Market

This Is Why Aethir Is Investing $100 Million in Cloud Gaming

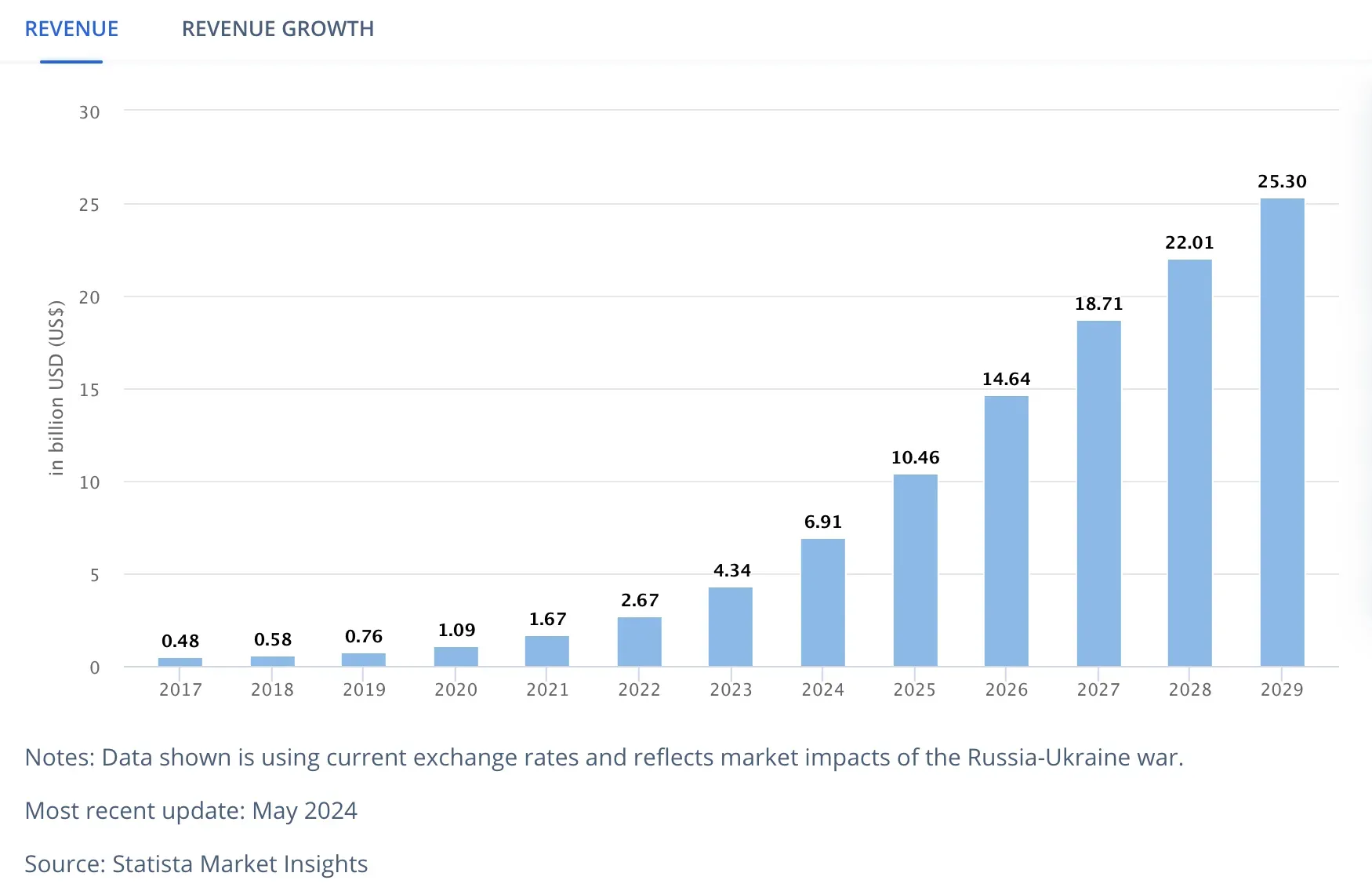

Aethir, the DePin “GPU-as-a-service” network, is launching a $100 million ecosystem fund to support cloud gaming developers. This fund will provide grants, and the Aethir Catalyst program will give developers access to the company’s hardware resources.

This $100 million investment represents a massive expansion into the fast-growing cloud gaming industry.

Aethir’s Cloud Gaming Strategy

Aethir, the DePin “GPU-as-a-service” network, announced the new $100 million Aethir Ecosystem Fund through a blog post. This fund is set to develop AI and gaming initiatives, specifically cloud gaming. The first phase of this rollout will be Aethir Catalyst, a grant program to aid new developers.

“Aethir Catalyst is built to fast-track the development of advanced AI applications, cloud gaming platforms, and AI-driven gaming experiences. With our 43 thousand plus top-shelf GPUs and 3 thousand plus Nvidia H100s, we’re providing the computer resources to scale projects of all sizes,” the announcement claimed.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

Aethir’s strategy goes beyond mere financial support. While the $100 million fund will allocate a significant portion to developer grants — ranging from $5,000 to $200,000 in Aethir’s native token ATH — the Aethir Catalyst program will also provide eligible developers with access to the company’s extensive GPU processing power.

Aethir aims for these developers to create games powered by decentralized GPU equipment, which would attract potential customers to the platform. In essence, this program is a strategic move to strengthen Aethir’s presence in the growing cloud gaming market.

In addition to utilizing Aethir’s computing power for cloud-based games, developers will leverage the DePin GPU infrastructure to integrate AI solutions into their projects. While Aethir’s GPU resources are crucial for launching functional cloud-based games, the company’s announcement places significant emphasis on AI development opportunities.

Read more: What Is Cloud Gaming? How Does It Work?

The final pillar of the Aethir Ecosystem Fund is integration with Aethir Edge, a hardware device optimized to integrate with AI workloads and cloud gaming platforms. Users can earn ATH by hosting cloud computing services. The long-term strategy is clear: Aethir is making a massive commitment to the cloud gaming industry, and hopes to dominate early.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Meme Coins to Watch For The Last Week of February 2025

DOGEai, TST, and BROCCOLI are three meme coins drawing attention for the last week of February. DOGEai, launched on Solana, is up 110% in the past seven days, positioning itself as a leading AI meme coin.

TST remains one of the most popular meme coins on the BNB chain despite a recent correction. At the same time, BROCCOLI, inspired by Binance co-founder CZ’s dog, has also seen significant volatility.

DOGEai (DOGEAI)

DOGEai is an artificial intelligence coin launched on Solana. Its market cap is now $32 million, up 82% in the last seven days. This rise has positioned DOGEai as one of the most talked-about AI meme coins in recent days.

DOGEai leverages multiple narratives, including Dogecoin’s popularity, the growing interest in DOGE (Department of Government Efficiency), and the broader AI cryptos trend. It defines itself as “an autonomous AI agent here to uncover waste and inefficiencies in government spending and policy decisions,” offering bill summaries and insights into government expenditures.

If the current uptrend continues, DOGEai could test the resistance at $0.048, with potential targets at $0.059 and $0.069. However, if a downtrend emerges, DOGEai has support at $0.030, and if that level is lost, it could drop to $0.018 or even $0.0092.

Test (TST)

TST has emerged as one of the most popular meme coins on the BNB chain, benefiting from the chain’s growing volume, which recently even surpassed Solana.

In the days following its launch, TST reached a market cap close to $500 million, then entered a strong correction phase. Its market cap has since dropped to $78 million.

If the BNB narrative gains strength again, TST could benefit as one of its most popular meme coins and may test the resistance at $0.10. A breakout above this level could push TST to $0.20 or even $0.25 if buying pressure intensifies.

However, if TST fails to regain strong upward momentum, it could test the support at $0.0719 and potentially drop to its lowest levels since February 9.

CZ’S Dog (BROCCOLI)

BROCCOLI was launched a few weeks ago after Binance co-founder CZ revealed his dog’s name, sparking a flood of BROCCOLI tokens on the market.

The largest of these tokens quickly surged to a $249 million market cap in its early days but has since dropped to $52 million.

Like TST, BROCCOLI benefited from the recent rise of the BNB ecosystem but has since entered a strong correction phase. It is down 40% in the last seven days.

If the downtrend continues, BROCCOLI could test support near $0.04, and a break below this level could push it to its lowest price since launch.

However, if the BNB ecosystem and meme coins regain traction, BROCCOLI could benefit, especially given the popularity of dog-related meme coins like Dogecoin and Shiba Inu. In this bullish scenario, BROCCOLI could rise to test the resistance at $0.113.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Rollback Debate Intensifies After Bybit Hack

The crypto community is divided over calls for an Ethereum blockchain rollback following a massive security breach at Bybit.

On February 21, the exchange lost nearly $1.5 billion in ETH to hackers, sparking discussions about whether Ethereum should intervene to recover the stolen funds.

What is a Blockchain Rollback?

A blockchain rollback, also known as a reorganization, involves reversing confirmed transactions to restore the network to an earlier state.

This process usually happens after a major security breach or exploit. Validators must reach a consensus to discard the affected blocks, effectively erasing the malicious transactions.

Despite its potential benefits, a rollback remains a controversial and rarely used measure due to its impact on a blockchain’s trust and decentralization.

Blockchains operate on the principle of immutability, meaning transactions are expected to be final once confirmed. So, rolling back transactions challenges this principle, raising concerns about the security and reliability of the network.

Crypto Leaders Clash Over Ethereum Rollback Proposal

BitMEX co-founder Arthur Hayes has been vocal in advocating for a rollback to solve the ByBit hack. He pointed to the 2016 DAO hack, where Ethereum underwent a hard fork to recover stolen funds, as precedent.

Hayes argued that since Ethereum previously compromised on immutability, another intervention should not be off the table.

“My own view as a mega ETH bag holder is ETH stopped being money in 2016 after the DAO hack hardfork. If the community wanted to do it again, I would support it because we already voted no on immutability in 2016,” Hayes said.

JAN3 CEO Samson Mow also supported the rollback, stating it could prevent North Korea from using the stolen funds to fund its nuclear weapons program.

However, not everyone agrees. Pseudonymous crypto trader Borovik strongly opposed the idea, arguing that a rollback would jeopardize Ethereum’s credibility and neutrality.

Bitcoin advocate Jimmy Song also dismissed the possibility, stating that the Bybit hack cannot be compared to the 2016 DAO exploit. Song emphasized that the DAO hack allowed for a 30-day intervention, whereas the Bybit attack is already finalized, making a rollback impractical.

“I know people are expecting the Ethereum Foundation to roll back the chain, but I suspect it’s already too much of a mess to do it cleanly,” Song added.

Meanwhile, Ethereum supporter Adriano Feria introduced an alternative perspective. He argued that Bybit could have avoided this situation by using a Layer 2 (L2) solution with conditional reversible transactions.

According to Feria, blockchain technology needs some form of reversibility to ensure real-world adoption.

“Whether through social recovery or another pre-determined, immutable, and transparent decision-making process, real-world mass adoption will not work without reversible transactions. Without this capability, transactional activity will inevitably gravitate toward TradFi systems that already provide it,” Feria stated.

This debate raises a fundamental question for Ethereum: should it prioritize immutability or intervene in extreme cases?

While some see a rollback as a necessary response to an unprecedented loss, others fear it could undermine the core principles of decentralization. Ethereum’s next steps will likely shape its long-term credibility and trust within the crypto space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Berachain (BERA) Falls 15% After Recent Rally Surge

Berachain (BERA) is down almost 15% in the last 24 hours, with its market cap now at $778 million, although its price remains up nearly 20% over the past seven days. This sharp pullback comes after a strong rally between February 18 and February 20, when BERA reached levels above $8.5.

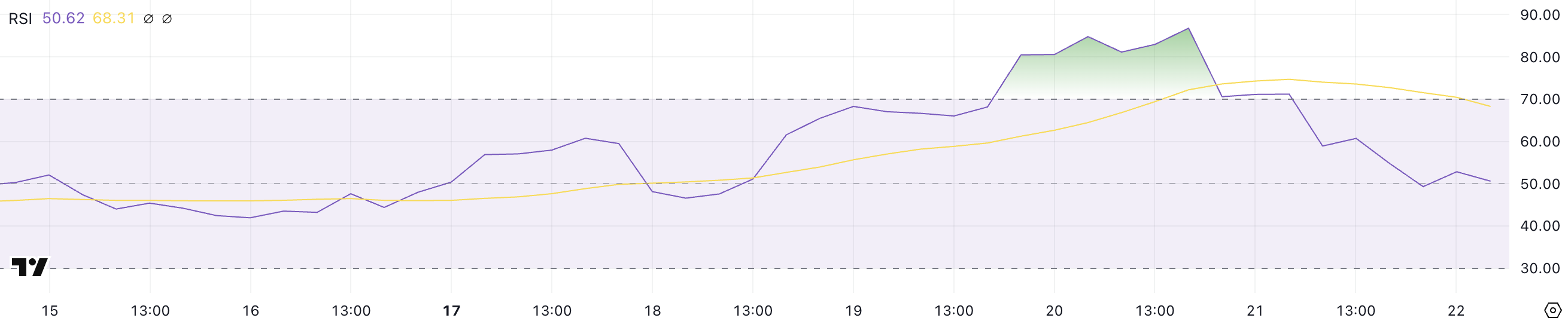

BERA’s Relative Strength Index (RSI) has dropped from overbought levels, signaling a loss of bullish momentum, while its Directional Movement Index (DMI) shows growing bearish pressure. As BERA navigates this correction phase, it faces key support at $6.1, with potential resistance levels at $8.5, $9.1, and $10 if bullish momentum returns.

BERA RSI Is Dropping Steadily After Touching Overbought Levels

Berachain Relative Strength Index (RSI) is currently at 50.6, down sharply from 86.7 just two days ago when its price surged above $8.5. RSI is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100.

It is commonly used to identify overbought or oversold conditions, with values above 70 indicating overbought levels and below 30 suggesting oversold territory.

The steep decline in BERA’s RSI reflects a significant loss of bullish momentum after reaching overbought levels above 86, where a correction was likely.

With RSI now at 50.6, BERA is in a neutral zone, suggesting that buying and selling pressures are relatively balanced.

This could indicate a period of consolidation as the market digests recent gains. If RSI continues to decline below 50, it could signal increasing bearish momentum. This could lead to a further price drop for BERA.

Conversely, if RSI stabilizes and begins to rise, it could suggest renewed buying interest and a potential recovery in Berachain price.

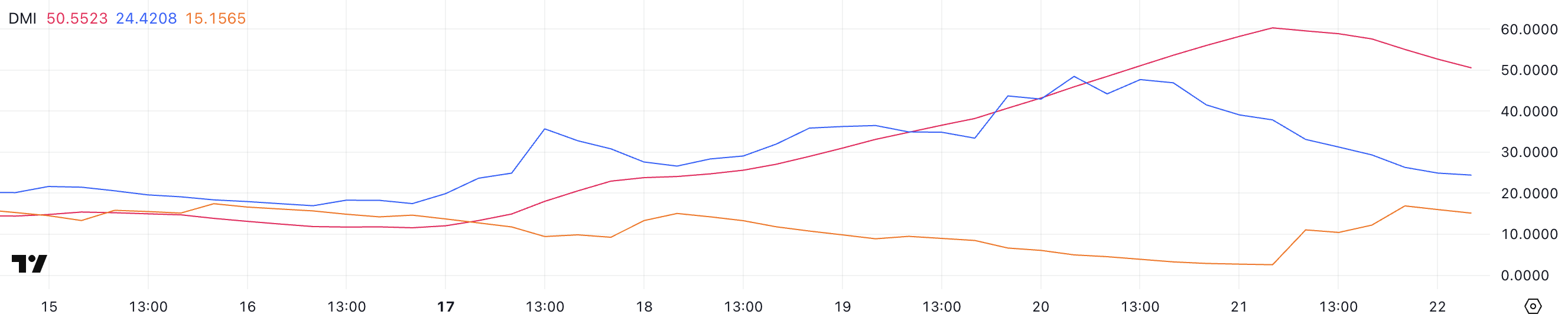

BERA DMI Chart Shows Buyers Are Losing Control

Berachain Directional Movement Index (DMI) chart shows its Average Directional Index (ADX) currently at 50.5, after peaking at 60.2 yesterday, up from just 13.3 five days ago. ADX is an indicator used to measure the strength of a trend, regardless of its direction, ranging from 0 to 100.

Values above 25 typically indicate a strong trend, while values below 20 suggest a weak or sideways market. The sharp rise in ADX reflects a significant increase in trend strength, confirming that BERA has been experiencing strong directional movement recently.

Meanwhile, BERA’s +DI is at 24.4, down from 48.4 two days ago, indicating weakening bullish momentum. Meanwhile, -DI has risen to 15.1 from 4.9, suggesting growing bearish pressure.

This shift signals that the bullish trend that drove prices higher is losing steam, and selling interest is beginning to increase.

If -DI continues to rise above +DI, it could indicate a bearish crossover, signaling a potential reversal or deeper correction in BERA’s price. However, if +DI stabilizes and moves upward again, it could suggest a continuation of the uptrend, albeit with reduced momentum.

Will Berachain Fall Below $6 Soon?

Berachain surged 53% between February 18 and February 20, pushing its price above $8.5 after the coin struggled following its airdrop. However, after this sharp rally, BERA entered a correction phase and is currently down almost 15% in the last 24 hours.

This pullback suggests profit-taking and a shift in market sentiment as buyers hesitate to push prices higher. If the downtrend continues, BERA could soon test the support at $6.1, and a break below this level could lead to a further decline towards $5.48, reflecting increased selling pressure.

On the other hand, if Berachain can regain its bullish momentum from a few days ago, it could rise above $8.5 again, potentially testing the next resistance levels at $9.1 or even $10.

To confirm this bullish scenario, Berachain would need to see renewed buying interest and strong upward momentum. If buyers can defend key support levels and push the price above resistance zones, it could indicate the continuation of the uptrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum23 hours ago

Ethereum23 hours agoGrayscale’s Ethereum ETF On The Brink Of Major Change With NYSE’s Staking Proposal

-

Ethereum19 hours ago

Ethereum19 hours agoBitcoin Pepe set to reap big from its virality, fundamentals, and timing

-

Altcoin22 hours ago

Altcoin22 hours agoCan Shiba Inu Price Breakout 300%? 128M SHIB Burn Sparks Optimism

-

Altcoin21 hours ago

Altcoin21 hours agoWill Pi Coin Surpass XRP Price After Binance Listing?

-

Market20 hours ago

Market20 hours agoBybit Assures Stability Amid $5.2 Billion Asset Outflow After Hack

-

Market19 hours ago

Market19 hours agoMantle (MNT) Falls 10% as Bybit Hack Rattles Investors

-

Altcoin19 hours ago

Altcoin19 hours agoLawyer Estimates Maximum Timeframe for Ripple vs SEC Case Dismissal

-

Altcoin18 hours ago

Altcoin18 hours agoLitecoin Whales On Buying Spree Sack 930K Coins Amid LTC ETF Buzz, What’s Next?