Market

Canary Capital Aims for Litecoin ETF After XRP ETF Submission

Nashville-based investment firm Canary Capital filed for a Litecoin exchange-traded fund (ETF) with the US Securities and Exchange Commission (SEC). This comes on the heels of Canary and BitWise filing for an XRP ETF earlier this month.

Litecoin’s official site made a statement after the ETF filing went public.

Canary’s New ETF Attempt

Nashville-based investment firm Canary Capital filed for a Litecoin (LTC) ETF with the Securities and Exchange Commission (SEC) today. This comes less than a week after Canary submitted an XRP ETF application, showing a multifaceted approach. Canary’s documents show it filed with CSC Delaware Trust Company for both attempts; BitWise also used it for its XRP ETF.

Read More: XRP ETF Explained: What It Is and How It Works

Litecoin published a positive statement about this ETF filing on its website, greeting this new development. It called special attention to Canary Capital’s founder, Steven McClurg, who was “former co-founder and Chief Investment Officer” at Valkyrie Funds. Valkyrie was among the first applicants for a Bitcoin Futures ETF several years ago.

“Steven established Canary Capital to drive innovation and deliver actively managed private strategies to meet institutional demand for sophisticated cryptocurrency investment solutions. If approved, the ETF will provide both consumer and institutional investors with wide-spread direct exposure to Litecoin,” the statement read.

October has seen a high level of action in the crypto ETF market so far. Bitcoin ETFs are currently surging with demand, and these three new applications took place in fairly quick succession. The prevailing opinion is that Solana is more likely to win the next ETF approval, but these predictions have not deterred proposals for LTC or XRP.

In the past 24 hours, Litecoin’s price has increased by around 7%. There have been signs that LTC may rally this month if whales move the needle, but this has not materialized. So far, on-chain data suggests a slight uptick, but nothing substantial has occurred.

Read More: How To Buy Litecoin (LTC) in 4 Easy Steps

Although approval for this ETF would be a substantial win for the crypto industry, Bloomberg analyst James Seyffart noted that several exchange-traded products (ETPs) already carry LTC. He mentioned both a Swiss and a German product and added that Grayscale already has a Litecoin ETP in the US.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Can Reach $3,500 On The Back Of These Factors

Ethereum, the second-largest cryptocurrency, recently failed to breach $3,524, triggering a sharp price drop. Since then, recovery efforts have remained weak as volatility persists.

However, the current conditions suggest Ethereum may be preparing for a comeback as the market stabilizes.

Ethereum Has Room For Recovery

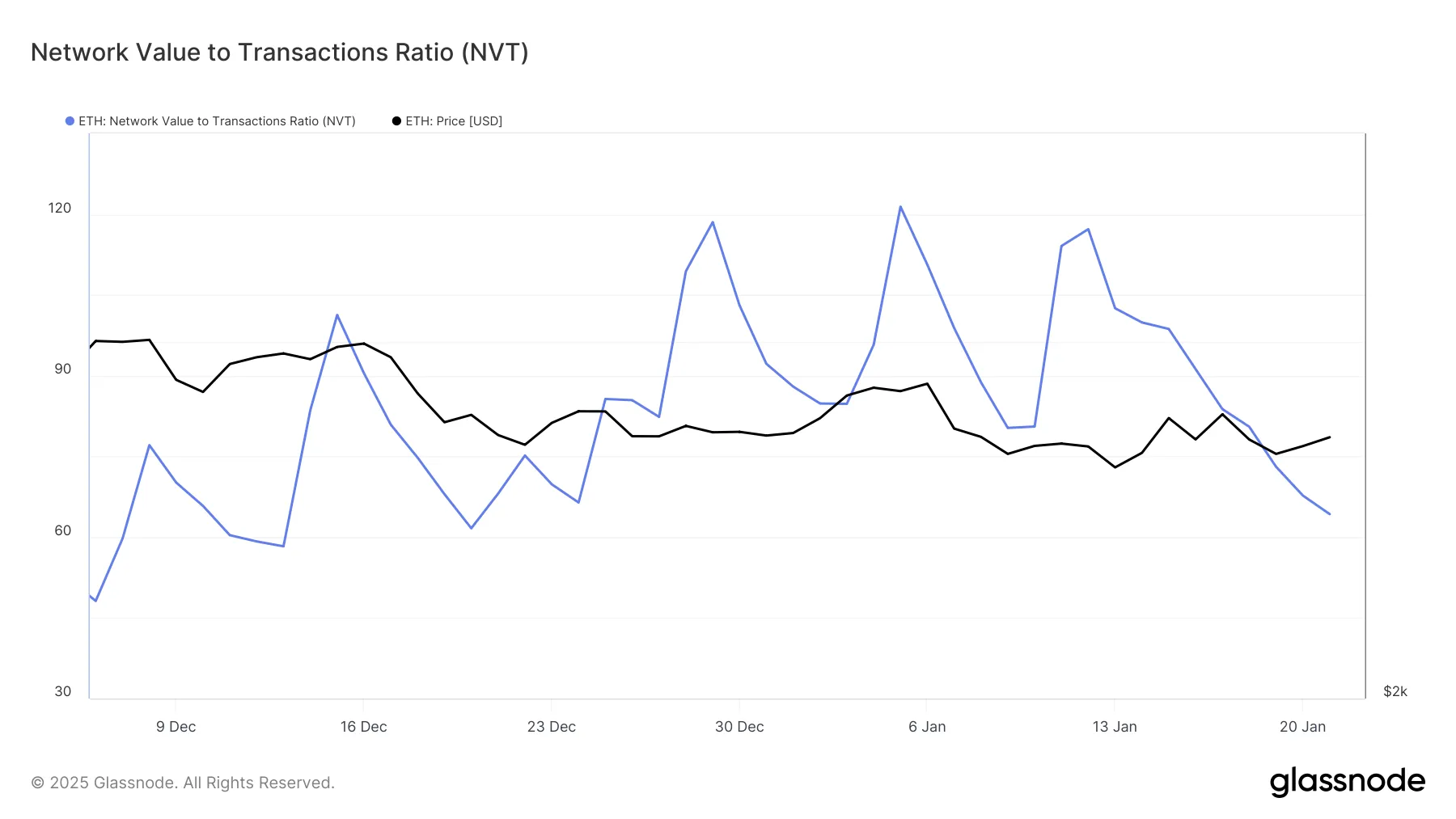

Ethereum’s Network Value to Transaction (NVT) Ratio is experiencing a decline, recently hitting a monthly low. A low NVT indicates that transaction activity is balanced with network value, reflecting reduced volatility. This creates an environment conducive to price recovery, something Ethereum urgently needs to regain its footing.

With the NVT ratio signaling healthy network activity, Ethereum is positioned to stabilize in the short term. Declining volatility often fosters investor confidence, making it more likely for the cryptocurrency to see renewed buying interest. As speculative activity wanes, Ethereum has an opportunity to chart a path toward meaningful recovery.

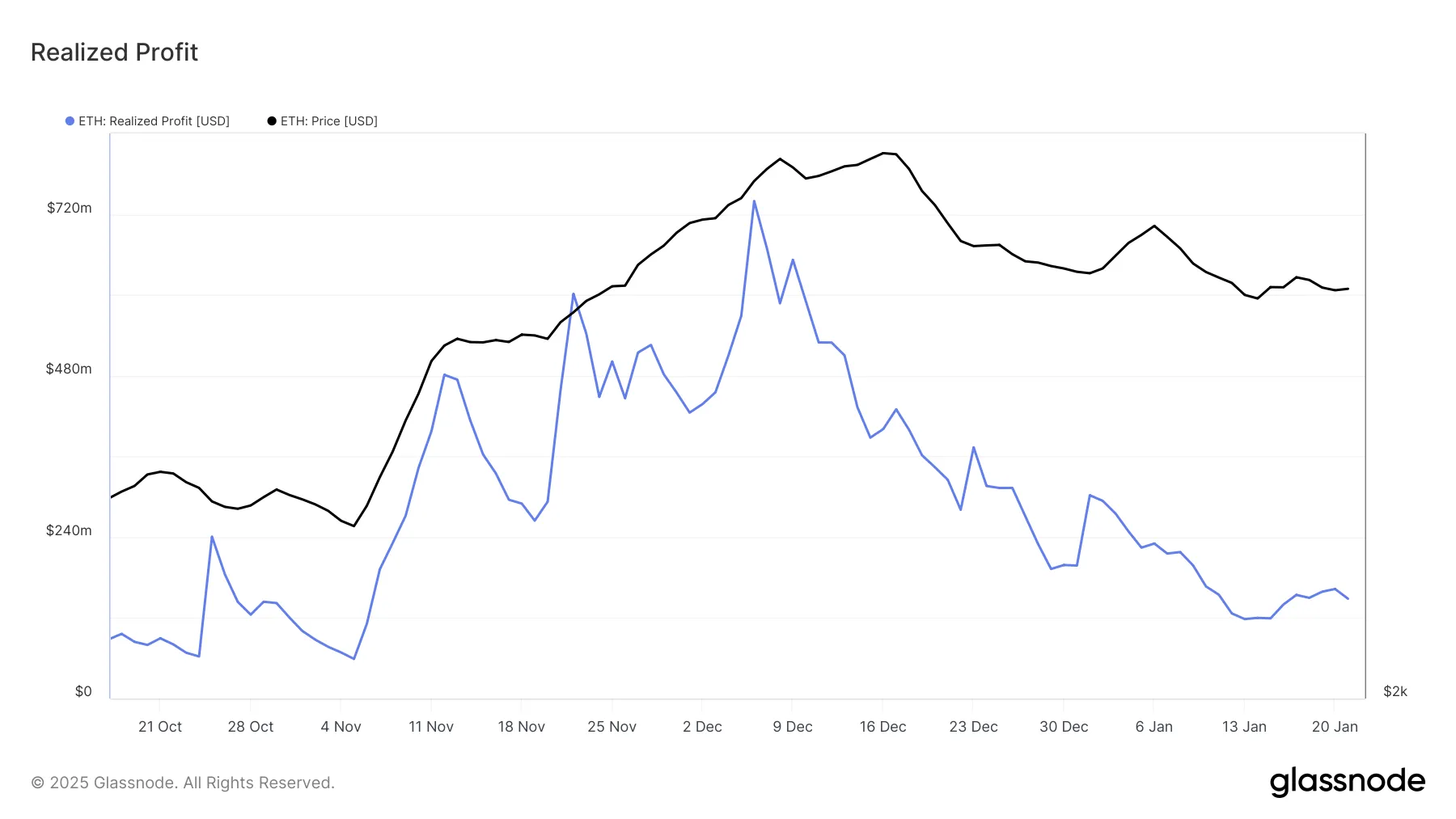

Ethereum’s realized profits recently dropped to a six-week low, pointing to a significant reduction in selling pressure from investors. This trend highlights the market’s shifting sentiment, with fewer participants looking to offload their holdings. Such conditions could provide Ethereum with the breathing room required to capitalize on broader bullish cues.

The lack of an uptick in realized profits suggests that the selling lull may persist, allowing Ethereum to focus on building upward momentum. With investors holding onto their coins, market conditions are primed for a gradual recovery, provided external factors remain favorable.

ETH Price Prediction: Breaking The Barrier

Ethereum is currently trading near $3,300, just below the critical resistance level of $3,327. Flipping this into support is essential for ETH to initiate a rally toward $3,524, representing a 6% increase from current levels. This move would mark a partial recovery from recent losses.

Breaking through the $3,524 resistance is crucial for Ethereum’s recovery. Achieving this would erase the recent downturn and also position the altcoin for further gains, potentially targeting $3,711. Such a move would underscore Ethereum’s resilience and align with the broader market’s bullish sentiment.

However, failing to establish $3,327 as a support level could stall Ethereum’s recovery. This scenario would leave the cryptocurrency vulnerable to a retracement toward $3,200, undermining recent progress and potentially delaying its path to $3,500.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Justin Sun, Vitalik Buterin Speak Amid Ethereum Reform Debate

TRON founder Justin Sun has offered a hypothetical plan for Ethereum and the Ethereum Foundation (EF) under his leadership. His remarks come amid controversy over EF’s leadership transformation.

In a series of posts on X (formerly Twitter), Ethereum co-founder Vitalik Buterin outlined the reforms’ goals and progress. He highlighted improvements in technical expertise, ecosystem engagement, and operational efficiency.

Justin Sun Outlines Blueprint for Ethereum Leadership

The TRON executive shared ambitious remarks on how he would lead the Ethereum Foundation if given the opportunity. Sun’s vision, shared on X, outlined a four-point plan to radically restructure EF operations, optimize Ethereum’s economic model, and drive the price of ETH to $10,000.

“If EF and Ethereum were under my leadership, ETH would hit $10,000,” Sun claimed.

Sun proposed an immediate halt to ETH sales for three years to stabilize supply and boost market confidence. He suggested covering EF’s operational costs through DeFi protocols like Aave, staking yields, and stablecoin borrowing, aligning with Ethereum’s deflationary goals.

A key component of his plan involves imposing significant taxes on Layer 2 (L2) solutions, aiming to generate $5 billion annually. The collected taxes would go toward exclusively repurchasing and burning ETH, further enhancing its scarcity and value.

Sun also called for a drastic downsizing of EF staff, retaining only top performers and offering them significant salary increases. This merit-based approach, he argued, would streamline operations and improve efficiency.

Finally, Sun emphasized adjusting node rewards and increasing fee burns to reinforce Ethereum’s deflationary narrative. He proposed redirecting all resources toward Ethereum’s core L1 development, focusing on scalability, security, and adoption. Justin Sun’s plan sparked a mixed response, with some applauding the bold vision.

“These are all very practical suggestions. Please pay attention to them and refer to them, Vitalik Buterin,” core developer 0xSea.eth posed.

Meanwhile, others challenged Sun to focus on TRON and explore bringing decentralized finance (DeFi) to its ecosystem.

“Maybe start with how to make DeFi great on TRON – you should ask your exec team (and yourself), “Why is DeFi nonexistent on TRON despite it being the chain with the most stable coins on it?” If you answer this, maybe TRON can beat eth one day,” ZIGChain co-founder Abdul Rafay Gadit remarked.

Vitalik Buterin Defends Leadership Amid Criticism

Sun’s proposed solution aligns with Vitalik Buterin’s recent post discussing ongoing changes over the past year, some of which have already been implemented. Buterin emphasized goals such as strengthening the EF’s technical leadership and improving collaboration with ecosystem participants. He also addressed concerns, rejecting the notion that the EF might adopt centralized or politically motivated roles.

“…these things aren’t what EF does and this isn’t going to change. People seeking a different vision are welcome to start their orgs,” Buterin articulated.

Aya Miyaguchi, an EF executive, confirmed the ongoing efforts, expressing excitement about forthcoming announcements. She noted that the reforms aim to solidify Ethereum’s position as a global neutral platform while embracing decentralized and privacy-preserving technologies.

The announcement has stirred controversy within the crypto community. Critics argue that the current leadership has failed to manage Ethereum effectively.

“Respectfully, just let new blood take over. You guys can’t even make a simple Twitter account work—how can you be trusted to lead the second biggest blockchain,” Wazz posed.

Another user, Coinmamba, suggested that pressuring Miyaguchi to resign could result in Ethereum reaching new all-time high. Buterin strongly condemned these comments, defending Miyaguchi and calling out the toxicity of such social media rhetoric.

“No. This is not how this game works,” Buterin retorted. “The person deciding the new EF leadership team is me. If you ‘keep the pressure on,’ then you are creating an environment that is actively toxic to top talent. YOU ARE MAKING MY JOB HARDER,” the Ethereum co-founder lamented.

Buterin also refuted specific claims against Miyaguchi, pointing out inaccuracies in translations and misinterpretations of her statements. He reiterated the need for a “proper board” within EF to enhance governance.

Ethereum’s ETH token was trading at $3,305 as of this writing, representing a modest 0.2% surge since Wednesday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin Holding Time and Whale Activity Spikes

Dogecoin (DOGE), a leading meme coin, is signaling a potential breakout from its narrow trading range.

If this momentum continues, it could reclaim its multi-year high of $0.48, fueled by extended holding periods and increased accumulation by large holders.

Dogecoin Investors Reduce Distribution

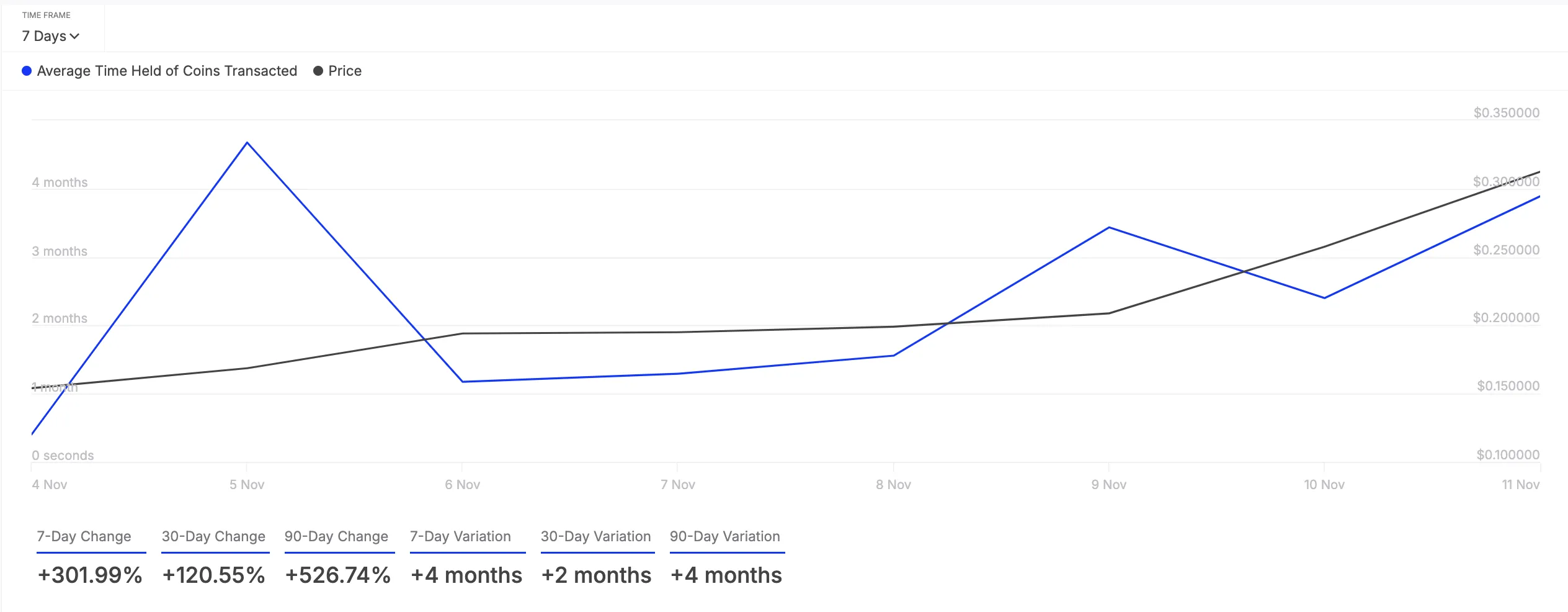

The on-chain assessment of DOGE’s performance has revealed a significant spike in the holding time of all its coins transacted in the past seven days. According to IntoTheBlock, this has climbed by 302% during the review period.

The holding time of an asset’s transacted coins represents the average duration tokens are kept in wallets before being sold or transferred.

Longer holding periods like this reduce selling pressure in the DOGE market. This reflects stronger investor conviction, as investors choose to keep their coins rather than sell them.

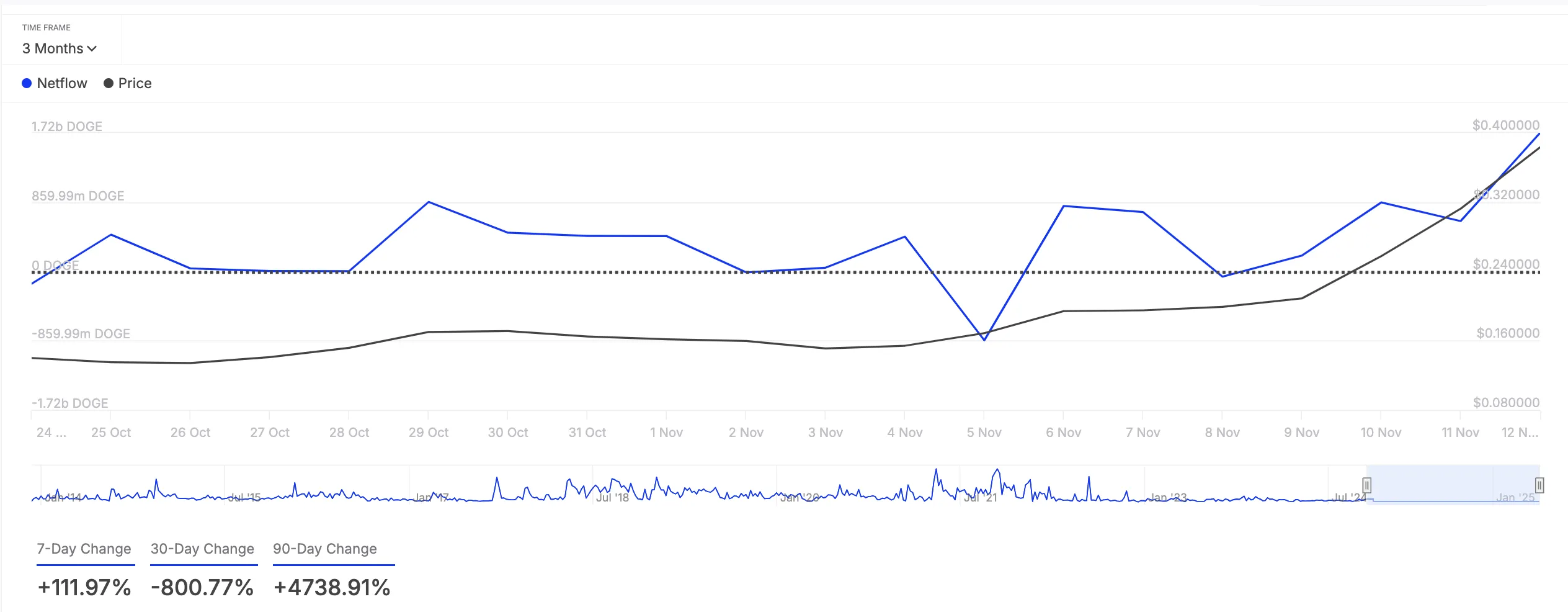

In addition to reducing selling activity, DOGE whales have increased their holdings over the past week. This is reflected by the 112% uptick in its large holders’ netflow during that period.

An asset’s large holders’ netflow metric tracks the movement of coins into and out of wallets controlled by whales or institutional investors. When this metric spikes, it suggests that these large holders are accumulating more of the asset, signaling increased confidence in its future price movement.

DOGE Price Prediction: Bullish Run Could Continue

If this bullish momentum is maintained, DOGE will extend its weekly 3% spike. As buying pressure strengthens, the meme coin could revisit its four-year high of $0.48.

However, this bullish outlook will be invalidated if accumulation stalls and selling activity recommences. In that scenario, DOGE’s price could slip to $0.29.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation24 hours ago

Regulation24 hours agoActing SEC Chair Uyeda announces new crypto task force

-

Regulation22 hours ago

Regulation22 hours agoTurkey rolls out new crypto AML regulations

-

Ethereum18 hours ago

Ethereum18 hours agoETH breaks $3,900 as Bitcoin spikes past $103k

-

Regulation18 hours ago

Regulation18 hours agoBitpanda becomes first European firm to secure Dubai VARA in-principle approval

-

Regulation20 hours ago

Regulation20 hours agoCrypto custody firm Copper withdraws UK registration

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum ETFs inflows surge as Bitcoin ETFs see major outflows

-

Market15 hours ago

Market15 hours agoWeekly Price Analysis: Bitcoin Remains Rangebound while Altcoins Fly

-

Market21 hours ago

Market21 hours agoBitcoin price analysis: economic headwinds push price lower