Market

This Is What Notcoin Needs to Make 17 Billion NOT Profitable

Notcoin’s (NOT) price has experienced a period of consolidation throughout most of September. While the Telegram coin briefly broke above the crucial resistance level of $0.0083, it quickly fell back into consolidation.

Despite this, there is optimism that a rally may be on the horizon if certain market conditions align.

Notcoin Investors Await Gains

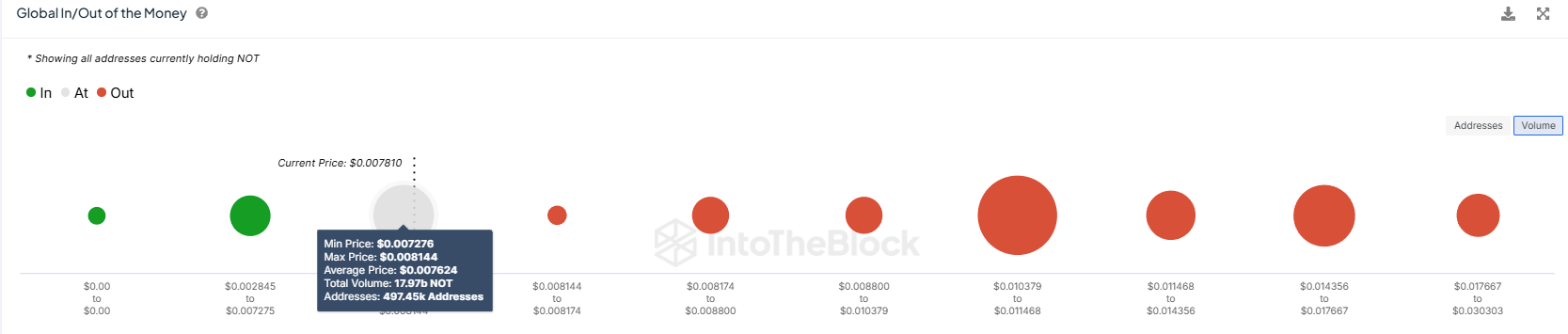

According to the Global In/Out of the Money (GIOM) indicator, approximately 17.97 billion NOT, valued nearly at $145 million, was purchased by investors between the price range of $0.0081 and $0.0072. These tokens represents a significant portion of the market supply, and the demand to turn these investments profitable could push the price higher. Investors who bought within this range are likely hoping for a breakout above the $0.0083 barrier to start seeing returns on their investments.

This large volume of purchased tokens is likely to drive up buying pressure, increasing the chances of breaching the resistance. Once this happens, Notcoin could experience an upswing, possibly bringing it closer to a more profitable trading range for these investors.

Read More: What is Notcoin (NOT)? A Guide to the Telegram-Based GameFi Token

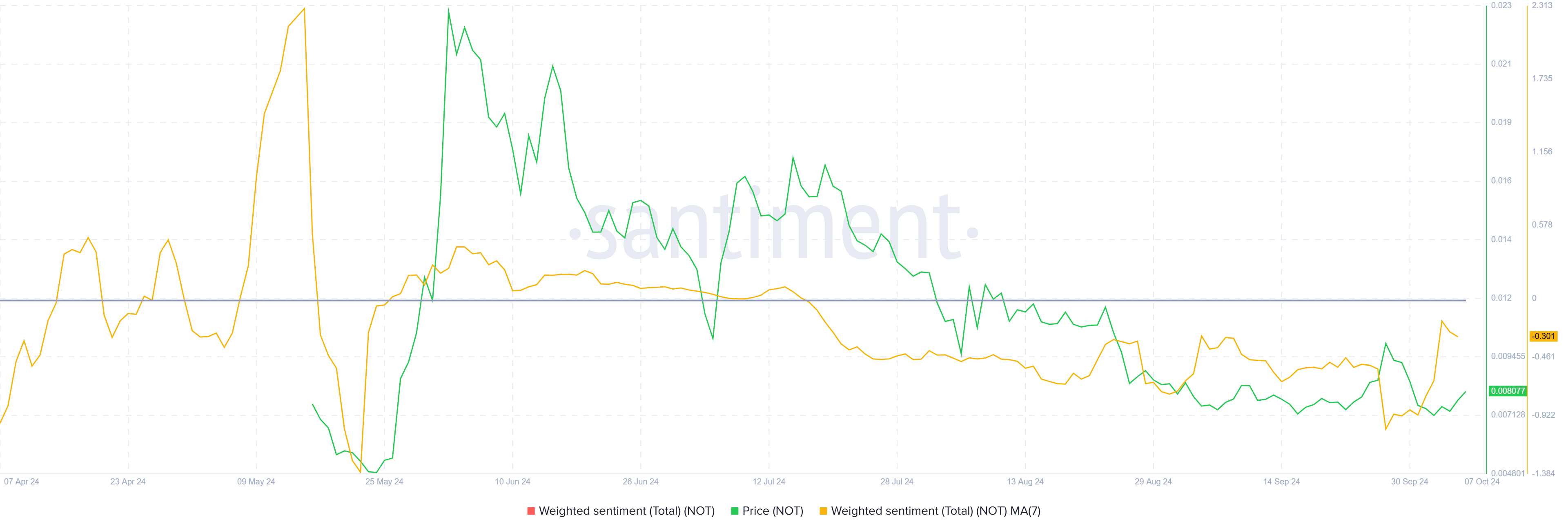

Despite this potential bullish scenario, the overall market sentiment for Notcoin remains bearish. The extended period of consolidation has led to growing pessimism among some investors, which could counter the upward pressure caused by the accumulation of 17.97 billion NOT. The lack of significant price movement has caused hesitation, as traders are wary of the token’s future prospects, and this could result in continued subdued price action.

If the bearish sentiment continues to dominate, it could keep Notcoin’s price trapped under the $0.0083 resistance level. The prolonged consolidation may discourage new buyers from entering the market, limiting the potential for upward momentum in the near term.

NOT Price Prediction: Attempting a Breach

At the time of writing, Notcoin is trading at $0.0080, stuck in a tight range between $0.0083 and $0.0070. A breakout above the $0.0083 resistance level could signal the start of a rally, potentially pushing the price toward $0.0094.

However, the mixed signals from both bullish and bearish factors suggest that consolidation may continue for the foreseeable future. The previously mentioned 17.97 billion NOT supply could still generate profits as long as the price stays above $0.0081, the upper limit of the accumulated range.

Read More: How To Buy Notcoin (NOT) and Everything You Need To Know

If Notcoin successfully breaks through the resistance, a rally could lead to a 17% price increase, sending the token to $0.0094. Such a move would invalidate the bearish-neutral outlook and potentially open the door for further gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Futures Traders Lead the Charge as Buying Pressure Grows

Hedera Foundation’s recent move to partner with Zoopto for a late-stage bid to acquire TikTok has sparked renewed investor interest in HBAR, driving a fresh wave of demand for the altcoin.

Market participants have grown increasingly bullish, with a notable uptick in long positions signaling growing confidence in HBAR’s future price performance.

HBAR’s Futures Market Sees Bullish Spike

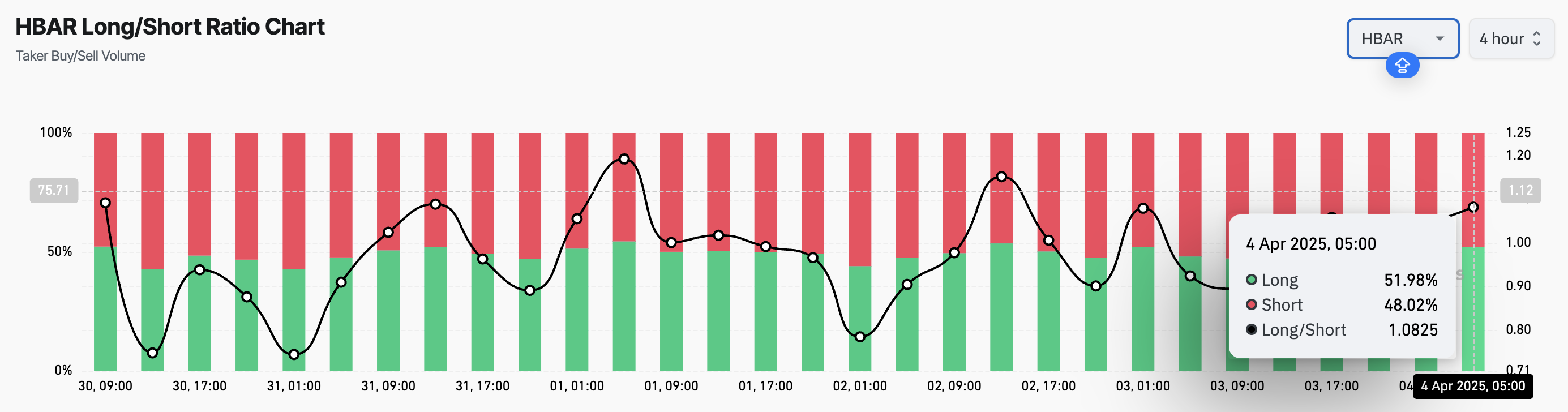

HBAR’s long/short ratio currently sits at a monthly high of 1.08. Over the past 24 hours, its value has climbed by 17%, reflecting the surge in demand for long positions among derivatives traders.

An asset’s long/short ratio compares the proportion of its long positions (bets on price increases) to short ones (bets on price declines) in the market.

When the long/short ratio is above one like this, more traders are holding long positions than short ones, indicating bullish market sentiment. This suggests that HBAR investors expect the asset’s price to rise, a trend that could drive buying activity and cause HBAR’s price to extend its rally.

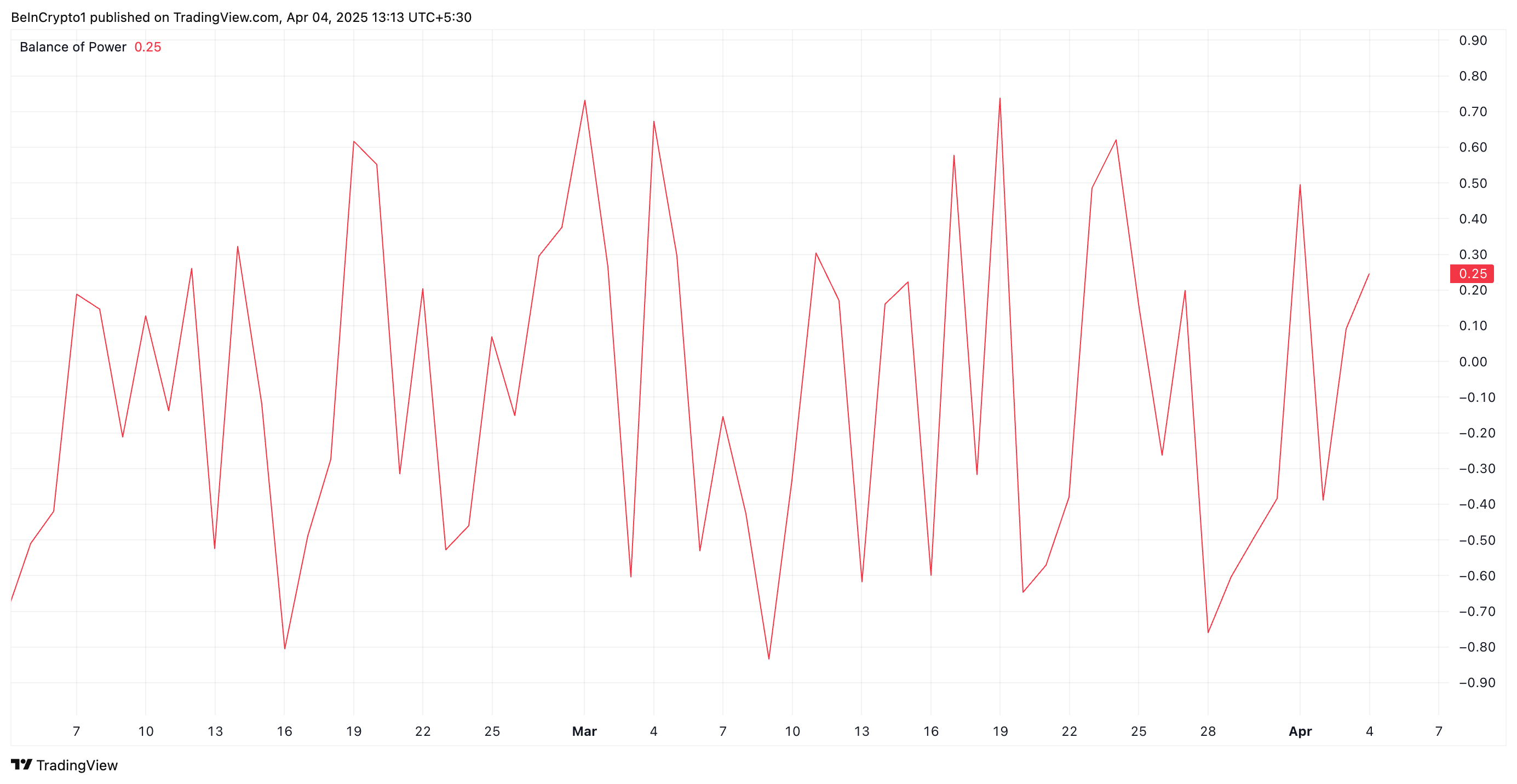

Further, the token’s Balance of Power (BoP) confirms this bullish outlook. At press time, this bullish indicator, which measures buying and selling pressure, is above zero at 0.25.

When an asset’s BoP is above zero, buying pressure is stronger than selling pressure, suggesting bullish momentum. This means HBAR buyers dominate price action, and are pushing its value higher.

HBAR Buyers Push Back After Hitting Multi-Month Low

During Thursday’s trading session, HBAR traded briefly at a four-month low of $0.153. However, with strengthening buying pressure, the altcoin appears to be correcting this downward trend.

If HBAR buyers consolidate their control, the token could flip the resistance at $0.169 into a support floor and climb toward $0.247.

However, a resurgence in profit-taking activity will invalidate this bullish projection. HBAR could resume its decline and fall to $0.129 in that scenario.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin is Far From a Bear Market But not Altcoins, Analysts Claim

Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how Bitcoin is holding firm above $79,000 despite a sharp equities sell-off. Markets are bracing for the March NFP report and rising recession risks. With Fed rate cuts on the table and ETF inflows staying strong, all eyes are on what’s next for macro and crypto markets.

Is Bitcoin in a Bear Market?

The highly anticipated March U.S. non-farm payrolls (NFP) report is due later today, and it’s expected to play a key role in shaping market sentiment heading into the weekend.

“With the key macro risk event now behind us, attention turns to tonight’s non-farm payroll report. Investors are bracing for signs of softness in the U.S. labour market. A weaker-than-expected print would bolster the case for further Fed rate cuts this year, as policymakers attempt to cushion a decelerating economy. At the time of writing, markets are pricing in four rate cuts in 2025—0.25 bps each in June, July, September and December,” QCP Capital analysts said.

Traditional markets are increasingly pricing in a recession, with equities retreating sharply—a 7% decline overall, including a 5% drop just yesterday. This broad de-risking environment helps explain the current pause in crypto inflows.

On the derivatives front, QCP adds:

“On the options front, the desk continues to observe elevated volatility in the short term, with more buyers of downside protection. This skew underscores the prevailing mood – uncertain and cautious.”

However, they also note that “with positioning now light and risk assets largely oversold, the stage may be set for a near-term bounce.”

Bitcoin remains resilient despite market volatility, holding above $79,000 with strong ETF inflows and signs of decoupling from stocks and altcoins. According to Nic Puckrin, crypto analyst, investor, and founder of The Coin Bureau: “Bitcoin is nowhere near a bear market at this stage. The future of many altcoins, however, is more questionable.”

Chart of the Day

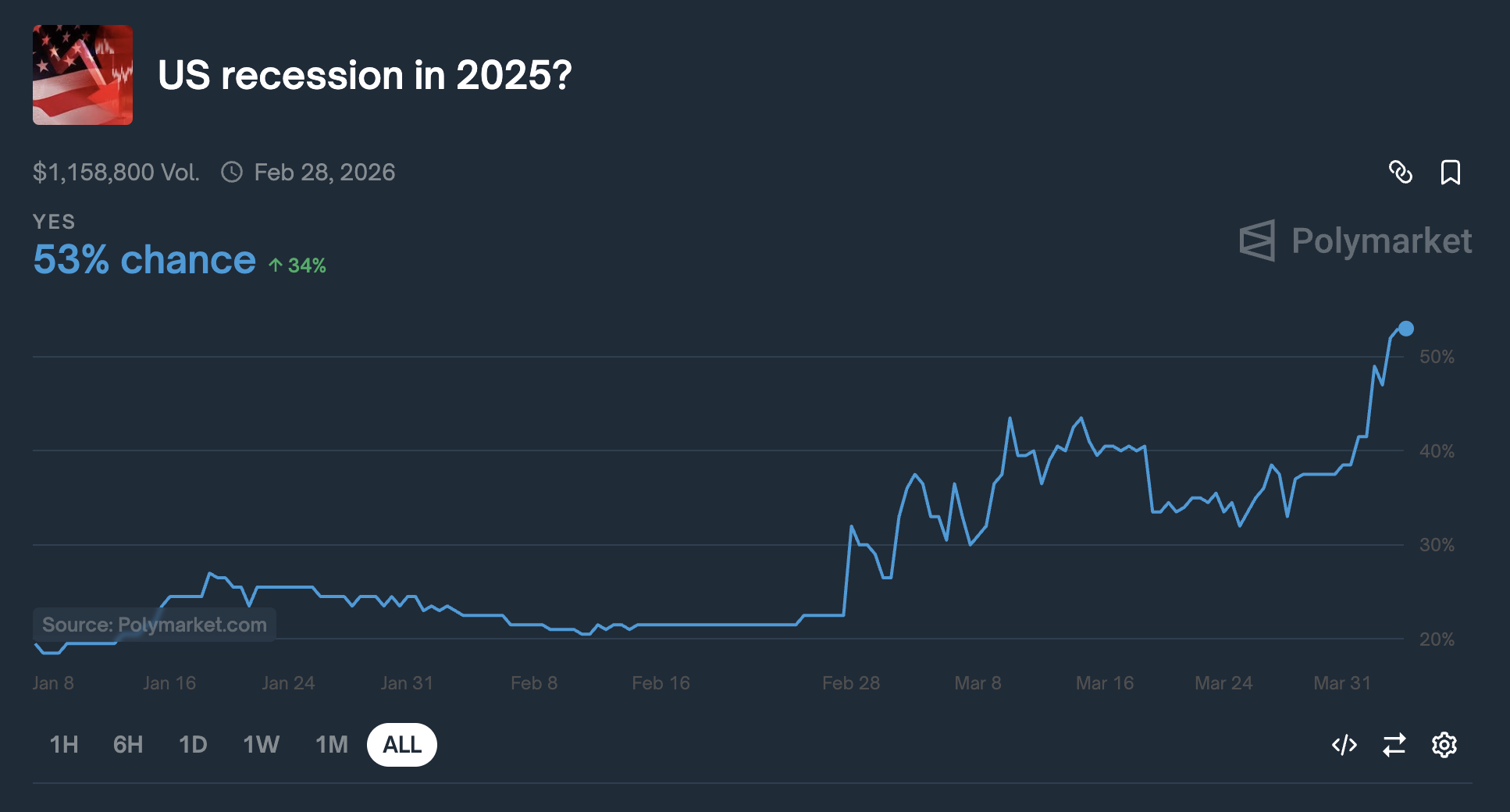

Chances of a US Recession in 2025 jumped above 50% for the first time, currently at 53%.

Byte-Sized Alpha

– Major ETF issuers are buying Bitcoin, with $220 million in inflows showing strong confidence despite volatility.

– Futures show bullish BTC sentiment, but options traders remain cautious, signaling mixed market outlook.

– Coinbase is launching XRP futures after Illinois lawsuit relief, signaling growing regulatory support for crypto.

– Despite Trump’s tariff-driven crash, analysts see potential for a Bitcoin rebound—though inflation may cap gains.

– The Anti-CBDC bill passed a key House vote, aiming to block Fed-issued digital currencies and protect privacy.

– Today at 11:25 AM, Fed Chair Jerome Powell will deliver a speech on the U.S. economic outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano Price Recovery Next As Whales Buy 230 Million ADA

Cardano has experienced a tough period, with the failed price recovery and declining market conditions. However, the recent buying behavior of whales and the potential for a price surge suggest a change in momentum.

If Cardano (ADA) can break through the $0.70 level, it could signal the end of the bearish sentiment.

Cardano Whales Are Hopeful

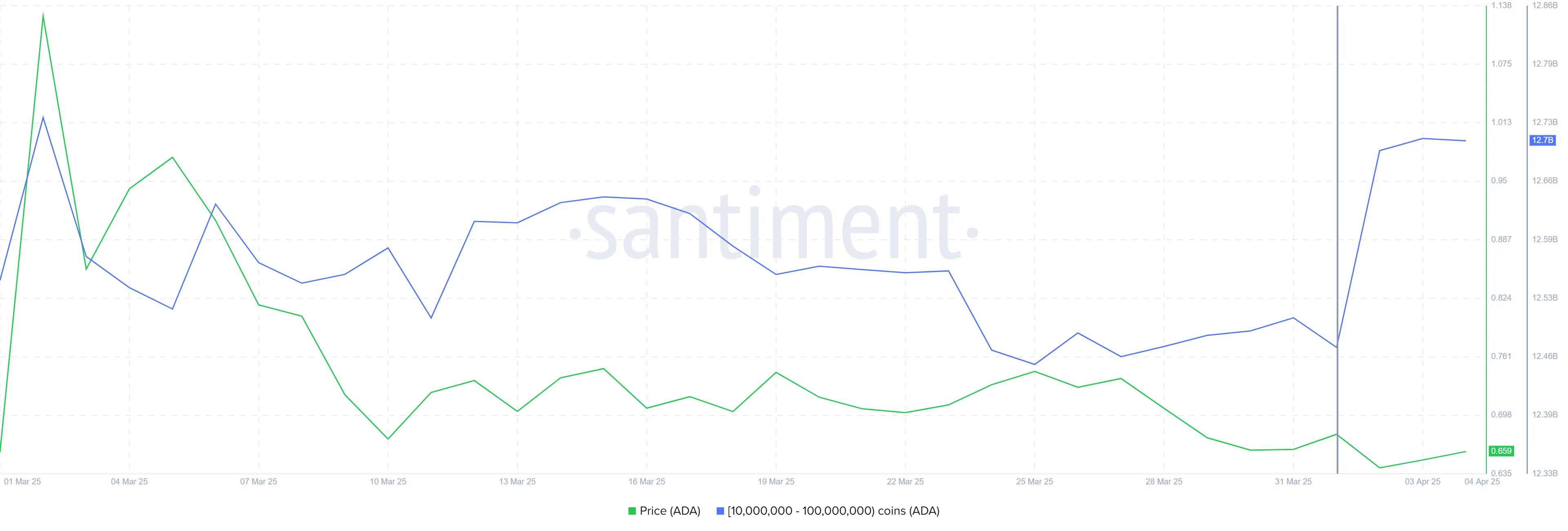

Over the past 72 hours, whales holding between 10 million and 100 million ADA have accumulated over 230 million ADA, valued at over $150 million at current prices. This shift from selling and staying neutral to accumulation indicates a shift in sentiment, with whales optimistic about ADA’s potential for Q2 2025. Their recent activity signals confidence in the altcoin’s recovery despite the recent market struggles.

Whale accumulation is often a bullish indicator as these investors have significant influence over the market. The accumulation is crucial, as it provides the support needed for ADA to break through resistance levels.

The liquidation map for Cardano shows that approximately $15 million in short contracts will expire as soon as ADA rises above the $0.70 level. This presents a key opportunity for the altcoin. Short-sellers may be forced to close their positions, which could lead to a short squeeze and drive the price higher.

Potential liquidation of short positions may create upward pressure, preventing further declines and allowing ADA to recover. The combination of whale accumulation and the looming liquidation of short contracts could provide Cardano with the momentum it needs to break free from its recent downtrend.

Can ADA Price Breach $0.70?

At the time of writing, Cardano’s price is at $0.65, holding above the crucial $0.62 support level. The altcoin has struggled in recent weeks, but the whale-buying activity offers hope for recovery. A breach of the $0.70 barrier could lead to further upward movement.

Should ADA successfully break through $0.70, it could gain the necessary momentum to continue its recovery. Flipping $0.77 into support would provide an additional boost, positioning Cardano to regain recent losses and possibly challenge higher resistance levels.

However, if Cardano fails to breach $0.70, the price may return to the $0.62 support level. Losing this support would invalidate the bullish outlook and send ADA to a lower level of $0.58, extending the ongoing decline.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation24 hours ago

Regulation24 hours agoUS Senate Banking Committee Approves Paul Atkins Nomination For SEC Chair Role

-

Market22 hours ago

Market22 hours agoBinance Managed 94% of All Crypto Airdrops and Staking Rewards

-

Market23 hours ago

Market23 hours agoPi Network Price Falls To Record New Low Amid Weak Inflows

-

Regulation21 hours ago

Regulation21 hours agoUS SEC Acknowledges Fidelity’s Filing for Solana ETF

-

Market19 hours ago

Market19 hours agoWormhole (W) Jumps 10%—But Is a Pullback Coming?

-

Altcoin19 hours ago

Altcoin19 hours agoAltcoin Season Still In Sight Even As Ethereum Struggles To Gain Upward Momentum

-

Market21 hours ago

Market21 hours agoXRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

-

Market20 hours ago

Market20 hours agoRipple Shifts $1B in XRP Amid Growing Bearish Pressure