Market

Russian Woman Charged in $22 Million Crypto Fraud Case

Valeria “Bitmama” Fedyakina, a Russian influencer, faces 10 years in prison for $22 million crypto fraud. Law enforcement previously suspected her of treason but recently charged her with economic crimes alone.

Fedyakina allegedly defrauded at least four Russian businessmen with a phony cross-border payment scheme.

Cross-Border Payments Fraud

According to a recent report from New York Post, Russian influencer Valeria “Bitmama” Fedyakina is nearing a trial for $22 million in alleged crypto fraud. She faces 10 years in prison if found guilty. Law enforcement officials arrested her in September 2023, and the state’s case relies on the testimony of four defrauded businessmen.

Read More: Top Cryptocurrency Scams in 2024

The center of Fedyakina’s scam operation was crypto’s use in cross-border payments, which have become particularly popular in Russia. The country is currently under international sanctions since the Ukraine invasion, and cryptocurrency can help private and institutional users evade these sanctions. Fedyakina allegedly posed as a facilitator for this exact use case.

According to these four defrauded individuals, Fedyakina portrayed herself as an international entrepreneur and investor who could help Russian businessmen move money abroad via crypto. She also promised to “sweeten the deal” by claiming that she would not charge for this service, but actually pay extra thanks to an convoluted energy scheme. Instead, she stole everything.

Reportedly, her crimes went far further, and Fedyakina attempted to fund Ukraine’s war effort with these assets. This claim has appeared in previous coverage, and state prosecutors apparently suspected her at one point. However, a more recent story from Russian state media outlet TASS quotes extensively from court documents.

“The investigative body has completed the investigation of the criminal case against Valeria Sergeevna Fedyakina, who committed fraud, that is, theft of someone else’s property by deception, on an especially large scale. In the final version, she was charged with committing four episodes of fraud, and four people were recognized as victims in the case,” it quoted.

In short, there’s no mention of high treason. TASS claims that Fedyakina was pregnant at the time of her arrest and has since given birth.

She may be able to request a lighter or deferred sentence on these grounds. This sort of leniency would not be appropriate for someone directly aiding an enemy war effort.

Read More: Crypto Social Media Scams: How to Stay Safe

Still, if nothing else, Fedyakina’s case represents a particular danger in the crypto space. Sophisticated phishing efforts are on the rise, and her operation was based on a very real use case in Russia.

Scammers often have a legitimate outward appearance and target desperate people. Several security solutions can help minimize users’ personal risk.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price 25% Rally: Breaking Barriers and Surpassing Odds

XRP price rallied above the $1.15 and $1.20 resistance levels. The price is up over 25% and might rise further above the $1.420 resistance.

- XRP price started a fresh surge above the $1.20 resistance level.

- The price is now trading above $1.250 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair is up over 25% and it seems like the bulls are not done yet.

XRP Price Eyes Steady Increase

XRP price formed a base above $1.050 and started a fresh increase. There was a move above the $1.150 and $1.20 resistance levels. It even pumped above the $1.25 level, beating Ethereum and Bitcoin in the past two sessions.

There was also a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair. A high was formed at $1.4161 and the price is now consolidating gains. It is trading above the 23.6% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high.

The price is now trading above $1.30 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $1.400 level. The first major resistance is near the $1.420 level. The next key resistance could be $1.450.

A clear move above the $1.450 resistance might send the price toward the $1.50 resistance. Any more gains might send the price toward the $1.550 resistance or even $1.620 in the near term. The next major hurdle for the bulls might be $1.750 or $1.80.

Are Dips Supported?

If XRP fails to clear the $1.420 resistance zone, it could start a downside correction. Initial support on the downside is near the $1.3350 level. The next major support is near the $1.2850 level.

If there is a downside break and a close below the $1.2850 level, the price might continue to decline toward the $1.240 support or the 50% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high in the near term. The next major support sits near the $1.20 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $1.3350 and $1.2850.

Major Resistance Levels – $1.4000 and $1.4200.

Market

WisdomTree Europe Launches XRP ETP

ETF issuer WisdomTree’s European division just announced a new ETP based on XRP. This product is currently available in four EU countries, which has led XRP’s price to jump slightly.

ETPs are a common issuer strategy to earn revenue without ETF approval, but Europe will not necessarily approve one even if the US does so.

WisdomTree’s XRP ETP

WisdomTree, one of the Bitcoin ETF issuers in the US, announced that its European branch is offering an exchange-traded product (ETP) based on XRP. This new product is currently available in Germany, Switzerland, France, and the Netherlands. A growing number of issuers have filed for an XRP ETF, but WisdomTree is taking a slightly different tack.

“The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest cryptocurrencies by market capitalization. Backed 100% by XRP, XRPW is the lowest-priced XRP ETP in Europe, providing direct spot price exposure,” the announcement claimed.

The possibility of an official XRP ETF is growing with the current bull market, and Ripple CEO Brad Garlinghouse considers it “inevitable.” Still, it hasn’t happened yet, and ETP offerings allow issuers to somewhat address customers’ requirements. BitWise, which has also filed for an XRP ETF in the US, recently acquired a European ETP issuer to enter the same market.

WisdomTree, however, is no stranger to this market strategy. In May this year, it won approval to offer ETPs based on Bitcoin and Ethereum to British investors.

The UK has not yet approved a full ETF for either of these assets, but WisdomTree still gained market access. Even a fraction of the XRP market could also prove lucrative; the asset’s value spiked today.

WisdomTree Europe’s strategy page does not describe any further actions upon full approval. Even if the US approves an XRP ETF under the SEC’s new leadership, that won’t necessarily benefit WisdomTree’s European branch. For now, these ETPs built on XRP will have to suffice for this market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Rallies 10% and Targets More Upside

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

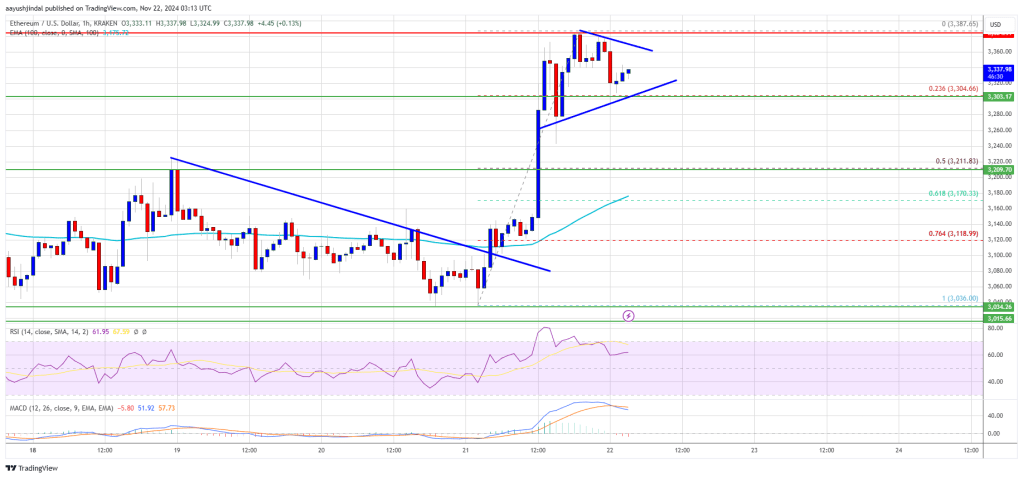

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

-

Ethereum23 hours ago

Ethereum23 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market20 hours ago

Market20 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Market23 hours ago

Market23 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?

-

Altcoin22 hours ago

Altcoin22 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Bitcoin15 hours ago

Bitcoin15 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Market15 hours ago

Market15 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Altcoin18 hours ago

Altcoin18 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Altcoin17 hours ago

Altcoin17 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?