Market

These 3 Crypto Airdrops in October Could Boost Your Portfolio

Three project are launching enticing crypto airdrops this week, offering investors a chance to get in on the ground floor without any initial financial investment.

Airdrop farmers can capitalize on the following participation opportunities from with renowned investors backing these three projects.

Xterio: Bringing Free Gameplay To Blockchain

Xterio combines free-to-play gaming with blockchain technology while delivering Web3 digital ownership. The project’s co-founder, Jeremy Horn, already hinted at multiple bullish plans in Q4 in his report on the Token 2049 experience in Singapore.

“I’m confident that Xterio’s strong Q4 lineup will help move the space forward, demonstrating how solid fundamentals and Web3 incentives can sustainably support a token ecosystem’s growth,” Horn wrote.

Participants start by signing up and playing the Age of Dino mini-game, among other activities, to earn XTER points and ROAR rewards. Xterio already announced a dashboard where airdrop participants can check their points for activities in the project ecosystem.

Read more: What are Crypto Airdrops?

Players earn rewards by participating in exciting activities, including gameplay, and collecting NFTs (non-fungible tokens), with the game’s powering token, XTER, to be airdropped after the token generation event (TGE).

Vana: AI and Data Ownership Combined

The project meets players at the intersection between artificial intelligence (AI) and data ownership, leveraging a decentralized Layer-1 blockchain. It empowers individuals to own, govern, and monetize their data, shifting control from big tech to the people.

Allowing users to explore and control their digital identities, Vana launched its mini-app on Telegram, for participants to mine and earn VANA tokens. Users can create their “Digital Self” using their Virtual DNA (VNA) to personalize experiences in the “Vanaverse.”

Participants need to launch the Vana Data Hero Bot on Telegram and link their TON wallet. To earn VANA points, they must complete various VANA challenges, such as tapping, inviting friends, and playing games.

Neon: The First Parallelized EVM on Solana

The project advertises itself as the first parallelized Ethereum Virtual Machine (EVM) on Solana, where developers can build and launch Ethereum-native dApps from their existing codebase.

Neon mainnet airdrop is already confirmed after garnering up to $45 million in funds led by Jump Capital. Other backers include Solana Ventures, IDEO CoLab Ventures, Rockaway X, Three Arrows Capital, and Ethereal Ventures.

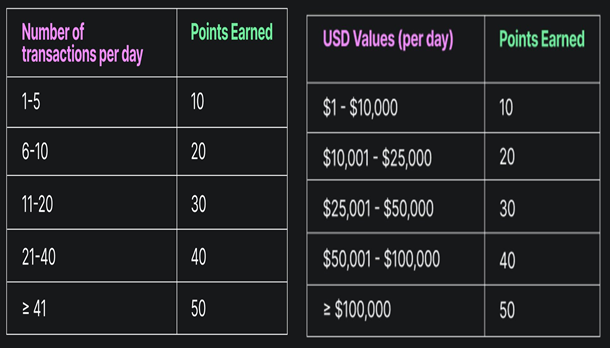

Participants complete tasks to qualify for potential airdrops and rewards, including following instructions and tracking task updates and statuses. Unlike Vana and Xterio, Daily on-chain activities are tracked and rewarded in Neon Points based on the number of daily transactions and total transaction value.

Read more: Best Upcoming Airdrops in 2024

First-time Neon users need to bridge funds into the Neon ecosystem by adding the Neon network to their EVM wallet. Solana users, on the other hand, can use NeonPass to transfer their Neon tokens into the ecosystem. Meanwhile, EVM users can utilize deBridge to transfer their funds to Neon.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BeInCrypto US Morning Briefing: Standard Chartered and Bitcoin

Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how Standard Chartered sees early signs of institutional investors turning to Bitcoin as a hedge against equity market volatility, just as traders gear up for a potentially volatile week driven by tariff news. At the same time, Coinbase wraps up its worst quarter since the FTX collapse, and U.S. regulators inch closer to unified stablecoin legislation.

Standard Chartered Sees Signs of Bitcoin Starting to Be Used as Hedge Against Market Volatility

Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, sees signs that institutional traders are starting to use Bitcoin as a hedge against equity market volatility.

In a recent exclusive interview with BeInCrypto, Kendrick highlighted that this trend is already underway, with investors seeking alternatives to traditional instruments. “This is happening already,” Kendrick stated. “Investors used to use FX, specifically AUD, for this purpose due to its highly liquid and positive correlation to stocks, but now I think Bitcoin is being used because it is also highly liquid and trades 24/7.”

Additionally, in an investor note from late March, Kendrick expanded on Bitcoin’s evolving role in investment portfolios, suggesting that over time, Bitcoin may serve multiple purposes—both as a hedge against traditional financial market fluctuations and as a proxy for tech stocks.

He pointed out signs that markets could anticipating a less severe tariff announcement from the U.S. on April 2. “Given this has been the worst quarter for the Nasdaq since Q2 2022, there should be a degree of portfolio rebalancing (buying) that needs to take place,” Kendrick added.

As of April 1, 2025, Bitcoin has shown resilience amid broader market uncertainties. The cryptocurrency is up approximately 3.32%, trading at $84,282. This uptick comes alongside an overall increase in the global cryptocurrency market capitalization. In contrast, U.S. stock futures, including Dow Futures, S&P 500 Futures, and Nasdaq Futures, are all trending lower in pre-market trading, reflecting investor caution ahead of the anticipated tariff announcements.

Bitcoin Options Heat Up Before Trump’s “Liberation Day”

FalconXCrypto Global Co-Head of Markets, Joshua Lim, noted that in anticipation of Wednesday’s Trump-tariff “Liberation Day,” crypto funds are actively purchasing Bitcoin options at two key strike prices: $75,000 on the downside to hedge against potential losses and $90,000 on the upside to capitalize on a price surge.

Lim highlighted that the options market is pricing in a potential 4% move in Bitcoin’s price during the event. “The implied event move embedded in Bitcoin options is around 4% for the 2 April event,” he told BeInCrypto.

He also pointed out that traders are likely to keep buying put options in the short term as a protective measure, maintaining a high options cost premium. “We believe the front of the options curve will hold its premium as traders continue to hedge their portfolios or replace spot positions with limited-loss option positions,” Lim added.

Additionally, he noted a 4-point increase in the VIX, signaling that investors expect heightened volatility in the coming days and are turning to options to manage risk or capitalize on price swings. “US equities are also showing a bid in options, with the front-month VIX up 4 points to 22v from last week,” he said.

Crypto Stocks Slide: Coinbase Suffers Worst Quarter Since FTX Collapse

Coinbase is closing out its roughest quarter since the FTX collapse, with its stock tumbling over 30% since January. While it dipped nearly 1% in early U.S. pre-market trading on Monday, the stock managed to claw back losses and is now up around 1%.

Other crypto-linked companies are also feeling the pressure. Galaxy Digital Holdings has dropped over 8% in pre-market trading, while mining firms Riot Platforms and Core Scientific are only barely staying afloat, each gaining less than 0.5%.

Meanwhile, CoreWeave, which pivoted from Bitcoin mining to AI infrastructure, is struggling after a disappointing IPO. Initially aiming for a $2.7 billion raise, the company had to settle for $1.5 billion, slashing its offer price from the $47–55 range to $40 per share. Since going public last Friday, its shares are down 6.8%, with a 7.3% drop recorded in the last 24 hours.

Byte-Sized Alpha

– Today’s JOLTS report, a key gauge of U.S. job openings, could sway Bitcoin—strong data may boost the dollar and hurt crypto, while a sharp decline could fuel rate-cut hopes and lift risk assets.

– Bitcoin is off to its worst quarterly start since 2018, dropping nearly 12% in Q1 2025—but growing whale accumulation, falling exchange supply, and signs of consolidation hint at a potential rebound ahead.

– Crypto scams are on the rise, with fake Gemini bankruptcy emails and a Coinbase employee breach fueling phishing attacks

– OKX has appointed former NYDFS Superintendent Linda Lacewell as Chief Legal Officer, a move aimed at bolstering its regulatory credibility as the exchange accelerates global expansion into regions like Europe and the UAE.

– A unified U.S. stablecoin regulation could soon become reality, as the STABLE and GENIUS Acts differ by only 20% and enjoy strong bipartisan support alongside SEC and CFTC involvement.

– A push for expanded crypto oversight is underway as incoming CFTC Chair Brian Quintenz meets with Senator Chuck Grassley to discuss regulating the crypto spot market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SUI Price Stalls After Major $147 Million Token Unlock

SUI enters a critical phase today as a $147 million token unlock threatens to inject selling pressure into a market already testing key resistance levels. Despite a sharp rebound in momentum—evident in the RSI’s surge from oversold territory—SUI failed to break above the crucial 60 mark, signaling buyer hesitation.

The Ichimoku Cloud shows price action pressing against the cloud’s edge, but lacking the conviction needed for a clear breakout. With a possible golden cross forming on the EMA lines, bulls still have a chance—if they can overcome resistance at $2.50 and avoid being dragged down by post-unlock volatility.

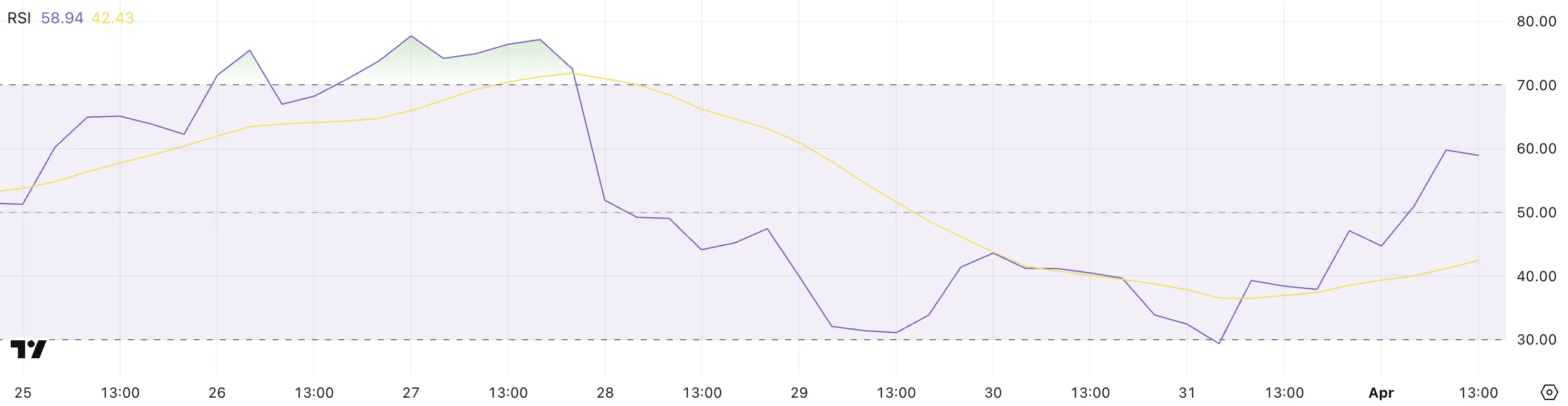

SUI RSI Surged Since Yesterday But Failed To Break Above 60

SUI’s Relative Strength Index (RSI) has jumped sharply to 58.94, up from 29.38 just a day ago, reflecting a strong shift in short-term momentum.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price changes. It typically ranges from 0 to 100. Readings below 30 suggest an asset may be oversold, while levels above 70 indicate it may be overbought.

The rapid rise in SUI’s RSI suggests buyers have stepped in aggressively after a period of heavy selling.

However, despite the impressive rebound, SUI’s RSI briefly approached but failed to break above the 60 threshold earlier today.

This level often acts as a short-term resistance during recovery phases, and the rejection may indicate lingering hesitation among buyers or profit-taking after the surge.

While the RSI nearing 60 is encouraging, a decisive move above it would be needed to confirm a breakout. For now, SUI appears to be in a recovery mode. However, the inability to push past 60 highlights that bulls are not fully in control just yet.

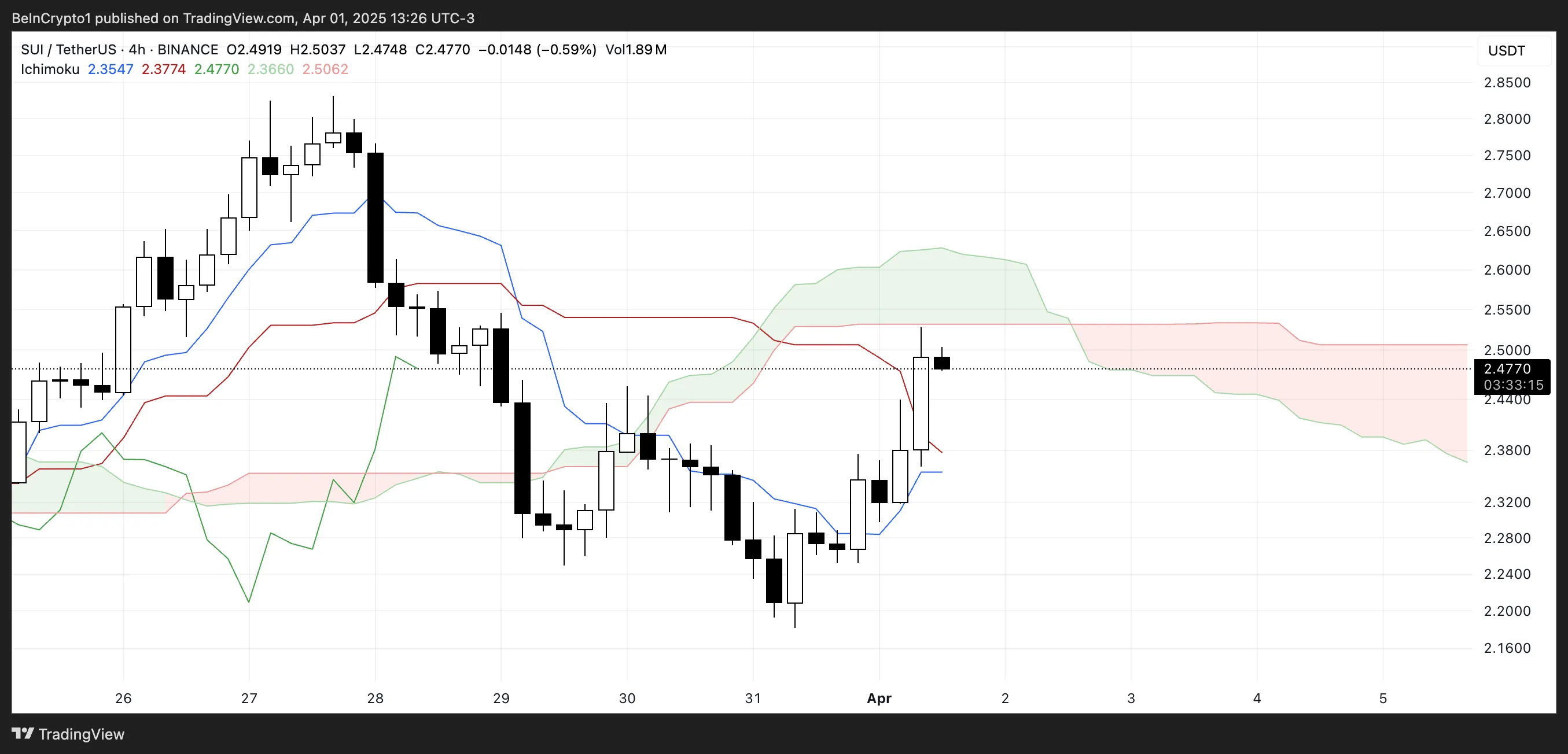

Ichimoku Cloud Shows Lack Of Strong Upward Momentum

SUI blockchain Ichimoku Cloud chart shows a potential breakout attempt, as the price has surged upward and is now hovering right at the edge of the Kumo (cloud).

This movement suggests bullish momentum is trying to build. However, the resistance provided by the thick, red cloud ahead could make it difficult for SUI to sustain the uptrend without stronger confirmation.

The Tenkan-sen (blue line) is starting to rise and has crossed above the Kijun-sen (red line), which is a bullish signal. However, the price still needs to clearly break and hold above the cloud to flip the overall trend from bearish to bullish.

For now, the cloud remains bearish and flat, indicating possible resistance and a lack of strong upward conviction.

The current position suggests that SUI is at a key decision point—either break through the cloud to initiate a trend reversal or get rejected and slip back into the previous downtrend range.

If buyers can sustain the pressure and push the price above the upper cloud boundary, it could trigger a stronger rally. But without increased volume and broader market support, the price risks getting stuck in consolidation or turning back downward.

Will SUI Rise Back To $2.80?

SUI’s EMA lines are tightening and showing signs of a potential golden cross. That happens when a short-term moving average crosses above a longer-term one—a classic bullish signal that often precedes upward momentum.

However, the price is currently grappling with a key resistance near the $2.50 level.

If bulls manage to break through this level, it could open the path for a move toward $2.83.

That said, downside risks remain, particularly with today’s $147 million token unlock, which could introduce significant selling pressure. If that selling materializes, SUI price could fall back to test the support at $2.23.

A breakdown below that level would likely shift momentum back in favor of bears. This would expose deeper supports at $2.11 and $1.96.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Circle Files for IPO

Leading stablecoin issuer Circle finally launched an IPO. It has been preparing for this launch for almost a year, and joins several other crypto firms that are interested in an IPO filing.

This gives Circle a number of opportunities, both to benefit financially and to better integrate with the financial infrastructure and regulatory apparatus.

Circle’s IPO Comes At Last

Circle, one of the world’s largest stablecoin issuers, just filed for an IPO. The firm has been planning this move for nearly a year, relocating to the United States to make the process easier. Since Trump won the most recent Presidential election, the firm’s chances of an IPO increased, and now it has finally pulled the trigger:

“For Circle, becoming a publicly traded corporation on the New York Stock Exchange is a continuation of our desire to operate with the greatest transparency and accountability possible. We are building what we believe to be critical infrastructure for the financial system, and we seek to work with leading companies and governments around the world in shaping and building this new internet financial system,” founder and CEO Jeremy Allaire claimed in the filing.

By launching this IPO, Circle has opened a few new doors for itself. Of course, it’s a substantial opportunity for revenue, but it’s also an important way to intensify the firm’s connections to the financial infrastructure. In this respect, it joins a number of other crypto firms that have sought their own IPO in the last month.

Circle’s IPO filing doesn’t list many concrete numbers, such as initial public offering price, number of available shares, proceeds to the selling stockholders, etc. However, this development is very recent. Further details will likely come to light as the sale progresses.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market19 hours ago

Market19 hours agoCFTC’s Crypto Market Overhaul Under New Chair Brian Quintenz

-

Altcoin12 hours ago

Altcoin12 hours agoWill XRP, SOL, ADA Make the List?

-

Altcoin19 hours ago

Altcoin19 hours agoA Make or Break Situation As Ripple Crypto Flirts Around $2

-

Market18 hours ago

Market18 hours agoXRP Bulls Fight Back—Is a Major Move Coming?

-

Market17 hours ago

Market17 hours agoIs CZ’s April Fool’s Joke a Crypto Reality or Just Fun?

-

Market16 hours ago

Market16 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Bitcoin14 hours ago

Bitcoin14 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Market23 hours ago

Market23 hours agoTop 3 Made in USA Coins to Watch In April