Market

Bybit COO Helen Liu on Cross-Cultural Leadership in Crypto

Helen Liu has forged a dynamic path from tech giants like Nokia and Microsoft to her current role as Chief Operating Officer at Bybit. With a wealth of experience in HR leadership across multiple countries, Liu’s transition to the blockchain industry was driven by a passion for innovation and the inspiring vision of Bybit’s founders.

In this interview, she discusses her transition from traditional tech to crypto, how her global experience has shaped her approach, and the unique challenges she navigates as a woman in the industry.

Your journey from HR leadership roles at global tech companies like Nokia and Microsoft to becoming COO of Bybit looks very inspiring for us. What motivated you to transition from “traditional” tech?

I was drawn to Bybit by the company’s strong values — putting people first — and the vision of its founders. Although I didn’t have extensive crypto knowledge when I first joined, I quickly realized that the skills I developed in traditional tech leadership were highly transferable.

The founders’ inspiring leadership encouraged me to take on this new challenge, and I’ve since realized how my past experience has helped drive success in both tech and blockchain.

You’ve worked across several countries and industries. How has your international experience shaped your leadership style, especially in the crypto sector?

My professional journey began in China. Since then, I’ve had the opportunity to work in Finland, Singapore, Indonesia, and now Dubai. Each of these experiences has provided me with valuable global exposure and a deep understanding of different working cultures.

This international perspective has been instrumental in shaping my leadership style. Especially in the crypto sector, where adaptability and cross-cultural communication are key to driving innovation and fostering collaboration.

As a female leader in the crypto space, what unique challenges have you faced, and how have you navigated them?

As a female leader in a male-dominated industry, I’ve observed differences in how male leaders approach business and relationships. Many blockchain ecosystem partners, KOLs, and institutional clients are men. They often thrive in social environments, which can feel energizing for them.

While I’m not naturally the most sociable person, I recognize the importance of these opportunities to build meaningful relationships. I approach these interactions by actively listening to their needs and challenges, inviting them to our office, or arranging meetings to deep dive together on areas we can do better. This allows me to have more empathy and listen to their pain points and establish a more personal connection.

Interestingly, many male clients feel comfortable sharing aspects of their career lives with me and often seek advice, especially in regions like Brazil and Argentina. It’s in these moments that I find a deeper level of engagement, where we discuss not only business but also personal challenges and aspirations.

What is the most significant leadership lesson you’ve learned throughout your career? How do you apply it in your role?

Throughout my career, I’ve gained invaluable lessons from working in diverse regions and cultures. During my time in Finland, I was in a role leading competence development for global Demand and Supply Chain where I learned the importance of making decisions with a global perspective, understanding the complexities and nuances of international markets. This experience taught me to approach broader issues with a clear rationale, balancing local needs with global objectives.

At Microsoft’s APAC office in Singapore, I witnessed firsthand the power of precision and excellence. The team demonstrated remarkable proficiency, a positive attitude, and zero-defect execution, which reinforced my belief in striving for accuracy and efficiency in all operations.

In Indonesia, I embraced the company’s deep-rooted culture of care, love, and forgiveness through Muslim culture. This philosophy of giving and fostering employee well-being has shaped my belief that a supportive and compassionate work environment is key to building strong, resilient organizations.

Now in Dubai at Bybit’s headquarters, I’m energized by the vibe of crypto and by the passion of the local community. I see this as an opportunity to harness diverse talents that align with the values of the industry, driving Bybit’s global expansion.

The mix of inclusivity, innovation and young entrepreneurship here enables us to accelerate as a truly crypto-native company. Each of these experiences has shaped my leadership style, helping me apply a blend of strategic thinking, precision, and empathy in my role at Bybit and beyond.

You founded the Blockchain for Good Alliance, stressing blockchain’s potential for positive social impact. What personal experiences or insights led you to focus on this mission?

With the support and trust of over 51 million global registered users, Bybit deeply values the importance of giving back to the community. This sense of responsibility inspired me to explore how blockchain could be used for positive social impact, which led to the founding of the Blockchain for Good Alliance.

We believe that by leveraging the power of blockchain, we can help address real-world problems and make a meaningful difference. The Alliance is our way of ensuring that blockchain contributes to solving pressing global challenges.

As a founder of Moledao, what inspired you to focus on developing blockchain talent? What gaps do you see in the current landscape for growing future leaders in this space?

Moledao has two primary missions. First, we aim to empower entrepreneurs, recognizing how challenging it can be to build and complete projects without adequate support.

We encourage these builders to stay true to their vision and persevere. Second, we’re focused on creating a “LinkedIn for blockchain talent.” The crypto industry is still in its infancy compared to traditional sectors, with many young leaders who have ambitious mindsets but require guidance. Moledao acts as a mentor, offering leadership, direction, and a platform where blockchain professionals can connect with alumni, find support, and access job opportunities.

Additionally, Moledao’s Founder Club and Hackathons help incubate new projects, providing entrepreneurs with a community of like-minded individuals to share ideas, offer mentorship, and support each other’s growth. These initiatives aim to nurture talent and build the next generation of blockchain leaders.

What are some personal habits or practices that help you stay effective and balanced while managing the complexities of a global operation in such a dynamic industry?

While I’m naturally a workaholic, I make time for activities like hiking and swimming, often with colleagues. These moments not only help me recharge but also open many new windows seeing a topic.

The casual interactions, especially with colleagues from different age groups, often spark new ideas and fresh perspectives. Balancing these activities with my work helps me stay energized and continuously think of doing the right things to drive immediate success and long-term vision.

What advice would you give to young women aspiring to leadership roles in emerging technologies?

My advice to all young talents aspiring to leadership roles in emerging technologies is to stay hungry but humbly. While achieving success is rewarding, it’s important to focus on long-term goals rather than just short-term wins.

Also, never settle too quickly — always be open to learning and trying something new. The tech is constantly evolving, and a mindset of continuous growth will help you navigate effectively in this space.

As women leaders, I believe our strength lies in operational excellence. For example, structuring a solid go-to-market plan, closely tracking metrics, and reflecting on outcomes before launching the next initiative.

This same attention to detail can be applied across many missions. I find that women often excel when it comes to ensuring things are done with precision and excellence.

Looking back at your career, what accomplishment are you most proud of, and how has it shaped your vision for the future of both your personal and professional life?

One of the proudest moments in my career was when Bybit became the world’s second-largest crypto exchange. To be honest, it was a great surprise, especially with such a lean team — yet, it was also the most committed team.

What makes this accomplishment so special is that our focus was never on chasing rankings. Instead, we dedicated ourselves to building trust and confidence with customers through products and services.

The recognition we’ve received has far exceeded our expectations, and it proves that our approach and efforts are on the right path. We are more engaged, to make even better achievements, to our clients, and to the industry.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Justin Sun, Vitalik Buterin Speak Amid Ethereum Reform Debate

TRON founder Justin Sun has offered a hypothetical plan for Ethereum and the Ethereum Foundation (EF) under his leadership. His remarks come amid controversy over EF’s leadership transformation.

In a series of posts on X (formerly Twitter), Ethereum co-founder Vitalik Buterin outlined the reforms’ goals and progress. He highlighted improvements in technical expertise, ecosystem engagement, and operational efficiency.

Justin Sun Outlines Blueprint for Ethereum Leadership

The TRON executive shared ambitious remarks on how he would lead the Ethereum Foundation if given the opportunity. Sun’s vision, shared on X, outlined a four-point plan to radically restructure EF operations, optimize Ethereum’s economic model, and drive the price of ETH to $10,000.

“If EF and Ethereum were under my leadership, ETH would hit $10,000,” Sun claimed.

Sun proposed an immediate halt to ETH sales for three years to stabilize supply and boost market confidence. He suggested covering EF’s operational costs through DeFi protocols like Aave, staking yields, and stablecoin borrowing, aligning with Ethereum’s deflationary goals.

A key component of his plan involves imposing significant taxes on Layer 2 (L2) solutions, aiming to generate $5 billion annually. The collected taxes would go toward exclusively repurchasing and burning ETH, further enhancing its scarcity and value.

Sun also called for a drastic downsizing of EF staff, retaining only top performers and offering them significant salary increases. This merit-based approach, he argued, would streamline operations and improve efficiency.

Finally, Sun emphasized adjusting node rewards and increasing fee burns to reinforce Ethereum’s deflationary narrative. He proposed redirecting all resources toward Ethereum’s core L1 development, focusing on scalability, security, and adoption. Justin Sun’s plan sparked a mixed response, with some applauding the bold vision.

“These are all very practical suggestions. Please pay attention to them and refer to them, Vitalik Buterin,” core developer 0xSea.eth posed.

Meanwhile, others challenged Sun to focus on TRON and explore bringing decentralized finance (DeFi) to its ecosystem.

“Maybe start with how to make DeFi great on TRON – you should ask your exec team (and yourself), “Why is DeFi nonexistent on TRON despite it being the chain with the most stable coins on it?” If you answer this, maybe TRON can beat eth one day,” ZIGChain co-founder Abdul Rafay Gadit remarked.

Vitalik Buterin Defends Leadership Amid Criticism

Sun’s proposed solution aligns with Vitalik Buterin’s recent post discussing ongoing changes over the past year, some of which have already been implemented. Buterin emphasized goals such as strengthening the EF’s technical leadership and improving collaboration with ecosystem participants. He also addressed concerns, rejecting the notion that the EF might adopt centralized or politically motivated roles.

“…these things aren’t what EF does and this isn’t going to change. People seeking a different vision are welcome to start their orgs,” Buterin articulated.

Aya Miyaguchi, an EF executive, confirmed the ongoing efforts, expressing excitement about forthcoming announcements. She noted that the reforms aim to solidify Ethereum’s position as a global neutral platform while embracing decentralized and privacy-preserving technologies.

The announcement has stirred controversy within the crypto community. Critics argue that the current leadership has failed to manage Ethereum effectively.

“Respectfully, just let new blood take over. You guys can’t even make a simple Twitter account work—how can you be trusted to lead the second biggest blockchain,” Wazz posed.

Another user, Coinmamba, suggested that pressuring Miyaguchi to resign could result in Ethereum reaching new all-time high. Buterin strongly condemned these comments, defending Miyaguchi and calling out the toxicity of such social media rhetoric.

“No. This is not how this game works,” Buterin retorted. “The person deciding the new EF leadership team is me. If you ‘keep the pressure on,’ then you are creating an environment that is actively toxic to top talent. YOU ARE MAKING MY JOB HARDER,” the Ethereum co-founder lamented.

Buterin also refuted specific claims against Miyaguchi, pointing out inaccuracies in translations and misinterpretations of her statements. He reiterated the need for a “proper board” within EF to enhance governance.

Ethereum’s ETH token was trading at $3,305 as of this writing, representing a modest 0.2% surge since Wednesday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin Holding Time and Whale Activity Spikes

Dogecoin (DOGE), a leading meme coin, is signaling a potential breakout from its narrow trading range.

If this momentum continues, it could reclaim its multi-year high of $0.48, fueled by extended holding periods and increased accumulation by large holders.

Dogecoin Investors Reduce Distribution

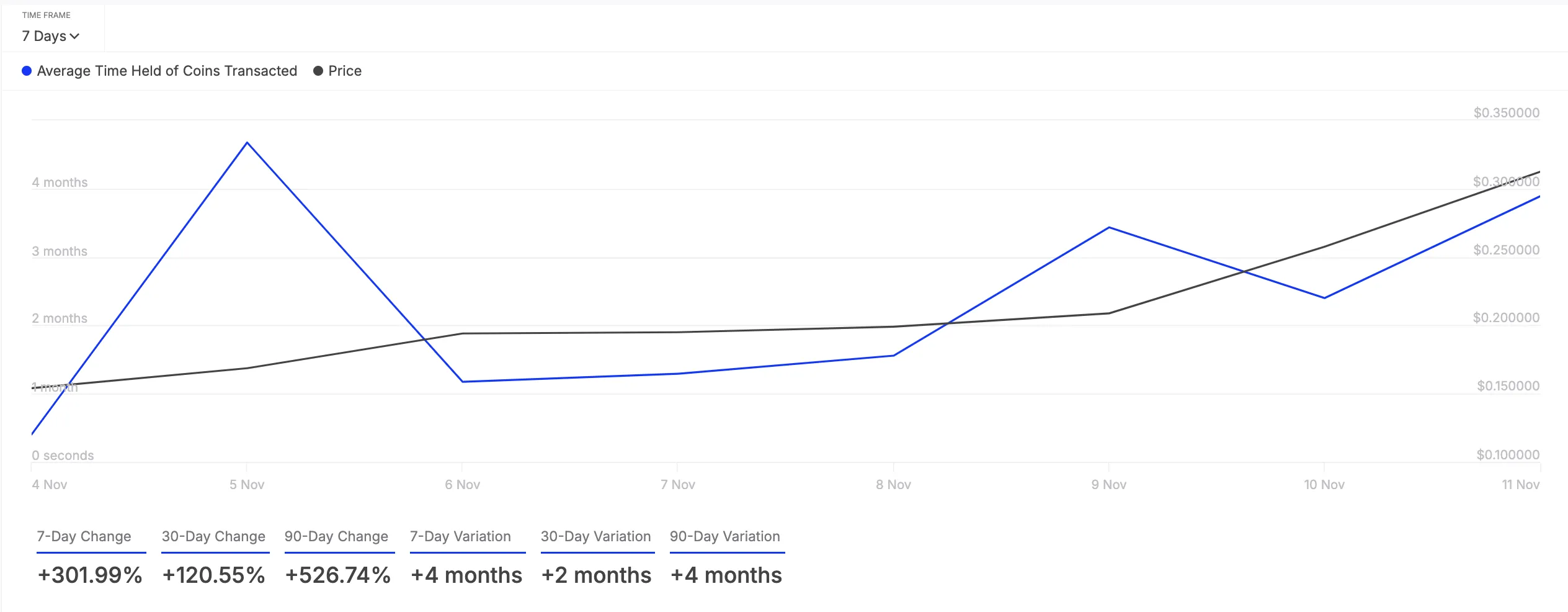

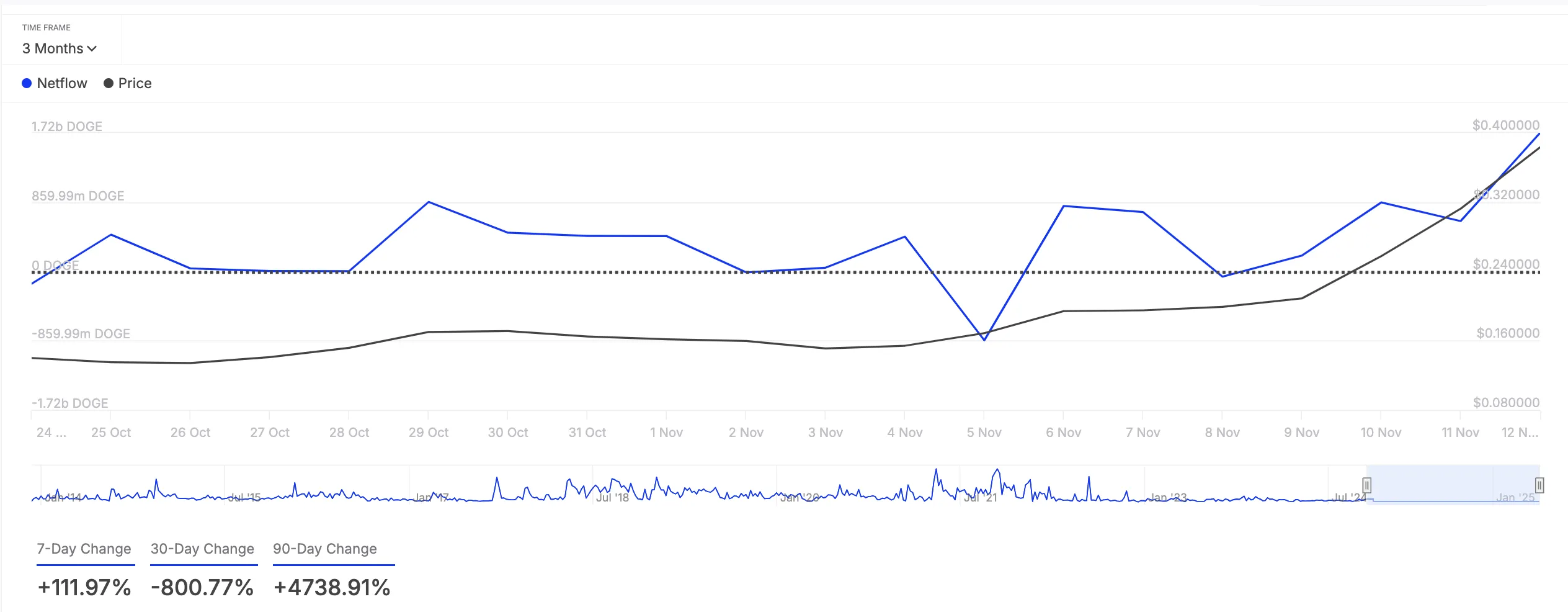

The on-chain assessment of DOGE’s performance has revealed a significant spike in the holding time of all its coins transacted in the past seven days. According to IntoTheBlock, this has climbed by 302% during the review period.

The holding time of an asset’s transacted coins represents the average duration tokens are kept in wallets before being sold or transferred.

Longer holding periods like this reduce selling pressure in the DOGE market. This reflects stronger investor conviction, as investors choose to keep their coins rather than sell them.

In addition to reducing selling activity, DOGE whales have increased their holdings over the past week. This is reflected by the 112% uptick in its large holders’ netflow during that period.

An asset’s large holders’ netflow metric tracks the movement of coins into and out of wallets controlled by whales or institutional investors. When this metric spikes, it suggests that these large holders are accumulating more of the asset, signaling increased confidence in its future price movement.

DOGE Price Prediction: Bullish Run Could Continue

If this bullish momentum is maintained, DOGE will extend its weekly 3% spike. As buying pressure strengthens, the meme coin could revisit its four-year high of $0.48.

However, this bullish outlook will be invalidated if accumulation stalls and selling activity recommences. In that scenario, DOGE’s price could slip to $0.29.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

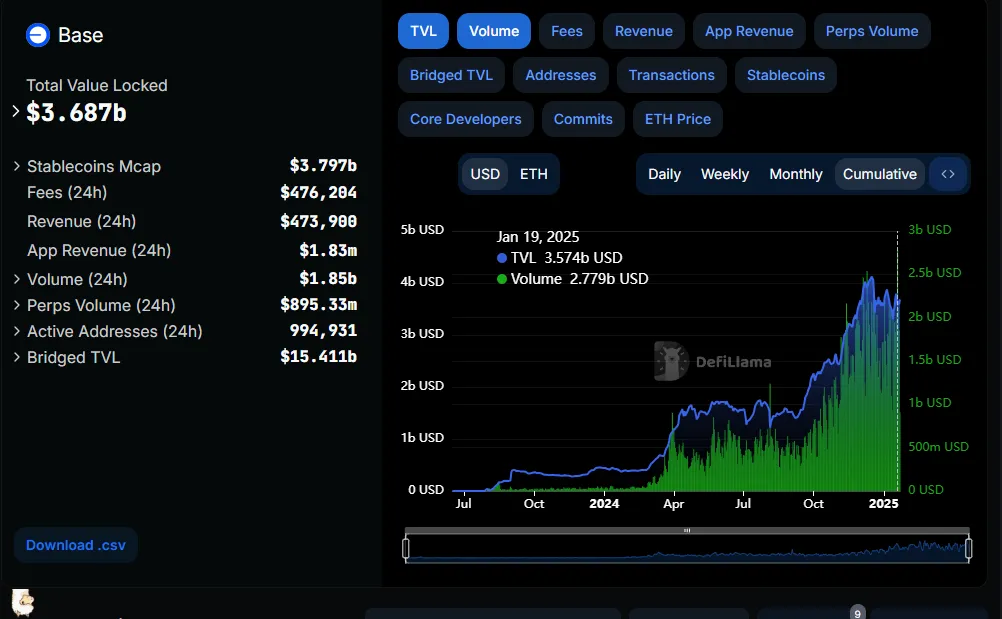

Base DEX Volume Approaches $3 Billion Amid Growing Adoption

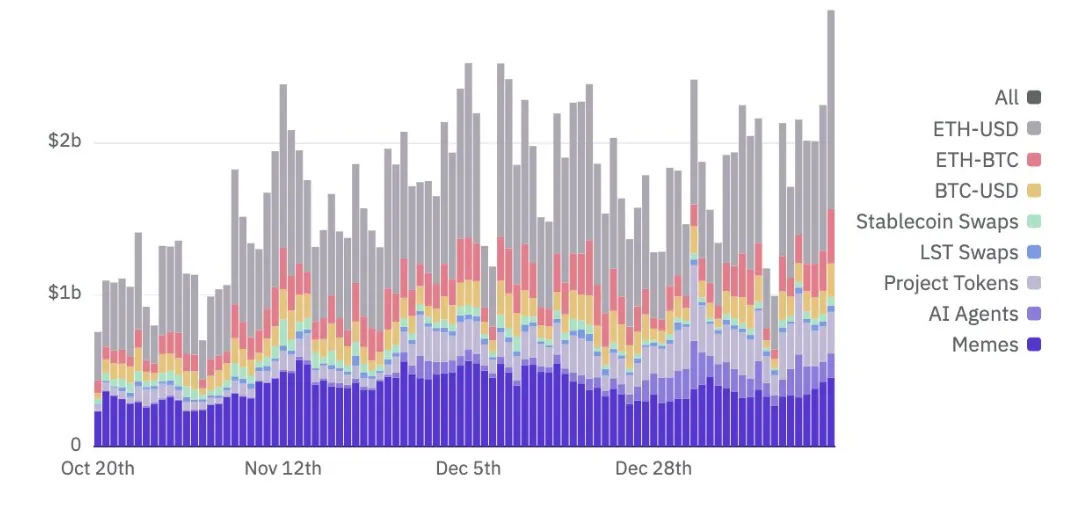

Base, Coinbase’s Layer-2 (L2) blockchain solution, has reached new heights, setting an all-time high daily decentralized exchange (DEX) trading volume near $3 billion.

This milestone reflects Base’s growing prominence in the L2 space and its role in scaling on-chain transactions for Coinbase users.

Base Hits New Milestone in DEX Volume

Blockchain analyst Dan Smith highlighted Base L2’s record-breaking volume of $2.9 billion, including $1.3 billion in ETH-USD trading, which also hit an all-time high. Other trading pairs, such as ETH-cbBTC and BTC-USD, were close to breaking their own records.

The $2.9 billion DEX volume reflects Base’s growing appeal among traders, particularly in ETH-USD pairs, which benefited from recent price volatility. Alexander, another blockchain enthusiast, noted that this milestone marked the first time Base nearly tagged $3 billion in daily volume, alluding to the development as evidence of L2’s growing adoption.

AerodromeFi, a liquidity-focused decentralized protocol on Base, also recorded an all-time high of $1.68 billion in volume, further emphasizing the ecosystem’s momentum.

“This is the first time Base nearly passed $3 billion and AerodromeFi set a new ATH of $1.68 billion in volume,” Alexander commented.

Base’s success is particularly notable because it operates without a native token. Coinbase explicitly ruled out launching a token for Base, prioritizing ecosystem growth and user adoption instead. This approach has likely contributed to its traction by focusing on utility and reducing speculative risks that could deter long-term users.

“There are no plans for a Base network token. We are focused on building, and we want to solve real problems that let you build better,” Base lead developer Jesse Pollak stated recently.

Consistent Growth in Transactions and TVL

The recent achievement follows Base’s earlier milestones, including reaching one billion transactions two months ago and surpassing six million daily transactions in October. More closely, the network recently outpaced Ethereum in user growth amid growing crypto markets.

Additionally, Base’s Total Value Locked (TVL) has seen consistent growth, indicating increased user participation, asset inflows, and liquidity within its ecosystem. A rising TVL signals greater confidence in the platform, fostering a stronger and more sustainable DeFi environment.

Despite its impressive growth, Base has faced some criticism. The network was accused of copying aspects of an NFT project, sparking concerns over originality and intellectual property. While this controversy did not deter adoption, it highlights the challenges of rapid innovation in the competitive blockchain space.

Base’s trajectory positions it as a serious contender in the L2 space, competing with established players like Arbitrum (ARB) and Optimism (OP). Its emphasis on utility, combined with rising user participation and liquidity, paints a promising picture for its future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation23 hours ago

Regulation23 hours agoActing SEC Chair Uyeda announces new crypto task force

-

Ethereum17 hours ago

Ethereum17 hours agoETH breaks $3,900 as Bitcoin spikes past $103k

-

Regulation21 hours ago

Regulation21 hours agoTurkey rolls out new crypto AML regulations

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum ETFs inflows surge as Bitcoin ETFs see major outflows

-

Market14 hours ago

Market14 hours agoWeekly Price Analysis: Bitcoin Remains Rangebound while Altcoins Fly

-

Market20 hours ago

Market20 hours agoBitcoin price analysis: economic headwinds push price lower

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum to rebound as iDEGEN remains on track to a billion-dollar valuation

-

Market17 hours ago

Market17 hours agoTop 4 altcoins to buy before the market fully recovers