Market

Ethereum Price Hits Roadblock After $1 Billion Exchange Inflow

The value of Ethereum (ETH) sent into exchanges has surpassed $1 billion just two days after the altcoin’s price climbed to $2,600. This sudden influx of ETH onto exchanges often signals a potential shift in market sentiment, as traders may be preparing to cash out on recent gains.

With Ethereum’s price swinging sideways, the question now is whether this inflow will lead to increased selling pressure for one of the market’s top assets.

Ethereum Holders Book Quick Gains

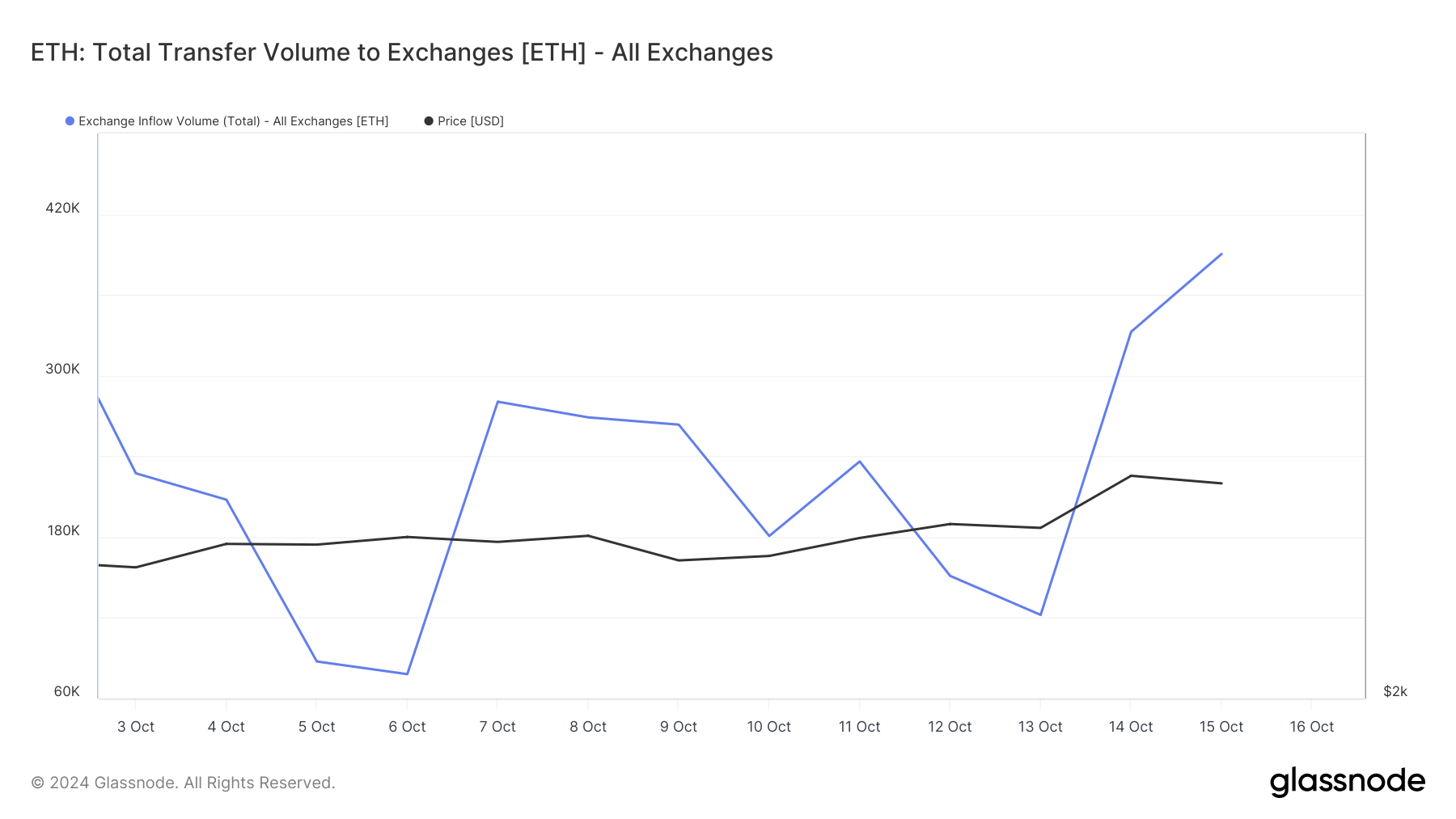

On October 13, Glassnode data revealed that 122,164 ETH were held on exchanges. However, as of this writing, that number has surged to 390,432 ETH. At the current price of ETH, this represents a value of over $1 billion.

Exchange inflow shows the number of coins leaving external wallets and going into centralized platforms. The significant increase in ETH on exchanges could indicate rising selling pressure. Notably, more coins being transferred to exchanges often suggests that holders may be preparing to liquidate their assets.

If sustained, this could have bearish implications for the cryptocurrency’s short-term price movement. Moreover, this development is also another reason ETH’s price might struggle to reach $3,000.

Read more: Ethereum ETF Explained: What It Is and How It Works

A further on-chain assessment suggests that crypto whales have contributed to Ethereum’s recent price decline. According to IntoTheBlock, the large holders’ netflow to exchange ratio has increased over the past seven days.

This ratio offers insight into whale activity. When it decreases, it indicates that whales are withdrawing assets from exchanges, typically signaling a bullish trend as they may be holding long-term.

Conversely, the recent increase in the ratio suggests that these large holders are sending their Ethereum to exchanges, potentially for sale. This increase in exchange inflows from whales is often seen as a bearish sign, as it can create downward pressure on the cryptocurrency’s price.

ETH Price Prediction: $2,440 Pullback Looms

On the daily chart, the Chaikin Money Flow (CMF) has fallen below the zero signal line. The CMF is a technical oscillator that measures accumulation and distribution in the market. When it increases, accumulation dominates, suggesting that the price can increase.

A decrease, on the other hand, indicates a rising level of distribution. For ETH, it is the latter, as the indicator suggests that the cryptocurrency could drop below $2,500.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Should this be the case, Ethereum’s price may decline to $2,440. However, if bulls begin to buy ETH in large volumes again, the cryptocurrency’s value could climb toward $3,018.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin Holding Time and Whale Activity Spikes

Dogecoin (DOGE), a leading meme coin, is signaling a potential breakout from its narrow trading range.

If this momentum continues, it could reclaim its multi-year high of $0.48, fueled by extended holding periods and increased accumulation by large holders.

Dogecoin Investors Reduce Distribution

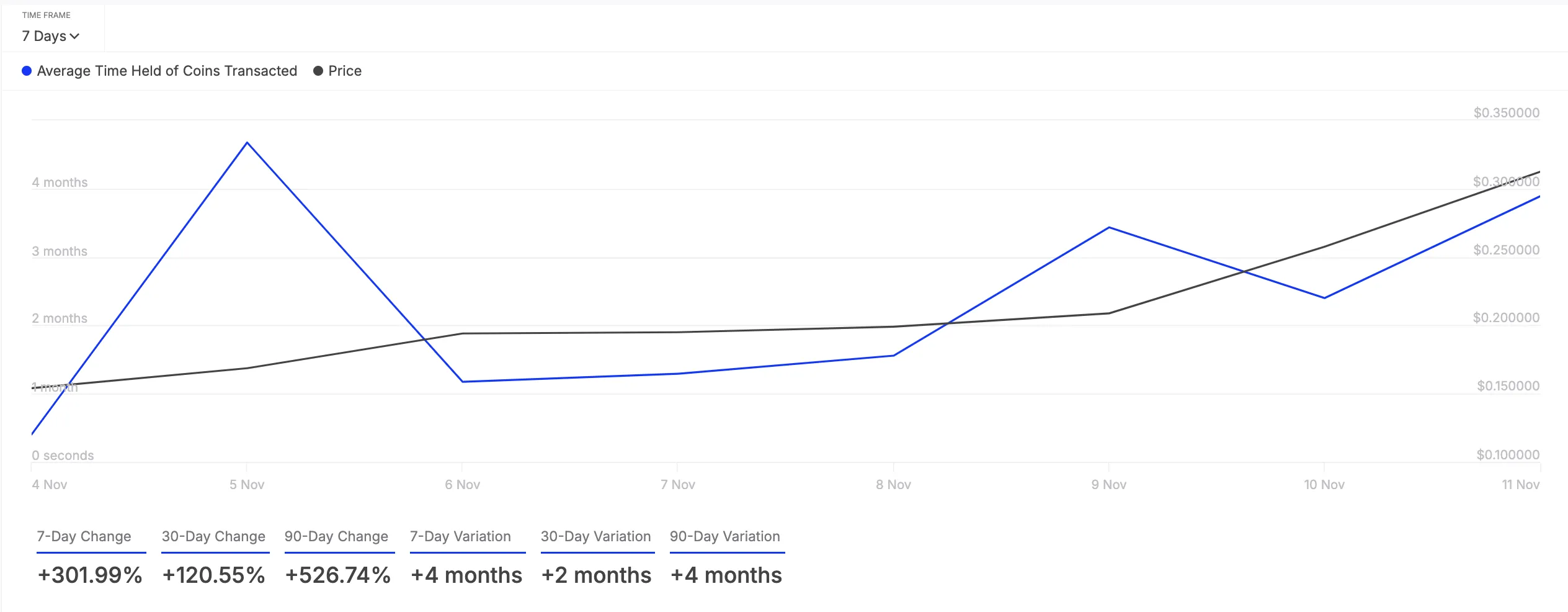

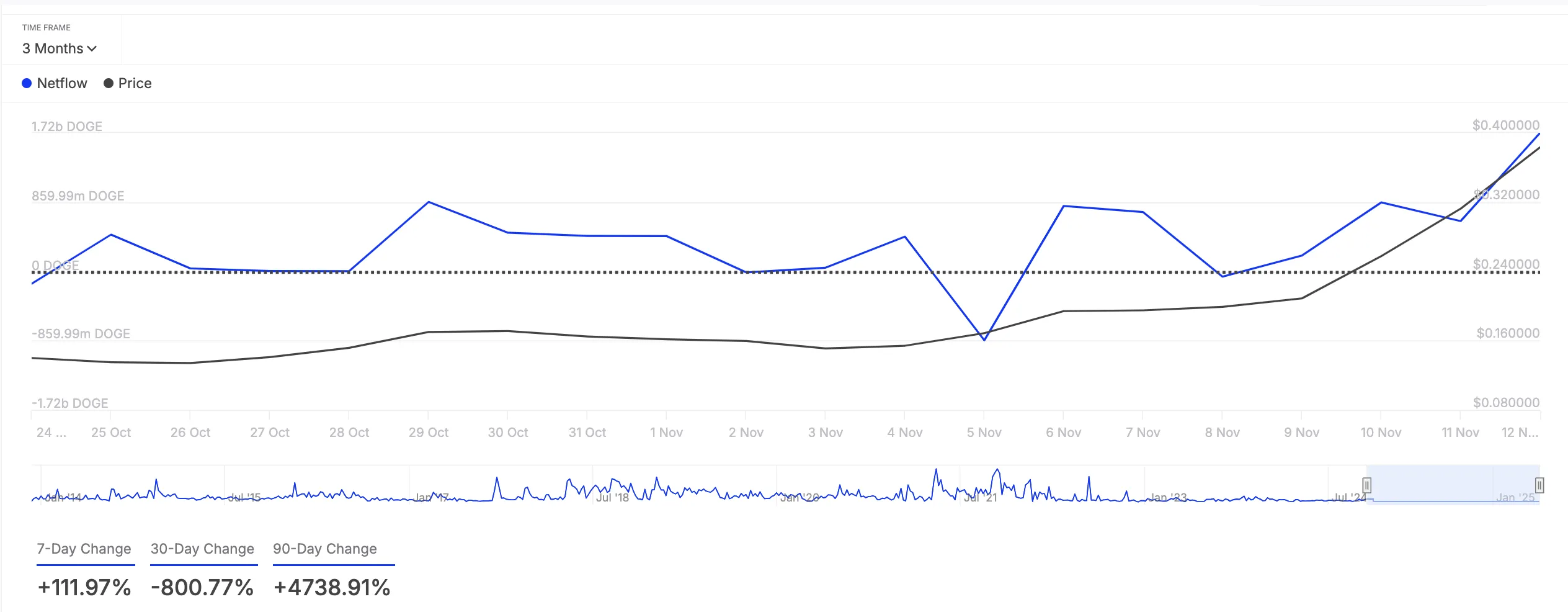

The on-chain assessment of DOGE’s performance has revealed a significant spike in the holding time of all its coins transacted in the past seven days. According to IntoTheBlock, this has climbed by 302% during the review period.

The holding time of an asset’s transacted coins represents the average duration tokens are kept in wallets before being sold or transferred.

Longer holding periods like this reduce selling pressure in the DOGE market. This reflects stronger investor conviction, as investors choose to keep their coins rather than sell them.

In addition to reducing selling activity, DOGE whales have increased their holdings over the past week. This is reflected by the 112% uptick in its large holders’ netflow during that period.

An asset’s large holders’ netflow metric tracks the movement of coins into and out of wallets controlled by whales or institutional investors. When this metric spikes, it suggests that these large holders are accumulating more of the asset, signaling increased confidence in its future price movement.

DOGE Price Prediction: Bullish Run Could Continue

If this bullish momentum is maintained, DOGE will extend its weekly 3% spike. As buying pressure strengthens, the meme coin could revisit its four-year high of $0.48.

However, this bullish outlook will be invalidated if accumulation stalls and selling activity recommences. In that scenario, DOGE’s price could slip to $0.29.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Base DEX Volume Approaches $3 Billion Amid Growing Adoption

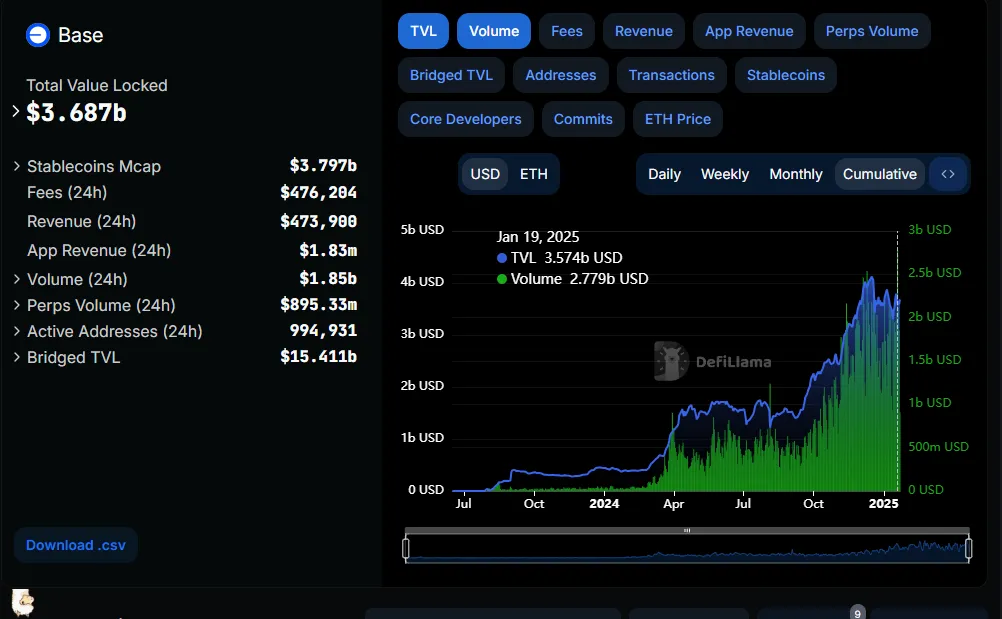

Base, Coinbase’s Layer-2 (L2) blockchain solution, has reached new heights, setting an all-time high daily decentralized exchange (DEX) trading volume near $3 billion.

This milestone reflects Base’s growing prominence in the L2 space and its role in scaling on-chain transactions for Coinbase users.

Base Hits New Milestone in DEX Volume

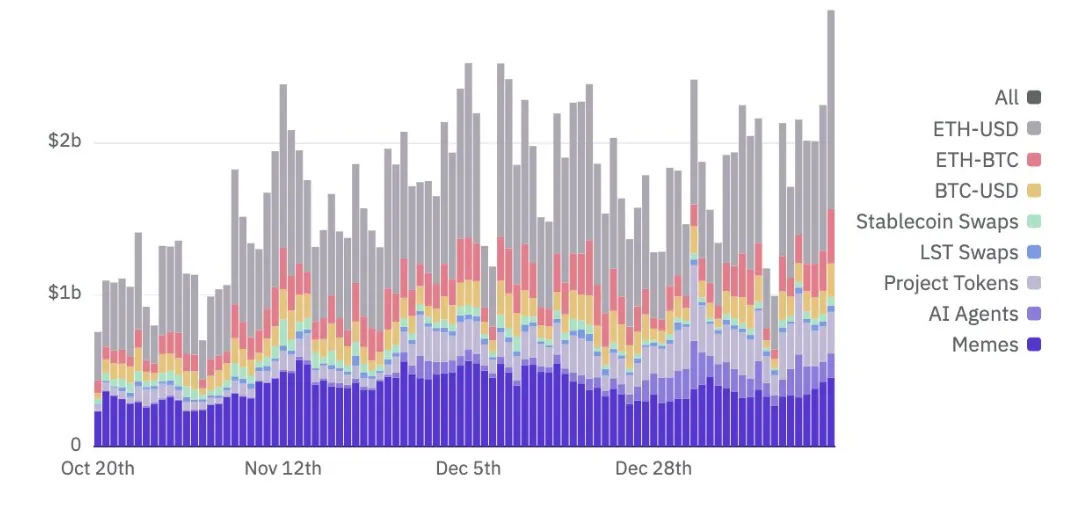

Blockchain analyst Dan Smith highlighted Base L2’s record-breaking volume of $2.9 billion, including $1.3 billion in ETH-USD trading, which also hit an all-time high. Other trading pairs, such as ETH-cbBTC and BTC-USD, were close to breaking their own records.

The $2.9 billion DEX volume reflects Base’s growing appeal among traders, particularly in ETH-USD pairs, which benefited from recent price volatility. Alexander, another blockchain enthusiast, noted that this milestone marked the first time Base nearly tagged $3 billion in daily volume, alluding to the development as evidence of L2’s growing adoption.

AerodromeFi, a liquidity-focused decentralized protocol on Base, also recorded an all-time high of $1.68 billion in volume, further emphasizing the ecosystem’s momentum.

“This is the first time Base nearly passed $3 billion and AerodromeFi set a new ATH of $1.68 billion in volume,” Alexander commented.

Base’s success is particularly notable because it operates without a native token. Coinbase explicitly ruled out launching a token for Base, prioritizing ecosystem growth and user adoption instead. This approach has likely contributed to its traction by focusing on utility and reducing speculative risks that could deter long-term users.

“There are no plans for a Base network token. We are focused on building, and we want to solve real problems that let you build better,” Base lead developer Jesse Pollak stated recently.

Consistent Growth in Transactions and TVL

The recent achievement follows Base’s earlier milestones, including reaching one billion transactions two months ago and surpassing six million daily transactions in October. More closely, the network recently outpaced Ethereum in user growth amid growing crypto markets.

Additionally, Base’s Total Value Locked (TVL) has seen consistent growth, indicating increased user participation, asset inflows, and liquidity within its ecosystem. A rising TVL signals greater confidence in the platform, fostering a stronger and more sustainable DeFi environment.

Despite its impressive growth, Base has faced some criticism. The network was accused of copying aspects of an NFT project, sparking concerns over originality and intellectual property. While this controversy did not deter adoption, it highlights the challenges of rapid innovation in the competitive blockchain space.

Base’s trajectory positions it as a serious contender in the L2 space, competing with established players like Arbitrum (ARB) and Optimism (OP). Its emphasis on utility, combined with rising user participation and liquidity, paints a promising picture for its future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is a Drop Below $0.92 Inevitable?

Cardano’s recent sideways price action has led to a surge in demand for short positions among futures traders.

As the coin’s momentum slows, traders are increasingly betting on a price decline, signaling a bearish sentiment toward ADA.

Cardano Traders Bet on a Price Decline

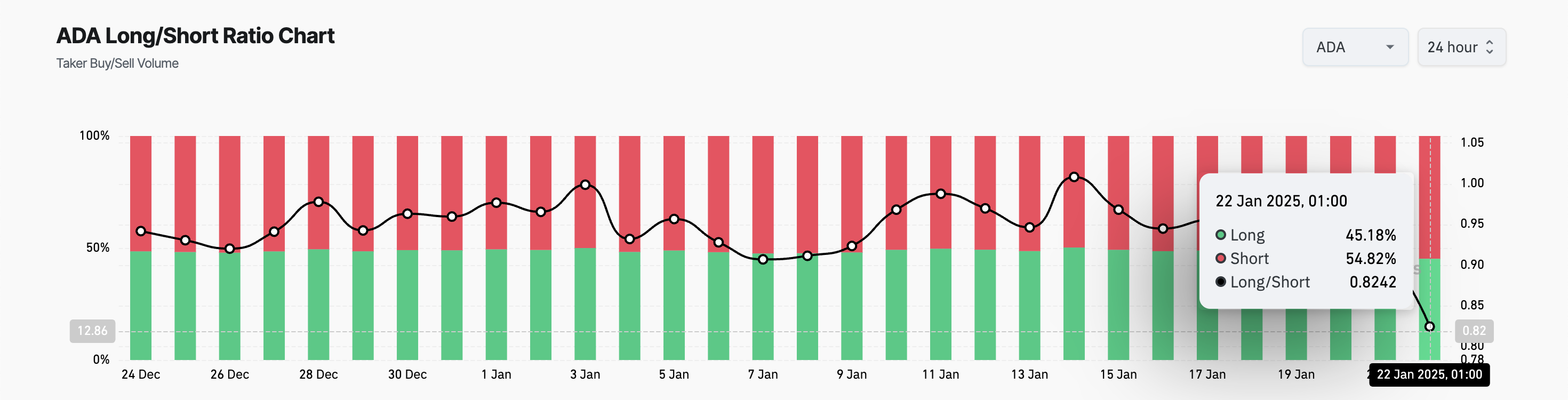

According to Coinglass, ADA’s Long/Short Ratio is at a monthly low of 0.82, indicating a high demand for short positions.

An asset’s Long/Short Ratio compares the number of its long (buy) positions to short (sell) positions in a market. As with ADA, when the ratio is below one, more traders are betting on the price falling (shorting) rather than rising. If short sellers continue to dominate, this can increase the downward pressure on the asset’s price.

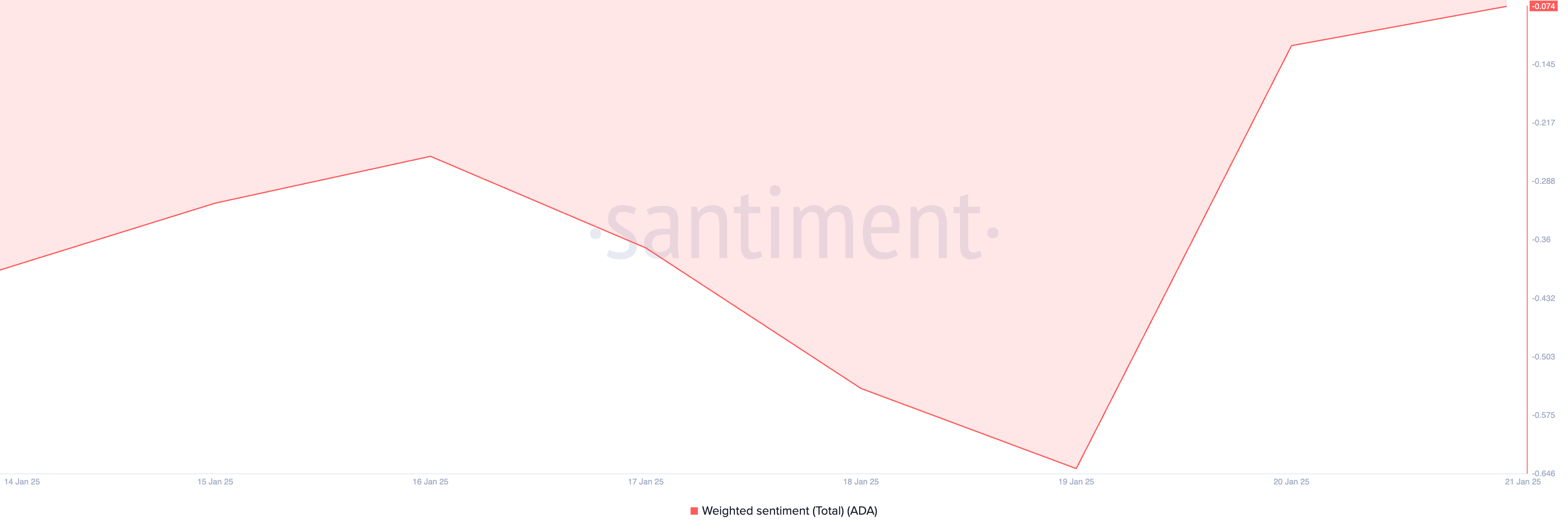

Additionally, ADA’s Weighted Sentiment remains negative, currently standing at -0.074, reinforcing the bearish outlook for the altcoin.

Weighted Sentiment gauges the overall market bias by analyzing the volume and tone of social media mentions. A negative value signals growing skepticism among investors, often leading to reduced trading activity and downward pressure on the asset’s price.

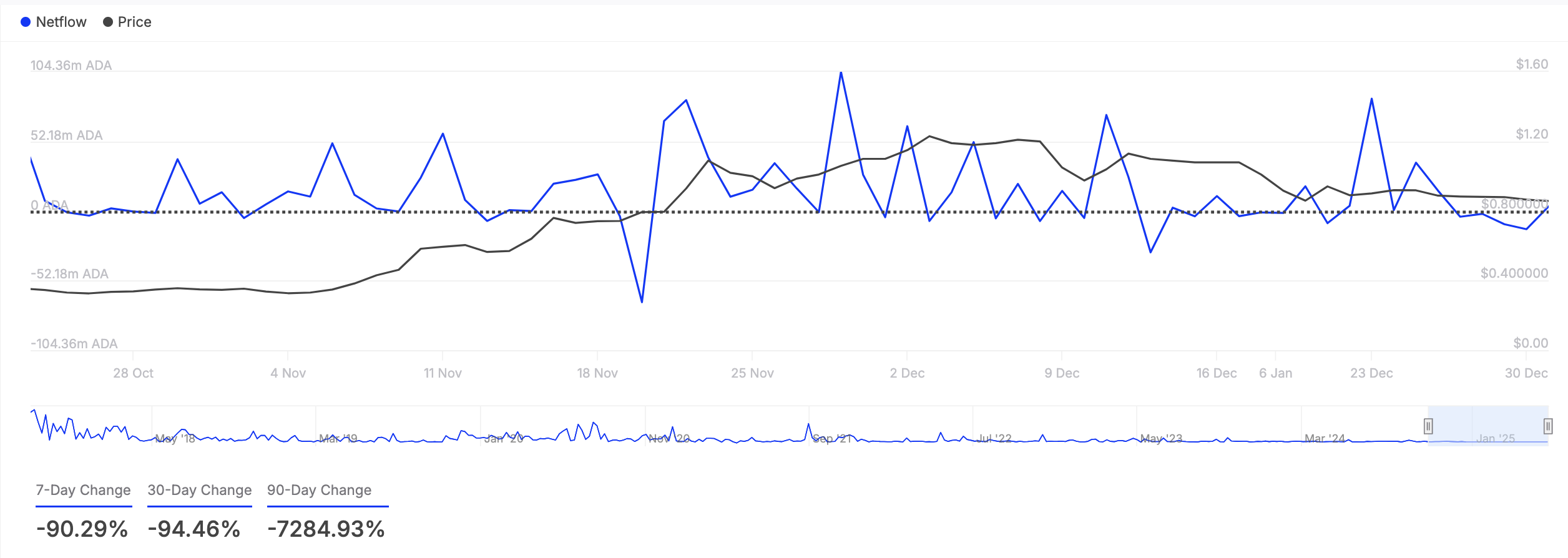

Notably, ADA whales have reduced their trading activity over the past week, with the coin’s large holders’ netflow dropping by 90.29%, according to IntoTheBlock.

Large holders, defined as addresses holding more than 0.1% of an asset’s circulating supply, play a significant role in market movements. A decline in their netflow indicates reduced buying activity, adding to the downward pressure on ADA’s price.

ADA Price Prediction: Recovery to $1 or Decline to $0.80?

ADA is currently trading at $0.98, hovering just above its support level of $0.90. If bearish pressure intensifies, the price may test this support. A failure to hold at $0.90 could see ADA’s decline extend further, potentially dropping to $0.80.

Conversely, if buying activity resurges, ADA’s price could stabilize above the $1 mark.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation21 hours ago

Regulation21 hours agoActing SEC Chair Uyeda announces new crypto task force

-

Regulation19 hours ago

Regulation19 hours agoTurkey rolls out new crypto AML regulations

-

Ethereum16 hours ago

Ethereum16 hours agoETH breaks $3,900 as Bitcoin spikes past $103k

-

Regulation23 hours ago

Regulation23 hours agoTether’s market capitalisation slips as MiCA regulations kick in

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum ETFs inflows surge as Bitcoin ETFs see major outflows

-

Market13 hours ago

Market13 hours agoWeekly Price Analysis: Bitcoin Remains Rangebound while Altcoins Fly

-

Market19 hours ago

Market19 hours agoBitcoin price analysis: economic headwinds push price lower

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum to rebound as iDEGEN remains on track to a billion-dollar valuation