Bitcoin

What is Matt Hougan’s Bitcoin Price Prediction For 2025?

Matt Hougan, Bitwise’s Chief Investment Officer, has forecast a significant price surge for Bitcoin and Ethereum in 2025.

During a YouTube interview, he outlined the reasons behind this bold prediction.

3 Reasons Why Bitcoin Could Reach $200,000 by 2025

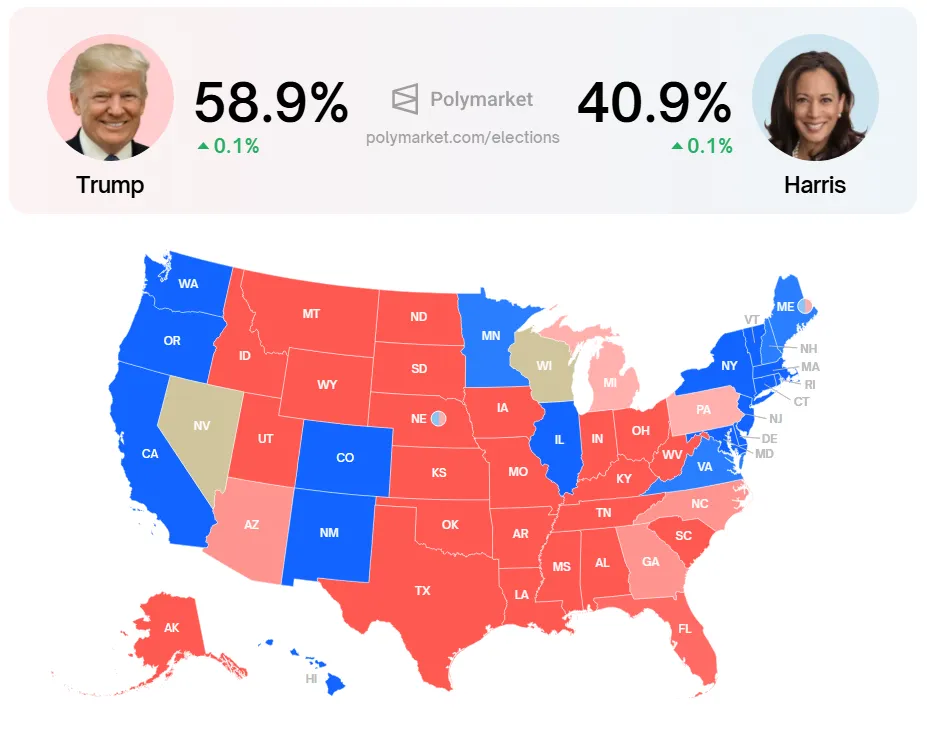

Hougan shared three key factors for his bullish outlook. These stem from the US elections, large amounts of sidelined capital, and the long-term impact of Bitcoin ETFs. On the political front, Hougan argued that either a pro-crypto President, Donald Trump, or a neutral President, Kamala Harris, could have a positive—or at least non-negative—impact on Bitcoin.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

At the time of writing, Trump’s chances of becoming president reached 58.9%. Bitcoin prices have also surpassed $67,000, as investors believe that Trump will introduce policies that could drive significant market growth.

Moreover, Hougan revealed that many major investors have yet to enter the market. They are waiting for more political and regulatory clarity. However, if Bitcoin continues its upward trajectory, these investors may feel compelled to jump in sooner rather than later.

“The election represent uncertainty, and so investors are sitting on the sidelines, waiting. They realized that crypto is not going away. They realized that it’s moving into the institutional sort of part of the world, but they thought they could wait and delay. I think if this rally continues, if [Bitcoin] trips up towards $70,000, then, it becomes a self-fulfilling prophecy. People would realize they have to get on the train.” Hougan said.

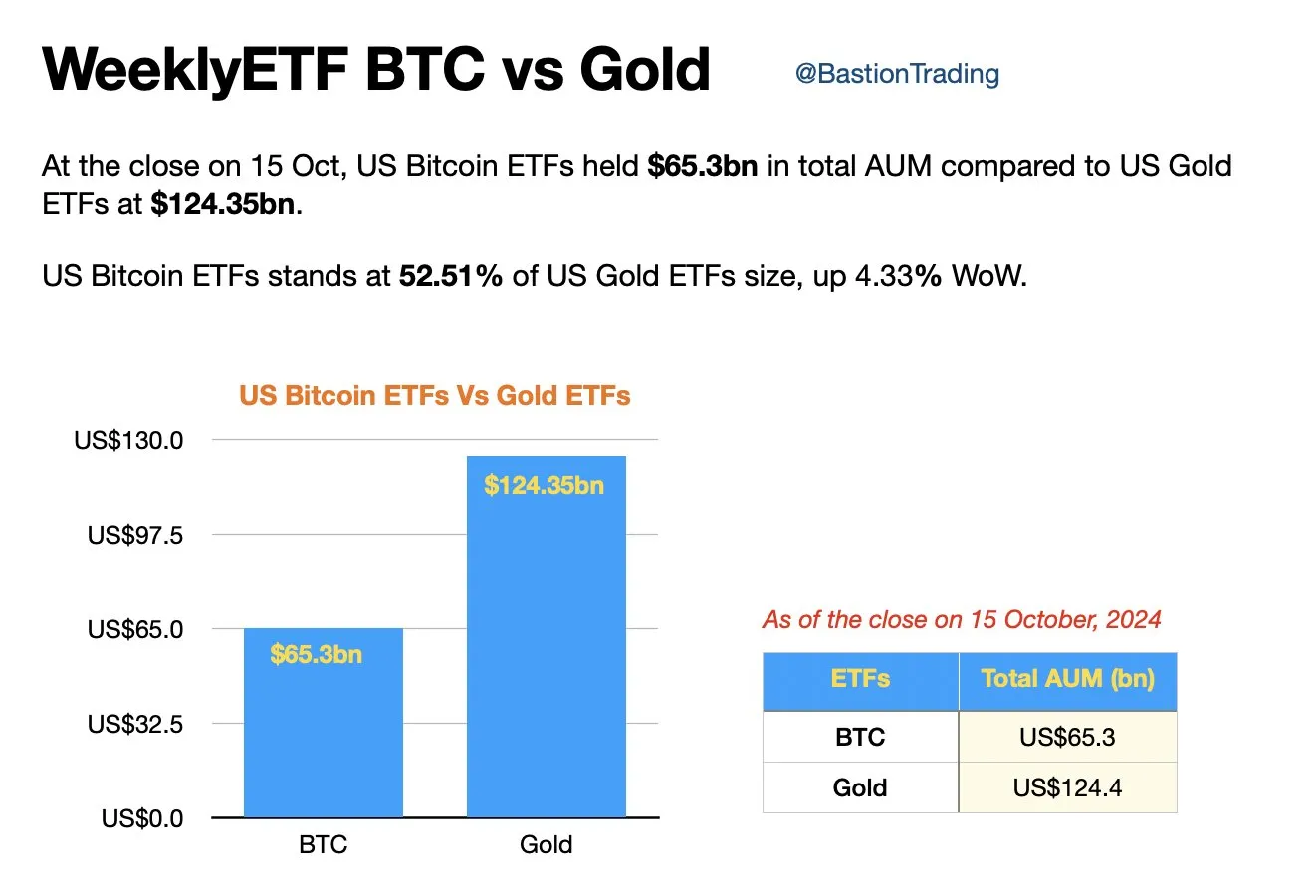

Additionally, Hougan also emphasized the long-term potential of Bitcoin ETFs. As a former CEO of ETF.com, he believes the $20 billion inflow in the first year of Bitcoin ETFs represents a major success. Similar to gold ETFs, Bitcoin ETFs are still in their early stages.

The latest data shows that, despite being in existence for less than a year, Bitcoin ETFs’ Assets Under Management (AUM) are already over 52% of that of Gold ETFs.

“Before I came to Bitwise six and a half years ago, I was the CEO of etf.com, so this is my neck of the woods. The thing that crypto should realize about ETFs is that they are multi-year stories. If you look back at the Gold ETF, which launched the most successful ETF launch of all time…I think the same thing is going to happen for Bitcoin ETFs. We’re still really at the earliest stage.” Hougan said.

When asked about his Bitcoin price forecast, Hougan predicted that BTC would reach a new all-time high by the end of the year. Moreover, he affirmed that Bitcoin could hit $200,000 in 2025.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Hougan is also optimistic about Ethereum. He says that while it is currently undervalued due to the rise of competing blockchains, it remains the top platform for DeFi applications, stablecoins, and tokenization. With regulatory and technological advancements, Ethereum could also set a new record high by 2025.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

US Bitcoin Revolution Begins, Senator Lummis Says

Senator Cynthia Lummis has laid the groundwork for the upcoming development of Bitcoin in the United States. As an avid supporter of cryptocurrency, Lummis has worked very hard for years to integrate digital assets into the financial system of the country, and every statement seems to be underlining what has been done so far in terms of crypto regulation. Under her leadership, Bitcoin is on the verge of being recognized as a key component of the national economy.

Lummis’ Vision For Bitcoin

Lummis is however looking beyond investment in Bitcoin and seeing it as a key ingredient in the financial future of the US. Ongoing efforts span legislation that would foster a nurturing environment for crypto technologies to grow.

Taking a proactive posture, Lummis has indicated that she believes, in the future, Bitcoin could quite possibly provide an alternative means to decentralized financial systems for the unbanked population.

So great to meet with David Bailey. The future for Bitcoin and digital assets in America has never been brighter. pic.twitter.com/m2apTVpFVO

— Senator Cynthia Lummis (@SenLummis) January 21, 2025

Changing Regulatory Landscape

Certainly, one of the most pertinent things she said is that she would work towards having a crypto regulation that seeks a balance between innovation and transparent oversight. It should lessen the barriers for institutions and encourage greater integration into the mainstream financial services ecosystem.

This could open more doors for Bitcoin adoption into both sectors-public and private-in light of the recent developments with regard to regulatory measures.

Institutional Interest Grows

The increase in interest from institutional participants in Bitcoin and other currencies is also noted. Crypto platforms like CryptoCom have invested heavily in rolling out services targeting institutional investors because they simply acknowledge the need for Bitcoin in the wider financial ecosystem.

Lummis, also known as the “Bitcoin Senator,” has declared 2025 to be a critical year for Bitcoin and cryptocurrency. She anticipates that a number of proposed policies and critical government positions will coalesce and precipitate change.

Most Pro-Crypto Admin?

“This will be the most pro-digital asset administration ever,” Lummis recently wrote on X, with David Sacks serving as Crypto Czar. “I am eager to collaborate with [Sacks] to ensure the successful passage of comprehensive digital asset legislation and my strategic bitcoin reserve.”

Proposed Bitcoin Reserve bill. Source: US Congress

Lummis’ enthusiasm is the result of a recent reorganization of key government officials, which includes the appointment of a new SEC head, prior to Donald Trump’s reelection.

The “Bitcoin Act,” also known as the “Boosting Innovation, Technology, and Competitiveness Through Optimized Investment Nationwide Act,” is integral to the Senator’s vision.

She characterized the legislation as “a network of secure storage vaults, purchase program, and other programs to ensure the transparent management of Bitcoin holdings of the federal government.” The legislation proposes the establishment of a Strategic Bitcoin Reserve.

Featured image from Inc. Magazine, chart from TradingView

Bitcoin

Roger Ver Supporters Call for Clemency after Ulbricht’s Pardon

Elon Musk, who leads President Donald Trump’s Department of Government Efficiency (D.O.G.E), has committed to exploring the pardon of ‘Bitcoin Jesus’ Roger Ver.

It comes after US President Trump recently granted Ross Ulbricht, the founder of the Silk Road, clemency.

Elon Musk to “Inquire” on Roger Ver’s Pardon

Ross Ulbricht’s presidential pardon has ignited a spirited online campaign for the pardon of Roger Ver, another high-profile figure in the crypto arena. As BeInCrypto reported, Ulbricht’s full and unconditional pardon on Tuesday was widely celebrated. Trump called his previous sentence of two life terms “ridiculous.”

Amid the celebratory discussions, however, attention quickly shifted to Bitcoin Jesus. Ray Youssef, an executive at the crypto platform Noonesapp, was among the first to call for Ver’s release.

“Ross is free. A full unconditional pardon has been signed. Thank God. Don’t forget Roger Ver and all the builders who have been through hell,” Youssef said.

Roger Ver was a vocal proponent of Bitcoin Cash and an early adopter of cryptocurrency. He faced legal troubles over tax evasion allegations. Nine months ago, US authorities accused Ver of owing $48 million in taxes, allegedly stemming from his expatriation process.

Ver challenged these charges two months ago, asserting that he relied on expert advice to ensure compliance with the law. His defense also cited constitutional violations, including claims that privileged communications with his legal team were subpoenaed. Critics have argued that this represents overreach and a troubling precedent for attorney-client privilege.

“Please look into a pardon for Roger Ver. That privileged communications with his lawyers were subpoenaed is a terrible precedent for privacy and the ability to defend oneself,” said Naomi Brockwell, founder of Ludlow Institute.

They also say potentially exculpatory evidence was withheld during grand jury proceedings. Meanwhile. Angela McArdle, chair of the Libertarian National Committee, also expressed her support for Ver’s release. Following these calls, Elon Musk said he would inquire about it.

“Will inquire,” Musk tweeted.

Ver’s supporters argue that a pardon would correct a perceived injustice and reinforce the principles of privacy and due process. The parallels with Ulbricht’s case highlight the dangers of excessive sentencing and systemic government overreach. Taken together, these have strengthened the calls for Ver’s pardon.

Elon Musk’s acknowledgment of the issue has brought renewed attention to the case, potentially amplifying the push for clemency. Many hope that his platform, D.O.G.E, and influence will pressure leaders to address what they see as an unjust precedent. This is amidst a broader campaign for freedoms essential to innovation and prosperity in the cryptocurrency space.

“Roger Ver deserves a pardon to liberate him from the malicious prosecution he still faces–lawfare that threatens to take his freedom for 109 years for an exotic crime he *clearly* did not commit. Pardoning Roger is the strongest signal the President could send that Biden’s war on crypto is over. Please, President Trump, Free Roger Ver,” Bret Weinstein lamented.

Meanwhile, others see Bitcoin Jesus’ case as emblematic of the tension between individual liberties and state power.

“Also (preemptively) Roman Storm while you’re at it please Elon Musk. Publishing open-source privacy tools is an act of free speech — not an act in furtherance of a conspiracy. Whatever crimes committed with the software — developers should not be held vicariously liable for them,” another user added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Brian Armstrong’s Bold Bitcoin Prediction: Multi-Millions Ahead

Coinbase CEO Brian Armstrong has expressed the belief that Bitcoin could eventually reach a price in the multi-million dollar range. This comes as BTC peaked at a new all-time high just hours before Donald Trump returned to the Oval Office for a second term.

Armstrong attributed Bitcoin’s impressive growth to increasing institutional interest and rising national-level adoption.

Coinbase CEO’s $1 million Bitcoin vision

Speaking on CNBC’s Squawk Box, Armstrong described Trump’s presidency as the “dawn of a new day” for cryptocurrency.

Although the first round of executive orders under Trump’s new term did not directly mention crypto, the CEO remained optimistic about Bitcoin’s long-term potential.

“I think over time we’ll see Bitcoin get into the multiple millions price range,” Armstrong predicted.

He attributed this confidence to the growing demand from institutional players. For instance, on January 21, MicroStrategy purchased 11,000 BTC worth $1.1 billion in Bitcoin. This acquisition increased the company’s total reserves to a staggering 461,000 BTC.

Armstrong also pointed to Bitcoin ETFs as a significant factor contributing to the asset’s growth. Approved in January 2024, these ETFs have attracted substantial inflows. According to data from Farside Investors, Bitcoin ETFs have seen cumulative net inflows of $38.9 billion so far.

Additionally, the ETFs recorded four consecutive days of inflows, with the daily net inflow reaching $802.6 million as of January 21.

US Bitcoin Strategic Bitcoin Reserve: A Possibility?

Armstrong explained that Trump’s campaign promise to establish a strategic Bitcoin reserve could further accelerate the adoption of cryptocurrency on a national scale. It could also act as a catalyst for other G20 nations, which have already shown interest, to follow suit.

“Bitcoin has a long way to go. It’s going to become the new gold standard, and crypto is much bigger than that too,” noted the Coinbase CEO.

Notably, Trump has already fulfilled one of his initial promises by pardoning Silk Road founder Ross Ulbricht, effectively ending his life sentence. This move has sparked renewed hope that the President may deliver on other promises, including creating a strategic Bitcoin reserve.

“If Ross Ulbricht got the pardon, we are definitely getting the Strategic Bitcoin Reserve,” CEO of Professional Capital Management, Anthony Pompliano, said in an X post.

Prediction platform Polymarket corroborated this sentiment, showing a 37% probability that Trump would create a Bitcoin reserve within his first 100 days in office. This was a noticeable recovery from the previous day’s low of 29%.

As these developments unfold, Bitcoin continues to soar. At the time of writing, the leading cryptocurrency was trading at $105,366. This marked a 3.0% increase over the past 24 hours.

With increasing institutional involvement, rising ETF inflows, and potential national-level initiatives, Armstrong’s multi-million-dollar Bitcoin prediction may not be far-fetched.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation24 hours ago

Regulation24 hours agoActing SEC Chair Uyeda announces new crypto task force

-

Ethereum18 hours ago

Ethereum18 hours agoETH breaks $3,900 as Bitcoin spikes past $103k

-

Regulation22 hours ago

Regulation22 hours agoTurkey rolls out new crypto AML regulations

-

Market21 hours ago

Market21 hours agoBitcoin price analysis: economic headwinds push price lower

-

Market18 hours ago

Market18 hours agoTop 4 altcoins to buy before the market fully recovers

-

Regulation18 hours ago

Regulation18 hours agoBitpanda becomes first European firm to secure Dubai VARA in-principle approval

-

Regulation20 hours ago

Regulation20 hours agoCrypto custody firm Copper withdraws UK registration

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum ETFs inflows surge as Bitcoin ETFs see major outflows