Market

Is Cardano dead? Trader says Rexas Finance (RXS) could beat ADA in 2025, RXS now listed on CoinMarketCap

Cardano (ADA) was at the center of interest a few years ago, but many investors now wonder if it has lost its ‘wow’ factor. The coin, which is relatively steady and has built a good system of development, reached its maximum in 2021 and has since been experiencing slower growth. However, some traders believe that Cardano isn’t over, but should not be a primary focus for traders looking at explosive long-term growth. On the other hand, projects like Rexas Finance (RXS) are emerging and a growing number of traders believe that RXS may offer more upside than ADA during the 2025 rally.

Is Cardano dead?

So, is Cardano dead in the real sense of the word? The answer is no. Despite facing declining interest over the years, Cardano has still striven to remain on course as a secure and relatively stable network. The design philosophy that underpins Cardano is very conservative, and therefore, it has been pretty slow in deploying updates and new features. Such a strategy appeals to the subset of investors who are more conservative and abhor speculation. Cardano also stands out because of its dedication to enhancing the ecosystem. Its smart contract platform allows for decentralized applications (dApps) and this still has room for growth in the years to come.However, for investors in the parabolic gains segment who are at present considering Cardanol, its relatively stagnant growth may not be the most compelling option. As of today, Cardano has lost significant ground at $0.3605, which is a 65.75% price drop since the March 2024 peak. The downtrend may be slow but that’s a far cry from the previous, and many are seeking alternative bets that are more enticing.

Why Rexas Finance (RXS) could beat ADA

The other such opportunity is Rexas Finance (RXS), a new RWA token that traders think will beat its predecessor within the next few years. Rexas Finance addresses the real-world assets market and a crypto trader says RXS ‘will have an easy time ‘ surpassing ADA this 2025 rally.Many investors already find the presale price of this token appealing as it is pegged at $0.060, which is more than 100% appreciation compared to the first presale price of $0.030. Rexas Finance has been outlined to be listed at $0.2 but could then skyrocket to $16 according to some forecasts, which would represent an astonishing 26,500% appreciation by the year 2025.

However, one may ask, what will enable Rexas Finance to outdo Cardano? A simple explanation is that this allows actual functioning in the asset class market. Rexas Finance provides a platform that enables users to purchase asset fractions of tokenized assets such as real estate, art, and other physical commodities. This means that investors will be able to access the global market for assets without barriers of geography or capital.

For instance, one person in one part of the world can, with just a few clicks, own a section of a well-appointed property located in another part of the world. This freedom provides new avenues for clients and property managers alike on how to tokenize and exchange pockets of interest in investment assets. Thanks to the efficient token builder tool that it offers, Rexas Finance can let even non-tech people securitize their physical assets without coding. It is compatible with various token standards which include ERC-20, ERC-721, and ERC-1155 making it very useful and expandable. Investors can also look for funding for their tokenized assets from the Rexas Launchpad creating a lively environment for the functional development of the ecosystem.

Tracking Rexas Finance (RXS) on CoinMarketCap

Once Rexas Finance gained some traction, it has now been included in the listings at CoinMarketCap. This listing allows investors to keep a keen eye on the price changes, their news, and the developments of RXS. Having RXS on a reputable site such as CoinMarketCap helps Rexas Finance reach a wider audience, offering investors the proper tools to manage their investments and helping them to choose proper actions.

Presale opportunity and $1,000,000 giveaway

To encourage early investors, Rexas Finance gives them an interesting opportunity to engage in its presale. As such, the project is conducting a $1,000,000 giveaway, in which 20 random participants are to receive $50,000 each.By coming on board early in the presale, there are strong possibilities to benefit from the giveaway while it lasts, and also your investment could grow with the anticipated increase in the value of the RXS token.

Conclusion

While Cardano remains a stable and secure platform, its slow growth might not appeal to investors looking for fast gains. Rexas Finance, on the other hand, offers a compelling alternative, with its innovative real-world asset tokenization and impressive growth potential. As the 2025 rally approaches, some traders are increasingly optimistic about Rexas Finance’s ability to outperform ADA, with some of the most optimistic forecasts predicting a 26,500% surge by the end of next year. Getting listed on CoinMarketCap and launching a $1,000,000 giveaway in its presale stage, Rexas Finance is positioning itself as an opportunity for anyone who’s been waiting to invest in the next big crypto.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Market

Can Ethereum’s Utility Make a Comeback Against Bitcoin?

Ethereum (ETH) is still a leader in decentralized finance (DeFi) and smart contract applications, but it’s at a crossroads. The community has questioned Ethereum’s relevance in the shifting crypto industry, putting the altcoin’s future under intense scrutiny.

Mainstream narratives paint a dark picture of Ethereum’s developer exodus and underperformance.

Is Ethereum Getting Left Behind?

Critics reflect how Bitcoin’s ideological and political dominance, particularly after President Donald Trump’s pro-crypto stance, overshadowed Ethereum’s early promise of a global, decentralized computer.

Ethereum’s price downturn — down 44% in 2025 — is being driven by the exodus of developers, and network activity dropping 17% last year.

In contrast, Solana has spiked with an 83% uptick in developer engagement, partly driven by its adoption of meme coins and fast transaction speeds.

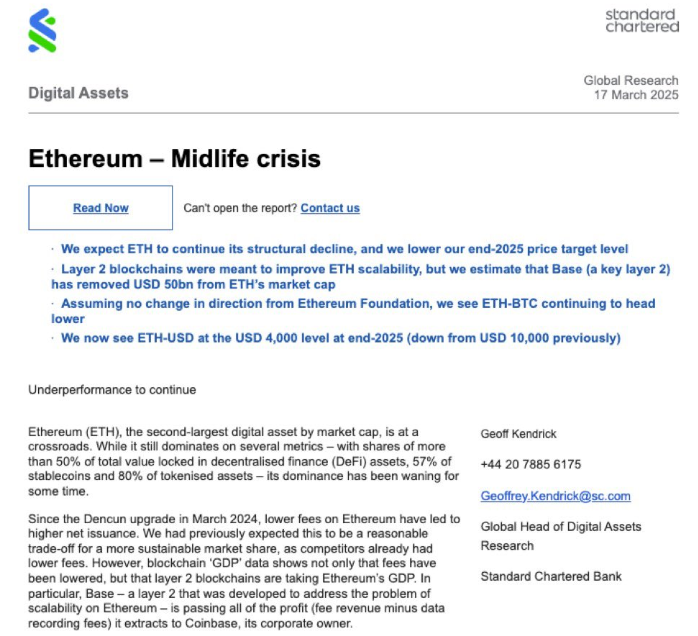

Standard Chartered analysts also cut their end-of-year Ether price forecast by 60%, based on what they told clients was Ethereum’s “identity crisis” and unclear direction forward.

Ethereum’s co-founder, Vitalik Buterin, acknowledged the growing criticism but rejected demands for quick fixes.

He reiterated Ethereum’s trajectory hinges on “long-term value” and real-world utility, not short-term speculation or political power.

“The only thing that can move Ethereum forward at this point is things that give long term value in a way where you can clearly see that the value is coming from a thing that is actually sustainable — like actual use for people,” Bloomberg reported citing Buterin.

Grassroots Push: Ethereum’s Loyalists See Opportunity

Despite growing critics, Ethereum’s most diehard supporters remain undeterred. They view the pessimism around the largest altcoin by market cap metrics as an inflection point for a turnaround.

“This is a bottom signal. Mainstream media almost always get the timing wrong,” a user on X remarked.

Ethereum Layer-2 (L2) solutions continue to dominate chain activity, while real-world asset (RWA) growth on Ethereum looks “exponential,” the user added.

Other users also reacted to the Bloomberg article, which renewed bullishness.

“Was starting to feel bearish but this post has me all bulled up again,” one added in a post.

These responses, among others, speak to Ethereum’s strong community, which has tended to shine in the face of adversity and innovation.

There is no political spectacle for Ethereum, unlike Bitcoin, with growth hinging on scalability and real-world use.

Recently, Buterin outlined a roadmap to Ethereum’s L2 ecosystem, calling for funding of open-source development to guarantee continued progress.

His vision is already coming to fruition as projects like Celo successfully transition to Ethereum layer-2 solutions. As BeInCrypto reported, Celo completed the migration after 20 months of testing, which aimed to improve scalability and transaction efficiency.

Adoption of Ethereum’s L2 scaling solutions, such as Arbitrum, Optimism, and Polygon, has also increased.

This aligns with Buterin’s perspective that sustainable blockchain growth comes from strengthened infrastructures, not hype-driven narratives.

These moves indicate that while speculation on Ethereum may be declining, long-term technological adoption could pick up the slack.

Can the Pectra Upgrade Flip the Narrative?

Likewise, Ethereum managed to overcome challenges through significant upgrades. Against that backdrop, its soon-to-be-released Pectra Upgrade could be revolutionary.

Though delays have frustrated some in the community, the upgrade is anticipated to offer improved security, transaction efficiency, and developer-friendly tools.

Ethereum’s continued commitment to innovation and ongoing testnet trials may be the perfect catalyst for reclaiming its DeFi throne. The network’s dominance in decentralized finance (DeFi) and NFT (non-fungible tokens) ecosystems proves particularly resilient.

Indeed, meme coins and speculative trading have shifted to faster chains such as Solana.

That said, when it comes to high-value applications, Ethereum is still at the heart of it all — from decentralized exchanges (DEXs) to institutional-grade financial products.

The question now, however, is whether Ethereum’s focus on real-world adoption can preserve and outlast Bitcoin’s dominance in the halls of political and financial attention.

With the Pectra upgrade on the horizon and a community loyal to the chain’s dominance in the ecosystem, Ethereum may soon show again that its greatest strength lies not in the hype but in resilience and innovation.

Despite community optimism, Ethereum’s price is down by 2.22% in the last 24 hours. BeInCrypto data shows ETH was trading for $1,842 as of this writing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Derivatives Get a Boost from US CFTC

The US Commodities Futures Trading Commission (CFTC) scrapped a key directive that had previously signaled increased scrutiny for digital asset derivatives.

This decision indicates a friendlier regulatory climate for digital assets in the US, given the Trump administration’s pro-crypto stance.

CFTC Loosens Oversight for Crypto Derivatives

The CFTC withdrew Staff Advisory No. 23-07 and No. 18-14 by its Division of Clearing and Risk (DCR).

The former, issued in May 2023, focused on the risks of clearing digital assets. Meanwhile, the latter targeted virtual currency derivatives listings.

Upon establishment, both directives hinted at the singling out of crypto products for tougher oversight.

However, both have now been deemed unnecessary, effective immediately, amid the commodities’ regulator’s push toward regulatory consistency.

The decision indicates a shift to treating digital asset derivatives like those on Ethereum (ETH) as traditional finance (TradFi) products.

“As stated in today’s withdrawal letter, DCR determined to withdraw the advisory to ensure that it does not suggest that its regulatory treatment of digital asset derivatives will vary from its treatment of other products,” the CFTC explained.

This move will eliminate the perceived distinctions between digital asset derivatives and TradFi instruments.

It also paves the way for enhanced market participation, which will facilitate broader involvement from financial institutions in the digital asset derivatives market. This could lead to increased liquidity and market maturity.

Nevertheless, the advisory warned derivatives clearing organizations (DCOs) to prepare for risk assessments specific to digital products’ unique characteristics.

Therefore, while it reflects the CFTC’s commitment to promoting innovation, it also suggests the intention to maintain strong financial oversight.

Meanwhile, this decision comes only weeks after the Office of the Comptroller of the Currency (OCC) allowed US banks to offer crypto and stablecoin services without prior approval.

However, the OCC had articulated that despite lifting the approval requirement, banks must maintain strong risk management controls akin to those required for traditional banking operations.

“The OCC expects banks to have the same strong risk management controls in place to support novel bank activities as they do for traditional ones,” said Rodney E. Hood, the acting Comptroller of the Currency.

Therefore, the CFTC’s move to eliminate regulatory bias for crypto derivatives marks a major divide in US policy. On the one hand, the CFTC seeks to scrap the distinction between crypto derivatives and TradFi instruments.

On the other hand, the FDIC (Federal Deposit Insurance Corporation) and OCC want banks to maintain risk management controls similar to those required for traditional banking operations despite providing crypto and stablecoin services.

Notwithstanding, these efforts mirror a growing trend among US financial regulators to lower barriers and foster responsible innovation in the crypto industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Falls 12% in a Week as Network Activity Declines

XRP is under heavy selling pressure, down more than 5% in the last 24 hours and over 12% in the past seven days. The recent downturn has been accompanied by increasingly bearish technical indicators, including a sharp spike in trend strength and a collapse in on-chain activity.

With price momentum weakening and user engagement dropping, concerns are mounting over XRP’s ability to hold key support levels. Unless sentiment shifts quickly, the path of least resistance appears to remain to the downside.

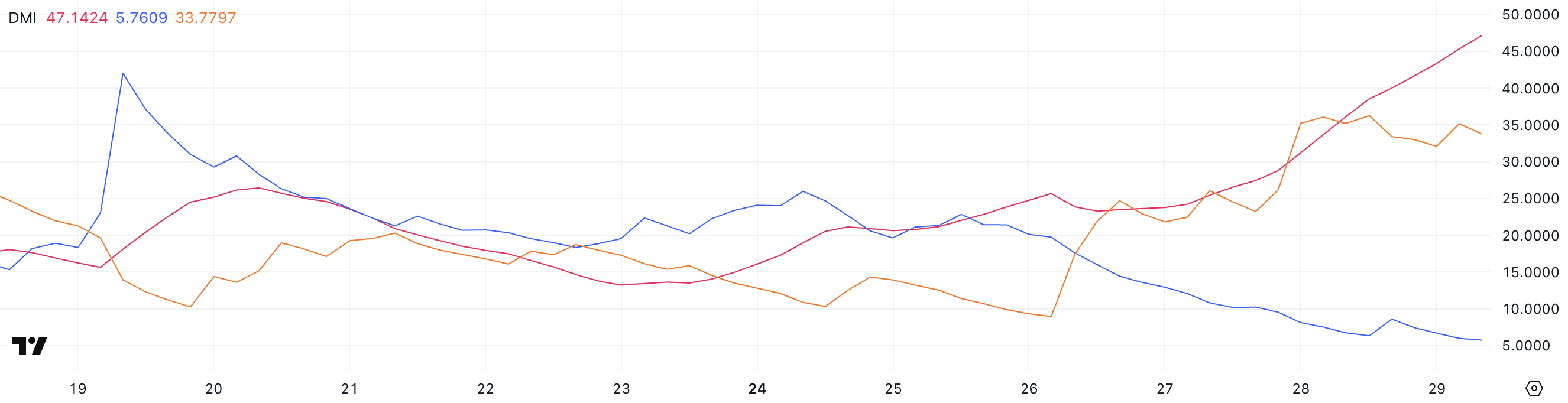

DMI Chart Shows The Current Downtrend Is Very Strong

XRP’s Directional Movement Index (DMI) is currently flashing strong bearish signals, with the Average Directional Index (ADX) surging to 47.14 from 25.43 just a day ago.

The ADX measures the strength of a trend, regardless of its direction, and values above 25 generally indicate that a trend is gaining momentum.

A reading above 40—like XRP’s current level—suggests a very strong trend is in play. Given that XRP is currently in a downtrend, this rising ADX points to intensifying bearish momentum and a market leaning heavily toward further declines.

Digging deeper into the DMI components, the +DI, which tracks upward price pressure, has dropped sharply from 20.13 to 5.76. Meanwhile, the -DI, which tracks downward price pressure, has surged from 8.97 to 33.77.

This stark divergence reinforces the bearish trend, indicating that sellers are aggressively taking control while buyer strength fades.

With ADX confirming the strength of this move and directional indicators tilting heavily to the downside, XRP’s price could remain under pressure in the short term unless a significant reversal in sentiment occurs.

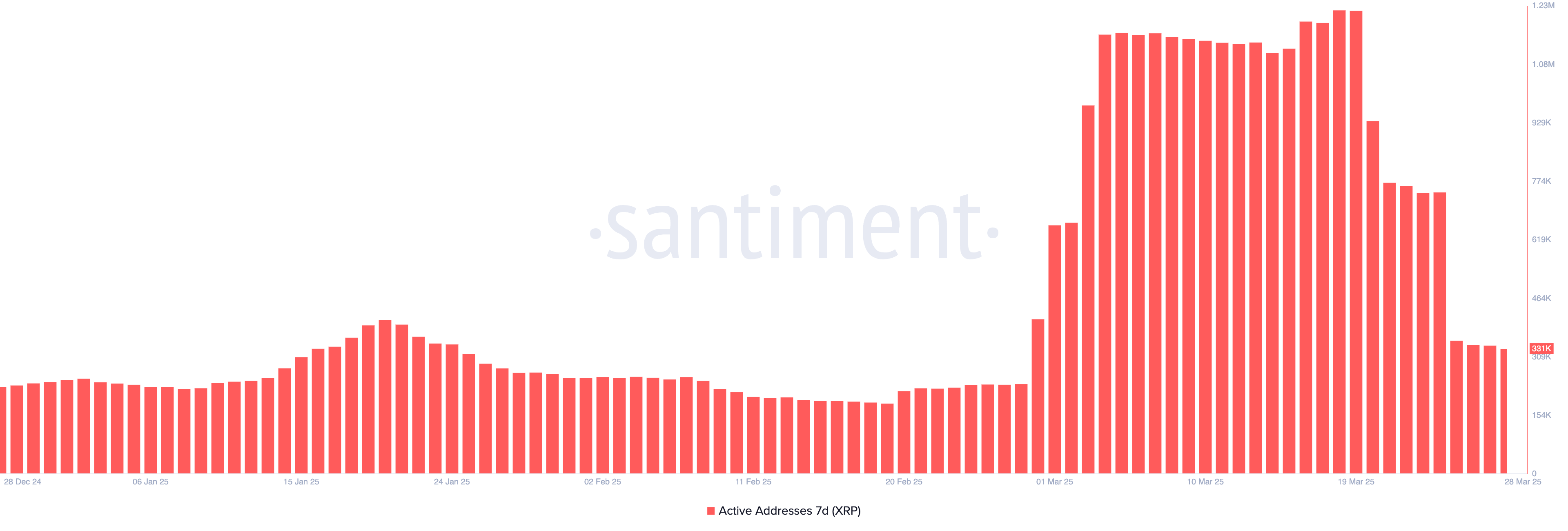

XRP Active Addresses Are Heavily Down

XRP’s 7-day active addresses have seen a sharp decline over the past week, following a recent surge to new all-time highs. On March 19, the metric peaked at 1.22 million, signaling strong network activity and user engagement.

However, since then, it has plummeted to just 331,000—a drop of over 70%. This sudden fall suggests that interest in transacting on the XRP has cooled off significantly in a short span of time.

Tracking active addresses is a key way to gauge on-chain activity and overall network health. A rising number of active addresses typically reflects growing user participation, increased demand, and potential investor interest—factors that can support price strength.

Conversely, a sharp decline like the one XRP is currently experiencing can point to weakening momentum and fading interest, which could put additional pressure on price.

Unless user activity begins to rebound, this drop in network engagement may continue to weigh on XRP’s short-term outlook.

XRP Could Drop Below $2 Soon

XRP’s Exponential Moving Average (EMA) lines are currently signaling a strong downtrend, with the short-term EMAs positioned below the longer-term ones—a classic bearish alignment.

This setup indicates that recent price momentum is weaker than the longer-term average, often seen during sustained corrections. If this downtrend continues, XRP could retest the support level at $1.90.

A break below that could open the door to a deeper drop toward $1.77 in April.

However, if market sentiment shifts and XRP price manages to reverse course, the first key level to watch is the resistance at $2.22.

A successful breakout above this point could trigger renewed bullish momentum, potentially driving the price up to $2.47.

If that level also gets breached, XRP could push further to test the $2.59 mark.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin21 hours ago

Altcoin21 hours agoDid XRP Price Just Hit $21K? Live TV Display Error Goes Viral

-

Altcoin15 hours ago

Altcoin15 hours agoPepe Coin Whale Sells 150 Billion Tokens, Price Fall Ahead?

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Breakdown, Analyst Eyes $1,130–$1,200 Price Target

-

Market14 hours ago

Market14 hours agoXRP Falls 12% in a Week as Network Activity Declines

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin Price Could Surge To $95,000 — But Analyst Sounds ‘Bull Trap’ Alarm

-

Market20 hours ago

Market20 hours agoDark Web Criminals Are Selling Binance and Gemini User Data

-

Market17 hours ago

Market17 hours agoVitalik Buterin Promotes Ethereum Layer 2 Roadmap

-

Altcoin17 hours ago

Altcoin17 hours agoExpert Predicts Listing Date For WLFI’s USD1 Stablecoin, Here’s When