Market

Rachel Conlan on Binance’s Expansion and Community

During ETHWarsaw, held on 5-6 September 2024, BeInCrypto had the exclusive opportunity to attend a special event organized by Binance, where key representatives shared insights into the company’s growth and future plans. Among the highlights of the event was an insightful interview with Rachel Conlan, Binance’s Global Chief Marketing Officer, who played a crucial role in shaping the company’s global marketing strategy.

The event, dedicated to select media outlets, offered an intimate setting for discussions on the crypto landscape, particularly in markets like Poland and LATAM. Rachel Conlan shared her thoughts on Poland’s growing role in the European crypto ecosystem, citing high adoption rates and a thriving tech-savvy population. This conversation, held against the backdrop of ETHWarsaw, also touched on the broader global trends impacting Binance, including increased institutional interest and the company’s focus on community-driven growth.

BeInCrypto Meets Rachel Conlan at ETHWarsaw

Jakub Dziadkowiec (JD): Hello Rachel! How are you doing today?

Rachel Conlan (RC): I’m well. How are you doing? Thank you for joining us today.

JD: Thank you. It was a pleasure listening to your speech at the beginning of our lunch here at ETHWarsaw. Could you briefly explain your role at Binance and share some of the most recent developments you’ve been covering?

RC: I am the Global Chief Marketing Officer at Binance. I’ve got the most fun role within the business, but it’s also one of the most challenging because I’m responsible for growing the industry. I’ve been in the role for a couple of years now, and I’m really lucky to work with Richard Teng, our founders, and the broader team.

Binance is in a strong position right now. After seven years, we’ve reached 219 million users, which is an incredible milestone. But it’s also a huge responsibility because it means we must continuously improve our products, optimize what we already have, and ensure Binance is always safe and secure for our users.

JD: That sounds like a lot of responsibility.

RC: It definitely is. But when we think about it, our user base is still in its early stages of growth.

The Growth Potential of Crypto Adoption

JD: Yes, this is one of the main points you often emphasize—that crypto is still in the early adoption phase, with a lot of room for growth. What’s your take on that? How much growth potential do you see?

RC: The potential to unlock is still enormous. Currently, global crypto penetration is around 5-6%, representing roughly 500-600 million users. Many users have second or third accounts, but the adoption is still in its early stages.

Recently, we’ve seen significant attention on the industry—since ETF approval in December, the Bitcoin halving, and the influx of institutions into the space. From a marketing perspective, this momentum is a dream.

I was with the Google team last week, and they mentioned that Bitcoin became the most searched financial product globally in the first quarter of 2024. This kind of spotlight is incredibly exciting, and we’re fully committed to supporting our existing community while engaging with the next generation of crypto users, who are entering for various reasons.

Traveling and Expanding Binance’s Global Presence

JD: You’ve been traveling a lot, given your global marketing responsibilities. Can you share some of the places you’ve visited recently, and what your plans are for the next few months?

RC: Over the past year, I’ve probably visited around 25 different countries with Binance. Most recently, I spent time in the LATAM region, which is an important and rapidly growing market for us. The crypto penetration there ranges from 12% to 20%.

People in LATAM use crypto for different reasons, from using stablecoins to protect their assets against high inflation and unstable governments, to institutional trading and high-level training.

However, I arrived here in Poland just yesterday, and it’s my first time visiting. I’m Irish, and I’ve had Polish friends for over 20 years, but seeing the appetite and curiosity for crypto and blockchain here is extraordinary. Poland is far ahead of much of Europe in terms of crypto penetration.

JD: That leads me to my next question. You’ve mentioned that Poland ranks in the top three European countries within the Binance ecosystem. Could you elaborate on how you perceive Poland as a market for Binance, both in Europe and globally?

RC: One thing I love about the crypto industry, having worked in traditional finance for a long time, is how it’s turning the global financial map upside down. When we grew up, cities like New York, London, Hong Kong, and Singapore were seen as financial hubs.

But now, we’re seeing places like Dubai and Abu Dhabi take leading positions in crypto. Poland is another prime example—its crypto penetration is at 11.7%, while most of Europe is at just 5%. That’s a significant difference.

Poland’s Role in the Global Crypto Ecosystem

JD: That’s quite close to the LATAM region penetration rates you mentioned earlier. What do you think drives this high adoption rate in Poland?

RC: I believe there are two main reasons, from an outsider’s perspective. First, Poland has an incredibly tech-savvy and digitally literate population that’s very engaged with the digital world—not just in terms of trading, but in the broader crypto and blockchain industry.

Second, this has led to the rise of incredible businesses and Web3 startups coming out of Poland. Even just walking around the ETHWarsaw conference, you can feel the energy and enthusiasm for the space.

JD: That’s true. As a Pole, it’s great to see how local events are becoming international ones, with esteemed guests like yourself and representatives from top global crypto companies. It’s amazing that we’re establishing new crypto financial centers for the future.

RC: Exactly! The landscape of financial centers could look completely different in the next few decades. Just last night, we had 500 crypto enthusiasts join us for a meet-up, and I got to hear their stories—how they got into the industry. Some were recent adopters, while others were OGs.

There’s so much potential here, and Poland has the appetite and infrastructure to support it. One interesting fact I learned this week is that Poland ranks in the top 10 globally for the number of crypto ATMs. That’s a significant achievement and a big part of making crypto accessible for the next generation.

Accessibility and Community in Crypto Adoption

JD: That focus on accessibility resonates with our traditional banking system as well. Poland has a highly developed payment system called BLIK, which allows users to send money instantly peer-to-peer, without the need for bank interference. This kind of technological development is a great foundation for the growth of crypto adoption.

RC: Yes, it’s a huge opportunity. You’re right — localization is key, not just having a presence but ensuring we’re speaking the local language and addressing the needs of each community. That’s something we’re focusing on at Binance as well. It’s not just about talking to these communities but engaging with them at a grassroots level.

JD: That must be costly, right? Establishing small, local communities requires specialists in each area. But I imagine it’s worth the effort to build these growing communities. For example, I recently met David Princay, who’s been a mastermind in growing Binance communities in France and other European markets.

RC: David is amazing! He was one of our former Binance Angels. Speaking of which, our Binance Angels program operates globally, and we have around 500 Angels who are early crypto adopters dedicated to sharing their knowledge. They volunteer their time, and their incentives are non-monetary.

Poland accounts for 2% of the global program, which is impressive considering we’re in 100 markets. These Angels support our educational initiatives, spending time both online and in person with communities, helping people understand how to navigate what can sometimes be a complex industry.

JD: Rachel, thank you so much for the interview. It’s been a pleasure talking with you.

RC: I really appreciate it. Thank you so much!

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Whales Are Selling These Altcoins Post Trump Tariffs

Crypto whales have begun to quietly shift their altcoin positions following Trump’s Liberation Day tariffs. Uniswap (UNI), Chainlink (LINK), and Ondo Finance (ONDO) have all seen declines in the number of wallets holding between 10,000 and 100,000 tokens.

While the sell-off hasn’t been dramatic, the timing and consistency across multiple tokens suggest growing caution or short-term repositioning. As these altcoins face key support and resistance levels, whale behavior could continue to shape their price trajectories in the coming days.

Uniswap (UNI)

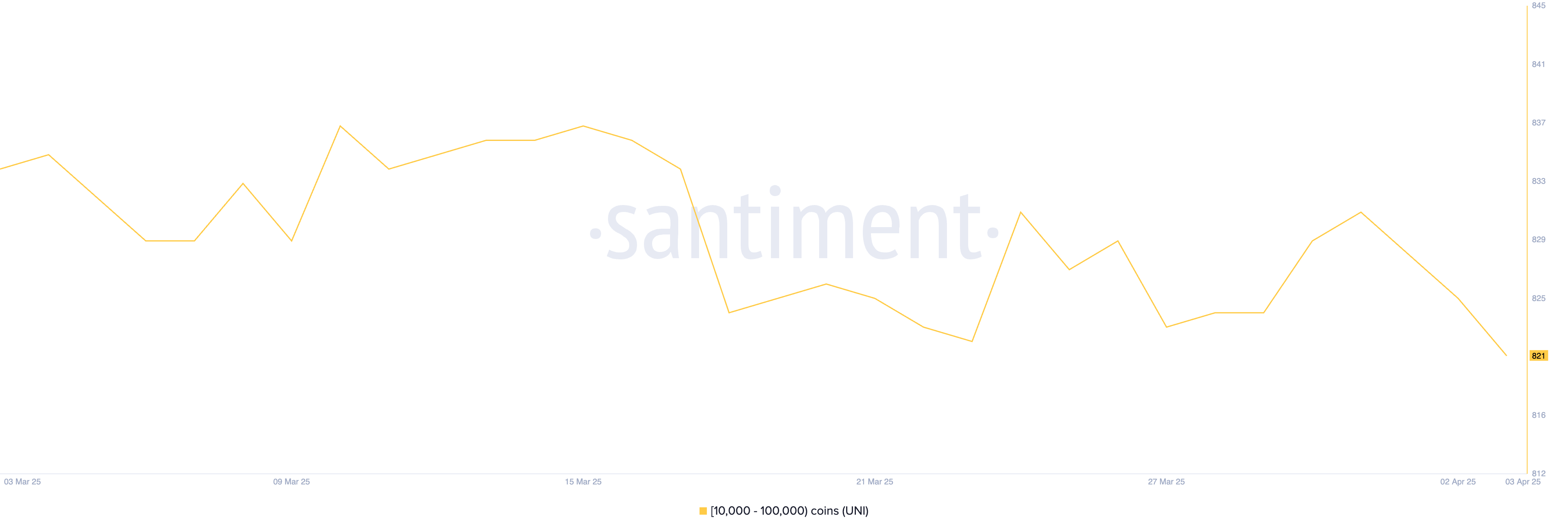

The number of Uniswap (UNI) addresses holding between 10,000 and 100,000 tokens has been steadily declining, a trend that began before Trump’s so-called Liberation Day and has continued in its aftermath.

Between April 2 and April 3 alone, this group of crypto whales dropped from 825 to 821, signaling a slight but notable reduction in confidence or positioning from a segment often seen as strategically reactive.

While this decline may seem modest, it reflects a broader sentiment of caution among larger UNI holders, which often precedes or reinforces price weaknesses.

Currently, UNI price remains in a clear downtrend, with growing risks of a drop toward the $5.50 level or even below it if bearish momentum continues. However, if the trend begins to reverse, the token could first test resistance at $5.97.

A successful breakout from there could push Uniswap higher toward $6.23, a level that would suggest a stronger recovery is underway.

For now, though, the decrease in whale-sized wallets and prevailing bearish momentum place the asset in a vulnerable technical position.

Chainlink (LINK)

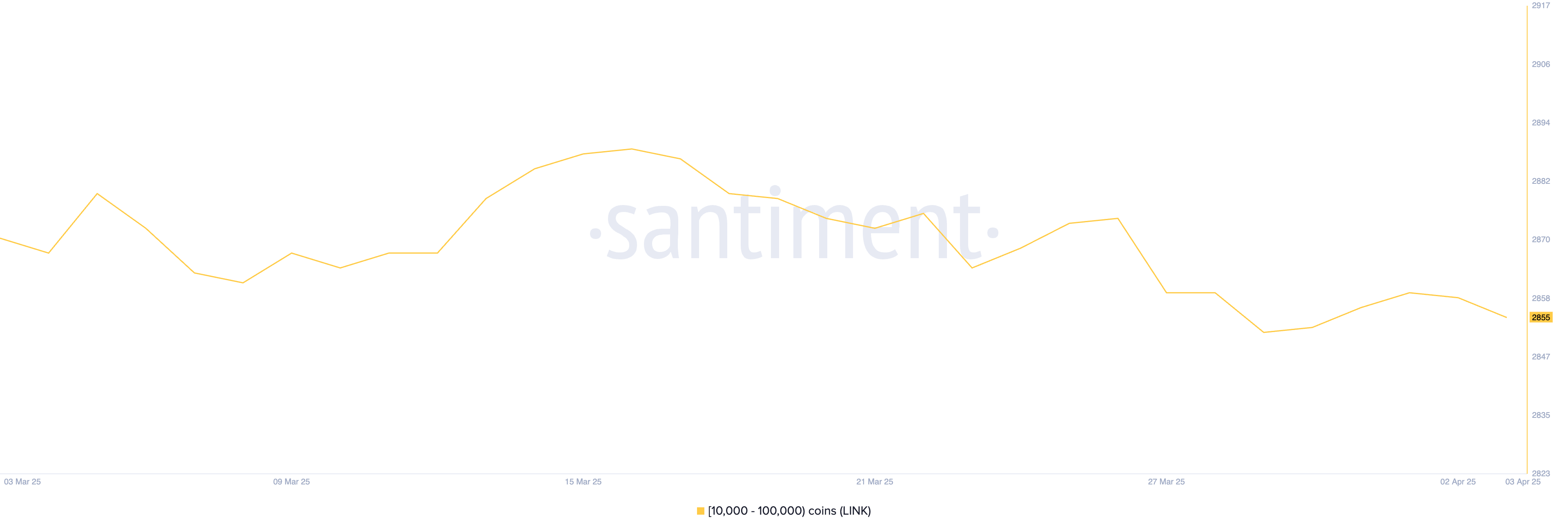

While the number of Chainlink (LINK) whale addresses—those holding between 10,000 and 100,000 LINK—only slightly declined after Trump’s Liberation Day, falling from 2,859 to 2,855, the context leading up to that matters more.

From March 29 to April 1, this group was actively accumulating, with the number of crypto whales rising from 2,852 to 2,860. This short burst of accumulation suggested growing confidence in LINK’s upside potential heading into the month.

The recent dip may simply reflect mild profit-taking or caution during the current correction rather than a broader shift in sentiment.

Technically, LINK is at a critical point. If the ongoing correction deepens, the token could fall below $12 for the first time since November 2024, with $11.85 as the key support to watch.

However, if the trend shifts and buyers regain control, LINK could first test resistance at $13. A break above that level would likely open the door for a move toward $13.45.

Ondo Finance (ONDO)

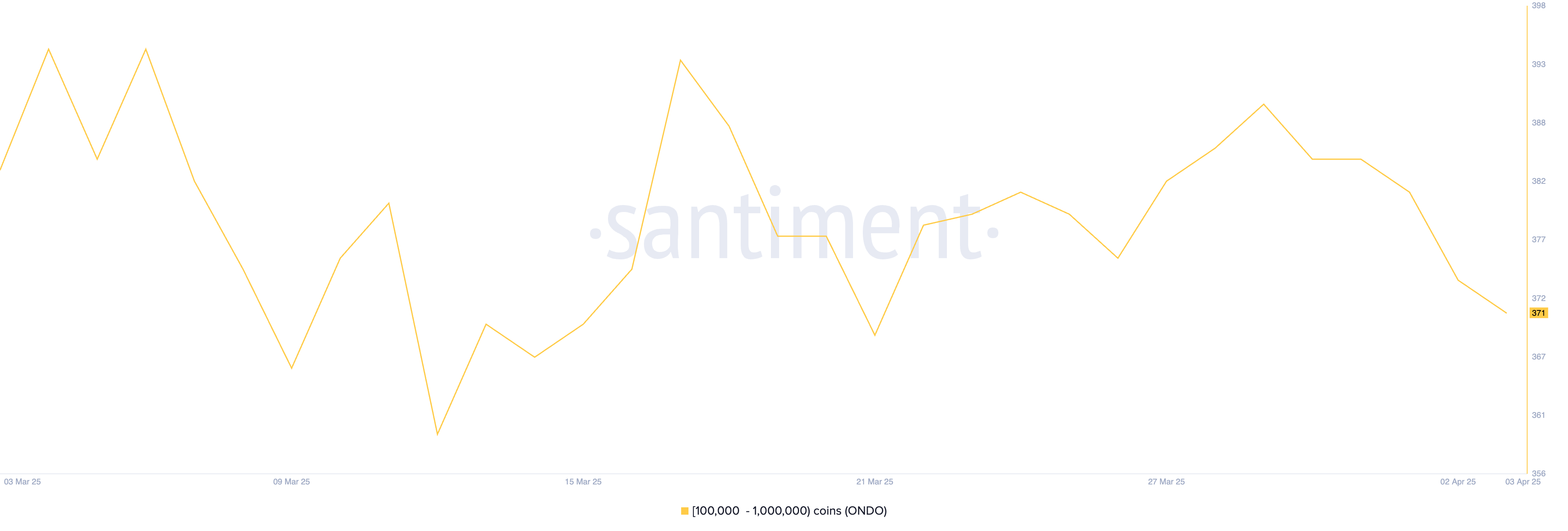

ONDO is showing a trend similar to Chainlink, with whale accumulation taking place between March 26 and March 29 as the number of addresses holding between 10,000 and 100,000 ONDO grew from 376 to 390.

This wave of accumulation pointed to growing interest and confidence from larger holders. However, after peaking, the number of whales started to drop, falling from 374 to 371 following Trump’s Liberation Day.

This decline, while subtle, may indicate a pause in optimism or a cautious shift in positioning among key players.

From a price perspective, ONDO now sits at an important moment. If it can regain the bullish momentum seen last month, it could push through the resistance at $0.82, with the potential to climb further toward $0.90 or even $0.95 if strength persists.

However, if momentum continues to fade, downside risks increase, with support levels around $0.76 and $0.73 likely to be tested.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

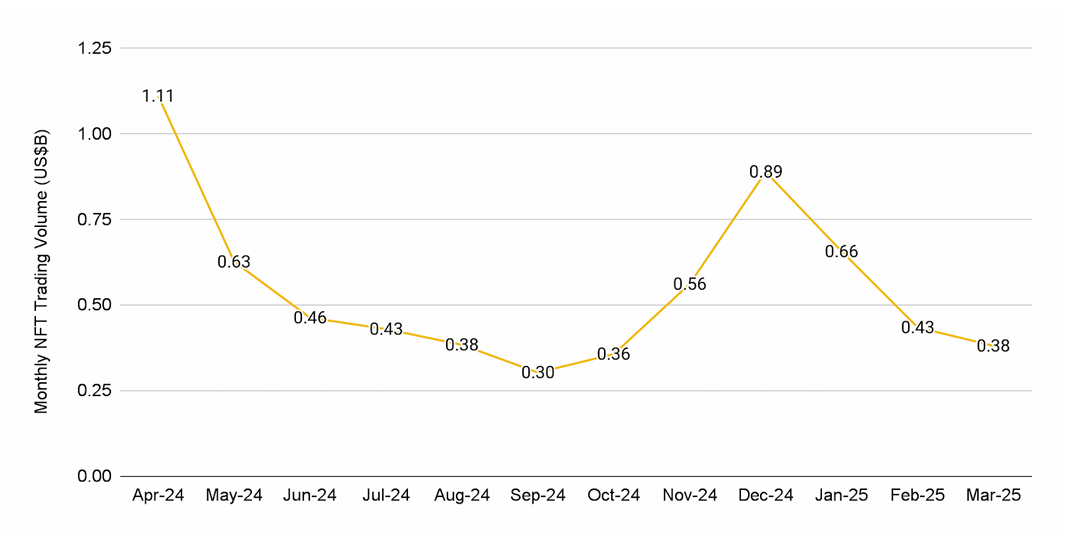

NFT Market Falls 12% in March as Ethereum Sales Drop 59%

According to the latest Binance research, the NFT market saw a sharp drop in March 2025. Total sales volume across the top 10 blockchains fell by 12.4%, signaling weaker buyer interest. Only two chains—Immutable and Panini—bucked the trend.

The number of unique NFT buyers dropped to its lowest level since October 2023, pointing to a slowdown caused by global economic pressures.

Are NFTs Dying Out in 2025?

Ethereum-based NFTs suffered the most. Sales on the network dropped 59.3%, with only CryptoPunks recording any growth among the top 20 collections. Bored Ape Yacht Club and Pudgy Penguins both posted losses of more than 50%.

Panini saw a strong surge in activity. Its digital collectibles jumped 259.2% in sales, placing it among the top 10 NFT blockchains.

With a long legacy in physical collectibles, Panini’s digital offering uses blockchain to validate asset ownership.

Despite the broader slowdown, brands and creators continue to explore new NFT concepts. Azuki collaborated with artist Michael Lau to launch a physical-backed NFT.

The Sandbox teamed up with Jurassic World to bring licensed dinosaurs into its metaverse experience.

Still, market contraction has led to several closures. Bybit announced it is shutting down its NFT Marketplace, Inscription Marketplace, and IDO platform.

X2Y2 is also winding down after handling $5.6 billion in trading volume. Activity has dropped by 90% since NFTs peaked in 2021, pushing many platforms out of the market.

“Marketplaces live or die by network effects. We fought tooth and nail to be #1, but after three years, it’s clear it’s time to move on. The NFT chapter taught us a lot—most of all, that lasting value beats chasing trends. That lesson’s why we’re drawing a line here, not a pause or a maybe, but a full stop on X2Y2 as we knew it,” X2Y2 wrote in its announcement.

Also, Kraken ended its NFT operations in February, shifting focus to other business areas.

Meanwhile, NFT-related tokens continue to fall. Magic Eden has lost 94% of its value since its launch four months ago. Pudgy Penguins (PENGU) has declined nearly 30% over the past month, despite its Coinbase listing.

Ethereum’s revenue has also taken a hit. Transaction fee income has dropped by 95% since late 2021, driven by falling NFT activity and fewer contributions from Layer 2 networks.

This has been reflected in Ethereum’s price, as the altcoin declined by 58.8% from its all-time high. Q1 2025 marked its worst quarter since 2018.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Price Falls 19%; Losses Push Investors To Sell And Exit

Solana has faced significant price corrections recently, erasing gains made in mid-March. The altcoin is currently trading at $116, reflecting a 19% loss over the past ten days.

As the price continues to struggle, many investors are losing patience, pushing them to sell their holdings and exit the market.

Solana Losses Mount

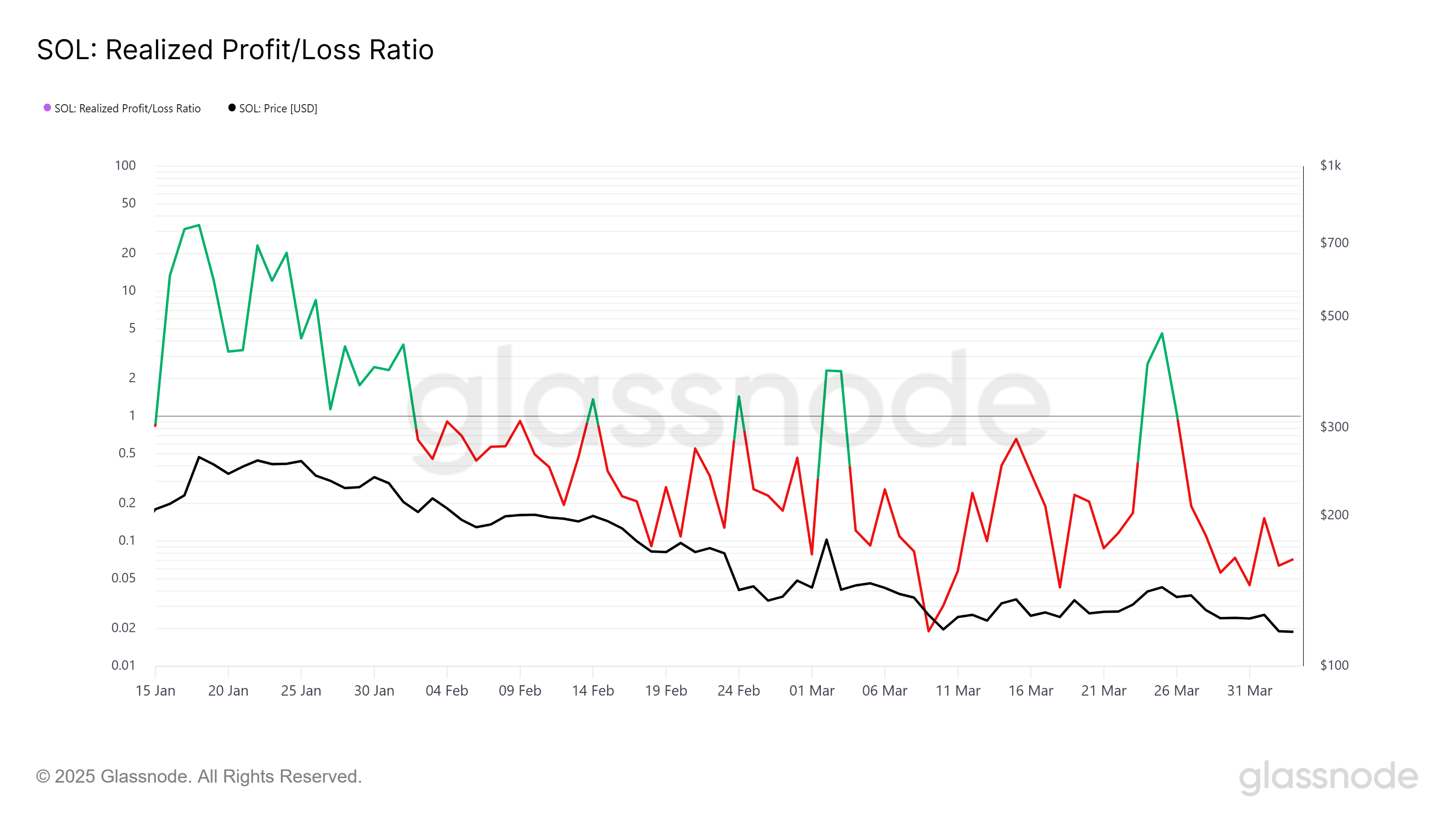

The Realized Profit/Loss (RPL) indicator shows that Solana has been underperforming for most of February and March. While there were brief moments of profit for short-term holders (STHs), the overall trend has been bearish.

These losses have contributed to mounting frustration among investors, leading many to consider selling their positions. The selling pressure is keeping the market from recovering as more and more investors choose to cut their losses.

As a result, investor sentiment has weakened, with many unwilling to hold onto their positions in the face of continued price declines. The Realized Profit/Loss data indicates that, in addition to the selling pressure from STHs, the broader market is also showing signs of caution.

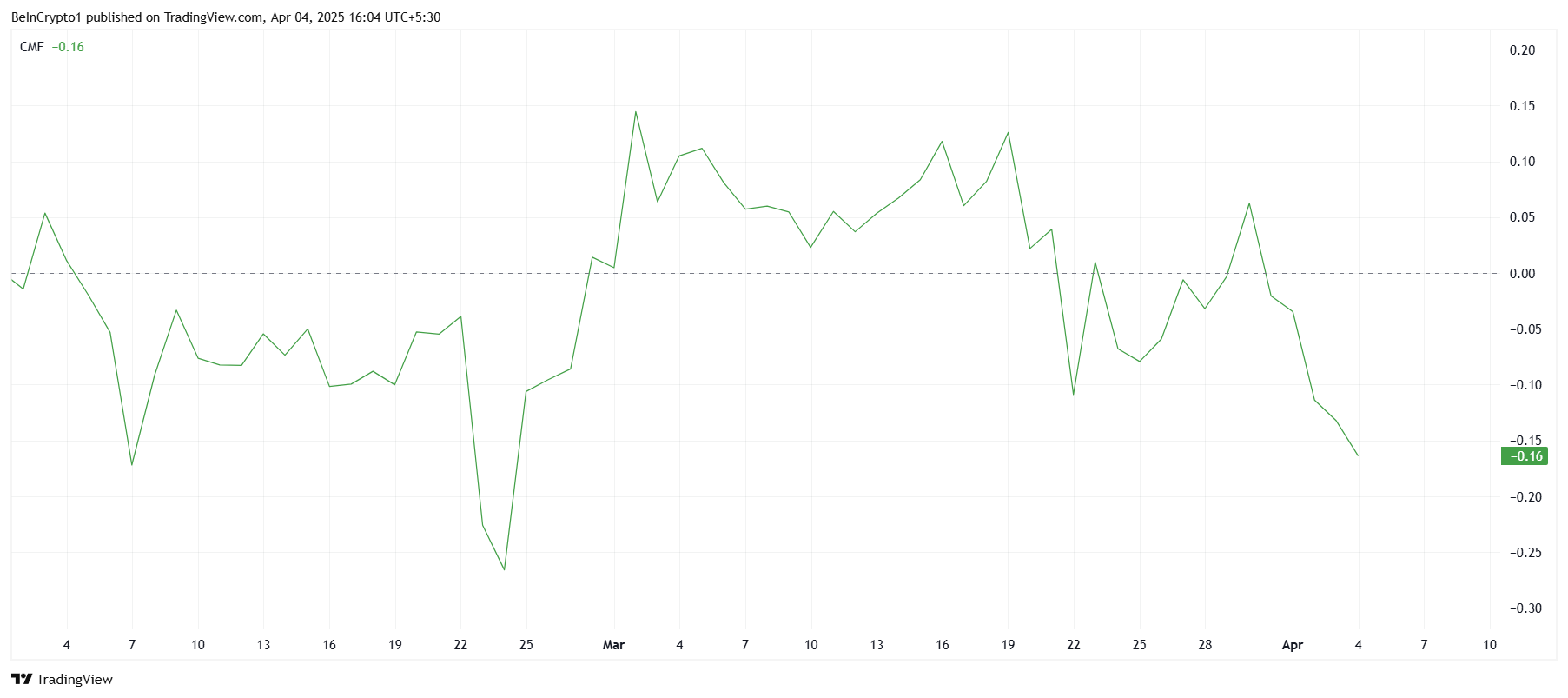

The Chaikin Money Flow (CMF) indicator also shows a concerning trend for Solana. Currently, at a monthly low, the CMF reflects that outflows are exceeding inflows, indicating that investors are pulling their money out of Solana. This lack of buying pressure is detrimental to the altcoin’s recovery prospects, as the outflows signal reduced confidence in the asset.

With the CMF in negative territory, Solana’s ability to rally appears limited, as the overall market sentiment remains subdued. The lack of investor conviction is further exacerbating the downward momentum.

SOL Price Could Witness Further Decline

At the time of writing, Solana’s price is at $116, and it is struggling to recover from the recent losses. Despite the slight uptick observed in the past 24 hours, the altcoin’s recovery remains uncertain. With investor confidence at a low, the price may continue to struggle in the short term.

The aforementioned factors suggest that Solana could dip further to $109, extending investors’ losses. If the bearish trend continues, SOL could test this support level before any potential signs of recovery emerge. This price action would keep investors on edge and delay any sustained rally.

However, if Solana can reclaim $118 as a support floor, it could spark a reversal. A breach of this level would push the altcoin toward $123, and flipping it into support would significantly bolster the bullish thesis. In this scenario, Solana could break through resistance levels and rise toward $135.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Faces ‘Hyperinflation Hellscape’—Analyst Reveals Key On-Chain Insights

-

Market23 hours ago

Market23 hours agoWhat to Expect After March’s Struggles

-

Market22 hours ago

Market22 hours agoBitcoin Price Still In Trouble—Why Recovery Remains Elusive

-

Market21 hours ago

Market21 hours agoEthereum Price Losing Ground—Is a Drop to $1,550 Inevitable?

-

Bitcoin16 hours ago

Bitcoin16 hours agoJapanese Company Unveils Plans To Buy Crypto

-

Market20 hours ago

Market20 hours agoXRP Battle Heats Up—Can Bulls Turn the Tide?

-

Bitcoin17 hours ago

Bitcoin17 hours agoWhy Are Retail Investors Turning to XRP Over Bitcoin?

-

Altcoin16 hours ago

Altcoin16 hours agoPi Coin Price Crashes 15%, Is Coinbase Listing Only Hope?