Market

Bitcoin Price Pauses In Consolidation: Aiming for New Gains

Bitcoin price started a downside correction and tested the $66,500 zone. BTC is now consolidating and might aim for a fresh increase above $67,800.

- Bitcoin struggled to test the $70,000 resistance zone and started a downside correction.

- The price is trading below $67,500 and the 100 hourly Simple moving average.

- There is a short-term contracting triangle forming with support at $67,100 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a fresh increase unless there is a close below the $66,500 zone.

Bitcoin Price Starts Consolidation Phase

Bitcoin price struggled to continue higher toward the $70,000 level and started a downside correction. There was a move below the $68,500 and $67,500 levels.

The price even tested the $66,500 support zone. A low was formed at $66,564 and the price is now consolidating losses. There was a minor increase above the $66,850 level. The price climbed above the 23.6% Fib retracement level of the downward move from the $69,427 swing high to the $66,564 low.

Bitcoin price is now trading below $67,500 and the 100 hourly Simple moving average. On the upside, the price could face resistance near the $67,100 level. There is also a short-term contracting triangle forming with support at $67,100 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $68,000 level or the 50% Fib retracement level of the downward move from the $69,427 swing high to the $66,564 low. A clear move above the $68,000 resistance might send the price higher. The next key resistance could be $68,500.

A close above the $68,500 resistance might initiate more gains. In the stated case, the price could rise and test the $69,200 resistance level. Any more gains might send the price toward the $70,000 resistance level.

Another Decline In BTC?

If Bitcoin fails to rise above the $67,100 resistance zone, it could start another decline. Immediate support on the downside is near the $66,800 level.

The first major support is near the $66,500 level. The next support is now near the $66,200 zone. Any more losses might send the price toward the $65,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $66,800, followed by $66,500.

Major Resistance Levels – $67,100, and $68,000.

Market

Cardano Price Recovery Next As Whales Buy 230 Million ADA

Cardano has experienced a tough period, with the failed price recovery and declining market conditions. However, the recent buying behavior of whales and the potential for a price surge suggest a change in momentum.

If Cardano (ADA) can break through the $0.70 level, it could signal the end of the bearish sentiment.

Cardano Whales Are Hopeful

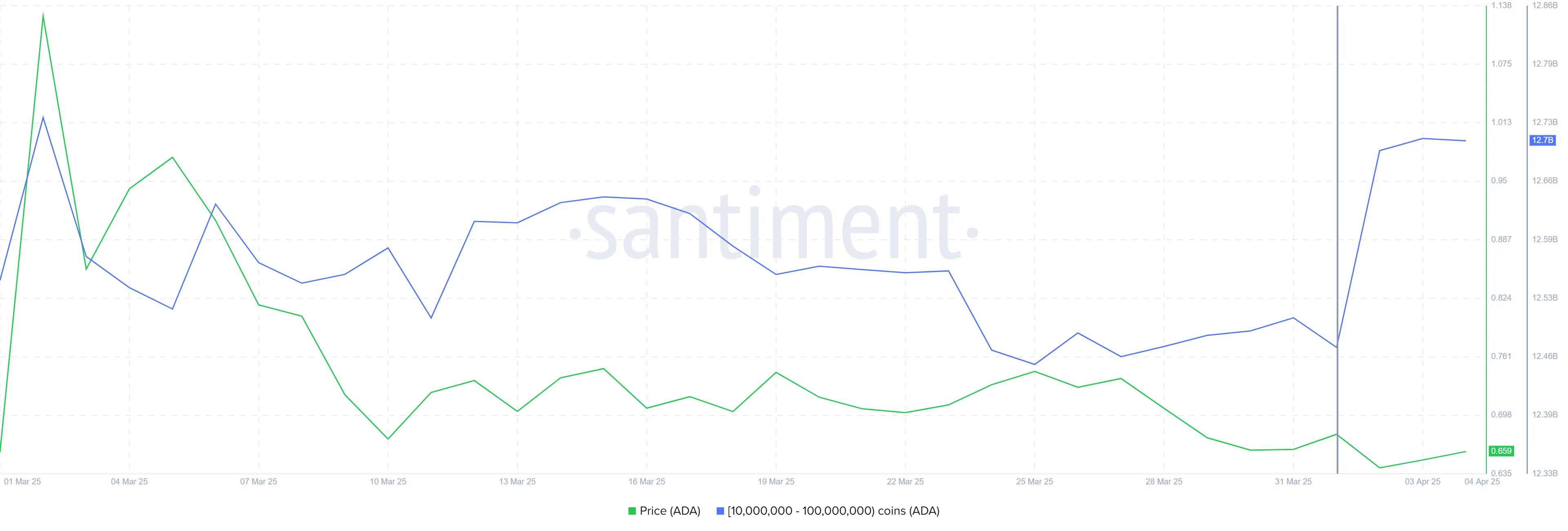

Over the past 72 hours, whales holding between 10 million and 100 million ADA have accumulated over 230 million ADA, valued at over $150 million at current prices. This shift from selling and staying neutral to accumulation indicates a shift in sentiment, with whales optimistic about ADA’s potential for Q2 2025. Their recent activity signals confidence in the altcoin’s recovery despite the recent market struggles.

Whale accumulation is often a bullish indicator as these investors have significant influence over the market. The accumulation is crucial, as it provides the support needed for ADA to break through resistance levels.

The liquidation map for Cardano shows that approximately $15 million in short contracts will expire as soon as ADA rises above the $0.70 level. This presents a key opportunity for the altcoin. Short-sellers may be forced to close their positions, which could lead to a short squeeze and drive the price higher.

Potential liquidation of short positions may create upward pressure, preventing further declines and allowing ADA to recover. The combination of whale accumulation and the looming liquidation of short contracts could provide Cardano with the momentum it needs to break free from its recent downtrend.

Can ADA Price Breach $0.70?

At the time of writing, Cardano’s price is at $0.65, holding above the crucial $0.62 support level. The altcoin has struggled in recent weeks, but the whale-buying activity offers hope for recovery. A breach of the $0.70 barrier could lead to further upward movement.

Should ADA successfully break through $0.70, it could gain the necessary momentum to continue its recovery. Flipping $0.77 into support would provide an additional boost, positioning Cardano to regain recent losses and possibly challenge higher resistance levels.

However, if Cardano fails to breach $0.70, the price may return to the $0.62 support level. Losing this support would invalidate the bullish outlook and send ADA to a lower level of $0.58, extending the ongoing decline.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Standard Chartered Calls for Bitcoin Push Above $88,500

Standard Chartered has predicted that Bitcoin (BTC) will likely break above $88,500 this weekend following a strong performance in the tech sector.

The bank’s Global Head of Digital Assets Research, Geoff Kendrick, shared these expectations in an exclusive with BeInCrypto.

What Standard Chartered Says About Bitcoin This Weekend

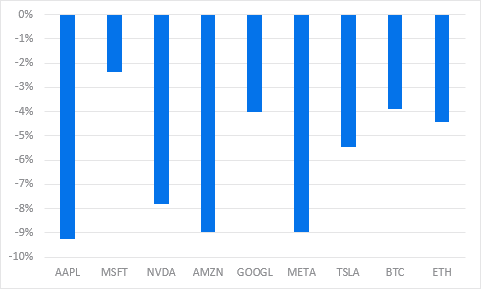

In an email to BeInCrypto, Kendrick pointed to recent price action among major technology stocks, including Microsoft, as an indicator of Bitcoin’s short-term trajectory.

“Strongest performers were MSFT and BTC. Same again so for today in Bitcoin spot and tech futures,” Kendrick said.

He explained that a decisive break above the critical $85,000 level appears likely post-US non-farm payrolls. The Standard Chartered executive explained that such an outcome would pave the way for a return to Wednesday’s pre-tariff level of $88,500.

However, China’s retaliatory tariffs could increase market uncertainty, driving prices down in the short term. This volatility might dampen investor confidence, overshadowing any weekend gains.

Kendrick’s assertions come ahead of the much-anticipated US employment report, Non-Farm Payrolls (NFP). The report would present a comprehensive labor market update, including jobs added, the unemployment rate, and wage growth.

A strong report could bolster faith in the economy, particularly if it comes in higher than the previous reading of 151,000 jobs. This is more so if accompanied by a steady 4.1% unemployment rate. Such an outcome could curb crypto gains if the dollar rallies.

Conversely, a disappointing tally, potentially below the median forecast of 140,000 jobs with unemployment ticking beyond 4.1%, could ignite recession worries. This would send investors flocking to Bitcoin and crypto.

Standard Chartered may be pivoting to the latter outcome, with Kendrick emphasizing Bitcoin’s growing role as a key asset.

“Bitcoin is proving itself to be the best of tech upside when stocks go up and also as a hedge in multiple scenarios…I argued that Bitcoin trades more like tech stocks than it does gold most of the time. At other times, and structurally, Bitcoin is useful as a TradFi hedge,” he added.

Standard Chartered has increasingly highlighted Bitcoin’s strategic importance within financial markets. The bank recently identified Bitcoin and Avalanche (AVAX) as likely beneficiaries of a potential post-Liberation Day crypto surge. BeInCrypto reported the forecast, which now aligns with the latest one, that institutional investors could be preparing for a market upswing.

Additionally, the bank has positioned Bitcoin as a growing hedge against inflation. It argued that its limited supply and decentralized nature make it an attractive alternative to traditional safe-haven assets.

Standard Chartered Calls to HODL Bitcoin

Amid Bitcoin’s growing role in traditional finance (TradFi), Kendrick advised investors to maintain their holdings.

“Over the last 36 hours, I think we can also add ‘US isolation’ hedge to the list of Bitcoin uses,” he added.

This suggests that Bitcoin could serve as a protective asset in geopolitical and macroeconomic uncertainty.

Meanwhile, the BTC/USDT daily chart shows a critical technical setup, with Bitcoin’s price currently trading around $82,643. A former support level of $85,000 now stands as resistance, limiting the pioneer crypto’s upside potential. The supply zone near $86,508 adds further selling pressure.

On the downside, a key demand zone between $77,500 and $80,708 provides support. Despite price consolidation, the Relative Strength Index (RSI) is forming higher lows, indicating sustained growing momentum and a potential reversal.

If BTC successfully reclaims $85,000, it could trigger a move toward $87,480. However, to confirm the continuation of the uptrend, BTC must record a daily candlestick close above the midline of the supply zone at $86,508.

The bullish volume profile (blue) supports this thesis, showing that bulls are waiting to interact with the Bitcoin price above the midline of the supply zone.

Failure to breach the immediate resistance at $85,000 might lead to a retest of the demand zone, potentially breaking lower. In such a directional bias, a break and close below the midline of this zone at $79,186 could exacerbate the downtrend.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BTC Futures Show Bullish Sentiment, Options Traders Cautious

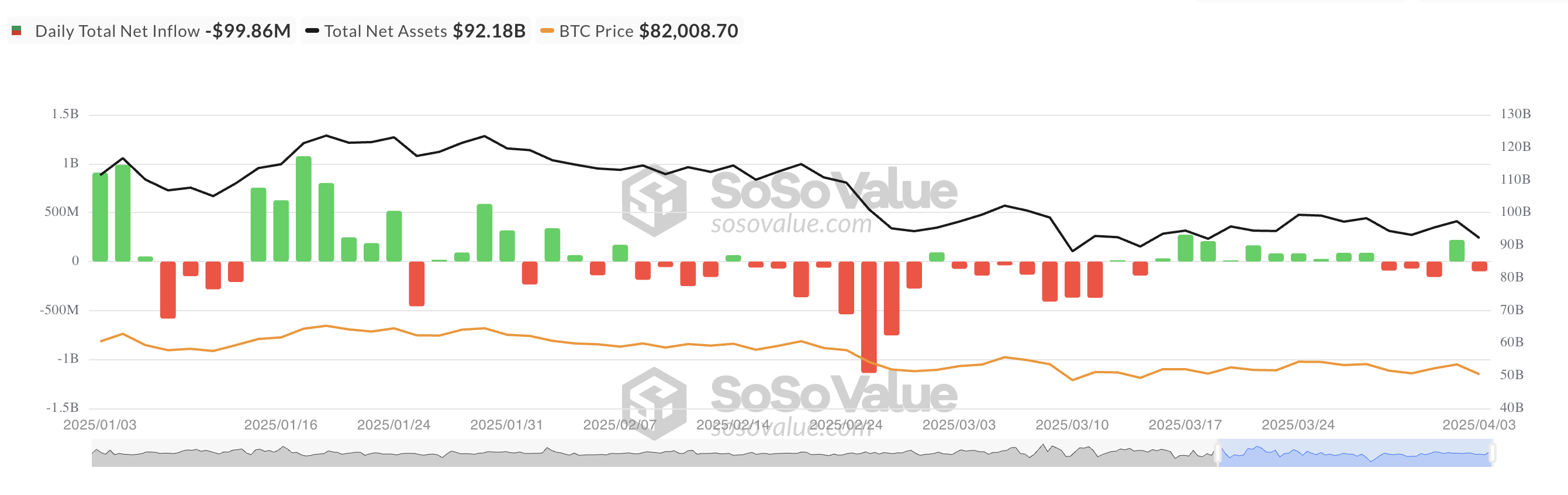

After a surge in Bitcoin spot ETF inflows on April 2, yesterday’s market action painted a different picture as institutional investors began offloading BTC holdings.

Despite this retreat, futures traders remain confident, with open interest climbing and funding rates staying positive. However, the options market tells a different story, with traders showing less conviction in sustained upward momentum. As a key batch of BTC options nears expiration, all eyes are on how the market will respond to this divergence.

BTC Spot ETFs See $99.86 Million Outflow as Institutional Confidence Wavers

Institutional investors withdrew liquidity from BTC spot ETFs yesterday, resulting in a net outflow of $99.86 million.

This abrupt shift followed April 2’s $767 million net inflow, which ended a three-day streak of outflows. It signaled a brief return of institutional confidence before momentum quickly reversed.

Grayscale’s ETF GBTC saw the highest amount of fund exits, with a daily net outflow of $60.20 million, bringing its net assets under management to $22.60 billion.

However, BlackRock’s ETF IBIT stood out, witnessing a daily net inflow of $65.25 million. At press time, Bitcoin Spot ETFs have a total net asset value of $92.18 billion, plummeting 5% over the past 24 hours.

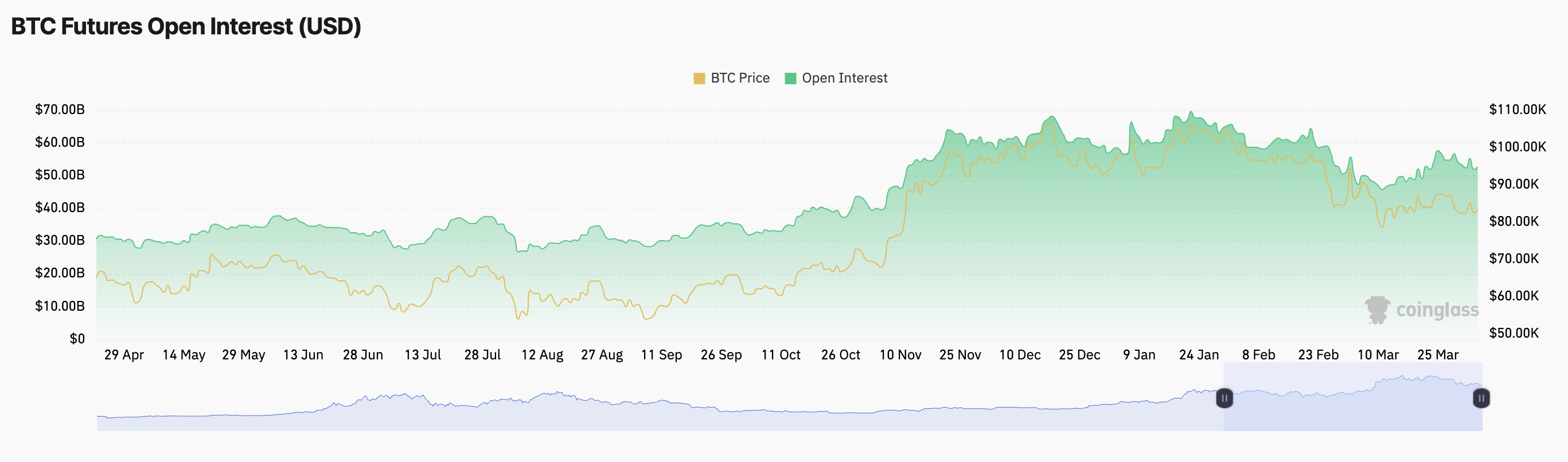

Bitcoin Derivatives Split as Traders Bet on Both Sides of the Market

Meanwhile, the derivatives market remains split—Bitcoin futures traders are leaning bullish, backed by rising open interest and positive funding rates. In contrast, options traders appear more hesitant, signaling uncertainty in the market’s next move.

At press time, Bitcoin futures open is $52.63 billion, up 2% over the past day. The coin’s funding rate remains positive and currently stands at 0.0084%.

Notably, amid the broader market dip, BTC’s price has noted a minor 0.34% decline during the review period.

When BTC’s price declines while its futures open interest rises and funding rates remain positive, it suggests that traders are increasing leveraged positions despite the price drop. The positive funding rate indicates that long positions remain dominant, meaning traders expect a rebound.

However, caution is advised. If BTC’s price continues to fall, it could trigger long liquidations as overleveraged positions get squeezed.

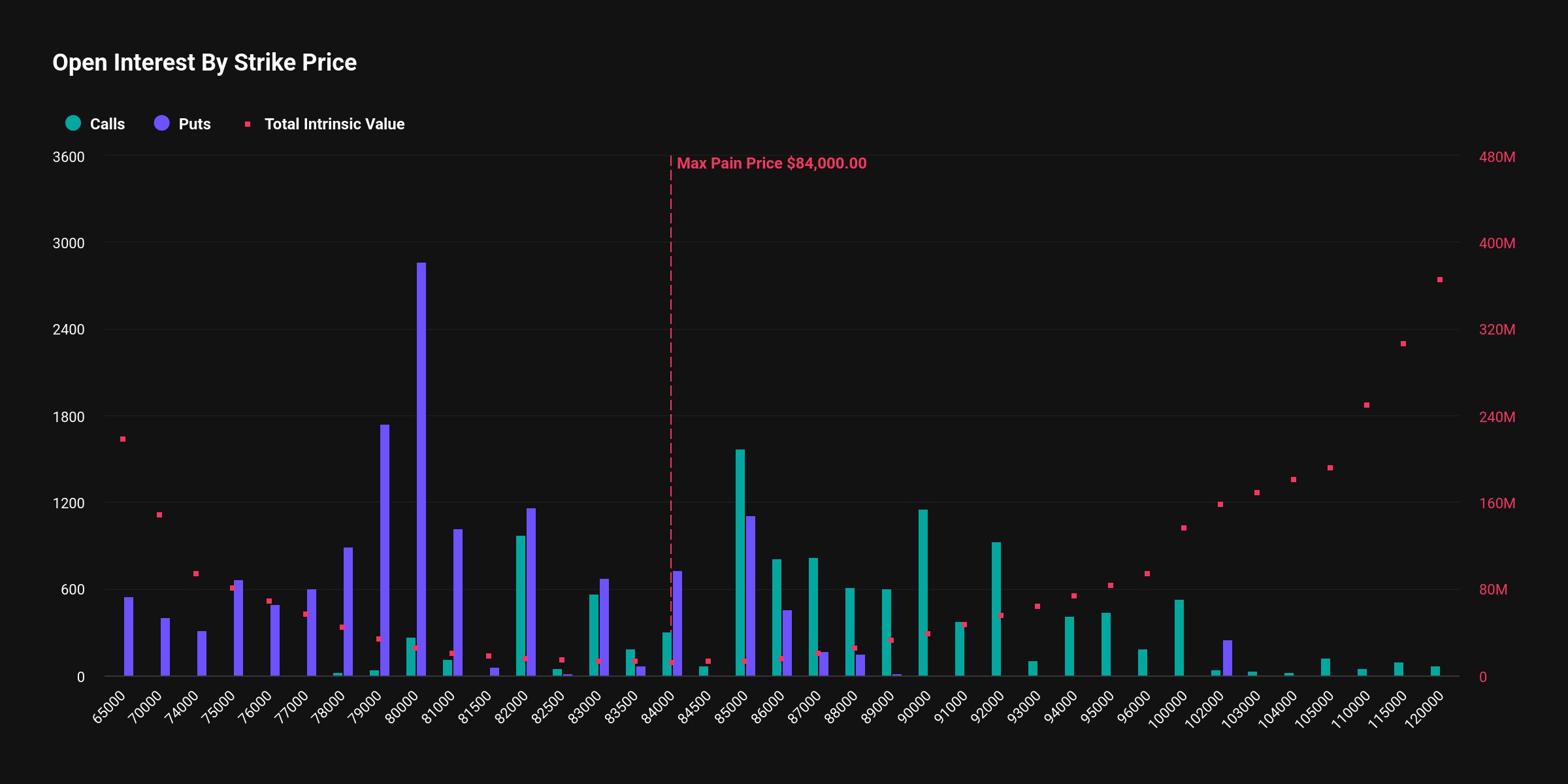

In contrast, the options market tells a different story, with traders showing less conviction in sustained upward momentum. This is evident from the high demand for put options.

According to Deribit, the notional value of BTC options expiring today is $2.17 billion, with a put-to-call ratio of 1.24. This confirms the prevalence of sales options among market participants.

This divide between futures and options traders suggests a tug-of-war between bullish speculation and cautious hedging, potentially leading to heightened volatility in the near term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin’s Future After Trump Tariffs

-

Regulation22 hours ago

Regulation22 hours agoUS Senate Banking Committee Approves Paul Atkins Nomination For SEC Chair Role

-

Market20 hours ago

Market20 hours agoBinance Managed 94% of All Crypto Airdrops and Staking Rewards

-

Market22 hours ago

Market22 hours agoTRUMP Token Hits Record Low Due To Liberation Day Tariffs

-

Market21 hours ago

Market21 hours agoPi Network Price Falls To Record New Low Amid Weak Inflows

-

Regulation19 hours ago

Regulation19 hours agoUS SEC Acknowledges Fidelity’s Filing for Solana ETF

-

Market19 hours ago

Market19 hours agoXRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

-

Market18 hours ago

Market18 hours agoRipple Shifts $1B in XRP Amid Growing Bearish Pressure