Market

How Bitcoin Price May Miss the $70,000 Mark In October

Despite Bitcoin’s (BTC) price increase in the last 24 hours, key market indicators are flashing caution, suggesting that the coin may face significant hurdles in reaching the $70,000 mark. This development is contrary to the expectations investors have about the coin this month.

Though Bitcoin’s price has surpassed the $63,000 level again, this analysis discloses the reasons why investors should take these warning signs seriously.

On-Chain Metrics Flash Warning Signs for Bitcoin

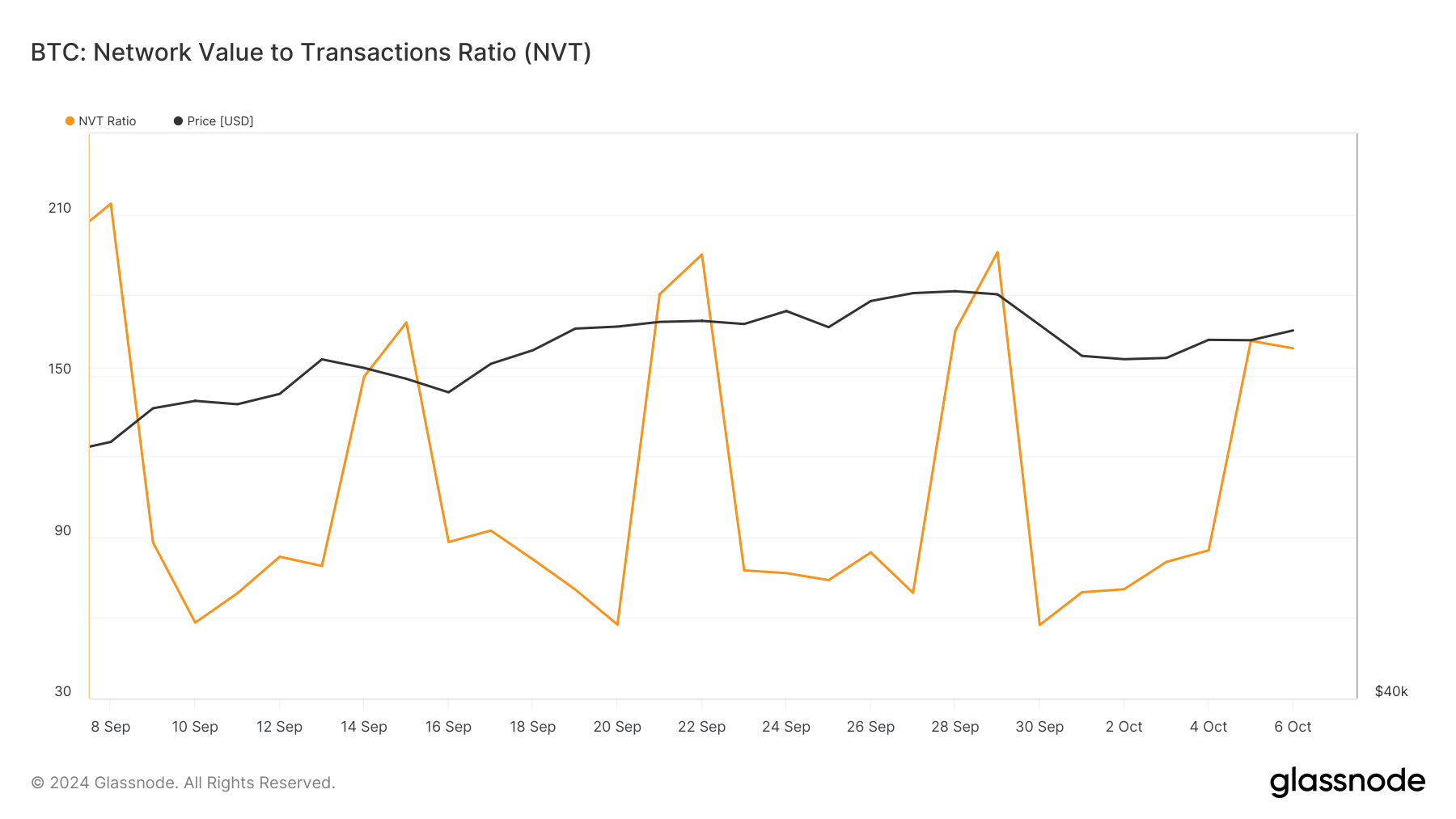

One key metric supporting a Bitcoin price retracement is the Network Value to Transactions (NVT) ratio. The NVT ratio shows if the market cap is growing faster than a cryptocurrency’s transaction volume.

When the NVT ratio decreases, transaction volume is growing higher than the market cap. In most cases, this is bullish for the price. On the other hand, a rising NVTV ratio indicates that the Bitcoin network is overhead as the market cap outpaces the volume.

As of this writing, Glassnode data shows that the ratio has increased recently. This suggests potential overvaluation, indicating a possible short-term Bitcoin price correction.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks After 2024 Halving

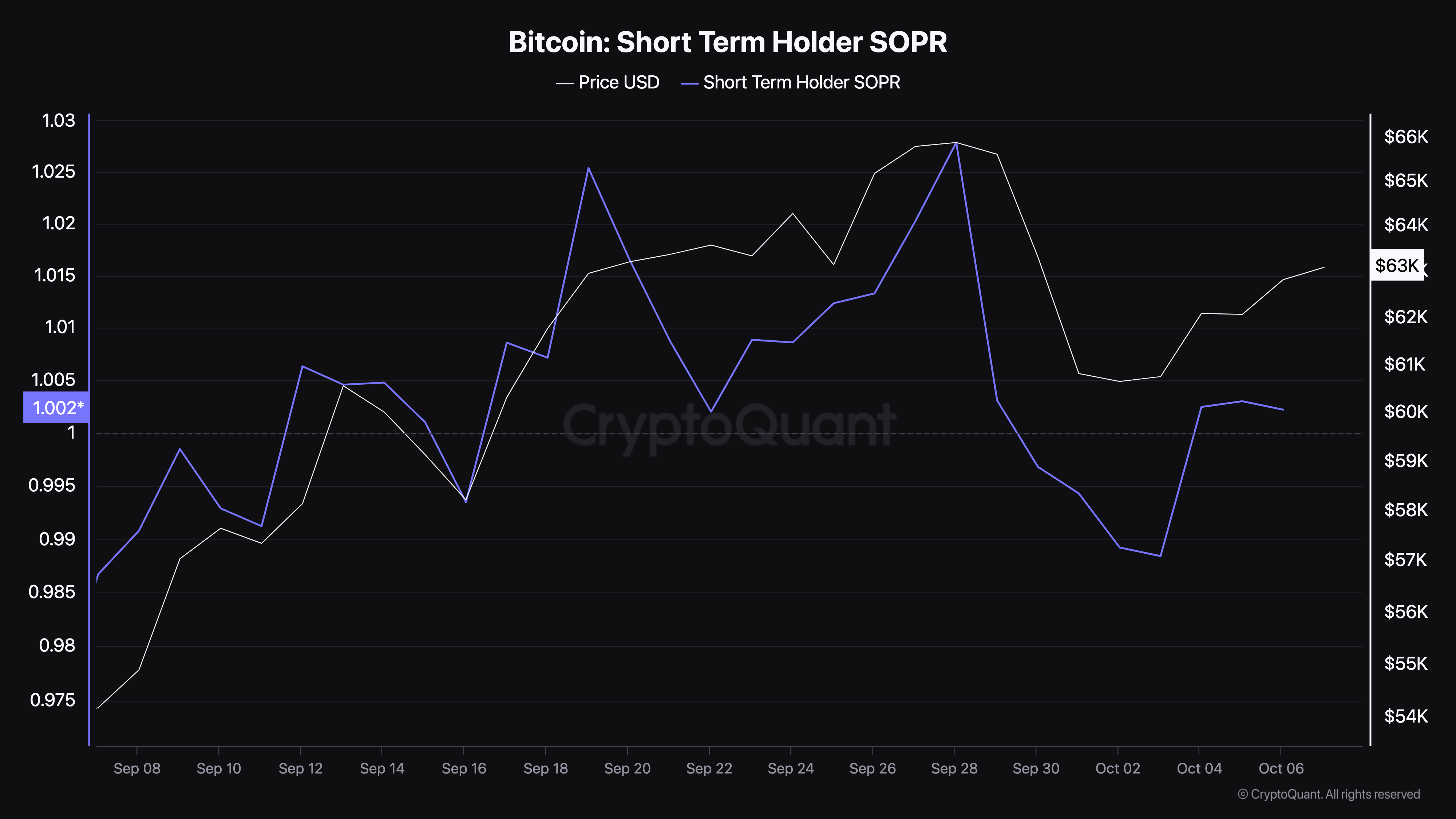

This outlook is enhanced by the Short-Term Holder-Spent Output Profit Ratio (STH-SOPR). This metric measures the behavior of short-term investors, indicating whether they are selling at a profit or a loss.

When the STH-SOPR is below 1, investors are selling at a loss. On the other hand, when the metric is below 1, investors are selling at a profit. However, as of this writing, the ratio is exactly 1, suggesting that the volume sold at a loss and in profit matched one another.

Considering the impact on Bitcoin’s price, this development implies that the coin could keep swinging sideways. However, a potential Bitcoin rally toward $70,000 could be implausible.

BTC Price Prediction: Coin Could Go Below $60,000

On the daily chart, Bitcoin’s price is currently $62,856, an increase from 24 hours ago. However, the Money Flow Index (MFI) shows that capital flowing into the cryptocurrency has decreased.

The MFI is a technical indicator that uses price and volume to check the level of buying and selling pressure in the market. When the MFI increases, more liquidity is flowing, and the price can increase.

Since the indicator’s reading dropped, it implies that investors are cashing out on recent gains, which could halt the price increase. If this remains the same, BTC’s price might decrease to $59,978.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

However, if investors stop distributing and start accumulating in large numbers, the coin might appreciate toward $66,527 and eventually $70,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Price Risks Dip Below $110 as Bears Gain Control

Solana (SOL) has dropped over 6% in the past seven days and has been trading below $150 since March 6. The current trend shows clear bearish signals across multiple indicators.

From a death cross to a rising ADX and a red Ichimoku Cloud, technicals suggest growing downside pressure. With SOL nearing key support, the next few days could be critical for its price direction.

SOL Ichimoku Cloud Paints A Bearish Picture

The Ichimoku Cloud chart for Solana shows a clear bearish structure, with price action trading below both the Kijun-sen (red line) and Tenkan-sen (blue line).

The Lagging Span (green line) is also positioned below the price candles and the cloud, reinforcing the negative outlook. The Kumo ahead is red and descending, suggesting that resistance remains strong in the near term.

Solana has struggled to break above short-term resistance levels and remains stuck in a downward channel. The thin nature of the current cloud suggests weak support, making the price vulnerable to further downside if bearish momentum continues.

For a reversal, Solana would need to break above the Kijun-sen and push decisively toward the cloud, but for now, the trend remains tilted to the downside.

Solana DMI Shows Sellers Are In Control

Solana’s DMI chart shows a sharp rise in the ADX, now at 40.87—up from 19.74 just three days ago.

The ADX (Average Directional Index) measures the strength of a trend, with values above 25 indicating a strong trend and values above 40 signaling a very strong one.

This surge confirms that the current downtrend in SOL is gaining momentum.

At the same time, the +DI has dropped from 17.32 to 8.82, while the -DI has climbed to 31.09, where it has held steady for the past two days.

This setup suggests that the sellers are firmly in control, and the downtrend is strong and also strengthening.

As long as the -DI remains dominant and ADX stays elevated, SOL is likely to remain under pressure in the short term.

Can Solana Drop Below $110 Soon?

Solana recently formed a death cross, a bearish signal where short-term moving averages cross below long-term ones.

It’s now approaching key support at $120—if that level breaks, Solana price could drop to $112, and possibly below $110 for the first time since February 2024.

If bulls step in and buying pressure returns, SOL could rebound toward resistance at $136.

A breakout above that level may lead to a push toward $147, which acted as strong resistance just five days ago.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 Made in USA Coins to Watch This Week

Made in USA coins are showing mixed signals as April begins, with XRP, SUI, and Pi Network (PI) standing out. XRP leads in market cap but also posted the biggest drop among the top 10, down 10.6% this week.

SUI is the only major gainer, up 3.8%, showing some strength despite broader weakness. Meanwhile, PI has been the worst performer, plunging over 23% and staying below $1 all week.

XRP

XRP is the largest Made in USA crypto by market cap, but it’s also down 10.6% over the last 7 days—the biggest drop among the top 10. This sharp correction could present an opportunity, especially with Trump’s “Liberation Day” event coming up on April 2.

If XRP builds an uptrend, it could push to test resistance at $2.22. A breakout there may lead to moves toward $2.47 and even $2.59 if momentum grows.

If the downtrend continues, XRP could revisit support at $2.06. A breakdown below that level might drag it further down to $1.90.

With volatility rising and a possible narrative shift on the horizon, XRP could be a key coin to watch this week.

SUI

SUI is the only among major Made in USA cryptos showing gains over the past week, up 3.8%, even though it’s still down 13% over the last 30 days. This resilience sets it apart from the rest of the pack.

In the last 24 hours, trading volume has dropped 15% to $767 million. The coin’s current market cap is $7.43 billion.

SUI’s EMA lines recently formed a death cross, hinting at a possible downtrend. If confirmed, the price could drop to $2.23, with further downside to $2.11 and $1.96.

If SUI manages to reverse the trend, it could climb toward $2.50. A breakout there would open the door to $2.83, nearly 20% higher from current levels.

Pi Network (PI)

Pi Network (PI) is the biggest loser among Made in USA cryptos this week, with its price down over 23% in the last seven days.

It has been trading below $1 throughout the entire week.

If sentiment shifts, PI could rebound toward resistance at $1.05. A breakout there might lead to a push-up to $1.23.

But if bearish pressure continues, PI could fall to test support at $0.718. A drop below that would send it to $0.62—its lowest level since February 21.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

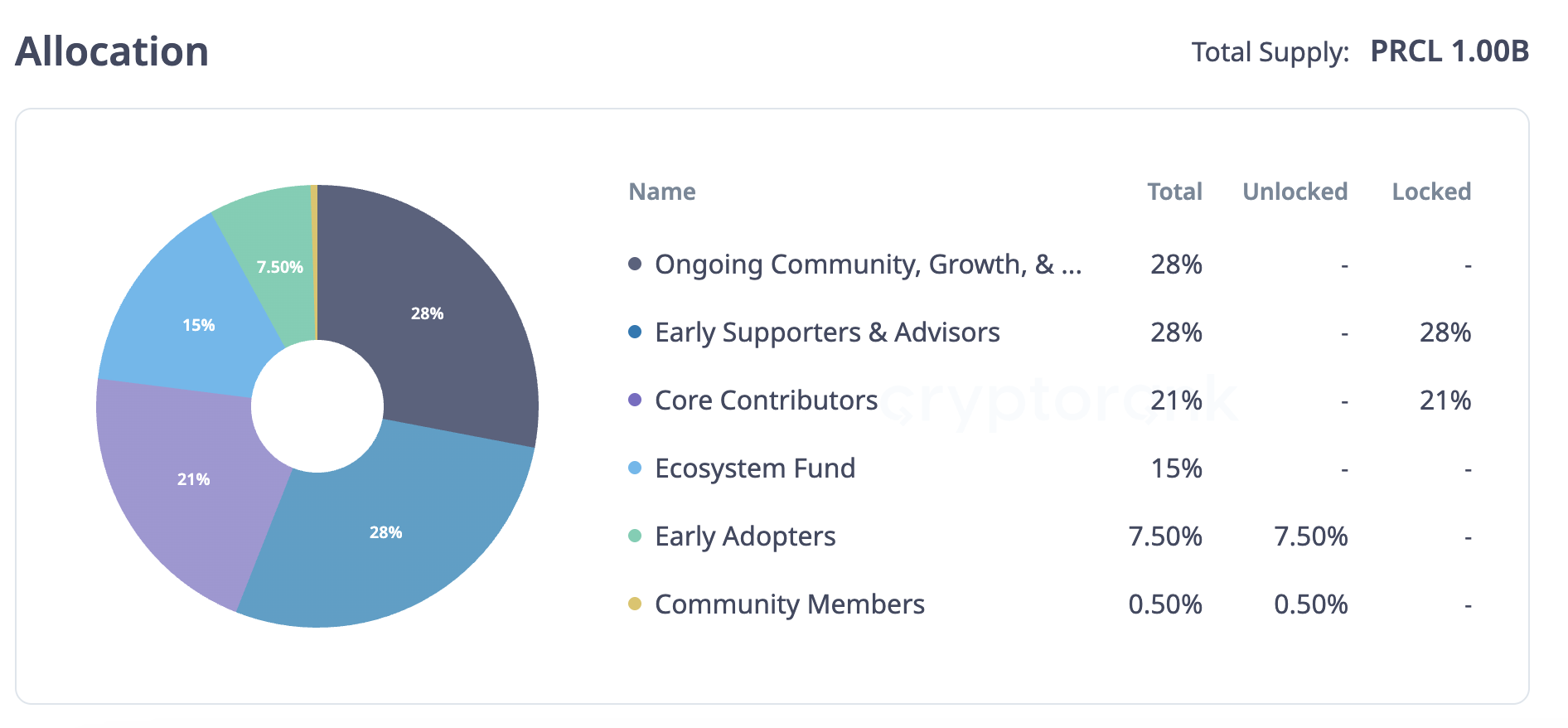

3 Token Unlocks for April: Parcl, deBridge, Scroll

Three major token unlocks involving PRCL, DBR, and SCR are set to take place in April. Parcl will unlock 161.7 million PRCL on April 16, followed by deBridge unlocking 1.11 billion DBR on April 17 and Scroll releasing 40 million SCR on April 22.

These events could significantly impact each token’s supply dynamics and short-term price action. With large allocations set aside for contributors, partners, and airdrops, these unlocks are worth watching closely.

Parcl (PRCL)

Unlock Date: April 16

Number of Tokens to be Unlocked: 161.7 million PRCL (16.2% of Total Supply)

Current Circulating Supply: 270.8 million PRCL

Total supply: 1 Billion PRCL

Parcl is a decentralized exchange that lets users trade real estate price movements without owning property. The ecosystem—made up of Parcl, Parcl Labs, and Parcl Limited—governs the Parcl Protocol, which offers synthetic exposure to real-world real estate markets. It allows users to go long or short on property prices across different regions.

On April 16, 161.7 million PRCL tokens, worth roughly $15.56 million, will be unlocked. This could increase the token supply and lead to short-term market volatility.

The unlock includes 92.4 million tokens for early supporters and advisors, and 69.3 million for core contributors. PRCL price is down 33% in the last 30 days and trading below $0.1 since yesterday.

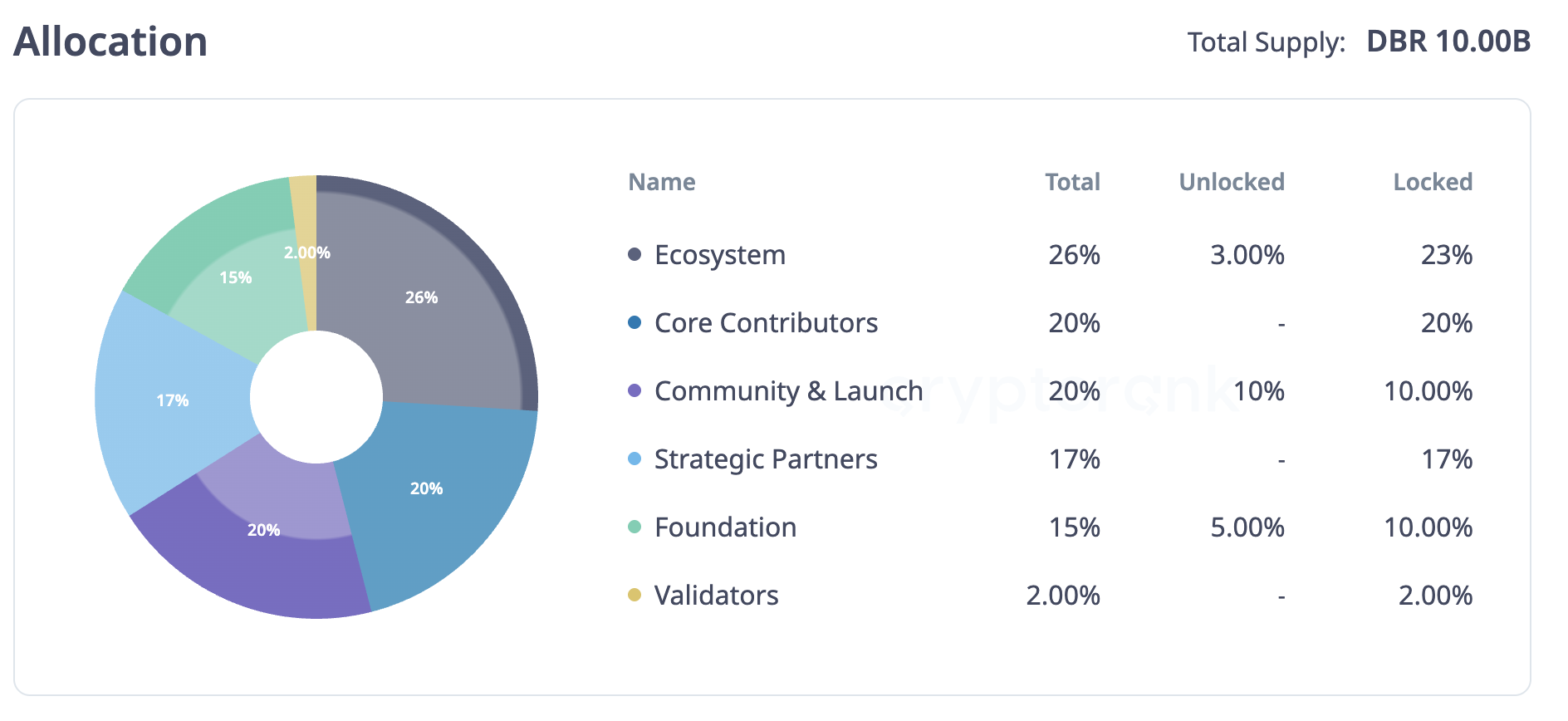

deBridge (DBR)

Unlock Date: April 17

Number of Tokens to be Unlocked: 1.11 billion DBR (11.1% of Total Supply)

Current Circulating Supply: 1.16 billion

Total supply: 10 Billion DBR

deBridge is a cross-chain protocol that allows users to transfer assets and data between different blockchains. It aims to simplify interoperability and make decentralized applications more connected and efficient.

On April 17, 1.11 billion BDR tokens, worth around $32.19 million, will be unlocked. This unlock will nearly double the current circulating supply, adding roughly 95% more tokens to the market.

The allocation includes 400 million for core contributors, 340 million for strategic partners, and 176.93 million for the ecosystem. The rest goes to the community, foundation, and validators. Despite the upcoming unlock, deBridge has gained nearly 38% in the past month, with its market cap now nearing $34 million.

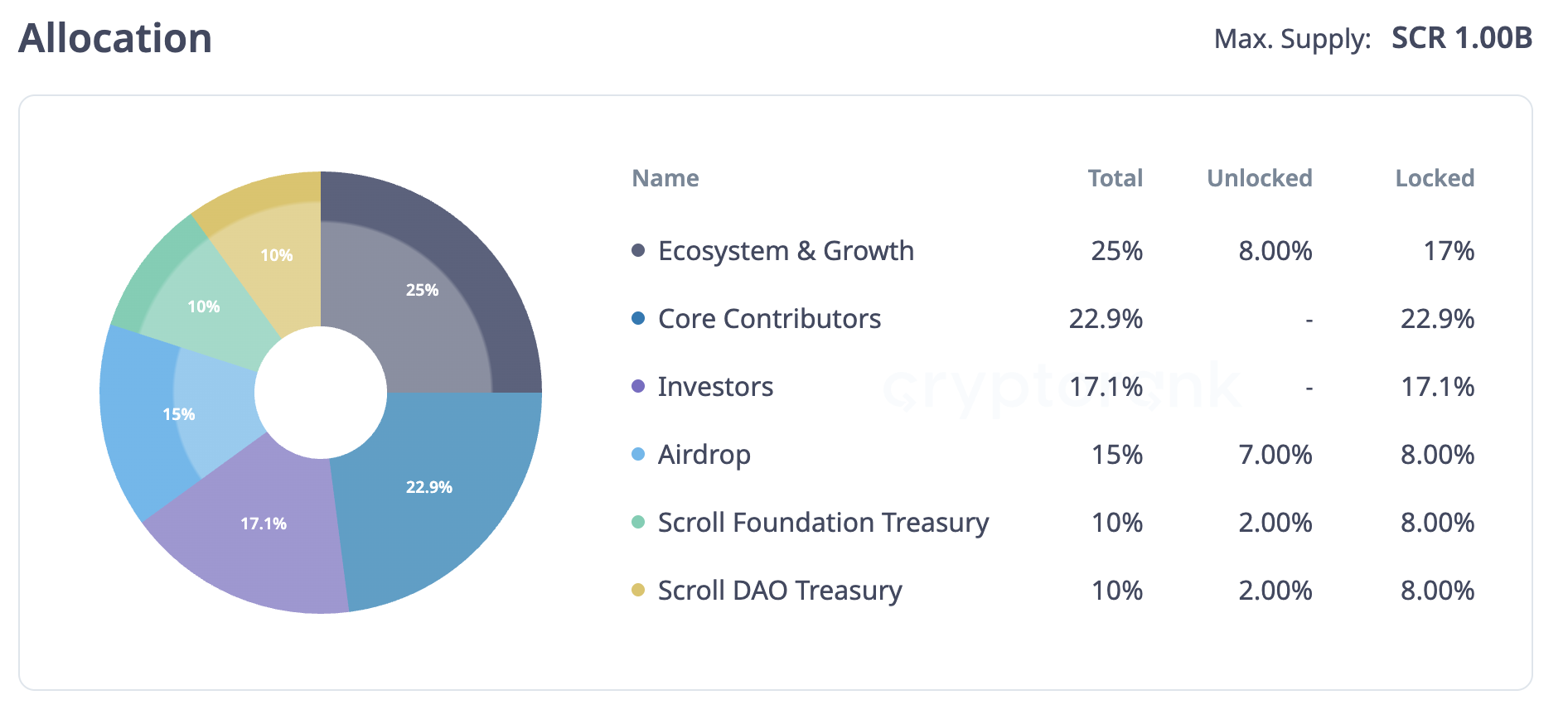

Unlock Date: April 22

Number of Tokens to be Unlocked: 40 million SCR (4% of Total Supply)

Current Circulating Supply: 190 million

Total supply: 1 Billion SCR

Scroll is a Layer 2 solution built to improve Ethereum’s scalability and efficiency. It uses zkRollup technology to lower transaction costs and increase throughput, helping ease issues like high gas fees and congestion.

On April 22, 40 million SCR tokens, valued at about $11.52 million, will be unlocked. This unlock could introduce added liquidity to the market and maybe renewed interest in Scroll. Its price is down roughly 46% in the last 30 days, with its market cap at $55 million, down from its peak of $265 in October 2024.

All 40 million tokens are allocated for airdrops.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoEthereum Price Falls Below $1900 As Expert Blames Decline On Network Stagnation

-

Altcoin21 hours ago

Altcoin21 hours agoGemini Crypto Exchange Announces Rewards For XRP Users, Here’s How To Get In

-

Ethereum14 hours ago

Ethereum14 hours agoEthereum Playing Catch-Up? Bloomberg Examines ETH’s Struggles In New Report

-

Market14 hours ago

Market14 hours agoWhale Leverages $27.5 Million PEPE Long on Hyperliquid

-

Ethereum13 hours ago

Ethereum13 hours agoEthereum MVRV Ratio Nears 160-Day MA Crossover – Accumulation Trend Ahead?

-

Ethereum12 hours ago

Ethereum12 hours agoEthereum May Have Hit Cycle Bottom, But Pricing Bands Signal Strong Resistance At $2,300

-

Market12 hours ago

Market12 hours agoBitcoin (BTC) Whales Accumulate as Market Faces Uncertainty

-

Ethereum11 hours ago

Ethereum11 hours agoEthereum Analyst Eyes $1,200-$1,300 Level As Potential Acquisition Zone – Details