Market

Bitwise Moves Closer to XRP ETF Despite Legal ‘Grey Area’

Bitwise has taken another step towards launching an XRP-based ETF, updating its submission to the US Securities and Exchange Commission (SEC). Based on the filing, the crypto index fund manager revised its S-1 registration, clarifying the structure of the trust, custody measures, and the processes for share creation and redemption.

XRP’s regulatory status remains contentious, with the uncertainty playing a role in Bitwise’s move to update its filing.

Bitwise Updates XRP ETF Filling

A key highlight of the new filing is the trust’s use of cold storage for most of its XRP holdings. This ensures enhanced security, with only a limited amount moved to hot storage to facilitate efficient basket creations and redemptions when necessary.

The updated structure of the trust details the process of creating and redeeming shares in blocks of 10,000 units, referred to as “Baskets.” The number of XRP required per Basket will be adjusted daily, accounting for any accrued fees or expenses.

Additionally, the XRP Custody Agreement emphasizes plans to keep the trust’s assets separate from the custodian’s other holdings. This segregation aims to protect the private keys associated with the XRP and enhance overall security.

To streamline trading, Bitwise has appointed a Prime Execution Agent. This agent will handle the purchase and sale of XRP across major platforms like Bitstamp, Kraken, Coinbase, and LMAX. Their role includes providing short-term financing, known as Trade Credits. These ensure the execution of orders promptly, even if the trust’s XRP or funds are temporarily unavailable.

Read more: XRP ETF Explained: What It Is and How It Works

Similarly, Coinbase Global holds a commercial crime insurance policy covering risks such as theft, fraud, and cyber-attacks. This adds to the guardrails, with Coinbase affiliated with Prime Execution Agent and the XRP Custodian. Nevertheless, Bitwise articulates that this policy stands for all Coinbase customers, thereby limiting its ability to cover specific losses related to the trust.

The revision builds on the initial S-1 form submitted on October 2, which was Bitwise’s first formal attempt to introduce an XRP ETF to the US market. Canary Capital is another firm pushing for this financial instrument, with rising interest sidestepping a possible Solana ETF.

Bitwise Trust Hinges On XRP Token Classification

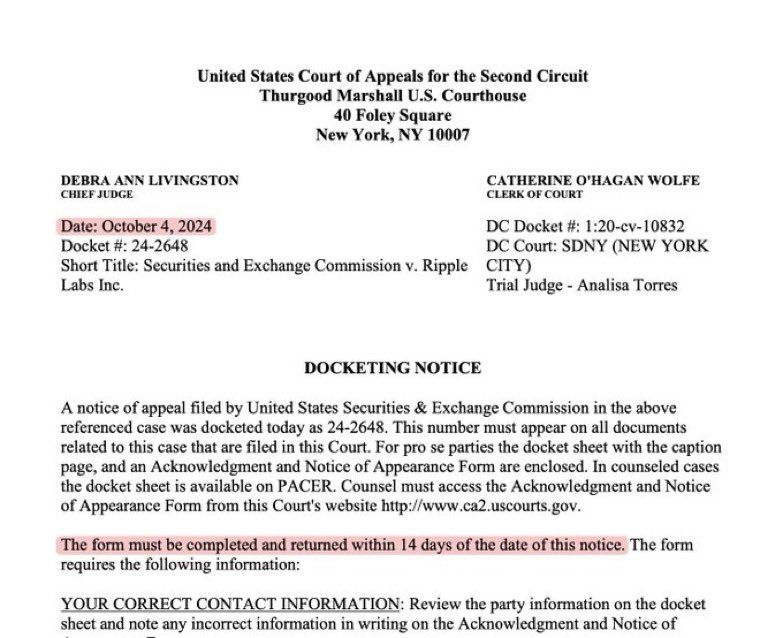

The update also highlighted ongoing regulatory uncertainties surrounding XRP. Bitwise cautioned that if XRP is classified as a security, the trust may be forced to liquidate its holdings. The outcome of the SEC’s appeal in the Ripple case will significantly influence the future of the Bitwise XRP ETF.

This decision could directly impact whether the ETF moves forward. In light of this, the update introduced measures to protect investors and ensure compliance with federal securities laws. As BeInCrypto reported, the Ripple vs. SEC case is a lengthy legal battle, potentially extending through July 2025.

Of note, the SEC’s appeal, filed on October 2, faces a deadline of Friday, October 18. If the regulator misses this deadline, the appeal could be dismissed.

Read more: How To Buy XRP and Everything You Need To Know

While Bitwise updates its XRP ETF submission, the crypto index fund manager is also making strides with its Bitcoin ETF. The firm’s Bitcoin ETF has exceeded $5 billion in AUM, marking significant progress. This milestone applies across its range of beta and alpha investment products, showcasing strong investor interest and growth in its Bitcoin offerings.

Bitwise indicated that this represents a 400% surge in 2024. It ascribes the traction to existing and new investors and comes after Luis Berruga’s ascension as the company’s strategic advisor.

“This year, investors have trusted Bitwise to manage billions of dollars of investments in Bitcoin and crypto,” Bitwise CEO Hunter Horsley said.

Optimists predict even more growth for Bitwise, with some forecasting its Bitcoin ETF could reach $20 billion in AUM by 2026. This comes after the firm achieved several key milestones in 2024, further cementing its position in the crypto investment space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will the SEC Approve Grayscale’s Solana ETF?

Grayscale has submitted a registration statement with the SEC to convert its Grayscale Solana Trust (GSOL) into an ETF listed on NYSE Arca.

Despite the filing, prediction markets remain unconvinced about the chances of approval.

Is a Solana ETF Approval Still Unlikely for Q2?

On Polymarket, odds for a Solana ETF approval in the second quarter of 2025 stand at just 23%. Broader expectations for any 2025 approval are at 83%, down from 92% earlier this year.

The decline reflects regulatory delays. In March, the SEC extended review timelines for several ETF applications tied to Solana, XRP, and other altcoins.

This pattern suggests the agency may be holding off on decisions until a permanent chair takes over. Mark Uyeda, currently serving as interim chair, has not signaled a shift in stance.

Paul Atkins, Trump’s nominee to lead the agency, appeared before the Senate last week. Lawmakers questioned his involvement in crypto-related businesses, adding further uncertainty around future approvals.

Grayscale’s latest filing excludes staking, which could speed up the review process. The SEC has previously objected to staking features in ETF proposals.

When spot Ethereum ETFs moved forward last year, Grayscale, Fidelity, and Ark Invest/21Shares all removed staking components to align with the SEC’s expectations at the time.

Under Gary Gensler’s leadership, the SEC expressed concern that proof-of-stake protocols could fall under securities law. Asset managers adjusted their applications accordingly to move forward.

Following approvals for spot Bitcoin and Ethereum ETFs, several firms aim to expand their offerings to include other cryptocurrencies. They plan to offer access through traditional brokerage accounts without requiring direct asset custody.

Solana remains a strong contender due to its growing futures market in the US and a more favorable regulatory environment. Analysts view it as one of the next likely approvals if the SEC opens the door to more altcoin ETFs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Vulnerable To Falling Below $2 After 18% Decline

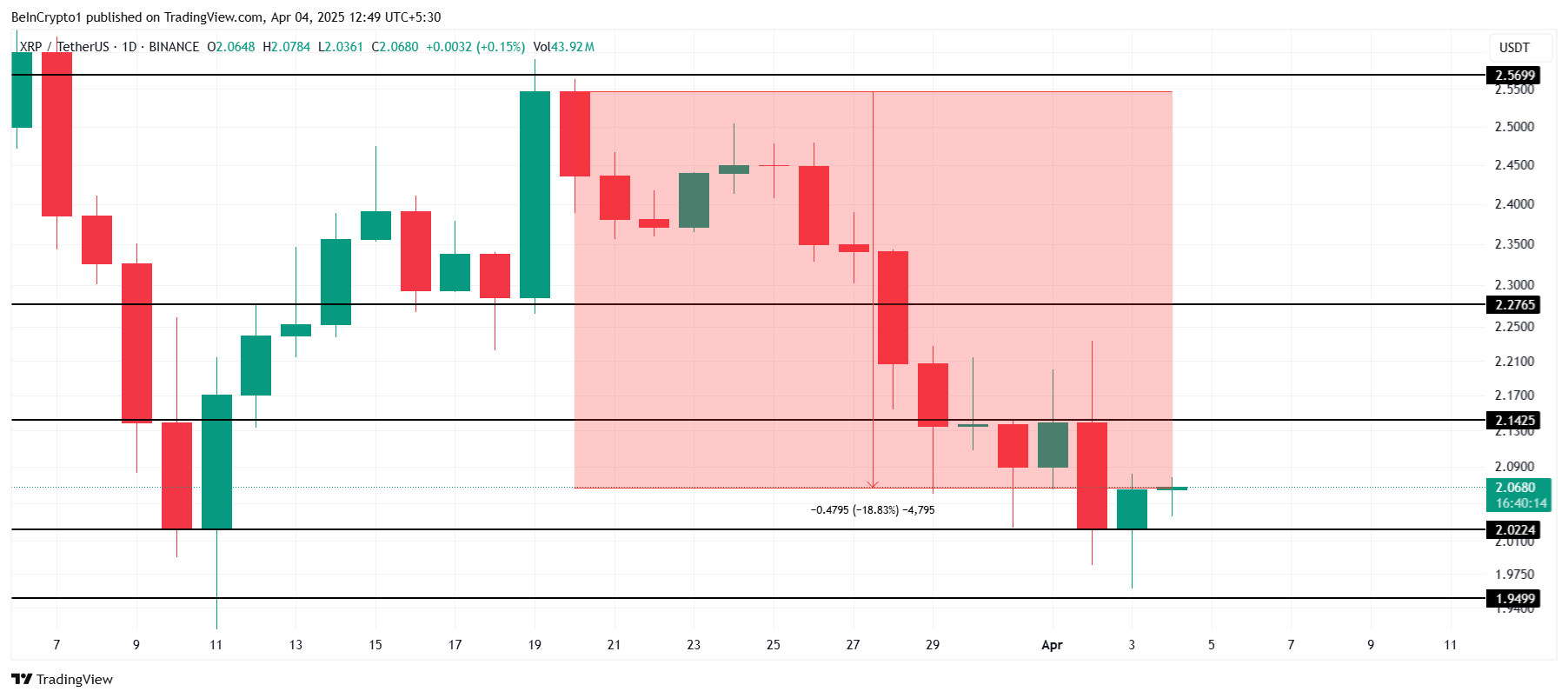

XRP has faced a significant correction in recent weeks, resulting in an 18% decline in the altcoin’s price. As a result, XRP is currently struggling to maintain upward momentum, with investors losing confidence.

This recent slump has raised concerns about the asset’s future, especially as certain XRP holders begin to sell their positions, increasing bearish pressure.

XRP Investors Are Pulling Back

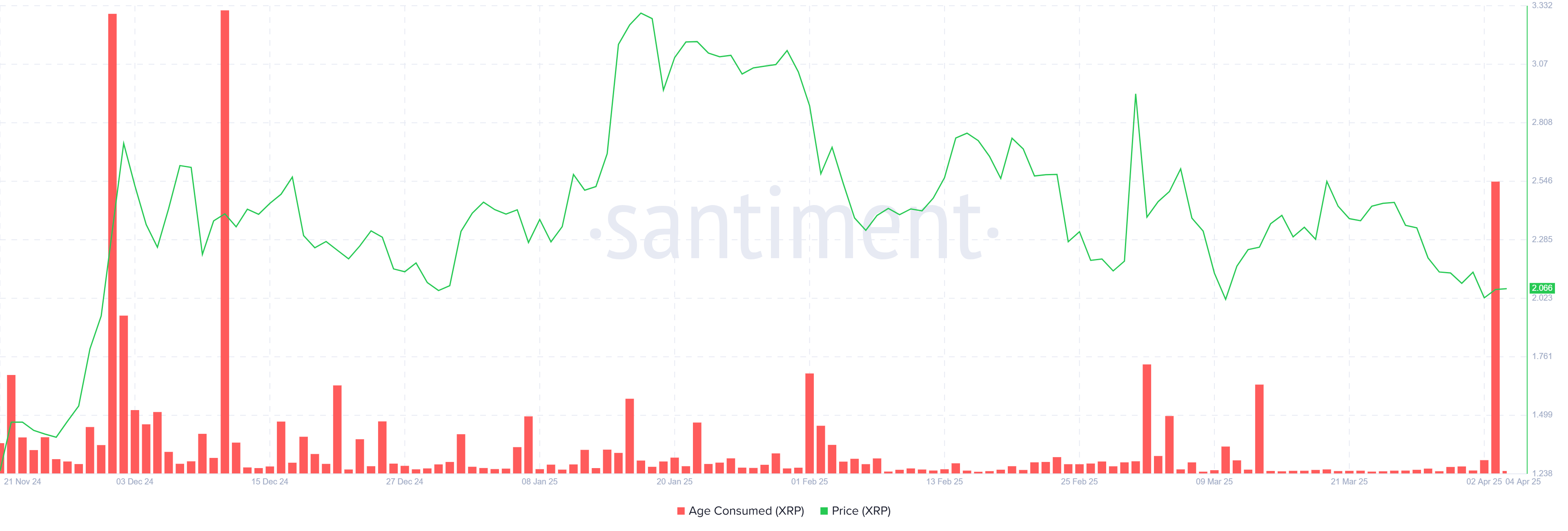

The recent downturn in XRP’s price has triggered a sharp spike in the “Age Consumed” metric. This indicator tracks the movement of coins from long-term holders (LTHs) and has reached its highest level in over four months. The increase suggests that LTHs, who have been holding XRP for extended periods, are now losing patience.

This selling behavior may be driven by the lack of price recovery and the overall weak market conditions that have not improved. These holders appear to be attempting to limit their losses by liquidating their positions, which in turn increases the downward pressure on XRP’s price. This mass selling from LTHs further compounds the challenges for XRP, as their decision to sell is often seen as a sign of waning confidence in the cryptocurrency.

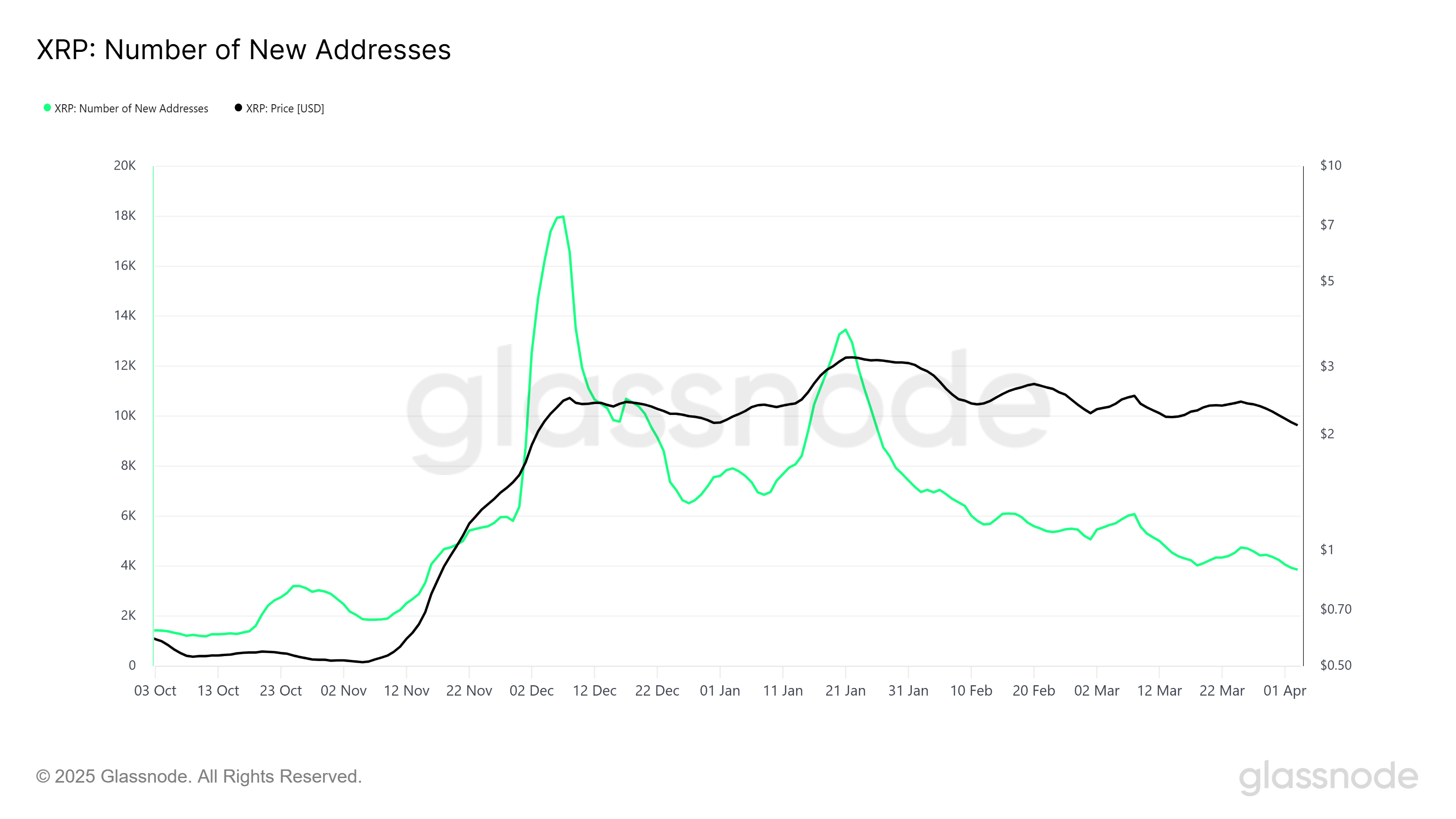

XRP’s market momentum appears to be weakening, as evidenced by the recent decline in the number of new addresses. The metric tracking new addresses has fallen to a five-month low, suggesting that XRP is struggling to attract new investors. This lack of fresh interest signals growing skepticism within the broader market, with potential investors hesitant to buy into an asset that has failed to deliver strong price action.

The drop in new addresses reflects a broader trend of reduced market traction and the lack of conviction from buyers. When combined with the selling pressure from LTHs, it creates a challenging environment for XRP to regain bullish momentum

XRP Price Needs A Boost

XRP’s price is currently holding at $2.06, just above the key support level of $2.02. If it manages to stabilize and break through the immediate resistance at $2.14, there could be a potential rebound, taking XRP higher.

However, with the continued weakness in market sentiment and the aforementioned bearish cues, XRP remains vulnerable to further declines. If the support of $2.02 fails, the price could drop further to $1.94, extending the 18% decline noted in the last two weeks.

If XRP manages to reclaim the $2.14 level and holds above it, the price could make its way toward $2.27. Breaching this level would invalidate the bearish outlook, signaling a potential recovery and restoring investor confidence in the cryptocurrency.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Futures Traders Lead the Charge as Buying Pressure Grows

Hedera Foundation’s recent move to partner with Zoopto for a late-stage bid to acquire TikTok has sparked renewed investor interest in HBAR, driving a fresh wave of demand for the altcoin.

Market participants have grown increasingly bullish, with a notable uptick in long positions signaling growing confidence in HBAR’s future price performance.

HBAR’s Futures Market Sees Bullish Spike

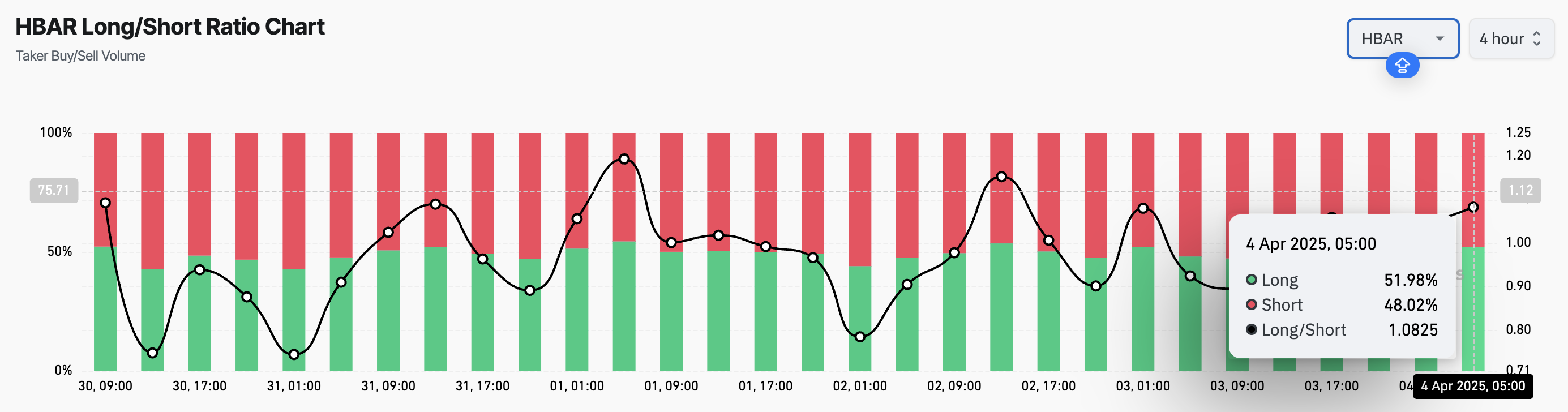

HBAR’s long/short ratio currently sits at a monthly high of 1.08. Over the past 24 hours, its value has climbed by 17%, reflecting the surge in demand for long positions among derivatives traders.

An asset’s long/short ratio compares the proportion of its long positions (bets on price increases) to short ones (bets on price declines) in the market.

When the long/short ratio is above one like this, more traders are holding long positions than short ones, indicating bullish market sentiment. This suggests that HBAR investors expect the asset’s price to rise, a trend that could drive buying activity and cause HBAR’s price to extend its rally.

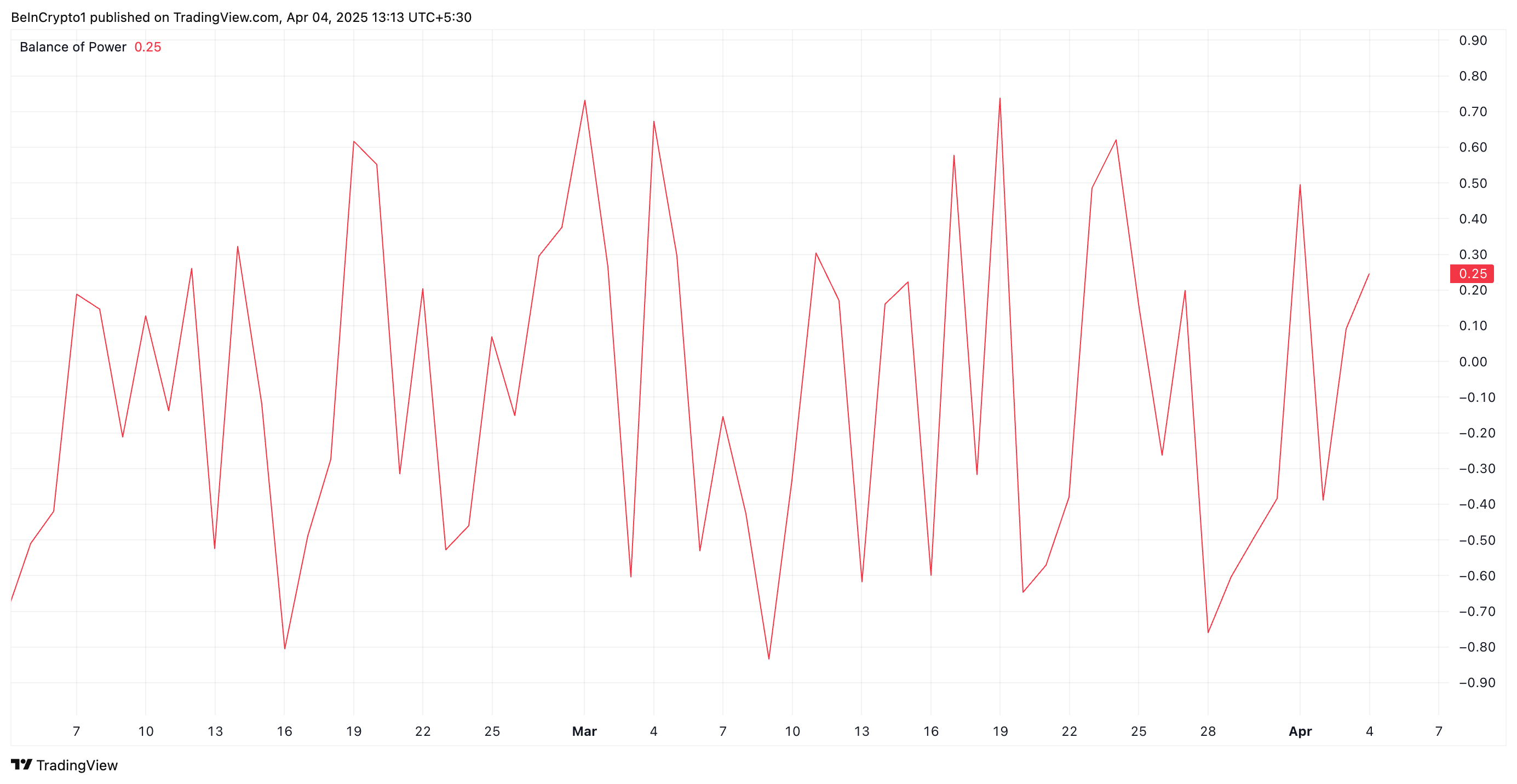

Further, the token’s Balance of Power (BoP) confirms this bullish outlook. At press time, this bullish indicator, which measures buying and selling pressure, is above zero at 0.25.

When an asset’s BoP is above zero, buying pressure is stronger than selling pressure, suggesting bullish momentum. This means HBAR buyers dominate price action, and are pushing its value higher.

HBAR Buyers Push Back After Hitting Multi-Month Low

During Thursday’s trading session, HBAR traded briefly at a four-month low of $0.153. However, with strengthening buying pressure, the altcoin appears to be correcting this downward trend.

If HBAR buyers consolidate their control, the token could flip the resistance at $0.169 into a support floor and climb toward $0.247.

However, a resurgence in profit-taking activity will invalidate this bullish projection. HBAR could resume its decline and fall to $0.129 in that scenario.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoBinance Managed 94% of All Crypto Airdrops and Staking Rewards

-

Market21 hours ago

Market21 hours agoWormhole (W) Jumps 10%—But Is a Pullback Coming?

-

Altcoin21 hours ago

Altcoin21 hours agoAltcoin Season Still In Sight Even As Ethereum Struggles To Gain Upward Momentum

-

Regulation23 hours ago

Regulation23 hours agoUS SEC Acknowledges Fidelity’s Filing for Solana ETF

-

Market22 hours ago

Market22 hours agoRipple Shifts $1B in XRP Amid Growing Bearish Pressure

-

Market23 hours ago

Market23 hours agoXRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

-

Market20 hours ago

Market20 hours agoBinance’s CZ is Helping Kyrgyzstan Become A Crypto Hub

-

Altcoin20 hours ago

Altcoin20 hours agoHere’s Why Is Shiba Inu Price Crashing Daily?