Market

The Future of Blockchain: Experts Share Insights on Privacy and Transparency

The allure of anonymity has always been a significant draw in the blockchain ecosystem. Early adopters touted the ability to conduct transactions in secrecy, far from the prying eyes of centralized institutions and regulators.

However, as blockchain evolves, the industry faces a critical question – Is anonymity still paramount, or is it a fading aspect amidst growing demands for transparency?

Why Blockchain Transparency is Important?

The blockchain sector is undergoing a transformation. Enhanced regulatory scrutiny and advancements in blockchain analytics are slowly demystifying the once-opaque crypto ecosystem.

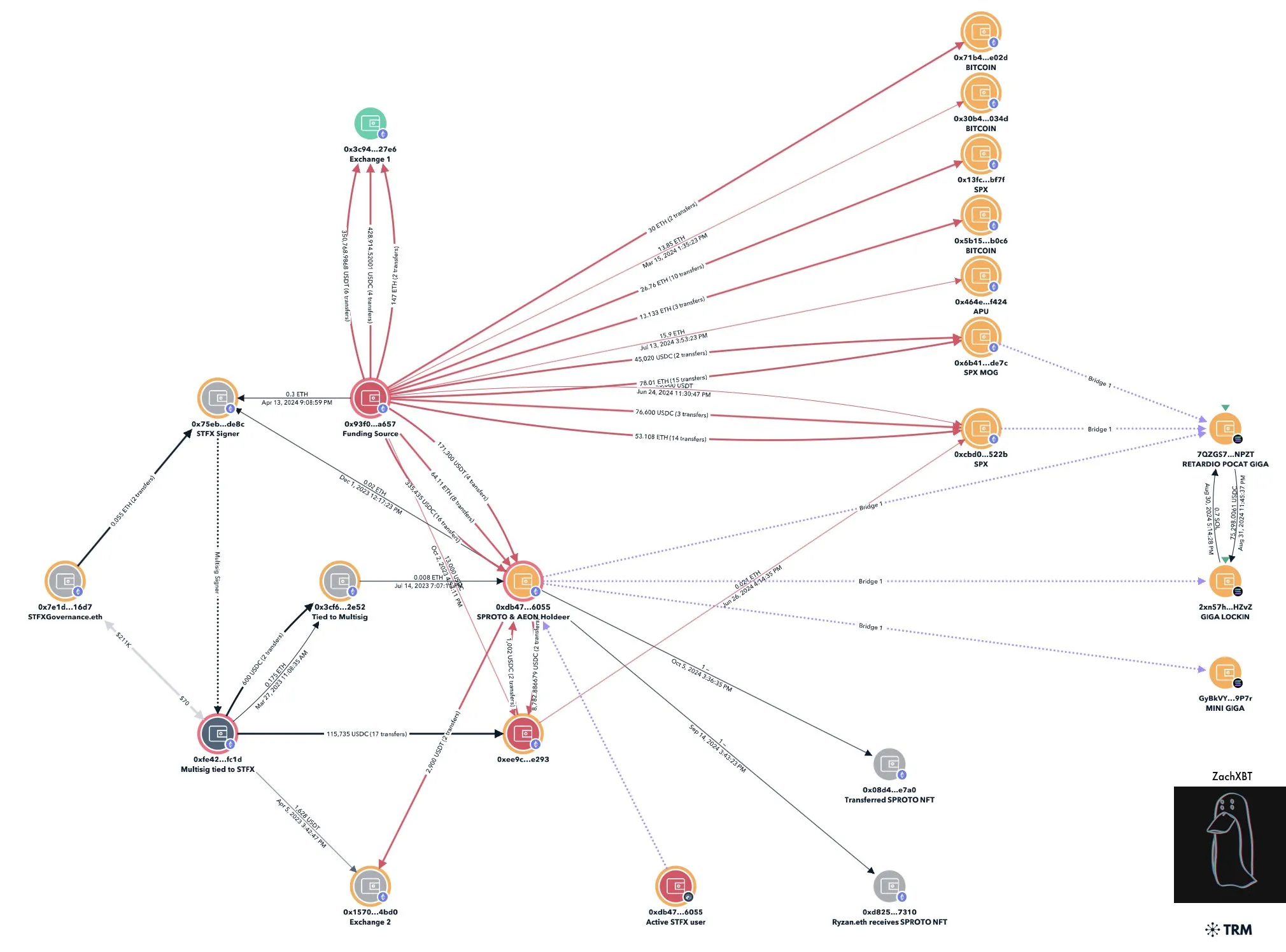

A revelation by the on-chain detective ZachXBT, who exposed the crypto holdings of a meme coin trader, Murad, highlights this shift. This exposure ignited debates about the ethics of revealing such information and whether such acts undermine the foundational privacy promised by blockchain.

Read more: Who Is ZachXBT, the Crypto Sleuth Exposing Scams?

Despite concerns, many argue that transparency is crucial for combating fraud, money laundering, and other illicit activities within the crypto space.

The call for greater oversight is partly driven by the increasing incidents of crypto-related frauds and hacks. According to an Immunefi report, over $412 million was lost to such incidents in the third quarter of 2024 alone. Moreover, year-to-date, the total reached $1.3 billion across 169 incidents by September 2024.

These security breaches and the utilization of cryptocurrency in illegal activities fuel the debate over blockchain’s dual nature—offering freedom yet potentially facilitating unlawful acts.

Need For a Balanced Approach

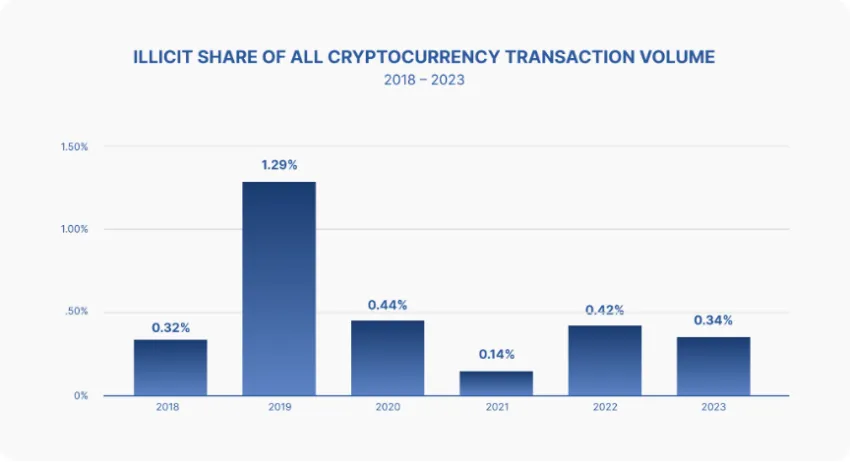

In an interview with BeInCrypto, Alex Pruden, Executive Director at Aleo Foundation, countered this perspective. He highlighted the misuse of traditional financial systems in crimes.

“The traditional financial system is used for illegal activities all the time. 99% of money laundering and sanctions evasion actually happens through large financial institutions (who don’t catch it until after the crime has been perpetrated). Does that mean we should ban banks and payment processors? Of course not, because these institutions provide benefits to everyone else. The key is finding the right balance,” Pruden told BeInCrypto.

Supporting this, a Crypto Information Sharing and Analysis Center (ISAC) report notes that cash is used far more frequently than crypto in illegal activities. The report challenged the notion that crypto is predominantly the currency of criminals.

Read more: Anonymity vs. Pseudonymity: Understanding the Key Differences

Moreover, purists and privacy advocates contend that an extreme move towards openness erodes the core values of blockchain. Pruden emphasized the importance of privacy.

“Real-world financial transactions between parties are often predicated on a notion of confidentiality. And this confidentiality/privacy is essential for businesses to function. For example, businesses transacting with one another may not want the contents of that transaction public to competitors. Likewise, individual financial transactions on public blockchains are at risk from surveillance, data mining, and cyberattacks,” Pruden stated.

Contrary to Pruden’s view, Adrian Brink, co-founder of Namada, argues that blockchain was never truly about privacy.

“I don’t think that blockchain was built on the promise of privacy at all. Bitcoin doesn’t offer any privacy guarantees. The potential for de-anonymization was there from the beginning,” Brink told BeInCrypto.

Read more: Top 7 Privacy Coins in 2024

Experts Claim Zero Knowledge Proof is the Solution

This tension between privacy and transparency raises pivotal questions about the future of blockchain. Can it remain decentralized and secure while compromising on anonymity? Or is privacy still essential to protect users and uphold the technology’s principles?

William Wendt, Head of Ecosystem at Oasis, told BeInCrypto that privacy isn’t a binary choice.

“Often, this issue of privacy vs. transparency is looked at through a binary lens. Either a blockchain is fully transparent or fully anonymous. However, this is not the case. Privacy is a spectrum, and different dApps and users will have different preferences for what level of privacy/transparency they will need,” Wendt said.

According to all three experts, a promising solution lies in zero-knowledge technology, which offers a way for transparency and privacy to coexist. Zero-knowledge proofs (ZKPs) allow for the verification of transactions without revealing underlying data, thus maintaining user privacy while ensuring compliance with laws.

“Historically, transparency was seen as a mechanism to enforce compliance, but it doesn’t have to come at the cost of user privacy. Cryptographic solutions like ZK proofs (ZKP) enable a system where transactions can be “correct by construction” in terms of the law, without revealing the underlying data. This protects user privacy and creates a user interface closer to a bank account/payment app than most Web3 applications today,” Pruden noted.

Brink also supports this nuanced approach, emphasizing that the need for privacy varies by context.

“What you need to share with your local government is going to be different from what you want to share with the world. The key issue is primarily self-sovereignty. We’re moving towards a world where technologies like zero-knowledge cryptography empower users with the choice of what to share. Privacy can coexist with transparency, but the architecture must be thoughtfully designed,” Brink told BeInCrypto.

Read more: What are Zero-Knowledge Proofs? Securing Growth for Web3 Apps

Zero-knowledge cryptography addresses privacy concerns and also meets regulatory requirements, offering a balanced solution that protects individual privacy and fulfills transparency obligations. This technology proves compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations without disclosing personal information, providing a win-win scenario for all stakeholders.

Due to heightened interest, the zero-knowledge sector is growing. According to data from CoinGecko, the total market capitalization of zero-knowledge coins stands at nearly $13.5 billion.

In conclusion, while blockchain was initially celebrated for its privacy features, the changing environment suggests that both transparency and privacy are necessary for its future. The ongoing development of zero-knowledge cryptography and similar technologies may hold the key to maintaining blockchain’s founding principles while adapting to new regulatory environments.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

DOGS Token Faces Major Test as 99% of Holders Are Underwater

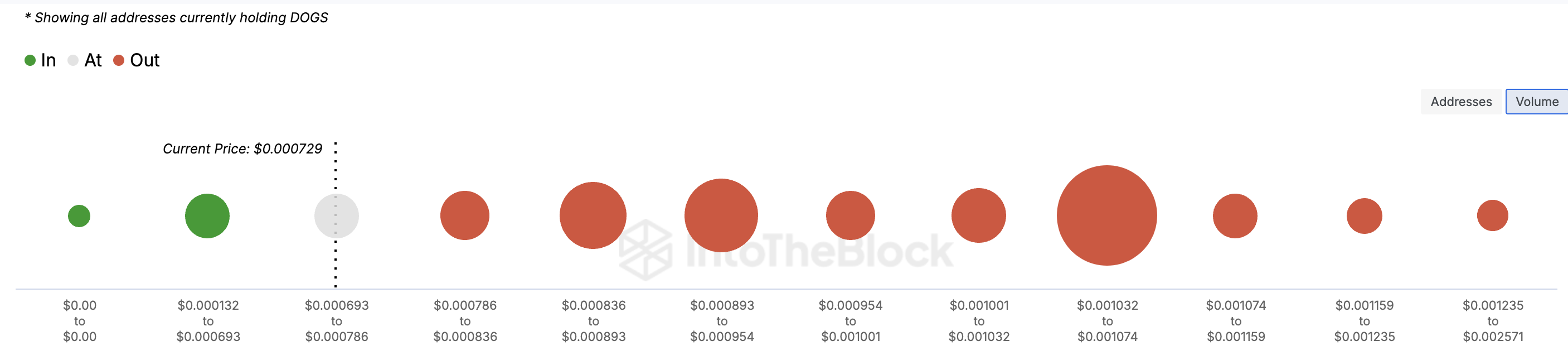

The hype around the Telegram-linked meme coin DOGS has taken a sharp turn, as nearly 99% of its holders are now in losses just about 60 days after its listing.

Once a token of high expectations, DOGS has been hit by relentless selling pressure, leaving early investors deep underwater. With mounting concerns over its future, the meme coin now faces a crucial test. Can it recover, or is it heading towards further decline?

Interest in Telegram’s Flagship Meme Coin Plunges

DOGS, which launched on August 26 with the distribution of approximately 40 billion tokens to around 17 million Telegram users, had an initial price of $0.0017. However, since then, the meme coin has plummeted by 56%.

According to the Global In/Out of Money (GIOM) indicator, nearly 99% of DOGS holders are at a loss, with billions of addresses that purchased DOGS between $0.00079 and $0.0013 currently holding the token at a loss.

Apart from highlighting the on-chain cost basis, the GIOM also reveals whether a token is facing resistance or support. A large cluster of addresses or tokens within a price range signals significant support or resistance. Presently, the large number of DOGS holders out of the money indicates that the price may struggle to rise and could potentially fall again.

Read more: What Are Telegram Bot Coins?

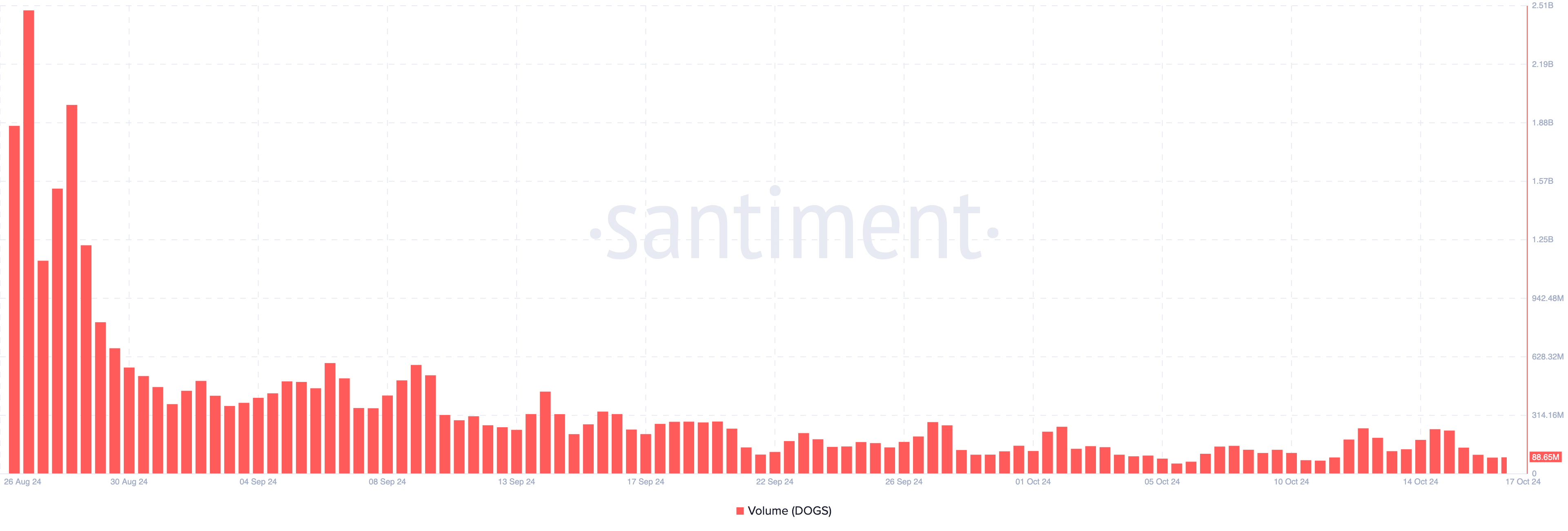

Another reason DOGS’ price could fall again is its volume. Around the time the meme coin launched, the volume was over $2 billion, indicating that the market was highly interested in it.

As of this writing, the token’s trading volume has dropped to $88.65 million, a significant decline from earlier levels. This drop in volume suggests reduced buying and selling activity, which may make it difficult for the meme coin to rebound from its current lows.

With lower market activity, price recovery could be a challenge as fewer traders are interacting with the token.

DOGS Price Prediction: Lower Lows

Based on the daily chart, the Bollinger Bands (BB) around DOGS have contracted. This suggests that volatility is currently low, and the price may remain range-bound without experiencing significant price swings.

When the bands expand, it typically indicates high volatility and the potential for more dramatic price movements. However, with the BB contracting, it seems the market is expecting stability or muted price action in the short term for DOGS.

Read more: Top 7 Telegram Tap-to-Earn Games to Play in 2024

Considering DOGS’ current movement, the meme coin’s price is likely to drop below $0.00061. However, if investors step in and buy the dip in large volumes, the trend could reverse. In that scenario, the meme coin’s value might rise to $0.00081 or potentially even as high as $0.0010.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can Ethereum Price Make It Back to $3,000 This Month?

Ethereum’s price has fluctuated under $2,800 for the past few weeks, and it is stuck in a consolidation phase. Despite several attempts, ETH has been unable to break through key resistance levels, leaving investors uncertain.

Mixed signals from various technical indicators are adding to the ambiguity, making it difficult to predict whether Ethereum can climb back to $3,000 soon.

Ethereum Is Losing Money

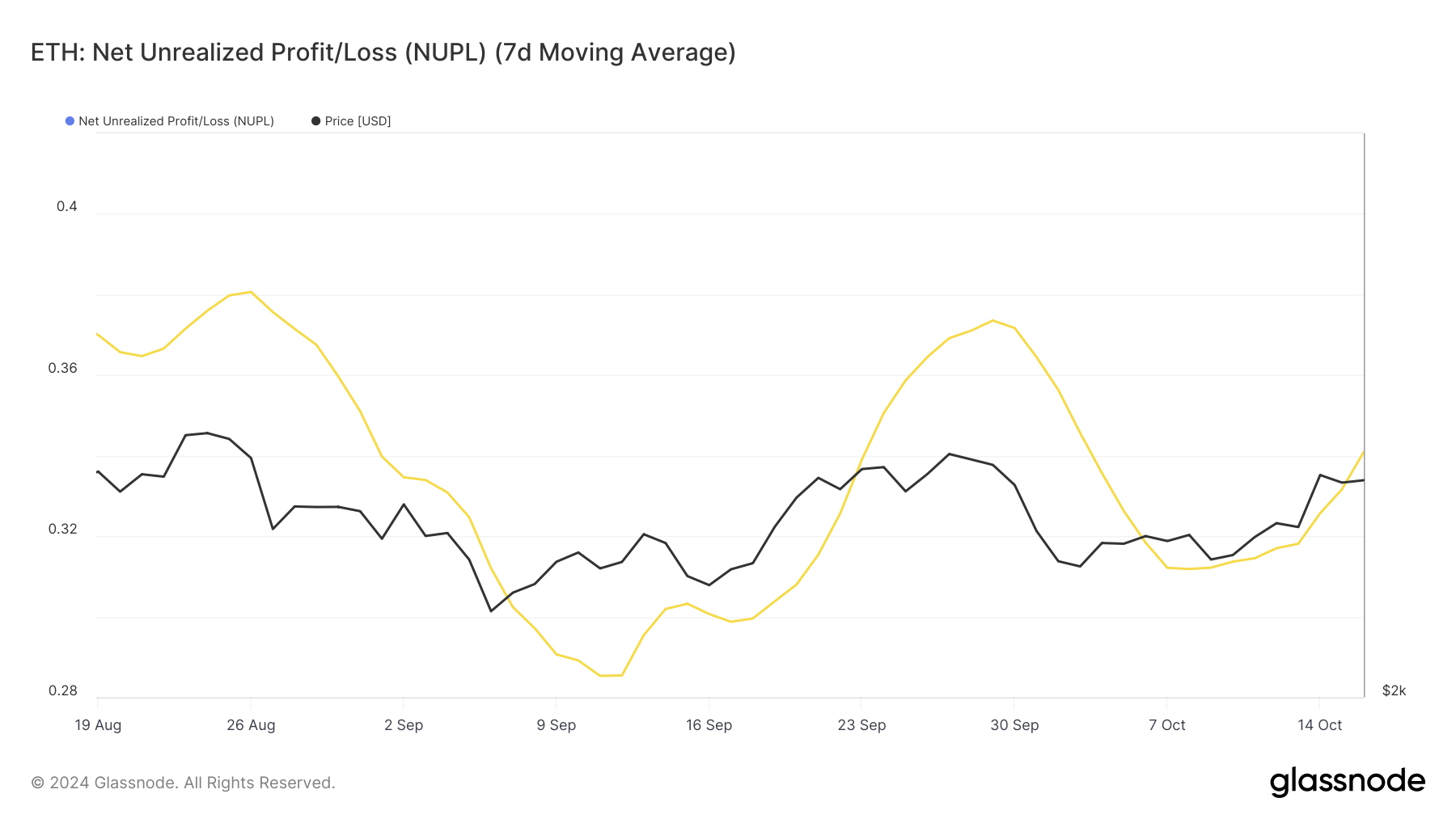

Ethereum’s Network Unrealized Profit/Loss (NUPL) currently sits in the optimism zone, signaling improving market sentiment. This indicator tracks all holders’ total profit or loss relative to when they acquired their assets. The current levels reflect growing confidence among investors.

This optimistic sentiment is keeping investors engaged, with many holding their assets rather than selling them. As long as the NUPL remains in this favorable range, the chances of a dramatic sell-off are slim, which could support Ethereum’s price in the near term.

Read more: How to Invest in Ethereum ETFs?

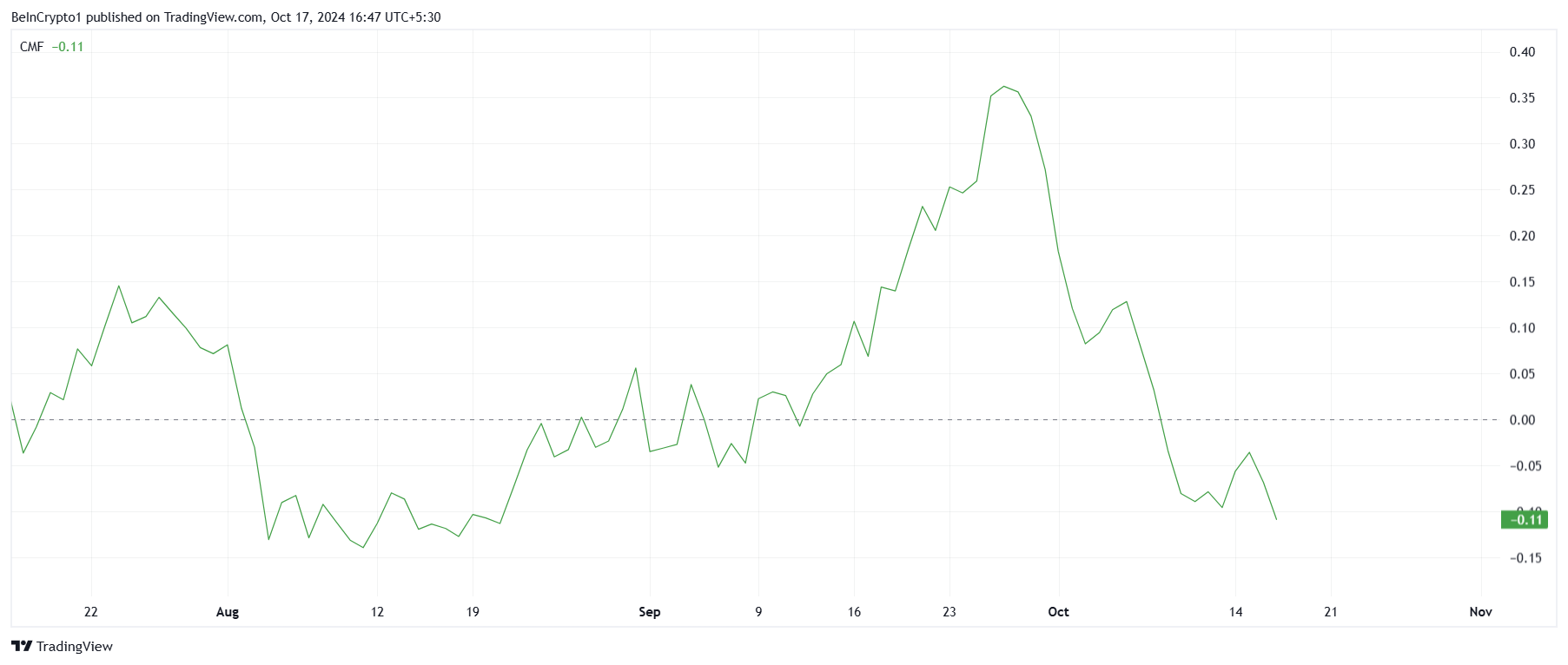

On the macro side, Ethereum’s momentum appears mixed, as shown by the Chaikin Money Flow (CMF) indicator. The CMF, which tracks the flow of capital into and out of an asset, briefly rose last week but has since dipped again.

This decline is a bearish signal, as it suggests that more capital is flowing out of Ethereum than coming in. It is an indication that the selling pressure is potentially increasing.

The outflow of capital is a critical factor to watch, as sustained declines in the CMF often precede price drops. Ethereum could face additional challenges in breaking through its current resistance levels despite the otherwise positive market sentiment if this trend continues.

ETH Price Prediction: Staying in Lane

Ethereum is currently trading at $2,610, struggling to overcome resistance at $2,700. Since early August, ETH has been repeatedly blocked by this level, with brief breaches above it failing to hold. As long as Ethereum remains under this resistance, significant upward momentum may be difficult to achieve.

Mixed signals from key indicators suggest that the ongoing consolidation between $2,700 and $2,344 will continue. The market may remain in this tight range until there is a decisive shift in sentiment or capital inflows.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

For Ethereum to reach $3,000, it must first flip the $2,700 resistance into support. Once this level is breached, the next key barrier will be $2,930. If Ethereum can rise above this, it will hit a two-and-a-half-month high, potentially invalidating the current bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will Toncoin Price Hit $6.57 After Whales Inject $72 Million?

In a bold move to prevent Toncoin’s (TON) price from sliding further, crypto whales have stepped in to buy the cryptocurrency in large volumes. This influx of buying pressure comes after several instances where Toncoin appeared poised to drop to the $4 mark.

But over the last few days, bulls have ensured that the altcoin does not go below that threshold. With whales now in the picture, here is what could be next for TON.

Whales Scopp Over 13 Million Toncoin

According to IntoTheBlock, Toncoin’s large holders’ netflow surged by 44% over the past seven days. In the crypto space, large holders are addresses that control approximately 1% of a token’s total circulating supply.

These major stakeholders often exert significant influence on price movements. When large holders’ netflow decreases, it signals that whales are selling more of the asset than they are purchasing.

However, in Toncoin’s case, these holders accumulated roughly 13.83 million tokens on October 16, valued at over $72 million at the current price, indicating potential bullish momentum for the altcoin.

Read more: Top 9 Telegram Channels for Crypto Signals in October 2024

Beyond the increase in large holders’ netflow, Toncoin’s Coins Holding Time has also risen. This metric tracks how long a cryptocurrency has been held without being sold. A longer holding time often reflects growing confidence that the asset will generate favorable returns.

When the holding time decreases, it usually signals potential selling pressure, which could lead to a price drop. However, an uptick in holding time suggests that most holders are refraining from selling, which can strengthen buying momentum and raise the likelihood of a price hike.

TON Price Prediction: Eyes Above $6

A look at the daily chart shows that Toncoin’s price is $5.13. Although the current value is decreasing, BeInCrypto noticed strong support at $5.05. This support, which has historically prevented TON from undergoing a significant correction, could become vital again.

As it stands, TON’s price is unlikely to drop below this region. If that happens, the next move for the Telegram-native coin could be a run toward $5.80. But at $5.80, the altcoin might experience some level of resistance that might want to push it back.

However, if buying pressure continues to increase, Toncoin might successfully breach this zone, and its value might climb to $6.75.

Read more: 6 Best Toncoin (TON) Wallets in 2024

However. in a case where bears force a rejection, TON might not reach this point. Instead, the cryptocurrency might decline below the $5 mark.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin4 months ago

Altcoin4 months ago2.52 Million Altcoins Are Ruining Crypto’s Future

-

NFT2 months ago

NFT2 months agoAnimoca Brands Valuation Tanks 75% In Two Years, Here’s Why

-

Ethereum4 weeks ago

Ethereum4 weeks agoCrypto exchange BingX hacked for $43 million

-

Ethereum4 weeks ago

Ethereum4 weeks agoAre The Big Players Losing Interest?

-

Bitcoin3 weeks ago

Bitcoin3 weeks agoCoinbase cbBTC Set to go Live on Solana

-

Blockchain6 months ago

Blockchain6 months agoHong Kong’s Securities Association Tips Authorities On Crypto Self-Regulation

-

NFT4 months ago

NFT4 months agoBLUR Is Down 30%, And Whales Are To Blame–Here’s Why

-

NFT4 months ago

NFT4 months agoNew And Upcoming NFT Projects