Market

Binance Secures Registration in Argentina

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup features Binance’s VASP registration in Argentina, Ripple’s expansion into Brazil, and other major developments.

Binance Secures VASP Registration in Argentina

Binance, one of the largest cryptocurrency platforms globally, has reached a major milestone in Argentina by registering as a Virtual Asset Service Provider (VASP) with the country’s National Securities Commission (CNV). This registration strengthens Binance’s commitment to adhering to regulatory frameworks, not only in Argentina but around the world.

Argentina becomes the 20th country where Binance has secured a license or regulatory registration, following the company’s recent progress in key jurisdictions like India, Kazakhstan, and Indonesia. Binance has already established a presence in other major markets, having secured licenses in Dubai, France, Japan, and El Salvador, which continues to solidify its global footprint.

With this VASP registration, Argentine users can now fully access Binance’s suite of services and tools through both its website and mobile app. This move will make it easier for local users to engage in the cryptocurrency ecosystem, offering them the security of a platform that upholds the highest standards of compliance and protection.

“Argentina is a key market for Binance. We will continue to work closely with the local authorities to develop the industry in the safest and most sustainable way possible. This is for the benefit of the crypto community and society in general,” said Guilherme Nazar, Binance’s director for Latin America.

Read more: How To Trade Crypto on Binance Futures: Everything You Need To Know

Nazar also highlighted Binance’s belief in proactive regulation as essential for the orderly and safe evolution of the cryptocurrency industry, a principle that is central to the company’s ongoing global expansion efforts. This regulatory breakthrough further demonstrates Binance’s commitment to creating a secure, compliant environment for its users while advancing the development of the global cryptocurrency market.

Ripple Expands in Brazil Through Partnership with Mercado Bitcoin

Ripple has launched Ripple Payments in Brazil through a partnership with local exchange Mercado Bitcoin. This collaboration will allow businesses to explore cross-border payments using Ripple’s end-to-end blockchain-based payment solution.

Mercado Bitcoin, the first in Latin America to use Ripple’s solution, will enhance its internal treasury between Brazil and Portugal and offer international payments for retail customers. These customers will be able to make payments in reais via a non-resident account, with funds transferred globally 24/7 and settled within minutes.

“Ripple Payments offers capabilities that are important to crypto businesses, enabling them to streamline operations, optimize liquidity, and improve margins through real-time payment settlement. We are delighted to partner with Mercado Bitcoin, a crypto market leader with more than a decade of experience in providing tokenized services to Brazil,” said Silvio Pegado, CEO of Ripple in Latin America.

Read more: XRP ETF Explained: What It Is and How It Works

Ripple Payments will focus on small and medium-sized enterprises, providing optimized onboarding, global access to over 80 payment markets, and 24/7 liquidity. Jordan Abud, Head of Banking at Mercado Bitcoin, added, “The partnership allows Bitcoin Market to take another step towards internationalization…offering lower costs and a more complete platform.”

Ripple Payments currently covers 80 payment markets, with 90% coverage of the FX market and more than $50 billion in processed volume. For now, the service is available to Mercado Bitcoin customers in Brazil and Portugal.

IMF Urges El Salvador to Limit Public Sector Exposure to Bitcoin

The International Monetary Fund (IMF) has once again urged El Salvador to limit its public sector exposure to Bitcoin and to strengthen oversight of its regulatory framework. Despite the country’s notable 3% GDP growth in 2024, the IMF continues to express concerns about the risks posed by cryptocurrency volatility.

Since El Salvador made Bitcoin legal tender, the IMF has conducted several assessments, maintaining that the risks associated with Bitcoin’s price swings remain significant. While the IMF has adopted a more moderate stance compared to earlier years, it still insists on stricter regulations to ensure economic stability.

“We have recommended reducing the scope of the Bitcoin law, strengthening the regulatory framework and oversight of the Bitcoin ecosystem, and limiting public sector exposure to Bitcoin,” said Julie Kozack, IMF communications director, quoted by Reuters.

Read more: Who Owns the Most Bitcoin in 2024?

President Nayib Bukele, currently on an official visit to Argentina, remains a strong advocate for Bitcoin, though he acknowledges that adoption rates in El Salvador have fallen short of his expectations. He expressed a desire for greater acceptance among Salvadorans but emphasized that adopting the cryptocurrency has been a free choice for citizens.

Despite the IMF’s warnings, El Salvador continues to purchase Bitcoin through its Dollar Cost Averaging (DCA) strategy. To date, the government has accumulated 5,892.76 BTC, valued at approximately $360.97 million.

Nubank to Reduce Crypto Transaction Fees

On October 2, Brazil’s Nubank Cripto announced plans to lower the fees for cryptocurrency transactions in its app, with the changes set to roll out gradually through October and November. Under the new system, transaction fees will be based on the volume of customer trades, with potential reductions of up to 60%.

According to Nubank, the fee for buying and selling cryptocurrencies could drop to as low as 0.6% per transaction. Customers will have a 45-day cycle to accumulate transactions, after which the fee will be adjusted according to their trading volume. The new system improves upon the previous average rate of 1.6%, which had already decreased to 0.8% between March and September 2024.

The volume tiers Nubank will use to determine fees are as follows:

- Between 0 and 99 reais

- 100 to 1,999 reais

- 2,000 to 9,999 reais

- More than 10,000 reais

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

This fee structure rewards high-volume traders with lower transaction costs, a common practice in the crypto industry, known as “transaction tiers.” Major platforms like Binance also use a similar model. Nubank Cripto expects all customers to access the new system, though the implementation will be gradual.

Transaction fees, essential for on-chain processes, incentivize miners or nodes to validate transactions. While networks like Ethereum have struggled with high fees for years, Nubank Cripto’s new system aims to offer a more user-friendly experience for its customers.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price 25% Rally: Breaking Barriers and Surpassing Odds

XRP price rallied above the $1.15 and $1.20 resistance levels. The price is up over 25% and might rise further above the $1.420 resistance.

- XRP price started a fresh surge above the $1.20 resistance level.

- The price is now trading above $1.250 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair is up over 25% and it seems like the bulls are not done yet.

XRP Price Eyes Steady Increase

XRP price formed a base above $1.050 and started a fresh increase. There was a move above the $1.150 and $1.20 resistance levels. It even pumped above the $1.25 level, beating Ethereum and Bitcoin in the past two sessions.

There was also a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair. A high was formed at $1.4161 and the price is now consolidating gains. It is trading above the 23.6% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high.

The price is now trading above $1.30 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $1.400 level. The first major resistance is near the $1.420 level. The next key resistance could be $1.450.

A clear move above the $1.450 resistance might send the price toward the $1.50 resistance. Any more gains might send the price toward the $1.550 resistance or even $1.620 in the near term. The next major hurdle for the bulls might be $1.750 or $1.80.

Are Dips Supported?

If XRP fails to clear the $1.420 resistance zone, it could start a downside correction. Initial support on the downside is near the $1.3350 level. The next major support is near the $1.2850 level.

If there is a downside break and a close below the $1.2850 level, the price might continue to decline toward the $1.240 support or the 50% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high in the near term. The next major support sits near the $1.20 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $1.3350 and $1.2850.

Major Resistance Levels – $1.4000 and $1.4200.

Market

WisdomTree Europe Launches XRP ETP

ETF issuer WisdomTree’s European division just announced a new ETP based on XRP. This product is currently available in four EU countries, which has led XRP’s price to jump slightly.

ETPs are a common issuer strategy to earn revenue without ETF approval, but Europe will not necessarily approve one even if the US does so.

WisdomTree’s XRP ETP

WisdomTree, one of the Bitcoin ETF issuers in the US, announced that its European branch is offering an exchange-traded product (ETP) based on XRP. This new product is currently available in Germany, Switzerland, France, and the Netherlands. A growing number of issuers have filed for an XRP ETF, but WisdomTree is taking a slightly different tack.

“The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest cryptocurrencies by market capitalization. Backed 100% by XRP, XRPW is the lowest-priced XRP ETP in Europe, providing direct spot price exposure,” the announcement claimed.

The possibility of an official XRP ETF is growing with the current bull market, and Ripple CEO Brad Garlinghouse considers it “inevitable.” Still, it hasn’t happened yet, and ETP offerings allow issuers to somewhat address customers’ requirements. BitWise, which has also filed for an XRP ETF in the US, recently acquired a European ETP issuer to enter the same market.

WisdomTree, however, is no stranger to this market strategy. In May this year, it won approval to offer ETPs based on Bitcoin and Ethereum to British investors.

The UK has not yet approved a full ETF for either of these assets, but WisdomTree still gained market access. Even a fraction of the XRP market could also prove lucrative; the asset’s value spiked today.

WisdomTree Europe’s strategy page does not describe any further actions upon full approval. Even if the US approves an XRP ETF under the SEC’s new leadership, that won’t necessarily benefit WisdomTree’s European branch. For now, these ETPs built on XRP will have to suffice for this market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Rallies 10% and Targets More Upside

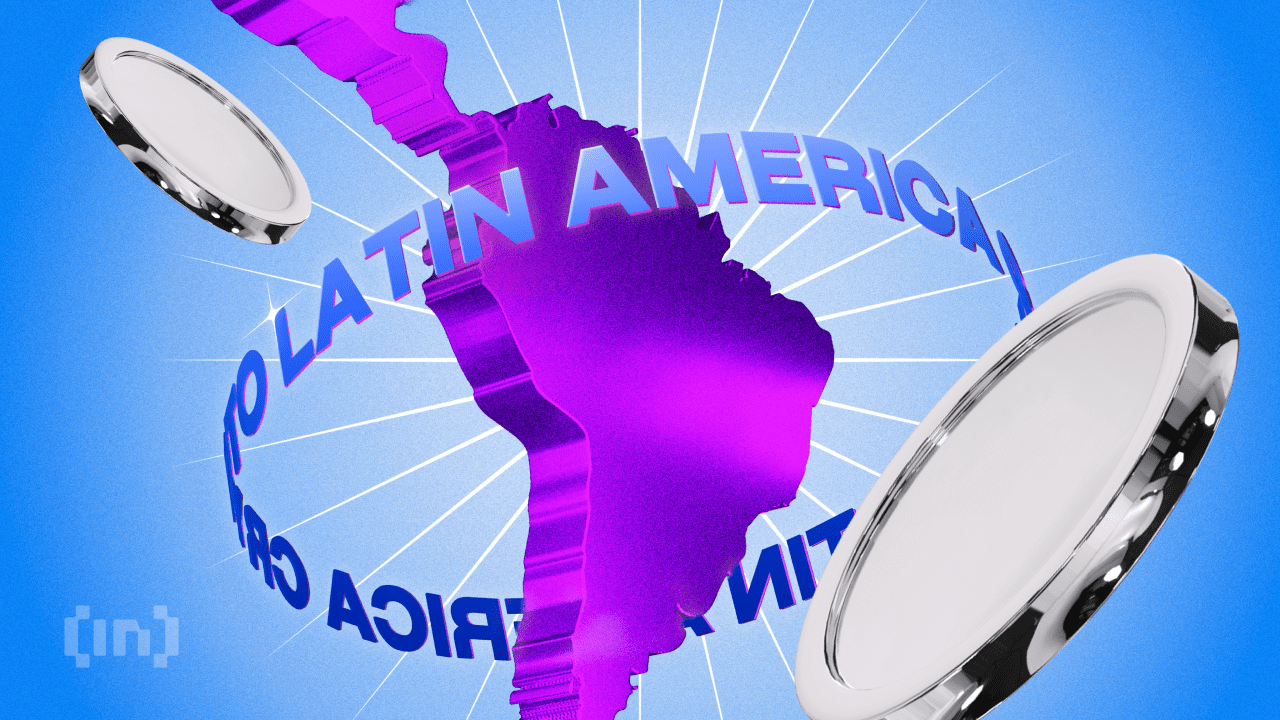

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

-

Ethereum23 hours ago

Ethereum23 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market20 hours ago

Market20 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Market24 hours ago

Market24 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Altcoin17 hours ago

Altcoin17 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin22 hours ago

Altcoin22 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Bitcoin15 hours ago

Bitcoin15 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Market15 hours ago

Market15 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Altcoin18 hours ago

Altcoin18 hours agoSui Network Back Online After 2-Hour Outage, Price Slips