Market

How Chainlink Bears May Stop the Price from Notable Rally

For some days, the price of Chainlink (LINK) has been swinging between $10 and $11. This is a surprising move, considering the project’s recent notable developments.

But with Chainlink bears at the forefront of control, here is why the altcoin might find it challenging to react positively in the short term.

Chainlink Bears Take Bulls Out

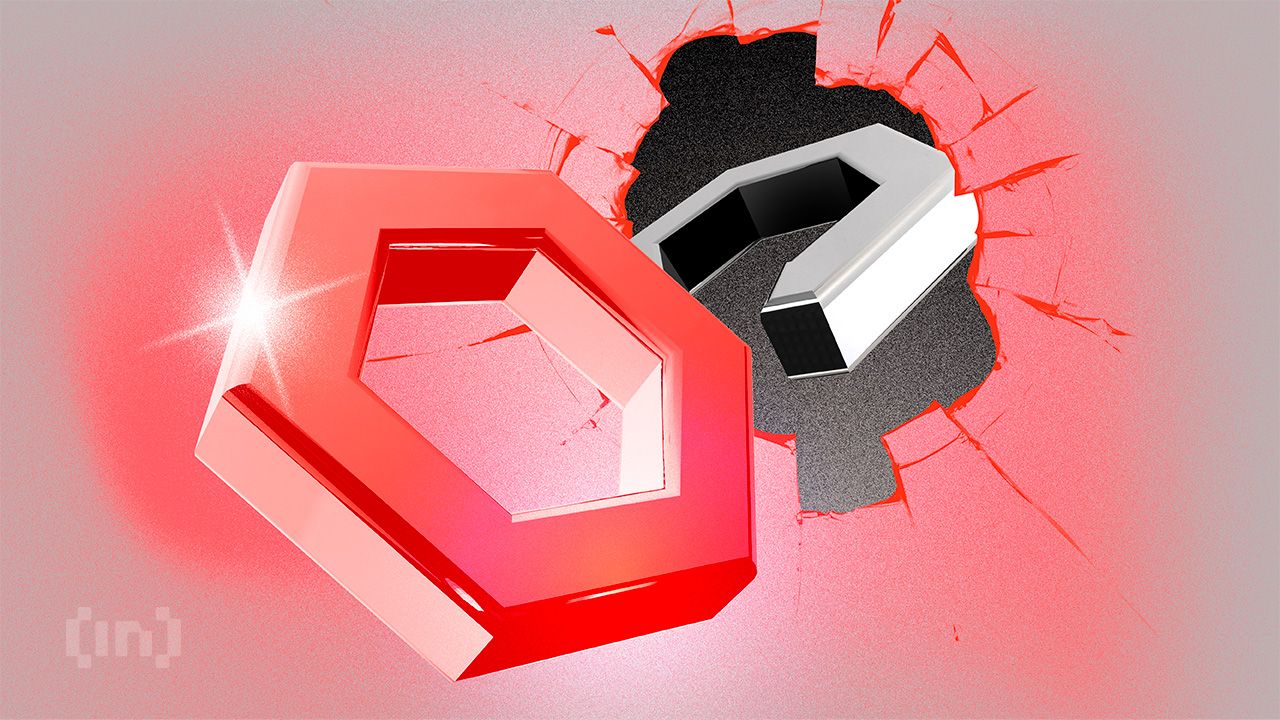

According to IntoTheBlock, the Chainlink Bulls and Bears indicator favors bears. In this context, bears are addresses selling at least 1% of the total trading volume. Bulls, on the other hand, are those selling the same supply.

When bulls have more volume than bears, the price of the asset can increase. But as of this writing, Chainlink bears have sold over 500,000 more tokens than bulls purchased.

Given this position, it seems highly unlikely that LINK’s price will increase, despite some analysts believing that the token should be trading for at least $15.

Read more: How to Buy Chainlink (LINK) With a Credit Card: A Step-By-Step Guide

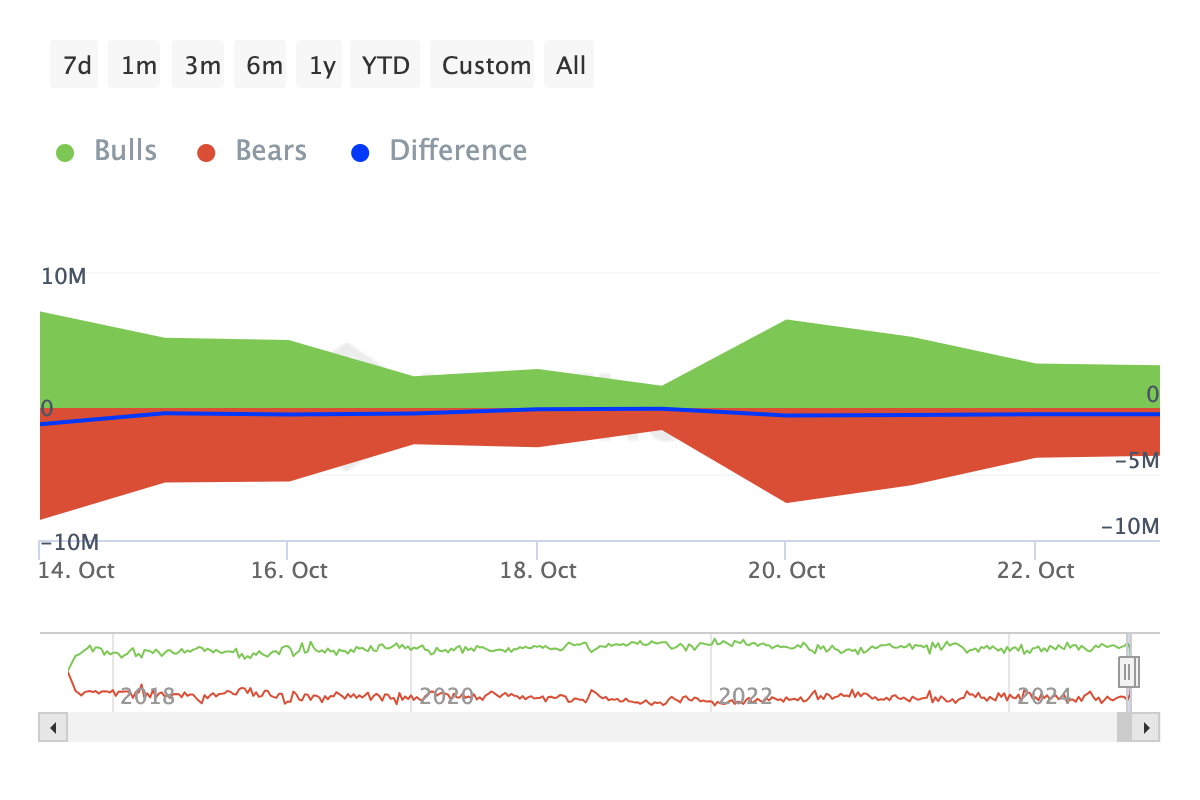

Besides this, the In/Out of Money Around Price (IOMAP) shows that LINK might continue to face resistance despite several attempts to surpass $12. The IOMAP shows the number of addresses and volume holding a token in unrealized profits or losses.

If the volume of losses surpasses that of profits, the next cluster will likely serve as a major resistance point. Conversely, a higher volume of profits will create a significant support region.

As shown above, the major resistance lies between $12.47 and $12.82. At this point, almost 18,000 addresses purchased more than 100 million LINK tokens. Therefore, if the price moves toward this region, some addresses might break even, possibly pushing the value lower.

LINK Price Prediction: Lower Lows

On the daily chart, Chainlink faces a notable resistance to $12.70. Besides that, the Exponential Moving Average (EMA) suggests that the altcoin might drop lower than the current value.

As seen below, the 20 EMA (blue) and 50 EMA (yellow) are in the same region. This trend suggests indecision among traders. But it appears that Chainlink bears have the upper hand.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

Given the current situation, LINK’s price may drop below $10. However, bulls can prevent this decline. To achieve this, Chainlink bears must take a back seat. If they do, the token could rebound and reach $15.25.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump Media Files Trademark for Crypto Platform TruthFi

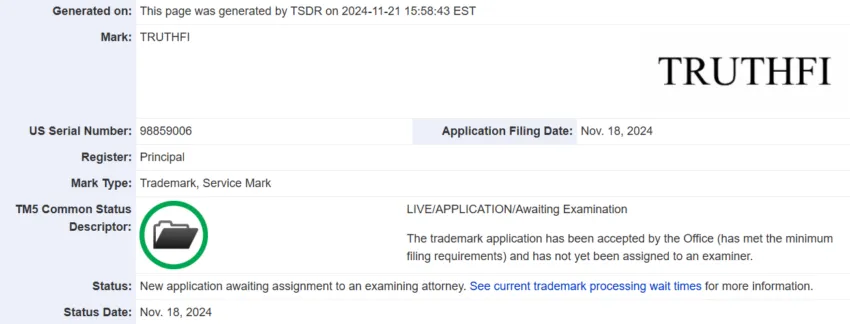

Trump Media & Technology Group is exploring the development of a crypto payment platform, as revealed by a recent trademark filing.

The application, submitted by Donald Trump’s social media company on Monday, outlines plans for a service named TruthFi. The proposed platform aims to offer crypto payments, financial custody, and digital asset trading.

Following the trademark announcement, Trump Media’s stock rose approximately 2%. At the time of writing, the stock was trading at $30.44, up by nearly 75% this year.

However, details about TruthFi remain scarce, including its timeline or operational specifics. This initiative suggests an effort by Trump Media to expand its business model beyond Truth Social.

The social media platform was established back in 2022, after Trump was banned from Facebook and X (formerly Twitter).

Nevertheless, launching a large-scale cryptocurrency platform could require Trump Media to acquire additional resources or partner with an established firm. This is because the firm currently has a small workforce of less than 40 employees.

“The filing, made with the USPTO on Monday, indicates that Trump Media plans to offer: Digital wallets, Cryptocurrency payment processing services, and A digital asset trading platform,” US Trademark Attorney Josh Gerben wrote on X (formerly Twitter).

As reported by BeInCrypto earlier, Trump Media is also in discussions to purchase the b2b crypto trading platform Bakkt. Shares in Bakkt surged by nearly 140% since the news earlier this week.

Meanwhile, the President-elect’s crypto plans seem to be in full swing even before he takes office in January. He is also reportedly considering the first-ever crypto advisor role for the White House, and interviewing several potential candidates.

Earlier today, the current SEC chair Gary Gensler announced his resignation before Trump’s term begins. Gensler’s resignation boosted the crypto market, as it signals a major change in the SEC’s regulatory stance.

Notably, XRP surged 7% to its highest value in three years. Bitcoin also neared $99,000, as the overall crypto market cap reached $3.4 trillion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Banana Gun Rises After Justin Sun’s $6.2 Million Art Purchase

Justin Sun, founder of TRON and Poloniex CEO, has purchased the viral art piece Comedian—a banana duct-taped to a wall—for $6.2 million at Sotheby’s.

Following the purchase, Sun announced on X (formerly Twitter) that he plans to eat the artwork. This has ignited a frenzy of memes, commentary, and market reactions, even causing the crypto token Banana Gun to spike in value.

Crypto Reacts: Banana Gun on the Rise

Maurizio Cattelan’s Comedian gained international fame in 2019 when it was first displayed at Art Basel Miami. Its simplicity and absurdity—a banana taped to a wall—sparked debates about the nature of art. The so-called artwork became viral when performance artist David Datuna ate it in a stunt dubbed Hungry Artist.

Sun’s pledge to eat the $6.2 million fruit has also drawn parallels, adding another layer of humor to the piece’s history. The Tron founder even said he’s willing to donate the banana to Elon Musk and send it to Mars.

Meanwhile, several users even recreated their own version of Comedian and shared it on social media. One fan followed up by taping bananas around the Massachusetts Institute of Technology (MIT) campus, encouraging others to “tape all over the world” and start a movement.

What they are campaigning for, precisely, remains to be seen.

“In the coming days, I will personally eat the banana as part of this unique artistic experience, honoring its place in both art history and popular culture. Stay tuned,” Sun said on X.

The ripple effects of Sun’s purchase eventually trickled beyond the confines of art and humor and into crypto markets. The token Banana Gun, which shares its name with the theme, surged nearly 16% following the news. Traders and enthusiasts, ever attuned to cultural moments, appear to have seized the chance to capitalize on the buzz.

Sun’s acquisition and the banana’s virality bring to mind another recent development in the art-crypto nexus. Earlier this week, Ethereum co-founder Vitalik Buterin allegedly minted 400 Patron NFTs. This development sparked hopes of a resurgence for the NFT market.

This aged well…. $BANANA is an insane project. For me, this is in the same league as $ZIG. Fundamentals are truly insane. No matter which narrative will cook next, $BANANA will profit from it,” said one trader on X.

The combination of Sun’s high-profile purchase and the market’s reaction to Banana Gun demonstrates how art, humor, and technology continue to blur boundaries. Whether Sun’s banana-eating spectacle will leave a lasting impact or peel away (pun intended) into meme history, one thing is certain—the intersection of crypto and culture remains as unexpected as ever.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Price Hits 41% Weekly Growth, $1 Target in Sight

Cardano (ADA) price has surged 41.89% in the last seven days, signaling strong bullish momentum in the market. The uptrend remains strong, supported by key technical indicators like the ADX and Ichimoku Cloud, which point to sustained positive sentiment.

However, signs of consolidation and narrowing gaps in short-term indicators suggest that the rally could face challenges if buying pressure weakens.

ADA Current Uptrend Is Still Strong

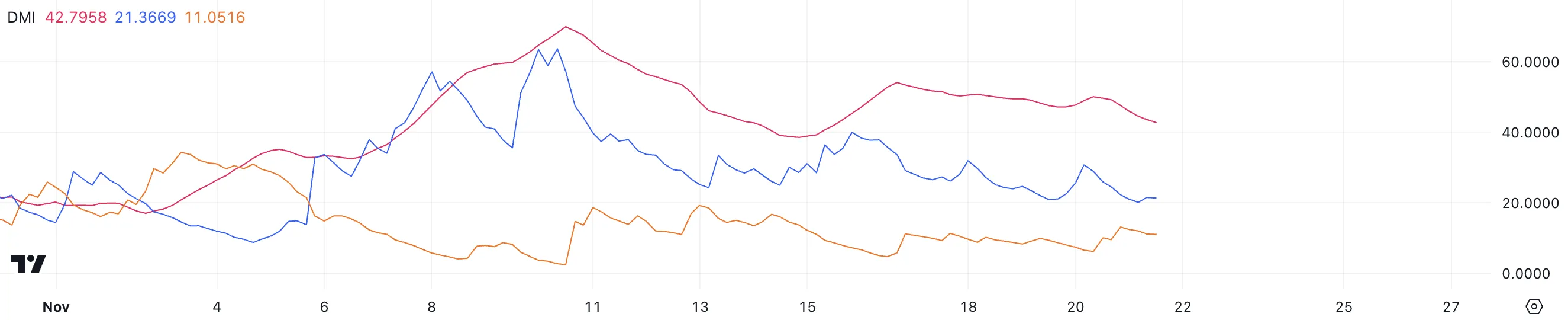

Cardano DMI chart shows an ADX of 42.7, indicating a strong trend. The metric has remained above 40 since November 7. This high ADX value confirms the robustness of ADA ongoing uptrend, signaling solid momentum behind the recent price movements.

With the positive directional index (D+) at 21.3 and the negative directional index (D-) at 11, bullish pressure continues to outweigh bearish activity, further supporting the upward trajectory.

The ADX measures the strength of a trend without considering its direction. Values above 25 indicate a strong trend, while those below 20 suggest a weak or nonexistent trend. With an ADX at 42.7, ADA is clearly in a strong uptrend, showing significant market confidence.

The gap between D+ and D- reinforces the bullish dominance, suggesting that ADA price could sustain its upward movement if current conditions persist.

Cardano Ichimoku Cloud Shows An Important Signal

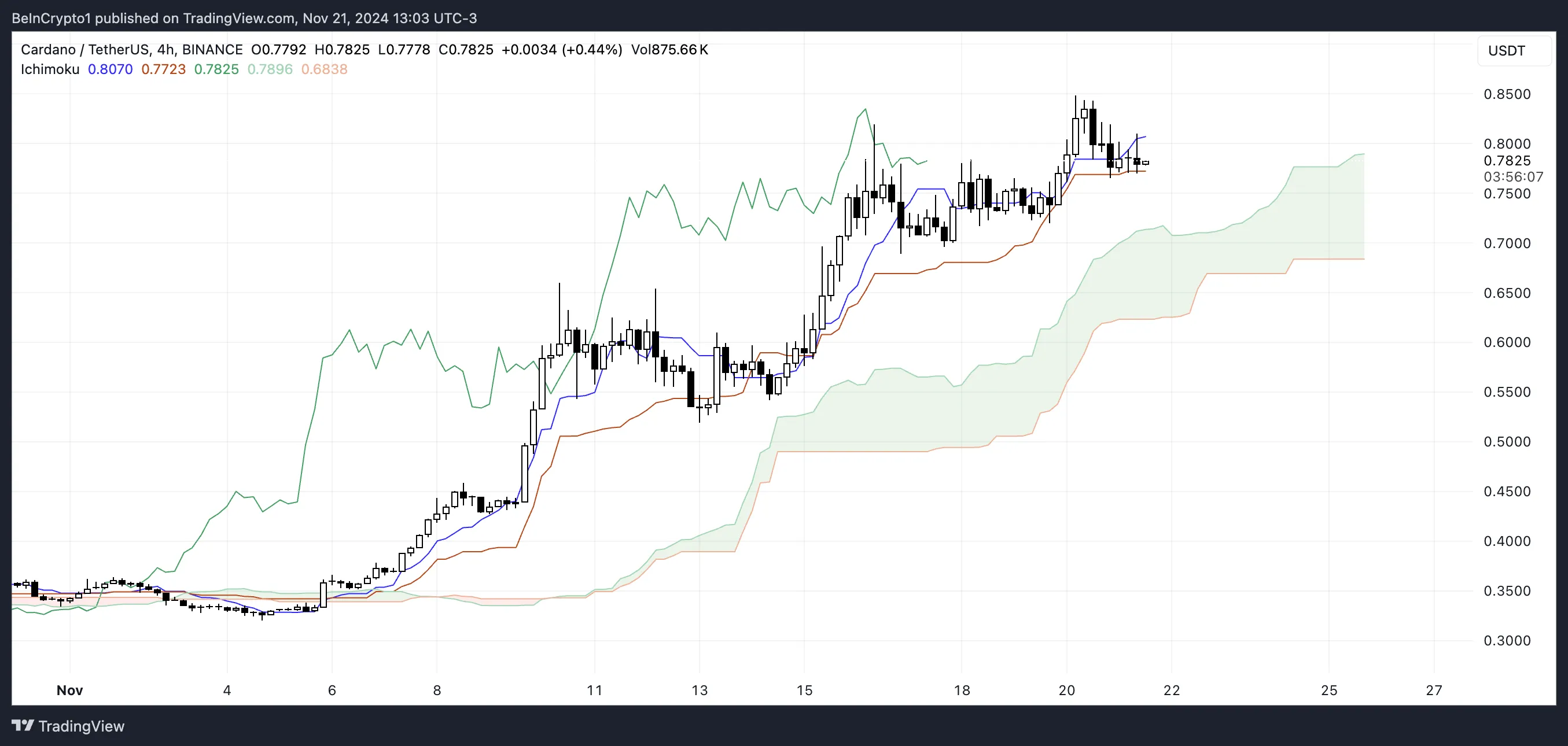

The Ichimoku Cloud chart for Cardano indicates a generally bullish trend, as the price remains above the cloud (Kumo). The Tenkan-sen (blue line) and Kijun-sen (red line) are relatively flat, showing signs of consolidation after ADA’s recent rally.

While the price is still trading above these lines, the narrowing gap between the price and the Tenkan-sen suggests weakening short-term momentum.

The green cloud ahead signals potential support for ADA uptrend, but the current consolidation phase highlights the need for sustained buying pressure to maintain this momentum.

If the price drops below the Kijun-sen or approaches the cloud, it could signal a possible shift toward bearish sentiment.

ADA Price Prediction: Can It Reach $1 In November?

If Cardano (ADA) maintains its strong uptrend, it could test the resistance at $0.85. Breaking this level could pave the way for further gains, with the potential to reach the $1 threshold, marking a 20% rise from current levels and the highest price for Cardano since April 2022.

However, as indicated by the Ichimoku Cloud, a potential reversal could be on the horizon. If bearish momentum takes over, ADA price could face significant downward pressure, potentially dropping to $0.51.

If this support fails, the price could decline further to $0.32, representing a steep 59% correction. This highlights the importance of the current support and resistance levels in determining ADA’s next direction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market18 hours ago

Market18 hours agoThis is Why MoonPay Shattered Solana Transaction Records

-

Ethereum15 hours ago

Ethereum15 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Regulation23 hours ago

Regulation23 hours agoUS SEC Pushes Timeline For Franklin Templeton Crypto Index ETF

-

Market23 hours ago

Market23 hours agoRENDER Price Soars 48%, But Whale Activity Declines

-

Regulation22 hours ago

Regulation22 hours agoBitClave Investors Get $4.6M Back In US SEC Settlement Distribution

-

Market22 hours ago

Market22 hours agoNvidia Q3 Revenue Soars 95% to $35.1B, Beats Estimates

-

Market20 hours ago

Market20 hours agoDogecoin (DOGE) Price Momentum Weakens Despite Rally

-

Altcoin20 hours ago

Altcoin20 hours agoCrypto Analyst Says Dogecoin Price Has Entered Parabolic Surge To $23.36. Here Are The Reasons Why