Market

SUI, NEIRO, and Rexas Finance (RXS): Top trending tokens today as RXS launches on CoinMarketCap

The cryptocurrency market is on fire right now, but three tokens in particular are gaining investors’ enthusiasm: SUI, NEIRO, and Rexas Finance (RXS). Each of these tokens has been doing well of late, but Rexas Finance could be the best option for those who want to invest in the tokenization of real-world assets (RWAs). With its recent addition to CoinMarketCap and a successful presale, Rexas Finance seems to be growing rapidly and may become the next crypto sensation.

SUI: A new high

SUI has been a great revelation in the world of crypto since it has sustained above its all-time high of $2.18. This rather remarkable leap was preceded by a 400% surge from the support area located at $0.50. There is sustained interest by investors and confidence that SUI will grow during those times; to the market, it is a growth supporting intrinsic value determination. Today’s marketplace boasts of one of the superior tokens and there is aggressive buying from the investors.

This is not just a once-off occasion during SUI’s upward trending cycle; rather it shows the ability of the token to ride on market dynamics and market appetite. For those who want to add miscellaneous assets to their investment collection, SUI is a good offer with its growth rate being that of high competition.

NEIRO: The 6,900% surge

Another altcoin gaining attention is NEIRO, which opened at $0.00000033, and over time raised by an extraordinary 6,900% selling for $0.002177. This sharp spike can be attributed to growing confidence in NEIRO, as people are rushing to exploit the apparent growth opportunity. Demand is sufficiently increasing that it is pushing the token higher in the ranking of hottest tokens at the moment.

The volatility of the contemporary market reveals the performance of NEIROs. It positions itself as an example of how early investments in tokens can pay off considerably. NEIRO is a digital asset that is on the rise and this is a trend that every investor should look out for.

Rexas Finance (RXS): The RWA powerhouse

With the gains of SUI and NEIRO, other projects like Rexas Finance are steadily growing and creating a presence in the real-world assets sector. Last week, RXS’s price jumped 108%, hitting an all-time high of $0.060 in comparison to the Initial Coin Offering Price which was at $0.030. With more than 160,000 potential investors, Rexas Finance has been able to raise $3.4 million in its presale.

The project aims to make the process of tokenization of real assets as simple and as democratic as possible making it possible for the investors to access the markets which up to now they have been unable to do. Using this way, the visibility of the RXS token further increases, since it is listed on CoinMarketCap further increasing growth opportunities. The RXS token allows for ERC-20, ERC-721, and ERC-1155 among other forms of the tokens. All in all, that means there is more room for investors, with a total supply of 1 billion RXS tokens of this wonder.

Exciting giveaway for early investors

To further attract potential early investors, Rexas Finance is giving away $1,000,000 towards this project’s presale. 20 fortunate participants will each receive a huge amount of $50,000 just for being active participants in the project. This not only makes investing in RXS even more appealing to prospective investors but also gives investors a glimpse at Rexas Finance’s resolve to reward its community.

Conclusion: Join the trend

Whereas chronicled as impressive performers, SUI and NEIRO, Rexas Finance is quickly becoming a strong player in RWA tokenization. With a recent CoinMarketCap listing, commendable presale, and awesome giveaway, Rexas is set for greater achievements with RXS within the short term. Investors looking for new opportunities in today’s crypto market should pay attention to RXS. The RWA asset focus helps Rexas Finance stand out as one of the strongest investment options available in crypto today.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Market

Why Ethereum Price May Fall Under $3,000

Ethereum (ETH) is currently facing significant downward pressure, with its price declining by 3% over the past 24 hours. This bearish trend could push ETH’s price below the critical $3,000 price level.

This analysis examines the factors contributing to this likelihood.

Ethereum Sellers Re-Emerge

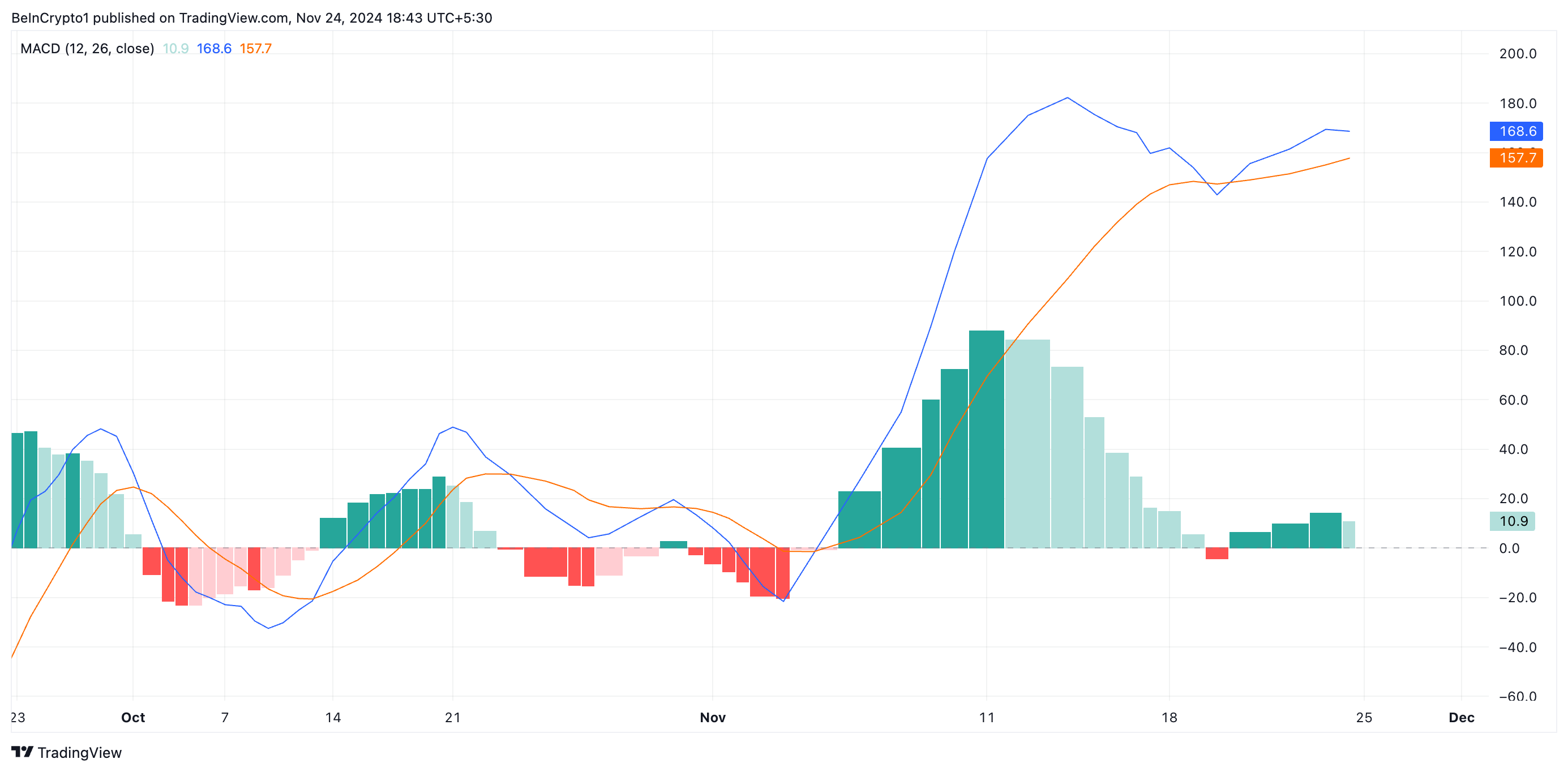

An assessment of the ETH/USD one-day chart has revealed that the coin’s moving average convergence divergence (MACD) indicator is forming a potential death cross. As of this writing, the coin’s MACD line (blue) is attempting to fall below its signal line (orange).

This indicator measures an asset’s price trends and momentum and identifies its potential buy or sell signals. A MACD death cross occurs when the MACD line (the shorter-term moving average) crosses below the signal line (the longer-term moving average), indicating a bearish trend or momentum reversal. This signal suggests that selling pressure is increasing, and the asset’s price could decline further.

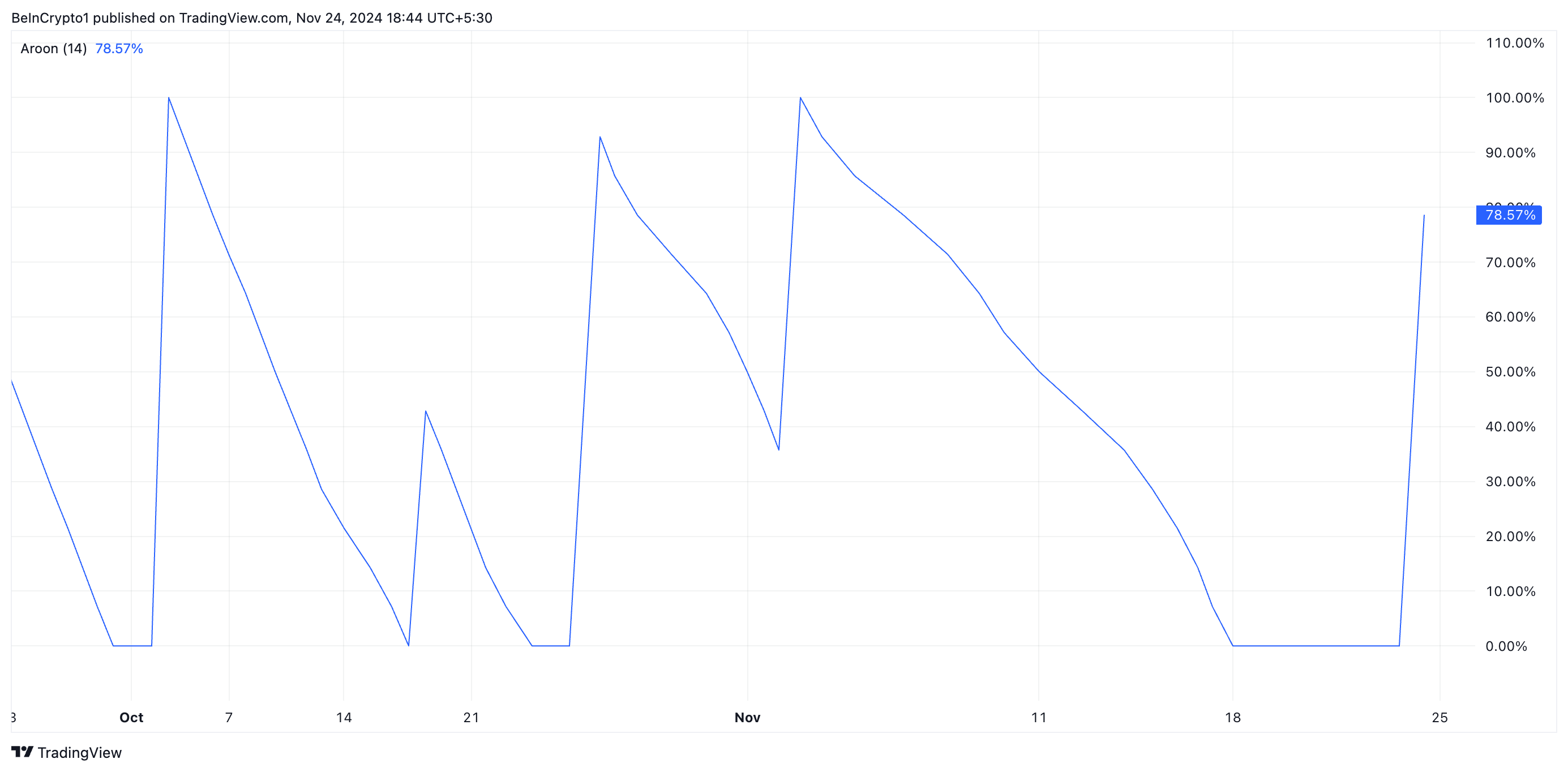

ETH’s rising Aroon Down Line confirms this strengthening bearish pressure. It currently sits at 78.57%, confirming that the decline in ETH’s price is gaining momentum.

The Aroon Indicator evaluates the strength of an asset’s price trend through two components: the Aroon Up line, which reflects the strength of an uptrend, and the Aroon Down line, which reflects the strength of a downtrend. A rising Aroon Down line indicates that recent lows are occurring more frequently, signaling growing bearish momentum or the start of a downtrend.

ETH Price Prediction: Key Support Level To Watch

ETH currently trades at $3,333, resting above the support formed at $3,203. This level is crucial because a decline below it will cause ETH to exchange hands under $3000. According to readings from the coin’s Fibonacci Retracement tool, the Ethereum price will drop to $2,970 if this happens.

However, a resurgence in the demand for the leading altcoin will invalidate this bearish thesis. If this occurs, Ethereum will rally toward $3,500.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cantor Fitzgerald Deepens Tether Ties With 5% Stake Acquisition

Cantor Fitzgerald, a prominent US financial services firm, is expanding its alliance with Tether, a key player in the digital asset industry and the issuer of the world’s largest stablecoin.

According to reports, the firm has agreed to acquire a 5% stake in Tether as part of a broader collaboration that includes Bitcoin-backed lending initiatives.

Tether Mints $13 Billion USDT as Cantor Fitzgerald Deepens Tie

The acquisition talks, reportedly finalized in 2023, valued the 5% stake at approximately $600 million. This partnership positions Tether to gain strategic advantages, particularly as Cantor Fitzgerald’s CEO, Howard Lutnick, takes on his new role as Secretary of Commerce under President-elect Donald Trump.

Market observers suggest that the nomination raises the possibility of enhanced regulatory support for Tether, which has faced scrutiny over potential violations of sanctions and anti-money laundering regulations—a claim the company has denied. However, Lutnick has promised to step down from his positions at Cantor Senate confirmation.

Beyond the ownership stake, Tether is expected to support Cantor Fitzgerald’s Bitcoin lending program, a multi-billion-dollar initiative. The program aims to offer loans backed by Bitcoin, initially funded with $2 billion, with plans for significant future expansion.

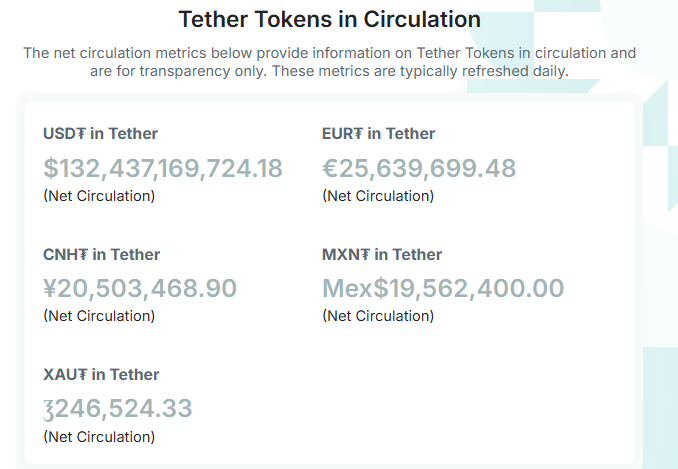

Meanwhile, Cantor Fitzgerald is already a critical partner for Tether, reportedly holding a significant portion of the stablecoin issuer’s $134 billion reserves in US Treasury bills.

As Cantor Fitzgerald deepens its involvement with Tether, the firm has continued its aggressive token minting. On November 24, blockchain analytics platform Lookonchain reported that stablecoin company minted an additional $3 billion USDT, bringing the total minted since November 8 to $13 billion. This expansion has pushed the total supply of USDT to approximately $132 billion.

The increased USDT supply may reflect the growing demand for stablecoins, often used to hedge market positions or facilitate crypto transactions without converting to fiat. This liquidity influx could reduce volatility and enhance price stability across the digital asset market.

This surge in USDT supply coincides with a broader market rally led by Bitcoin and other assets such as Dogecoin and Solana, signaling renewed investor confidence in the crypto ecosystem.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can the SAND Token Price Rally Be Sustained?

SAND, the token powering the metaverse platform The Sandbox, has seen a meteoric rise, surging 55% in the past 24 hours. This performance far outpaces leading assets like Bitcoin and Ethereum, which each gained just 1% during the same period. SAND’s trading volume has also skyrocketed, surpassing $1.91 billion — a climb of over 500% in 24 hours.

On-chain data has shown a significant increase in daily SAND transactions and a decrease in selling pressure. These factors suggest the potential for a sustained rally.

The Sandbox Holders Adopt a Bullish Approach

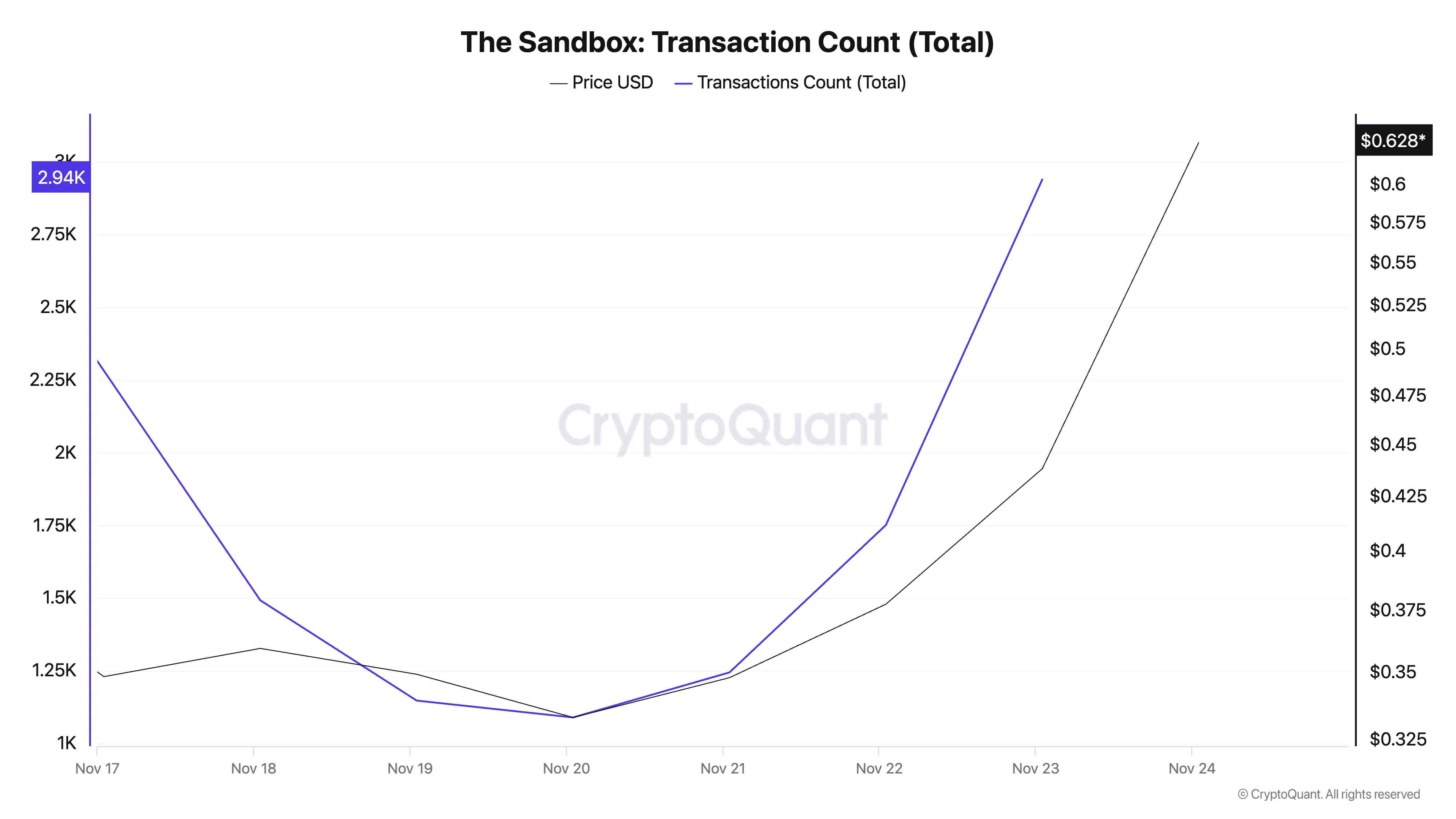

According to CryptoQuant’s data, the daily count of SAND transactions has rocketed over the past few days. For context, on November 23, 2,940 transactions involving SAND were completed, representing the highest count over the past seven days.

This is a bullish signal for the metaverse-based token because a surge in an asset’s transaction count indicates increased activity and interest. It signals higher demand and participation by market participants. Also, it suggests growing confidence in SAND’s price, potentially driving it further upward.

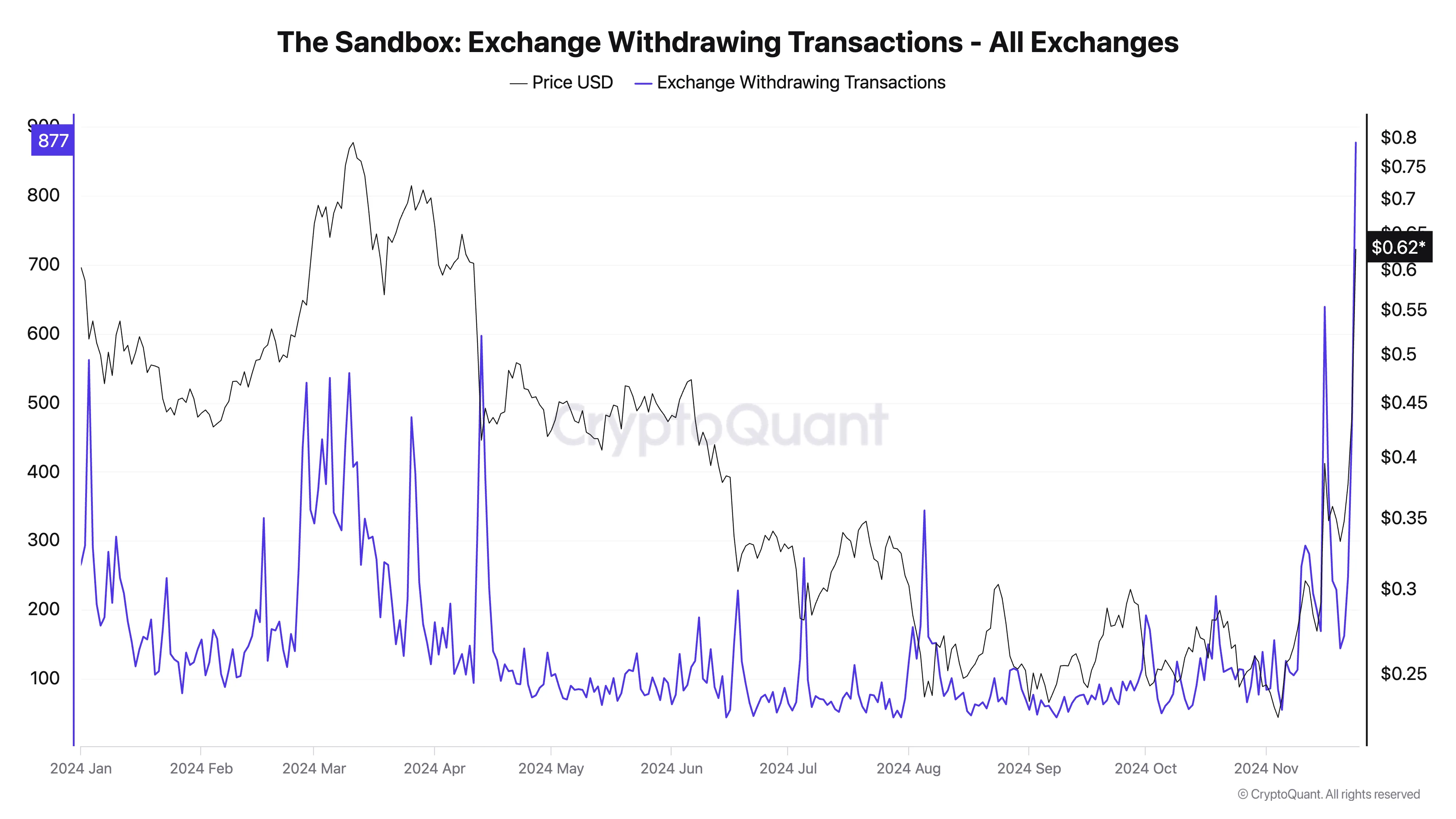

Additionally, a notable increase in exchange withdrawals for SAND has been observed. Per CryptoQuant’s data, the token’s exchange withdrawal transactions currently total 877, its single-day highest since June 2023.

The exchange withdrawing transaction metric tracks the number of cryptocurrency withdrawals from exchanges. A spike in this metric indicates that investors are moving their assets off exchanges. This is a bullish signal, suggesting increased confidence and a potential long-term holding trend.

SAND Price Prediction: Rally Above $0.66?

On the daily chart, SAND is trading at $0.61, a level last seen in April. Its price currently sits below the resistance at its cycle peak of $0.66. If bullish momentum strengthens, SAND could rally toward this peak and reclaim it.

Conversely, if bullish sentiment wanes and selling pressure strengthens, the SAND token price may plunge toward support at $0.56, invalidating this bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin14 hours ago

Altcoin14 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Market24 hours ago

Market24 hours agoKraken Eyes Token Expansion as Trump Promises Crypto Support

-

Altcoin24 hours ago

Altcoin24 hours agoXRP Price To $28: Wave Analysis Reveals When It Will Reach Double-Digits

-

Market23 hours ago

Market23 hours agoXRP To Hit $40 In 3 Months But On This Condition – Analyst

-

Market11 hours ago

Market11 hours agoWhy a New Solana All-Time High May Be Near

-

Bitcoin9 hours ago

Bitcoin9 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?

-

Market22 hours ago

Market22 hours agoExploring Hottest New Coins: FINE, CHILLGUY, and CHILLFAM

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin Price To $100,000? Here’s What To Expect If BTC Makes History