Market

Why Maker (MKR) Price May Extend Its Fall

MKR, the governance token of the leading stablecoin lender MakerDAO, has experienced a sharp decline in recent weeks. It currently trades at $1,206, noting an 11% price drop over the past week.

The altcoin now trades at its lowest price since September 2023. If the downward trend continues, MKR’s price could fall below $1,000 for the first time since 2023. This analysis explains why.

Maker Holders May Be in Trouble

Since August, MKR has traded below its Ichimoku Cloud. This indicator tracks the momentum of its market trends and identifies potential support/resistance levels.

Read More: What Are Tokenized Real-World Assets (RWA)?

When an asset’s price falls below it, it signals a shift from a bullish to a bearish trend. If the price consistently stays beneath this cloud, it strengthens the downtrend. It suggests that a recovery above the cloud may be challenging unless driven by a significant increase in new demand.

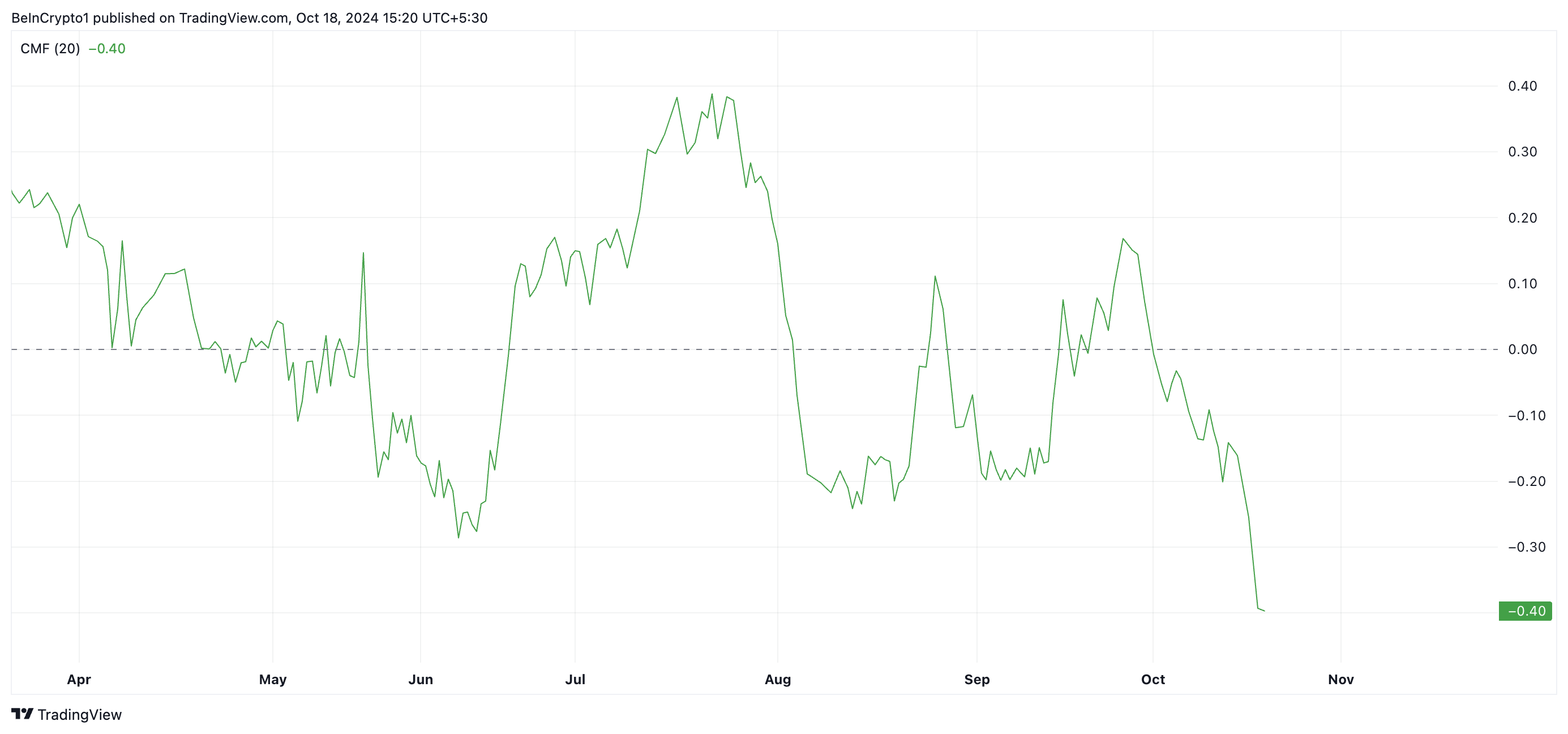

However, such new demand has been lacking in the MKR market for several weeks, as evidenced by its plummeting Chaikin Money Flow (CMF). This indicator, which measures how money flows into and out of an asset, is at -0.40, MKR’s lowest since August 2022.

When an asset’s CMF drops along with its price, it indicates weakening buying pressure and growing selling momentum. This alignment between price decline and a falling CMF reinforces the bearish outlook in the market. It signals that capital is flowing out of the asset, making a recovery less likely without a shift in market sentiment.

MKR Price Prediction: Sentiment Has To Shift

As of this writing, MKR is trading at $1,206. Based on readings from the altcoin’s Fibonacci Retracement tool, with the increasing selling pressure, MKR’s price could fall toward $511, marking its lowest level since May 2023.

Read More: Maker (MKR) Price Prediction 2023/2025/2030

However, this downward projection could be invalidated if market sentiment shifts from bearish to bullish. In that case, MKR’s price may attempt to break through the resistance levels formed by its Ichimoku Cloud at $1,954 and $2,632. A successful breakout could set the stage for a potential rally toward a six-month high of $4,118.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Grayscale Altcoins, Tesla’s Bitcoin, and More

This week in the crypto market, Bitcoin’s price surpassed $68,000, and the market capitalization returned to over $2.28 trillion.

BeInCrypto noted special investor interest in events such as Grayscale’s review of 35 altcoins for potential investment products and investors’ expectations of an altcoin season ahead of the US elections.

Additionally, Miles Deutscher has suggested several altcoins, claiming they might have a strong growth potential. The community is also paying attention to Craig Wright’s legal plans and Tesla’s Bitcoin movements.

Grayscale Unveils 35 Potential Altcoins

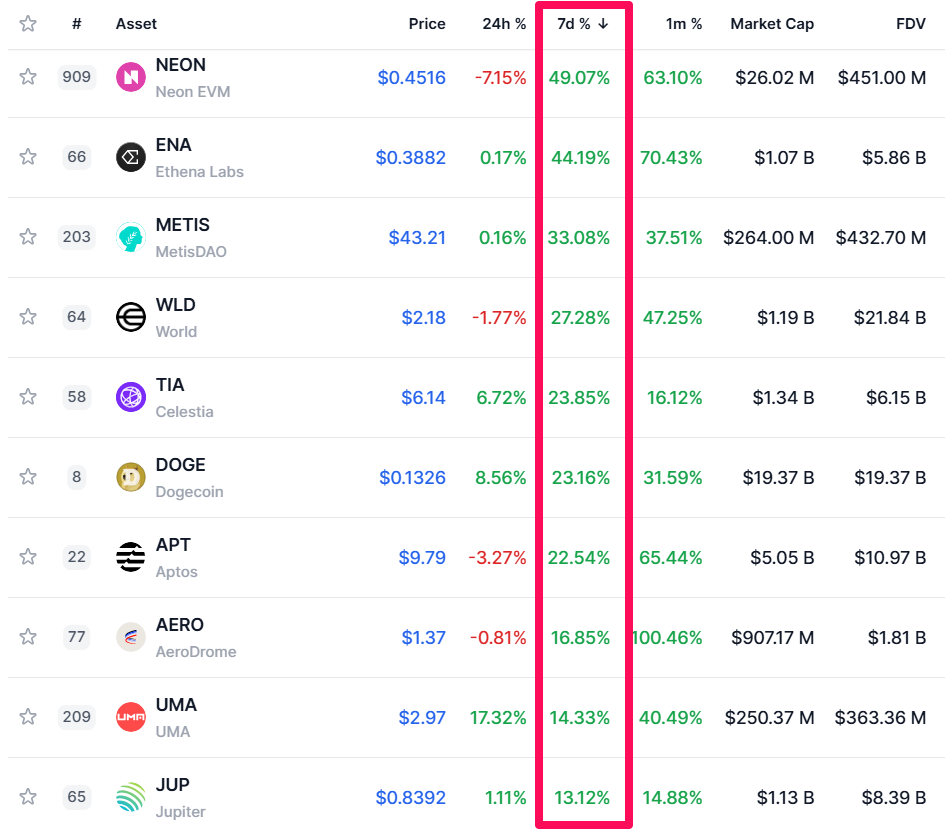

Earlier this week, Grayscale announced a list of 35 altcoins under consideration for future investment products. Following the announcement, many of these altcoins experienced significant price increases over the week. The top 10 altcoins on the list saw gains ranging from 13% to 49%.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Thirty of the 35 altcoins enjoyed a green week, with only Kaspa (KAS) and Helium (HNT) facing notable declines of -4% and -7.4%, respectively.

“Assets Under Consideration lists digital assets not currently included in a Grayscale investment product but identified by our team as possible candidates for inclusion in a future product,” Grayscale explained.

Additionally, Grayscale filed with the SEC to convert its Digital Large Cap Fund into an ETF, following the success of transforming Bitcoin Trust and Ethereum Trust into spot ETFs.

Miles Deutscher Highlights 4 Altcoins

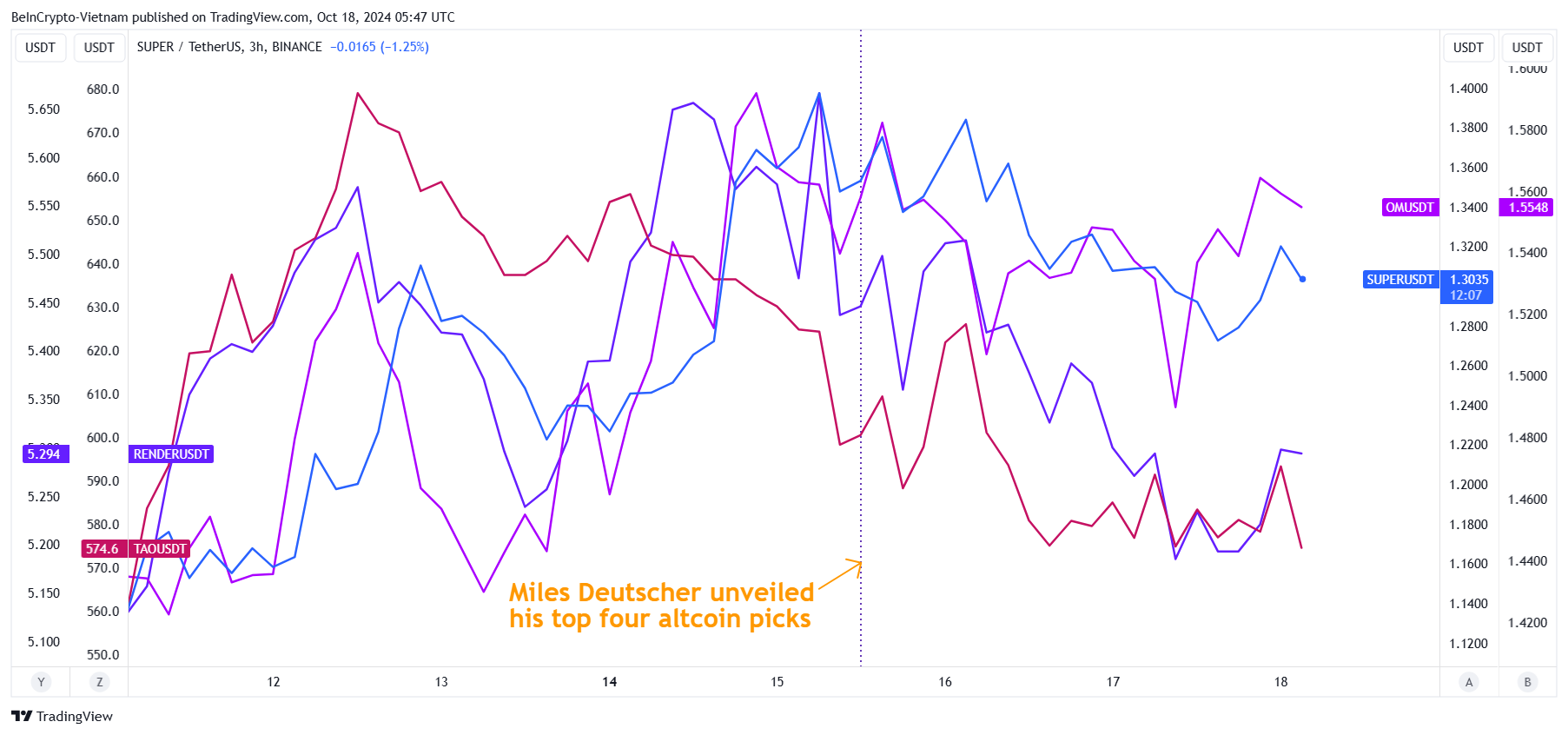

Investor Miles Deutscher introduced four altcoins that he believes could deliver 10x returns. These altcoins focus on GameFi, artificial intelligence (AI), Decentralized Physical Infrastructure Network (DePIN), and real-world assets (RWA) sectors, including:

- SuperVerse (SUPER)

- Bittensor (TAO)

- Mantra (OM)

- Render (RNDR)

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

Since his announcement, the prices of these altcoins have slightly declined, which occurred as Bitcoin Dominance reached a three-year high. Deutscher also commented on meme coins, suggesting they are at a crossroads and may face a short-term correction.

Craig Wright Plans to Sue Bitcoin Core

On October 11, a tracker from the UK High Court revealed that Craig Wright is taking legal action against Bitcoin Core and Square.

Wright, representing himself in the case as a “direct claimant,” is seeking £911 billion ( ~$1.18 trillion) from Bitcoin Core and Square, alleging they misrepresented Bitcoin (BTC) as the true version of the digital asset created by Satoshi Nakamoto.

Additionally, Wright threatened to sue MicroStrategy CEO Michael Saylor for allegedly misrepresenting Bitcoin. The Australian computer scientist is also filing three other legal appeals in the UK, two against the Crypto Open Patent Alliance (COPA) and one targeting Peter McCormack.

Read more: Satoshi Nakamoto – Who is the Founder of Bitcoin?

Altcoin Season Ahead of US Presidential Election?

Throughout the week, several crypto industry experts expressed optimism for altcoin’s price ahead of the US presidential election. Ki Young Ju, CEO of CryptoQuant, suggested that a Trump victory could spur regulatory changes that would trigger an altcoin season.

“If Trump wins, expect regulatory changes, including fee switches enabling token burns for revenue-generating projects,” Ki Young Ju said.

Technical analysts Michaël van de Poppe and CRG also predicted that the altcoin season could begin next month. Echoing these views, Crypto Rover forecasted an impending altcoin season by monitoring Bitcoin Dominance’s movements. Bitcoin Dominance (BTC.D) represents Bitcoin’s share of total market capitalization. Its adjustments often signal an altcoin rally.

Read more: Bitcoin Dominance Chart: What Is It and Why Is It Important?

Tesla Moves Bitcoin Worth Up to $760 Million

This week, Elon Musk’s Tesla unexpectedly moved nearly all of the Bitcoin it had held for the past three years to new wallet addresses. Initially, investors feared Tesla might be preparing to sell the BTC through OTC, but those concerns quickly dissipated as Bitcoin’s price remained unaffected.

“No proof it’s an OTC deal yet. Even if it was, that means someone else bought it so it’s not entirely bearish. Who knows,” Sir Doge of the Coin said.

Read more: Who Owns the Most Bitcoin in 2024?

Many now believe the move was a simple reallocation. In 2021, Musk had stated that Bitcoin payments made to Tesla would be held as Bitcoin, not converted into fiat.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Solana Price May Not Break Its All-Time High in 2024

Despite a strong performance and increasing adoption, Solana’s (SOL) price might fail to break its all-time high this year. This prediction is based on several key indicators that have been crucial in determining the altcoin’s direction.

At the beginning of 2024, SOL’s value was less than $100. Three months later, the altcoin broke the $200 mark. However, since then, it has struggled to reach the milestone, and investors might have to wait until 2025 before seeing the token surpass $260.

Investors Reduce Exposure to Solana

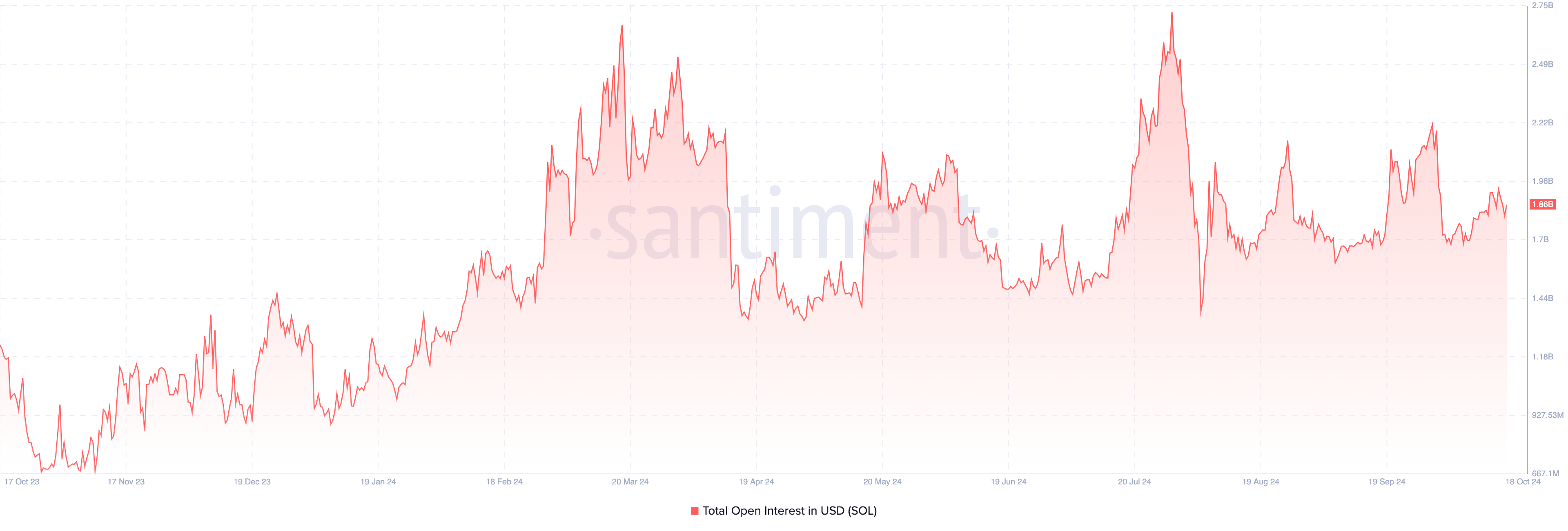

One reason SOL reached $208 was its Open Interest (OI), which is an indicator of speculative activity. At that time, the OI climbed to $2.65 billion. Open Interest refers to the sum of the value of all open contracts in the market.

An increase in open interest, coupled with rising prices, typically signals the buildup of long positions. In most cases, this suggests that the upward trend is likely to continue. However, as of this writing, open interest has dropped by nearly $1 billion, indicating that many traders have reduced their exposure to the cryptocurrency.

From a price perspective, the declining OI, combined with the recent price surge over the past seven days, indicates that the uptrend may be losing momentum. If this trend continues, Solana’s price could struggle to retest the $200 mark before the end of 2024.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

Besides that, one deciding factor has been the $180 supply zone. On several occasions, wherever SOL’s price hits $180, it becomes challenging to rise above the level without substantial buying pressure.

For instance, on April 9, the token hit $180. But a few days later, it lost 23% of its value. Fast-forward to July 30, and a similar thing happened as the altcoin declined by a similar ratio. Therefore, even if SOL tries to hit that point again, it might experience a double-digit decline.

SOL Price Prediction: Sub-130 Still Possible

From a short-term perspective, the Chaikin Money Flow (CMF) has fallen into negative territory. The CMF is a technical oscillator that gauges the level of accumulation or distribution.

When the CMF rises, it signals a high level of accumulation, which can lead to a price increase if sustained. Conversely, a decline in the CMF indicates a higher level of distribution, which could signal potential bearish pressure.

Read more: 13 Best Solana (SOL) Wallets To Consider in October 2024

Due to the CMF’s current condition, Solana’s price might decrease to $127.75. But If the OI increases massively before this quarter ends, the prediction might not come to pass. Instead, SOL could rally above $200.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How DBS Bank is Leading Blockchain in Singapore

DBS Bank, the largest consumer bank in Singapore, is opening its DBS Token Services to institutional clients. This program connects the bank’s functions to an EVM-compatible blockchain, enabling tokenization and smart contracts.

So far, DBS Bank has yet to comment on a possible rollout to non-institutional clients.

DBS Bank’s New Program

DBS Bank, the largest consumer bank in Singapore, announced today via press release that it would introduce blockchain-powered banking. The program, available to institutional clients, is called DBS Token Services, and it includes a variety of new features like tokenization and smart contracts.

Read More: What is Tokenization on Blockchain?

More specifically, DBS Token Services integrates the bank’s payment channels into an EVM-compatible blockchain. This enables several new functions by hooking up the bank’s pre-existing “Treasury Tokens” system to smart contract features, thus allowing clients to program various novel solutions.

“By leveraging tokenization and smart contract capabilities, DBS Token Services enables companies and public sector entities to optimize liquidity management, streamline operational workflows, strengthen business resilience, and unlock new opportunities for end-customer or end-user engagement. It marks a significant step forward in transaction banking,” Lim Soon Chong, Group Head of Global Transaction Services

This is far from DBS Bank’s first foray into the crypto space. Two years ago, the firm opened up crypto trading to its wealthiest clients, which inspired its main competitors to enter the space as well. Additionally, it conducted a brief experiment with the Metaverse last year after it had already lost mainstream interest.

However, considering that this feature was only available to clients with at least $246,000 in investible assets, it does beg the question of whether these services will ever reach private clients. The press release discusses tools for “corporate treasurers” and “public sector entities,” but does not mention non-institutional clients.

Read More: Understanding Smart Contracts: Read, Write, and Audit

Nevertheless, this is still a landmark for crypto’s institutional adoption. DBS Bank has over $200 billion in assets under management, and Singapore has attracted a great deal of interest from the space. If this move inspires its main competitors to start offering similar services, as it did two years ago, the industry as a whole will benefit.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin4 months ago

Altcoin4 months ago2.52 Million Altcoins Are Ruining Crypto’s Future

-

NFT2 months ago

NFT2 months agoAnimoca Brands Valuation Tanks 75% In Two Years, Here’s Why

-

Ethereum4 weeks ago

Ethereum4 weeks agoCrypto exchange BingX hacked for $43 million

-

Ethereum1 month ago

Ethereum1 month agoAre The Big Players Losing Interest?

-

Bitcoin4 weeks ago

Bitcoin4 weeks agoCoinbase cbBTC Set to go Live on Solana

-

Blockchain6 months ago

Blockchain6 months agoHong Kong’s Securities Association Tips Authorities On Crypto Self-Regulation

-

NFT4 months ago

NFT4 months agoBLUR Is Down 30%, And Whales Are To Blame–Here’s Why

-

NFT4 months ago

NFT4 months agoNew And Upcoming NFT Projects