reviews of tokens with the Monitoring Tag and Seed Tag. During these reviews, several factors are taken into account. This includes the project team’s commitment, development activity, token liquidity, and community engagement.

The latest development follows a similar announcement from Binance in March. The exchange routinely delists tokens that fail to keep up with its criteria.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Foundation Eyes TikTok, Price Rally To $0.20 Possible

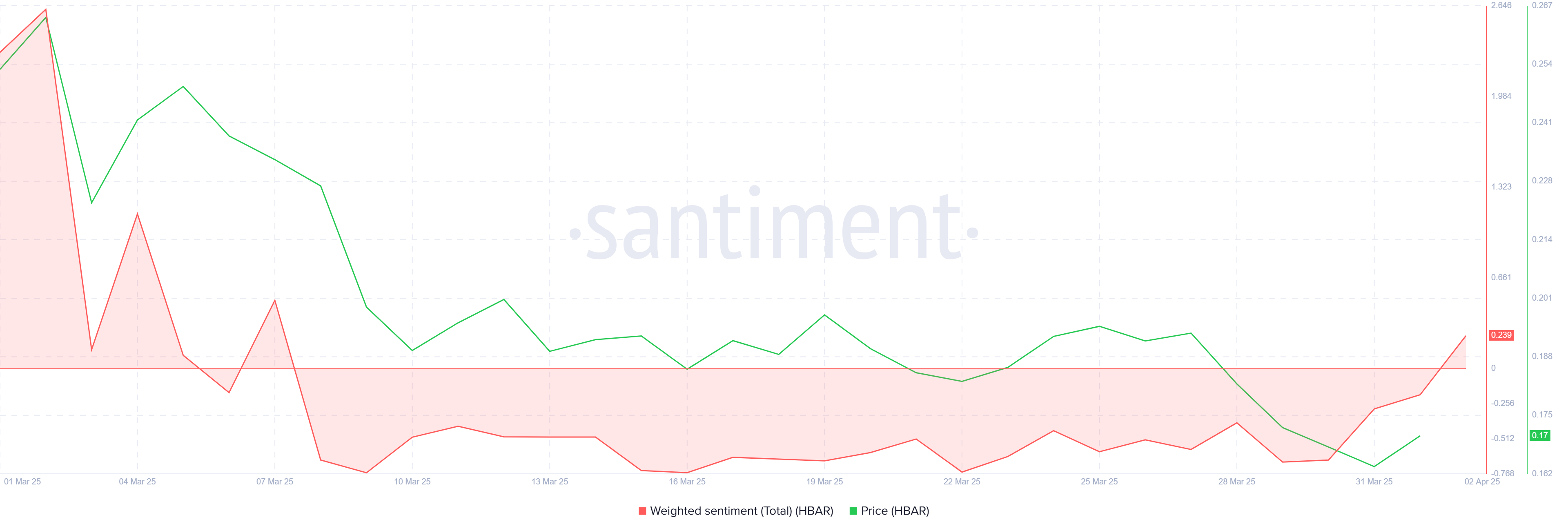

Hedera (HBAR) has faced a downtrend recently, with the crypto asset’s price failing to maintain support at $0.200. This failure to establish a solid base has led to a pullback.

However, key developments within the Hedera ecosystem and shifting investor sentiment could spark a potential price rally in the coming days.

HBAR Foundation Eyes TikTok

After nearly a month of bearish sentiment, investors are beginning to shift their stance towards bullishness. The Hedera Foundation’s recent move to team up with Zoopto for a late-stage bid to acquire TikTok has played a pivotal role in this shift. If the acquisition is approved, the partnership could expose HBAR to a massive audience due to TikTok’s extensive user base, potentially driving up demand and mainstream adoption.

The prospect of this collaboration has reignited interest among investors, sparking optimism about Hedera’s future growth potential. With TikTok’s wide-reaching influence, the strategic partnership could offer Hedera an edge in the competitive crypto market, encouraging further accumulation of HBAR tokens.

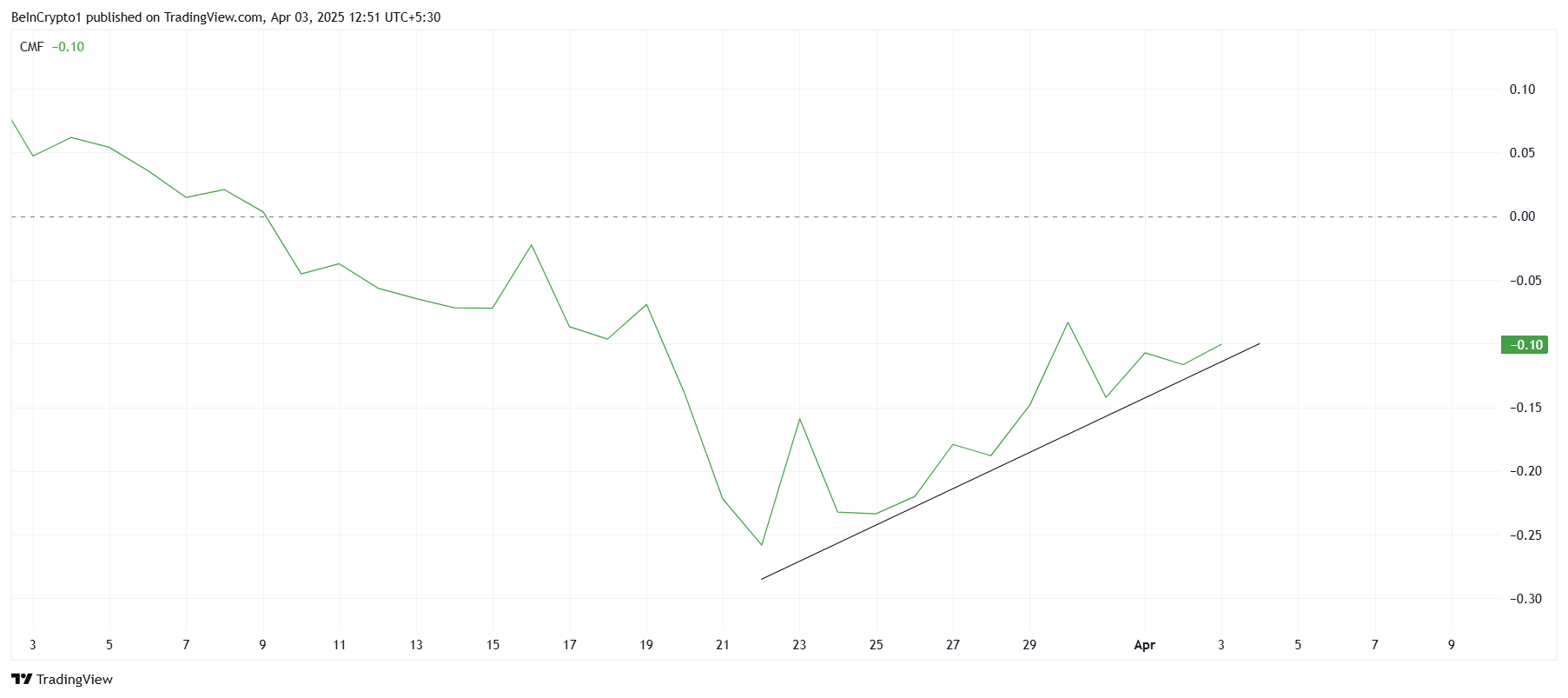

On the technical front, the Chaikin Money Flow (CMF) indicator is showing signs of recovery. The CMF has started to tick upwards, signaling a potential increase in inflows. While it hasn’t yet crossed above the zero line, the growing positive momentum indicates that more capital could be entering the market. Continued inflows could provide the necessary push for HBAR to break through key resistance levels.

The increase in capital flow suggests a strengthening of investor confidence. However, for a sustained rally, more substantial buying pressure will be required to move HBAR above its current price point. If this trend continues, HBAR may see a rise in both investor interest and market value in the near future.

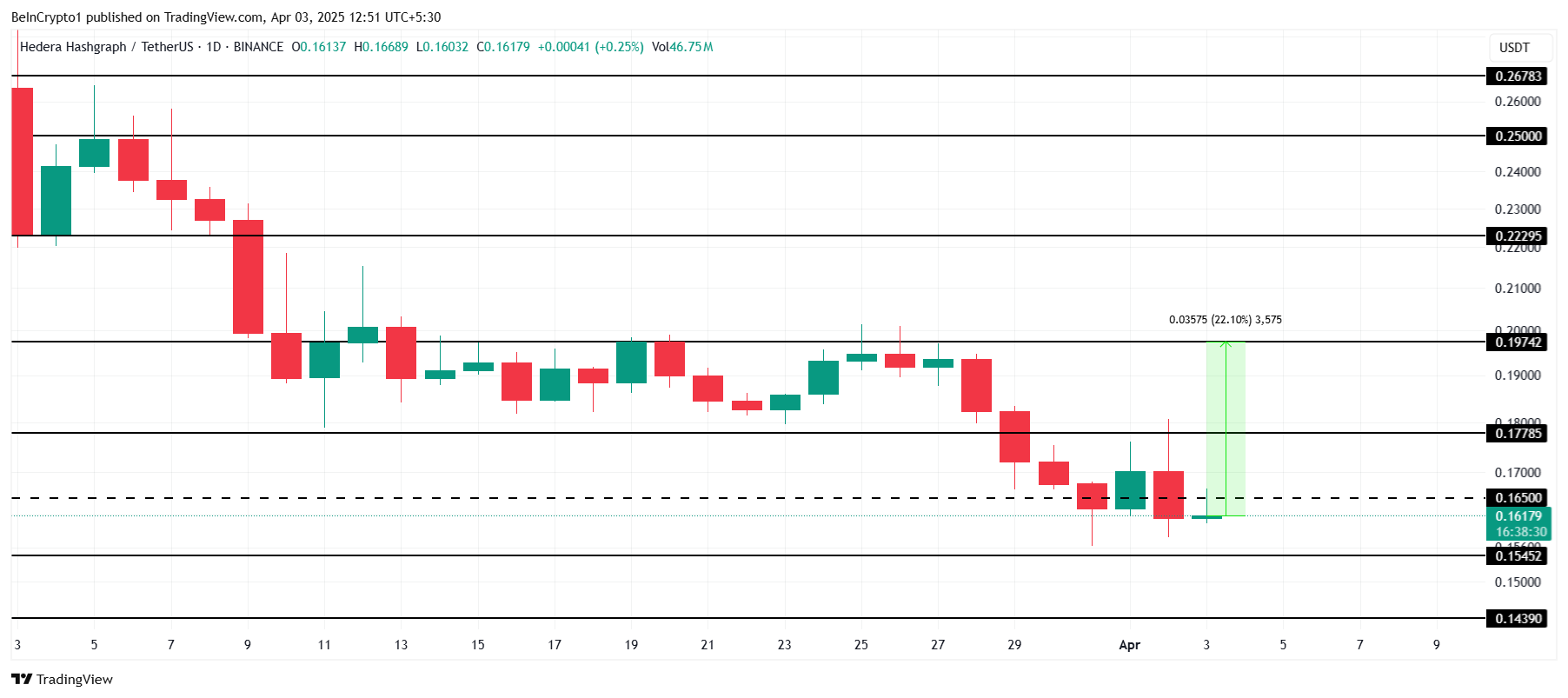

HBAR Price Finds Support

Currently, HBAR is priced at $0.161, just under the key resistance level of $0.165. The next significant resistance lies at $0.197, which has acted as a barrier to HBAR’s price recovery. With a 22% gap between the current price and this resistance, overcoming this hurdle could pave the way for a move toward $0.200.

Given the positive developments surrounding Hedera, it is plausible that HBAR could move toward these resistance levels. If the token can breach $0.165 and then $0.177, the path to $0.197 becomes much clearer. This would mark a critical point for HBAR as it seeks to regain lost ground.

However, if investors decide to take profits and sell before further upward movement, HBAR could fail to breach the $0.177 resistance. Such a scenario could push the price back down towards $0.154 or $0.143, invalidating the bullish outlook and prolonging the consolidation phase.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

IP Token Price Surges, but Weak Demand Hints at Reversal

Story’s IP is today’s top-performing asset. Its price has surged 5% to trade at $$4.37 at press time, defying the broader market’s lackluster performance.

However, despite the price uptick, the weakening demand for the altcoin raises concerns about its rally’s sustainability.

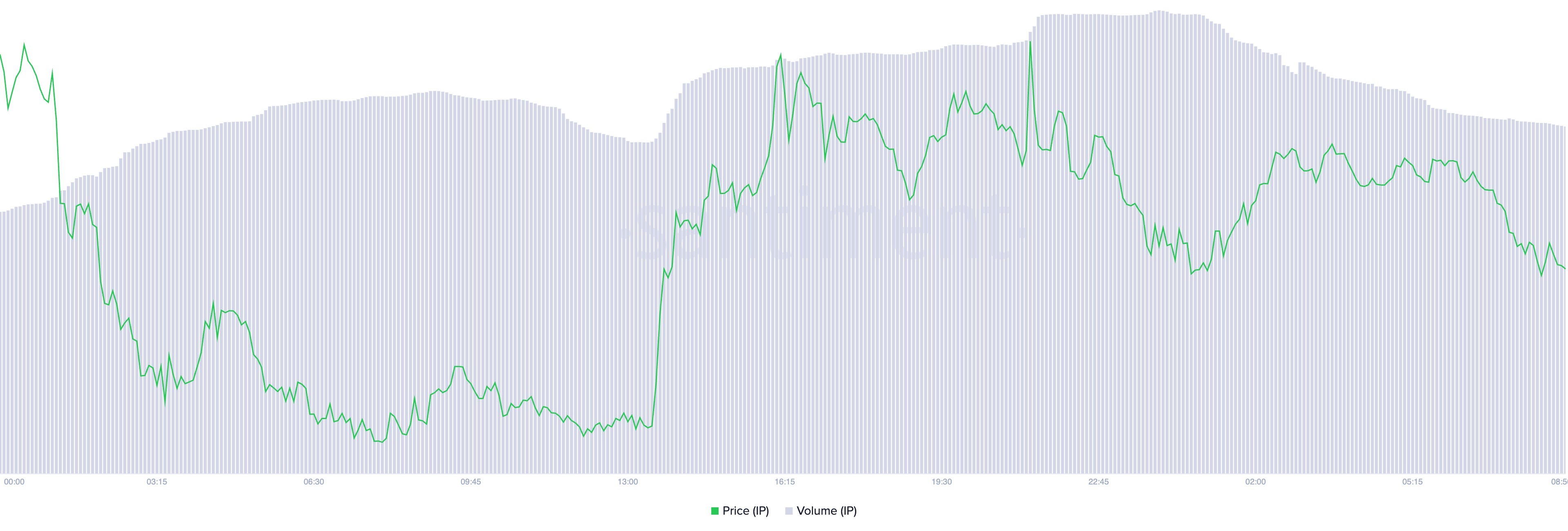

IP Price Rises, But Falling Volume Signals Weak Buying Momentum

IP’s daily trading volume has plummeted by 7% over the past 24 hours despite the token’s price surge. This forms a negative divergence that hints at the likelihood of a price correction.

A negative divergence emerges when an asset’s price rises while trading volume falls. It suggests weak buying momentum and a lack of strong market participation.

This indicates that the IP rally may not be sustainable, as fewer traders are backing its upward move. Without sufficient volume to reinforce the price increase, the altcoin is at risk of a potential reversal or correction.

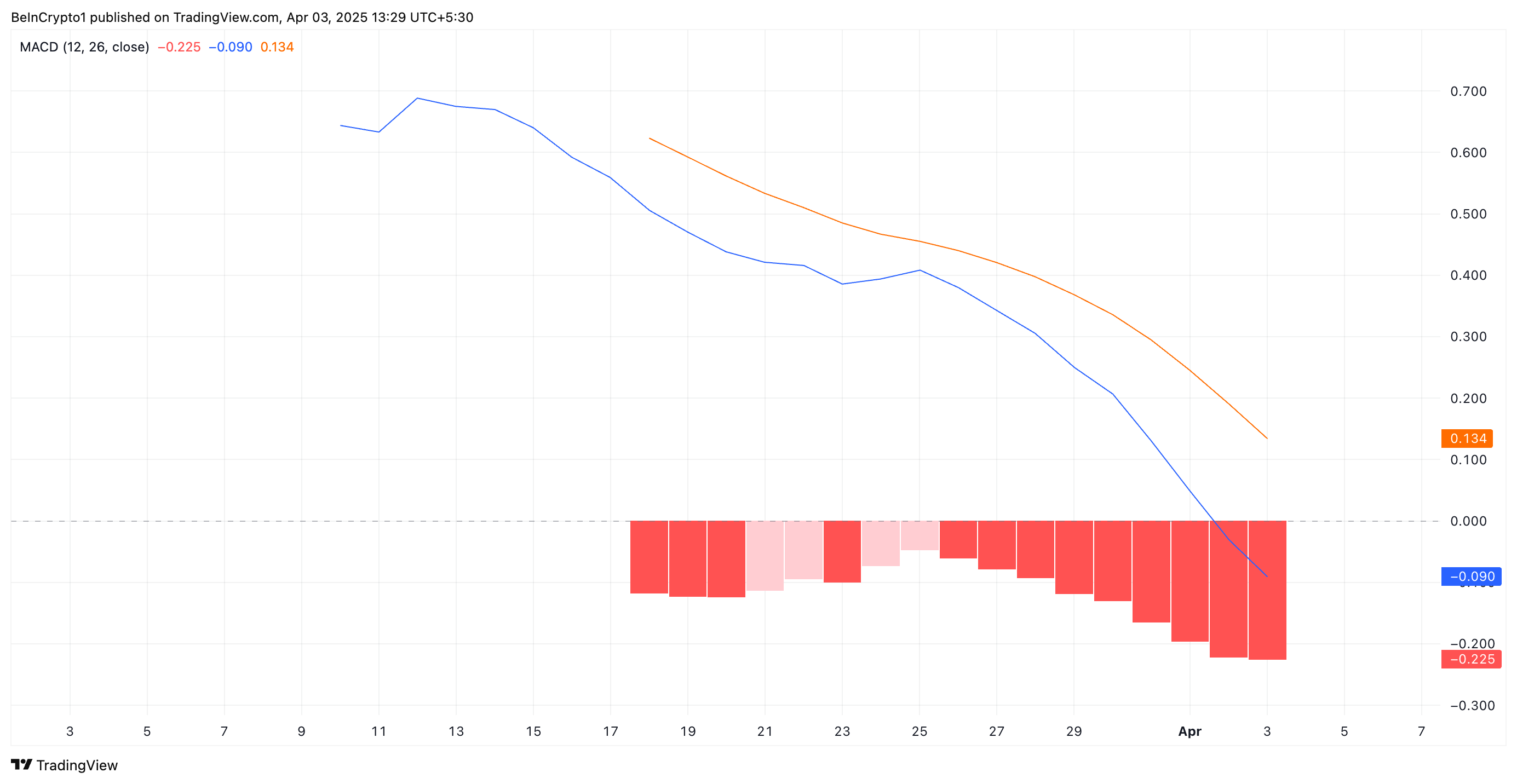

Further, IP’s Moving Average Convergence Divergence (MACD) setup supports this bearish outlook. As of this writing, the token’s MACD line (blue) rests below its signal line (orange), reflecting the selling pressure among IP spot market participants.

The MACD indicator measures an asset’s trend direction and momentum by comparing two moving averages of an asset’s price. When the MACD line is below the signal line, it indicates bearish momentum, suggesting a potential downtrend or continued selling pressure.

If this trend persists, IP’s recent 5% price surge may lose steam, increasing the likelihood of a short-term correction.

IP’s Bearish Structure Remains Intact – How Low Can It Go?

On the daily chart, IP has traded within a descending parallel channel since March 25. This bearish pattern emerges when an asset’s price moves within two downward-sloping parallel trendlines, indicating a consistent pattern of lower highs and lower lows.

This pattern confirm’s IP prevailing downtrend, suggesting continued bearish pressure unless a breakout above resistance occurs.

If the downtrend strengthens, IP’s price could break below the lower trend line of the descending parallel channel and fall to $3.68.

On the other hand, if the altcoin witnesses a spike in new demand, it could break above the bearish channel and rally toward $5.18.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin24 hours ago

Bitcoin24 hours agoLummis Confirms Treasury Probes Direct Buys

-

Altcoin18 hours ago

Altcoin18 hours agoHere’s Why This Analyst Believes XRP Price Could Surge 44x

-

Regulation22 hours ago

Regulation22 hours agoKraken Obtains Restricted Dealer Registration in Canada

-

Ethereum16 hours ago

Ethereum16 hours agoWhy A Massive Drop To $1,400 Could Rock The Underperformer

-

Altcoin14 hours ago

Altcoin14 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin17 hours ago

Altcoin17 hours agoHow Will Elon Musk Leaving DOGE Impact Dogecoin Price?

-

Altcoin15 hours ago

Altcoin15 hours agoWill Cardano Price Bounce Back to $0.70 or Crash to $0.60?

-

Market7 hours ago

Market7 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead