Bitcoin

El Salvador’s Bitcoin Gamble Under Scrutiny: IMF Urges Policy Change

According to latest reports, El Salvador Bitcoin’s dream is now under scrutiny by The International Monetary Fund (IMF). Particularly, the IMF has urged El Salvador to reconsider its approach to its Bitcoin law, recommending “narrowing” the law’s scope and reducing the public sector’s exposure to Bitcoin.

Notably, BTC became a legal tender in El Salvador in September 2021, and ever since, the country has been actively working to integrate the crypto asset within the region.

The Push To Tame Bitcoin Law, Why?

The IMF’s call for El Salvador to limit its Bitcoin policy comes from ongoing discussions with Salvadoran authorities about “macroeconomic stabilization and reform policies.” Julie Kozack, IMF’s communications director, addressed the organization’s concerns at a recent press briefing.

She emphasized the need to address risks associated with Bitcoin adoption in El Salvador, stating that regulatory oversight and the overall framework governing the country’s BTC ecosystem require strengthening.

The briefing revealed that the IMF is in talks with El Salvador to establish a program to stabilize the economy, support growth reforms, and tackle issues tied to BTC’s legal status.

Specifically, they disclosed that their push for El Salvador to make a policy change on its Bitcoin laws is due to the “potential risks” involved in El Salvador’s comprehensive embrace of the asset, concerning “fiscal policies and financial stability.”

What is Next for El Salvador?

Despite the legal integration of BTC as an alternative currency, the IMF believes that many of the associated risk are yet to be materialized completely. The IMF noted in a statement published in August:

There is joint recognition that further efforts are needed to enhance transparency and mitigate potential fiscal and financial stability risks from the Bitcoin project. Additional discussions in this and other key areas remain necessary,

Notably, the IMF plan, as disclosed, is to ensure that El Salvador’s public sector does not become “overly exposed” to BTC’s volatility and that the digital currency is “well-regulated” within the broader financial system. They added in the statement:

Progress has been made in the negotiations toward a Fund-supported program, focused on policies to strengthen public finances, boost bank reserve buffers, improve governance and transparency, and mitigate the risks from Bitcoin

Meanwhile, it is worth noting that the Salvadoran government’s bold move to recognize Bitcoin as a legal tender marked a global first and has positioned the country at the forefront of crypto innovation.

The region has made several developments concerning crypto to cement it as a crypto hub further. El Salvador added 162 BTC to its national holdings in August this year.

Additionally, in February, the country launched a BTC educational project to empower its young citizens with the skills needed to run a node on the BTC network.

Featured image created with DALL-E, Chart from TradingView

Bitcoin

Strategy Adds 22,048 BTC for Nearly $2 Billion

Michael Saylor announced that Strategy purchased nearly $2 billion worth of Bitcoin. This is a massive leap over last week’s purchase, which was already quite substantial.

Nonetheless, the firm was only able to make this acquisition thanks to major stock offerings. Bitcoin’s price has been sinking over the last few weeks, and this could mature into a potential liquidation crisis.

Strategy Maintains Bitcoin Purchases

Since Strategy (formerly MicroStrategy) began acquiring Bitcoin, it’s become one of the world’s largest BTC holders. This plan has totally reoriented the company around its massive acquisitions, inspiring other firms to take up the same plan.

Today, the firm’s Chair, Michael Saylor, announced another purchase, much larger than the last few.

“Strategy has acquired 22,048 BTC for ~$1.92 billion at ~$86,969 per bitcoin and has achieved BTC Yield of 11.0% YTD 2025. As of 3/30/2025, Strategy holds 528,185 BTC acquired for ~$35.63 billion at ~$67,458 per bitcoin,” Saylor claimed via social media.

Strategy’s latest Bitcoin acquisition, worth just shy of $2 billion, is a major commitment. In February, the firm made a similar $2 billion purchase, and it was followed by a tiny $10 million buy and a $500 million one. The $500 million purchase, which took place on March 24, only happened thanks to a huge new stock offering. This move further cements Strategy’s faith in BTC.

By making these billion-dollar buys, Strategy is able to buttress the entire market’s confidence in Bitcoin. However, investors should be aware of a few potential cracks.

First of all, Bitcoin’s performance is a little subpar at the moment. Despite hitting an all-time high recently, Bitcoin is having its worst quarter since 2019, and there is not much forward momentum.

This could cause a unique problem for the company. Since Strategy is a cornerstone of market confidence, it is unable to offload its assets without jeopardizing Bitcoin’s price.

The firm’s debts are growing at a fast rate, and this could have dangerous implications if Bitcoin keeps falling. Strategy could be forced to liquidate, even if that seems unlikely now.

Still, it’s important to remember that these are only possible scenarios. Strategy has maintained its consistent Bitcoin investments for nearly five years, and it’s paid off tremendously well. However, if it keeps taking on billions in fresh debt obligations, this faith will turn into a gamble with very high stakes.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

BTC Price Rebound Likely as Long-Term Holders Reenter Market

Bitcoin (BTC) is on track to end Q1 with its worst performance since 2019. Without an unexpected recovery, BTC could close the quarter with a 25% decline from its all-time high (ATH).

Some analysts have noted that experienced Bitcoin holders are shifting into an accumulation phase, signaling potential price growth in the medium term.

Signs That Veteran Investors Are Accumulating Again

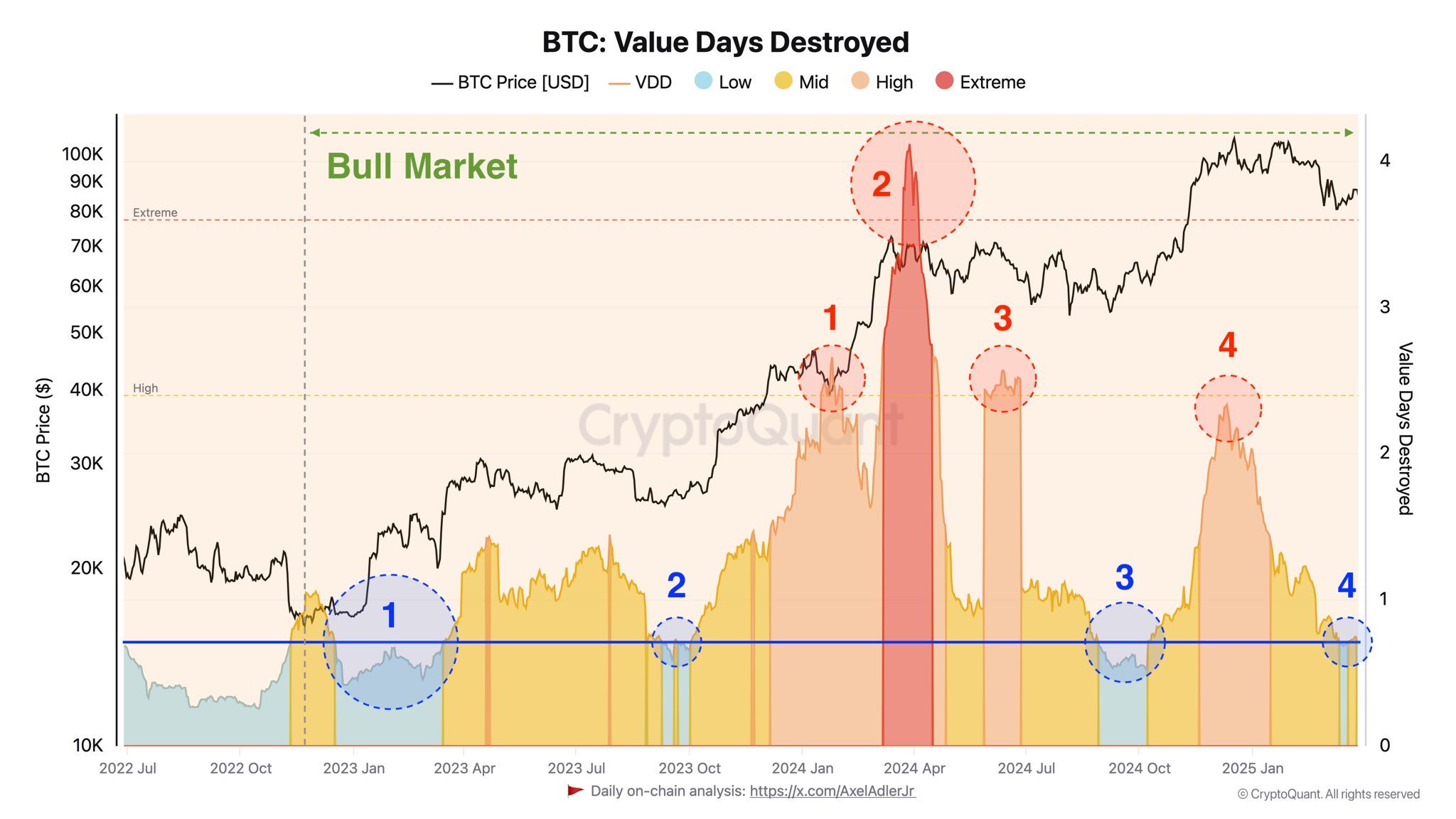

According to AxelAdlerJr, March 2025 marks a transition period where veteran investors move from selling to holding and accumulating. This shift is reflected in the Value Days Destroyed (VDD) metric, which remains low.

VDD is an on-chain indicator that tracks investor behavior by measuring the number of days Bitcoin remains unmoved before being transacted.

A high VDD suggests that older Bitcoin is being moved, which may indicate selling pressure from whales or long-term holders. A low VDD suggests that most transactions involve short-term holders, who have a smaller impact on the market.

Historically, low VDD periods often precede strong price rallies. These phases suggest that investors are accumulating Bitcoin with expectations of future price increases. AxelAdlerJr concludes that this shift signals Bitcoin’s potential for medium-term growth.

“The transition of experienced players into a holding (accumulation) phase signals the potential for further BTC growth in the medium term,” AxelAdlerJr predicted.

Bitcoin’s Sell-Side Risk Ratio Hits Low

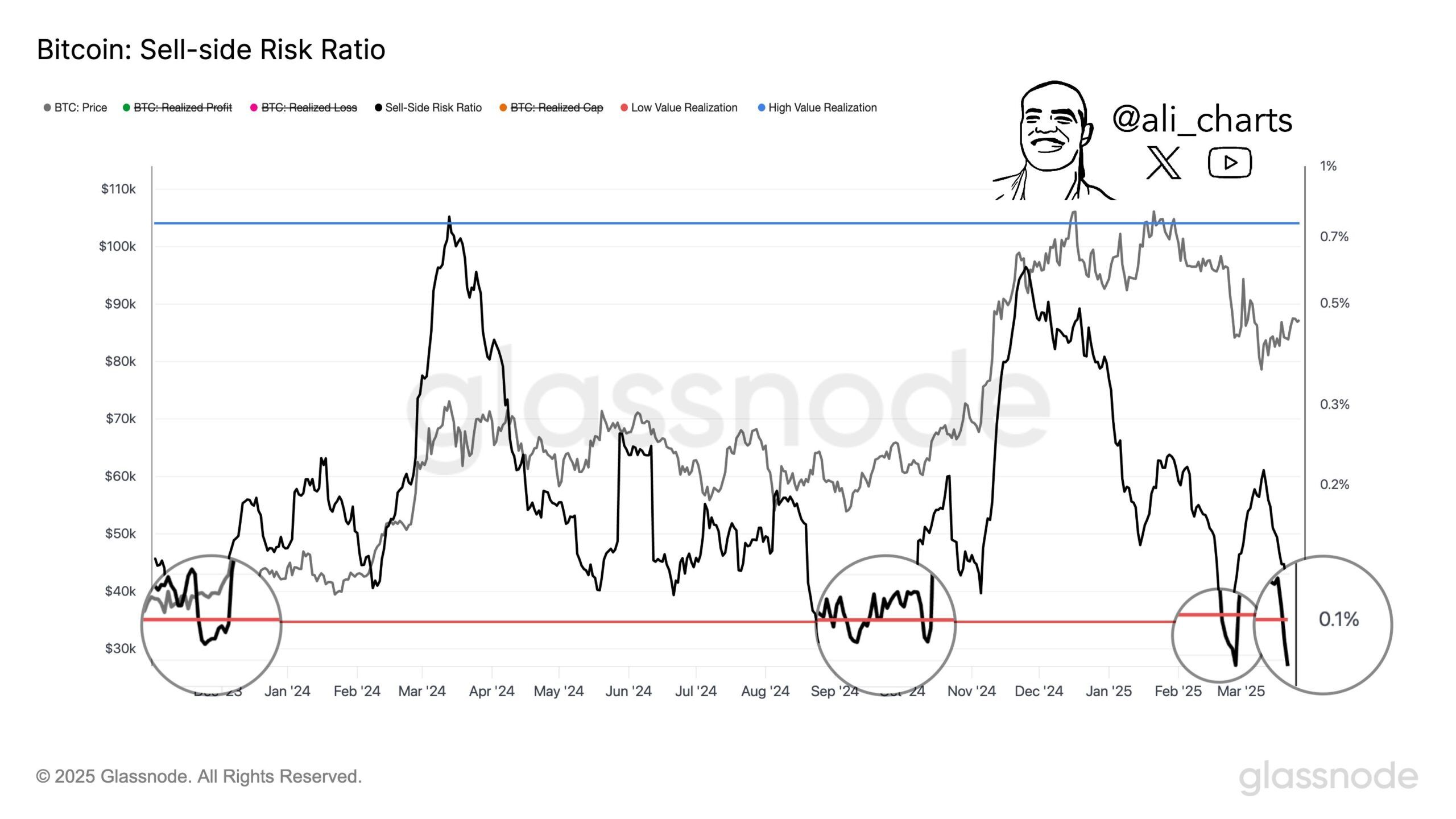

At the same time, analyst Ali highlighted another bullish indicator: Bitcoin’s sell-side risk ratio had dropped to 0.086%.

According to Ali, over the past two years, every time this ratio fell below 0.1%, Bitcoin experienced a strong price rebound. For example, in January 2024, Bitcoin surged to a then-all-time high of $73,800 after the sell-side risk ratio dipped below 0.1%.

Similarly, in September 2024, Bitcoin hit a new peak after this metric reached a low level.

The combination of veteran investors accumulating Bitcoin and a sharp decline in the sell-side risk ratio are positive signals for the market. However, a recent analysis from BeInCrypto warns of concerning technical patterns, with a death cross beginning to form.

Additionally, investors remain cautious about potential market volatility in early April. The uncertainty stems from President Trump’s upcoming announcement regarding a major retaliatory tariff.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Marathon Digital to Sell $2 Billion in Stock to Buy Bitcoin

Marathon Digital Holdings, one of the largest Bitcoin mining companies in the US, made headlines with its announcement of a $2 billion stock offering to increase its Bitcoin holdings.

This strategic move, detailed in recent SEC filings, shows Marathon’s aggressive approach to capitalize on the growing crypto market.

Marathon’s $2 Billion Stock Offering: Key Details

On March 30, 2025, Marathon Digital Holdings announced a $2 billion at-the-market (ATM) stock offering to fund its strategy of acquiring more Bitcoin. The company filed a Form 8-K with the SEC, outlining its plan to raise capital through the sale of shares, with the proceeds primarily aimed at increasing its Bitcoin holdings.

According to the SEC filing (Form 424B5), Marathon intends to use the funds for “general corporate purposes,” which include purchasing additional Bitcoin and supporting operational needs.

Marathon holds 46,376 BTC, making it the second-largest publicly traded company in Bitcoin ownership, behind MicroStrategy. The company’s Bitcoin holdings have grown significantly in recent years, from 13,726 BTC in early 2024 to the current figure.

“We believe we are the second largest holder of bitcoin among publicly traded companies. From time to time, we enter into forward or option contracts and/or lend bitcoin to increase yield on our Bitcoin holdings.” Marathon confirmed

This $2 billion stock offering continues Marathon’s strategy to bolster its balance sheet with Bitcoin, a move that aligns with its long-term vision of leveraging cryptocurrency as a store of value.

Marathon’s strategy mirrors that of MicroStrategy. MicroStrategy’s stock price has soared with Bitcoin’s value, providing a blueprint for companies like Marathon to follow. By increasing its Bitcoin holdings, Marathon aims to position itself as a leader in the crypto mining sector while diversifying its revenue streams beyond traditional mining operations.

Marathon Digital CEO Fred Thiel advises investing small amounts in Bitcoin monthly, citing its consistent long-term growth potential.

The issuance of new shares to raise $2 billion could dilute the ownership of existing shareholders, potentially impacting the company’s stock price (MARA). As of March 31, 2025, MARA stock has experienced volatility, trading at around $12.47 per share, down from a 52-week high of $24, according to data from Yahoo Finance.

Moreover, Marathon’s heavy reliance on Bitcoin exposes it to the cryptocurrency’s price fluctuations. If Bitcoin’s price were to decline significantly, the value of Marathon’s holdings would decrease, potentially straining its financial position.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market19 hours ago

Market19 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market18 hours ago

Market18 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?

-

Altcoin23 hours ago

Altcoin23 hours agoCardano Price Eyes Massive Pump In May Following Cyclical Patern From 2024

-

Market11 hours ago

Market11 hours agoStrategic Move for Trump Family in Crypto

-

Market6 hours ago

Market6 hours agoBNB Breaks Below $605 As Bullish Momentum Fades – What’s Next?

-

Market10 hours ago

Market10 hours agoTop Crypto Airdrops to Watch in the First Week of April

-

Market5 hours ago

Market5 hours agoTrump Family Gets Most WLFI Revenue, Causing Corruption Fears

-

Altcoin10 hours ago

Altcoin10 hours ago$33 Million Inflows Signal Market Bounce