Market

Could Bittensor (TAO) Price Face A Downside?

Bittensor (TAO), one of the leading artificial intelligence coins in the market, is currently showing signs of consolidation. Market indicators suggest indecision, with neither buyers nor sellers taking firm control.

TAO’s movement appears range-bound, lacking clear momentum to either break higher or fall significantly lower. The EMA lines suggest the possibility of a “death cross,” which could spark a significant correction if the market loses momentum further.

TAO Ichimoku Cloud Shows Consolidation

The Ichimoku Cloud chart for TAO shows a mixed picture of the current market conditions. The price is currently trading near the cloud, suggesting indecision.

The cloud itself (Kumo) is mostly flat and has both green and red areas, indicating an overall neutral trend. The price recently tried to break above the cloud, but failed to gain significant upward momentum, indicating resistance.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

The Tenkan-sen (Conversion Line) and Kijun-sen (Base Line) intersect near the current price, suggesting the market is looking for direction. The leading span A and leading span B, which form the cloud, are not diverging sharply, pointing to potential range-bound movement.

If TAO, which is the biggest artificial intelligence coin in the market today, can break decisively above the cloud, it could indicate a bullish shift. Conversely, a fall below the lower cloud boundary would suggest a bearish trend. At the moment, the market appears hesitant, with buyers and sellers evenly matched, leading to sideways movement.

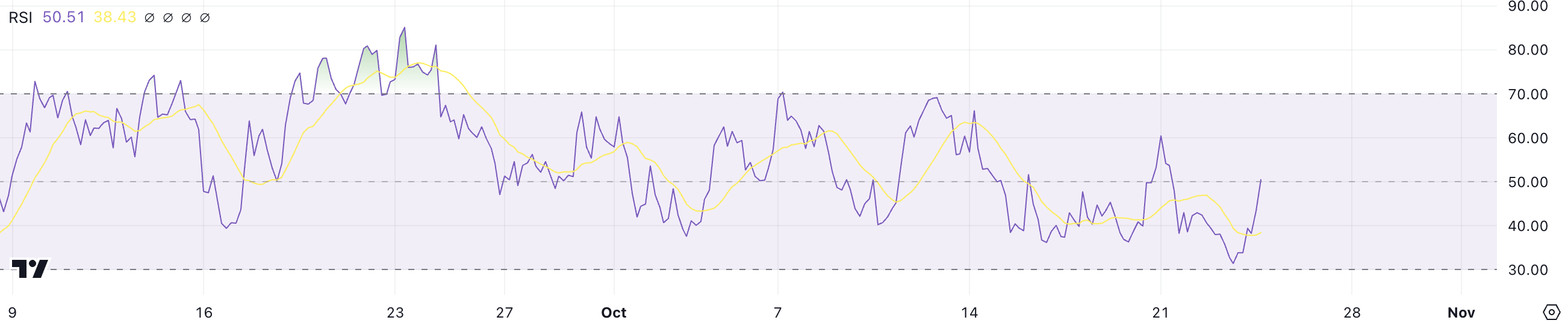

Bittensor RSI Is Back To 50

TAO’s RSI is currently at 50, rising from 31 just a day ago. This swift movement suggests renewed buying pressure, bringing market sentiment to a neutral level.

A jump from oversold conditions to a midpoint like this often implies a shift away from strong bearishness but not necessarily toward bullish dominance yet.

The Relative Strength Index (RSI) measures momentum by indicating whether an asset is overbought or oversold. An RSI of 50 means that the market sentiment for TAO is currently balanced.

At this level, there is no strong bias towards buying or selling, suggesting that the price might consolidate until new catalysts drive momentum in either direction.

TAO Price Prediction: No $700 Level in the Near Term

The TAO price chart shows that the price is currently in a consolidation phase, trading between key support and resistance levels. Resistance lies at $600 and $618, where previous attempts to break above have failed, while the support levels at $503 and $473 are holding for now, providing a cushion against further downside.

The EMA lines also reflect this sideways action, with the short-term EMAs getting closer to the long-term ones, indicating reduced bullish momentum.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

The short-term EMA lines are on the verge of crossing below the long-term EMA lines, which, if confirmed, could form a “death cross.” A death cross typically signals a bearish reversal, implying that downward pressure could intensify and trigger a significant correction.

If TAO price can recover its uptrend, it could test the resistances at $600 and $618 soon. This would mark a potential 12% price surge. However, if the uptrend isn’t strong enough and the trend is reverted, TAO could go as down as $473, marking a 14% price correction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple May Settle SEC’s $50 Million Fine Using XRP

Ripple’s long-running legal clash with the US Securities and Exchange Commission (SEC) appears to be nearing its final chapter.

However, a surprising detail has emerged from the ongoing settlement talks, which could see Ripple pay its reduced $50 million penalty using its native token, XRP.

Ripple Could Use XRP Token to Pay SEC Fine

On April 11, Ripple CEO Brad Garlinghouse appeared on FOX Business. At the interview, he revealed that the idea of paying the penalty in XRP was floated during settlement discussions.

“The SEC is going to end up with $50 million and the US government gets $50 million and we talked about making that available in XRP,” Garlinghouse stated.

The ongoing negotiations follow Ripple’s and the SEC’s decision to drop their appeals, bringing the multi-year legal battle closer to closure.

“We’re moving past the SEC’s war on crypto and entering the next phase of the market – true institutional flows integrating with decentralized finance,” Garlinghouse added in a post on X.

Judge Analisa Torres originally set the fine at $125 million in 2024, linking it to Ripple’s unregistered XRP sales to institutional investors. Ripple complied by placing the funds in an interest-bearing account, but the appeals process delayed any further action.

With those appeals now abandoned, Ripple is expected to pay a reduced fine of $50 million.

A recent joint court filing confirms that both sides have reached a preliminary agreement. They are now seeking final approval from the SEC’s commissioners.

Once internal reviews are complete, the parties plan to request a formal ruling from the district court.

“There is good cause for the parties’ joint request that this Court put these appeals in abeyance. The parties have reached an agreement-in-principle, subject to Commission approval, to resolve the underlying case, the Commission’s appeal, and Ripple’s cross-appeal. The parties require additional time to obtain Commission approval for this agreement-in-principle, and if approved by the Commission, to seek an indicative ruling from the district court,” the filing stated.

If the commission votes in favor, this case could conclude one of the most closely watched regulatory battles in crypto history. More importantly, the use of XRP for the settlement could mark a significant shift in the SEC’s approach to digital assets.

This turnaround would represent a major regulatory shift and could trigger further bullish momentum for the token.

Since Donald Trump’s election victory in November 2024, investor confidence in XRP has grown sharply, pushing the token’s value up by more than 300%.

At the same time, institutional interest continues to rise, as seen in the wave of spot exchange-traded fund applications tied to the token

Market analysts have linked this performance to the friendlier political climate. They also point to the potential reclassification of XRP as a commodity as a key factor driving the asset’s rise.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

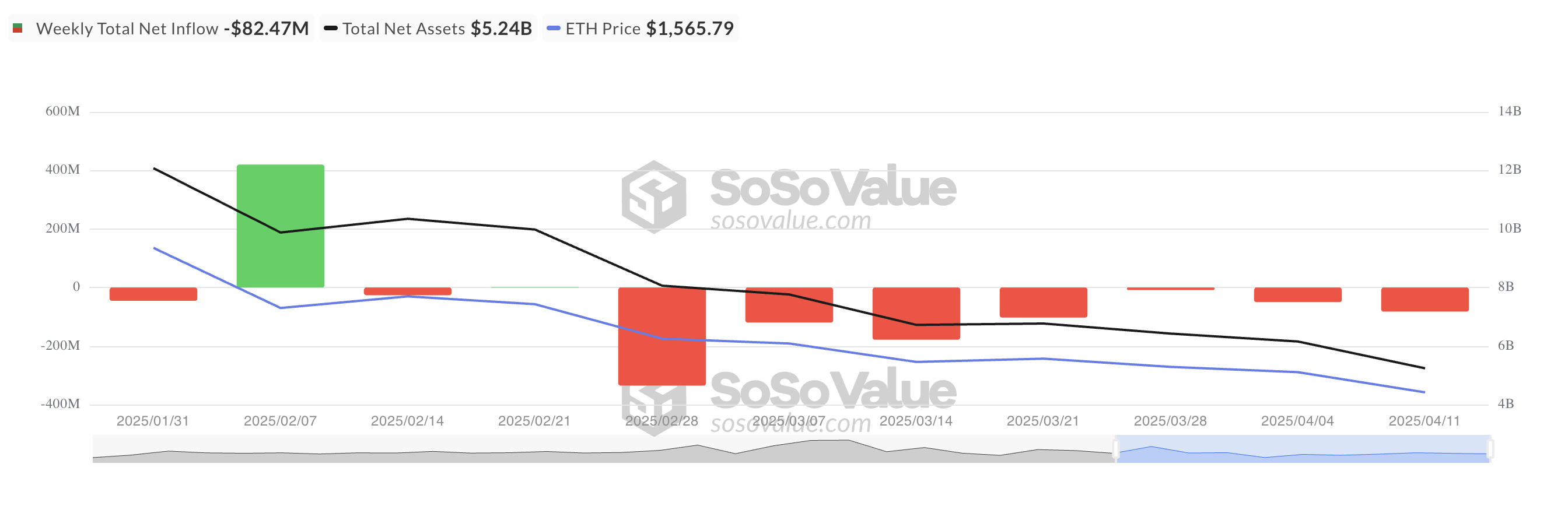

Ethereum ETFs See Seventh Consecutive Week of Net Outflows

Ethereum ETFs have closed yet another week in the red, recording net outflows amid continued investor hesitation.

Notably, there has been no single week of net inflows since the end of February, highlighting waning institutional interest in ETH-related products.

Ethereum ETFs Face Steady Outflows

Ethereum-backed ETFs have recorded their seventh consecutive week of net outflows, highlighting sustained institutional hesitance toward the asset.

This week alone, net outflows from spot ETH ETFs totaled $82.47 million, marking a 39% surge from the $49 million recorded in outflows the previous week.

With the steady decline in institutional presence in the ETH market, the selling pressure on the coin has soared.

Over the past week, ETH’s price has declined by 11%. The steady outflows from the funds backed by the coin suggest that the downward momentum may persist, increasing the likelihood of a price drop below the $1,500 mark.

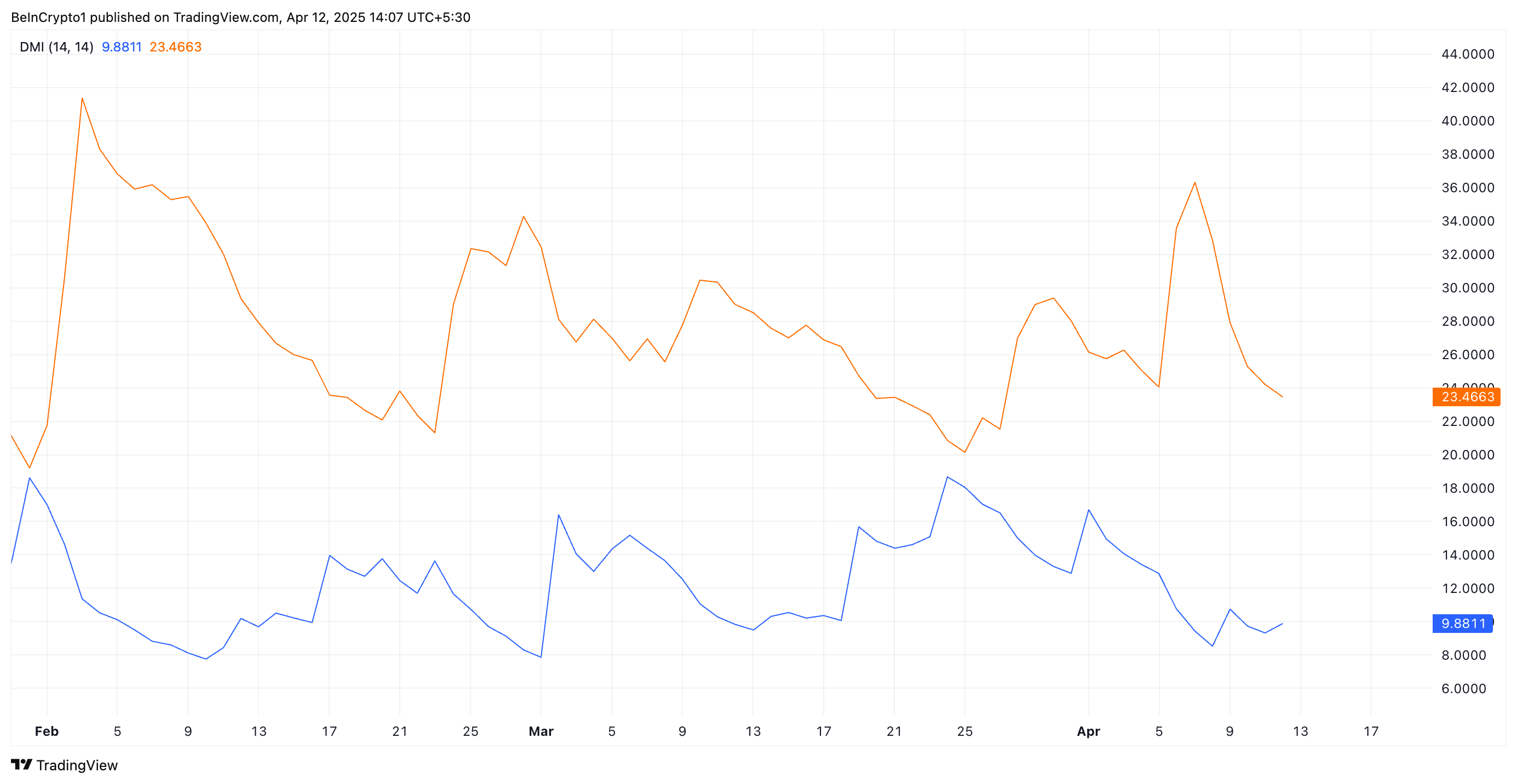

On the price chart, technical indicators remain bearish, confirming the mounting pressure from the selling side of the market. For example, at press time, readings from ETH’s Directional Movement Index (DMI) show its positive directional index (+DI) resting below the negative directional index (-DI).

The DMI indicator measures the strength of an asset’s price trend. It consists of two lines: the +DI, which represents upward price movement, and the -DI, which represents downward price movement.

As with ETH, when the +DI rests below the -DI, the market is in a bearish trend, with downward price movement dominating the market sentiment.

Ethereum’s Price Could Drop Below $1,500

The lack of institutional capital could delay any significant rebound in ETH price, further dampening short-term prospects for recovery. If demand leans further, ETH could break out of its narrow range and follow a downward trend.

The altcoin could fall below $1,500 in this scenario to reach $1,395.

However, if ETH witnesses a positive shift in sentiment and demand spikes, its price could climb to $2,114.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Signals Readiness to Rethink Crypto Trading Oversight

Mark Uyeda, Acting Chair of the US Securities and Exchange Commission (SEC), has encouraged crypto industry participants to offer input on a proposed framework. The initiative is designed to ease regulatory pressure on digital asset trading.

Speaking at the SEC’s April 11 Crypto Task Force roundtable, Uyeda highlighted the growing disconnect between current regulations and the realities of blockchain innovation.

SEC Considers Federal Licensing Model to Streamline Crypto Compliance

Uyeda likened the evolution of crypto markets to the early days of US securities trading, which began under a buttonwood tree in New York City.

He argued that early brokers created rules that suited the needs of their time. In the same way, modern regulators must now consider frameworks that align with the distinct structure of crypto platforms.

Unlike traditional exchanges, crypto trading systems often combine custody, execution, and clearing into one platform. Blockchain technology makes this integration possible.

Uyeda pointed out that this setup can improve transparency, efficiency, and trading speed. He also highlighted benefits like 24/7 trading through smart contracts and streamlined collateral management via tokenization.

“Blockchain technology offers the potential to execute and clear securities transactions in ways that may be more efficient and reliable than current processes,” Uyeda said.

Still, Uyeda acknowledged that the architects of US securities laws never anticipated blockchain technology or decentralized systems. As a result, compliance challenges have emerged as many tokenized securities remain unregistered and ineligible for national exchanges.

Besides that, existing rules, such as the order protection rule, are also difficult to apply in hybrid trading environments where assets move between on-chain and off-chain systems.

Uyeda also criticized the current patchwork of state-by-state licensing requirements, which create barriers for crypto firms aiming to operate nationwide.

To address these gaps, Uyeda proposed a conditional relief framework that could support experimentation while maintaining investor protections. He also suggested that a unified federal licensing model under the SEC could simplify compliance and enhance market consistency.

“Under an accommodating federal regulatory framework, some market participants would likely prefer to offer trading in both tokenized securities and non-security crypto assets under a single SEC license rather than offer trading solely in non-security crypto assets under fifty different state licenses,” Uyeda said.

Nonetheless, he invited industry experts to recommend specific areas where such relief would unlock practical use cases without undermining market integrity.

Uyeda’s remarks signal the SEC’s growing awareness that digital asset regulation must evolve. While long-term reform may take time, the proposed relief framework could create room for innovation without compromising market safeguards

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours ago3 Altcoins to Watch for Binance Listing This April

-

Market20 hours ago

Market20 hours agoThis is Why The Federal Reserve Might Not Cutting Interest Rates

-

Regulation23 hours ago

Regulation23 hours agoUS Senators Reintroduce PROOF Act To Set Reserve Standards for Crypto Firms

-

Market21 hours ago

Market21 hours agoLawmakers Propose the PROOF Act to Avoid Another FTX Incident

-

Market19 hours ago

Market19 hours agoXRP Price Flashes Symmetrical Triangle From 2017, A Repeat Could Send It as Flying To $30

-

Market17 hours ago

Market17 hours agoCrypto Whales Are Buying These Altcoins Post Tariffs Pause

-

Market16 hours ago

Market16 hours agoBinance and the SEC File for Pause in Lawsuit

-

Market6 hours ago

Market6 hours agoDogecoin and D.O.G.E – Elon Musk’s Billionaire Crypto Experiment