Market

How These PolitiFi Meme Tokens Are Faring Today

Kamala Horris (KAMA) is outpacing its Trump-themed rivals in the PolitiFi meme tokens market today. In the last 24 hours, KAMA’s price has increased by 4.80%, while several Trump-related tokens have added to their seven-day double-digit decline.

This shift highlights increasing investor interest in politically satirical tokens linked to U.S. Vice President Kamala Harris. What makes this trend particularly surprising is that it coincides with Donald Trump maintaining a lead in the polls ahead of the November 5 U.S. elections. Below is a detailed breakdown of how PolitiFi meme tokens KAMA, MAGA (TRUMP), and Donald Trump (TREMP) could perform in the coming days.

Kamala Horris (KAMA)

As of this writing, KAMA’s price stands at $0.0066. Prior to this, the meme coin’s price dipped to $0.0057 after being trapped in a descending triangle pattern. To provide context, a descending triangle is a technical pattern defined by a falling trendline that creates lower highs, alongside a horizontal support level.

If Kamala Horris had slipped below the support, then the price could have experienced another correction. Instead, it broke out of the channel. This breakout is further supported by an increase in the Relative Strength Index (RSI), indicating strengthening bullish momentum.

Read more: What Are Meme Coins?

Should the PolitFi meme coin momentum get better, KAMA’s price could climb to $0.0079. However, if Kamala Harris’ odds of winning the election continue to plummet, this forecast could be invalidated. In that scenario, KAMA might decline to $0.0054.

MAGA (TRUMP)

In contrast to KAMA, MAGA—the Trump-themed meme coin with the highest market capitalization—has experienced a price decline. At press time, TRUMP’s price is $3.30, reflecting a significant drop of 35.60% over the past seven days.

Currently, the Moving Average Convergence Divergence (MACD) is in the negative region. Like the RSI, the MACD is a technical oscillator that measures momentum. Thus, a negative region suggests a bearish outlook for the meme coin.

Besides that, TRUMP’s value is below the 20 and 50-period Exponential Moving Averages (EMA). Assuming the price was above these thresholds, the trend would have been bullish. However, since it is the other way around, it aligns with the MACD bearish stance.

In this scenario, TRUMP could drop to $1.95. On the flip side, the meme coin’s value could rebound if momentum becomes bearish and the price moves above the EMAs. If that happens, it could rise to $5.20.

Donald Tremp (TREMP)

TREMP is another Donald Trump-themed meme coin that has declined within the past week. As of this writing, its price is $0.30, representing an 18% decrease from seven days ago.

However, contrary to other Trump PolitiFi meme token conditions, TREMP could erase part of those losses. One reason for this forecast is the Bull Bear Power (BBP), which has recently recorded a jump. The BBP measures the strength of buyers (bulls) to sellers (bears).

When it is negative, bears are in control. But in this case, the BBP is negative, indicating bulls have the upper hand. This Money Flow Index (MFI), which has begun to move higher, also reinforces this bias.

Read more: Top 9 Safest Crypto Exchanges in 2024

Should these indicators maintain or improve their positions, TREMP’s price could rise to $0.37. However, if bears push bulls out of the way, the price might decrease, and the meme coin might decline to $0.22

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Poised for Gains: $3,600 Within Reach?

Ethereum price started a fresh increase above the $3,320 zone. ETH is rising and aiming for more gains above the $3,500 resistance.

- Ethereum started a fresh increase above the $3,300 and $3,320 levels.

- The price is trading above $3,300 and the 100-hourly Simple Moving Average.

- There is a short-term bearish trend line forming with resistance at $3,350 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,420 resistance zone.

Ethereum Price Eyes More Gains

Ethereum price remained supported above $3,120 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,220 and $3,300 resistance levels.

The bulls pumped the price above the $3,400 level. It gained over 10% and traded as high as $3,499. Recently, there was a downside correction below $3,400. The price dipped below $3,320 and tested $3,280. A low was formed at $3,288 and the price is now consolidating above the 23.6% Fib retracement level of the recent decline from the $3,499 swing high to the $3,288 low.

Ethereum price is now trading above $3,300 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term bearish trend line forming with resistance at $3,350 on the hourly chart of ETH/USD.

The first major resistance is near the $3,400 level. The main resistance is now forming near $3,420 or the 61.8% Fib retracement level of the recent decline from the $3,499 swing high to the $3,288 low.

A clear move above the $3,420 resistance might send the price toward the $3,500 resistance. An upside break above the $3,500 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,600 resistance zone or even $3,620.

Downsides Limited In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,320 level. The first major support sits near the $3,285 zone.

A clear move below the $3,285 support might push the price toward $3,220. Any more losses might send the price toward the $3,120 support level in the near term. The next key support sits at $3,040.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,300

Major Resistance Level – $3,350

Market

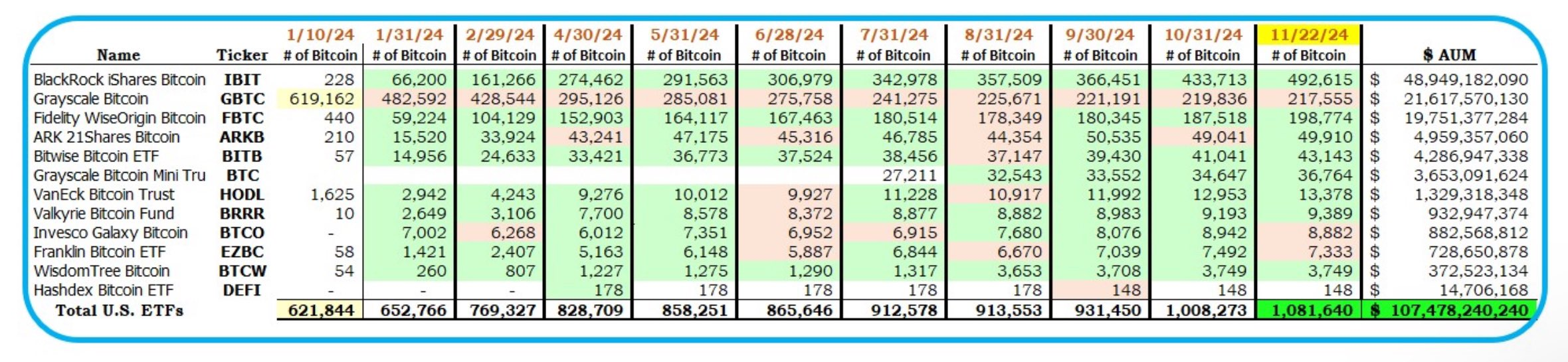

Bitcoin ETFs Could Overtake Gold ETFs by End of The Year

Spot Bitcoin exchange-traded funds (ETFs) in the US are nearing a major milestone. They are set to become the biggest BTC holders in the world, even surpassing the amount held by Bitcoin’s creator, Satoshi Nakamoto.

Additionally, they are catching up to gold ETFs in total net assets.

Bitcoin ETFs on The Verge of Surpassing Satoshi Nakamoto’s BTC Stash

Since their launch in January, US spot Bitcoin ETFs have grown significantly. According to crypto analyst HODL15Capital, these funds now hold about 1.081 million Bitcoin, just below Nakamoto’s estimated 1.1 million.

Satoshi Nakamoto, the anonymous creator of Bitcoin, is believed to own approximately 5.68% of the total Bitcoin supply. These holdings, valued at over $100 billion, place Nakamoto among the world’s wealthiest individuals — if they are alive and a single person.

However, Bloomberg’s Senior ETF Analyst, Eric Balchunas, pointed out that ETFs are now 98% of the way to overtaking Nakamoto. He predicted that if the current pace of inflows continues, this could happen by Thanksgiving.

“US spot ETFs now 98% of way there to passing Satoshi as world’s biggest holder. My over/under date of Thanksgiving looking good. If next 3 days are like the past 3 days flow-wise it’s a done deal,” Balchunas stated.

SoSoValue data shows inflows into these ETFs grew by around 97% week-on-week to $3.3 billion over the last five trading days, with BlackRock’s iShares Bitcoin Trust (IBIT) contributing $2 billion. This surge coincides with the introduction of options trading for these products, which many believe is attracting more institutional investors.

Meanwhile, Bitcoin ETFs are also narrowing the gap with gold ETFs, which currently hold $120 billion in assets under management (AUM). According to Balchunas, Bitcoin ETFs manage $107 billion and could overtake gold ETFs by Christmas.

These bullish predictions reflect Bitcoin’s exceptional performance in 2024. The top cryptocurrency has surged nearly 160% since January, trading near the $100,000 landmark. In addition, its $1.91 trillion market capitalization now exceeds that of silver and major corporations like the state-owned oil company Saudi Aramco.

However, BTC still lags behind gold, which remains the world’s largest asset with a market capitalization of more than $18 billion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Ethereum Price May Fall Under $3,000

Ethereum (ETH) is currently facing significant downward pressure, with its price declining by 3% over the past 24 hours. This bearish trend could push ETH’s price below the critical $3,000 price level.

This analysis examines the factors contributing to this likelihood.

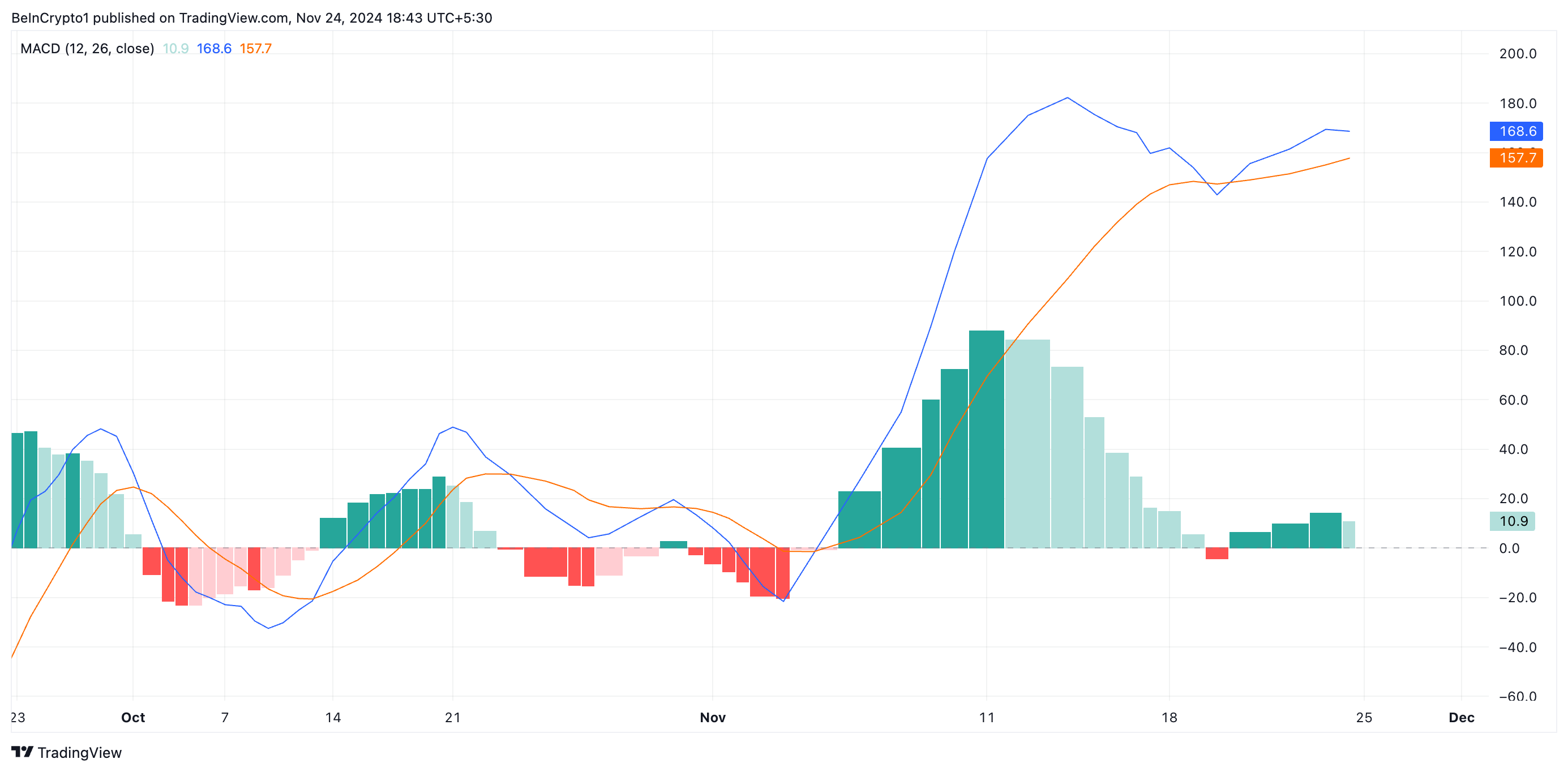

Ethereum Sellers Re-Emerge

An assessment of the ETH/USD one-day chart has revealed that the coin’s moving average convergence divergence (MACD) indicator is forming a potential death cross. As of this writing, the coin’s MACD line (blue) is attempting to fall below its signal line (orange).

This indicator measures an asset’s price trends and momentum and identifies its potential buy or sell signals. A MACD death cross occurs when the MACD line (the shorter-term moving average) crosses below the signal line (the longer-term moving average), indicating a bearish trend or momentum reversal. This signal suggests that selling pressure is increasing, and the asset’s price could decline further.

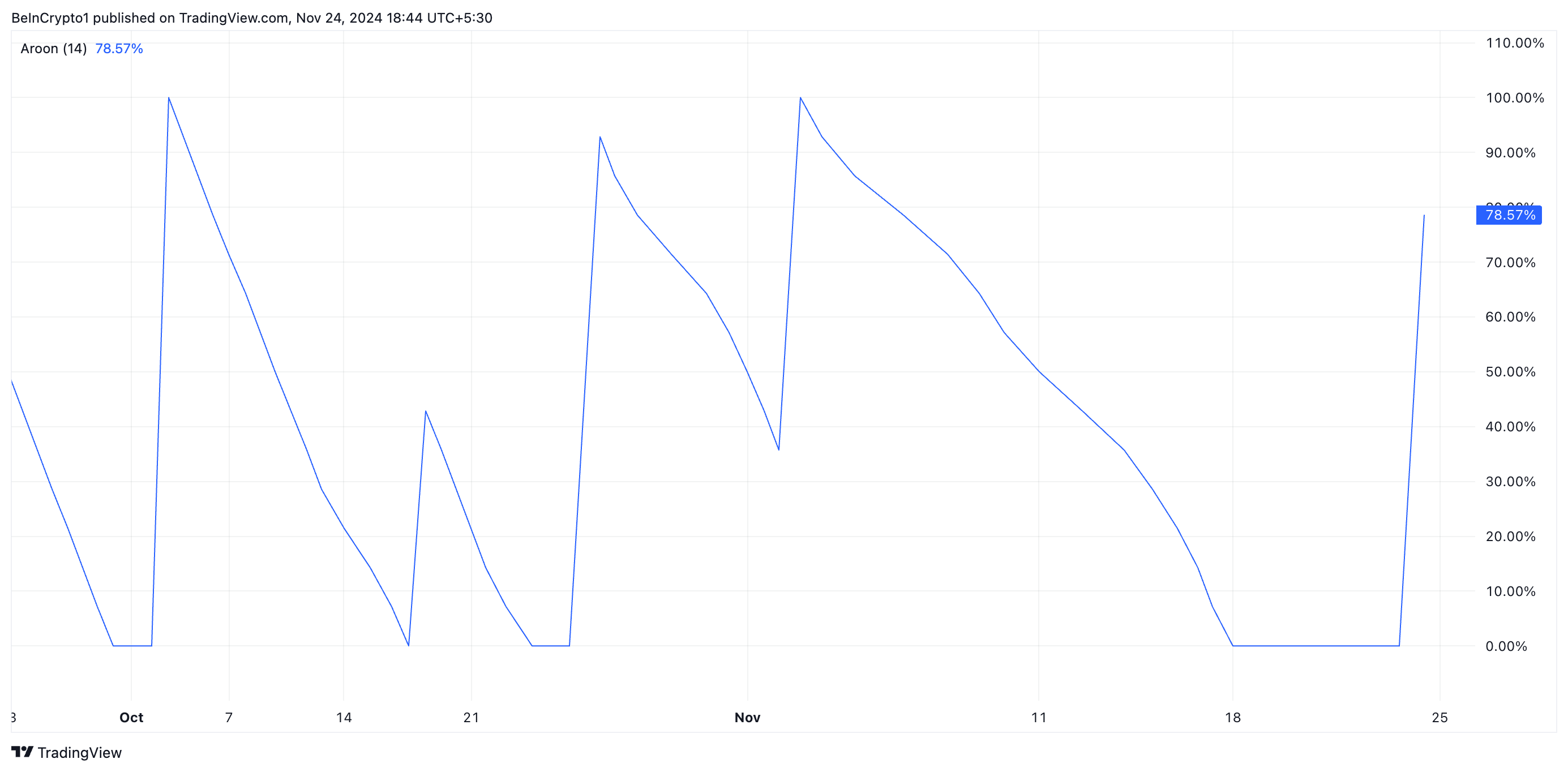

ETH’s rising Aroon Down Line confirms this strengthening bearish pressure. It currently sits at 78.57%, confirming that the decline in ETH’s price is gaining momentum.

The Aroon Indicator evaluates the strength of an asset’s price trend through two components: the Aroon Up line, which reflects the strength of an uptrend, and the Aroon Down line, which reflects the strength of a downtrend. A rising Aroon Down line indicates that recent lows are occurring more frequently, signaling growing bearish momentum or the start of a downtrend.

ETH Price Prediction: Key Support Level To Watch

ETH currently trades at $3,333, resting above the support formed at $3,203. This level is crucial because a decline below it will cause ETH to exchange hands under $3000. According to readings from the coin’s Fibonacci Retracement tool, the Ethereum price will drop to $2,970 if this happens.

However, a resurgence in the demand for the leading altcoin will invalidate this bearish thesis. If this occurs, Ethereum will rally toward $3,500.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?

-

Market20 hours ago

Market20 hours agoWhy a New Solana All-Time High May Be Near

-

Bitcoin16 hours ago

Bitcoin16 hours agoBitcoin Correction Looms As Analyst Predicts Fall To $85,600

-

Bitcoin15 hours ago

Bitcoin15 hours agoAI Company Invests $10 Million In BTC Treasury

-

Market15 hours ago

Market15 hours agoIs the XRP Price Decline Going To Continue?

-

Market14 hours ago

Market14 hours agoToken Unlocks to Watch Next Week: AVAX, ADA and More

-

Bitcoin13 hours ago

Bitcoin13 hours agoSenator’s Bold Proposal To Replenish US Reserves