Market

Crypto Airdrops to Watch: SupraOracles, Aptos, Scroll, Eclipse

The crypto market continues to show strength, with Bitcoin eyeing the $70,000 psychological level. Amidst the broader market optimism, well-informed investors are now eyeing crypto airdrops as a potentially lucrative avenue.

For investors and crypto enthusiasts, these airdrops offer the chance to acquire new tokens and join the vibrant crypto communities. Airdrops aim to distribute free tokens while attracting new followers and expanding user bases. This week, there are four significant airdrops to watch.

SupraOracles: Countdown to Blast off

SupraOracles is airdropping free SUPRA tokens after the Snapshot on October 21. The fundraiser raised $26.52 million, and participants included Coinbase Ventures, HashKey Capital, Animoca Brands, and HTX Ventures.

Users who completed simple airdrop tasks, including participating in the airdrop campaign and completing tasks, can now see the eligible tokens. The users can also select a token claim plan to confirm the token claim method, with participants that fail to choose expected to be enrolled into a 30-month vesting plan automatically.

Read more: What are Crypto Airdrops?

Additionally, SupraOracles has unleashed another activity named Supra Starcade, with 250 million SUPRA tokens allocated. It comes amid a bigger prize pool and more user transactions. Participants will have to guess the prices of different tokens, and all activities will take place in the test network.

Following an October 19 snapshot, new developments have emerged in the Scroll airdrop. The project recently raised $80 million in a fundraiser led by Polychain Capital, with participation from Variant, IOSG, and Bain Capital Crypto. This brings the Scroll airdrop closer to fruition.

The momentum comes after the listing of Scroll’s SCR token on Binance’s launch pool, setting the stage for formal community rewards. The SCR token will debut on major cryptocurrency exchanges on Tuesday, October 22, alongside the launch of the claim portal, allowing farmers to redeem the airdrop.

The airdrop will likely be based on marks accumulated by various Ethereum addresses. On-chain footprint criteria will also be used to filter out Sybil attackers and bots. As reported by BeInCrypto, 1 billion SCR tokens will be available, with 15% allocated to the airdrop, split into two phases of 7% and 8%.

Despite this, community sentiment around the airdrop appears sour. Concerns have arisen about the team’s ability to offer substantial rewards to over 2 million active addresses. Additionally, speculation suggests that some insiders may have unfairly accumulated large amounts of marks.

“Scroll team is so greedy! After allocating %23 to themselves, they also chose to sybil the airdrop by allocating team addresses 1m+ marks each,” said Anon Vee, a crypto investor and trader on X.

Eclipse: Blockchain Infrastructure Token Watchlist

Eclipse, the first Ethereum Layer-2 solution powered by Solana Virtual Machine (SVM), has raised $65 million from investors including Polychain Capital and Delphi Ventures. Tribe Capital, Hack VC, and Placeholder Ventures also co-led contributions.

Although the reward date remains uncertain, Eclipse is among the potential airdrops expected this week. To participate, users will need to mint NFTs as the project’s mainnet or official bridge becomes operational.

“To honor this milestone, claim “Path of Discovery”, a commemorative NFT designed by Nio on Scope. Mint is open for 7 days,” Eclipse wrote.

Notably, participants must add the Eclipse network to their wallets before minting the NFTs, with the bridge allowing a minimum of 0.002 ETH per transaction.

Aptos: Production Ready Blockchain

In the pursuit of new projects, airdrop farmers could forget about existing giants like Aptos. Based on the project’s tokenomics, 51% of tokens are allocated for community rewards. The airdrop also comes as a celebration of the second anniversary of the launch of the mainnet.

Against these backdrops, Aptos has raised $350 million in a fundraiser co-led by Binance Labs, Andreessen Horowitz (a16z), DragonFly Capital, FTX Ventures, and Jump Crypto. Other participants include Coinbase Ventures, Circle, and Multicoin Capital.

With this, it also passes as a potential airdrop with participation involving NFT minting. Aptos released a limited edition NFT to celebrate the second anniversary of the launch of the mainnet.

“Cheers to Two Years! If you’re here, you’re early to celebrate the 2nd Anniversary of Aptos Mainnet, we’ve released a commemorative AptosTwo NFT—available for a limited time. Mint yours today and tell all your friends you were first,” Aptos shared.

Read more: Best Upcoming Airdrops in 2024

While it did not indicate whether there will be an airdrop for this NFT, the mint is free and can give bonuses from Aptos, as well as projects from the Aptos ecosystem.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Don’t Fall for These Common Crypto Scams

ZachXBT, a well-known blockchain investigator, recently shared two key “minimum checks” on Telegram to avoid crypto scams.

He emphasized that users must accept full financial responsibility if they take risks in these situations and added that recovering lost funds would be extremely difficult.

Evaluating a Project’s Credibility is Crucial

ZachXBT highlighted two critical scenarios: depositing funds into forked DeFi protocols on newly launched EVM chains and getting scammed by projects with few smart followers on Kaito.

“If you make either of these decisions, it is your own personal choice to risk funds, and I will NOT help you,” ZachXBT stressed.

Many newly launched DeFi protocols on EVM chains are replicas of existing ones. Their teams often do not create original code but instead, fork from established protocols. This process requires minimal technical skills yet introduces significant security risks.

A recent incident highlighted the risks in the DeFi space. The DeFi protocol SIR.trading was reportedly hacked, leading to an estimated loss of $350,000. Despite the project’s documentation promoting it as a “new DeFi protocol for safer leveraged trading,” it acknowledged the risks related to smart contract vulnerabilities.

This case illustrates how new DeFi protocols often become targets for hackers. Additionally, in late March, the DeFi lending protocol Abracadabra suffered a loss of approximately $13 million due to an exploit involving collateralized tokens.

The second situation ZachXBT warned about involves getting “rugged” (falling victim to a rug pull) by projects with few smart followers on Kaito. Kaito is an AI-powered analysis tool that measures real community interest. He advised that checking followers’ numbers and quality is a basic step to avoid falling for projects that use fake engagement or empty marketing hype.

Investor Xero agreed with ZachXBT, stating that Kaito can be a credibility assessment tool.

“Kaito has become an amazing security and reputation tool that I value over others. It can help you identify an impersonator or a new rug project fast. If a 40k+ follower project isn’t connecting with real smart followers, it’s not legit,” Investor Xero commented.

Other Emerging Crypto Scams

In addition to ZachXBT’s warnings, several new scam tactics have recently been flagged.

Investor Jerome warned about a scheme that exploits browsers’ automatic download function to trick users into downloading malicious software.

Another method involves scammers creating and sending small transactions. They would be often as little as 0.001 tokens—using fake wallet addresses that closely resemble legitimate ones. Their goal is to deceive users into copying and pasting the fraudulent address when making future transactions.

Additionally, Microsoft has identified StilachiRAT, a new remote access trojan specifically designed to target cryptocurrency wallets and login credentials.

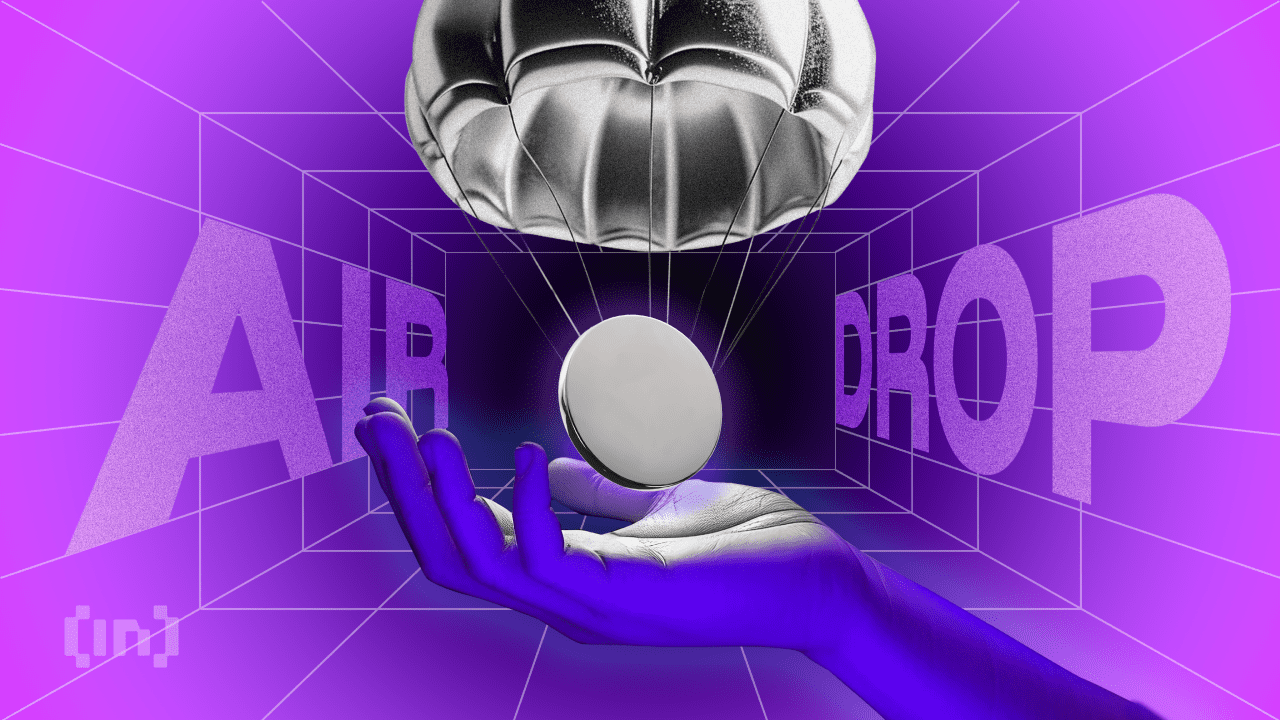

According to a Chainalysis report, from 2021 to 2024, decentralized finance (DeFi) platforms have been the primary targets of crypto hacks.

The report explains that DeFi platforms may be more vulnerable because developers prioritize rapid growth and launch over security measures. This lack of security focus makes them prime targets for hackers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This Is How Dogecoin Price Reacted To Elon Musk’s Comment

Dogecoin has faced a series of setbacks recently, including a failed breakout attempt that led to a decline in its price. This downward movement was further exacerbated by a recent comment from Elon Musk, which cast doubt on Dogecoin’s future.

However, despite these challenges, the altcoin is showing some signs of recovery, largely driven by long-term holders (LTHs) who accumulate more DOGE at current low prices.

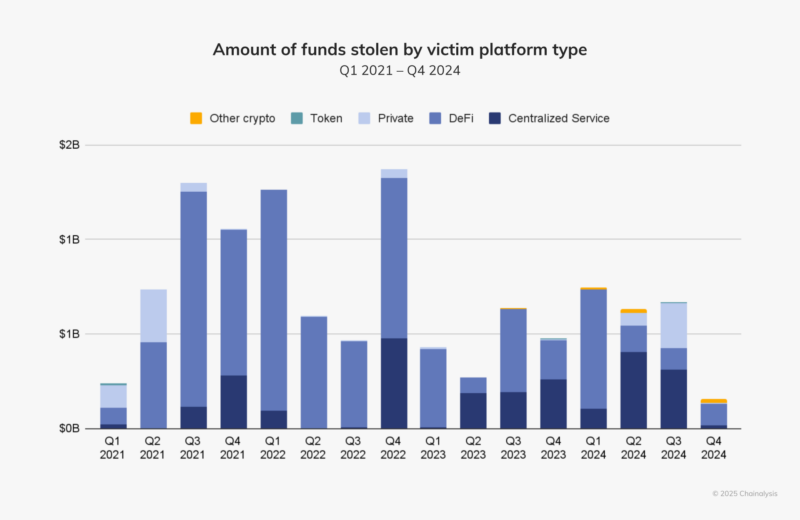

Dogecoin Is Facing Mixed Signals

Dogecoin’s Network Value to Transaction (NVT) ratio has spiked significantly, reaching a three-month high. This suggests that the network’s value does not match the number of transactions, pointing to a possible lack of investor confidence.

Elon Musk’s recent comment regarding DOGE further fueled the discourse surrounding the cryptocurrency. He clarified that the US government does not intend to use Dogecoin in any form, which led to some negative sentiment. This statement dampened expectations for the coin, although it hasn’t completely derailed its market standing.

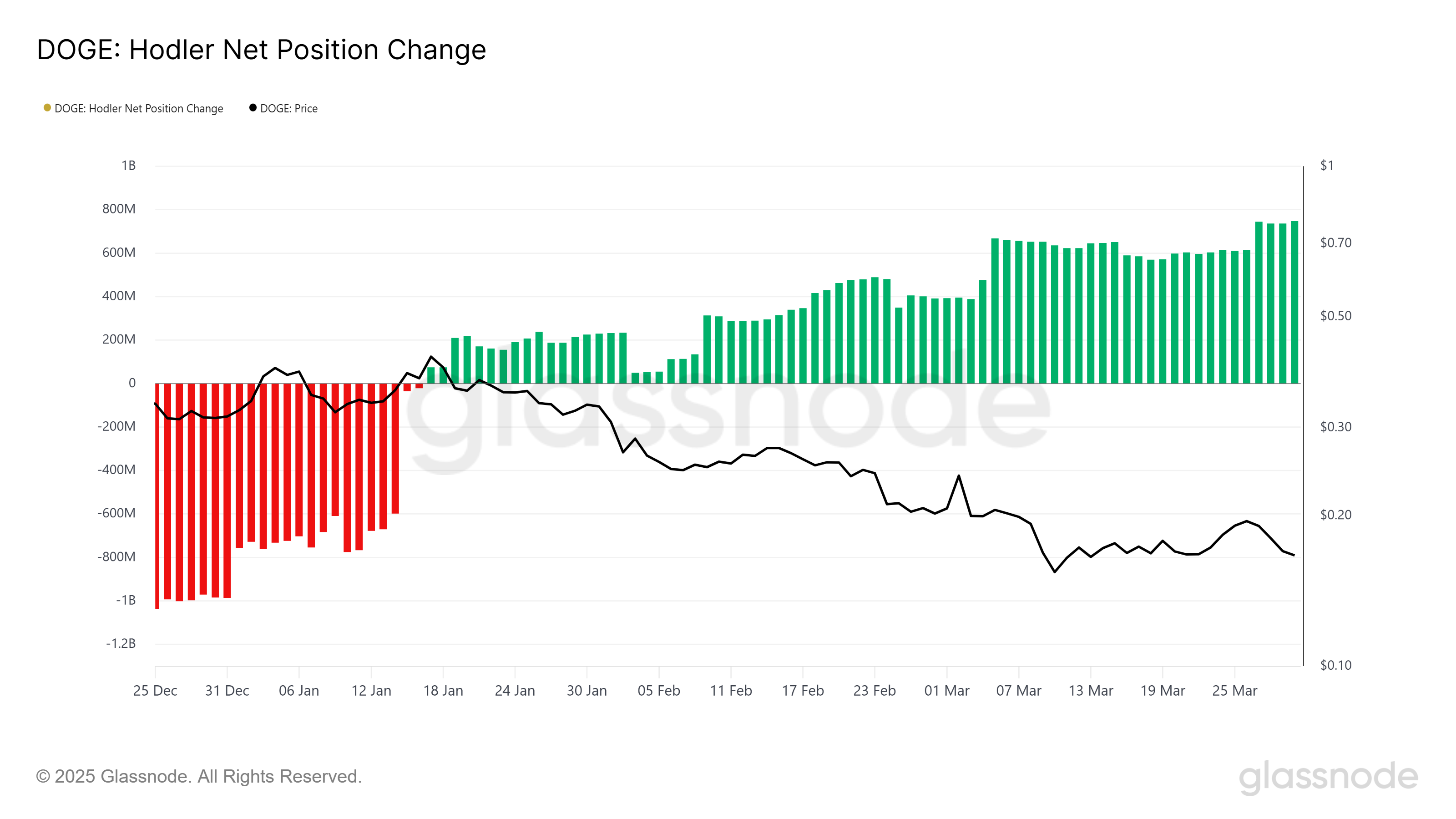

The macro momentum of Dogecoin shows signs of stabilizing, as evidenced by the recent spike in the HODLer Net Position Change. LTHs have been actively accumulating DOGE during the recent dip, which indicates strong conviction among these holders.

This accumulation provides a level of support, potentially helping the coin recover and preventing further price declines. The increased position change suggests that LTHs are confident in the long-term viability of Dogecoin despite recent market turbulence and Musk’s controversial comment.

This continued accumulation by LTHs could lead to a floor forming under Dogecoin’s price, providing a buffer against further bearish pressures. As the market stabilizes and sentiment shifts, these holders could become a driving force that will trigger the next upward movement.

DOGE Price Stumbles, But Can It Recover?

Dogecoin is currently trading at $0.163, with the price just below the support level of $0.164. Over the last five days, the coin has experienced a 16% decline following a failed attempt to break through the $0.198 resistance level. This failure to breach key resistance levels indicates that DOGE may not experience immediate price gains without external catalysts.

Given the current market conditions, it’s likely that Dogecoin will not experience significant declines in the near future. The coin may reclaim $0.164 as support and continue consolidating just below the $0.198 resistance. However, this consolidation could persist until stronger market cues emerge to push the price higher.

The only scenario in which this bullish-neutral outlook would be invalidated is if Musk’s comment causes further damage to DOGE’s price. In that case, the meme coin could dip to $0.147, extending its recent losses. A sustained downturn would signal more negative sentiment in the market and potentially halt Dogecoin’s recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Nears $80,000; Fuels Death Cross Potential

Bitcoin’s recent price action has shown some concerning signs. The crypto king has failed to break through key resistance levels, leaving it vulnerable to further declines.

As Bitcoin inches closer to testing the $80,000 support level, the potential for a Death Cross looms, increasing bearish sentiment in the market.

Bitcoin Investors Are Skeptical

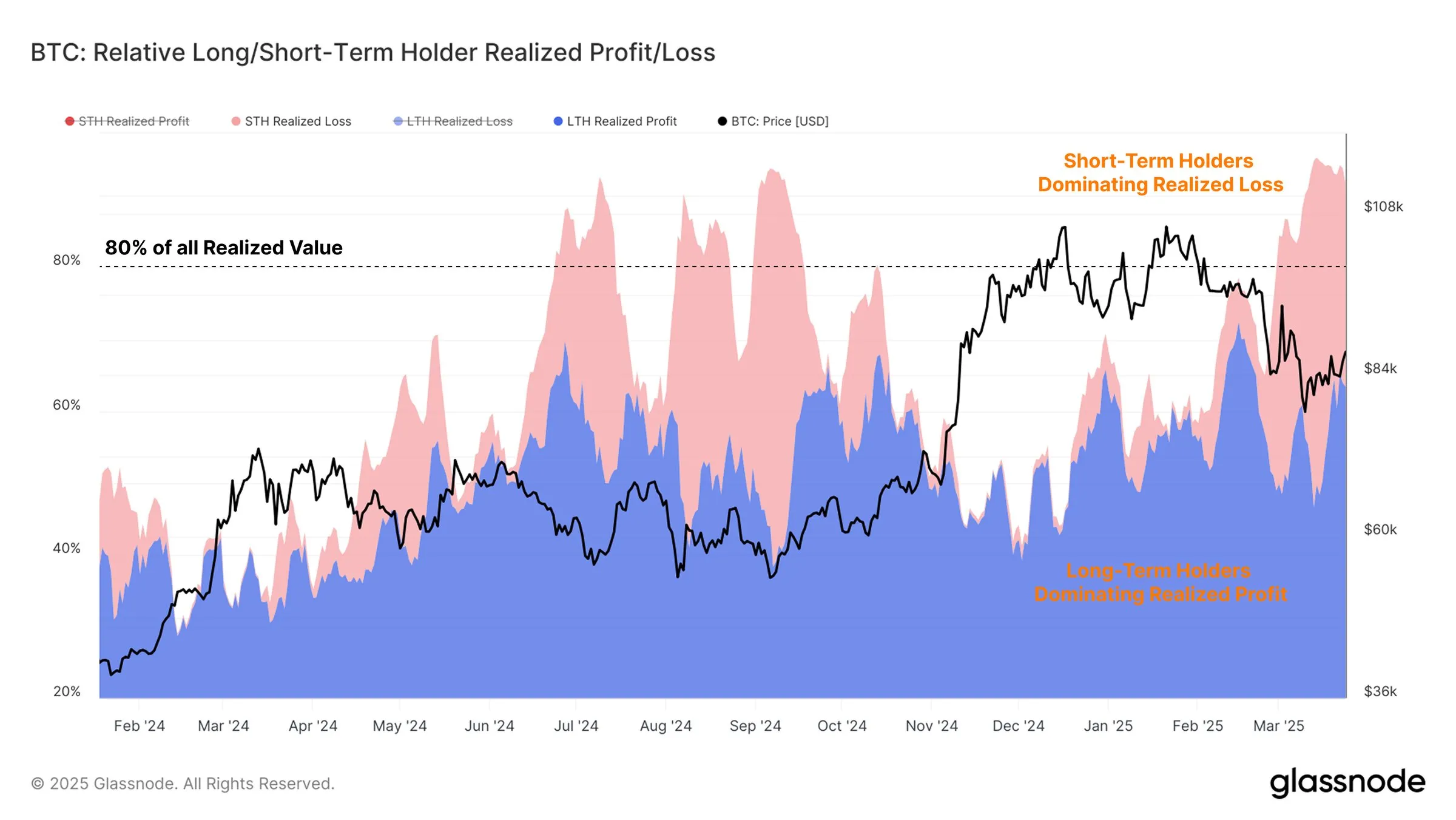

Short-Term Holders (STHs), who buy at higher prices, are primarily responsible for the ongoing losses. These investors have been actively noting losses in response to Bitcoin’s volatile market conditions, reflecting the unpredictable environment that has made it difficult for new investors to navigate.

Meanwhile, Long-Term Holders (LTHs) continue to realize profits, benefiting from their extended market presence. However, the current market conditions show stagnation in new capital inflows, with LTH profits offset by STH losses. This creates weaker demand and resistance, signaling a potential slowdown in price momentum.

Maintaining bullishness in the market typically requires consistent capital inflows, but the market now seems to be lacking that crucial support. The overall sentiment reflects a neutral stance, with both profit-taking and loss-realization balancing out.

The crypto king’s macro momentum is showing additional signs of bearish pressure, particularly with the Exponential Moving Averages (EMAs). The 200-day EMA is less than 3% away from crossing the 50-day EMA, which would result in a Death Cross. This technical pattern has historically signaled significant corrections in price, marking a potential end to Bitcoin’s 18-month-long Golden Cross.

As the EMAs approach this critical point, traders and investors are closely watching for any signs of a correction. The fear of a Death Cross brings further concern to Bitcoin’s price stability. If the 50-day EMA crosses below the 200-day EMA, it could trigger more sell-offs, intensifying the bearish sentiment in the market.

Is BTC Price Primed For Further Decline?

Bitcoin is currently trading at $82,248, nearing the key psychological support level of $80,000. Despite attempts at a breakout, Bitcoin has failed to move beyond the two-month-long broadening descending wedge pattern. This pattern suggests that Bitcoin could be on the brink of further decline.

If the downward momentum persists, Bitcoin is likely to fall through the $80,000 support level and approach $76,741. This scenario would reinforce the bearish outlook, especially considering the technical indicators and the lack of strong buying support. A breakdown below these levels could signal a deeper correction, with the potential for further declines.

However, this short-term bearish thesis can be invalidated if Bitcoin’s price manages to reclaim $82,761 as support. If Bitcoin breaks through the $85,000 barrier, it could break out of the current pattern, signaling a potential reversal. A strong rally above $86,822 would suggest a resumption of the bullish trend, invalidating the bearish momentum that currently dominates the market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Analyst Eyes $1,200-$1,300 Level As Potential Acquisition Zone – Details

-

Ethereum21 hours ago

Ethereum21 hours agoWhales Accumulate 470,000 Ethereum In One Week – Bullish Momentum Ahead?

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum May Have Hit Cycle Bottom, But Pricing Bands Signal Strong Resistance At $2,300

-

Bitcoin22 hours ago

Bitcoin22 hours agoGold Keeps Outperforming Bitcoin Amid Trump’s Trade War Chaos

-

Market17 hours ago

Market17 hours agoTop 3 Made in USA Coins to Watch This Week

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum MVRV Ratio Nears 160-Day MA Crossover – Accumulation Trend Ahead?

-

Market22 hours ago

Market22 hours agoBitcoin (BTC) Whales Accumulate as Market Faces Uncertainty

-

Altcoin21 hours ago

Altcoin21 hours agoAnalyst Reveals Why The XRP Price Can Hit ATH In The Next 90 To 120 Days