Market

Will It Clear The Hurdles?

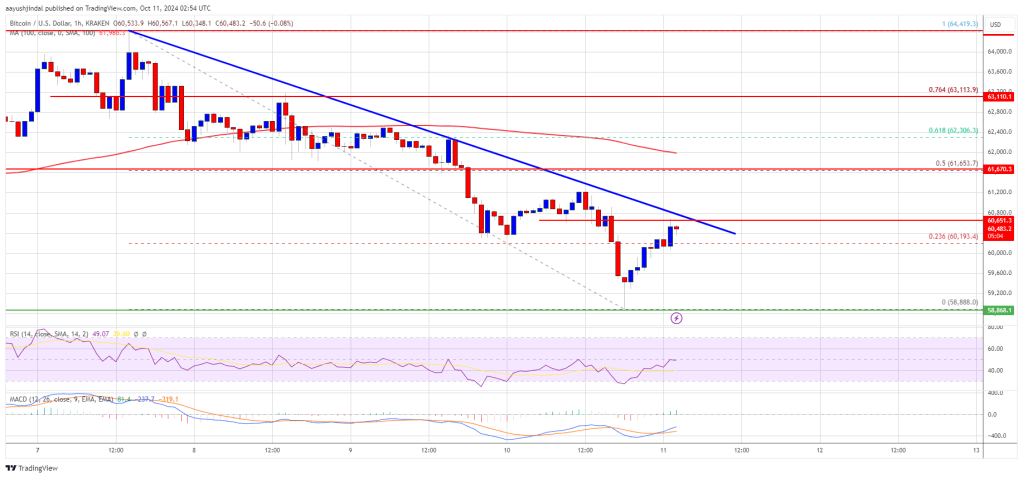

Bitcoin price extended losses and traded below the $60,000 zone. BTC is now attempting a recovery wave and facing hurdles near $60,800.

- Bitcoin is struggling to start a fresh increase above the $61,200 zone.

- The price is trading below $61,000 and the 100 hourly Simple moving average.

- There is a key bearish trend line forming with resistance at $60,800 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could struggle to recover if it stays below the $62,000 resistance zone.

Bitcoin Price Falls Again

Bitcoin price failed to start a fresh increase above $62,000 and started a fresh decline. BTC traded below the $61,500 and $60,500 levels. It even broke the $60,000 support.

A low was formed at $58,888 and the price is now consolidating losses. There was a minor increase above the $60,000 level. The price was able to climb above the 23.6% Fib retracement level of the downward move from the $64,420 swing high to the $58,888 low.

Bitcoin price is now trading below $61,000 and the 100 hourly Simple moving average. On the upside, the price could face resistance near the $60,800 level. There is also a key bearish trend line forming with resistance at $60,800 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $61,650 level or the 50% Fib retracement level of the downward move from the $64,420 swing high to the $58,888 low. A clear move above the $61,650 resistance might send the price higher. The next key resistance could be $62,000.

A close above the $62,000 resistance might initiate more gains. In the stated case, the price could rise and test the $63,200 resistance level. Any more gains might send the price toward the $64,000 resistance level.

More Downsides In BTC?

If Bitcoin fails to rise above the $60,800 resistance zone, it could start another decline. Immediate support on the downside is near the $59,600 level.

The first major support is near the $58,850 level. The next support is now near the $58,500 zone. Any more losses might send the price toward the $57,200 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $59,600, followed by $58,850.

Major Resistance Levels – $60,800, and $61,650.

Market

Trump’s $500 Billion Stargate Venture Sparks AI Crypto Boom

AI tokens surged on Wednesday after President Donald Trump unveiled a new joint venture to invest up to $500 billion in artificial intelligence infrastructure.

The partnership involves major players such as OpenAI, Oracle, and SoftBank and will form a new entity called Stargate.

Market Focuses on AI Coins as Trump’s Stargate Initiative Gains Traction

The Stargate Project will invest $500 billion over the next four years, building new AI infrastructure in the US. The venture will focus on developing crucial data centers and the electricity generation required to power the AI sector.

The announcement has already had a noticeable impact on the broader market, particularly in AI-related cryptocurrencies. Following the news, the market capitalization of AI tokens surged by 9%, reaching $45.83 billion at press time, according to CoinGecko.

In fact, the market cap of AI agent tokens alone rose by 13% to hit $14.9 billion.

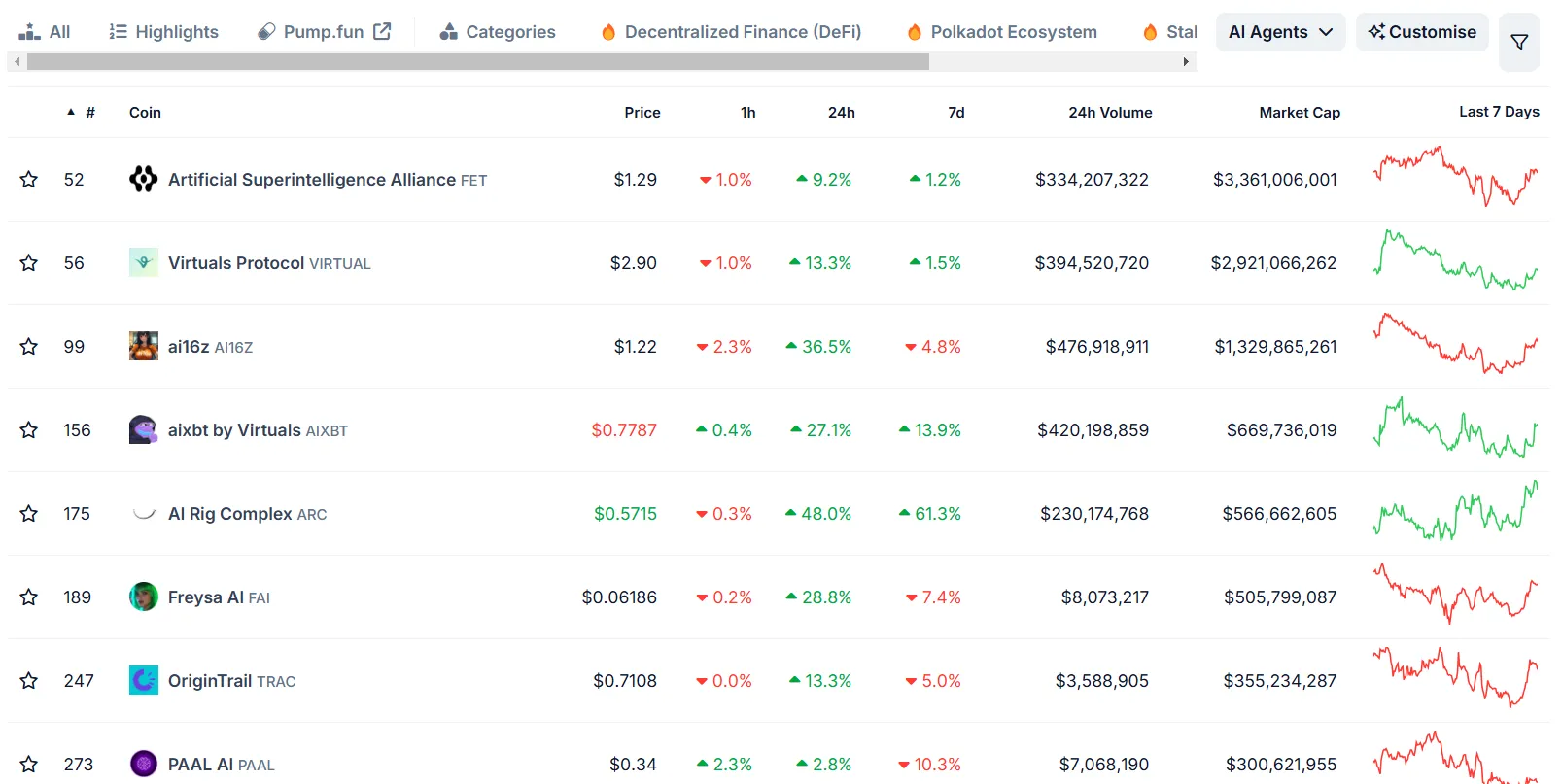

AI agent tokens, such as Virtuals Protocol, AIXBT, and AI16Z, saw impressive gains. Virtuals Protocol rose by over 13% in the past 24 hours, while AI16Z experienced a remarkable 36% increase. AIXBT token rose by 27% over the same period.

The surge in AI tokens reflects a broader shift in market interest as investors move capital towards more “sentient” tokens.

“Capital is rotating back from static memes to sentient coins,” AI researcher S4mmy commented on Twitter.

The analyst added that Fartcoin and AIXBT are sustaining their “mindshare dominance,” but face declining market caps after a heated run. Commenting on Virtuals Protocol, he said it continues to solidify its position as a backbone of the Agentic infrastructure.

Moreover, analyst CyrilXBT said he believes “AI will create generational wealth in 2025.”

“People said Bitcoin was a joke. People said AI agents are a gimmick. Guess what else they’ll say? ‘Why didn’t I listen when generational wealth was staring me in the face?,” CyrilXBT commented.

The shift towards AI is particularly interesting, given the trend of investments a few days back. Capital was flowing into Donald Trump-related tokens, such as TRUMP and MELANIA, which have seen significant volatility.

However, BeInCrypto reported that smart money traders are now focusing on AI tokens after the hype around TRUMP faded. According to data from Nansen, a substantial amount of VIRTUAL, FARTCOIN, and AIXBT tokens are held by smart money.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will an Upside Break Spark a Surge?

Ethereum price is struggling below the $3,500 resistance while Bitcoin gains. ETH is consolidating above $3,150 and might aim for an upside break.

- Ethereum failed to gain pace for a close above $3,400 and $3,450.

- The price is trading above $3,300 and the 100-hourly Simple Moving Average.

- There is a key contracting triangle forming with resistance at $3,355 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start another increase if it clears the $3,400 resistance level.

Ethereum Price Aims Key Upside Break

Ethereum price started a decent upward move from the $3,200 level but upsides were limited compared to Bitcoin. ETH cleared the $3,250 resistance to move into a short-term bullish zone.

The bulls were able to push the price above the $3,300 resistance zone. Besides, there was a clear move above the 50% Fib retracement level of the downward move from the $3,445 swing high to the $3,203 low. However, the bears are still active below $3,400.

Ethereum price is now trading above $3,300 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level or the 61.8% Fib retracement level of the downward move from the $3,445 swing high to the $3,203 low.

There is also a key contracting triangle forming with resistance at $3,355 on the hourly chart of ETH/USD. The first major resistance is near the $3,400 level. The main resistance is now forming near $3,445.

A clear move above the $3,445 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,720 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $3,400 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250.

A clear move below the $3,250 support might push the price toward the $3,200 support. Any more losses might send the price toward the $3,120 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,200

Major Resistance Level – $3,400

Market

What Fueled Its New High

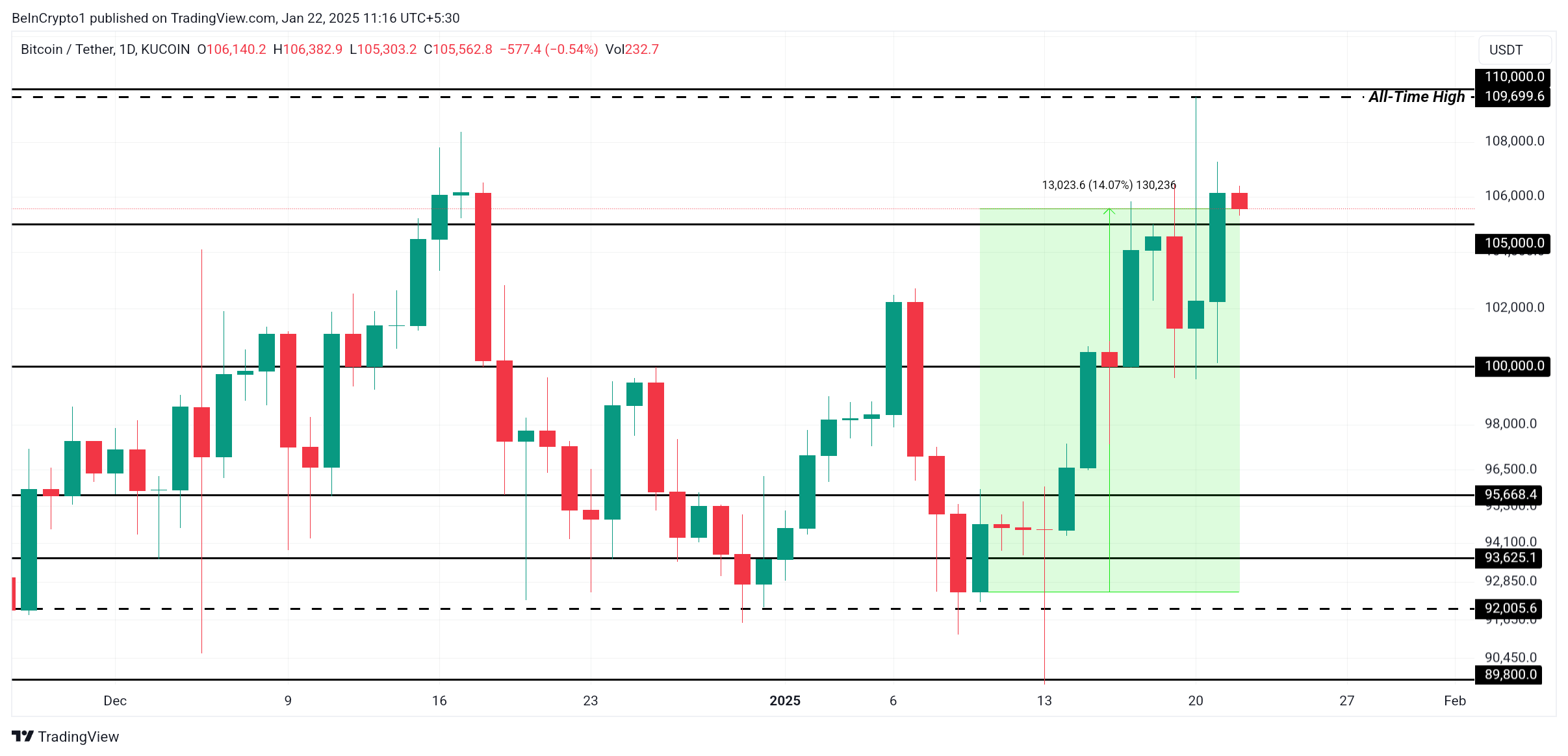

Bitcoin, the leading cryptocurrency, has once again captured the spotlight after rallying to a new all-time high of $109,699.

With the $110,000 milestone in sight, Bitcoin’s recent price action is being closely monitored by investors. A combination of sustained market conditions and renewed institutional interest has positioned the crypto king for potentially historic gains.

Bitcoin Investors Are Bullish

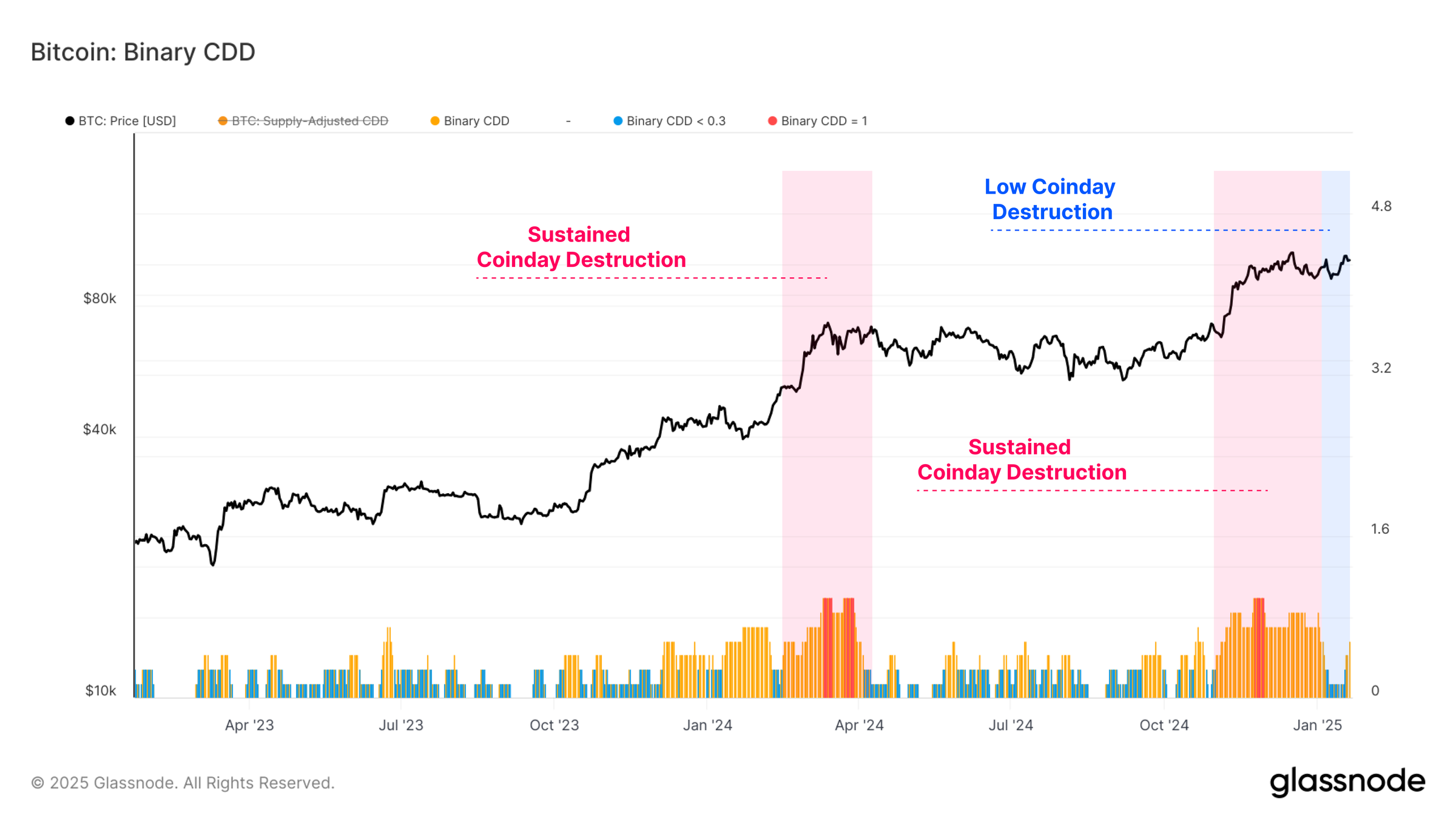

Market sentiment has shown a significant shift in recent weeks, particularly through the lens of Coin Days Destroyed (CDD). Late 2024 saw a period of elevated CDD, signaling heavy activity among Bitcoin long-term holders (LTHs) cashing out during the rally.

However, January has brought a notable cooldown in CDD, indicating reduced selling pressure from these key investors. This trend suggests that most profit-taking among LTHs is complete, paving the way for a more stable price trajectory.

Low CDD is often interpreted as a positive sign for Bitcoin’s recovery. It reflects conviction among long-term investors, who are holding onto their coins rather than selling into the market. Such investor behavior typically builds confidence and supports upward price momentum, providing a favorable backdrop for Bitcoin’s push to $110,000 and beyond.

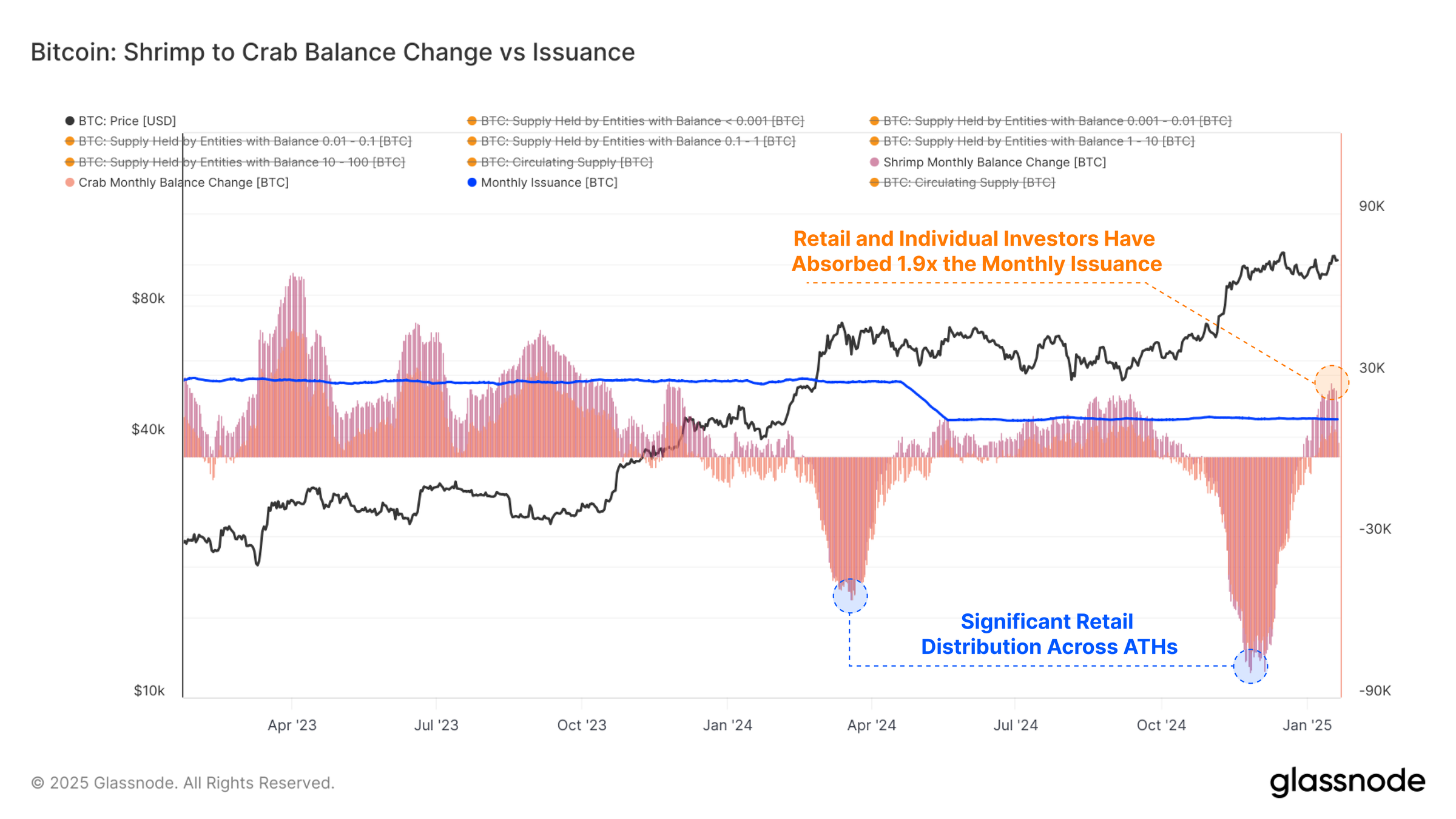

Bitcoin’s macro momentum has also gained strength, supported by the accumulation activity of smaller investors, often referred to as “Shrimps” and “Crabs.” These holders, who possess less than 10 BTC, collectively added over 25,600 BTC worth approximately $2.71 billion. This surge in accumulation is proof of growing confidence among retail investors.

The Shrimp-to-Crab balance spike indicates a broad base of support for Bitcoin’s price. This demographic’s increasing participation reflects long-term bullish sentiment. Their buying activity often stabilizes the market, acting as a cushion during corrections and amplifying price rallies during bullish phases.

BTC Price Prediction: Onto New High

Bitcoin’s recent all-time high of $109,699 was fueled by strong market fundamentals and strong investor sentiment. If momentum continues, the cryptocurrency could breach the $110,000 mark, cementing its position as a high-performing asset in 2025. This milestone would likely attract additional buying interest, reinforcing Bitcoin’s bullish outlook.

To secure its ascent, Bitcoin must establish $105,000 as a strong support level. Currently trading around $105,562, the crypto king appears well-positioned to achieve this. A successful defense of this support zone could propel Bitcoin to new highs, unlocking further upside potential.

However, failure to maintain $105,000 as support could lead to a retracement toward $100,000. Such a decline would negate Bitcoin’s recent gains and dampen short-term bullish sentiment, raising the risk of prolonged consolidation before a renewed rally.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation17 hours ago

Regulation17 hours agoActing SEC Chair Uyeda announces new crypto task force

-

Ethereum12 hours ago

Ethereum12 hours agoETH breaks $3,900 as Bitcoin spikes past $103k

-

Regulation19 hours ago

Regulation19 hours agoTether’s market capitalisation slips as MiCA regulations kick in

-

Regulation15 hours ago

Regulation15 hours agoTurkey rolls out new crypto AML regulations

-

Market15 hours ago

Market15 hours agoBitcoin price analysis: economic headwinds push price lower

-

Market11 hours ago

Market11 hours agoTop 4 altcoins to buy before the market fully recovers

-

Regulation11 hours ago

Regulation11 hours agoBitpanda becomes first European firm to secure Dubai VARA in-principle approval

-

Blockchain19 hours ago

Blockchain19 hours agoJordan Adopts Blockchain Policy To Propel Government Into The Future