Market

WLFI Token Sale, and More

This week, several major cryptocurrency events are expected to drive volatility across key tokens. Among the highlights are large token unlocks, Donald Trump’s WLFI token sale, and the long-anticipated token generation event (TGE) for DeBridge.

These developments, along with updates from the decentralized finance (DeFi) and blockchain sectors, are likely to influence investor behavior and shape market performance in the coming days.

World Liberty Financial Token Sale

Donald Trump’s DeFi venture, World Liberty Financial, is set to launch its WLFI token on Tuesday, October 15. The project promises to democratize and depoliticize finance, offering an alternative to traditional financial institutions.

“World Liberty Financial Token Sale goes live on Tuesday morning, October 15th! This is YOUR chance to help shape the future of finance. Be there on Monday, October 14th at 8 AM EST for an Exclusive Spaces to learn more. Join the whitelist today and be ready for Tuesday,” an announcement read.

As markets anticipate the debut of the WLFI token, uncertainty surrounds the project’s overall dynamics. BeInCrypto reported at the project’s official launch that crypto investors have expressed a dented first impression of World Liberty Financial. Concerns about its viability, business model, and ability to deliver on its promises continue to be topics of discussion.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

Despite these uncertainties, WLFI is reportedly targeting $300 million in its upcoming token sale. WLFI will function as a governance token, granting holders the right to participate in the ecosystem’s development and decision-making. Notably, the sale will only be accessible to select individuals.

Binance to Delist ORN for LUMIA

Binance is also on the top crypto news this week, with a planned delisting of Orion (ORN) token. This is part of a rebranding process, with ORN transitioning to Lumia (LUMIA). Notably, the transition from ORN to LUMIA will occur at a 1:1 ratio, mirroring the recent MATIC to POL migration.

“We are pleased to inform you that Binance will support the Orion (ORN) mainnet swap and rebranding to Lumia (LUMIA). Binance will handle all technical requirements for users involved in this event. Please note that all ORN tokens will be swapped to LUMIA at a ratio of 1 ORN = 1 LUMIA,” Binance announced.

This means that after October 15, traders would not be able to trade ORN on Binance, but LUMIA instead. The supply of LUMIA tokens will more than double that of ORN, from 92,631,255 million to 238,888,888 million.

Lumia, which is a pioneer hyper-liquid restaking rollup Layer-2 (L2) for Real-World Assets, asked ORN token holders on other exchanges to wait for confirmation about swaps to LUMIA from those trading platforms about the transition.

First Avalanche Summit in LATAM

Traders and investors will also be watching AVAX price in the days leading to, and after, Wednesday, October 16, when the Avalanche Summit LATAM will take place at the Ciudad Cultural Konex in Buenos Aires, Argentina.

“We are thrilled to bring the Avalanche Summit to Latin America for the first time. We chose Buenos Aires for its exceptional talent pool and its rapid evolution as a key player in the world of Web3 and blockchain,” said Emin Gün Sirer, CEO of Ava Labs.

The last Avalanche Summit took place on May 3 in Spain, remembered to be bullish on blockchain, gaming, and Web3. The two-day event, between Wednesday and Friday, will offer a unique opportunity for developers, entrepreneurs, and blockchain technology enthusiasts to connect and learn about the latest innovations in the Avalanche ecosystem.

Noteworthy, the residents of Latin America have free entry benefits, as the event commits to be a milestone in the history of blockchain in the region. It will set the stage for the Avalanche-based game Off The Grid, potentially setting the tone for it to become a top gameplay on Epic Games.

Network participants also anticipate the launch of Avalanche 9000, an update that promises to change the way of applications development and launches on the blockchain.

deBridge TGE and DBR Airdrop

deBridge Finance will hold its token generation event (TGE) on Thursday, positioning itself as “the bridge that DeFi deserves.” The project has three primary stakeholders: the team, strategic partners, and the community. DBR, an SPL token on Solana, serves as the governance token for the deBridge ecosystem.

As the TGE approaches, deBridge will launch with an initial circulating supply of 1.8 billion tokens, or 18% of the total supply, aligning with other Solana TGEs like Pyth (15%) and Wormhole (18%). Jupiter (JUP) community members will also benefit from the event, as it includes an airdrop.

“When Jupiter had an airdrop, deBridge users received 4.6 million JUP because Jupiter’s API was integrated into deBridge’s API. Similarly, Jupiter users are now among the largest DBR airdrop recipients because the deBridge widget and API are integrated into the JUP ecosystem,” deBridge Finance co-founder Alex Smirnov said.

WCT Airdrop Registration Deadline

The WalletConnect (WCT) airdrop registration closes on Friday, October 18, with interested participants urged to act before the four-day window elapses. Further, users should use the WalletConnect option instead of connecting their wallet directly.

The registration started on September 24, and as the window closes on Friday, the token checker and claim will be in November 2024. According to an official blog announcement, 18.5% of the total supply, or 185 million WCT tokens, are allocated to the community.

Read more: Best Upcoming Airdrops in 2024

5% of the total DBR supply will be distributed in the first airdrop, with an additional 13.5% slated for subsequent airdrops in 2025. Additionally, users who mint the Wallet Connect badge will automatically rank among the top 1% of WCT airdrop farmers, granting them priority in future distributions.

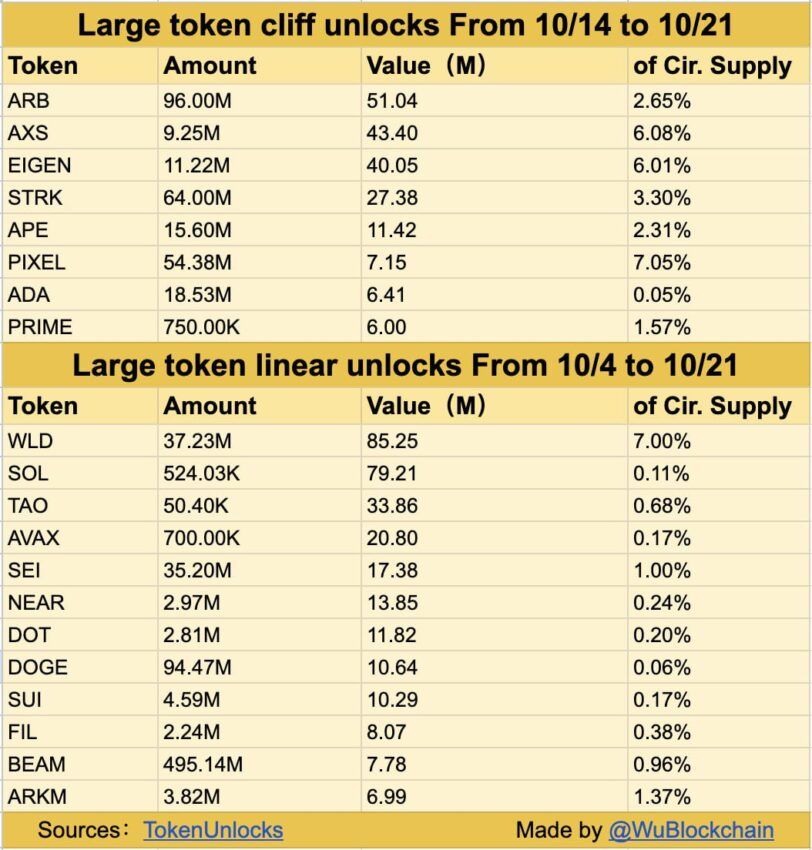

Over $173 Million Worth Cliff Unlocks

As BeInCrypto reported, there are several token unlock events this week. The most significant ones will concern Axie Infinity (AXS), Starknet (STRK), EigenLayer (EIGEN), Arbitrum (ARB), and ApeCoin (APE). Collectively, these unlocks will release over $173.29 million across the respective ecosystems.

Token unlocks often increase market liquidity and cause volatility. As these tokens enter circulation, their prices may experience flactuations, making it essential for traders to monitor the events closely.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Can Reach $3,500 On The Back Of These Factors

Ethereum, the second-largest cryptocurrency, recently failed to breach $3,524, triggering a sharp price drop. Since then, recovery efforts have remained weak as volatility persists.

However, the current conditions suggest Ethereum may be preparing for a comeback as the market stabilizes.

Ethereum Has Room For Recovery

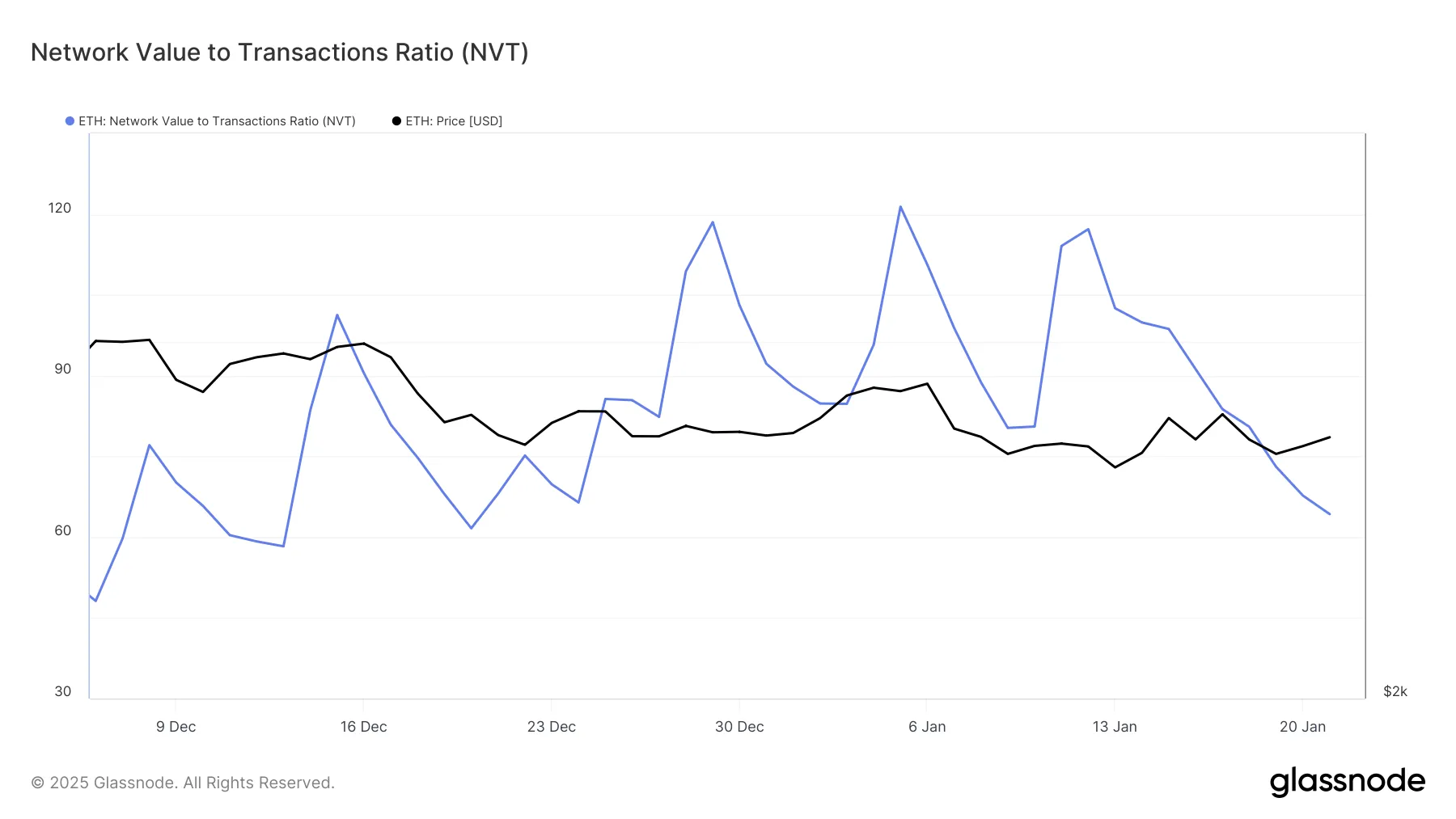

Ethereum’s Network Value to Transaction (NVT) Ratio is experiencing a decline, recently hitting a monthly low. A low NVT indicates that transaction activity is balanced with network value, reflecting reduced volatility. This creates an environment conducive to price recovery, something Ethereum urgently needs to regain its footing.

With the NVT ratio signaling healthy network activity, Ethereum is positioned to stabilize in the short term. Declining volatility often fosters investor confidence, making it more likely for the cryptocurrency to see renewed buying interest. As speculative activity wanes, Ethereum has an opportunity to chart a path toward meaningful recovery.

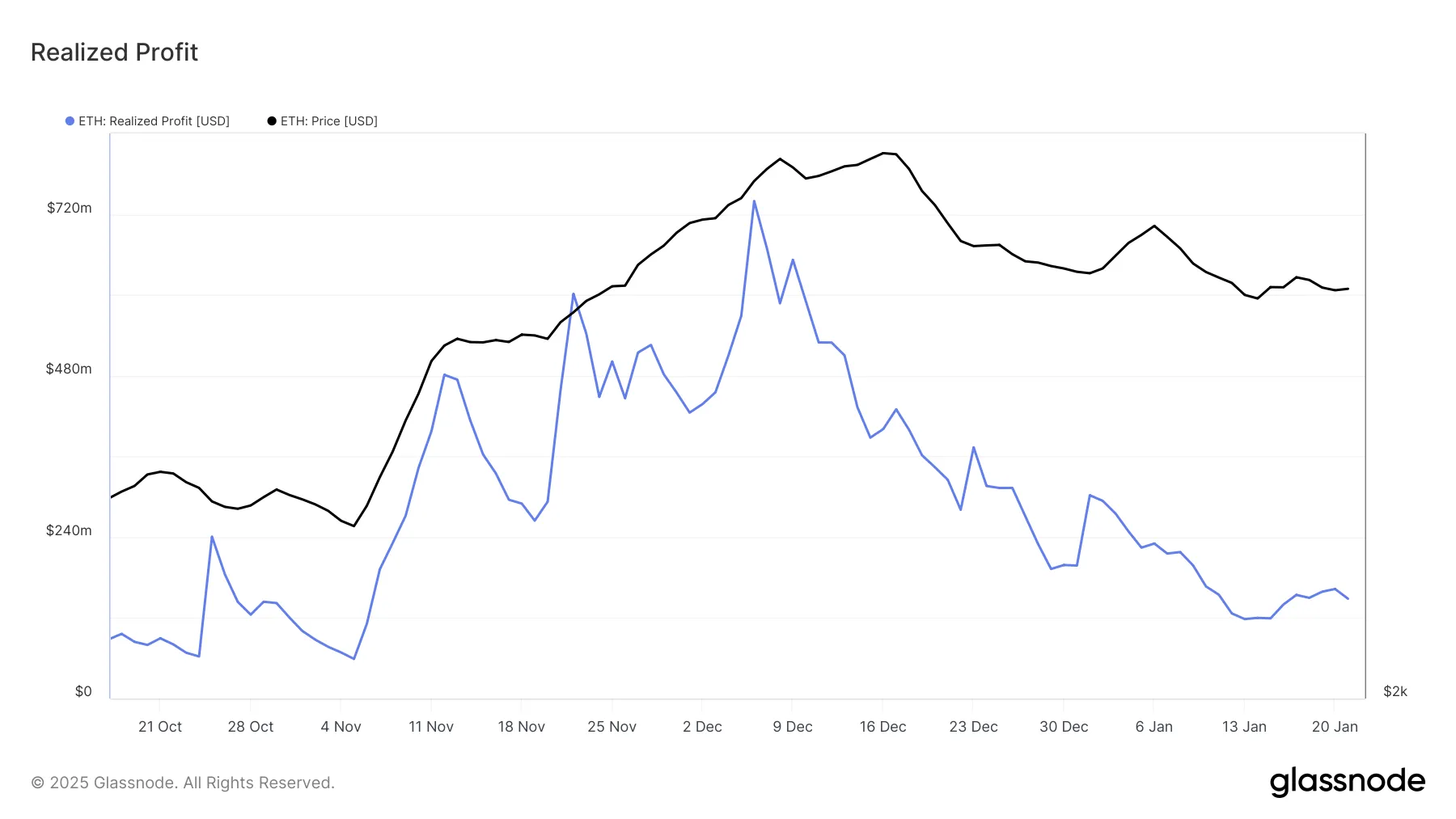

Ethereum’s realized profits recently dropped to a six-week low, pointing to a significant reduction in selling pressure from investors. This trend highlights the market’s shifting sentiment, with fewer participants looking to offload their holdings. Such conditions could provide Ethereum with the breathing room required to capitalize on broader bullish cues.

The lack of an uptick in realized profits suggests that the selling lull may persist, allowing Ethereum to focus on building upward momentum. With investors holding onto their coins, market conditions are primed for a gradual recovery, provided external factors remain favorable.

ETH Price Prediction: Breaking The Barrier

Ethereum is currently trading near $3,300, just below the critical resistance level of $3,327. Flipping this into support is essential for ETH to initiate a rally toward $3,524, representing a 6% increase from current levels. This move would mark a partial recovery from recent losses.

Breaking through the $3,524 resistance is crucial for Ethereum’s recovery. Achieving this would erase the recent downturn and also position the altcoin for further gains, potentially targeting $3,711. Such a move would underscore Ethereum’s resilience and align with the broader market’s bullish sentiment.

However, failing to establish $3,327 as a support level could stall Ethereum’s recovery. This scenario would leave the cryptocurrency vulnerable to a retracement toward $3,200, undermining recent progress and potentially delaying its path to $3,500.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Justin Sun, Vitalik Buterin Speak Amid Ethereum Reform Debate

TRON founder Justin Sun has offered a hypothetical plan for Ethereum and the Ethereum Foundation (EF) under his leadership. His remarks come amid controversy over EF’s leadership transformation.

In a series of posts on X (formerly Twitter), Ethereum co-founder Vitalik Buterin outlined the reforms’ goals and progress. He highlighted improvements in technical expertise, ecosystem engagement, and operational efficiency.

Justin Sun Outlines Blueprint for Ethereum Leadership

The TRON executive shared ambitious remarks on how he would lead the Ethereum Foundation if given the opportunity. Sun’s vision, shared on X, outlined a four-point plan to radically restructure EF operations, optimize Ethereum’s economic model, and drive the price of ETH to $10,000.

“If EF and Ethereum were under my leadership, ETH would hit $10,000,” Sun claimed.

Sun proposed an immediate halt to ETH sales for three years to stabilize supply and boost market confidence. He suggested covering EF’s operational costs through DeFi protocols like Aave, staking yields, and stablecoin borrowing, aligning with Ethereum’s deflationary goals.

A key component of his plan involves imposing significant taxes on Layer 2 (L2) solutions, aiming to generate $5 billion annually. The collected taxes would go toward exclusively repurchasing and burning ETH, further enhancing its scarcity and value.

Sun also called for a drastic downsizing of EF staff, retaining only top performers and offering them significant salary increases. This merit-based approach, he argued, would streamline operations and improve efficiency.

Finally, Sun emphasized adjusting node rewards and increasing fee burns to reinforce Ethereum’s deflationary narrative. He proposed redirecting all resources toward Ethereum’s core L1 development, focusing on scalability, security, and adoption. Justin Sun’s plan sparked a mixed response, with some applauding the bold vision.

“These are all very practical suggestions. Please pay attention to them and refer to them, Vitalik Buterin,” core developer 0xSea.eth posed.

Meanwhile, others challenged Sun to focus on TRON and explore bringing decentralized finance (DeFi) to its ecosystem.

“Maybe start with how to make DeFi great on TRON – you should ask your exec team (and yourself), “Why is DeFi nonexistent on TRON despite it being the chain with the most stable coins on it?” If you answer this, maybe TRON can beat eth one day,” ZIGChain co-founder Abdul Rafay Gadit remarked.

Vitalik Buterin Defends Leadership Amid Criticism

Sun’s proposed solution aligns with Vitalik Buterin’s recent post discussing ongoing changes over the past year, some of which have already been implemented. Buterin emphasized goals such as strengthening the EF’s technical leadership and improving collaboration with ecosystem participants. He also addressed concerns, rejecting the notion that the EF might adopt centralized or politically motivated roles.

“…these things aren’t what EF does and this isn’t going to change. People seeking a different vision are welcome to start their orgs,” Buterin articulated.

Aya Miyaguchi, an EF executive, confirmed the ongoing efforts, expressing excitement about forthcoming announcements. She noted that the reforms aim to solidify Ethereum’s position as a global neutral platform while embracing decentralized and privacy-preserving technologies.

The announcement has stirred controversy within the crypto community. Critics argue that the current leadership has failed to manage Ethereum effectively.

“Respectfully, just let new blood take over. You guys can’t even make a simple Twitter account work—how can you be trusted to lead the second biggest blockchain,” Wazz posed.

Another user, Coinmamba, suggested that pressuring Miyaguchi to resign could result in Ethereum reaching new all-time high. Buterin strongly condemned these comments, defending Miyaguchi and calling out the toxicity of such social media rhetoric.

“No. This is not how this game works,” Buterin retorted. “The person deciding the new EF leadership team is me. If you ‘keep the pressure on,’ then you are creating an environment that is actively toxic to top talent. YOU ARE MAKING MY JOB HARDER,” the Ethereum co-founder lamented.

Buterin also refuted specific claims against Miyaguchi, pointing out inaccuracies in translations and misinterpretations of her statements. He reiterated the need for a “proper board” within EF to enhance governance.

Ethereum’s ETH token was trading at $3,305 as of this writing, representing a modest 0.2% surge since Wednesday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin Holding Time and Whale Activity Spikes

Dogecoin (DOGE), a leading meme coin, is signaling a potential breakout from its narrow trading range.

If this momentum continues, it could reclaim its multi-year high of $0.48, fueled by extended holding periods and increased accumulation by large holders.

Dogecoin Investors Reduce Distribution

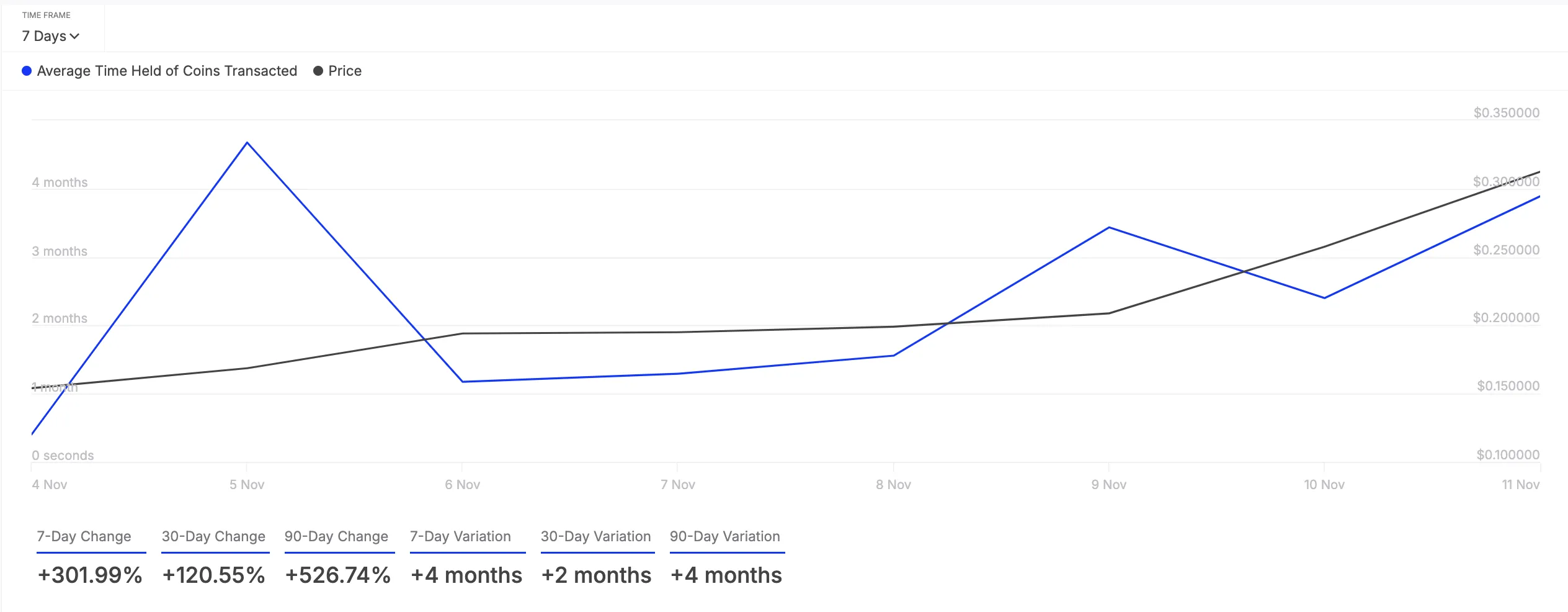

The on-chain assessment of DOGE’s performance has revealed a significant spike in the holding time of all its coins transacted in the past seven days. According to IntoTheBlock, this has climbed by 302% during the review period.

The holding time of an asset’s transacted coins represents the average duration tokens are kept in wallets before being sold or transferred.

Longer holding periods like this reduce selling pressure in the DOGE market. This reflects stronger investor conviction, as investors choose to keep their coins rather than sell them.

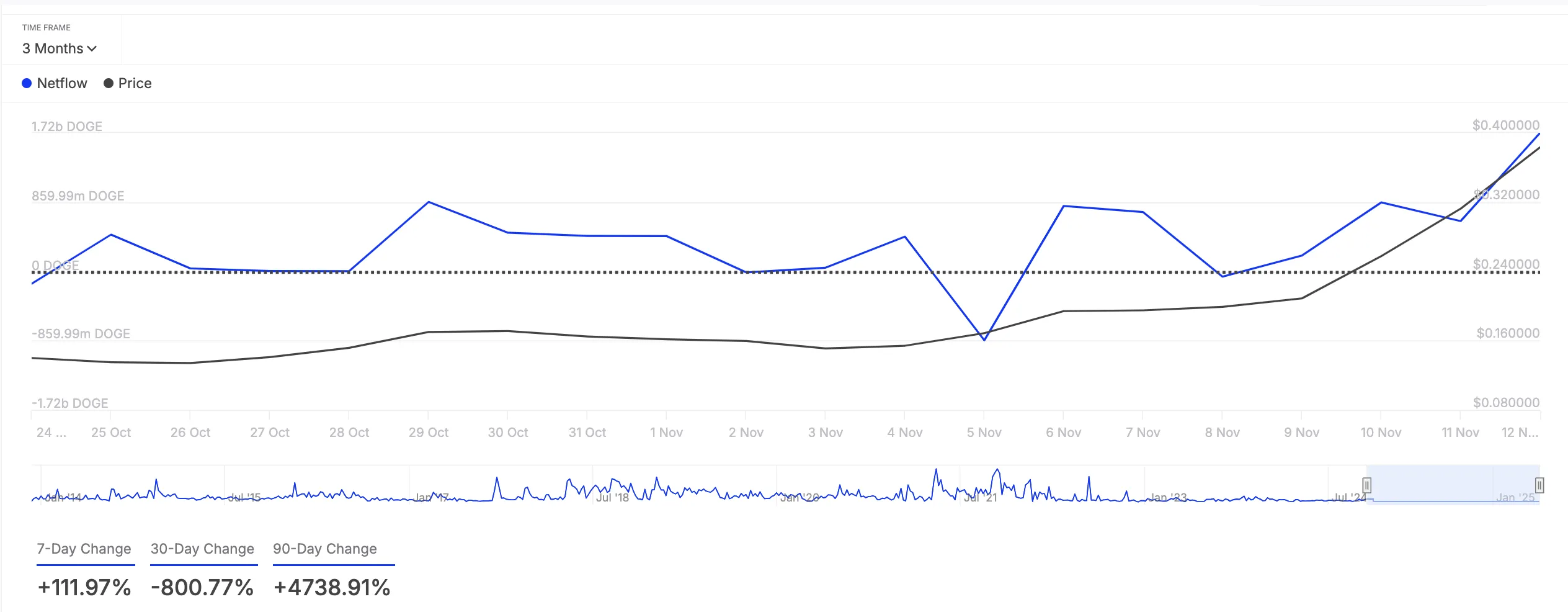

In addition to reducing selling activity, DOGE whales have increased their holdings over the past week. This is reflected by the 112% uptick in its large holders’ netflow during that period.

An asset’s large holders’ netflow metric tracks the movement of coins into and out of wallets controlled by whales or institutional investors. When this metric spikes, it suggests that these large holders are accumulating more of the asset, signaling increased confidence in its future price movement.

DOGE Price Prediction: Bullish Run Could Continue

If this bullish momentum is maintained, DOGE will extend its weekly 3% spike. As buying pressure strengthens, the meme coin could revisit its four-year high of $0.48.

However, this bullish outlook will be invalidated if accumulation stalls and selling activity recommences. In that scenario, DOGE’s price could slip to $0.29.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation24 hours ago

Regulation24 hours agoActing SEC Chair Uyeda announces new crypto task force

-

Regulation22 hours ago

Regulation22 hours agoTurkey rolls out new crypto AML regulations

-

Ethereum18 hours ago

Ethereum18 hours agoETH breaks $3,900 as Bitcoin spikes past $103k

-

Regulation18 hours ago

Regulation18 hours agoBitpanda becomes first European firm to secure Dubai VARA in-principle approval

-

Regulation20 hours ago

Regulation20 hours agoCrypto custody firm Copper withdraws UK registration

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum ETFs inflows surge as Bitcoin ETFs see major outflows

-

Market15 hours ago

Market15 hours agoWeekly Price Analysis: Bitcoin Remains Rangebound while Altcoins Fly

-

Market21 hours ago

Market21 hours agoBitcoin price analysis: economic headwinds push price lower