Market

Crypto.com Sues SEC: Marszalek Defends Crypto Future

Crypto.com filed a lawsuit against the US Securities and Exchange Commission after receiving Wells notice, signaling future prosecution. The SEC seeks to cast most crypto transactions as securities transactions, greatly tightening restrictions on the industry.

Crypto.com is not the first company to file a preemptive lawsuit over this issue, but as of yet, there is no clear conclusion.

The development began on the morning of October 8, when the SEC sent a Wells notice to Crypto.com. A Wells notice is a declaration from the SEC that its investigation of a company is over, and that it seeks to prosecute it. In response, Crypto.com’s CEO Kris Marszalek announced that he would sue the SEC first.

“This unprecedented action by our company against a federal agency is a warranted response to the SEC’s regulation by enforcement regime which has hurt more than 50 million American crypto holders. The SEC’s unauthorized overreach and unlawful rulemaking regarding crypto must stop,” Marszalek said.

Read more: What Does It Mean To Receive a Wells Notice From the SEC?

Crypto.com’s official statement regarding this lawsuit was direct and bellicose. It claimed that improper attacks from the SEC are “part of the process” of running a legitimate exchange, and that regulator actions against the industry left Crypto.com with “no other choice”. It even added that this prosecution goes against the growing bipartisan pro-crypto consensus in government.

In short, Marszalek and Crypto.com have depicted the SEC’s impending lawsuit as wholly illegitimate. They claim that the SEC is seeking to consider nearly every crypto asset transaction a securities transaction, minus Bitcoin and Ethereum. The firm even filed a petition to the SEC and CFTC, asking for explicit confirmation that some crypto assets are in fact commodities.

The SEC’s War on Exchanges

This preemptive strike mirrors a similar action from Consensys this April. In response to the threat of impending prosecution, it also launched a lawsuit against the SEC, over the same concern about securities transactions. This lawsuit was dismissed in late September, and there has been no satisfying answer to any of these questions.

Essentially, Marszalek may have a point in describing this suit as an act to “protect the future of crypto”. Commodity regulations are looser than securities, and that’s a big part of why Bitcoin and Ethereum are considered commodities. However, if every single other asset is held to a higher standard, it would have dramatic effects on the entire industry.

Read More: What Is the Howey Test and How Does It Impact Crypto?

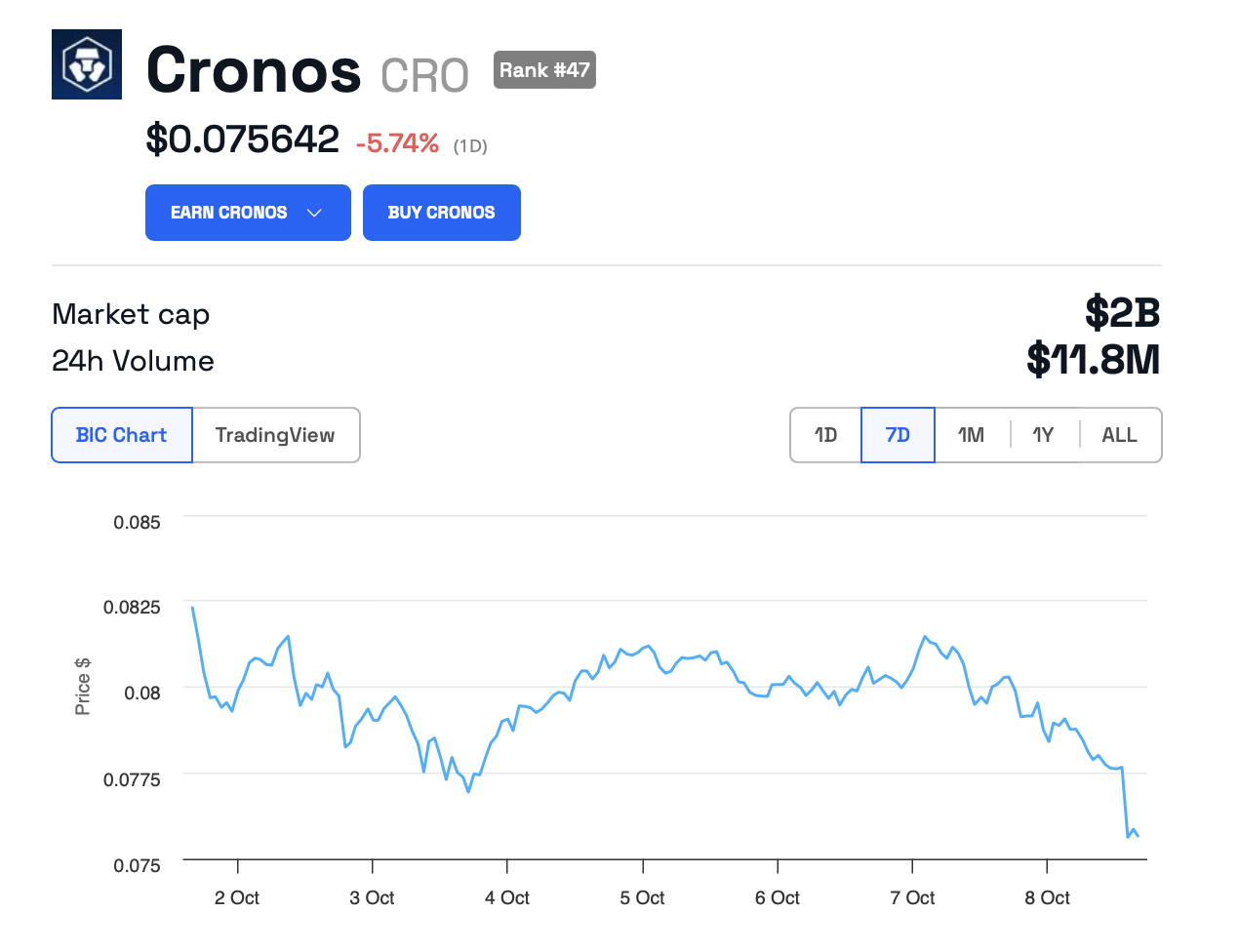

For now, this legal battle is in the very early stages. Cronos (CRO), a native token built on Crypto.com’s blockchain, has dropped in price since the announcement. Other than this slightly bearish omen, however, the proceedings are unclear. Marszalek and his team will likely pursue this case to the fullest, and hopefully, it will clarify all exchanges’ legal status.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price on Track to Break This 6-Week-Old Barrier

Ethereum (ETH) price has recently experienced a 13% decline, with prices dipping towards the end of September. Despite this drop, Ethereum is currently holding strong above its bear market support floor, suggesting that the cryptocurrency may be poised for a recovery.

Investors are now looking for bullish signals that could push ETH beyond the six-week barrier, bringing new opportunities for price growth.

Ethereum Investors Are Resilient

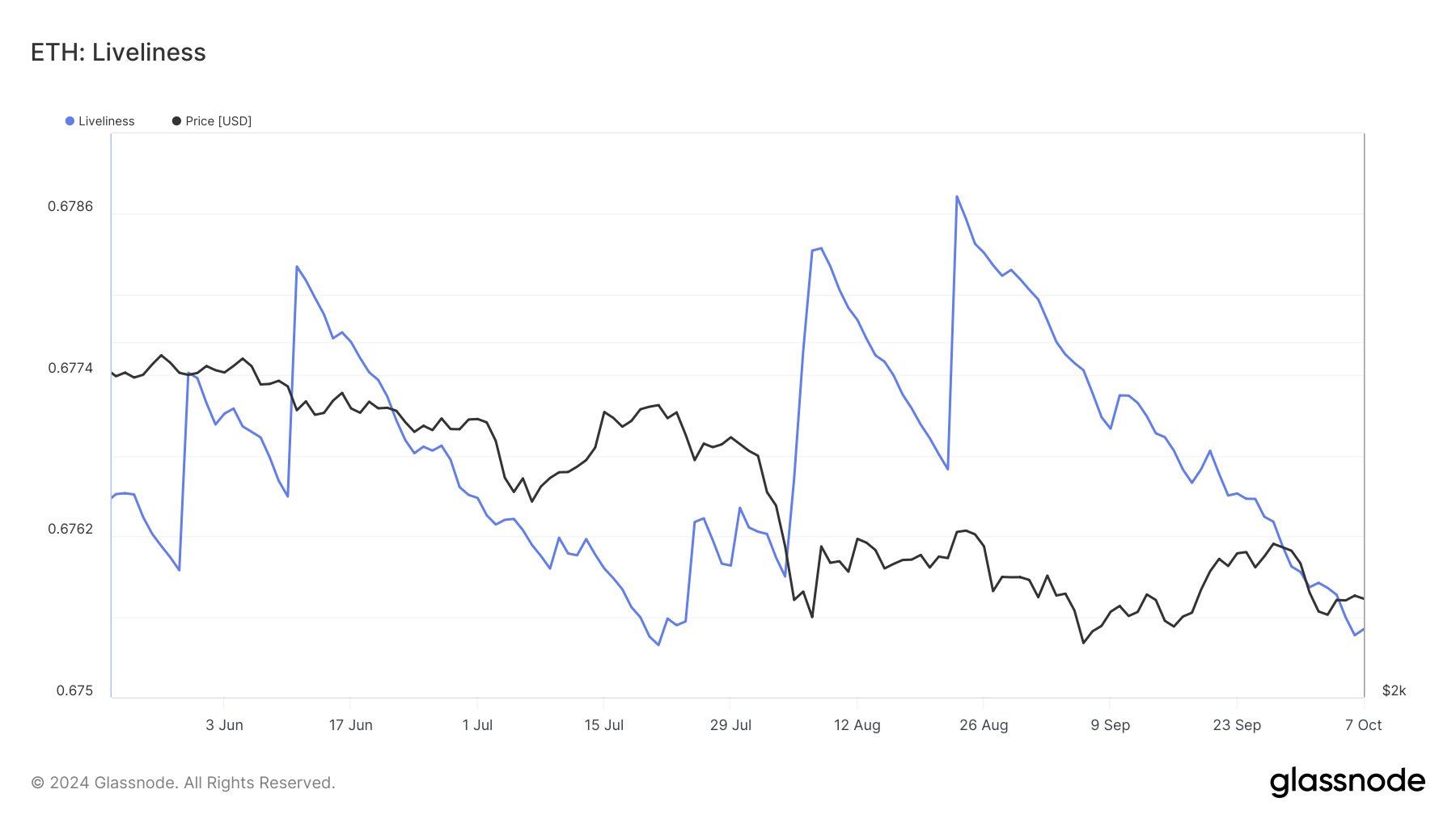

Ethereum’s long-term holders (LTHs) are showing renewed strength, as indicated by the Liveliness metric. This indicator tracks LTHs’ behavior, declining when they accumulate and increasing when they liquidate their holdings. Currently, the LTHs are in accumulation mode, a positive sign for Ethereum’s price trajectory.

As more holders choose to HODL, the potential for a bullish breakout increases, signaling long-term confidence in the cryptocurrency. This stability could be the foundation Ethereum needs to break through its current resistance levels.

Read more: How to Invest in Ethereum ETFs?

From a technical perspective, Ethereum is also showing signs of macro-bullish momentum. The Relative Strength Index (RSI) has been trending positively since the beginning of August, hovering near the neutral line at 50.0. Once this line is flipped into support, Ethereum’s bullish momentum will likely gain further strength, pushing prices higher.

The macro momentum, supported by technical indicators like the RSI, suggests that Ethereum is building a solid foundation for further gains. If the broader cryptocurrency market remains stable, Ethereum could capitalize on this momentum and target higher price levels in the coming weeks.

ETH Price Prediction: Old Barriers, New Highs

Ethereum is currently trading at $2,431, holding above the critical 23.6% Fibonacci Retracement level at $2,401, also known as the bear market support floor. As long as ETH remains above this level, it is likely to continue consolidating while awaiting a bullish trigger that could drive its price higher.

Should the anticipated bullish signals arrive, Ethereum could surge towards $2,591. This level coincides with the 38.2% Fibonacci line, and flipping it into support could allow ETH to rise towards $2,745. Notably, this price point has remained unbreached for the past six weeks, making it a key target for Ethereum’s next breakout.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, if Ethereum fails to gather enough momentum to surpass $2,591, the price may consolidate within this range, remaining above $2,401. This lack of movement would invalidate the bullish outlook, leading to a prolonged period of sideways trading.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ty Dolla Sign Lost $409,000 in SUNDOG, Justin Sun Saves Him

Tron founder Justin Sun rescued American singer, songwriter, and record producer Ty Dolla Sign from losing his Sundog (SUNDOG) meme coin bag.

SUNDOG is one of the Tron network’s leading meme coins, boasting a market capitalization above $265 million. It is fueled by large investments and vocal support from the controversial Tron executive.

Justin Sun Bails Out Ty Dolla Sign’s $409,000 SUNDOG Mishap

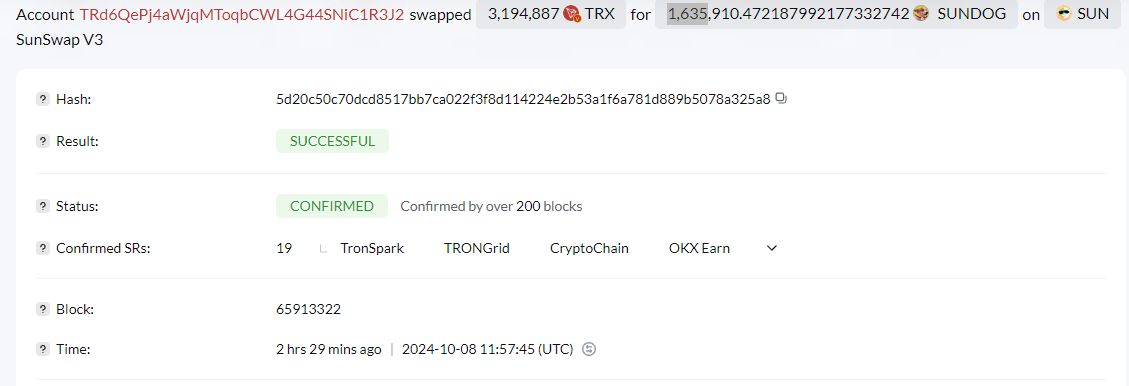

The American celebrity Ty Dolla Sign mistakenly sent 1.66 million SUNDOG tokens, valued at $409,000, to a contract address instead of his TRX account. To assist him, Justin Sun, founder of Tron, stepped in by sending 3,194,887 TRX tokens (worth $500,000) from his HTX4 wallet to Ty Dolla Sign, stating that this would help him “get back in the game.”

Ty Dolla Sign then used the TRX tokens to re-invest in the SUNDOG meme coin. According to data on Tronscan, the artist swapped the 3,194,887 TRX tokens for 1,635 SUNDOG coins on SunSwap V3, effectively channeling the funds back into the meme coin market.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

Lookonchain data supports the report on Ty Dolla Sign’s token recovery. However, the incident sparked conversations around token recovery after such massive losses.

“You are telling me that if I’m dumb enough to burn my $400k I’ll get $500k back? Where do I sign?” Dead Cat Bounce, a pseudonymous user on X commented.

It remains unclear whether Ty Dolla Sign’s celebrity profile played a role in attracting Justin Sun’s attention. Nevertheless, it is worth noting that the behavior and outcome when one sends tokens to a contract address varies. Specifically, it depends on the contract’s design, with one of five outcomes possible:

- Rejection. Some contracts’ designs are such that they reject incoming token transfers. In this case, the tokens sent to the contract address are not accepted, and the transaction may fail.

- Fallback Function Execution. If the contract has a fallback function or a receive function defined, it may execute certain code logic when one sends tokens to the address. This function could handle the incoming tokens in a specific way defined by the contract creator.

- Token lockup. The contract’s programming may be such that it locks up or stores the tokens sent to it for specific purposes outlined in its code. These tokens could be held in escrow or used for certain functionalities within the contract.

- Token Swap/Exchange. Some contracts allow for token swaps or exchanges. One can then exchange the tokens sent for other tokens or assets, depending on the contract’s rules.

- Loss of Tokens. In some cases, sending tokens to a contract address may result in the loss of those tokens if the contract does not handle incoming tokens properly or if the contract code has vulnerabilities.

Ty Dolla Sign’s incident highlights the need for caution when performing crypto transactions. It also stresses the importance of reviewing a contract’s code and functionality before sending tokens to a contract address, to avoid potential losses.

Read more: 7 Best Tron Wallets for Storing TRX

Against this backdrop, however, SUNDOG’s price is up by 5.45%. It has effectively outperformed leading meme coins like DOGE, SHIB, and PEPE, which are down between 6% and 10%. As of this writing, the Tron-based meme coin is trading for $0.2588.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

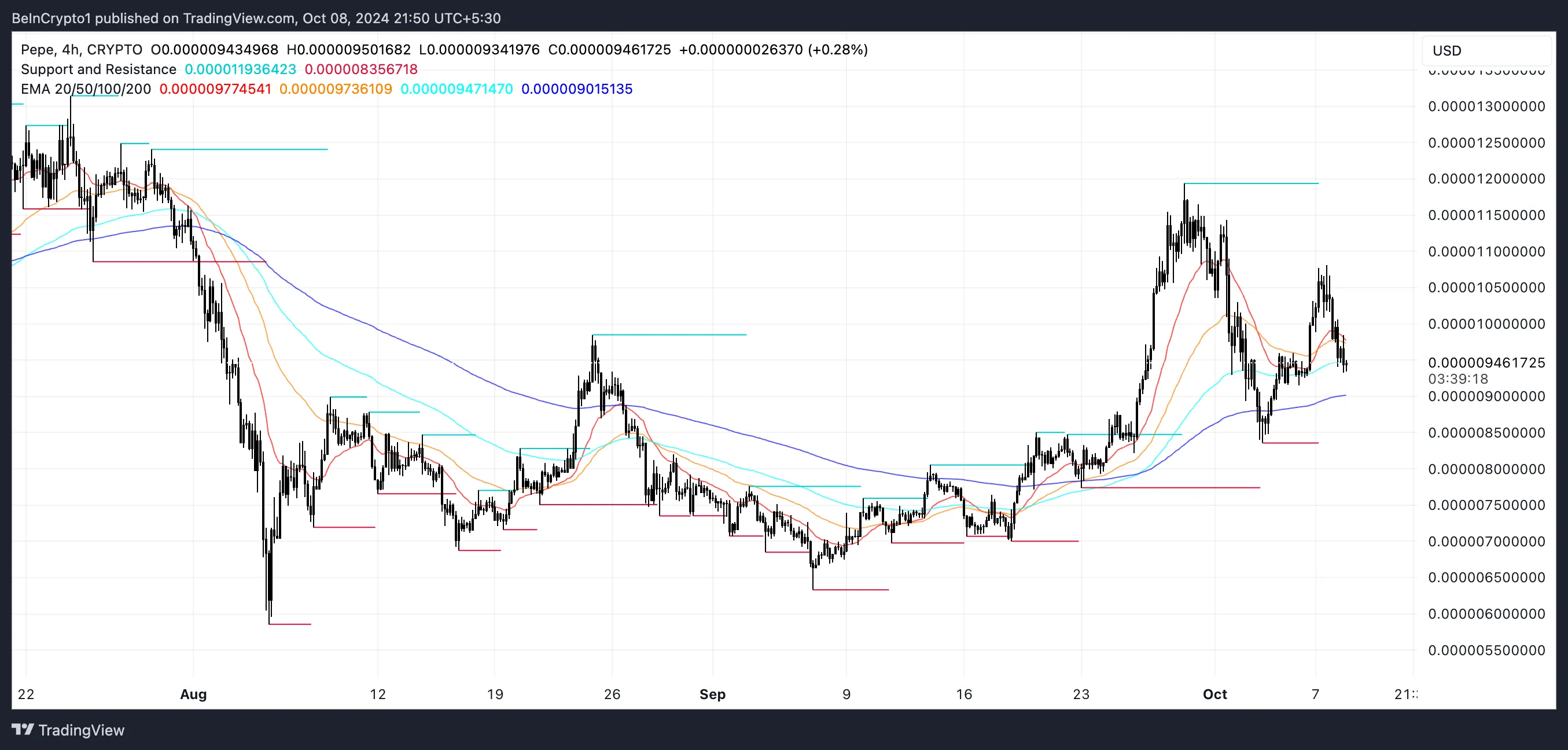

PEPE Price Fades as Traders Await Stronger Direction

PEPE price is showing signs of weakening momentum. Key technical indicators suggest the recent uptrend is losing steam. As a result, the coin has fallen almost 10% in the last 24 hours.

Additionally, short-term price indicators, such as the EMA lines, remain neutral, signaling that PEPE may test important support levels in the near future. While the possibility of a downward move exists, a resurgence in bullish momentum could push PEPE toward retesting key resistance levels.

PEPE ADX Shows The Current Uptrend Is Fading Away

PEPE’s ADX has dropped to 17.89, a sharp decline from its peak of 58.52 on September 30, when PEPE was trading at $0.00001147. The ADX (Average Directional Index) is a key technical indicator used to measure the strength of a trend. That measure is regardless of whether it’s bullish or bearish.

When the ADX is above 25, it indicates a strong market trend. That suggests that momentum is likely driving the price in one clear direction. On the other hand, when the ADX falls below 20, it signals a weak or nonexistent trend.

That points to consolidation or a phase of indecision where no clear price movement is dominant. Currently, with PEPE’s ADX at 17.89, this suggests that the market is in a consolidation phase, lacking strong directional momentum.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

Such a low ADX value indicates that the price is likely ranging within a narrow band, neither gaining nor losing much ground. This aligns with the idea that PEPE is in a period of reduced volatility, even as one of the biggest meme coins in the market.

The sharp drop in ADX also confirms that the strong trend observed in late September has faded, leaving PEPE without a clear directional force. That makes it more susceptible to sideways trading or minor fluctuations until a new trend emerges.

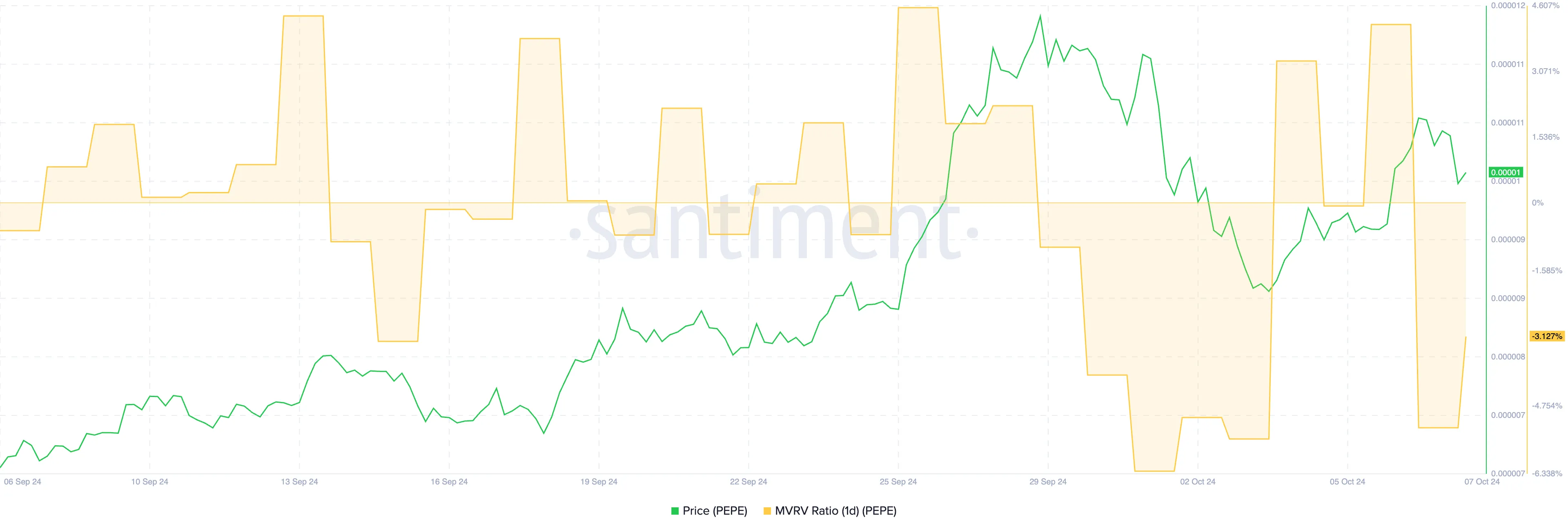

PEPE MVRV Ratio Is Now Negative

PEPE’s 1D MVRV Ratio is currently at -3.12%, indicating that, on average, recent investors are holding PEPE at a loss relative to its current price. The 1D MVRV (Market Value to Realized Value) Ratio is a key metric used to gauge whether a token is overvalued or undervalued by comparing the market value of an asset with its realized value.

When the MVRV ratio is positive, it suggests that holders are generally in profit, while a negative ratio implies that they are in a loss position. Extremely positive values signal that a sell-off could be imminent, as investors may start taking profits.

On the flip side, a negative MVRV ratio, like the current -3.12%, suggests that the market is undervalued. That could present a buying opportunity as sellers have largely exhausted themselves. The drop from 4.17% to -3.12% in just one day is a sharp reversal. That indicates that many investors have moved from being in profit to holding losses in a very short period.

This sudden shift suggests a rapid sell-off or price drop, likely driven by market volatility or external factors impacting PEPE’s price. This could trigger further cautious behavior in the market as traders wait for the MVRV to stabilize or reverse upward again.

PEPE Price Prediction: A Potential Downtrend Ahead?

PEPE’s EMA lines are currently neutral without a clear indication of an uptrend or downtrend, reflecting the market’s indecision. EMA (Exponential Moving Average) lines are widely used in technical analysis to smooth out price data and identify trends by giving more weight to recent price movements.

Short-term EMA lines react quickly to price changes, while long-term EMA lines offer a broader view of the trend. In PEPE’s case, the short-term EMAs are still above the long-term ones. This is generally considered a bullish signal, but they are starting to slope downward.

Read more: 5 Best Pepe (PEPE) Wallets for Beginners and Experienced Users

This downward tilt suggests that the bullish momentum is weakening, and a potential shift could be on the horizon. If the current price action continues in this neutral to slightly bearish direction, PEPE might test the support level at $0.00000835 in the coming days. Should this support fail to hold, the price could drop further, with the next strong support at $0.00000776.

However, if bullish momentum picks up again, PEPE price could challenge the resistance at $0.0000119. For now, the market remains in a state of uncertainty, and traders are likely waiting for a clearer signal to determine the next move.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin4 months ago

Altcoin4 months ago2.52 Million Altcoins Are Ruining Crypto’s Future

-

NFT2 months ago

NFT2 months agoAnimoca Brands Valuation Tanks 75% In Two Years, Here’s Why

-

Ethereum3 weeks ago

Ethereum3 weeks agoCrypto exchange BingX hacked for $43 million

-

Ethereum3 weeks ago

Ethereum3 weeks agoAre The Big Players Losing Interest?

-

Bitcoin2 weeks ago

Bitcoin2 weeks agoCoinbase cbBTC Set to go Live on Solana

-

Blockchain5 months ago

Blockchain5 months agoHong Kong’s Securities Association Tips Authorities On Crypto Self-Regulation

-

NFT4 months ago

NFT4 months agoBLUR Is Down 30%, And Whales Are To Blame–Here’s Why

-

NFT4 months ago

NFT4 months agoNew And Upcoming NFT Projects