Market

XRP, FTX Payouts, Satoshi Reveal

The crypto markets are gearing up for a news-packed week, with several key events on the horizon.

Meanwhile, Bitcoin (BTC) flipped green after climbing above $63,000, signaling that “Uptober” might be in play again.

FTX Court Hearing

The deadline for the court hearing related to FTX creditor repayments is on October 7, amid chatter that the exchange will begin distributing $16 billion to its creditors sometime this month. BeInCrypto reported on the controversy, with creditors angry about the abysmal compensation coming their way.

FTX creditor activist Sunil Kavuri explained expectations in a recent post on X. He said that if the court approves the repayment plan, claimants expecting amounts below $50,000 could start receiving payments by late 2024. However, those owed larger sums may have to wait until mid-2025.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

However, FTX token FTT recorded significant volatility amidst buzz about the upcoming hearing. Token deposits increased as traders positioned for potential exits amid volatility ahead of a crucial hearing.

OKX Delists These Five Tokens

OKX exchange also makes it to the top crypto news this week, with five tokens up for delisting, according to a late September announcement. On October 8, the exchange will delist spot trading for REN, TAKI, LEASH, ORB, and KINE tokens.

“We advise users to cancel orders on these trading pairs (REN/USDT, REN/USDC, TAKI/USDT, LEASH/USDT, ORB/USDT, and KINE/USDT) before the delisting. Otherwise, the system will automatically cancel these orders. The cancellation may take 1-3 working days,” the exchange said.

Token delisting typically causes a drop in trading volume and liquidity, making it harder for holders to sell at fair prices. It often leads to sharp price declines as investors panic sell or lose confidence in the token. Consequently, holders may face significant losses in the value of their assets.

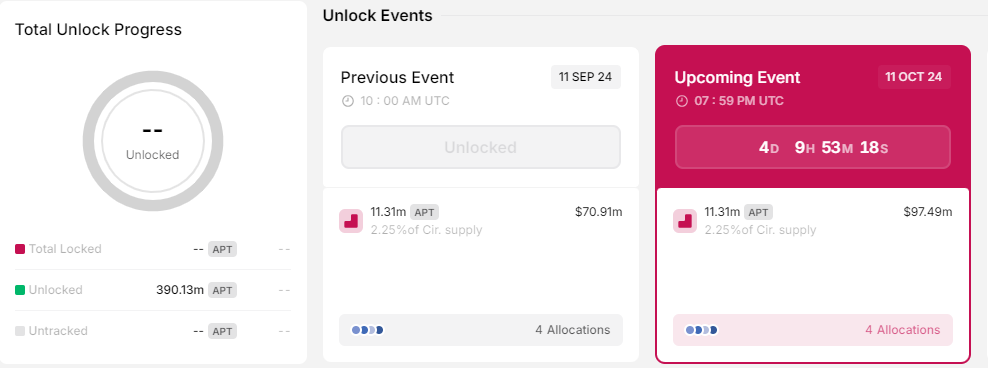

EIGEN and APT Token Unlocks

EIGEN token holders should brace for volatility ahead of a $35.75 million worth of unlocks on Tuesday. An official announcement from the Eigen Foundation said this unlock event would bring new opportunities for participation across the EigenLayer ecosystem. Notably, this will mark the network’s first cliff unlock event.

On Friday, October 11, the Aptos ecosystem is set to unlock 11.31 million APT tokens, valued at $97 million based on current prices. These tokens will be distributed among the foundation, community, core contributors, and investors.

Tokens allocated to the community and investors may enter the market quickly as holders cash in for short-term profits. This influx could potentially impact APT’s price, creating downward pressure.

HBO’s Big Satoshi Nakamoto Reveal

Satoshi Nakamoto’s identity may become public information this week, with American television network HBO due to premiere its much-awaited documentary on Tuesday. Opinion polls on Polymarket suggest Len Sassaman may be the creator of Bitcoin.

Sassaman, now late, was an American technologist, cryptographer, and privacy advocate, a befitting profile for the pseudonymous Satoshi Nakamoto. He is said to be the biggest crypto billionaire ever, holding 1.1 million BTC tokens worth almost $67.5 billion at current rates.

“Len Sassaman’s wife had direct communication with the “creator” of Bitcoin After he died she was “thinking about” fundamentally altering Bitcoin She still has access to his “old hard drives” which means she has access to 1 million Bitcoin (5% of all Bitcoin, worth nearly$65 billion),” one X user commented.

Stacks Nakamoto Hard Fork

Nakamoto is making headlines twice in crypto news this week, with the second being the upcoming Stacks hard fork on October 9. It is a major upgrade on the Stacks network designed to bring several benefits, the main ones being increased transaction throughput and 100% Bitcoin finality.

With this upgrade, the Stacks blockchain would realize new capabilities and improvements, focusing on key advancements. These include improved transaction speed, enhanced finality guarantees for transactions, mitigated Bitcoin miner MEV (miner extractable value) opportunities that affect PoX, and enhanced robustness against chain reorganizations.

PEPPER Airdrop Snapshot

After the first snapshot on September 30, fan engagement Web3 project Chiliz (CHZ) has another airdrop of its PepperChain (PEPPER) token to CHZ holders on October 10 across major exchanges outside the US.

PEPPER airdrop is part of a continued strategy to expand and diversify the Chiliz ecosystem. The ecosystem is popular for its fan token platform and is deeply involved in the sports and entertainment industries.

Read more: What are Crypto Airdrops?

The addition of PepperChain positions Chiliz for community-centric initiatives that will reward active participation and engagement.

Upbit Suspends MKR and DAI Trading

Korea’s largest exchange, Upbit, will suspend trading pairs for MKR/BTC and DAI/BTC from 14:00 local time on October 11, 2024. This will support brand reshaping as Maker transitions to Sky Protocol and its MKR token changes to Sky.

Similarly, Dai stablecoin will change to USDS. The suspension will last until the rebranding and token exchange is completed.

The DeFi community has its reservations about the rebranding. Some laud the move as a necessary evolution in response to market demands. Meanwhile, others are concerned that it shifts away from the decentralized principles that originally defined MakerDAO.

“MakerDAO was an OG DeFi protocol aiming to build an autonomous, decentralized stablecoin with low volatility against fiat currency, backed by ETH. DAI is now migrating to USDS, a stablecoin that goes against its original vision,” Lumberg, one of the prominent DeFi community members, commented.

Still, others say the change could have long-term effects on the DeFi sector, as introducing USDS and SKY could lead to a centralization trend within the space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BTC Futures Show Bullish Sentiment, Options Traders Cautious

After a surge in Bitcoin spot ETF inflows on April 2, yesterday’s market action painted a different picture as institutional investors began offloading BTC holdings.

Despite this retreat, futures traders remain confident, with open interest climbing and funding rates staying positive. However, the options market tells a different story, with traders showing less conviction in sustained upward momentum. As a key batch of BTC options nears expiration, all eyes are on how the market will respond to this divergence.

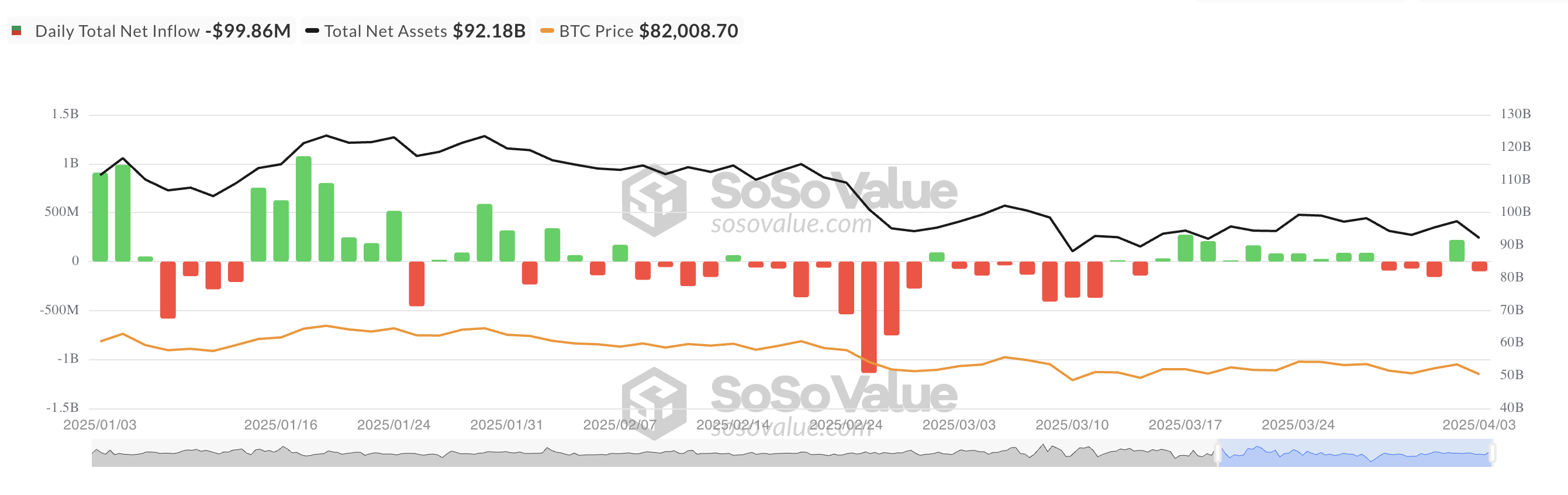

BTC Spot ETFs See $99.86 Million Outflow as Institutional Confidence Wavers

Institutional investors withdrew liquidity from BTC spot ETFs yesterday, resulting in a net outflow of $99.86 million.

This abrupt shift followed April 2’s $767 million net inflow, which ended a three-day streak of outflows. It signaled a brief return of institutional confidence before momentum quickly reversed.

Grayscale’s ETF GBTC saw the highest amount of fund exits, with a daily net outflow of $60.20 million, bringing its net assets under management to $22.60 billion.

However, BlackRock’s ETF IBIT stood out, witnessing a daily net inflow of $65.25 million. At press time, Bitcoin Spot ETFs have a total net asset value of $92.18 billion, plummeting 5% over the past 24 hours.

Bitcoin Derivatives Split as Traders Bet on Both Sides of the Market

Meanwhile, the derivatives market remains split—Bitcoin futures traders are leaning bullish, backed by rising open interest and positive funding rates. In contrast, options traders appear more hesitant, signaling uncertainty in the market’s next move.

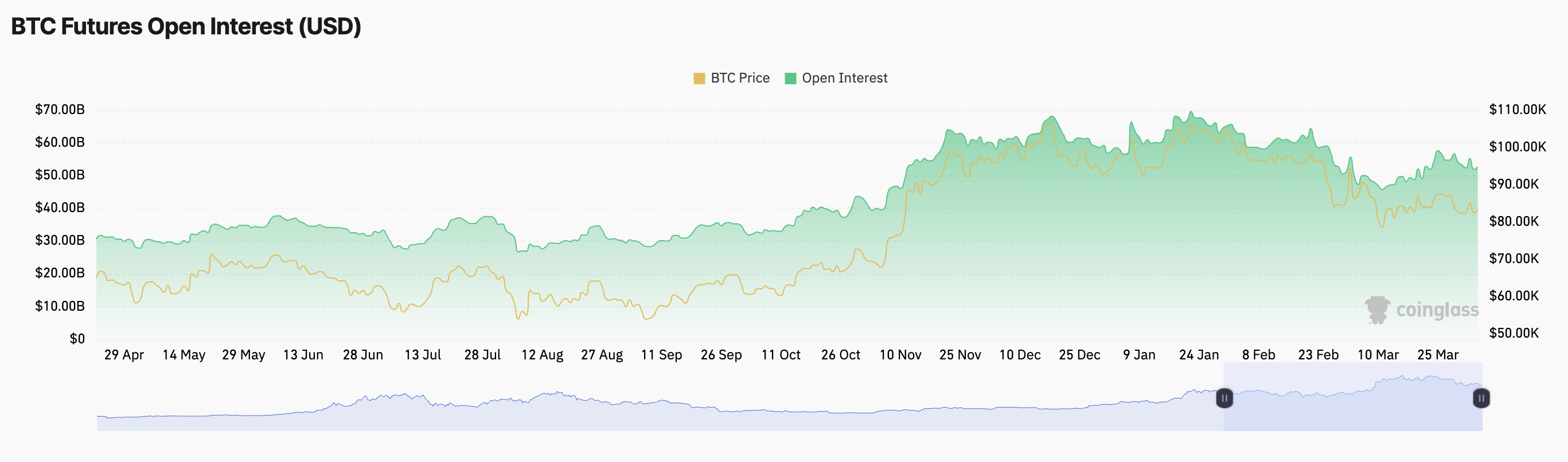

At press time, Bitcoin futures open is $52.63 billion, up 2% over the past day. The coin’s funding rate remains positive and currently stands at 0.0084%.

Notably, amid the broader market dip, BTC’s price has noted a minor 0.34% decline during the review period.

When BTC’s price declines while its futures open interest rises and funding rates remain positive, it suggests that traders are increasing leveraged positions despite the price drop. The positive funding rate indicates that long positions remain dominant, meaning traders expect a rebound.

However, caution is advised. If BTC’s price continues to fall, it could trigger long liquidations as overleveraged positions get squeezed.

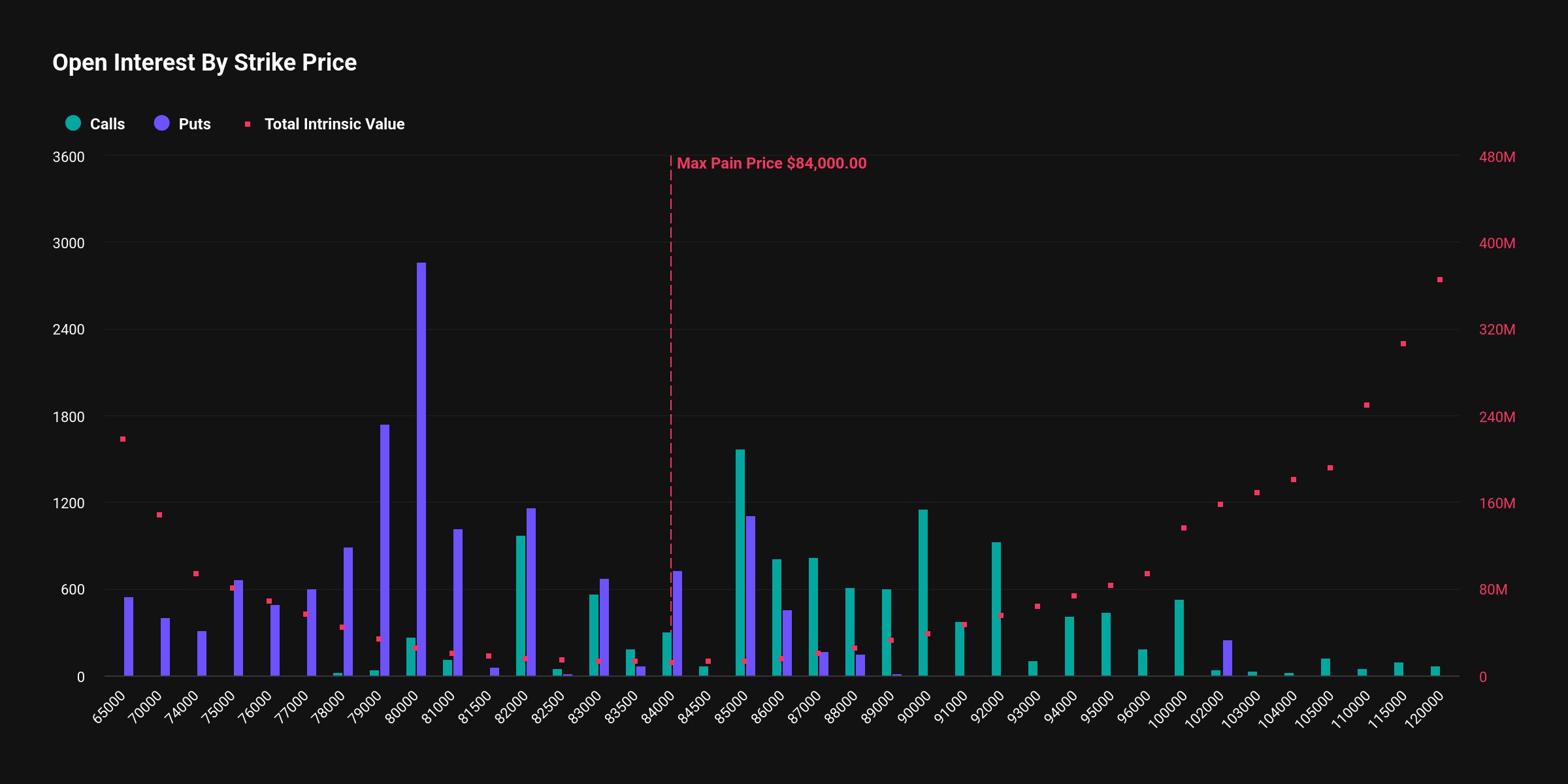

In contrast, the options market tells a different story, with traders showing less conviction in sustained upward momentum. This is evident from the high demand for put options.

According to Deribit, the notional value of BTC options expiring today is $2.17 billion, with a put-to-call ratio of 1.24. This confirms the prevalence of sales options among market participants.

This divide between futures and options traders suggests a tug-of-war between bullish speculation and cautious hedging, potentially leading to heightened volatility in the near term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

What to Expect on May 7

The highly anticipated Pectra upgrade will launch on the Ethereum (ETH) mainnet on May 7, 2025, after overcoming a series of technical challenges and delays in the testnet phase.

Ethereum developers announced the date during the All Core Developers Consensus (ACDC) meeting on April 3, 2025.

Pectra Upgrade Countdown Begins

The upgrade was initially slated for a tentative mainnet launch on April 30. However, Ethereum developers have postponed the launch by one week.

“We’ll go ahead and lock in May 7 for Pectra on mainnet,” Ethereum Foundation researcher Alex Stokes said.

In preparation for this, Stokes confirmed that client releases will be made available by April 21, ensuring that all users have the necessary updates and tools ahead of the mainnet launch. On April 23, a detailed blog post outlining the Pectra mainnet will be published.

The Pectra upgrade will introduce 11 Ethereum Improvement Proposals (EIPs) to enhance various aspects of the network. Notably, three EIPs are dedicated to improving the validator experience.

The first is EIP-7251. This will increase the staking limit for validators from 32 ETH to 2,048 ETH per validator. This change aims to enhance capital efficiency for large stakers and staking pools.

“This simplifies the staking experience, allowing users to manage multiple validators under one node instead of several,” an analyst remarked.

Moreover, EIP-7002 introduces execution-layer triggerable withdrawals, giving validators more control. Meanwhile, EIP-6110 reduces the deposit processing delay from about 9 hours to just 13 minutes.

The upgrade will also include EIP-7702, a major step toward account abstraction. It allows Externally Owned Accounts (EOAs) to gain smart contract functionality while maintaining simplicity. This enables features like transaction batching, gas sponsorship (where third parties pay fees), passkey-based authentication, spending controls, and asset recovery mechanisms.

Finally, the upgrade increases blob capacity through EIP-7691. In addition, EIP-7623 helps manage the increased bandwidth requirements. These updates aim to make Ethereum more scalable, efficient, and user-friendly.

It is worth noting that the road to the mainnet launch has not been without hurdles. Two previous tests on the Holesky and Sepolia test networks failed to finalize properly. However, Pectra achieved full finalization on the Hoodi testnet on March 26, marking a significant milestone toward the successful deployment of the upgrade.

Despite the technical progress, ETH continues to face market challenges.

Data from BeInCrypto shows that ETH dropped 4.8% over the past week, with weekly losses extending to 17.1%. At the time of writing, the altcoin was trading at $1,822, reflecting a small daily gain of 0.8%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Futures and Illinois Lawsuit Relief

Coinbase filed with the US Commodity Futures Trading Commission (CFTC) to launch futures contracts for Ripple’s XRP token.

The move comes after a positive development for the crypto derivatives market in the US, reflecting shifting regulatory ties in the country.

Coinbase Files for XRP Futures Trading With CFTC

Coinbase Derivatives has submitted a filing to self-certify XRP futures. It will provide a regulated, capital-efficient means for market participants to gain exposure to XRP. The new contract could go live as soon as April 21.

“We’re excited to announce that Coinbase Derivatives has filed with the CFTC to self-certify XRP futures – bringing a regulated, capital-efficient way to gain exposure to one of the most liquid digital assets. We anticipate the contract going live on April 21, 2025,” read the announcement.

Meanwhile, the official filing indicates that the XRP futures contract will be a monthly cash-settled and margined contract trading under the symbol XRL.

Each contract represents 10,000 XRP and will be settled in US dollars. Trading will be available for the current month and two subsequent months. As a protective measure, trading will be temporarily halted if the spot XRP price moves more than 10% within an hour.

The Coinbase Exchange also confirmed that it has engaged with Futures Commission Merchants (FCMs) and other market participants. Both references reportedly expressed support for the launch.

However, Coinbase is not the first US-based exchange to introduce regulated XRP futures. In March, Chicago-based Bitnomial launched what it advertised as the country’s first CFTC-regulated XRP futures contract.

For Coinbase, however, the boldness comes after the CFTC eased key regulatory hurdles for crypto derivatives trading. As BeInCrypto reported, this signaled a more accommodating stance towards the sector.

“Pursuant to Commodity Futures Trading Commission (“CFTC” or “Commission”) Regulation 40.2(a), Coinbase Derivatives, LLC (the “Exchange” or “COIN”) hereby submits for self-certification its initial listing of the XRP Futures contract to be offered for trading on the Exchange…,” an excerpt in the filing indicated.

This suggests that the commodities regulator’s shift, revoking previous crypto-related guidelines, may boost institutional confidence. For XRP, this development bolsters confidence in the asset’s previously contentious status following Ripple’s recent regulatory breakthrough.

“Coinbase Derivatives’ filing with the CFTC to self-certify XRP futures aims to legitimize XRP trading by offering a regulated, capital-efficient product for investors,” one user remarked.

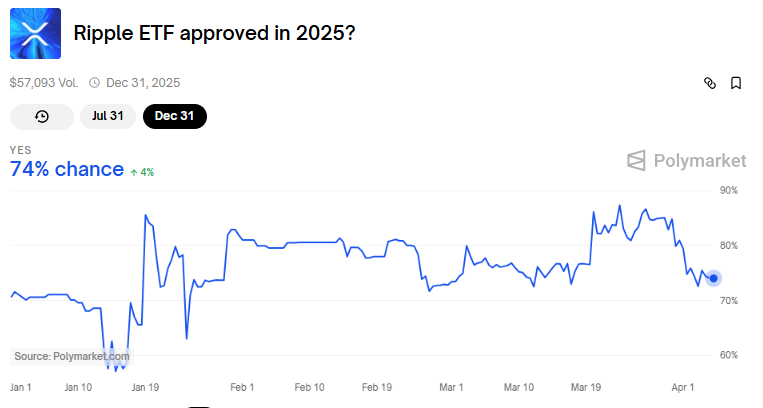

The futures contract might also help the odds of XRP ETF approval. Recently, the SEC delayed several applications to create one, and its status is in limbo.

Data on Polymarket shows bettors see a 74% chance for XRP ETF approval in 2025 and a more modest 34% by July 31.

Regulatory and Legal Developments Favor Coinbase

Elsewhere, the timing of this filing aligns with recent favorable regulatory developments for Coinbase. Reports suggest Illinois intends to drop its lawsuit against the exchange over its staking services.

Up to 10 states filed a lawsuit against Coinbase in June 2023 alleging that its staking program constituted unregistered securities offerings.

This recent development makes Illinois the fourth state to withdraw legal action against Coinbase. Vermont, South Carolina, and Kentucky also dismissed their cases on March 13, 27, and 31, respectively.

However, the cases remain active in Alabama, California, Maryland, New Jersey, Washington and Wisconsin.

These legal retreats coincide with the US SEC’s (Securities and Exchange Commission) February decision to abandon its federal lawsuit against Coinbase. BeInCrypto reported that this development marked a broader shift in the regulatory approach under the current administration.

“Regulators are losing steam, and Coinbase is stacking quiet courtroom wins. Staking’s future in the US might just be back on track,” a user commented.

Illinois’ decision to drop its lawsuit comes as the state advances a Bitcoin strategic reserve bill. Specifically, Illinois State Representative John M. Cabello introduced House Bill 1844 (HB1844), highlighting Bitcoin’s potential as a decentralized, finite digital asset.

“A strategic bitcoin reserve aligns with Illinois’ commitment to fostering innovation in digital assets and providing Illinoisans with enhanced financial security,” the bill read.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoBitcoin’s Future After Trump Tariffs

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?

-

Bitcoin24 hours ago

Bitcoin24 hours agoBlackRock Approved by FCA to Operate as UK Crypto Asset Firm

-

Market23 hours ago

Market23 hours agoHBAR Foundation Eyes TikTok, Price Rally To $0.20 Possible

-

Altcoin23 hours ago

Altcoin23 hours agoJohn Squire Says XRP Could Spark A Wave of Early Retirements

-

Market22 hours ago

Market22 hours ago10 Altcoins at Risk of Binance Delisting

-

Market21 hours ago

Market21 hours agoEDGE Goes Live, RSR Added to Roadmap

-

Regulation19 hours ago

Regulation19 hours agoUS Senate Banking Committee Approves Paul Atkins Nomination For SEC Chair Role